Ultra High Purity Colloidal Silica Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432406 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Ultra High Purity Colloidal Silica Market Size

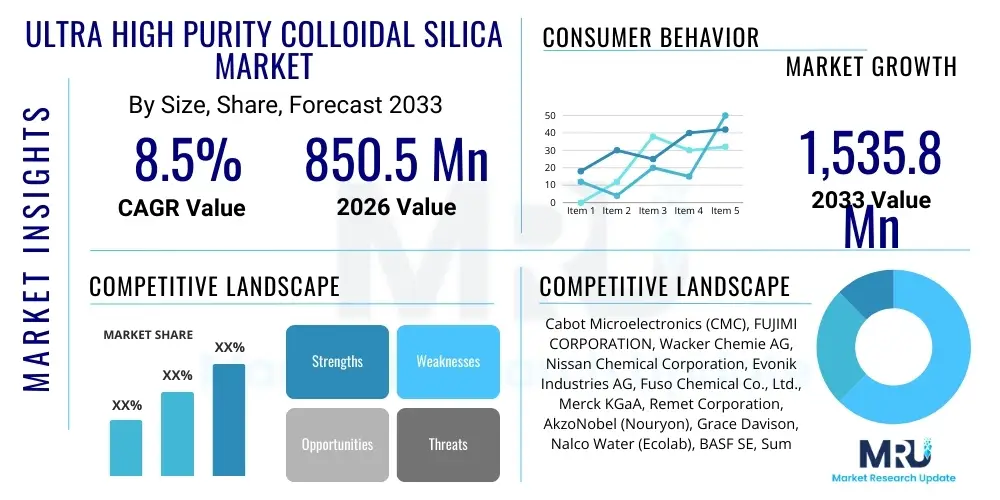

The Ultra High Purity Colloidal Silica Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,535.8 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for advanced materials in the semiconductor industry, particularly for Chemical Mechanical Planarization (CMP) slurries, where material purity is paramount for achieving complex nanoscale device architectures. The market's valuation reflects the high cost associated with producing these materials, which require stringent control over particle size distribution, morphology, and trace metal contamination levels, crucial for preventing defects in high-performance electronics.

Market growth is further supported by innovations in adjacent sectors such as advanced coatings, precision casting, and specialized biomedical applications. Ultra High Purity (UHP) colloidal silica, characterized by particle sizes typically ranging from 5 nm to 100 nm and impurity levels often below parts per billion (ppb), provides superior surface finish and stability compared to standard grades. The increasing sophistication of electronic devices, including memory chips, logic integrated circuits, and advanced packaging solutions, necessitates materials that can consistently deliver ultra-flat surfaces with minimal defectivity, thereby locking in strong long-term demand for UHP products.

Ultra High Purity Colloidal Silica Market introduction

Ultra High Purity Colloidal Silica constitutes a specialized segment of the broader silica market, encompassing stable dispersions of non-porous silica nanoparticles in an aqueous or organic solvent base, distinguished by their exceptional chemical purity and narrow particle size distribution. These properties are critical for their use in high-technology applications where even trace contaminants can degrade performance. The primary product description highlights their amorphous nature, high specific surface area, and highly controlled surface chemistry, which dictates their stabilization mechanism—often alkaline (ammonia stabilized) or acidic (ion-exchange derived). UHP grades are typically utilized where stringent quality control is mandatory, ensuring compatibility with sensitive manufacturing processes.

Major applications of UHP colloidal silica center heavily on the electronics industry, primarily as a key component in Chemical Mechanical Planarization (CMP) slurries used to polish silicon wafers and inter-layer dielectrics during semiconductor fabrication. Beyond semiconductors, their applications span high-performance functional coatings for aerospace and automotive industries, advanced binders in precision investment casting to achieve dimensional accuracy, and specialty fillers in biomedical and dental materials. The core benefits include superior thermal stability, excellent binding strength, enhanced friction control, and the ability to act as a highly effective polishing agent that minimizes surface scratching or defect generation, directly translating to higher yields in chip manufacturing.

Key driving factors propelling this market include the global expansion of data centers, the rollout of 5G infrastructure, and the massive increase in complex integrated circuit production driven by Artificial Intelligence (AI) and Internet of Things (IoT) devices. Each generation of semiconductor fabrication technology, moving towards smaller process nodes (e.g., 7nm, 5nm, and below), demands ever higher purity and tighter tolerances in CMP consumables, guaranteeing sustained investment and innovation within the UHP colloidal silica manufacturing sector. Furthermore, regulatory support for environmentally safer water-based systems over organic solvents also subtly encourages the adoption of these aqueous dispersions in industrial coatings.

Ultra High Purity Colloidal Silica Market Executive Summary

The Ultra High Purity Colloidal Silica market is experiencing robust growth fueled primarily by undeniable business trends in advanced electronics manufacturing and strategic regional concentration in Asia Pacific. Business trends show a distinct shift toward custom-formulated colloidal silica solutions, tailored precisely for specific CMP steps (e.g., tungsten, copper, or oxide polishing) and utilizing innovative stabilizing agents to ensure slurry stability under aggressive processing conditions. Key industry players are focusing on backward integration to secure sources of high-purity silicon tetrachloride or sodium silicate precursors, mitigating supply chain risks and ensuring material integrity. Furthermore, a growing emphasis on sustainability drives R&D towards less energy-intensive and waste-minimizing production processes, aligning with corporate social responsibility mandates and stricter environmental regulations across major industrialized regions.

Regional trends unequivocally highlight Asia Pacific (APAC) as the epicenter of demand and consumption, largely due to the concentration of global semiconductor manufacturing giants in Taiwan, South Korea, China, and Japan. This region dictates technology adoption rates and volume requirements, with significant capital expenditure continuously flowing into new fabrication facilities (fabs), driving localized growth for UHP colloidal silica suppliers. North America and Europe, while smaller in volume, are crucial centers for research, development, and high-value, specialized applications like aerospace coatings and high-end automotive electronics, where material specifications often exceed standard commercial requirements. These Western markets are also important for patented advanced synthesis technologies that allow for ultra-precise particle morphology control.

Segmentation trends indicate that the application segment of Chemical Mechanical Planarization (CMP) remains the dominant revenue generator, projected to maintain the highest CAGR throughout the forecast period due to ongoing node shrink and 3D stacking technologies (e.g., NAND flash). Within product type, alkaline-stabilized silica is widely used, but there is growing exploration of novel surface-modified and functionalized UHP silica variants designed to enhance selectivity and removal rates in complex multi-layer device structures. End-use segmentation confirms the electronics and semiconductor sectors as the primary driver, though secondary growth is noted in specialized industrial segments such as solar panel manufacturing and advanced battery technology, requiring high-purity binders and fillers to improve energy density and longevity.

AI Impact Analysis on Ultra High Purity Colloidal Silica Market

User inquiries regarding AI's impact on the Ultra High Purity Colloidal Silica Market frequently revolve around optimizing complex manufacturing processes, ensuring consistent quality control at nanoscale levels, and predicting volatile raw material demand. Specifically, users ask how AI can stabilize particle size distribution across large production batches, minimize defect rates in CMP slurries, and enable real-time adjustments in synthesis reactions to maintain ultra-low impurity levels. Key themes emerging from these concerns include leveraging Machine Learning (ML) for predictive maintenance of synthesis reactors, utilizing computer vision systems for automated quality inspection of dried silica powders or dispersed solutions, and employing neural networks to model the intricate relationship between precursor quality, synthesis parameters (pH, temperature, stirring rate), and final product performance metrics relevant to advanced semiconductor processing nodes. This collective interest emphasizes AI as a critical tool for achieving the next level of precision, scalability, and cost efficiency in UHP colloidal silica production, thereby accelerating R&D cycles for customized CMP formulations necessary for sub-5nm fabrication.

- AI optimizes synthesis parameters (temperature, pressure, precursor flow) using predictive modeling to maintain uniform particle size distribution (PSD) and minimize aggregation, crucial for ultra-high purity.

- Machine Learning algorithms analyze vast quantities of sensor data from CMP processes, enabling real-time slurry reformulation and adjustment to maximize planarization efficiency and minimize scratching defects on critical wafers.

- Predictive maintenance using AI minimizes unexpected downtime in capital-intensive UHP manufacturing facilities, improving overall equipment effectiveness (OEE) and lowering long-term operating costs.

- Computer vision systems integrated with quality control analyze particle morphology and contamination levels faster and more accurately than human operators, ensuring compliance with stringent ppb impurity standards.

- AI-driven supply chain forecasting enhances the resilience of the market by predicting demand fluctuations from major semiconductor fabs and optimizing inventory management of high-cost, specialized precursors like high-purity silicon tetrachloride.

- Generative AI tools assist R&D chemists in simulating novel surface functionalizations of colloidal silica nanoparticles, speeding up the development of next-generation slurries tailored for emerging material stacks in advanced logic chips.

DRO & Impact Forces Of Ultra High Purity Colloidal Silica Market

The market for Ultra High Purity Colloidal Silica is shaped by a powerful interplay of drivers, restraints, and opportunities (DRO), which collectively form the critical impact forces steering its evolution and profitability. Primary drivers include the relentless technological advancements in the semiconductor industry, specifically the scaling down of feature sizes (Moore's Law continuation) and the proliferation of 3D integration technologies, which demand flawless surface quality achievable only with UHP materials. These market drivers create a sustained, non-negotiable demand curve for high-specification polishing agents. Restraints largely center on the prohibitively high cost of manufacturing and purification infrastructure required to achieve parts-per-billion impurity levels, coupled with the volatility and concentration risk associated with the global supply of specialized silicon precursors. These factors limit the number of viable market entrants and contribute to market price inelasticity, despite intense competition among established players.

Opportunities for growth are abundant, particularly in diversifying applications beyond traditional silicon wafer CMP, such as high-energy density battery components (solid-state electrolytes or separators), advanced material synthesis (catalysts and catalyst supports), and specialized anti-reflective or anti-scratch coatings utilized in demanding aerospace and military optics. Furthermore, the development of localized, decentralized supply chains in North America and Europe presents an opportunity to mitigate geopolitical risks associated with Asian manufacturing dominance. The key impact forces—including the pace of technological innovation in chip design (external force) and the capital intensity of manufacturing (internal force)—determine the speed and direction of market development, emphasizing that only those manufacturers capable of continuous purity improvement and cost optimization will secure long-term contracts with tier-one semiconductor foundries.

Segmentation Analysis

The Ultra High Purity Colloidal Silica market is comprehensively segmented based on its structural characteristics, chemical properties, application area, and the specific end-user industry it serves. This segmentation is crucial for understanding the diverse demands placed on manufacturers and for tailoring product specifications to meet the exacting needs of different sectors. Segmentation by Type focuses primarily on the stabilization method and the resulting pH environment of the dispersion—namely alkaline, acidic, or neutral stabilized, which dictates their compatibility with various polishing or binding chemistries. Application segmentation reveals the dominance of CMP, but also encompasses lucrative niche areas like specialized functional coatings and precision investment casting binders. End-user segmentation confirms the overwhelming reliance of the electronics and semiconductor industry on UHP materials, although diversification into energy storage and specialized industrial coatings offers future growth pathways, each requiring distinct purity standards and particle specifications.

- By Type:

- Alkaline Stabilized Colloidal Silica (dominant in general CMP and binding applications, pH > 9)

- Acidic Stabilized Colloidal Silica (used for specific semiconductor steps and specialized coatings, pH < 4)

- Neutral/Modified Colloidal Silica (advanced formulations often surface-functionalized)

- By Particle Size:

- Less than 20 nm (Critical for fine polishing steps, e.g., STI, oxide)

- 20 nm to 50 nm (Standard range for intermediate layers and bulk material removal)

- Greater than 50 nm (Used in specialized applications like scratch reduction or thicker material planarization)

- By Application:

- Chemical Mechanical Planarization (CMP) Slurries (Highest revenue segment, driven by logic and memory chip production)

- Advanced Functional Coatings (Anti-scratch, anti-reflective, thermal insulation)

- Precision Investment Casting (Used as binders for high-tolerance metal parts)

- Catalyst Carriers and Supports (Requiring high thermal stability and surface area)

- Specialty Binders and Fillers (Including dental materials and separators)

- By End-Use Industry:

- Electronics and Semiconductors (Primary end-user, demanding ppb purity)

- Aerospace and Defense (High-performance coatings and composites)

- Automotive (Advanced battery components and protective coatings)

- Energy (Solar and fuel cell applications)

- Medical and Pharmaceutical (Diagnostic and drug delivery systems)

Value Chain Analysis For Ultra High Purity Colloidal Silica Market

The value chain for Ultra High Purity Colloidal Silica is characterized by high barriers to entry at the manufacturing stage due to the immense capital investment required for cleanroom facilities and sophisticated purification equipment. Upstream analysis begins with the sourcing of highly purified precursor chemicals, primarily silicon tetrachloride (SiCl4) or high-grade sodium silicate. The quality of these precursors directly dictates the feasibility of achieving UHP status in the final product; impurities introduced here are extremely costly or impossible to remove later. Manufacturers then employ complex synthesis processes, such as the modified Stöber method or various ion-exchange purification techniques, to control particle nucleation, growth, and stabilization. This manufacturing stage is the highest value-add step, requiring proprietary technology and stringent process control to minimize trace metals (Fe, Cu, Na, etc.) down to ppb levels.

Downstream analysis involves the direct interaction of UHP colloidal silica manufacturers with slurry formulators, who blend the silica with various oxidizers, stabilizers, surfactants, and proprietary additives to create specific CMP slurries optimized for different material stacks (e.g., copper, tungsten, oxide, or poly-silicon). This formulation step is critical for performance and represents a significant intellectual property barrier. From the formulators, the slurries are distributed directly to large semiconductor fabrication facilities (fabs) globally. The distribution channel is often direct or relies on highly specialized, qualified chemical distributors capable of handling, storing, and delivering these sensitive, high-value materials under strict temperature and cleanliness protocols. Indirect channels are more common for lower-purity grades or non-semiconductor applications like coatings.

Due to the critical nature of CMP slurries in semiconductor yield, relationships within the value chain are long-term and highly collaborative, linking precursor suppliers, silica manufacturers, slurry formulators, and end-users (fabs) in a tight technical alliance. This closeness ensures continuous quality feedback and rapid iteration on new product development, particularly as semiconductor nodes shrink. Efficiency in this chain is determined by the seamless flow of ultra-pure materials and the ability to maintain zero contamination throughout storage and transport, making quality assurance and logistical expertise vital components of market success.

Ultra High Purity Colloidal Silica Market Potential Customers

The primary and most lucrative potential customers for Ultra High Purity Colloidal Silica are global leaders in semiconductor manufacturing and their specialized supply chain partners responsible for wafer processing and materials deposition. These end-users, typically large-scale integrated device manufacturers (IDMs) and pure-play foundries, require colloidal silica in enormous volumes for their CMP operations, where quality standards are non-negotiable and defects can cost millions of dollars in lost yields. Secondary, yet highly valuable, customer segments include specialized chemical companies that formulate and supply high-end functional coatings for optical components in aerospace and defense systems, requiring exceptional hardness and clarity derived from the UHP silica’s unique nanostructure. Additionally, advanced investment casting foundries serving the turbine blade and medical implant markets are significant buyers, utilizing the silica as a high-temperature binder that guarantees dimensional stability and superior surface finish in complex metal parts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,535.8 Million |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cabot Microelectronics (CMC), FUJIMI CORPORATION, Wacker Chemie AG, Nissan Chemical Corporation, Evonik Industries AG, Fuso Chemical Co., Ltd., Merck KGaA, Remet Corporation, AkzoNobel (Nouryon), Grace Davison, Nalco Water (Ecolab), BASF SE, Sumitomo Osaka Cement Co., Ltd., Shin-Etsu Chemical Co., Ltd., DuPont, K.I. Chemical Industry Co., Ltd., Gelest, Inc., ChemPoint. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultra High Purity Colloidal Silica Market Key Technology Landscape

The technological landscape of the Ultra High Purity Colloidal Silica market is dominated by sophisticated synthesis and purification methodologies aimed at achieving the dual objectives of ultra-low contamination and precise particle morphology control. The foundational production method remains the Stöber process (hydrolysis of alkyl silicates), but key technological advancements focus on refining this process through continuous flow reactors and controlled temperature/pressure environments to achieve narrower particle size distributions (PSD). Another critical technology involves ion-exchange techniques, which are paramount for reducing trace metal contaminants from initial precursor solutions or post-synthesis dispersions. Ultra-filtration and dialysis are routinely employed as secondary purification steps, ensuring the final product meets the stringent parts-per-billion (ppb) standards required for advanced semiconductor manufacturing, where even femtogram levels of impurities can compromise device performance.

Furthermore, significant technological investment is directed towards surface modification and stabilization chemistries. Manufacturers employ various surface treatments—including polymer grafting or functional group attachment—to alter the zeta potential of the silica particles. This modification is essential for optimizing the colloidal stability of the dispersion across different pH ranges and enhancing the compatibility of the silica particles when integrated into complex multi-component CMP slurry formulations. These advanced surface technologies allow the UHP silica to interact specifically with target substrate materials (e.g., oxides, metals, nitrides) during planarization, thereby improving polishing selectivity and reducing surface defects, which is a major focus area for proprietary intellectual property development across leading vendors.

The continuous drive toward smaller semiconductor nodes necessitates innovations in both in-situ monitoring and scale-up technologies. Real-time monitoring technologies, utilizing techniques like dynamic light scattering (DLS) and inductively coupled plasma mass spectrometry (ICP-MS), are becoming integrated into production lines to ensure instant feedback and maintain continuous quality assurance across massive production batches. The ability to scale up these high-precision synthesis methods while maintaining consistency is a major technological hurdle. Therefore, process engineering expertise related to large-scale, contaminant-free chemical synthesis represents a core competency and a high-value technological asset in the competitive Ultra High Purity Colloidal Silica market, ensuring that manufacturers can meet the exponential volume growth demanded by the global foundry market without compromising material integrity.

Regional Highlights

- Asia Pacific (APAC): APAC is overwhelmingly the dominant market for Ultra High Purity Colloidal Silica, driven by the massive concentration of semiconductor fabrication facilities (fabs) and outsourced semiconductor assembly and test (OSAT) operations located in Taiwan, South Korea, China, and Japan. The region accounts for the highest consumption volume of CMP slurries globally. Continuous capital expenditure in new fabrication facilities (e.g., TSMC, Samsung, SK Hynix expansions) and government incentives (e.g., China’s emphasis on self-sufficiency) ensure APAC remains the primary growth engine. Localized manufacturing in APAC is intensely competitive, fostering rapid innovation in material synthesis tailored for specific regional foundry processes.

- North America: North America represents a critical hub for high-end research, process technology development, and specialized applications. While consumption volume is lower than APAC, it focuses on high-margin, ultra-specialized grades for R&D in emerging materials (e.g., solid-state batteries, advanced photonics) and defense-related coatings. Recent geopolitical and supply chain shifts are driving strategic investment toward establishing domestic UHP colloidal silica manufacturing capabilities in the US (e.g., through CHIPS Act initiatives) to secure a resilient supply for leading-edge chip production.

- Europe: The European market demonstrates steady growth, primarily focused on automotive electronics, high-precision industrial applications (e.g., precision investment casting for aerospace parts), and pharmaceutical uses. The region benefits from a strong base of global chemical companies (e.g., Evonik, Wacker) engaged in advanced material research and sustainability-focused product development. Demand is often centered around tailored formulations compliant with strict European environmental and chemical registration regulations (e.g., REACH).

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent nascent markets for UHP colloidal silica, with consumption largely limited to specialized industrial coatings, petrochemical applications, and small-scale electronics assembly or maintenance. Growth is anticipated to be slower but steady, correlating with overall industrialization, particularly in sectors requiring enhanced material durability and stability, though dependence on imports from established APAC and North American manufacturers remains high.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultra High Purity Colloidal Silica Market.- Cabot Microelectronics (CMC)

- FUJIMI CORPORATION

- Wacker Chemie AG

- Nissan Chemical Corporation

- Evonik Industries AG

- Fuso Chemical Co., Ltd.

- Merck KGaA

- Remet Corporation

- AkzoNobel (Nouryon)

- Grace Davison

- Nalco Water (Ecolab)

- BASF SE

- Sumitomo Osaka Cement Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- DuPont

- K.I. Chemical Industry Co., Ltd.

- Gelest, Inc.

- ChemPoint

- JGC Catalysts and Chemicals Ltd.

- PPG Industries, Inc. (In coatings applications)

Frequently Asked Questions

Analyze common user questions about the Ultra High Purity Colloidal Silica market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines Ultra High Purity (UHP) Colloidal Silica in the market?

UHP Colloidal Silica is defined by extremely low levels of trace metal contaminants (often measured in parts per billion or ppb) and a narrow, highly controlled particle size distribution (5 nm to 100 nm), essential for preventing defects in high-end semiconductor manufacturing processes like CMP.

Which application segment drives the most demand for UHP Colloidal Silica?

The Chemical Mechanical Planarization (CMP) process in the semiconductor industry is the largest demand driver. CMP uses UHP colloidal silica slurries to achieve ultra-flat surfaces on silicon wafers required for fabricating advanced logic and memory chips below 7nm node sizes.

How is the market performance linked to the semiconductor industry?

The UHP Colloidal Silica market is directly correlated with semiconductor capital expenditure and technological scaling. As chip nodes shrink and 3D stacking increases, the demand for higher purity and more specialized CMP slurries utilizing UHP silica escalates, driving market growth.

What are the primary technological challenges in manufacturing UHP Colloidal Silica?

Key challenges include maintaining precise control over particle morphology and size distribution during scalable synthesis, and minimizing trace metal contamination throughout the production process, requiring significant investment in advanced purification (ion-exchange, ultra-filtration) and cleanroom technologies.

Why is the Asia Pacific region dominant in this market?

APAC dominates due to the concentration of major global semiconductor foundries (fabs) in countries like Taiwan, South Korea, and China. These regions consume the vast majority of UHP colloidal silica for their extensive chip manufacturing and wafer processing operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager