Ultra Fine Silver Powders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435236 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Ultra Fine Silver Powders Market Size

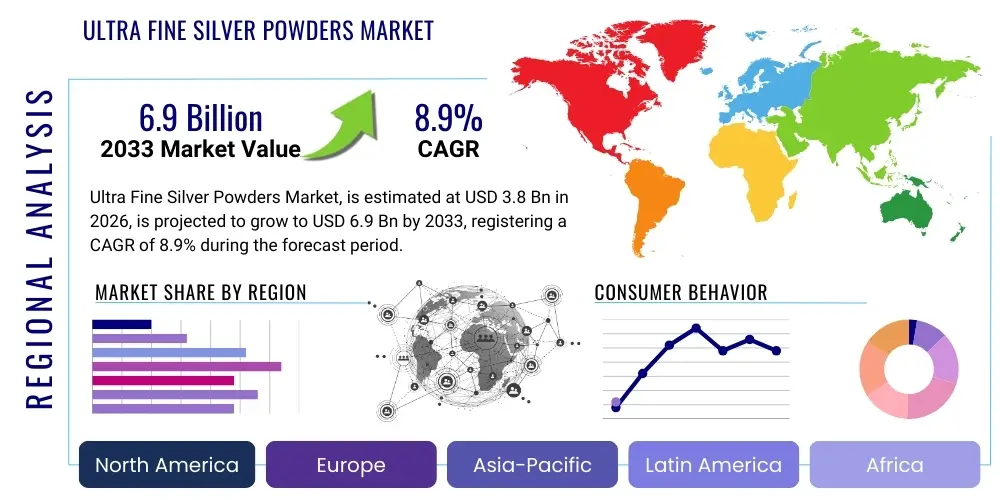

The Ultra Fine Silver Powders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 6.9 Billion by the end of the forecast period in 2033.

Ultra Fine Silver Powders Market introduction

Ultra Fine Silver Powders, often characterized by particle sizes ranging from tens of nanometers up to a few micrometers, represent a critical category of advanced materials vital across several high-technology sectors. These powders exhibit superior electrical conductivity, high surface area, and robust antibacterial properties, distinguishing them from conventional bulk silver materials. The unique properties inherent in these fine particles, such as reduced sintering temperatures and enhanced reactivity, make them indispensable components in cutting-edge electronics and emerging biomedical applications. The market expansion is intrinsically linked to the global acceleration of digitalization, miniaturization of electronic devices, and the continuous demand for highly efficient conductive materials in printed electronics (PE).

The primary applications driving the consumption of ultra fine silver powders include conductive inks and pastes utilized in solar cells (photovoltaics), touch panels, radio-frequency identification (RFID) tags, and various printed circuit board (PCB) components. In the solar energy sector, silver paste is crucial for creating the front-side and back-side electrodes of crystalline silicon solar cells, significantly impacting energy conversion efficiency. Furthermore, the burgeoning electric vehicle (EV) market and advanced packaging technologies in semiconductors rely heavily on high-purity, ultra fine silver materials for robust and reliable interconnections.

Key benefits associated with using ultra fine silver powders include enhanced performance attributes such as superior thermal management capabilities, extremely low resistivity in conductive traces, and flexibility in manufacturing processes, especially in additive manufacturing techniques. Major driving factors for market growth include supportive government policies promoting renewable energy infrastructure globally, massive investment in 5G and 6G network deployment requiring high-performance electronic components, and the ongoing shift toward flexible electronics. However, the high cost of silver raw materials and volatility in supply chains present persistent challenges that necessitate continuous innovation in production cost optimization.

Ultra Fine Silver Powders Market Executive Summary

The global Ultra Fine Silver Powders market is witnessing rapid expansion driven primarily by the escalating demand for high-performance electronic packaging and the ubiquitous integration of photovoltaic technology. Business trends indicate a strong move towards customization, with manufacturers focusing on tailored particle morphologies (spherical, flaky, dendritic) and specialized surface coatings to meet stringent application requirements in advanced semiconductors and flexible displays. Strategic collaborations between materials suppliers and end-user device manufacturers are becoming prevalent, aiming to optimize ink and paste formulations for specific printing techniques like inkjet and aerosol jet printing. Furthermore, sustainability is emerging as a critical business consideration, pushing R&D efforts towards high-efficiency, low-silver-loading formulations to mitigate material cost pressures while maintaining performance integrity.

Regionally, the Asia Pacific (APAC) stands as the undisputed epicenter for market growth, underpinned by its dominance in global electronics manufacturing, solar cell production, and robust investments in consumer electronics assembly hubs across China, South Korea, and Taiwan. Europe and North America, while having mature markets, are focusing on high-value, niche applications such as aerospace electronics, specialized medical devices, and advanced automotive sensors, prioritizing quality and reliability over sheer volume. The competitive landscape is characterized by intense technological rivalry, forcing key players to constantly enhance powder purity, control particle size distribution (PSD), and introduce highly stable, ready-to-use conductive pastes that simplify integration for industrial users.

Segment trends underscore the supremacy of the Electronics segment due to the pervasive integration of silver paste in bonding, shielding, and conducting applications across smartphones, computers, and sophisticated sensing equipment. Within application types, thick film paste formulations currently command the largest market share but are increasingly challenged by advancements in nano-scale inks designed for thin-film applications and high-resolution printing processes. The shift toward nano silver powders, driven by the needs of advanced printed electronics requiring resolution far exceeding traditional printing methods, promises significant long-term growth opportunities, fundamentally altering the existing market dynamics concerning material cost-to-performance ratio.

AI Impact Analysis on Ultra Fine Silver Powders Market

User inquiries frequently center on how Artificial Intelligence (AI) and machine learning (ML) are influencing the efficiency, quality control, and R&D cycles within the ultra fine silver powders industry. Key concerns revolve around AI's ability to predict optimal synthesis parameters, analyze material defects in real-time, and accelerate the discovery of new conductive formulations, particularly in conjunction with generative design tools. Users expect AI to reduce the variability inherent in chemical synthesis processes, leading to higher batch consistency and lower production costs. They are also keen on understanding how AI-driven predictive maintenance can optimize expensive manufacturing equipment and minimize downtime, ensuring a stable supply of high-purity powders essential for sensitive electronic applications.

- AI-driven optimization of material synthesis parameters (e.g., precipitation rate, temperature, solvent ratios) leading to precise control over particle morphology and size distribution (PSD).

- Enhanced quality control using machine vision and ML algorithms for real-time defect detection during powder production and conductive paste formulation.

- Accelerated R&D by simulating the performance of novel silver particle structures and composite inks before physical experimentation, reducing time-to-market.

- Predictive modeling of raw silver commodity price volatility, aiding procurement strategies and minimizing input cost risks for manufacturers.

- Optimization of inventory management and supply chain logistics using AI forecasting tools, ensuring timely delivery to high-demand sectors like 5G infrastructure and solar manufacturing.

- AI facilitating the development of low-sintering temperature silver inks, enabling broader use on heat-sensitive flexible substrates.

DRO & Impact Forces Of Ultra Fine Silver Powders Market

The Ultra Fine Silver Powders market is currently propelled by significant global drivers, predominantly the explosive growth in photovoltaic installations worldwide and the escalating complexity and demand for miniaturization in consumer electronics, including next-generation smartphones and wearable devices. These driving forces create substantial volume demand for high-quality conductive pastes and inks. However, the market faces considerable restraints, notably the persistently high and often volatile pricing of silver as a commodity, which puts continuous pressure on manufacturers’ margins and necessitates investment in alternative lower-cost conductive materials, such as copper or aluminum, although they do not yet match silver's performance. Furthermore, strict environmental regulations concerning nanoparticle waste disposal and handling present operational hurdles that require significant compliance investments.

Opportunities abound in emerging technological niches, particularly the rapid commercialization of flexible and stretchable electronics, which are poised to redefine human-machine interfaces and medical diagnostics. The increasing adoption of 3D printing technologies (additive manufacturing) for electronics fabrication, requiring specialized high-viscosity, ultra fine silver inks, offers a fertile ground for market expansion. Additionally, the automotive industry's electrification trend, necessitating durable, reliable silver-based connections for power electronics and battery management systems (BMS), represents a multi-billion dollar opportunity. Leveraging these opportunities requires strategic partnerships and continuous material innovation to maintain a competitive edge.

The market impact forces are highly concentrated around technological substitution risk and standardization requirements. The risk of substituting silver with cheaper alternatives, particularly nano-copper, acts as a continuous ceiling on pricing and forces silver manufacturers to justify the premium cost through superior performance characteristics (e.g., oxidation resistance, high frequency performance). Standardization in conductive paste specifications, especially within the highly regulated aerospace and medical device sectors, dictates product development pathways. Overall, the market remains highly dynamic, where the interplay of cost pressures (Restraint) and performance demand (Driver) defines the innovation trajectory, while opportunities in new applications provide crucial long-term growth visibility.

Segmentation Analysis

The Ultra Fine Silver Powders market is meticulously segmented based on particle size, ensuring tailored performance characteristics suitable for diverse end-use applications; by product type, differentiating between spherical, flake, and dendritic morphologies; and by application, highlighting critical end-use industries such as electronics, photovoltaics, and medical devices. This structure allows both suppliers and end-users to precisely match material specifications with operational requirements, significantly impacting process efficiency and final product performance. The choice of segmentation parameters is directly tied to the desired conductivity, sintering behavior, and stability required in the subsequent conductive paste or ink formulation.

Particle size segmentation, particularly the nano-size category (less than 100 nm), is currently experiencing the fastest growth due to its necessity in high-resolution, low-temperature curing printed electronics required for flexible substrates and advanced display technologies. Meanwhile, the micron-sized segment retains a large market share, particularly in traditional thick film applications, solar cell metallization, and certain durable electronic bonding processes where material cost-effectiveness and volume are prioritized. The application segmentation clearly shows the dominance of the Electronics sector, which includes everything from integrated circuits to simple conductive traces, reinforcing the centrality of ultra fine silver in the modern digital infrastructure.

- By Particle Size:

- Nano-sized Silver Powder (1 nm to 100 nm)

- Micron-sized Silver Powder (100 nm to 10 µm)

- By Morphology:

- Flake Silver Powder

- Spherical Silver Powder

- Dendritic Silver Powder

- By Application:

- Electronics (Conductive Pastes, Electromagnetic Shielding, Multilayer Ceramic Capacitors (MLCCs))

- Photovoltaics (Solar Cell Electrodes)

- Chemical Catalysts

- Medical and Healthcare (Antibacterial Coatings, Diagnostic Sensors)

- Others (Automotive, RFID)

- By End-Use Industry:

- Consumer Electronics

- Automotive

- Renewable Energy

- Aerospace and Defense

- Healthcare

Value Chain Analysis For Ultra Fine Silver Powders Market

The value chain for Ultra Fine Silver Powders begins with the rigorous upstream analysis involving the sourcing and refinement of high-purity silver precursors, typically silver nitrate. Given the necessity for ultra fine and nano materials, the purity of the raw metal is paramount, influencing the final electrical performance and long-term stability of the powder. Primary manufacturers focus heavily on chemical precipitation methods, physical vapor deposition, or wet-chemical synthesis techniques to achieve precise particle size distribution and morphology. Investment in specialized equipment for high-volume, contamination-free production is a significant barrier to entry at this stage, dictating the concentration of specialized material producers primarily in Asia and North America.

The midstream stage involves the conversion of the raw silver powders into finished products, primarily high-performance conductive inks and pastes. This involves blending the silver powder with various organic vehicles, binders, and solvents to achieve desired rheological properties necessary for specific printing or dispensing techniques (e.g., screen printing, jet printing, dipping). Key players in this stage, often integrated specialty chemical companies, must possess deep expertise in material science and formulation chemistry. The efficiency and quality of this conversion step directly impact the end-user's manufacturing yield, making proprietary paste formulation a critical competitive advantage.

Downstream analysis focuses on the distribution channel and the end-use application segments. Distribution often involves a mix of direct sales channels for major OEM customers (especially in solar and automotive sectors) and indirect channels utilizing specialized distributors and agents for smaller electronics fabricators and R&D institutions. The direct channel ensures tight control over product specifications and technical support, which is essential for high-precision applications. End-users in electronics, photovoltaics, and medical devices utilize the finished conductive materials to fabricate components, where the performance, reliability, and sintering characteristics of the ultra fine silver powder directly determine the functionality and longevity of the final electronic device or solar cell.

Ultra Fine Silver Powders Market Potential Customers

The primary customers for Ultra Fine Silver Powders are manufacturers engaged in producing advanced electronic components and devices requiring superior conductivity, thermal management, and reliability. This encompasses large-scale electronics manufacturing service (EMS) providers, photovoltaic cell producers, and specialized thick film paste formulators who aggregate the raw powder and convert it into ready-to-use conductive materials. Given the material’s high cost and specific performance criteria, customers typically possess high technical capabilities and stringent quality requirements, often necessitating custom material specifications tailored to their proprietary production lines.

Key buying centers within these organizations include R&D departments focused on material innovation, procurement teams responsible for sourcing high-value raw materials, and process engineering units focused on yield and efficiency improvements. For instance, solar cell manufacturers are continually seeking silver powders that enable thinner lines and lower lay-down weights to reduce silver consumption while maintaining or enhancing efficiency. Similarly, semiconductor packaging firms require ultra fine silver for die attach applications where high thermal dissipation is critical, demanding specific particle shape and high purity levels to ensure long-term reliability in severe operating environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.9 Billion |

| Growth Rate | CAGR 8.9% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ames Goldsmith Corporation, DuPont (Meger with Dow Chemical), Tanaka Kikinzoku Kogyo, DOWA High-Tec Co., Ltd., Sumitomo Metal Mining Co., Ltd., Heraeus Group, Technic Inc., Mitsui Kinzoku, Metalor Technologies SA, C.I. Kasei Co., Ltd., Nano-Tech (Suzhou) Co., Ltd., Shin Nihon Kogyo Co., Ltd., Shanghai Tankii Advanced Materials Co., Ltd., XFNANO, Chemet Corporation, PVD Advanced Materials, American Elements, Umicore, Alpha Assembly Solutions, Chengdu Guibao Science and Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultra Fine Silver Powders Market Key Technology Landscape

The manufacturing of Ultra Fine Silver Powders is dominated by advanced chemical synthesis methods, crucial for controlling the morphology and particle size distribution (PSD) critical for specific electronic performance. The primary technologies include chemical precipitation, polyol synthesis, and reduction methods utilizing controlled reagents to yield high-purity particles, often followed by sophisticated washing and drying processes to prevent agglomeration. Polyol synthesis, in particular, is highly favored for producing nano-sized silver powders due to its scalability and ability to yield highly crystalline structures with narrow PSDs, essential for high-resolution printing applications like inkjetting onto flexible substrates.

Beyond the synthesis, critical technologies lie in the surface modification and functionalization of the powders. Manufacturers increasingly apply stabilizing and protective organic coatings to the silver particles to prevent oxidation during storage and processing, and to ensure compatibility with various solvents used in conductive ink and paste formulations. These surface treatments are pivotal for achieving low-temperature sintering capabilities, allowing the final electronic traces to be cured efficiently without damaging heat-sensitive components or substrates, thus accelerating adoption in flexible electronics and bio-sensors.

The technological landscape also incorporates advanced characterization techniques such as Transmission Electron Microscopy (TEM), Dynamic Light Scattering (DLS), and specific surface area (BET) analysis. These tools ensure rigorous quality control over particle size, morphology, and dispersibility, which are the fundamental determinants of final product conductivity and reliability. The convergence of these material science technologies with advanced printing methods—such as micro-dispensing and high-speed rotary screen printing—is shaping the future of electronic manufacturing, consistently demanding smaller, more stable, and highly conductive silver materials to facilitate miniaturization and integration in advanced packaging.

Regional Highlights

- Asia Pacific (APAC): APAC commands the dominant market share, driven by its expansive electronics manufacturing ecosystem in countries like China, South Korea, Japan, and Taiwan. The region is the global hub for consumer electronics assembly, semiconductor production, and photovoltaic cell manufacturing, all high-volume consumers of ultra fine silver powders. Government initiatives supporting solar energy and massive internal investment in 5G infrastructure further solidify APAC’s growth trajectory, making it the most critical region for volume production and consumption.

- North America: This region focuses heavily on high-value, niche segments, including aerospace and defense electronics, advanced medical devices (e.g., printed sensors), and high-reliability automotive components. Demand here is characterized by stringent quality requirements and a preference for highly specialized, often proprietary, conductive formulations. North America remains a significant center for R&D in printed electronics and additive manufacturing, driving continuous innovation in nano silver technology.

- Europe: European market growth is primarily fueled by the strong automotive industry, particularly electric vehicle (EV) manufacturing, which requires robust silver materials for power electronics and thermal interface management. Furthermore, the region is actively investing in smart grid infrastructure and specialized industrial electronics, necessitating reliable, high-pperformance silver pastes. Strict environmental and materials regulations also influence European producers to focus on low-toxicity and sustainable production methods.

- Latin America (LATAM) and Middle East & Africa (MEA): While smaller in comparison, these regions are emerging as important growth areas, particularly due to increasing infrastructure development and nascent solar energy adoption. Growth in LATAM is linked to expanding domestic electronics assembly and automotive parts production, while MEA benefits from large-scale solar projects and infrastructure investment, gradually increasing the localized demand for silver-based conductive materials, though much is currently imported.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultra Fine Silver Powders Market.- Ames Goldsmith Corporation

- DuPont (Meger with Dow Chemical)

- Tanaka Kikinzoku Kogyo

- DOWA High-Tec Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Heraeus Group

- Technic Inc.

- Mitsui Kinzoku

- Metalor Technologies SA

- C.I. Kasei Co., Ltd.

- Nano-Tech (Suzhou) Co., Ltd.

- Shin Nihon Kogyo Co., Ltd.

- Shanghai Tankii Advanced Materials Co., Ltd.

- XFNANO

- Chemet Corporation

- PVD Advanced Materials

- American Elements

- Umicore

- Alpha Assembly Solutions

- Chengdu Guibao Science and Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Ultra Fine Silver Powders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Ultra Fine Silver Powders market?

The primary driver is the pervasive demand for miniaturization and enhanced performance in consumer electronics, coupled with the rapid, global expansion of the photovoltaic industry, where ultra fine silver pastes are essential for efficient solar cell metallization.

How does particle size influence the application of silver powders?

Smaller, nano-sized silver powders are crucial for high-resolution printed electronics and low-temperature sintering on flexible substrates, while larger, micron-sized powders are typically used in cost-effective thick film applications and traditional solar cell electrodes requiring higher material volume.

What major restraint affects the profitability of silver powder manufacturers?

The high volatility and inherently elevated cost of silver as a commodity metal impose significant margin pressure and necessitate continuous R&D into low-sintering, high-efficiency formulations that minimize the required silver content per device.

Which industry segment holds the largest share in the Ultra Fine Silver Powders Market?

The Electronics segment, encompassing conductive pastes for semiconductor packaging, multilayer ceramic capacitors (MLCCs), and electromagnetic shielding applications, consistently commands the largest market share due to the widespread use of silver in modern digital devices.

What is the role of AI in the manufacturing process of ultra fine silver powders?

AI is increasingly used to optimize synthesis parameters, ensuring precise control over particle morphology and size distribution, and for real-time quality control to minimize defects and enhance batch consistency, thereby increasing production efficiency and reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager