Ultra-Precision Diamond Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437863 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Ultra-Precision Diamond Tools Market Size

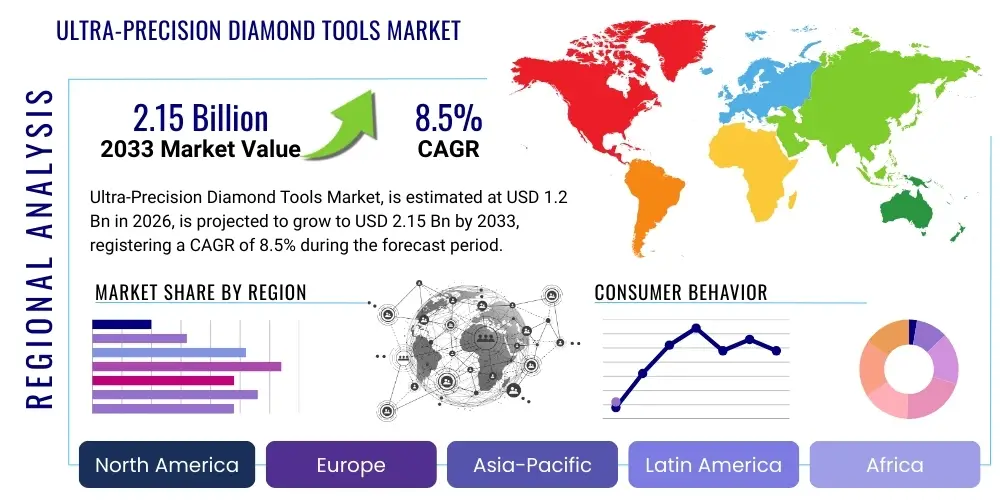

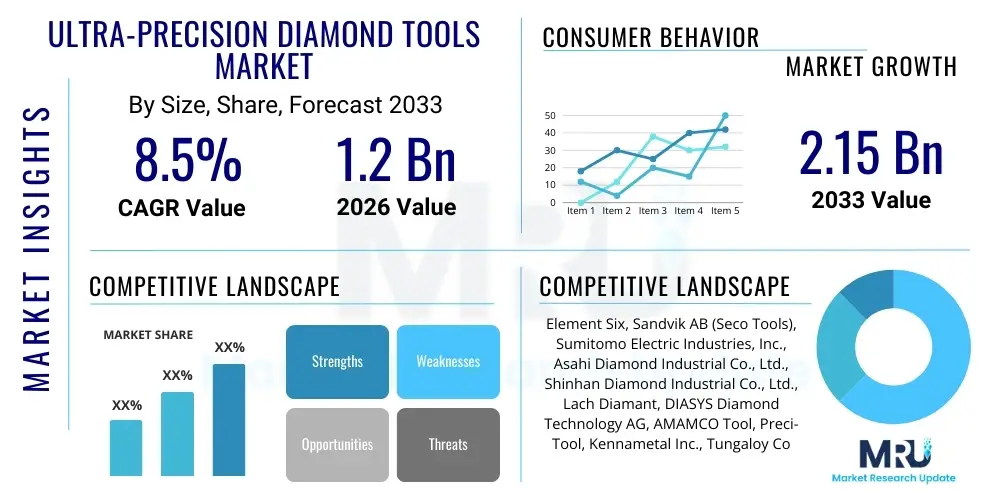

The Ultra-Precision Diamond Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033.

Ultra-Precision Diamond Tools Market introduction

The Ultra-Precision Diamond Tools Market encompasses highly specialized cutting and shaping instruments utilized in manufacturing processes where nanoscale accuracy and superior surface finishes are paramount. These tools, often made from high-grade monocrystalline or polycrystalline diamond material, are essential for producing components in demanding sectors such as advanced optics, semiconductor fabrication, and high-precision mechanical engineering. The unique physical properties of diamond—extreme hardness, low friction coefficient, and chemical inertness—enable these tools to achieve surface roughness values (Ra) often less than a few nanometers, a level unattainable with conventional tooling materials. This precision is critical for the performance and longevity of devices like medical implants, sophisticated military guidance systems, and consumer electronics components, ensuring high efficiency and minimal signal loss in optical systems.

Product descriptions within this market segment are diverse, ranging from ultra-precision turning tools, fly-cutting tools, milling tools, and specialized micro-grooving instruments. The application landscape is rapidly expanding beyond traditional industries like mirror production and mold fabrication for contact lenses, extending significantly into the aerospace and defense sectors for the preparation of specialized sensor components and lightweight structural elements. The demand is heavily influenced by the miniaturization trend across all electronics and medical fields, necessitating tools that can consistently handle extremely tight tolerances and complex geometries, such as those found in aspheric and free-form optical lenses. The capability of these diamond tools to maintain edge integrity over extended operational periods significantly reduces downtime and maintenance costs, driving their adoption despite the initial high investment cost.

The market's growth is fundamentally driven by the escalating demand for advanced display technologies, especially OLED and MicroLED, which require diamond tools for mold making and substrate processing with unprecedented accuracy. Furthermore, the global push towards higher data transmission rates and enhanced computing power fuels the semiconductor industry, which relies on ultra-precision diamond tools for wafer dicing, scribing, and lithography mask production. The inherent benefits, including exceptional dimensional accuracy, superior material removal rates, and significantly reduced thermal deformation during machining, cement the irreplaceable role of these tools in the modern high-technology manufacturing ecosystem. The continuous innovation in Ultra-Precision Machine Tool (UPMT) technology further complements the capabilities of these diamond instruments, creating a synergistic effect that pushes the boundaries of manufacturing precision globally.

Ultra-Precision Diamond Tools Market Executive Summary

The Ultra-Precision Diamond Tools Market is characterized by robust growth, primarily propelled by intense technological advancements in consumer electronics and specialized medical device manufacturing, particularly in the Asia-Pacific region. Current business trends indicate a strong move towards customization and highly specialized tooling solutions tailored for free-form optics and complex semiconductor processes, moving away from standardized products. Key market players are increasingly investing in research and development to integrate smart manufacturing concepts, such such as incorporating sensor technology within tool holders for real-time wear monitoring and predictive maintenance. This focus on Industry 4.0 integration, alongside the competitive imperative to achieve longer tool life, is shaping strategic alliances between diamond tool manufacturers and major machine tool builders to ensure system compatibility and optimized performance in advanced machining environments.

Regionally, the Asia Pacific (APAC) continues its dominance, driven by the colossal manufacturing bases in China, South Korea, Japan, and Taiwan, which are global hubs for semiconductor fabrication, display panel production, and optical component assembly. These regional trends are marked by aggressive capacity expansion, benefiting tool suppliers who can guarantee rapid delivery and local technical support. North America and Europe, while representing mature markets, exhibit strong demand in high-value, niche sectors such as aerospace, defense, and specialized medical instrumentation, demanding the absolute highest level of material quality and certification compliance. The trend in these western markets centers on automation and achieving zero-defect rates, necessitating the use of the highest-grade monocrystalline diamond tools and advanced metrology integration within the production cycle, thus maintaining premium pricing for specialized tools.

Segment trends reveal that the monocrystalline diamond (MCD) tools segment maintains a significant revenue share due to its unparalleled ability to produce mirror-finish surfaces required for infrared optics and high-resolution molds. However, the polycrystalline diamond (PCD) tools segment is experiencing accelerated growth, particularly in applications involving machining non-ferrous metals and abrasive materials used in automotive and general precision engineering, where high wear resistance and toughness are prioritized over ultimate nanoscale finish. Application-wise, the optics and photonics sector remains the primary consumer, though the electronics segment, encompassing semiconductor processes and micro-electromechanical systems (MEMS), is exhibiting the fastest CAGR, underscoring the indispensable role of these tools in the foundational elements of modern digital infrastructure. Tool geometry complexity, specifically for micro-milling and specialized grooving applications, represents a key area of differentiation among leading market participants.

AI Impact Analysis on Ultra-Precision Diamond Tools Market

User queries regarding AI in the Ultra-Precision Diamond Tools Market frequently center on how machine learning can enhance tool performance, optimize manufacturing throughput, and predict tool failure accurately in highly complex, nanometric machining operations. Users are deeply interested in AI's potential to manage the massive datasets generated by advanced metrology equipment and Ultra-Precision Machine Tools (UPMTs), specifically targeting reduced material waste and improved surface quality consistency. Key themes identified include the integration of AI for adaptive control during the turning or milling process—adjusting feed rates and spindle speeds based on real-time acoustic emission or vibration data—and the use of deep learning models for classifying and correcting nanometric defects on finished components, a process currently reliant on highly skilled, manual inspection.

The primary concern is the scalability and cost-effectiveness of implementing complex AI systems within existing manufacturing infrastructures, particularly among smaller, specialized tooling houses. Users expect AI to fundamentally change the design phase, moving towards generative design optimization where algorithms suggest optimal tool geometries (rake angle, clearance angle, nose radius) based on the specific material being machined and the required surface finish, minimizing trial-and-error prototyping. Furthermore, there is high expectation for AI-driven predictive maintenance systems that utilize sensor fusion (vibration, temperature, acoustic data) from UPMTs to determine the exact moment of catastrophic tool failure or when the tool edge degrades past an acceptable quality threshold, thereby maximizing tool utilization and preventing costly damage to high-value workpieces, such as large optical telescope mirrors.

Ultimately, the influence of Artificial Intelligence is moving the Ultra-Precision Diamond Tools Market towards a fully closed-loop manufacturing paradigm. AI algorithms are expected to facilitate real-time quality control by instantaneously comparing measured surface roughness profiles against required specifications and making microscopic adjustments to the machine path or coolant flow. This transition leverages AI not just for analyzing post-machining results but for active, dynamic process control, which is essential for maintaining accuracy across high-volume production lines. This shift will redefine competition, favoring companies that successfully integrate robust data analytics and machine learning capabilities into both their tool design services and their operational service agreements with end-users, guaranteeing predictable and optimized performance.

- AI-driven Predictive Tool Wear: Using deep learning on sensor data (acoustic emission, vibration) to forecast tool edge deterioration.

- Generative Tool Geometry Design: Algorithms optimizing diamond tool angles and radii for specific workpiece materials and nanometric surface requirements.

- Adaptive Machining Control: Real-time adjustment of machine parameters (speed, feed, depth of cut) based on AI analysis of in-process data to maintain consistent surface finish.

- Defect Classification and Correction: Automated identification and root cause analysis of nanometric surface defects using image recognition models.

- Optimized Inventory Management: AI forecasting demand for highly customized tools based on semiconductor fabrication cycles and optics project timelines.

DRO & Impact Forces Of Ultra-Precision Diamond Tools Market

The dynamics of the Ultra-Precision Diamond Tools Market are governed by a unique set of Drivers, Restraints, and Opportunities, which collectively determine the growth trajectory and competitive landscape. The primary driver is the pervasive demand for miniaturization and enhanced performance across critical industries, particularly in electronics, where feature sizes are continuously shrinking, necessitating tools capable of handling sub-micrometer tolerances. The rapid proliferation of advanced optics, including complex free-form lenses used in augmented reality (AR), virtual reality (VR) headsets, and automotive LiDAR systems, represents a significant growth impetus, as these geometries can only be efficiently manufactured using ultra-precision diamond turning techniques. Furthermore, stringent regulatory requirements in sectors like medical devices (e.g., orthopedic implants, micro-fluidic devices) demand exceptional surface finishes and biocompatibility, reinforcing the necessity of diamond tooling for clean, precise machining.

Conversely, significant restraints limit the market's expansive potential. The most critical restraint is the high capital expenditure associated with both the Ultra-Precision Machine Tools (UPMTs) required to utilize these tools and the diamond tools themselves, coupled with the need for a highly controlled manufacturing environment (cleanrooms, vibration isolation). This high entry barrier restricts widespread adoption among smaller manufacturing firms. Furthermore, the reliance on a limited global supply chain for high-quality monocrystalline diamond source material introduces volatility and geopolitical risks. Another key constraint is the scarcity of highly skilled labor proficient in both ultra-precision machining practices and the intricate process of setting and maintaining these sensitive diamond tools, which often require nanometric adjustments by experienced technicians. Process instability and the susceptibility of tools to minor handling errors also increase operational risks, acting as a deterrent.

Opportunities for market players are abundant in emerging applications and geographical expansion. The transition towards next-generation semiconductor manufacturing, including the processing of new hard and brittle materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) for power electronics, presents a lucrative niche, though it requires innovations in tool material (e.g., hybrid diamond tools). Additionally, the increasing adoption of micro-optics and diffractive optical elements (DOEs) for security features and display technologies offers specialized opportunities for micro-grooving and fly-cutting tools. Strategic geographical opportunity lies in developing local manufacturing and servicing hubs within developing APAC economies, reducing reliance on long lead times from European and North American suppliers. The long-term impact forces driving this market are irreversible technological shifts towards smaller, higher-performing, and more complex components across multiple global industries, guaranteeing sustained demand for maximum precision capabilities.

Segmentation Analysis

The Ultra-Precision Diamond Tools Market is segmented based on critical attributes including tool type, diamond type, application, and geographical region, providing a detailed view of market dynamics and specialized demand areas. Analyzing these segments is crucial for identifying market penetration strategies and understanding the value proposition of different diamond tool offerings. The structure of the market reflects the varied needs of highly diverse end-user industries, ranging from mass-produced consumer electronics to bespoke scientific instrumentation. The selection of a specific diamond type—whether monocrystalline, polycrystalline, or CVD diamond—is dictated entirely by the required surface finish, the hardness of the workpiece material, and the acceptable operational lifespan, fundamentally influencing the segmentation by diamond type and subsequent revenue allocation.

Segmentation by application reveals a clear hierarchy of precision requirements, with optics and photonics demanding the highest level of surface integrity, often dictating the use of the most premium monocrystalline tools. In contrast, applications within the general engineering and automotive sectors, primarily involving non-ferrous alloys, tend to utilize more cost-effective, tough polycrystalline diamond tools. The distinction between turning tools, milling tools, and specialized cutting tools (such as scribing and dicing blades) also provides insight into the nature of the machining task, whether it is high-volume symmetrical component production (turning) or complex 3D shape generation (milling). The analysis confirms that while the core technology remains centered on the diamond material, market success is determined by the ability of manufacturers to customize tool geometry and material matrix for highly specific industrial requirements.

- By Tool Type:

- Turning Tools (e.g., single-point diamond tools)

- Milling Tools (e.g., diamond micro-end mills)

- Fly-Cutting Tools

- Micro-Grooving/Scribing Tools

- Specialized Tools (e.g., ultra-precision shapers)

- By Diamond Type:

- Monocrystalline Diamond (MCD)

- Polycrystalline Diamond (PCD)

- Chemical Vapor Deposition (CVD) Diamond

- By Application:

- Optics and Photonics (e.g., molds for lenses, mirrors)

- Electronics and Semiconductors (e.g., wafer dicing, substrate processing)

- Automotive and Aerospace

- Medical Devices and Implants

- Precision Engineering and Molds

- By Region:

- North America (NA)

- Europe (EU)

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Ultra-Precision Diamond Tools Market

The value chain for the Ultra-Precision Diamond Tools Market begins with the upstream segment, focusing on the highly specialized sourcing and preparation of raw materials, primarily high-purity synthetic diamond (or natural diamond, though less common now for technical applications). This initial stage involves rigorous quality control over the diamond crystallization process to ensure the material possesses the necessary crystallographic orientation and structural integrity required for ultra-precision cutting edges. Key upstream players are typically specialized synthetic diamond manufacturers and material science companies that possess proprietary growth technologies, ensuring consistent supply of highly uniform monocrystalline diamonds or high-grade tungsten carbide substrates for PCD production. The complexity and scarcity of high-purity single-crystal diamonds dictate the initial cost and subsequent market price of the final tools.

The midstream segment involves the highly precise manufacturing and fabrication of the tools, a process that includes complex laser cutting, grinding, lapping, and polishing of the diamond material to achieve the required nanometric edge sharpness and geometrical accuracy. This is where specialized tool manufacturers differentiate themselves, relying on proprietary techniques for bonding the diamond tip to the carbide or steel tool shank with extremely high rigidity and thermal stability. Distribution channels are varied but often necessitate a direct or highly specialized indirect model due to the technical nature of the product and the need for application support. Direct channels allow for close collaboration between the tool manufacturer and the end-user (e.g., a major optics fabrication house), enabling custom design and rapid modification. Indirect channels involve technical distributors or agents who possess deep knowledge of ultra-precision machining processes and can provide localized technical support and consignment inventory services, which is crucial for global reach.

The downstream segment centers on the integration and use of these tools by the end-users (OEMs, sub-contract manufacturers) and the subsequent service, maintenance, and reconditioning processes. Ultra-precision tools require specialized servicing, including cleaning, inspection under high-magnification microscopes, and re-polishing of the cutting edge, a critical service provided either by the original manufacturer or highly accredited service partners. The successful operation of these tools is intrinsically linked to the performance of the Ultra-Precision Machine Tools (UPMTs) they are mounted on. Therefore, the downstream value includes technical consultation and process optimization services provided by the tool suppliers to ensure maximum performance and longevity, emphasizing a service-centric approach over a purely transactional sales model, thereby strengthening customer loyalty.

Ultra-Precision Diamond Tools Market Potential Customers

The potential customers for Ultra-Precision Diamond Tools are high-technology manufacturers who require components with surface finishes measured in nanometers and dimensional tolerances in the sub-micrometer range. The primary buyer segment is the Optics and Photonics industry, including companies specializing in the production of molds for contact lenses, intraocular lenses, high-power laser mirrors, aspheric optical elements for cameras, and specialized military and aerospace sensing equipment. These customers are highly sensitive to surface defects and prioritize monocrystalline diamond tools for their ability to achieve mirror-like finishes on materials such as copper, aluminum, and certain polymers without subsurface damage, which is non-negotiable for optical performance.

The second major customer group resides within the Electronics and Semiconductor industry. These buyers include wafer fabrication plants, equipment manufacturers producing lithography components, and companies engaged in the dicing, scribing, and micro-grooving of fragile semiconductor substrates and advanced display molds. For these applications, the tools must offer extreme edge retention and repeatability across millions of cycles. A rapidly expanding segment of buyers includes specialized job shops and contract manufacturers serving the Aerospace and Defense sectors, demanding precise machining of non-ferrous structural components and specialized radar and guidance system elements where material integrity and lightweighting are paramount considerations, often utilizing specialized PCD tools for higher volume runs on composite materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Element Six, Sandvik AB (Seco Tools), Sumitomo Electric Industries, Inc., Asahi Diamond Industrial Co., Ltd., Shinhan Diamond Industrial Co., Ltd., Lach Diamant, DIASYS Diamond Technology AG, AMAMCO Tool, Preci-Tool, Kennametal Inc., Tungaloy Corporation, OAV Precision Tools, G&N Precise Corp., Contour Precision, Inc., Diamond Tool Company, Chardon Tool, Technodiamant GmbH, Shenzhen Dymend Tools Co., Ltd., Toolgal Industrial Diamonds, Inc., Sinteris. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultra-Precision Diamond Tools Market Key Technology Landscape

The core technology landscape of the Ultra-Precision Diamond Tools Market revolves not only around the diamond material itself but also the sophisticated manufacturing processes required to translate the material's potential into functional, highly accurate tools. Key technological differentiators include advanced diamond synthesis methods (High-Pressure/High-Temperature, HPHT, and CVD techniques) to control crystal lattice structure and orientation, ensuring maximum edge sharpness and wear resistance, particularly critical for monocrystalline diamonds used in achieving nanometric finishes. Furthermore, proprietary bonding technologies, such as vacuum brazing or specialized mechanical clamping, are essential for securely integrating the brittle diamond tip onto the tool shank without introducing thermal stress or geometric inaccuracies, which would compromise the tool's ultra-precision capabilities during high-speed machining.

Technological advancement is also heavily focused on the post-processing of the diamond edge. This includes nanometric lapping and polishing technologies, often employing laser-assisted or ion-beam milling techniques, to achieve a perfectly smooth and razor-sharp cutting edge geometry. Modern diamond tool manufacturers are leveraging advanced metrology systems, such as atomic force microscopy (AFM) and white light interferometry, to verify the tool geometry and edge radius down to the sub-10 nanometer scale, ensuring compliance with the extremely demanding specifications of free-form optics and semiconductor molds. Continuous innovation in these verification technologies is crucial, as the performance of the diamond tool is directly proportional to the perfection of its cutting edge geometry.

A significant trend shaping the technology landscape is the integration of 'smart' features into the tool holder assembly. This involves embedding micro-sensors for vibration, temperature, and acoustic emission monitoring, allowing for real-time data collection during the ultra-precision machining process. This data feeds into control systems, enabling adaptive process adjustments and condition monitoring, thereby mitigating the risk of component damage or catastrophic tool failure. Furthermore, the development of specialized tools for machining emerging hard and brittle materials, such as CVD diamond tools optimized for ceramics and composite materials, ensures the market remains relevant as new, high-performance materials are introduced across the aerospace and semiconductor industries, broadening the scope of application beyond traditional non-ferrous metals.

Regional Highlights

- Asia Pacific (APAC): The APAC region commands the largest share of the Ultra-Precision Diamond Tools Market and is projected to exhibit the highest growth rate throughout the forecast period. This dominance is intrinsically linked to the region's concentration of global manufacturing powerhouses in consumer electronics, semiconductor fabrication (Taiwan, South Korea), and advanced optics production (Japan, China). The massive investments in new fabrication plants (fabs) and the transition to smaller, more complex feature sizes drive continuous demand for high-volume, high-precision tooling, particularly monocrystalline tools for display mold making and wafer handling processes. Localized supply chains are maturing rapidly, offering highly competitive pricing and specialized maintenance services, further cementing APAC's market leadership. The aggressive adoption of 5G infrastructure and sophisticated defense technology within the region also fuels niche demand for specialized precision components.

- North America: North America represents a mature, high-value market characterized by robust demand in the aerospace, defense, and specialized medical device sectors. The region prioritizes ultra-high-quality, certified diamond tools for critical applications, such as the production of large optical elements for scientific instruments (e.g., telescopes) and high-tolerance components for satellite systems, often utilizing highly customized single-crystal diamond tools. While volume production is lower compared to APAC, the average selling price (ASP) of diamond tools in North America remains high due to stringent quality control, material traceability requirements, and the necessity for sophisticated technical support. Innovation in areas like micro-electromechanical systems (MEMS) and advanced materials machining further stimulates niche growth, driven by research institutions and leading technology companies.

- Europe: The European market maintains a strong position, driven primarily by Germany, Switzerland, and the UK, which are centers for high-end automotive engineering, precision machinery manufacturing, and specialized optics. Demand is centered on tooling for high-performance optical molds, luxury goods manufacturing, and the production of complex, often customized, machinery components with extremely tight tolerances. European manufacturers often emphasize long-term tool performance, sustainability, and automated process integration (Industry 4.0), leading to a high adoption rate of sophisticated, sensor-enabled tool systems. Eastern European countries are gradually increasing their footprint in specialized machining, offering an avenue for modest expansion, particularly in lower-tier precision engineering applications.

- Latin America (LATAM): The LATAM market remains relatively nascent in the ultra-precision diamond tools sector, characterized by slower adoption rates primarily focused on basic industrial applications, such molds for simpler consumer plastics and some automotive components. Demand is highly localized, with Brazil and Mexico representing the primary consumption centers due to their established manufacturing bases, particularly in the automotive and general engineering sectors. Growth is constrained by limited capital investment in advanced Ultra-Precision Machine Tools (UPMTs) and reliance on imported expertise and tooling. However, increasing foreign direct investment in localized high-technology manufacturing presents future opportunities for specialized PCD tools used in machining non-ferrous structural parts.

- Middle East and Africa (MEA): The MEA market for ultra-precision diamond tools is the smallest segment and is highly fragmented. Demand is largely concentrated in niche areas, such as the maintenance of critical infrastructure (oil and gas components requiring high surface integrity) and emerging defense applications in select countries. The lack of a substantial indigenous high-technology manufacturing base limits widespread adoption. Opportunities, however, are emerging in regions focusing on economic diversification and technology transfer, particularly in medical device manufacturing hubs and nascent aerospace maintenance, repair, and overhaul (MRO) facilities, which require highly accurate tooling for complex component repair and refurbishment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultra-Precision Diamond Tools Market.- Element Six

- Sandvik AB (Seco Tools)

- Sumitomo Electric Industries, Inc.

- Asahi Diamond Industrial Co., Ltd.

- Shinhan Diamond Industrial Co., Ltd.

- Lach Diamant

- DIASYS Diamond Technology AG

- AMAMCO Tool

- Preci-Tool

- Kennametal Inc.

- Tungaloy Corporation

- OAV Precision Tools

- G&N Precise Corp.

- Contour Precision, Inc.

- Diamond Tool Company

- Chardon Tool

- Technodiamant GmbH

- Shenzhen Dymend Tools Co., Ltd.

- Toolgal Industrial Diamonds, Inc.

- Sinteris

Frequently Asked Questions

Analyze common user questions about the Ultra-Precision Diamond Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Monocrystalline Diamond (MCD) and Polycrystalline Diamond (PCD) tools?

MCD tools utilize a single, perfectly oriented crystal structure, providing the sharpest possible cutting edge (often sub-10 nanometers radius) necessary for achieving mirror-like, nanometric surface finishes on ductile materials like copper, aluminum, and optical polymers. PCD tools consist of randomly oriented diamond micro-grains sintered together, offering superior toughness and wear resistance for machining abrasive non-ferrous materials and composites, where maximum tool life and higher material removal rates are prioritized over ultimate surface finish quality.

Which application segment drives the largest demand for Ultra-Precision Diamond Tools?

The Optics and Photonics segment consistently generates the largest demand by value for ultra-precision diamond tools. This is due to the non-negotiable requirement for achieving pristine, damage-free surfaces on optical components, such as aspheric and free-form lenses, molds for contact lenses, and high-power mirrors, where the slightest surface imperfection dramatically impairs performance. However, the Electronics and Semiconductors segment is growing fastest by volume and frequency of replacement.

What are the key technological restraints affecting the widespread adoption of diamond tools?

The major restraint is the extremely high capital investment required for the accompanying Ultra-Precision Machine Tools (UPMTs), which must possess high static and dynamic stiffness, advanced vibration dampening, and sophisticated hydrostatic bearings. Additionally, the high cost of the certified, high-purity monocrystalline diamond raw material and the need for specialized, highly trained labor to operate and maintain the tools restrict market accessibility and scalability, especially for small-to-midsize enterprises.

How is the integration of Industry 4.0 concepts impacting diamond tool usage?

Industry 4.0 integration involves embedding sensor technologies (like acoustic emission and vibration sensors) into tool holders and machine spindles to enable real-time condition monitoring and predictive maintenance. This data allows for the implementation of AI-driven adaptive control, maximizing tool utilization, predicting tool wear before catastrophic failure, and ensuring consistent nanometric surface quality across high-volume production runs, thus reducing scrap rate and enhancing overall manufacturing efficiency.

Why is the Asia Pacific region the leading consumer of ultra-precision diamond tools?

APAC leads consumption due to its status as the global manufacturing hub for electronics, display technology (OLED/MicroLED), and semiconductor fabrication. Countries like China, South Korea, Taiwan, and Japan host the largest concentration of high-volume production facilities requiring ultra-precision processes for components like wafer dicing, mold manufacturing for advanced displays, and consumer optical elements, driving sustained high demand for both MCD and high-grade PCD tooling solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager