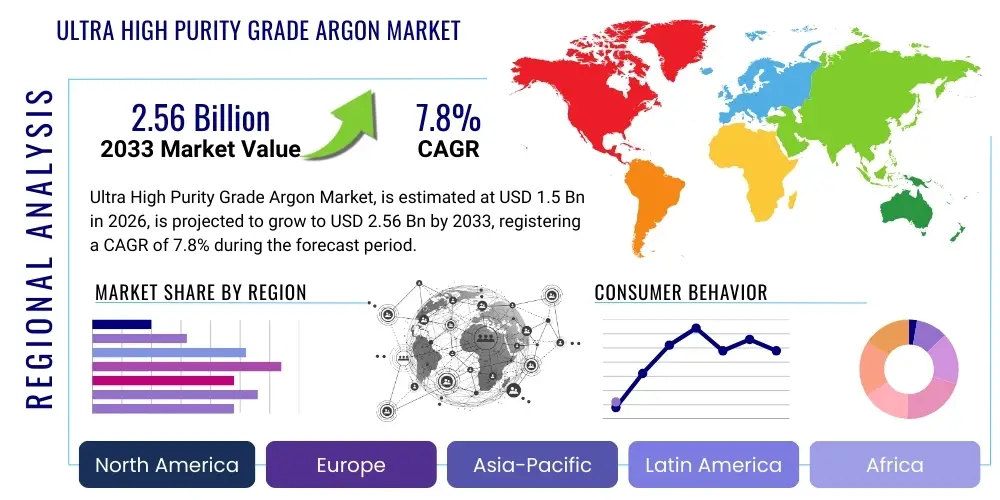

Ultra High Purity Grade Argon Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437126 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Ultra High Purity Grade Argon Market Size

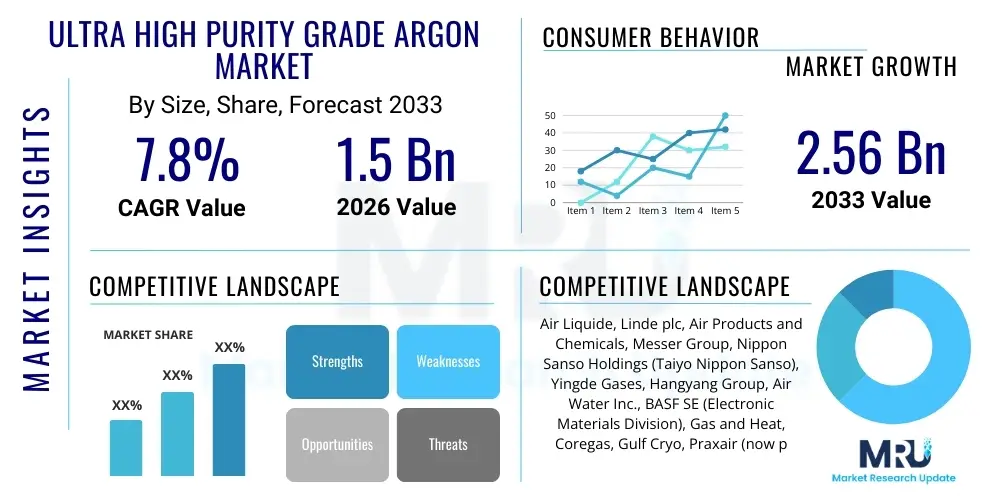

The Ultra High Purity Grade Argon Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.56 Billion by the end of the forecast period in 2033.

Ultra High Purity Grade Argon Market introduction

Ultra High Purity (UHP) Grade Argon, typically defined as having a purity level of 99.999% (Grade 5.0) or higher, is a critical industrial gas essential for sophisticated manufacturing processes where minute impurities can compromise product integrity. Its inherent inertness, stability, and lack of reactivity make it indispensable across several high-technology sectors, including semiconductor fabrication, specialized welding (such as TIG and plasma welding), optical fiber manufacturing, and advanced metallurgy. The market's growth is fundamentally tied to the proliferation of microelectronics and the continuous drive towards miniaturization, requiring increasingly stringent process environments that UHP argon facilitates, acting as a carrier gas, purge gas, or protective atmosphere.

The primary applications of UHP argon center on creating controlled atmospheres free of oxygen, nitrogen, and moisture, which are detrimental in processes like epitaxial growth, sputtering, and annealing within the semiconductor industry. Its benefits include enhanced process yield, improved material properties, and reduced component failure rates, particularly in environments exposed to extreme heat or sensitive chemical reactions. Key driving factors fueling the market include massive investments in new fabrication plants (fabs) globally, particularly in Asia Pacific, the rising demand for high-performance memory chips and advanced logic circuits, and the expansion of the aerospace and defense sectors, which rely on specialized joining techniques requiring premium shielding gases.

Ultra High Purity Grade Argon Market Executive Summary

The Ultra High Purity Grade Argon market is characterized by sustained demand resilience, primarily driven by the semiconductor industry's cyclical yet aggressive capacity expansion globally. Business trends indicate a focus on vertical integration among major gas producers to secure reliable raw material (air separation) sources and ensure sophisticated purification and distribution logistics required for UHP grades, especially those exceeding 99.9999% purity (Grade 6.0). Strategic long-term supply contracts with Tier 1 semiconductor manufacturers are defining competitive dynamics, shifting focus from pure price competition to guaranteed quality and seamless supply chain integration, reflecting the mission-critical nature of the product.

Regionally, Asia Pacific (APAC) stands as the undisputed epicenter of market growth, spearheaded by robust government support and private investment into semiconductor and display panel manufacturing hubs in countries like South Korea, Taiwan, China, and Japan. This region exhibits the highest consumption intensity and capital expenditure dedicated to new fabrication plants, translating directly into escalating UHP argon demand. Segment trends highlight that Grade 5.5 and Grade 6.0 purity levels are experiencing the fastest growth, propelled by the transition to smaller node technologies (7nm, 5nm, and below), where even parts-per-billion impurities are unacceptable, reinforcing the market’s trajectory towards higher specification products.

AI Impact Analysis on Ultra High Purity Grade Argon Market

Common user inquiries regarding AI's impact on the UHP Argon market often revolve around efficiency gains in production and logistics, predictive maintenance, and the direct correlation between AI adoption and semiconductor demand. Users frequently ask if AI algorithms can optimize the complex air separation unit (ASU) operations, reducing energy consumption and maximizing argon recovery rates. Furthermore, there is significant interest in how the massive computational requirements of AI and machine learning infrastructure necessitate continuous scaling of data centers and advanced chip manufacturing, which are direct consumption drivers for UHP argon. The consensus among market stakeholders is that while AI does not directly alter the chemical properties or applications of argon, it fundamentally enhances the efficiency of the supply chain and exponentially accelerates the underlying demand for the end products (microchips) manufactured using UHP argon.

- AI-driven Predictive Maintenance: Enhances the reliability of Air Separation Units (ASUs) and purification equipment, ensuring consistent UHP gas quality and minimizing costly unplanned shutdowns.

- Logistics Optimization: Uses machine learning algorithms to optimize complex delivery routes and inventory management for cylinders and bulk gas transport, crucial for maintaining just-in-time supply to semiconductor fabs.

- Demand Forecasting Accuracy: Improves the precision of forecasting UHP argon needs based on chip production cycles and global technology trends, allowing producers to better match supply capacity.

- Semiconductor Manufacturing Acceleration: AI adoption globally drives unprecedented demand for high-performance microprocessors and specialized memory, thereby directly increasing the consumption of UHP argon in fabrication processes.

- Process Control Automation: Integration of AI into gas monitoring and purity analysis systems to ensure real-time deviation correction, maintaining stringent purity levels required for sub-micron technology nodes.

DRO & Impact Forces Of Ultra High Purity Grade Argon Market

The Ultra High Purity Grade Argon market is influenced by a dynamic interplay of factors. Key drivers include the global semiconductor industry expansion, characterized by significant investment in advanced logic and memory fabrication facilities, which are highly dependent on ultra-pure inert atmospheres. Concurrently, the increasing complexity and sensitivity of advanced welding techniques in aerospace and specialty manufacturing further bolster demand. These drivers are amplified by technological advancements that mandate higher purity standards (e.g., Grade 6.0 argon) to prevent microscopic contamination in advanced materials processing. However, the market faces significant restraints, primarily high capital expenditure required for setting up and operating specialized cryogenic air separation units and the complex, energy-intensive purification processes needed to achieve UHP levels. Furthermore, regulatory hurdles related to industrial gas storage and transport, especially across international borders, contribute to operational costs and supply chain rigidity.

Opportunities for market expansion are substantial, particularly in emerging applications such as 3D printing of reactive metals and the continued proliferation of optical fiber networks, both of which require UHP inert environments. Producers have a significant opportunity to develop advanced, smaller-scale purification technologies suitable for localized, high-demand installations, addressing the logistical challenges of bulk gas transport. The primary impact forces driving competition include the threat of substitutes (minimal, given argon’s unique properties, but specialized processes might substitute Helium or Nitrogen in specific steps), the bargaining power of major buyers (semiconductor giants often demand competitive, long-term contracts), and the high entry barriers for new players due to substantial infrastructure investment and stringent quality control requirements, solidifying the market dominance of established global industrial gas majors.

Segmentation Analysis

The Ultra High Purity Grade Argon market is comprehensively segmented based on purity level, application, supply mode, and regional geography, reflecting the diverse and highly technical requirements of its end-user base. Segmentation by purity is crucial as it dictates the suitability of the gas for different technological nodes; Grade 5.0 (99.999%) is often used in general high-purity applications, while Grade 5.5 (99.9995%) and Grade 6.0 (99.9999%) are strictly reserved for the most advanced semiconductor and OLED manufacturing processes. Application segmentation highlights the dominance of electronics and metallurgy, although niche segments like healthcare and specialty chemicals are growing due to increasing use of controlled inert environments in complex synthesis and device manufacturing. The market structure mandates rigorous quality control across all segments, ensuring that gas supplied matches the exact technical specification required by the downstream process.

Further analysis of segmentation reveals critical trends within the supply mode. Bulk supply, delivered via liquid argon tankers to large fabrication sites, represents the largest revenue segment, driven by the massive consumption rates of integrated device manufacturers (IDMs) and foundries. However, cylinder and packaged gas delivery remain vital for smaller research institutions, specialized welders, and maintenance applications that require portability or lower volumes, often demanding even stricter adherence to contamination control protocols within the packaging itself. Regional segmentation confirms Asia Pacific’s lead due to its dense manufacturing base, but North America and Europe continue to hold significant market share, focusing on high-value applications like aerospace, advanced defense systems, and R&D activities that necessitate premium UHP argon grades.

- By Purity Level:

- Grade 5.0 (99.999%)

- Grade 5.5 (99.9995%)

- Grade 6.0 (99.9999%) and above

- By Application:

- Semiconductor and Electronics Manufacturing (Etching, Sputtering, Annealing, Epitaxial Growth)

- Metallurgy and Metal Fabrication (Specialized TIG/Plasma Welding, Advanced Shielding Gas)

- Optical Fiber Manufacturing

- Aerospace and Defense

- 3D Printing (Additive Manufacturing)

- Chemical and Pharmaceutical Industries

- By Supply Mode:

- Bulk Supply (Liquid Argon Transport)

- Cylinder and Packaged Gas

- Pipeline

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Ultra High Purity Grade Argon Market

The value chain for Ultra High Purity Grade Argon begins with upstream analysis, which involves the extraction of crude argon, a byproduct of the cryogenic air separation process used primarily to produce high-volume oxygen and nitrogen. Argon, comprising less than 1% of air, requires specialized and energy-intensive distillation columns for initial concentration. The subsequent purification stage is the most critical and capital-intensive step, involving specialized technologies like catalytic purification, adsorption, and chromatography to remove minute impurities such as hydrogen, carbon monoxide, and moisture down to parts-per-billion levels, transforming industrial argon into UHP grades (5.0, 5.5, or 6.0). Major industrial gas companies dominate this upstream and purification segment due to the requirement for extensive infrastructure and proprietary purification intellectual property.

The distribution channel analysis involves managing complex logistics required for transporting liquid UHP argon, which must maintain its cryogenic state and purity throughout the supply chain. Distribution methods are classified as direct and indirect. Direct distribution involves large-scale, long-term contracts where producers supply bulk liquid argon via dedicated cryogenic tankers directly to major end-users, primarily semiconductor fabrication plants, often installing and managing dedicated storage and vaporization facilities on the customer's site. Indirect distribution typically involves smaller volumes sold through local distributors or regional branches utilizing high-pressure cylinders and tube trailers for lower-volume users, such as specialized welding shops or R&D laboratories, where the distributor acts as an intermediary responsible for cylinder maintenance and quality assurance. Downstream analysis focuses on the end-user application, where UHP argon is consumed. The efficiency and reliability of the supply chain directly impact the end-user's manufacturing yield, making reliable logistics a crucial determinant of market success rather than just the purity of the product itself.

Ultra High Purity Grade Argon Market Potential Customers

Potential customers for Ultra High Purity Grade Argon are primarily concentrated in sectors that require extremely inert atmospheres for processes sensitive to trace contaminants, ensuring material integrity and high product yield. The largest cohort of buyers are Integrated Device Manufacturers (IDMs) and Semiconductor Foundries, including global leaders in memory, logic, and analog chip production, who use UHP argon extensively during photolithography, etching, and thin-film deposition processes. These customers necessitate pipeline or bulk liquid supply due to their enormous, continuous consumption volumes. A secondary, but highly specialized, customer base exists within the aerospace and defense industries, where companies involved in manufacturing critical components like jet engine parts, satellite structures, and specialized armor demand UHP argon for high-integrity welding and brazing of exotic, reactive alloys (e.g., titanium and nickel-based superalloys) to prevent oxidation and ensure structural longevity.

Furthermore, emerging customer segments include advanced materials companies specializing in the production of high-performance materials such as silicon carbide (SiC) and gallium nitride (GaN), crucial for power electronics and 5G/6G communication infrastructure, all requiring ultra-clean processing environments. Optoelectronics manufacturers, specifically those producing OLED displays and optical fibers, form another key customer group, utilizing UHP argon as a protective atmosphere during crystal growth and vapor deposition processes. These potential customers prioritize suppliers who can not only guarantee Grade 5.5 or 6.0 purity but also provide sophisticated point-of-use purification systems and advanced analytical monitoring to certify gas quality at the crucial moment of consumption, underscoring the high-specification nature of the required supply partnership.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.56 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Air Liquide, Linde plc, Air Products and Chemicals, Messer Group, Nippon Sanso Holdings (Taiyo Nippon Sanso), Yingde Gases, Hangyang Group, Air Water Inc., BASF SE (Electronic Materials Division), Gas and Heat, Coregas, Gulf Cryo, Praxair (now part of Linde), N.V. BOC (part of Linde), Universal Industrial Gases, Chengdu Huarong Chemical, Shenghong Gas, Dalian Furuide Gas, Wuhan Iron and Steel Co. Gases. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultra High Purity Grade Argon Market Key Technology Landscape

The core technology underpinning the Ultra High Purity Grade Argon market remains cryogenic air separation, although the sophistication lies in the subsequent purification stages. Modern Air Separation Units (ASUs) incorporate highly optimized distillation columns designed not only for high throughput of oxygen and nitrogen but also for efficient recovery and initial concentration of crude argon. Advanced process control systems and energy integration technologies are being deployed to mitigate the substantial energy costs associated with maintaining cryogenic temperatures and high compression ratios. Continuous technological advancements focus on maximizing argon recovery yields, which historically lag behind O2 and N2 recovery, thus directly impacting the availability and cost of the UHP feedstock.

The critical technological differentiators for market leaders involve proprietary UHP purification techniques. These include specialized catalytic converters used to remove trace hydrogen and oxygen, followed by multi-stage adsorption technologies utilizing custom-designed molecular sieves and activated carbon beds to strip residual contaminants like carbon monoxide, methane, and moisture down to single-digit parts-per-billion (ppb) levels, which is necessary for Grade 6.0 certification. Furthermore, the technology landscape includes advanced analytical instrumentation, such as high-sensitivity gas chromatographs (GC) and mass spectrometers (MS), which are essential for real-time quality assurance and certifying the ultra-low impurity levels required by high-end semiconductor fabrication, ensuring regulatory compliance and meeting customer specifications.

Packaging and delivery also constitute a vital technological domain. Innovations here include the development of specialized cylinder internal surface treatments and cleaning protocols designed to prevent outgassing and contamination during storage and transport, which is a major concern for UHP products. Sophisticated telemetry and IoT-enabled monitoring systems are increasingly used in bulk supply logistics and pipeline distribution to remotely track pressure, temperature, and purity levels continuously. This level of technological oversight in the distribution chain minimizes the risk of product integrity loss between the purification facility and the point of use, offering an invaluable layer of security and reliability to critical manufacturing processes globally.

Regional Highlights

- Asia Pacific (APAC)

- North America

- Europe

- Latin America, Middle East, and Africa (LAMEA)

APAC dominates the global UHP Argon market, driven by the colossal concentration of semiconductor fabrication facilities (fabs) across Taiwan, South Korea, China, and Japan. These countries are not only leaders in advanced logic and memory chip production but are also heavily investing in display technology (OLED and LCD panel production), all of which rely on continuous, high-volume UHP argon supply. Government incentives and strategic national industrial policies, particularly in China and South Korea, aimed at achieving technological independence and expanding domestic chip manufacturing capacity, are the primary propellers of demand. The intensity of chip manufacturing expansion in Taiwan (TSMC) and South Korea (Samsung, SK Hynix) demands strict adherence to Grade 5.5 and Grade 6.0 purity levels, forcing industrial gas suppliers to implement localized, dedicated purification and pipeline infrastructure near major technology parks. This robust investment cycle ensures APAC maintains the highest CAGR and market share throughout the forecast period.

The region’s rapid urbanization and infrastructural development also contribute to demand through the construction and aerospace sectors, although the electronics industry remains the largest consumer. Logistical complexity is managed through localized production hubs and strong alliances between regional gas producers and global majors. The competition in APAC is intensifying, focusing less on basic supply and more on integrated utility provision, including the management of specialized onsite gas generation and purification plants within the customer premises to guarantee the highest possible quality and reliability required for next-generation node processes. Regulatory environments in key markets are evolving rapidly, focusing on safety standards and environmental impact, pushing gas suppliers toward highly efficient and localized production models.

North America holds a significant share, primarily driven by high-value, research-intensive applications and the recent push for semiconductor manufacturing repatriation and expansion through initiatives like the CHIPS and Science Act in the United States. While the volume consumption is lower than APAC, the market value is sustained by premium pricing derived from complex end-user requirements in the aerospace, defense, and advanced R&D sectors. Key demand centers include specialized welding for aircraft and defense components, fabrication of sensitive medical devices, and the operation of long-established, high-technology semiconductor foundries focused on specialized or leading-edge nodes.

The region is characterized by established supply chains and a focus on reliability and advanced technology integration. UHP argon suppliers in North America emphasize offering comprehensive gas management solutions, including remote inventory monitoring and specialized analytical services to ensure compliance with stringent quality requirements set by military specifications and regulatory bodies like the FDA (for medical device manufacturing). Market growth here, while steady, is increasingly dependent on the successful execution and ramp-up of new domestic fabrication capacity announced recently, particularly in states like Arizona and Ohio, which promise to significantly increase the bulk consumption of high-purity process gases.

The European UHP Argon market is characterized by mature industrial sectors, including specialized automotive manufacturing, advanced metal fabrication, and a growing cluster of high-tech R&D institutions and small to mid-sized semiconductor firms. Germany, France, and Ireland are key consumption hubs, with Ireland hosting a significant portion of Europe's high-tech manufacturing base. Demand is stabilized by strict quality standards in the metallurgy sector, where UHP argon is crucial for specialty welding of structural components used in demanding environments (e.g., nuclear power, high-speed rail).

Market dynamics in Europe are heavily influenced by environmental regulations and high energy costs, prompting producers to focus on energy-efficient ASU operations and optimized logistics to minimize the carbon footprint associated with gas transport. The region sees strong growth in additive manufacturing (3D printing) of critical metal parts, where UHP argon is essential to prevent rapid oxidation of reactive powders (like titanium and aluminum alloys) in the build chamber. Future growth is projected to accelerate, supported by the European Chips Act, aiming to bolster domestic semiconductor production capacity and reduce reliance on APAC supply chains, which will translate into substantial, long-term contracts for UHP gas supply.

The LAMEA region represents a smaller, yet expanding, market segment. Demand is concentrated primarily in metallurgy, petrochemical processing, and infrastructure projects, particularly in countries like Brazil, Saudi Arabia, and South Africa. The Middle East segment, in particular, exhibits growth potential driven by substantial investments in industrial diversification, including the establishment of domestic high-tech manufacturing and advanced metal fabrication facilities related to oil and gas infrastructure and defense. UHP argon is vital for high-quality pipeline welding and specialized coating applications.

Market challenges in LAMEA often relate to logistical complexities, fragmented distribution networks, and varying regulatory standards across different nations, which often necessitates greater reliance on imported product or smaller, localized production units managed by international majors. As industrialization deepens and countries invest in complex manufacturing capabilities, such as solar panel production or localized electronics assembly, the demand for certified UHP gases is expected to see accelerated, albeit gradual, expansion throughout the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultra High Purity Grade Argon Market.- Air Liquide

- Linde plc

- Air Products and Chemicals

- Messer Group

- Nippon Sanso Holdings (Taiyo Nippon Sanso)

- Yingde Gases

- Hangyang Group

- Air Water Inc.

- Coregas

- Gas and Heat

- Gulf Cryo

- Universal Industrial Gases

- Shenghong Gas

- Dalian Furuide Gas

- Wuhan Iron and Steel Co. Gases

- BASF SE (Electronic Materials Division)

- Sumitomo Seika Chemicals Co., Ltd.

- Norco Inc.

- Matheson Tri-Gas, Inc. (Part of Taiyo Nippon Sanso)

- Praxair (Part of Linde)

Frequently Asked Questions

Analyze common user questions about the Ultra High Purity Grade Argon market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Ultra High Purity Grade Argon (UHP Argon) and where is it primarily used?

UHP Argon refers to gas with purity levels of 99.999% (Grade 5.0) or higher, crucial for sensitive processes. Its primary use is in the semiconductor industry for etching and thin-film deposition, and in specialized metallurgy for protecting reactive metals during welding or 3D printing.

Which purity grades are most critical for advanced semiconductor manufacturing?

Grade 5.5 (99.9995%) and Grade 6.0 (99.9999%) purity levels are considered most critical for advanced semiconductor manufacturing processes, such as those involving 7nm and 5nm node technologies, where trace impurities can severely compromise yield and performance.

How does the semiconductor industry expansion impact the UHP Argon market?

The global expansion of semiconductor fabrication plants (fabs), particularly in Asia Pacific, is the single largest driver of the UHP Argon market. Each new fab requires massive, continuous, and highly reliable bulk supply of UHP argon as an essential process gas, significantly driving both volume and demand for higher purity standards.

What are the main logistical challenges associated with supplying UHP Argon?

The main logistical challenges include the high cost and complexity of maintaining the gas in cryogenic liquid form for bulk transport, preventing contamination within the storage and distribution vessels, and managing the specialized, high-pressure cylinder logistics for smaller end-users while guaranteeing certified purity at the point of consumption.

Which region dominates the global consumption of Ultra High Purity Grade Argon?

Asia Pacific (APAC), particularly driven by major chip manufacturing hubs in Taiwan, South Korea, and China, dominates the global consumption of UHP Argon due to the dense concentration of advanced electronics, display panel, and semiconductor fabrication facilities located within the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager