Ultra-High Purity Colloidal Silica Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440499 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Ultra-High Purity Colloidal Silica Market Size

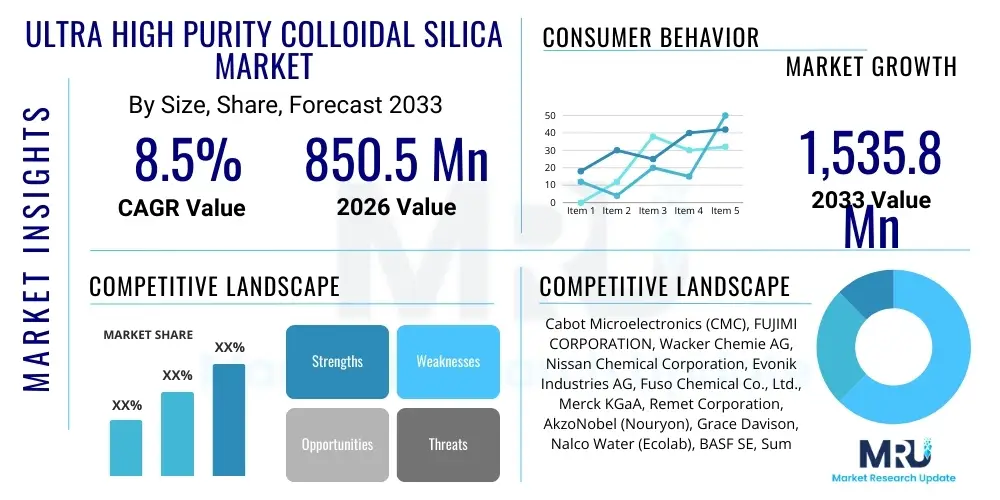

The Ultra-High Purity Colloidal Silica Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.9% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.5 Billion by the end of the forecast period in 2033.

Ultra-High Purity Colloidal Silica Market introduction

The Ultra-High Purity (UHP) Colloidal Silica market encompasses specialized dispersions of nanometer-sized silica particles suspended in a liquid medium, characterized by extremely low levels of metallic and organic impurities. This critical material is distinguished by its precise particle size distribution, exceptional chemical stability, and high surface area, attributes that are paramount for its demanding applications. UHP colloidal silica serves as a fundamental component in industries where material contamination can severely compromise product performance or functionality, making its purity a non-negotiable requirement. Its unique properties allow it to be tailored for specific uses, offering solutions that conventional silica materials cannot provide.

Major applications of Ultra-High Purity Colloidal Silica span across the semiconductor industry, particularly in Chemical Mechanical Planarization (CMP) processes, where it is essential for achieving ultra-smooth surfaces on silicon wafers without introducing defects. Beyond semiconductors, it is extensively used in advanced coatings for optics and displays to enhance durability and optical clarity, as a binder in high-performance catalysts, and in various precision electronics and biomedical applications. The inherent benefits of UHP colloidal silica include superior abrasion resistance, improved adhesion, enhanced mechanical strength, and precise control over material properties at the nanoscale. These benefits drive its adoption in next-generation technologies requiring unparalleled material integrity and performance.

The primary driving factors propelling the growth of the UHP colloidal silica market are deeply rooted in the rapid advancements and increasing complexities within the electronics sector, especially the semiconductor industry's continuous push for miniaturization and higher performance. The escalating demand for high-performance computing, advanced consumer electronics, and sophisticated optical devices necessitates materials that can meet increasingly stringent quality and purity standards. Furthermore, the expansion of applications into emerging fields such as medical diagnostics, energy storage solutions, and advanced materials science, coupled with robust research and development activities aimed at exploring new functionalities and sustainable production methods, further underpins the market's robust growth trajectory.

Ultra-High Purity Colloidal Silica Market Executive Summary

The Ultra-High Purity Colloidal Silica market is experiencing dynamic shifts driven by relentless technological innovation and evolving industrial demands. Business trends indicate a strong emphasis on strategic partnerships and collaborations between raw material suppliers, UHP colloidal silica manufacturers, and end-use industry leaders to co-develop customized solutions that address specific application challenges. There is a discernible trend towards integrating advanced analytics and automation in manufacturing processes to enhance efficiency, reduce costs, and ensure consistent product quality. Furthermore, the market is witnessing increased investment in research and development to explore novel synthesis methods, improve purity levels, and expand the functional capabilities of colloidal silica for future applications, particularly in areas like sustainable electronics and advanced biomedical devices. Supply chain resilience and diversification are also becoming critical business imperatives given geopolitical uncertainties and the need for uninterrupted production.

Regionally, the market exhibits significant variances, with the Asia Pacific (APAC) region standing out as the undisputed leader, primarily due to its robust manufacturing infrastructure for semiconductors, consumer electronics, and display panels in countries like China, South Korea, Taiwan, and Japan. This region not only serves as a major consumption hub but also hosts several key production facilities for UHP colloidal silica. North America and Europe, while representing mature markets, continue to be significant contributors, driven by strong R&D activities, high-value applications in aerospace, defense, and advanced medical sectors, and a strong focus on premium, specialized products. Emerging economies in Latin America and the Middle East & Africa are showing nascent but growing potential as industrialization progresses and local electronics manufacturing capabilities expand, attracting foreign investments and creating new demand pockets for UHP materials.

Segment-wise, the Chemical Mechanical Planarization (CMP) application segment continues to command the largest share of the UHP colloidal silica market, fueled by the ever-increasing complexity of semiconductor fabrication processes and the necessity for defect-free wafer surfaces. However, other segments such as advanced coatings, where UHP colloidal silica imparts superior scratch resistance and optical properties, and high-performance catalysts, are demonstrating accelerated growth. There is also a notable upward trend in demand from the medical and diagnostics sector, where UHP colloidal silica is being explored for drug delivery systems, biosensors, and imaging agents due to its biocompatibility and tunable surface chemistry. Purity levels exceeding 5N (99.999%) are increasingly sought after, especially in leading-edge semiconductor nodes, pushing manufacturers to innovate in purification technologies and quality control methodologies to meet these exacting specifications.

AI Impact Analysis on Ultra-High Purity Colloidal Silica Market

Users frequently inquire about how Artificial Intelligence will revolutionize the production, quality control, and application development of Ultra-High Purity Colloidal Silica. Common questions revolve around AI's capability to optimize complex synthesis parameters, enhance the detection of ultra-trace impurities, and accelerate the discovery of novel formulations for specific end-use applications. There's also significant interest in AI's role in improving supply chain efficiency and enabling predictive maintenance within manufacturing facilities, ultimately leading to higher yields and reduced operational costs. Users anticipate AI will drive innovation in material design, allowing for the creation of UHP colloidal silica with precisely tailored properties for future technologies, while simultaneously addressing challenges related to sustainability and resource optimization.

- Enhanced process control and real-time optimization of synthesis parameters in UHP colloidal silica manufacturing, leading to improved consistency and yield.

- Accelerated discovery and development of new UHP colloidal silica formulations with tailored particle sizes, shapes, and surface chemistries through AI-driven material informatics.

- Advanced impurity detection and quality assurance systems, utilizing AI-powered vision systems and spectroscopy to identify and quantify ultra-trace contaminants more effectively.

- Predictive maintenance for production equipment, minimizing downtime and ensuring continuous operation in highly sensitive manufacturing environments.

- Optimization of supply chain logistics, including demand forecasting, inventory management, and raw material procurement for UHP components, reducing waste and lead times.

- Facilitation of new application development by simulating material interactions and performance in various end-use scenarios, speeding up market entry for innovative products.

- Automation of data analysis from R&D and production, providing deeper insights for process improvement and product refinement, thereby driving continuous innovation.

- Improved energy efficiency and resource utilization in manufacturing processes through AI-driven optimization algorithms, contributing to sustainable production practices.

DRO & Impact Forces Of Ultra-High Purity Colloidal Silica Market

The Ultra-High Purity Colloidal Silica market is shaped by a complex interplay of drivers, restraints, and opportunities, underpinned by various impact forces. Key drivers include the relentless expansion of the global semiconductor industry, particularly the demand for smaller, more powerful, and energy-efficient chips that necessitate advanced planarization techniques. The increasing adoption of UHP colloidal silica in other high-tech sectors such as advanced display technologies, optical components, and precision electronics, all requiring materials with exceptionally low impurity levels, further propels market growth. Moreover, the continuous push for miniaturization across various industries, from medical devices to consumer electronics, mandates the use of materials that can deliver superior performance at the nanoscale, directly benefiting the UHP colloidal silica market. Stringent quality and purity requirements, often dictated by regulatory bodies and performance specifications in sensitive applications, serve as a fundamental driver, ensuring a sustained demand for premium-grade materials.

Despite robust growth prospects, the market faces significant restraints. The manufacturing of Ultra-High Purity Colloidal Silica is inherently complex and capital-intensive, requiring specialized facilities, advanced purification techniques, and rigorous quality control protocols, which translate into high production costs. This often creates barriers to entry for new players and can impact pricing strategies. Furthermore, the market is susceptible to volatility in the prices of raw materials, primarily high-grade silicon compounds, which can fluctuate based on global supply and demand dynamics, affecting profitability for manufacturers. Strict environmental regulations pertaining to chemical manufacturing and waste disposal also impose compliance costs and operational challenges. Intense market competition from established global players, coupled with the constant need for product innovation to stay ahead, adds another layer of complexity for market participants.

Opportunities within the UHP colloidal silica market are abundant and diverse. The burgeoning demand from emerging applications in biomedical diagnostics, drug delivery systems, and advanced energy storage solutions (e.g., batteries and fuel cells) presents significant avenues for market expansion. Continuous research and development activities focused on exploring sustainable production methods, such as greener synthesis routes and recycling processes, are expected to unlock new market potentials by appealing to environmentally conscious industries and regulatory frameworks. Strategic collaborations and partnerships between UHP colloidal silica producers, academic institutions, and end-use industry giants can foster innovation, accelerate product development, and facilitate market penetration into niche high-value segments. Lastly, untapped markets in developing economies, as their industrial and technological infrastructures mature, offer long-term growth prospects for specialized UHP materials. The market is also heavily influenced by impact forces such as rapid technological advancements in nanomaterials science, global economic shifts affecting industrial output, evolving regulatory landscapes impacting manufacturing standards, the imperative for robust supply chain resilience, and broader geopolitical tensions that can disrupt trade and supply. These forces collectively dictate the market's trajectory and competitive dynamics.

Segmentation Analysis

The Ultra-High Purity Colloidal Silica market is comprehensively segmented to provide granular insights into its diverse applications, product characteristics, and end-user industries. This segmentation allows for a detailed analysis of market dynamics, growth drivers, and competitive landscapes across various dimensions. The market's structure reflects the specialized requirements of different applications, necessitating variations in particle size, purity levels, and formulation. Understanding these segments is crucial for strategic planning, product development, and market entry decisions for stakeholders within the UHP colloidal silica ecosystem, enabling them to identify high-growth opportunities and tailor their offerings to specific industrial needs.

- By Application:

- Chemical Mechanical Planarization (CMP)

- Coatings (Optical Coatings, Abrasion-Resistant Coatings, Thermal Barrier Coatings, Dielectric Coatings)

- Catalysis (Petrochemical Catalysis, Fine Chemical Synthesis, Environmental Catalysis)

- Electronics (Dielectric Materials, Insulators, Substrates, Semiconductor Packaging)

- Medical & Diagnostics (Drug Delivery Systems, Imaging Agents, Biosensors, Pharmaceutical Formulations)

- Others (Abrasives, Polishing Agents for Precision Optics, 3D Printing, Adhesives, Sealants)

- By Particle Size:

- Less than 20 nm (Ultra-small particles for precision polishing and specialized coatings)

- 20-50 nm (Commonly used for CMP and various coating applications)

- Greater than 50 nm (Used in specific abrasive applications and some larger-scale industrial processes)

- By Purity Level:

- 4N (99.99% Purity)

- 5N (99.999% Purity)

- 6N (99.9999% Purity) and above (For most advanced semiconductor nodes and sensitive applications)

- By End-Use Industry:

- Semiconductor Industry (Wafer polishing, dielectric layers)

- Optics and Photonics (Lens polishing, anti-reflective coatings)

- Aerospace and Defense (High-performance coatings, thermal management)

- Automotive (Advanced materials, catalysts)

- Healthcare and Pharmaceutical (Drug delivery, medical device coatings)

- Consumer Electronics (Displays, circuit boards, components)

- Energy Sector (Solar cells, battery materials, fuel cell components)

Value Chain Analysis For Ultra-High Purity Colloidal Silica Market

The value chain for Ultra-High Purity Colloidal Silica is characterized by a series of specialized processes, starting from the meticulous sourcing of raw materials to the intricate distribution channels that deliver the final product to highly demanding end-users. Upstream analysis reveals that the initial stages involve the procurement and purification of high-grade silicon compounds, typically silanes or fumed silica, and ultra-pure water. These raw material suppliers form a critical foundation, as the initial purity directly impacts the final product's quality and performance. Manufacturers in this segment focus heavily on achieving exceptionally low impurity levels, often employing advanced chemical synthesis and purification techniques to meet the exacting specifications required for UHP applications. Strategic partnerships with reliable and certified raw material providers are essential to maintain consistent product quality and supply chain integrity.

The core manufacturing stage involves sophisticated chemical processes such as the Stöber method, sol-gel techniques, or other proprietary synthesis routes to produce colloidal silica nanoparticles. Subsequent critical steps include precise control over particle size and morphology, followed by rigorous purification processes like ultrafiltration, ion exchange, and dialysis to remove residual ions and organic contaminants, achieving the ultra-high purity levels necessary. Downstream analysis focuses on the integration of UHP colloidal silica into the end-user products. This involves collaborations with semiconductor fabs for CMP slurries, advanced coating formulators, catalyst developers, and medical device manufacturers. The performance of UHP colloidal silica directly dictates the functionality and reliability of these high-value end products, making collaboration and technical support from manufacturers vital.

Distribution channels for Ultra-High Purity Colloidal Silica are primarily direct, especially for large industrial clients in the semiconductor and advanced materials sectors, due to the technical nature of the product, the need for customized formulations, and specific handling requirements. Direct sales ensure direct communication, technical service, and tailored delivery schedules. For smaller businesses or specialized applications, a network of highly specialized distributors with expertise in handling and delivering sensitive chemical products may be employed. These indirect channels often provide value-added services such as local warehousing, technical support, and smaller batch deliveries. Both direct and indirect distribution strategies emphasize cold chain management, contamination control, and efficient logistics to maintain product integrity from the manufacturing facility to the end-user's point of application, ensuring that the ultra-high purity is preserved throughout the supply chain.

Ultra-High Purity Colloidal Silica Market Potential Customers

The Ultra-High Purity Colloidal Silica market primarily caters to a sophisticated clientele across various high-technology and precision-driven industries, where the integrity and performance of materials are paramount and even trace impurities can lead to catastrophic failures. The most prominent end-users are within the semiconductor manufacturing sector, specifically companies involved in the fabrication of integrated circuits, memory chips, and processors. These companies utilize UHP colloidal silica as a crucial component in Chemical Mechanical Planarization (CMP) slurries, which are essential for achieving the ultra-flat and smooth surfaces required for advanced lithography and multi-layer device construction. The continuous pursuit of smaller feature sizes and higher transistor densities in semiconductor devices ensures a sustained and growing demand for the highest purity grades of colloidal silica, making these fabs primary target customers for manufacturers.

Beyond semiconductors, a significant segment of potential customers includes manufacturers in the optics and photonics industry. Companies producing high-performance lenses, mirrors, prisms, and other optical components, particularly for applications in aerospace, defense, scientific instrumentation, and consumer electronics (e.g., advanced camera lenses, display screens), require UHP colloidal silica for precision polishing and as a component in high-quality optical coatings. The material's ability to impart superior surface finish, scratch resistance, and optical clarity without introducing haze or defects is critical in these applications. Additionally, specialty chemical formulators who develop advanced coatings, adhesives, and sealants for various industrial applications, including automotive, aerospace, and construction, also represent a substantial customer base, as they leverage UHP colloidal silica for its reinforcing, binding, and rheological properties.

Furthermore, the healthcare and pharmaceutical sectors are emerging as increasingly important potential customers. Companies involved in the development and manufacturing of medical diagnostic tools, drug delivery systems, bio-imaging agents, and biocompatible coatings for medical devices are exploring and adopting UHP colloidal silica due to its non-toxicity, stability, and ability to be surface-modified for specific biological interactions. Catalyst manufacturers, particularly those focusing on petrochemical, fine chemical, and environmental catalysis, also rely on UHP colloidal silica as a high-surface-area support material or an active component to enhance catalytic efficiency and selectivity. The broad range of applications requiring stringent material specifications underscores the diverse yet technically demanding nature of the potential customer base for Ultra-High Purity Colloidal Silica, reflecting its critical role across numerous advanced technological domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.5 Billion |

| Growth Rate | 10.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FUJIMI CORPORATION, Nissan Chemical Corporation, Merck KGaA, Nouryon (formerly AkzoNobel Specialty Chemicals), W. R. Grace & Co., Evonik Industries AG, Cabot Corporation, K. I. Chemical Industry Co., Ltd., ADEKA Corporation, Fuso Chemical Co., Ltd., CeriaChem Inc., Remet Corporation, PPG Industries, Ferro Corporation, Sumitomo Chemical Co., Ltd., Shin-Etsu Chemical Co., Ltd., AGC Chemicals, Momentive Performance Materials Inc., Coorstek Inc., Dow. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultra-High Purity Colloidal Silica Market Key Technology Landscape

The Ultra-High Purity Colloidal Silica market is underpinned by a sophisticated technology landscape that encompasses advanced synthesis methods, rigorous purification techniques, and precise characterization tools, all critical for achieving the exacting specifications demanded by high-tech industries. The primary synthesis methods often employed include variations of the Stöber method, which allows for controlled growth of silica particles from alkoxides, and sol-gel processes, enabling the formation of silica networks from precursors. These methods are continuously refined to ensure narrow particle size distributions, desired morphologies, and optimal surface properties. Innovations in these synthesis routes focus on improving reproducibility, scalability, and reducing overall production costs while maintaining or enhancing purity levels. Furthermore, plasma-based synthesis techniques are emerging for generating highly uniform and pure nanoparticles, offering alternative pathways for advanced applications.

Beyond synthesis, the purification technologies are paramount in achieving ultra-high purity levels. This involves multi-stage filtration processes, including ultrafiltration and nanofiltration, to remove particulate matter and macromolecules. Ion exchange chromatography is extensively used to eliminate metallic and anionic impurities down to parts per billion (ppb) or even parts per trillion (ppt) levels, a crucial requirement for semiconductor applications. Dialysis and electrodialysis are also employed for highly efficient removal of ionic contaminants. These purification steps are meticulously controlled and often performed in cleanroom environments to prevent external contamination, underscoring the technological intensity required to produce UHP colloidal silica that meets the most stringent industry standards. The integration of advanced process analytical technology (PAT) ensures real-time monitoring and control of purity during these complex stages.

The characterization of Ultra-High Purity Colloidal Silica relies on a suite of sophisticated analytical instruments to confirm particle size, distribution, surface charge, and critically, the trace impurity profile. Techniques such as Dynamic Light Scattering (DLS) and Transmission Electron Microscopy (TEM) are essential for particle size and morphology analysis. Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and Atomic Absorption Spectroscopy (AAS) are indispensable for quantifying ultra-trace metallic impurities, providing confidence in the material's purity. Surface modification technologies, involving chemical grafting or encapsulation, are also gaining prominence to tailor the surface chemistry of UHP colloidal silica for specific application needs, such as improved dispersibility in various solvents or enhanced compatibility with specific matrices. This holistic technological approach, from synthesis to characterization and modification, ensures the production of high-performance UHP colloidal silica tailored for demanding, next-generation applications.

Regional Highlights

- Asia Pacific (APAC): The APAC region stands as the dominant market for Ultra-High Purity Colloidal Silica, primarily driven by its robust and rapidly expanding electronics and semiconductor manufacturing industry. Countries like China, South Korea, Taiwan, and Japan are global hubs for semiconductor fabrication, display panel production, and advanced consumer electronics, all of which are major consumers of UHP colloidal silica, particularly for Chemical Mechanical Planarization (CMP). The region benefits from significant investments in R&D, a large pool of skilled labor, and government support for high-tech industries. Rapid industrialization and urbanization in emerging economies across the region further contribute to the increasing demand for advanced materials, fueling substantial market growth and innovation.

- North America: North America represents a significant and mature market for UHP colloidal silica, characterized by a strong emphasis on research and development, innovation, and high-value applications. The region hosts leading semiconductor companies, advanced materials manufacturers, and robust aerospace and defense sectors. Demand is driven by the continuous advancement in semiconductor technology, development of specialized optical components, and growth in medical and diagnostics industries. Strategic investments in nanotechnology research and the presence of stringent quality standards also contribute to the region's prominent position in the UHP colloidal silica market, focusing on premium and customized solutions.

- Europe: The European market for Ultra-High Purity Colloidal Silica is characterized by a strong presence of specialty chemical manufacturers, a focus on advanced automotive electronics, and growing applications in medical technology and renewable energy sectors. Countries such as Germany, France, and the UK are key contributors, driven by stringent quality requirements and a push towards sustainable and high-performance materials. While not as dominant in semiconductor manufacturing as APAC, Europe excels in high-precision engineering, advanced optics, and research into new material functionalities, ensuring a steady demand for UHP colloidal silica for niche, high-value applications.

- Latin America: The Latin American market for Ultra-High Purity Colloidal Silica is in its nascent stages but demonstrates promising growth potential. Industrial expansion, particularly in countries like Brazil and Mexico, is leading to increased demand for advanced materials in sectors such as automotive, electronics assembly, and infrastructure development. While local manufacturing capabilities for high-tech products are still evolving, the region's growing economies and increasing foreign investments are creating new opportunities for UHP colloidal silica suppliers. The market is primarily driven by imports, with a gradual shift towards local sourcing and processing as industrial capabilities mature.

- Middle East and Africa (MEA): The MEA region currently holds a relatively smaller share of the UHP colloidal silica market but is projected to experience gradual growth. This growth is linked to economic diversification efforts, increasing investments in industrial infrastructure, and nascent developments in local electronics and advanced manufacturing sectors. The demand is largely concentrated in niche applications within oil and gas (e.g., catalysis), water treatment, and emerging sectors requiring specialized materials. As countries in the region continue to industrialize and develop their high-tech capabilities, the demand for Ultra-High Purity Colloidal Silica is expected to rise, creating long-term opportunities for market players.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultra-High Purity Colloidal Silica Market.- FUJIMI CORPORATION

- Nissan Chemical Corporation

- Merck KGaA

- Nouryon (formerly AkzoNobel Specialty Chemicals)

- W. R. Grace & Co.

- Evonik Industries AG

- Cabot Corporation

- K. I. Chemical Industry Co., Ltd.

- ADEKA Corporation

- Fuso Chemical Co., Ltd.

- CeriaChem Inc.

- Remet Corporation

- PPG Industries

- Ferro Corporation

- Sumitomo Chemical Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- AGC Chemicals

- Momentive Performance Materials Inc.

- Coorstek Inc.

- Dow

Frequently Asked Questions

What is Ultra-High Purity Colloidal Silica primarily used for?

Ultra-High Purity Colloidal Silica is primarily used in the semiconductor industry for Chemical Mechanical Planarization (CMP) to achieve ultra-flat surfaces on silicon wafers. It is also crucial in advanced coatings for optics, high-performance catalysts, precision electronics, and emerging biomedical applications, where its exceptional purity and tailored particle size are critical for optimal performance and preventing contamination.

Why is purity so important in the Ultra-High Purity Colloidal Silica market?

Purity is paramount because even trace impurities (at parts per billion or trillion levels) can severely compromise the functionality and reliability of high-tech products like semiconductors and optical components. Contaminants can cause defects, short circuits, or performance degradation, making UHP colloidal silica indispensable for industries requiring stringent material specifications and zero-defect manufacturing processes.

What are the key drivers of market growth for Ultra-High Purity Colloidal Silica?

The key drivers include the relentless expansion and technological advancements within the semiconductor industry, increasing demand for miniaturized and high-performance electronic devices, and the growing adoption of UHP colloidal silica in advanced coatings and emerging fields such as medical diagnostics and energy storage. Stringent quality standards across these high-tech sectors further propel market growth.

Which region dominates the Ultra-High Purity Colloidal Silica market and why?

The Asia Pacific (APAC) region dominates the Ultra-High Purity Colloidal Silica market. This is primarily due to the region's robust and expanding manufacturing base for semiconductors, consumer electronics, and display panels, especially in countries like China, South Korea, Taiwan, and Japan. Significant investments in high-tech industries and extensive manufacturing infrastructure drive high consumption of UHP colloidal silica in APAC.

What are the main challenges faced by manufacturers in this market?

Manufacturers in the Ultra-High Purity Colloidal Silica market face several challenges, including the high manufacturing costs associated with complex synthesis and rigorous purification processes, volatility in raw material prices, and adherence to stringent environmental regulations. Intense market competition and the continuous need for innovation to meet evolving application requirements also present significant hurdles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager