Ultra Fine Magnesium Hydroxide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435300 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Ultra Fine Magnesium Hydroxide Market Size

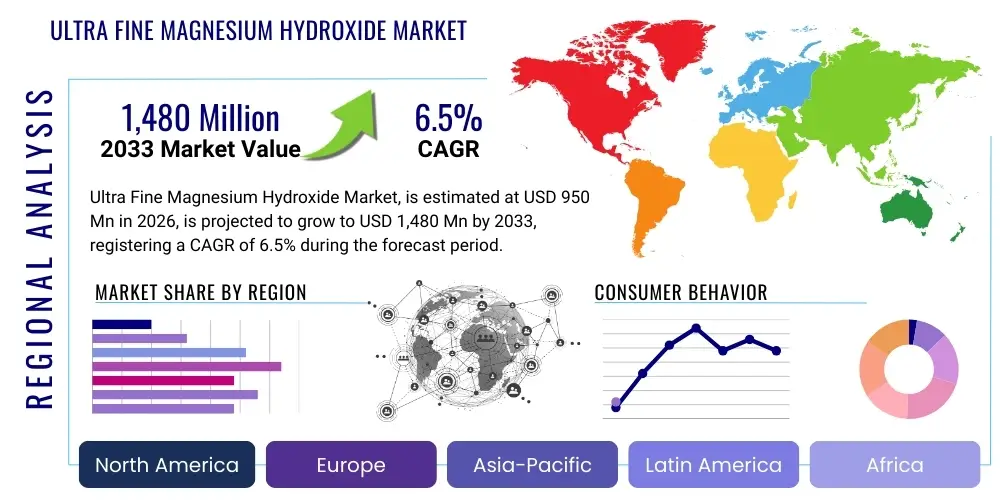

The Ultra Fine Magnesium Hydroxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 950 million in 2026 and is projected to reach USD 1,480 million by the end of the forecast period in 2033.

Ultra Fine Magnesium Hydroxide Market introduction

The Ultra Fine Magnesium Hydroxide (UFMGH) market encompasses the production and distribution of magnesium hydroxide particles with sizes typically ranging from nanometers to a few micrometers. This specialized grade of magnesium hydroxide is crucial due to its dramatically enhanced surface area and reactivity compared to standard technical grades, making it the preferred choice for demanding high-performance applications. UFMGH primarily serves as a high-performance, non-halogenated flame retardant and smoke suppressant, finding extensive use in polymers, plastics, and rubber compounds required across critical sectors such as construction, electrical insulation, high-voltage electronics, and the automotive industry. The product’s efficiency in fire safety applications stems from its unique endothermic decomposition process: when exposed to temperatures around 340°C, it absorbs significant heat, releases water vapor (Mg(OH)2 → MgO + H2O), and forms a protective magnesium oxide layer on the material surface. This combination effectively cools the material, dilutes flammable gases, and shields the underlying polymer, offering a superior environmental and safety profile compared to traditional halogenated alternatives which often release toxic and corrosive smoke. The development of ultra-fine grades addresses the dispersion challenges associated with high filler loadings, maintaining the mechanical and aesthetic properties of the final composite material.

Major applications of Ultra Fine Magnesium Hydroxide span across diverse industrial sectors, driven by increasingly stringent fire safety regulations worldwide, particularly in high-density infrastructure projects and mass transit systems. In the wire and cable sector, UFMGH is indispensable for producing Low Smoke Zero Halogen (LSZH) compounds, essential for ensuring passenger safety in enclosed public spaces, minimizing the risks associated with smoke inhalation and corrosive acid gas generation during a fire event. Beyond its dominant role as a flame retardant, UFMGH is also extensively utilized in specialized environmental applications, such as high-purity wastewater treatment and advanced acid neutralization processes in industrial effluent streams, capitalizing on its high alkalinity, non-toxic nature, and controlled solubility. Its ultra-fine particle size ensures maximum surface reactivity, allowing for efficient chemical reactions in both polymer compounding and environmental remediation systems. This multifunctionality, coupled with its inherent environmental compatibility, solidifies UFMGH's position as a premium specialty chemical additive essential for modern industrial safety and sustainability goals.

The primary driving factors propelling the structural growth of the Ultra Fine Magnesium Hydroxide market include mandatory governmental mandates promoting fire-safe building materials and electronics, coupled with growing global consumer preference and regulatory insistence for sustainable and halogen-free chemical additives. The superior performance characteristics of UFMGH, such as excellent thermal stability, non-corrosive nature, and minimal smoke production, solidify its position as the preferred additive in critical infrastructure components like communication cables and sensitive electronic encapsulation materials. Furthermore, continuous technological advancements in production techniques—including sophisticated wet chemical precipitation methods and surface modification processes—are improving particle size uniformity, purity, and dispersibility. These innovations are leading to the development of highly specialized, functionally tailored UFMGH grades designed for optimal compatibility with specific high-performance polymer matrices, such as those based on PE, EVA, and PVC, significantly enhancing overall efficacy, reducing filler weight, and expanding market penetration across new, specialized segments like electric vehicle battery insulation and advanced composite materials for aerospace applications. The market is increasingly competitive, with leading players focusing heavily on patented surface coating technologies to differentiate their product offerings based on application performance.

Ultra Fine Magnesium Hydroxide Market Executive Summary

The Ultra Fine Magnesium Hydroxide market is currently experiencing robust structural growth, predicated predominantly on the enforcement of rigorous international fire safety standards (IEC, UL, EN) and the accelerated worldwide transition towards non-halogenated flame retardancy solutions, particularly across major economic regions like Europe and Asia Pacific. Key business trends highlight a significant strategic shift toward vertical integration and operational consolidation among market leaders, aimed at securing reliable access to high-purity raw materials, namely magnesite ore and high-quality brine sources, which are essential for maintaining the stringent specifications of ultra-fine grades. Furthermore, intensive capital expenditure is being directed toward enhancing specialized manufacturing capabilities, specifically in advanced chemical precipitation and nano-milling techniques. Innovation in surface treatment technologies, such as microencapsulation, plasma surface activation, and the use of specialized silane and fatty acid coupling agents, remains a critical competitive differentiator. These technological advancements are focused on enabling manufacturers to produce UFMGH grades that offer significantly improved dispersibility and compatibility with hydrophobic polymers, thereby allowing higher loading levels (up to 60-70% weight) without detrimental effects on the polymer’s mechanical integrity, processing characteristics, or visual clarity, addressing the core technical challenge faced by compounders.

From a regional perspective, Asia Pacific (APAC) currently dominates the market volume and maintains the highest projected growth trajectory, a result of unparalleled infrastructural expansion, rapid industrialization, and the massive scale of its electronics and automotive manufacturing bases, particularly within Southeast Asia and the dominant economies of China and India. The increasing domestic demand for fire-safe consumer goods and implementation of new, local fire codes strongly support market expansion in this region. Conversely, Europe represents a mature, high-value market where growth is driven less by volume and more by the persistent need for premium, customized UFMGH grades that strictly comply with highly demanding environmental legislation, such as REACH and RoHS, particularly within the high-value automotive components, specialized railway materials, and energy cable sectors. North America exhibits consistent, steady growth, primarily concentrated in high-specification sectors like aerospace components, industrial coatings, and specialized wire and cable applications related to large-scale power transmission and data centers. The regional divergence in regulatory frameworks necessitates localized product development strategies, focusing on achieving specific national and industrial certifications, which significantly influences investment patterns and supply chain configurations globally.

Analysis of segmentation trends underscores the enduring dominance of the polymer and plastics application sector, especially within the insulation and jacketing of electrical cables, which remains the single largest end-use segment for UFMGH, driven by the requirement for Low Smoke Zero Halogen (LSZH) compounds. In terms of product type, Precipitated Ultra Fine Magnesium Hydroxide (P-UFMGH) continues to command a premium price and is increasingly utilized in advanced applications requiring the utmost purity and particle uniformity, such as electronic potting and high-temperature elastomeric parts. Simultaneously, the environmental applications segment—encompassing advanced flue gas desulfurization (FGD) systems and intricate municipal wastewater treatment facilities—is registering substantial accelerated growth. This segment diversification is key to market resilience, offering new revenue streams independent of traditional construction cycles. Furthermore, the integration of sustainability goals across manufacturing—including the utilization of recycled polymers and the shift towards bio-based resins—is creating specialized opportunities for UFMGH additives, necessitating new research efforts to optimize compatibility and ensure fire integrity within these next-generation composite materials, reinforcing the trend toward functionally surface-modified products.

AI Impact Analysis on Ultra Fine Magnesium Hydroxide Market

User inquiries and industry stakeholder discussions regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) in the Ultra Fine Magnesium Hydroxide sector overwhelmingly focus on enhancing material synthesis precision, optimizing complex formulation processes, and driving predictive analytics throughout the value chain. The complexity of UFMGH manufacturing—involving delicate control over chemical precipitation parameters (like temperature, pH, mixing kinetics, and reagent dosing) to achieve ultra-fine particle size and uniform morphology—makes it an ideal candidate for AI-driven process optimization. Common concerns users express include how AI can guarantee particle size distribution within a nanometer range consistently across large industrial batches, the potential for ML algorithms to significantly reduce raw material waste, and the ability of AI platforms to instantly simulate the performance of new UFMGH grades when compounded with novel polymer systems. The consensus view is that AI is poised to revolutionize the R&D cycle, shifting formulation science from extensive, slow physical testing to rapid, highly accurate computational modeling, thereby accelerating the development of specialized, highly efficacious surface-modified UFMGH products tailored for high-stakes applications like high-voltage EV battery components.

The application of AI extends significantly into operational efficiency and market forecasting. Manufacturers are exploring how predictive maintenance algorithms can monitor the health and performance of expensive milling and reactor equipment in real-time, proactively identifying potential failures and optimizing maintenance schedules, thereby minimizing costly downtime in capital-intensive production facilities. Furthermore, in an industry facing fluctuating raw material costs (e.g., magnesite, energy) and dynamic regulatory changes, AI-powered predictive models are crucial for analyzing geopolitical risks, forecasting supply chain disruptions, and optimizing inventory levels across geographically diverse manufacturing sites. This strategic implementation of AI enables quicker response times to market shifts and ensures a stable supply of specialized UFMGH products to highly regulated end-use sectors, contributing directly to improved profit margins and operational continuity in a globalized specialty chemicals market.

Ultimately, the widespread adoption of AI technology is anticipated to provide a strong competitive edge to early adopters in the UFMGH market. By enabling hyper-efficient process control, AI systems minimize batch variability—a persistent quality challenge in ultra-fine particle manufacturing—and significantly reduce the energy intensity associated with the drying and grinding stages, aligning with corporate sustainability goals. The long-term impact analysis suggests that ML-driven formulation screening will dramatically shorten the innovation lifecycle for new flame retardant compounds, allowing leading players to rapidly introduce materials that meet increasingly stringent and novel performance requirements, such as enhanced anti-dripping characteristics or improved compatibility with high-throughput processing equipment, thereby solidifying their leadership in technology and application science.

- AI-driven optimization of chemical precipitation parameters (temperature, pH, reagent concentration) to ensure consistent, nano-scale particle size distribution and morphology with minimal energy consumption.

- Predictive modeling using machine learning to forecast demand patterns across fluctuating end-use industries (construction, EV manufacturing), enabling proactive raw material procurement and optimized inventory management of specialty UFMGH grades.

- Enhanced quality control through real-time image analysis and spectroscopic data processing of particle aggregates, ensuring adherence to ultra-fine specifications and rapidly minimizing costly batch-to-batch variations.

- Accelerated discovery and screening of novel surface modification agents using AI algorithms, optimizing UFMGH compatibility with specialized hydrophobic engineering plastics for higher loading efficiencies.

- Optimization of energy consumption and process flow in energy-intensive grinding, drying, and classification stages, leading to reduced operational costs, lower carbon footprint, and increased manufacturing sustainability.

- AI integration in complex global supply chain risk management, analyzing geopolitical factors, logistics bottlenecks, and raw material sourcing volatility (e.g., high-purity magnesite) to ensure uninterrupted production flow.

- Computational fluid dynamics (CFD) simulations driven by AI to model dispersion behavior of UFMGH in various polymer melts, predicting compounding efficiency and final composite properties without extensive physical testing.

- Development of digital twins of manufacturing facilities, allowing for scenario analysis and continuous optimization of plant utilization rates and product output yields for different UFMGH types.

DRO & Impact Forces Of Ultra Fine Magnesium Hydroxide Market

The strategic dynamics of the Ultra Fine Magnesium Hydroxide market are primarily dictated by powerful regulatory drivers, challenging inherent material properties, and transformative technological opportunities. The most significant driver is the uncompromising global regulatory landscape that favors non-halogenated flame retardants (NHFRs). Legislation across major economies, including the European Union's REACH and RoHS directives, mandates the phase-out or restriction of brominated and chlorinated flame retardants (BFRs/CFRs) due to their environmental persistence and potential toxicity. This shift creates a non-negotiable pull for mineral-based alternatives like UFMGH, which offer an intrinsically safe, non-toxic, and environmentally benign fire protection solution. The superior mechanism of action—releasing non-toxic steam upon heat exposure and forming a barrier layer—makes it indispensable for critical infrastructure, including hospitals, data centers, and mass transit, where fire integrity and low smoke opacity are paramount safety requirements. Furthermore, the relentless growth in specialized sectors like electric vehicles, requiring fire protection for high-voltage battery systems under extreme thermal stress, continues to amplify this regulatory demand pull, stabilizing UFMGH as a core additive in high-performance composite formulations.

However, the market faces significant material and economic restraints that temper its expansion into broad commodity plastic markets. Foremost among these is the high production cost associated with achieving the ultra-fine particle size and requisite purity (especially for precipitated grades), demanding specialized, energy-intensive grinding, milling, and chemical precipitation technologies. This high cost of production often translates into a substantial price premium compared to commodity flame retardants, making its adoption challenging in highly price-sensitive, large-volume applications. A parallel technical restraint involves the critical challenge of achieving high loading levels (often 50% to 70% by weight) necessary for effective flame retardancy in polymers while simultaneously maintaining the crucial mechanical properties, suchability as tensile strength, flexibility, and impact resistance. High filler loadings of mineral products inherently degrade polymer performance, necessitating complex, costly surface modification processes to mitigate these adverse effects. Overcoming these technical trade-offs requires continuous innovation in surface chemistry and filler integration, adding to the overall cost and complexity of the final compound.

The structural opportunities for growth lie predominantly in technological innovation and diversification into new application areas. The burgeoning electric vehicle (EV) market presents a transformative opportunity, as UFMGH is ideally suited for the high-temperature, lightweight, fire-safe polymers required in battery modules, power electronics, and charging cables. The development of advanced, tailored composite materials for aerospace and defense, which require synergistic properties of lightweight construction, high fire resistance, and minimal smoke generation, represents a high-value, albeit niche, market segment ripe for penetration. Furthermore, expanding the application scope into the environmental sector—such as using highly reactive UFMGH in advanced, low-sludge-producing flue gas desulfurization (FGD) systems and precise industrial wastewater neutralization—offers substantial diversification away from the core flame retardant dependency. These opportunities depend significantly on the continuous successful refinement of particle engineering, functionalization, and developing synergistic systems combining UFMGH with other additives (e.g., red phosphorus or intumescent systems) to achieve optimal performance at lower concentration levels, thereby addressing the loading limitation restraint effectively. The interplay of technological innovation and regulatory pressure acts as a profound dynamic force shaping the competitive strategy and investment roadmap of all major market participants.

Segmentation Analysis

The Ultra Fine Magnesium Hydroxide market segmentation provides a comprehensive breakdown of the diversity in product offerings and their specialized end-use requirements. This market is fundamentally segmented by the method of manufacture into Precipitated Ultra Fine Magnesium Hydroxide (P-UFMGH) and Ground Ultra Fine Magnesium Hydroxide (G-UFMGH). P-UFMGH, synthesized through controlled chemical reactions, offers the superior attributes of highly uniform particle size, spherical or hexagonal platelet morphology, and exceptional purity (typically >99.5%). These characteristics make it the definitive choice for premium, high-stakes applications where performance consistency, transparency, and superior electrical insulation properties are non-negotiable, such as high-end electronic casings, specialized resin systems, and thin-wall electrical insulation. Conversely, G-UFMGH, typically derived from high-purity natural magnesite ore via intensive mechanical milling and classification, provides a more cost-effective solution with excellent bulk performance, making it highly suitable for large-volume industrial applications like construction sector polymers, commodity wire insulation, and general-purpose polymer compounding, where cost management is a primary procurement driver. The distinct characteristics of these two fundamental grades dictate the competitive landscape and pricing structures across the market.

Beyond the grade type, segmentation based on surface treatment is critical, as it directly addresses the material incompatibility challenge inherent in UFMGH use. The market differentiates between Untreated UFMGH, which is suitable only for aqueous systems or highly polar polymers; Organic Surface Treated UFMGH, typically coated with fatty acids (like stearic acid) to enhance hydrophobicity and dispersion in standard polymers like polyolefins (PE, PP); and Inorganic Surface Treated UFMGH, utilizing advanced coupling agents such as silanes or titanates. These inorganic treatments create robust chemical linkages between the UFMGH surface and the polymer matrix, which is essential for maintaining mechanical performance, particularly tensile and flexural strength, in high-performance engineering plastics exposed to moisture or high temperatures, such as those used in aerospace or automotive under-the-hood applications. The choice of surface treatment dictates the maximum possible loading level, processing stability, and the overall final physical properties of the composite, highlighting the value-added nature of this segment.

Finally, the application segmentation reveals the primary revenue streams and future growth opportunities. The Wire and Cable sector, driven by global demand for Low Smoke Zero Halogen (LSZH) cables used in public spaces, remains the largest revenue generator. The broader Plastics and Polymers segment includes both thermoplastics (e.g., EVA, PVC, TPO) and thermosets (e.g., epoxy resins), where UFMGH is utilized for general flame retardancy. The Elastomers and Rubber Products segment focuses on seals, gaskets, and specialized rubber components requiring fire safety, especially in automotive and industrial contexts. Crucially, the Environmental Applications segment, though smaller, is gaining strategic importance, focusing on the highly specialized use of UFMGH in advanced Flue Gas Desulfurization (FGD) processes in power generation and acid neutralization in complex industrial wastewater streams, offering resilience and diversification to the market against fluctuations in construction activity. Each application dictates precise requirements for particle size, surface chemistry, and purity, driving the necessity for highly specialized product portfolios from market suppliers.

- By Grade Type:

- Precipitated Ultra Fine Magnesium Hydroxide (High Purity, Controlled Morphology)

- Ground/Synthetic Ultra Fine Magnesium Hydroxide (Cost-Effective, Bulk Applications)

- By Application:

- Wire and Cable (Low Smoke Zero Halogen - LSZH compounds, High-Voltage Insulation)

- Plastics and Polymers (Thermoplastics, Thermosets, Electronic Encapsulation)

- Elastomers and Rubber Products (Automotive seals, Industrial belting, Hoses)

- Coatings and Resins (Industrial protective coatings, Fire-retardant paints)

- Environmental Applications (Wastewater treatment, Flue Gas Desulfurization, Soil remediation)

- By Surface Treatment:

- Untreated/Bare UFMGH (Aqueous and highly polar systems)

- Organic Surface Treated (e.g., Stearic Acid, Fatty Acid Esters for polyolefins)

- Inorganic Surface Treated (e.g., Silanes, Titanates for engineering plastics and high performance)

Value Chain Analysis For Ultra Fine Magnesium Hydroxide Market

The Ultra Fine Magnesium Hydroxide value chain commences with the upstream extraction and purification of source minerals. This foundational stage involves sourcing high-grade natural magnesite (MgCO3) or accessing high-purity brine solutions derived from seawater or subterranean deposits. For synthetic or precipitated grades, the quality and consistency of the raw material are paramount, as trace impurities significantly affect the final particle morphology and performance. Major chemical companies often vertically integrate to control this upstream supply, engaging in energy-intensive processes like calcination (to produce MgO) followed by hydration (to produce Mg(OH)2). The control over the quality of the precursor materials and the stability of their sourcing logistics—which can be subject to geopolitical and energy price volatility—imparts substantial leverage to the primary raw material suppliers and integrated chemical producers, forming the initial competitive barrier within the market.

The midstream processing phase is the core value-add segment, characterized by specialized and proprietary technological expertise. This involves the complex chemical process of controlled precipitation, crucial for achieving nano-scale particle uniformity and the desired crystalline structure (for P-UFMGH), or intensive mechanical processes like jet milling and ultra-fine grinding (for G-UFMGH). Following particle reduction, the essential step of surface modification occurs. This highly technical process involves coating the UFMGH particles with organic or inorganic functional groups to overcome their natural hydrophilicity, ensuring optimal dispersion in hydrophobic polymer matrices. The efficiency and durability of this surface treatment directly determine the performance metrics of the final compound, including its mechanical integrity and fire-retardant efficacy at high loadings. Companies investing heavily in patented surface chemistry technologies gain a significant competitive advantage here, enabling them to market specialized grades for premium applications like high-flexibility LSZH cables or demanding electronic components.

Downstream activities involve specialized compounding and distribution networks leading to the ultimate end-users. The distribution channel is bifurcated: direct sales are frequently utilized for supplying large-volume, sophisticated customers, such as multinational wire and cable manufacturers and global automotive compounders who purchase UFMGH in bulk for proprietary formulations. Conversely, indirect distribution relies heavily on specialty chemical distributors who manage warehousing, logistical complexity, and technical support for smaller-to-medium sized compounders and localized manufacturing operations across various regions. End-users—including producers of PVC sheeting, electrical conduits, injection-molded automotive parts, and specialized industrial coatings—rely on these compounders to provide ready-to-use masterbatches. Value addition at the downstream level focuses intensely on application engineering, ensuring that the formulated material not only meets the specific processing requirements of the end-user (e.g., extrusion temperature, shear forces) but, critically, complies with the complex array of local, national, and international fire safety certifications (e.g., NFPA, VDE, GOST standards). Technical service and regulatory compliance expertise are therefore paramount for success in the final stages of the Ultra Fine Magnesium Hydroxide value chain.

Ultra Fine Magnesium Hydroxide Market Potential Customers

The market for Ultra Fine Magnesium Hydroxide is driven by several highly demanding customer segments that prioritize safety, performance, and environmental compliance. The most dominant and indispensable segment consists of global and regional manufacturers of electrical wire and cable. These customers, operating primarily in the power transmission, telecommunications, and construction sectors, require vast quantities of UFMGH to produce Low Smoke Zero Halogen (LSZH) sheathing and insulation compounds. Their purchasing decisions are dictated by rigorous international standards (such as IEC 60332 and EN 50267) mandating minimal smoke opacity and zero corrosive gas release in the event of a fire, making UFMGH a non-substitutable ingredient for applications in public infrastructure, tunnels, airports, and marine vessels. This segment seeks grades offering high purity, excellent thermal stability, and superior compatibility with polyolefins and EVA.

A second major customer base is the specialized segment of polymer compounders and manufacturers operating within the Electrical and Electronics (E&E) industry. This includes producers of components for consumer electronics, industrial machinery, and high-performance computing, where materials must meet stringent fire safety standards like UL 94 V-0 for housing components and internal circuit boards. These customers often require precipitated, highly refined UFMGH grades to maintain excellent dielectric properties and mechanical performance in thin-wall applications and intricate electronic encapsulation resins. The rapid expansion of 5G infrastructure and the increasing complexity of data centers further amplify the demand from this sector, where non-flammability and low corrosivity are essential for protecting sensitive equipment. Furthermore, the rapidly expanding automotive sector, especially manufacturers focused on Electric Vehicle (EV) components, presents a burgeoning, high-value customer base. They utilize UFMGH in battery pack insulation, high-voltage wiring harnesses, and interior materials to manage thermal runaway risks and comply with escalating automotive fire protection requirements, favoring specialized, surface-treated grades that contribute to vehicle lightweighting.

Finally, a significant, non-traditional customer segment is found in heavy industrial and environmental sectors. This includes operators of coal-fired power plants and large industrial boilers, who utilize UFMGH as a highly efficient reagent in Flue Gas Desulfurization (FGD) systems to remove sulfur dioxide emissions, driven by environmental regulations. Similarly, municipal and large industrial wastewater treatment facilities utilize UFMGH for effective, safe pH neutralization and heavy metal precipitation, preferring it over alternatives like lime due to its non-corrosive handling characteristics and superior reaction kinetics. These diverse end-users ensure market stability by providing off-take demand that is insulated from the cyclical nature of the construction and electronics markets. Their requirements focus less on particle dispersion and more on consistent chemical reactivity and high purity for process efficiency and environmental compliance, demanding specialized high-volume industrial grades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 Million |

| Market Forecast in 2033 | USD 1,480 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Albemarle Corporation, Martin Marietta Materials, Kyowa Chemical Industry Co., Ltd., Huber Engineered Materials, ICL Group, Magnifin Magnesiaprodukte GmbH & Co KG, R. Grace & Co., Kumas, Israel Chemicals Ltd., Konoshima Chemical Co., Ltd., Wuxi City Xinghe Chemical Co., Ltd., Russian Mining Chemical Company (RMCC), Baymag Inc., Qingdao Marine Chemical Co., Ltd., J. M. Huber Corporation, Sakai Chemical Industry Co., Ltd., Nikko Materials, Kisuma Chemicals, Shandong Taimei Chemical Co. Ltd., Shandong Xinchang Chemical Co. Ltd., Mitsubishi Chemical Corporation, Sibelco, Refratechnik Group, Possehl Erzkontor GmbH, Premier Magnesia LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultra Fine Magnesium Hydroxide Market Key Technology Landscape

The technological sophistication of the Ultra Fine Magnesium Hydroxide market dictates product quality, cost structure, and competitive differentiation. The paramount technological category is focused on particle synthesis and morphology control, specifically through advanced wet chemical precipitation methods. These proprietary processes involve highly controlled reaction conditions—including precise monitoring of parameters such as supersaturation, pH gradients, temperature profiles, and specialized seeding techniques—to facilitate the homogeneous nucleation and growth of magnesium hydroxide crystals. Manufacturers leverage these methods to produce P-UFMGH with high aspect ratios, specific platelet thicknesses, or spherical morphologies, which are crucial for optimal performance in polymer rheology and fire suppression efficiency. Innovations in continuous flow reactors versus traditional batch systems are being aggressively pursued to enhance scalability, reduce production cycle times, and minimize batch-to-batch variation, thereby ensuring the ultra-high purity and consistency demanded by the most exacting end-use industries, such as medical devices and high-end electronics where material defects cannot be tolerated.

The second essential technological area encompasses mechanical particle reduction and classification, primarily utilized for converting calcined natural magnesite into cost-effective, high-volume G-UFMGH. Modern technology utilizes highly energy-efficient equipment, such as air-jet mills, fluidized bed mills, and advanced mechanical impactors, capable of generating particle sizes reliably in the sub-micron to low-micron range without causing significant thermal degradation or aggregation. The critical advancement in this domain involves precision air classification systems, which are integral for separating particles into narrow size distribution bands, ensuring the consistency required for polymer compounding. Recent R&D efforts are focused on developing hybrid milling techniques that combine mechanical grinding with surface activation treatments during the milling process itself (mechanochemical modification). This approach aims to reduce the particle size and simultaneously condition the surface for better polymer compatibility, offering a dual benefit of efficiency and enhanced performance, thereby incrementally closing the performance gap between the lower-cost ground grades and the premium precipitated products.

The third, and increasingly critical, set of technologies relates to surface engineering and functionalization, which represents the primary source of intellectual property and competitive edge in the high-end UFMGH market. Since magnesium hydroxide is inherently hydrophilic, its bare form poorly integrates with hydrophobic polymers (like PE or PP). Key technological innovations here include developing proprietary organic coatings (such as specialty functionalized fatty acids, polymeric dispersants, and waxes) and advanced inorganic coupling agents (silanes, titanates, aluminates). The deposition of these coatings must be precise and uniform, often employing sophisticated dry coating techniques like high-intensity mixing or electrostatic spray deposition under controlled atmospheric conditions. The latest frontier involves nanocapsulation and core-shell technologies, where the UFMGH particle is entirely encapsulated by a thin polymeric or inorganic layer. This not only enhances dispersion, allowing for higher filler loading, but also improves the material’s resistance to moisture uptake and its processing stability at elevated temperatures, which is a vital requirement for high-speed compounding operations in sectors like automotive manufacturing and high-speed data cabling. Continuous monitoring technologies, often integrated with AI, are used to ensure the uniformity and integrity of the coating layer across all production batches.

Regional Highlights

- Asia Pacific (APAC): APAC commands the dominant market share and exhibits the most aggressive growth rate globally. This unparalleled growth is fundamentally fueled by explosive rates of urbanization, monumental government-led infrastructure projects (e.g., smart cities, high-speed rail networks, massive energy grids), and the relocation and expansion of global manufacturing, particularly in the electronics and electric vehicle supply chains, across Southeast Asia, China, and India. The region's regulatory landscape is rapidly maturing, with countries increasingly adopting and enforcing international fire safety standards (e.g., those governing LSZH compounds for public transit systems), compelling a large-scale substitution of legacy halogenated flame retardants with UFMGH. Furthermore, the substantial local availability of high-purity magnesite in China and other surrounding areas facilitates competitive local sourcing and production, reinforcing APAC's position as both the largest producer and consumer of Ultra Fine Magnesium Hydroxide, driving high-volume demand for both ground and precipitated grades across commodity and specialized polymer applications.

- Europe: Europe represents the global benchmark for regulatory-driven demand, characterized by a sophisticated and highly specialized market. The stringent enforcement of environmental legislation, notably the European Union’s REACH regulation and Directives on the Restriction of Hazardous Substances (RoHS), makes non-halogenated flame retardants like UFMGH essential across almost all industrial applications, especially in the automotive, high-end construction, and aerospace sectors. The European market demands premium-quality, highly consistent, and specifically surface-modified UFMGH grades tailored to integrate seamlessly into complex engineering plastics, thereby maintaining high mechanical performance and meeting rigorous VDE and EN fire standards. Growth in Europe is qualitative, focusing on high-value applications such as high-temperature cable insulation for offshore wind farms and railway rolling stock, emphasizing sustainability and technical excellence over sheer volume consumption.

- North America: North America maintains a strong and stable market presence, driven predominantly by rigorous safety standards established by organizations such as the National Fire Protection Association (NFPA) and Underwriters Laboratories (UL), which dictate materials selection in the significant building and construction sector. High demand originates from specialized segments including industrial coatings, insulation materials for large data center infrastructure, and high-voltage power cable networks, where fire safety and reliability are critical concerns. The accelerating adoption of electric vehicles and associated charging infrastructure further stimulates demand for high-specification UFMGH in thermal management and fire protection systems for battery modules. The market is highly competitive, with a preference for domestically produced or regionally sourced specialty chemical products, often focusing on high-performance precipitated grades that guarantee product consistency and compliance with demanding state-level regulations.

- Latin America (LATAM): The LATAM market is currently in an emerging phase, with growth trajectory closely tied to regional economic stability, rates of urbanization, and public investment in modernization of utility and transportation infrastructure, particularly in the major economies of Brazil, Mexico, and Chile. While price sensitivity remains a considerable constraint, leading to a higher usage of more cost-effective ground UFMGH grades, the progressive tightening of local fire safety and building codes is steadily increasing the adoption of non-halogenated solutions. The primary application driver is the need for safer cabling and construction materials in major metropolitan centers. Market penetration is expected to increase significantly as safety standards harmonize with international norms, opening opportunities for global suppliers to introduce specialized surface-modified products.

- Middle East and Africa (MEA): Growth in the MEA region is strongly concentrated within the Gulf Cooperation Council (GCC) states, driven by monumental construction and infrastructural diversification projects, particularly in Saudi Arabia, UAE, and Qatar. The demand environment is unique, characterized by the need for materials that can withstand extremely high ambient temperatures and harsh environmental conditions while complying with demanding fire safety regulations for critical assets like oil and gas facilities, petrochemical plants, and large commercial developments. UFMGH is valued here for its high thermal decomposition temperature and stability. The African continent presents disparate growth pockets, mainly driven by localized industrialization and public sector infrastructure upgrades, with significant future potential once regulatory frameworks become more universally established and enforceable across national boundaries, prioritizing essential fire safety in public utilities and residential construction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultra Fine Magnesium Hydroxide Market.- Albemarle Corporation

- Martin Marietta Materials

- Kyowa Chemical Industry Co., Ltd.

- Huber Engineered Materials

- ICL Group

- Magnifin Magnesiaprodukte GmbH & Co KG

- R. Grace & Co.

- Kumas

- Israel Chemicals Ltd.

- Konoshima Chemical Co., Ltd.

- Wuxi City Xinghe Chemical Co., Ltd.

- Russian Mining Chemical Company (RMCC)

- Baymag Inc.

- Qingdao Marine Chemical Co., Ltd.

- J. M. Huber Corporation

- Sakai Chemical Industry Co., Ltd.

- Nikko Materials

- Kisuma Chemicals

- Shandong Taimei Chemical Co. Ltd.

- Shandong Xinchang Chemical Co. Ltd.

- Mitsubishi Chemical Corporation

- Sibelco

- Refratechnik Group

- Possehl Erzkontor GmbH

- Premier Magnesia LLC

Frequently Asked Questions

Analyze common user questions about the Ultra Fine Magnesium Hydroxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism by which UFMGH achieves fire retardancy?

Ultra Fine Magnesium Hydroxide achieves fire retardancy through an endothermic decomposition process. Upon heating (around 340°C), it absorbs heat from the fire (cooling the material), releases inert water vapor (diluting flammable gases), and forms a protective, ceramic-like layer of magnesium oxide on the polymer surface, effectively shielding the underlying material from further combustion.

How do global environmental regulations influence the demand trends for Ultra Fine Magnesium Hydroxide?

Global environmental regulations, particularly Europe's REACH and RoHS directives, severely restrict the use of traditional halogenated flame retardants (BFRs) due to their toxicity and environmental persistence. This regulatory pressure mandates the adoption of safer, mineral-based alternatives, positioning UFMGH as a preferred, non-toxic, and low-smoke solution, thereby driving its market growth exponentially.

What are the typical application differences between surface-treated and untreated UFMGH grades?

Untreated UFMGH is predominantly used in aqueous or highly polar polymer systems (like thermosets). In contrast, surface-treated UFMGH, functionalized with organic or inorganic coatings (e.g., silanes), is essential for use in hydrophobic polymer matrices (e.g., polyethylene, polypropylene). The treatment enhances dispersion, prevents agglomeration, and maintains the mechanical integrity of the final composite, crucial for demanding industrial applications.

What role does Ultra Fine Magnesium Hydroxide play in the electric vehicle (EV) industry?

UFMGH is crucial in the EV industry for enhancing the safety and thermal management of battery systems and high-voltage components. It is compounded into engineering plastics used for battery casings, insulation, and charging cables to provide effective fire retardancy, manage thermal runaway, and ensure compliance with stringent automotive safety standards for passenger protection.

Why is high filler loading a significant technical challenge for UFMGH manufacturers?

Effective fire retardancy often requires loading UFMGH at high concentrations (up to 70% by weight). This high mineral loading can severely compromise the mechanical properties (like flexibility and tensile strength) and processability of the polymer. Manufacturers address this challenge through advanced surface modification technologies and particle engineering to mitigate adverse effects and improve filler-matrix compatibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager