Ultra Fine Aluminium Hydroxide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434098 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Ultra Fine Aluminium Hydroxide Market Size

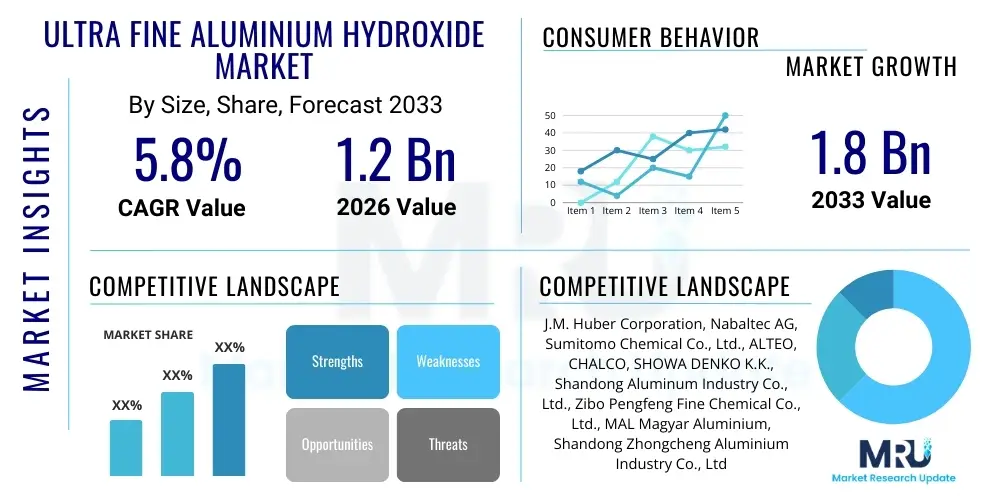

The Ultra Fine Aluminium Hydroxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for non-halogenated flame retardants across critical industrial sectors, particularly in electrical and electronics, construction, and transportation, which are increasingly governed by stringent fire safety standards globally.

Ultra Fine Aluminium Hydroxide Market introduction

Ultra Fine Aluminium Hydroxide (UFAH), chemically represented as Al(OH)3, is a specialized derivative of standard alumina hydrate, characterized by a median particle size typically below 1.5 micrometers. Its ultra-fine nature significantly enhances its dispersion characteristics and loading capacity within polymer matrices, making it an exceptional functional filler. UFAH functions primarily as a halogen-free flame retardant (FR) and smoke suppressant. When exposed to heat exceeding approximately 200°C, it undergoes an endothermic decomposition process, releasing water vapor, which cools the burning material and dilutes combustible gases. This mechanism provides dual functionality: reducing flammability while minimizing smoke generation, a critical advantage over conventional halogenated alternatives.

The principal applications of UFAH are concentrated in high-performance materials where thermal stability and fire safety are paramount. Key end-use sectors include the wire and cable industry, where UFAH is integral in jacket compounds for infrastructure and telecommunications, insulating materials for transportation (automotive and aerospace), and various plastics and thermosets utilized in electronics and building materials. The demand for UFAH is intrinsically linked to global regulatory shifts favoring environmentally benign and sustainable materials. As nations enforce stricter fire safety codes, particularly regarding smoke toxicity and corrosivity, the adoption of non-halogenated solutions like UFAH becomes mandatory, thereby underpinning sustained market expansion.

The superior performance characteristics, including excellent electrical properties, low abrasiveness, and ease of processing, further contribute to its widespread adoption. Beyond its role as a flame retardant, UFAH is also utilized as a filler to enhance mechanical strength, rigidity, and surface finish in various composites and molded parts. Driving factors for the market include rapid urbanization, increasing investments in renewable energy infrastructure (which requires high-specification, fire-resistant cabling), and the escalating manufacturing of electric vehicles (EVs) which necessitate advanced fire protection solutions for battery components and internal structures.

Ultra Fine Aluminium Hydroxide Market Executive Summary

The Ultra Fine Aluminium Hydroxide market is poised for robust expansion, fueled primarily by the global imperative to transition toward sustainable, non-toxic fire safety solutions. Business trends indicate a strong shift among compounders and material manufacturers away from traditional halogenated retardants, driven by regulatory pressures such as REACH in Europe and similar environmental directives worldwide. Investment is concentrating on developing surface-treated UFAH grades, which offer improved polymer compatibility, crucial for achieving high loading levels without sacrificing the mechanical integrity or aesthetic quality of the final product. Furthermore, strategic alliances between UFAH producers and specialized milling equipment providers are optimizing production efficiency, lowering the effective cost of ultra-fine grades and expanding their applicability across mid-tier markets.

Geographically, the Asia Pacific (APAC) region maintains its dominance in both production and consumption, largely due to rapid industrialization, massive infrastructure development, and burgeoning electronics manufacturing hubs in countries like China, India, and South Korea. However, North America and Europe demonstrate a higher market value per volume, reflecting stringent standards in the automotive and aerospace sectors, demanding premium, functionalized UFAH grades. Regional trends highlight significant growth in Latin America and the Middle East & Africa (MEA), catalyzed by large-scale construction projects and increased foreign direct investment into regional manufacturing capabilities, prompting a surge in demand for fire-safe building materials.

Segmentation trends reveal that the wire and cable segment remains the largest consumer, benefiting from the global rollout of 5G networks and smart grid initiatives, both requiring extensive fire-safe conduits. Concurrently, the plastics and polymers segment is experiencing accelerated growth, particularly in engineering plastics used in consumer appliances and automotive interiors. The technological evolution focuses on reducing the particle size even further (nano-AH), aiming to maintain transparency and improve flowability in specialized coating and adhesive formulations. The market structure remains highly competitive, with key players emphasizing capacity expansion, backward integration into bauxite sourcing, and continuous R&D into specialized surface modification technologies to gain a competitive edge.

AI Impact Analysis on Ultra Fine Aluminium Hydroxide Market

User inquiries regarding AI's influence on the UFAH market predominantly revolve around optimizing particle synthesis, predicting material performance, and improving supply chain resilience. Users are concerned with how AI can assist in achieving extremely narrow particle size distributions (PSD) consistently and efficiently, reducing batch-to-batch variability, which is critical for ultra-fine specifications. Furthermore, material scientists frequently explore AI’s potential in computational chemistry to rapidly screen and design novel surface modification agents tailored for specific polymer systems, bypassing lengthy traditional experimental cycles. A significant theme is the implementation of predictive maintenance and smart process control using machine learning algorithms to optimize energy consumption during the intensive milling and drying stages of UFAH production, thereby lowering operational expenditures and enhancing sustainability metrics demanded by global consumers.

- AI-Driven Process Optimization: Utilizing machine learning models to fine-tune parameters in precipitation and jet milling processes, ensuring uniform particle size distribution (PSD) and morphology, crucial for ultra-fine specifications.

- Predictive Material Science: Employing AI and computational chemistry (e.g., Density Functional Theory aided by machine learning) to accelerate the discovery and testing of effective surface coupling agents, enhancing UFAH compatibility with diverse polymer matrices.

- Supply Chain Forecasting: AI algorithms analyzing global bauxite and energy price fluctuations to provide optimized procurement and inventory strategies, stabilizing raw material costs for UFAH producers.

- Quality Control Automation: Implementing computer vision and sensor fusion systems for real-time, automated inspection of particle quality and surface treatment effectiveness, minimizing defect rates.

- Sustainability Enhancement: AI optimizing energy usage in drying and calcination processes, significantly reducing the carbon footprint associated with UFAH manufacturing.

DRO & Impact Forces Of Ultra Fine Aluminium Hydroxide Market

The Ultra Fine Aluminium Hydroxide market is primarily propelled by stringent global fire safety regulations mandating non-halogenated flame retardants in construction and electronics, alongside the robust expansion of the wire and cable sector, particularly in emerging economies. However, market growth faces significant restraint due to the high energy intensity and complexity of the ultra-fine milling process, leading to higher manufacturing costs compared to standard-grade ATH. The opportunity landscape is vast, centered on the increasing adoption of UFAH in lithium-ion battery encapsulation for electric vehicles, capitalizing on its thermal management capabilities. Impact forces, including economic volatility affecting construction spending and intense competition from newer synergistic FR systems (like ATH combined with metal phosphinates), constantly shape market dynamics. The overall force strongly favors specialized, high-performance UFAH grades, driving innovation towards particle surface functionalization and improved dispersibility in demanding engineering plastics.

Segmentation Analysis

The Ultra Fine Aluminium Hydroxide market is extensively segmented based on surface treatment, which critically determines its compatibility and performance within different polymeric systems, and by application, reflecting its diverse end-use spectrum across industrial sectors. The segmentation by treatment status is vital, differentiating between untreated (standard) UFAH, which offers basic flame retardancy but poor polymer compatibility, and surface-treated grades, which undergo modification using agents like silanes, stearates, or organophosphates. These treated grades command a premium price and are essential for high-loading, high-performance applications suching as cross-linked polyethylene (XLPE) used in medium and high voltage cables. The application segments are dominated by high-volume consumers, requiring tailored specifications for heat resistance and mechanical integrity in highly regulated environments.

- By Type

- Untreated Aluminium Hydroxide (Standard ultra-fine grade used where compatibility is less critical)

- Surface-Treated Aluminium Hydroxide (Modified with silanes, stearic acid, or other coupling agents for enhanced dispersion and physical property retention)

- By Application

- Plastics and Polymers (Including thermosets, polyolefins, PVC compounds)

- Wire and Cable (Low Smoke Zero Halogen (LSZH) compounds, insulation, jacketing)

- Rubber and Elastomers (Conveyor belts, gaskets, molded parts)

- Coatings and Paints (Fire-resistant coatings, intumescent systems)

- Adhesives and Sealants (Industrial and structural adhesives requiring thermal stability)

- By Particle Size

- 0.8 µm – 1.5 µm (Standard ultra-fine grades)

- < 0.8 µm (High-performance and nano-grades)

Value Chain Analysis For Ultra Fine Aluminium Hydroxide Market

The value chain for Ultra Fine Aluminium Hydroxide is complex, beginning with the upstream extraction and refining of bauxite ore, the primary raw material for aluminum production. Bauxite is processed using the Bayer process to yield standard Aluminium Hydroxide (ATH). The midstream phase, which is the most critical and value-additive for the ultra-fine segment, involves highly specialized processing. This includes precise precipitation control, subsequent filtration, and crucially, intensive fine grinding and milling (often using jet or ball mills) to reduce the particle size to the sub-micrometer range. Surface treatment, involving chemical coating to improve hydrophobicity and polymer matrix compatibility, also occurs at this stage, significantly boosting the material’s value proposition and application scope. This intricate processing differentiates UFAH from commodity ATH, demanding specialized expertise and significant capital investment in machinery.

Downstream analysis focuses on the distribution channels and end-user consumption. Distribution typically involves specialized chemical distributors capable of handling technical fillers, providing localized inventory, and offering formulation support to compounders. Direct sales are common for very large-volume contracts, particularly with global polymer manufacturers and major wire and cable companies. End-users, such as compounders and masterbatch producers, incorporate UFAH into their formulations for various applications, including construction materials, automotive components, and electronic enclosures. The demand pull is primarily driven by regulatory compliance and performance specifications in these specialized, safety-conscious industries, necessitating tight collaboration between UFAH producers and end-product formulators to ensure optimal flame retardant performance and material integrity.

The structure of the distribution channel is bifurcated. Indirect channels, utilizing specialized distributors, cater to smaller and medium-sized enterprises (SMEs) and geographically dispersed customers, offering flexible delivery and technical advice. Direct channels are utilized by market leaders and large volume consumers, allowing for customized product specifications, rigorous quality control agreements, and optimized pricing structures. The efficiency of the downstream market is heavily reliant on logistics for specialized powders and the technical support offered to facilitate the effective incorporation of UFAH into complex thermoplastic and elastomeric systems, ensuring proper dispersion and maximal fire safety performance.

Ultra Fine Aluminium Hydroxide Market Potential Customers

The primary consumers and buyers of Ultra Fine Aluminium Hydroxide are manufacturers operating in sectors where fire safety compliance, thermal stability, and minimization of smoke toxicity are mandated, often driven by government regulations and industry standards. These potential customers span a broad spectrum of industries, but the most significant purchasers are compounders and converters specializing in plastics for electrical applications, infrastructure, and transportation. Specifically, high-voltage cable producers utilize UFAH extensively in their Low Smoke Zero Halogen (LSZH) formulations to meet stringent fire performance specifications required for public infrastructure projects, metros, and data centers. The high volume requirements of these manufacturers make them cornerstone buyers in the market.

Another major segment of potential customers includes specialized masterbatch and compound producers who supply intermediate products to injection molders and extruders. These firms integrate UFAH into complex engineering plastics (such as polyamides and polyesters) and thermoplastic elastomers (TPEs) used in automotive interiors, consumer electronics casings, and appliance components. The ultra-fine nature of the product is critical here, as it allows for high filler loading without negatively impacting the mechanical properties or processing characteristics of the final molded part. Furthermore, the construction chemicals industry, particularly manufacturers of fire-resistant sealants, coatings, and structural composites, represents a steadily growing customer base, demanding fine particle grades for optimal formulation viscosity and application performance.

Emerging potential customers are concentrated in the rapidly expanding energy storage and electric mobility sectors. Manufacturers of lithium-ion battery modules and battery management systems (BMS) are increasingly seeking UFAH for incorporation into thermal interface materials, battery pack potting compounds, and housing components. UFAH’s endothermic decomposition helps manage thermal runaway risks, providing an added layer of safety. These customers demand highly specialized, often surface-modified, UFAH to achieve superior thermal conductivity and excellent adhesion to diverse substrate materials, positioning the automotive and energy storage verticals as high-growth customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | J.M. Huber Corporation, Nabaltec AG, Sumitomo Chemical Co., Ltd., ALTEO, CHALCO, SHOWA DENKO K.K., Shandong Aluminum Industry Co., Ltd., Zibo Pengfeng Fine Chemical Co., Ltd., MAL Magyar Aluminium, Shandong Zhongcheng Aluminium Industry Co., Ltd., Merck KGaA, TOR Minerals International, Inc., P-F-E Industries, R. J. Marshall Company, Hindalco Industries Limited, Kaizhong Aluminium Industry Co., Ltd., LKAB Minerals, Albemarle Corporation, Clariant AG, BASF SE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultra Fine Aluminium Hydroxide Market Key Technology Landscape

The technological landscape in the Ultra Fine Aluminium Hydroxide market is primarily defined by advancements in particle size reduction and surface modification techniques, both of which are critical to performance. Achieving sub-micrometer particle sizes consistently requires highly sophisticated equipment, chiefly utilizing wet grinding, stirred-media mills, and high-energy jet mills. These technologies minimize agglomeration and ensure a narrow particle size distribution (PSD), which is paramount for high loading in thin-walled applications, such as wire and cable insulation, without causing undesirable increases in melt viscosity or detrimental effects on the mechanical strength of the final product. Continuous improvement in milling efficiency is vital for profitability, given the substantial energy demands associated with pulverizing ATH to ultra-fine specifications.

Crucially, the effectiveness of UFAH is heavily dependent on surface treatment technology. Untreated UFAH is hydrophilic, making it incompatible with most hydrophobic polymers (e.g., polyolefins). The key technological evolution involves applying coupling agents—such as silanes, titanates, or specialty fatty acids (like stearic acid)—to the surface. This functionalization process makes the UFAH particles organophilic, significantly improving their dispersion, enhancing interface adhesion with the polymer matrix, and preventing moisture re-adsorption. Advanced surface treatment methods, including specialized dry coating processes, ensure uniform coverage and allow compounders to incorporate UFAH at high loadings (up to 60-65% weight) while maintaining favorable mechanical properties, such as elongation and tensile strength, essential for demanding applications like railway cable sheathing.

Furthermore, process control and quality assurance technologies are rapidly integrating into the UFAH manufacturing cycle. Techniques such as laser diffraction and dynamic light scattering are used for real-time monitoring of PSD during grinding, ensuring batch consistency. The development of synergistic flame retardant systems, where ultra-fine ATH is combined with complementary minerals or nitrogen-based FRs, is also a significant technological trend. This synergy allows formulators to optimize FR efficiency, potentially reducing the required loading level and improving overall material performance, positioning UFAH as a foundational element within sophisticated, multi-component fire safety solutions tailored for next-generation materials like high-voltage direct current (HVDC) cable compounds and specialty engineering thermoplastics.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, dominating both consumption and production capacity. This supremacy is attributed to the massive scale of infrastructure development, particularly in China and India, robust growth in the electronics assembly sector, and significant expansion of the automotive manufacturing base. Demand is highly concentrated in the wire and cable industry and general plastics manufacturing. Favorable raw material availability and lower operational costs compared to Western counterparts further solidify its market leadership.

- North America: This region is characterized by high demand for premium, highly functionalized UFAH grades, driven by stringent regulatory frameworks (e.g., UL standards) governing materials used in building and construction, aerospace, and defense applications. The focus is heavily on technical performance, low smoke density, and superior fire resistance in closed environments. The shift toward electric vehicle manufacturing is a major emerging driver, demanding specialized UFAH for battery components.

- Europe: Europe maintains a strong position, primarily propelled by strict environmental regulations, such as the Restriction of Hazardous Substances (RoHS) Directive and REACH, which strongly favor halogen-free solutions. The automotive, rail transport, and construction sectors are the main consumers. Technological innovation centers around sustainable manufacturing practices and the development of UFAH suitable for high-end engineering plastics and specialty coatings utilized in the highly competitive German and French markets.

- Latin America (LATAM): LATAM is an emerging market experiencing steady growth, driven by increasing foreign investment in public infrastructure, particularly in Brazil and Mexico. The market is increasingly adopting global fire safety standards, leading to a gradual but definite transition from commodity FRs to higher-specification, ultra-fine ATH in local construction and manufacturing processes.

- Middle East and Africa (MEA): Growth in MEA is highly dependent on large-scale construction and industrial projects, especially in the GCC countries (Saudi Arabia, UAE). Major infrastructure initiatives, coupled with mandated safety standards for oil, gas, and utility projects, generate strong demand for fire-safe materials, although the market structure often relies on imports from APAC and Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultra Fine Aluminium Hydroxide Market.- J.M. Huber Corporation

- Nabaltec AG

- Sumitomo Chemical Co., Ltd.

- ALTEO

- CHALCO (Aluminum Corporation of China Limited)

- SHOWA DENKO K.K.

- Shandong Aluminum Industry Co., Ltd.

- Zibo Pengfeng Fine Chemical Co., Ltd.

- MAL Magyar Aluminium

- Shandong Zhongcheng Aluminium Industry Co., Ltd.

- Merck KGaA

- TOR Minerals International, Inc.

- P-F-E Industries

- R. J. Marshall Company

- Hindalco Industries Limited

- Kaizhong Aluminium Industry Co., Ltd.

- LKAB Minerals

- Albemarle Corporation

- Clariant AG

- BASF SE

Frequently Asked Questions

Analyze common user questions about the Ultra Fine Aluminium Hydroxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Ultra Fine Aluminium Hydroxide (UFAH) in polymer systems?

UFAH primarily functions as a non-halogenated flame retardant and smoke suppressant. It works endothermically by decomposing under heat to release water vapor, cooling the substrate and diluting combustible gases, thereby suppressing fire and significantly reducing smoke generation.

Why are surface-treated grades of UFAH gaining increased market traction?

Surface-treated UFAH offers superior compatibility and adhesion with hydrophobic polymer matrices (like polyethylene and PVC), allowing for higher loading levels (essential for effective FR performance) without compromising the material’s mechanical strength, processing viscosity, or flexibility.

Which application segment holds the largest share in the UFAH market?

The Wire and Cable industry holds the largest market share, driven by stringent global regulations requiring Low Smoke Zero Halogen (LSZH) compounds for telecommunications, power transmission, and critical infrastructure projects, where UFAH is an indispensable filler.

What major regulatory factors influence the growth of the UFAH market?

Regulations such as the European Union’s REACH and RoHS directives, along with various national building and fire codes, are key drivers. These mandates increasingly restrict the use of toxic halogenated flame retardants, directly boosting the demand for safer alternatives like UFAH.

How does the ultra-fine particle size affect the material’s performance compared to standard Aluminium Hydroxide?

The ultra-fine particle size (typically <1.5 µm) ensures better dispersion within the polymer matrix, minimizes aesthetic impact (less opacity), and allows for high filler loading while maintaining essential material properties like flexibility and tensile strength, crucial in thin films and cable insulation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ultra Fine Aluminium Hydroxide Market Size Report By Type (), By Application (.), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Ultra Fine Aluminium Hydroxide Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (<1 μm, 1-1.5 μm, 1.5-3 μm), By Application (Flame-retardant Filler& Smoke Suppressants, Filling Material, Catalyst Carrier, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager