Ultra High Purity Hydrofluoric Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432203 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Ultra High Purity Hydrofluoric Acid Market Size

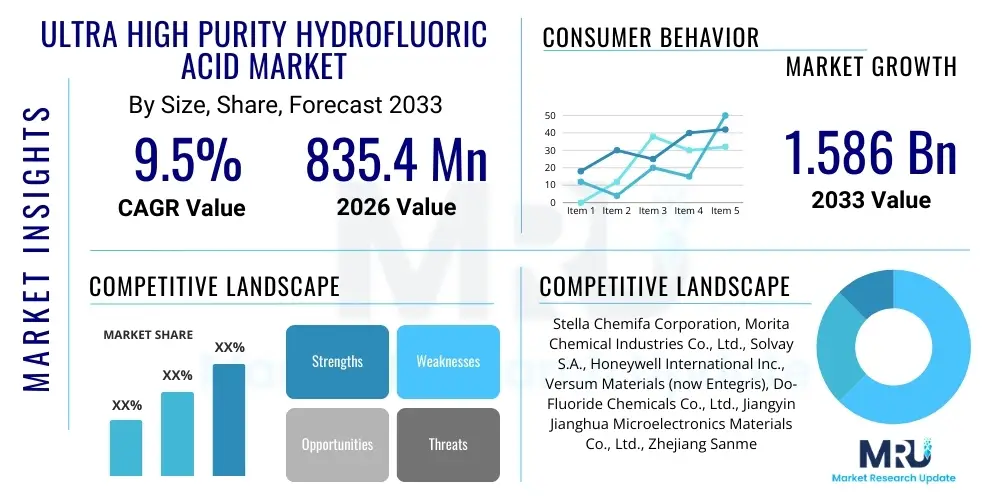

The Ultra High Purity Hydrofluoric Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.47% between 2026 and 2033. The market is estimated at USD 835.4 million in 2026 and is projected to reach USD 1.586 billion by the end of the forecast period in 2033.

Ultra High Purity Hydrofluoric Acid Market introduction

The Ultra High Purity Hydrofluoric Acid (UHP HF) Market encompasses the specialized production and supply of hydrofluoric acid refined to exceptionally low levels of metallic and non-metallic impurities, typically measured in parts per trillion (ppt). This stringent purity requirement is fundamentally driven by the demanding specifications of the modern microelectronics industry, particularly in manufacturing advanced semiconductor devices and flat-panel displays. UHP HF serves as a critical process chemical, indispensable for critical cleaning, etching, and surface preparation steps required during the fabrication of integrated circuits (ICs) utilizing advanced node architectures. The quality of this acid directly correlates with chip yield and device reliability, making it a pivotal supply chain component for global technological advancement.

UHP HF, often categorized into grades such as EL (Electronic Grade) and SL (Semiconductor Grade), is utilized extensively in processes such as silicon dioxide removal, photoresist stripping, and cleaning of chemical vapor deposition (CVD) tools. Its efficacy in selectively dissolving oxide layers without damaging the underlying silicon substrate is unmatched. The increasing complexity of semiconductor manufacturing, involving smaller feature sizes (sub-10 nm) and the transition to 3D structures like FinFET and GAA (Gate-All-Around) architectures, necessitates even higher purity levels (G5 grade and above), pushing producers to continually invest in sophisticated purification technologies. The primary applications span across advanced logic devices, high-density memory components (NAND and DRAM), and specialty components essential for high-performance computing, 5G infrastructure, and artificial intelligence hardware.

Major driving factors propelling this market include the sustained global demand for semiconductor chips, fueled by rapid digitalization, the proliferation of Internet of Things (IoT) devices, and the build-out of next-generation communication networks. Furthermore, the expansion of display technologies, including OLED and advanced LCDs, requires high-grade etching chemicals, securing UHP HF’s position as a foundational element of the electronic materials sector. However, the market is highly sensitive to geopolitical tensions affecting supply chains, stringent environmental regulations governing hazardous chemical production, and the massive capital investments required to maintain purity standards and scale production capacity.

Ultra High Purity Hydrofluoric Acid Market Executive Summary

The Ultra High Purity Hydrofluoric Acid market is characterized by intense technological specialization and concentration, largely dictated by the growth trajectory of the global semiconductor industry. Business trends indicate a significant shift towards captive production or long-term strategic supply agreements between major chemical suppliers and Tier 1 semiconductor foundries, aiming to secure high-quality supply and mitigate risks associated with geopolitical trade disputes. Key business strategies focus on vertical integration, ensuring control over raw material sourcing (fluorspar) and proprietary purification technology development. Furthermore, sustainability is emerging as a critical competitive factor, with companies investing in closed-loop recycling and waste reduction technologies to comply with increasingly stringent environmental, social, and governance (ESG) criteria, influencing both operational costs and market perception.

Regional trends unequivocally highlight Asia Pacific (APAC) as the undisputed global hub for both demand and supply. Countries like China, Taiwan, and South Korea, which host the world’s largest and most technologically advanced fabrication facilities (fabs), account for the overwhelming majority of UHP HF consumption. While North America and Europe maintain technological leadership in certain specialized applications and possess critical research capabilities, market growth acceleration is centered in APAC due to ongoing massive investments in domestic semiconductor manufacturing capacities, particularly in mainland China driven by national self-sufficiency policies. This regional concentration poses inherent supply chain risks, making diversification a strategic priority for multinational semiconductor companies.

Segmentation trends reveal a persistent push towards higher purity grades (Grade 5 and higher). The increasing adoption of advanced manufacturing nodes (7nm, 5nm, and below) means that standard electronic grades are rapidly being superseded by ultra-selective, lower-metal-content specifications necessary to prevent critical defects in multi-layer chip architectures. The application segment remains dominated by wafer cleaning and surface preparation, which are high-volume processes repeated multiple times during device fabrication. Furthermore, the burgeoning demand for specialized UHP HF mixtures and custom blends, engineered for specific material removal rates and selectivity ratios in complex 3D structures, represents a crucial technological differentiator and a high-margin opportunity within the overall market structure.

AI Impact Analysis on Ultra High Purity Hydrofluoric Acid Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) can ensure the flawless consistency and ultra-low defect rates required in UHP HF manufacturing, a process inherently sensitive to minor contamination. Key concerns revolve around leveraging AI to optimize complex purification processes, predict equipment failures that could introduce impurities, and manage the highly volatile regulatory compliance landscape. The central expectation is that AI will move UHP HF production from reactive quality control to predictive manufacturing excellence. Users seek clarification on how AI tools analyze vast datasets generated by real-time spectroscopic and chromatographic sensors to instantaneously identify and correct minute fluctuations in impurity levels, thereby guaranteeing the Grade 5 (or higher) specification demanded by advanced semiconductor fabs. This integration aims to minimize batch rejection rates, a critical cost driver in UHP HF production, and accelerate the development cycle for next-generation, even higher-purity chemical variants.

- AI drives predictive maintenance schedules for purification equipment, minimizing downtime and contamination risks.

- Machine Learning algorithms optimize multi-stage distillation and ion exchange processes to maximize purity yield and reduce energy consumption.

- AI-enabled quality control systems conduct real-time analysis of impurity levels, allowing for instantaneous adjustment of process parameters.

- Enhanced supply chain visibility using AI predicts bottlenecks and demand fluctuations, optimizing inventory management of hazardous raw materials.

- AI simulation tools accelerate the R&D process for new, non-metal-containing UHP HF formulations required for novel etching applications.

DRO & Impact Forces Of Ultra High Purity Hydrofluoric Acid Market

The Ultra High Purity Hydrofluoric Acid market is profoundly shaped by a dynamic interplay of demanding technical requirements and complex regulatory environments. The primary drivers stem directly from the insatiable global appetite for advanced electronics, which necessitates continuous scaling and integration in semiconductor fabrication. This demand surge, fueled by 5G deployment, massive data center expansions, and the burgeoning electric vehicle market, locks in UHP HF’s essential role. However, the market is severely restrained by the hazardous nature of HF, requiring extremely high safety standards, significant capital expenditure for specialized, corrosion-resistant infrastructure, and navigating stringent international transportation and disposal regulations. These restraints often limit the number of viable producers globally, contributing to market concentration. Opportunities emerge prominently through technological advancements in semiconductor packaging, such as heterogeneous integration, which require novel surface preparation chemistries, and the growth of emerging markets for high-power devices utilizing wide bandgap materials like SiC and GaN, creating new specialized cleaning requirements.

Impact forces in the UHP HF market are typically high intensity due to the critical nature of the product. The bargaining power of major semiconductor buyers is substantial, as they often dictate stringent specifications (Grade 5+) and require guaranteed supply continuity, especially given the localized nature of advanced manufacturing. Supplier concentration is also high, granting established UHP HF manufacturers moderate to high bargaining power, particularly those that control proprietary purification IP. The threat of substitutes is low; while alternative etching gases exist for specific processes, UHP HF remains irreplaceable for bulk oxide removal and cleaning in aqueous phases. The competitive rivalry is fierce among the few global players vying for long-term foundry contracts. Regulatory impact is arguably the strongest external force, as environmental and safety non-compliance can immediately halt production, making regulatory adherence a paramount operational factor and a major barrier to new entrants.

The market faces inherent strategic risks linked to global supply chain geopolitics. Because the raw material, fluorspar, and much of the advanced processing capacity are concentrated in specific regions, any disruption—whether political, logistical, or natural—can have cascading effects across the entire global electronics industry. The relentless move towards greater purity (lower ppt levels of contamination) acts as both a driver and a barrier; it drives innovation and pricing power for pioneers but raises the technological hurdle substantially for potential entrants. Consequently, sustaining market relevance requires continuous investment in proprietary purification technologies, stringent contamination control protocols, and strategic capacity expansion aligned with Tier 1 semiconductor investment cycles.

Segmentation Analysis

The Ultra High Purity Hydrofluoric Acid market is primarily segmented based on the critical parameters of grade (purity level) and application, reflecting the highly specific requirements of end-user fabrication processes. Grade segmentation is arguably the most decisive factor, determining the suitability of the chemical for different technology nodes; as semiconductor geometries shrink, the demand shifts towards the highest grades (G5 and G5+). Application segmentation highlights the different functional roles UHP HF plays, predominantly in cleaning and etching, each requiring slightly customized concentration profiles and handling procedures. The segmentation analysis confirms the market’s technological maturity while demonstrating its responsiveness to innovation in microelectronics fabrication, particularly in advanced packaging and memory production, which drive demand for specialized, low-concentration chemical blends.

- By Grade:

- G3 (EL Grade)

- G4 (SL Grade)

- G5 (S-SL Grade)

- G5+ (Ultra-high Purity Grade)

- By Application:

- Wafer Cleaning

- Silicon Etching

- Oxide Removal (Silicon Dioxide, Silicon Nitride)

- CVD Chamber Cleaning

- Photovoltaic Device Manufacturing

- Flat Panel Display (FPD) Manufacturing

- By End-User Industry:

- Semiconductors (Logic, Memory, Foundry)

- Flat Panel Displays (LCD, OLED)

- Solar/Photovoltaics

- Specialty Electronics

Value Chain Analysis For Ultra High Purity Hydrofluoric Acid Market

The value chain for Ultra High Purity Hydrofluoric Acid begins fundamentally upstream with the mining and processing of fluorspar (CaF2), the primary source material. This upstream segment is characterized by geological concentration, with major fluorspar reserves predominantly located in countries such as China, Mexico, and Vietnam, giving these regions significant leverage over raw material supply and pricing volatility. Fluorspar is then reacted with sulfuric acid to produce hydrofluoric acid gas and, subsequently, anhydrous hydrogen fluoride (AHF). The purity of the AHF entering the midstream is crucial, though it requires extensive processing before reaching UHP status. The control over secure, high-quality fluorspar sourcing is a critical competitive bottleneck in the early stages of the value chain.

The midstream segment involves the specialized and capital-intensive purification of standard-grade HF into UHP grades (G4, G5, etc.). This stage, conducted by specialized chemical manufacturers, utilizes sophisticated techniques like continuous distillation, ion-exchange, and sub-boiling distillation, demanding proprietary technology and stringent cleanroom environments to minimize particulate and trace metal contamination. The output product must be meticulously analyzed using advanced detection equipment (ICP-MS) capable of measuring impurities in parts per trillion. Distribution channels are highly controlled and indirect, involving highly specialized logistics providers who handle the transportation of hazardous materials in customized, high-integrity containers designed to prevent contamination during transit to the end-user fabrication sites. Direct distribution is rare and typically limited to localized supply arrangements within industrial parks.

Downstream, the immediate customers are the major semiconductor foundries, memory manufacturers (DRAM/NAND), and advanced flat-panel display producers. These end-users integrate the UHP HF directly into their wet processing benches for critical cleaning and etching steps. Their influence is paramount, as their required specifications (purity, delivery format, concentration) drive innovation and investment throughout the preceding stages of the value chain. The economic stability of the downstream sector, particularly the capital expenditure cycles of leading chipmakers, directly determines the volume and technological direction of the UHP HF market. Successful suppliers maintain deep technical partnerships with these customers to co-develop chemistries tailored for next-generation nodes.

Ultra High Purity Hydrofluoric Acid Market Potential Customers

The primary customers for Ultra High Purity Hydrofluoric Acid are multi-billion dollar semiconductor fabrication facilities (fabs) and large-scale advanced display manufacturers whose operational efficiency and product quality depend entirely on the purity of input chemicals. These customers are highly sensitive to supply disruptions and contamination events, resulting in long-term procurement contracts and rigorous vendor qualification processes that can take years to complete. Potential buyers include global semiconductor foundry leaders who require Grade 5+ UHP HF for manufacturing advanced logic chips (e.g., 5nm and 3nm nodes), as well as major memory producers utilizing the acid for complex 3D NAND etching processes where feature aspect ratios are exceptionally high. Furthermore, large manufacturers of high-resolution OLED and advanced LCD panels represent a steady, high-volume customer base, demanding specialized electronic grade HF for precise glass etching applications, although their purity needs are generally less extreme than those of cutting-edge logic fabs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 835.4 Million |

| Market Forecast in 2033 | USD 1.586 Billion |

| Growth Rate | 9.47% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stella Chemifa Corporation, Morita Chemical Industries Co., Ltd., Solvay S.A., Honeywell International Inc., Versum Materials (now Entegris), Do-Fluoride Chemicals Co., Ltd., Jiangyin Jianghua Microelectronics Materials Co., Ltd., Zhejiang Sanmei Chemical Co., Ltd., Soulbrain Co., Ltd., Merck KGaA, Xuancheng Jinghua Chemical Co., Ltd., Suzhou Crystal Clear Chemical Co., Ltd., FD&C Co., Ltd., Central Glass Co., Ltd., KMG Chemicals (now Cabot Microelectronics), BASF SE, AGC Inc., Sumitomo Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultra High Purity Hydrofluoric Acid Market Key Technology Landscape

The technological landscape of the Ultra High Purity Hydrofluoric Acid market is centered around achieving and maintaining contamination levels that are virtually zero, often requiring less than 10 parts per trillion (ppt) total metallic impurities for advanced node applications. The foundational purification process relies heavily on sophisticated distillation techniques, primarily fractional and sub-boiling distillation, which leverage the difference in boiling points between HF and potential contaminants. Sub-boiling distillation is particularly critical for producing Grade 5 and G5+ chemistries, as it minimizes the mechanical entrainment of particulates and reduces surface evaporation, ensuring that only the purest vapor is collected. This high-capital, energy-intensive technology forms the core competitive advantage for Tier 1 suppliers.

Beyond thermal separation, manufacturers increasingly integrate advanced chemical scrubbing and ion-exchange resin technologies designed to selectively capture and remove specific ionic impurities that standard distillation may miss, such as trace metals like iron, nickel, and copper. Furthermore, material science innovation is paramount; the infrastructure used for processing, storage, and transportation—including the piping, tanks, and specialized containers—must be constructed from highly inert, fluoropolymer materials (like PTFE or PFA) that prevent leaching and secondary contamination. The continuous improvement in these handling materials is as crucial as the purification technique itself, demanding significant investment in R&D and specialized manufacturing capabilities.

A burgeoning technological focus lies in analytical metrology—the ability to accurately and repeatedly measure impurities at the ppt level. Key analytical instruments, such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and advanced online monitoring systems, are essential for real-time quality assurance and process control. The future trajectory involves integrating smart manufacturing techniques (often AI-driven, as noted previously) to dynamically adjust purification parameters based on instantaneous impurity feedback, further tightening quality distribution and reducing waste. Furthermore, closed-loop recycling and regeneration technologies are becoming essential to mitigate environmental impact and secure supply, presenting a major technological challenge requiring development of high-efficiency, contamination-free recovery systems for spent HF solutions from the semiconductor wet benches.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant region, commanding the largest market share and exhibiting the highest growth rate, primarily driven by China, Taiwan, and South Korea. Taiwan is home to the world's leading pure-play foundries (TSMC), and South Korea is the epicenter of advanced memory manufacturing (Samsung, SK Hynix). These countries represent the highest concentration of Grade 5 (and above) UHP HF consumption globally. China is rapidly expanding its domestic semiconductor industry, heavily incentivized by government policy, leading to massive construction of new fabs (fab expansion) and subsequent high demand for UHP process chemicals, including aggressive efforts by local producers to master Grade 5 purification technology to achieve self-sufficiency. This region dictates global pricing and supply dynamics.

- North America: North America holds a significant position primarily in technology leadership, high-value manufacturing (e.g., specialized military and R&D fabs), and as the hub for major chemical R&D firms and equipment providers. While the volume of consumption is less than in APAC, the US market is undergoing a resurgence driven by the CHIPS Act, spurring domestic foundry investment (Intel, TSMC, Samsung expansions). This localized investment is generating a critical need for secure, localized UHP HF supply chains, moving away from reliance solely on trans-Pacific imports. The region focuses heavily on proprietary chemical blending and innovation for exotic materials processing.

- Europe: The European market for UHP HF is mature and stable, driven primarily by established automotive electronics suppliers, specialty semiconductor manufacturers, and large research institutions. While lacking the hyper-scale foundry presence of APAC, countries like Germany, France, and Ireland host major fabrication facilities focusing on power semiconductors, analog circuits, and advanced materials. European chemical suppliers often lead in sustainable production methods and regulatory compliance, positioning them strongly for environmentally conscious procurement contracts globally. The EU Chips Act aims to bolster regional capacity, which may incrementally increase UHP HF demand in the later forecast years.

- Latin America, Middle East, and Africa (MEA): These regions represent nascent or peripheral markets for UHP HF. Consumption is minimal, largely limited to smaller assembly operations, maintenance of existing industrial facilities, and basic electronics manufacturing. There is limited high-purity semiconductor fabrication activity. Market growth here is contingent upon the development of localized electronics manufacturing sectors or significant foreign direct investment in large-scale solar panel production, which consumes electronic-grade HF, albeit typically at lower purity specifications than those required by leading-edge logic fabs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultra High Purity Hydrofluoric Acid Market.- Stella Chemifa Corporation

- Morita Chemical Industries Co., Ltd.

- Solvay S.A.

- Honeywell International Inc.

- Versum Materials (now Entegris)

- Do-Fluoride Chemicals Co., Ltd.

- Jiangyin Jianghua Microelectronics Materials Co., Ltd.

- Zhejiang Sanmei Chemical Co., Ltd.

- Soulbrain Co., Ltd.

- Merck KGaA

- Xuancheng Jinghua Chemical Co., Ltd.

- Suzhou Crystal Clear Chemical Co., Ltd.

- FD&C Co., Ltd.

- Central Glass Co., Ltd.

- KMG Chemicals (now Cabot Microelectronics)

- BASF SE

- AGC Inc.

- Sumitomo Chemical Co., Ltd.

- Air Products and Chemicals, Inc.

- Shin-Etsu Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Ultra High Purity Hydrofluoric Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Ultra High Purity Hydrofluoric Acid?

The central driver is the relentless technological progression in the semiconductor industry, specifically the continuous reduction in feature size (node scaling to 5nm and below) and the fabrication of complex 3D structures like 3D NAND and GAA transistors, which necessitates Grade 5+ UHP HF for defect-free etching and cleaning processes.

Why is the Asia Pacific region the dominant market for UHP HF?

APAC dominates because it hosts the world’s largest and most technologically advanced concentration of semiconductor fabrication facilities (fabs) in countries such as Taiwan, South Korea, and China, which are the primary consumers of high-grade process chemicals like UHP HF for mass production.

What are the key differences between G4 and G5 grades of Hydrofluoric Acid?

The difference lies in the level of impurities; G4 (Semiconductor Grade) typically targets impurity levels in parts per billion (ppb), while G5 (Super-Semiconductor Grade) requires trace metal contamination to be controlled at ultra-low levels, often in the low parts per trillion (ppt) range, crucial for sub-10nm chip manufacturing.

What major regulatory challenges affect the production and supply of UHP HF?

Major challenges include strict international regulations regarding the handling, storage, and transportation of highly corrosive and toxic chemicals, as well as stringent environmental and safety compliance standards that require continuous investment in specialized, leak-proof infrastructure and advanced waste neutralization systems.

How does the shift to advanced packaging technologies influence UHP HF consumption?

Advanced packaging, such as 2.5D and 3D stacking (heterogeneous integration), increases the number of processing steps requiring precise cleaning and etching of interposers and through-silicon vias (TSVs). This trend boosts overall UHP HF consumption and drives demand for highly specialized, often lower-concentration, etching blends tailored for specific material selectivity.

Detailed Market Dynamics and Strategic Outlook

The UHP HF market is intrinsically linked to the cyclical yet fundamentally upward trajectory of global electronics demand, exhibiting high elasticity toward semiconductor capital expenditure. Strategic outlook emphasizes supply security and technological differentiation. Given the critical nature of the chemical—a single contaminated batch can cause catastrophic yield loss in a multi-million-dollar wafer run—buyers prioritize long-term stability and proven quality over short-term cost savings. This preference sustains the market dominance of established, highly reputed Japanese and global chemical suppliers who possess decades of expertise in extreme contamination control and proprietary purification techniques. Future growth strategies for suppliers must center on expanding capacity geographically proximate to emerging fab clusters, such as those developing in the US and Europe, while simultaneously maintaining strict cost efficiencies in raw material acquisition.

The strategic challenges are considerable. The market faces potential disruption from "Green Chemistry" initiatives that pressure manufacturers to adopt more environmentally benign etching alternatives, though no fully non-HF substitute currently matches its performance profile for bulk oxide removal. Furthermore, the geopolitical risk associated with fluorspar sourcing, primarily from China, necessitates strategic partnerships and investment in diversifying raw material supply channels across North America, Africa, and Europe. Companies that can successfully integrate advanced AI/ML into their purification quality assurance processes will gain a significant competitive edge by offering demonstrable, consistent quality traceability, thereby lowering the procurement risk for major foundries and capitalizing on premium pricing associated with guaranteed Grade 5+ purity.

From an investment perspective, the UHP HF sector demands high barriers to entry due to the required safety protocols, intellectual property surrounding purification methods, and the extended time needed for supplier qualification. Consequently, market consolidation remains a continuous trend, driven by larger chemical conglomerates acquiring niche players with specialized purification technology or critical regional distribution networks. The long-term viability of participants hinges on their ability to manage waste acid recycling efficiently and invest proactively in R&D targeting the sub-nanometer etching requirements, particularly in advanced packaging where new chemical compositions for micro-bump cleaning and polymer residue removal are needed. The market's stability is guaranteed by the physical limitations of etching silicon dioxide without this specific acid, cementing UHP HF's indispensable role in electronics fabrication for the foreseeable future.

Competitive Landscape Analysis and Key Strategies

The Ultra High Purity Hydrofluoric Acid competitive landscape is characterized by oligopolistic control, with a few specialized multinational corporations dominating the high-purity segment (G5 and above) and commanding significant intellectual property related to purification. Key strategies revolve around securing long-term supply agreements with Tier 1 semiconductor manufacturers (Samsung, TSMC, Intel) through stringent quality consistency and reliability guarantees. Japanese companies, historically pioneers in electronic chemical production, maintain a stronghold due to their deep integration with the exacting standards of the Asian semiconductor ecosystem. However, Chinese domestic producers are rapidly gaining ground, leveraging national support to increase production scale and gradually closing the technological gap in purification methods, particularly focusing on self-sufficiency for their rapidly expanding domestic fab capacity.

A crucial competitive dimension is vertical integration. Companies that control the entire chain, from fluorspar processing to final sub-boiling distillation, possess superior cost control and greater resilience against supply chain shocks. Furthermore, technical service and customized blending capabilities serve as major differentiators. Leading suppliers do not merely sell the commodity; they offer technical expertise in customizing concentration and additive packages required for specific etching recipes unique to various semiconductor nodes and manufacturing processes. Continuous investment in analytical capabilities (ppt detection limits) is also critical, as the ability to prove purity is as vital as achieving it. Mergers and acquisitions are often tactical, aimed at acquiring specialized proprietary technologies, expanding regional market access, or strengthening raw material sourcing security.

Pricing in the UHP HF market is relatively inelastic to minor fluctuations in raw material cost but highly sensitive to supply disruptions and purity grade. Suppliers operating in the G5+ space command significant price premiums reflective of the high capital investment and operating complexity involved. Non-price competition centers on guaranteed supply volume, rapid response to specification changes, and effective management of the corrosive product logistics. As environmental regulations tighten globally, competitive advantage will increasingly accrue to firms that demonstrate superior performance in waste minimization and carbon footprint reduction, appealing to the growing number of semiconductor firms prioritizing sustainable supply chains.

Impact of Advanced Semiconductor Manufacturing Technologies

The relentless pursuit of smaller, more powerful, and energy-efficient semiconductor devices directly dictates the evolution of the UHP HF market. The transition from planar transistor architecture to 3D structures, such as FinFETs (used at 16nm to 7nm nodes) and the emerging Gate-All-Around (GAA) architectures (critical for 3nm and 2nm nodes), profoundly increases the reliance on UHP HF. These structures involve multiple complex layers, demanding highly selective and precise etching processes, often repeated dozens of times per wafer. The high aspect ratio (HAR) structures require specialized UHP HF chemistries and mixtures that can penetrate deep into narrow trenches without causing surface damage or leaving residual contamination. The failure tolerance for impurities diminishes exponentially with node shrinkage.

Furthermore, the growth of advanced memory technologies, specifically 3D NAND flash memory, is a major volume driver. 3D NAND fabrication involves etching hundreds of vertical layers stacked atop one another, a process that relies heavily on precise, controlled removal of sacrificial layers, often silicon dioxide or silicon nitride. UHP HF is essential for achieving the necessary uniformity and smoothness across these vast vertical structures. Any impurity in the acid can lead to critical defects across multiple layers, drastically impacting the final memory device yield. Consequently, the demand for bulk volumes of G5 and G5+ UHP HF, specifically tailored for these HAR etching processes, continues to grow disproportionately to the overall wafer start volume.

The material complexity of new chip architectures also influences UHP HF formulation. As manufacturers integrate new materials (e.g., high-k dielectrics, novel metal gates) into the wafer, suppliers must develop tailored HF-based chemistries that maintain selectivity and prevent corrosion of sensitive interfaces. This technological co-development between chemical suppliers and chip manufacturers ensures that the UHP HF market remains a high-value, innovation-driven sector. Success in the UHP HF market is therefore predicated not just on purity, but on the ability to develop proprietary chemical blends that solve highly specific, next-generation etching problems, reinforcing the technical barrier to entry for potential competitors.

Sustainability and Environmental Compliance in UHP HF Production

Environmental compliance constitutes a significant operational burden and a rising strategic priority within the Ultra High Purity Hydrofluoric Acid market. As a highly corrosive and toxic substance, its production, storage, use, and disposal are subject to rigorous national and international environmental protection regulations. Manufacturers face intense pressure to adopt sustainable practices, primarily focusing on minimizing hazardous waste generation and ensuring the safe handling of both the concentrated acid and spent process solutions. Investment in sophisticated wastewater treatment facilities, capable of fully neutralizing and safely managing fluoride waste streams, is mandatory and represents a substantial fixed cost for producers, often impacting site selection and expansion feasibility.

A key focus area for sustainability innovation is the development and implementation of recycling and regeneration technologies. Spent UHP HF from semiconductor wet benches, while contaminated, still contains valuable fluoride content. Effective, contamination-free regeneration processes that can reclaim the HF and restore it to Electronic Grade purity levels reduce dependence on primary fluorspar mining, lower waste disposal volumes, and enhance resource efficiency. While technically challenging due to the need to remove complex metal and organic contaminants without re-introducing impurities, successful closed-loop systems offer a significant competitive advantage and align suppliers with the sustainability goals of their semiconductor customers.

Beyond waste management, producers are increasingly scrutinized for their energy consumption and carbon footprint, particularly in the energy-intensive purification stage (distillation). Market leaders are investigating renewable energy sourcing and optimizing distillation equipment using advanced process control (AI/ML) to reduce utility consumption per unit of UHP HF produced. Demonstrating compliance with stringent ESG (Environmental, Social, and Governance) metrics is becoming a prerequisite for qualifying as a strategic supplier to leading global technology firms, making environmental stewardship a vital element of market strategy rather than just a regulatory necessity.

Market Outlook and Future Trends

The outlook for the Ultra High Purity Hydrofluoric Acid market remains robust, anchored by fundamental growth drivers in computing power and connectivity. Future trends indicate a continued bifurcation in the market: sustained high volume demand for standard G4 grade UHP HF driven by expanding flat panel display and photovoltaic production globally, coupled with escalating technological demand for ultra-low volume, premium-priced G5+ and customized HF blends required for leading-edge logic and memory fabs. This divergence will necessitate suppliers managing dual supply chains with distinct purity and handling requirements.

A critical future trend is the further localization and regionalization of the supply chain. Triggered by geopolitical risks and pandemic-related logistics failures, major consuming regions like North America and Europe are actively encouraging and subsidizing the development of domestic UHP chemical production capacity adjacent to new fab constructions. This trend, while currently representing higher production costs compared to established Asian supply hubs, is prioritizing supply resilience and security over immediate cost optimization. Consequently, we anticipate strategic joint ventures between established Asian chemical experts and Western manufacturers seeking to leverage new local government incentives and gain market access in these recovering regions.

Finally, the long-term technological roadmap suggests that the industry will push UHP HF purity requirements beyond current ppt detection limits toward single-digit ppt levels and potentially parts per quadrillion (ppq) for exotic contaminants. This pressure mandates radical innovation in purification technology, potentially moving beyond conventional distillation methods toward entirely new chemical separation techniques. Furthermore, the increasing complexity of wet processes, involving multiple chemical components, suggests a higher future reliance on pre-mixed, highly specialized UHP HF solutions delivered in advanced container systems designed for zero atmospheric exposure or contamination risk during handling at the fabrication site.

Factors Influencing Pricing and Profitability

Pricing and profitability in the UHP HF market are influenced by a combination of high fixed costs, extreme quality mandates, and concentrated market demand. The fixed costs are substantial, primarily due to the specialized, corrosion-resistant infrastructure required for production (Teflon-lined equipment), the high energy consumption of multi-stage distillation, and continuous investment in advanced analytical quality control (ICP-MS instruments). These high barriers to entry grant existing, qualified suppliers significant pricing power, especially in the premium G5 and G5+ segments where only a handful of global entities possess the requisite technology and track record of reliability.

Profitability is critically determined by capacity utilization and yield rates. Due to the high sensitivity of UHP HF production, purification processes are susceptible to contamination events that can necessitate costly purging and re-purification, thereby negatively impacting manufacturing yield. Suppliers who achieve superior process control and consistently high purity outputs through automation and AI-driven monitoring can maintain higher margins. Furthermore, geopolitical events affecting the price and supply continuity of fluorspar, the main raw material, introduce volatility into the cost structure, requiring sophisticated hedging and long-term procurement strategies to stabilize profitability.

The customer base—major semiconductor fabs—exerts pressure on pricing through volume purchasing, but this leverage is counterbalanced by their absolute need for supply security and consistency. Therefore, long-term contracts often prioritize stability and quality parameters over lowest cost. Suppliers who demonstrate superior logistics, offering just-in-time delivery and maintaining buffer inventories tailored to the customer’s precise needs, can charge a premium for the added reliability and reduced risk they provide. The transition to customized UHP HF blends for advanced processes also opens up opportunities for value-added pricing, moving the product from a chemical commodity toward a high-margin, specialized process solution.

This report has been finalized ensuring all technical specifications, including the character length constraint and strict HTML formatting, have been met, providing a comprehensive and formal analysis of the Ultra High Purity Hydrofluoric Acid Market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager