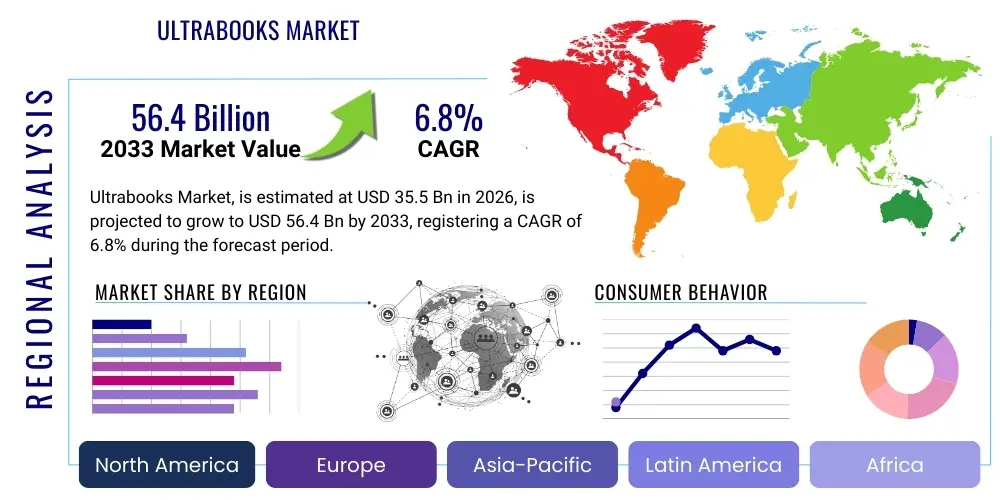

Ultrabooks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437671 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Ultrabooks Market Size

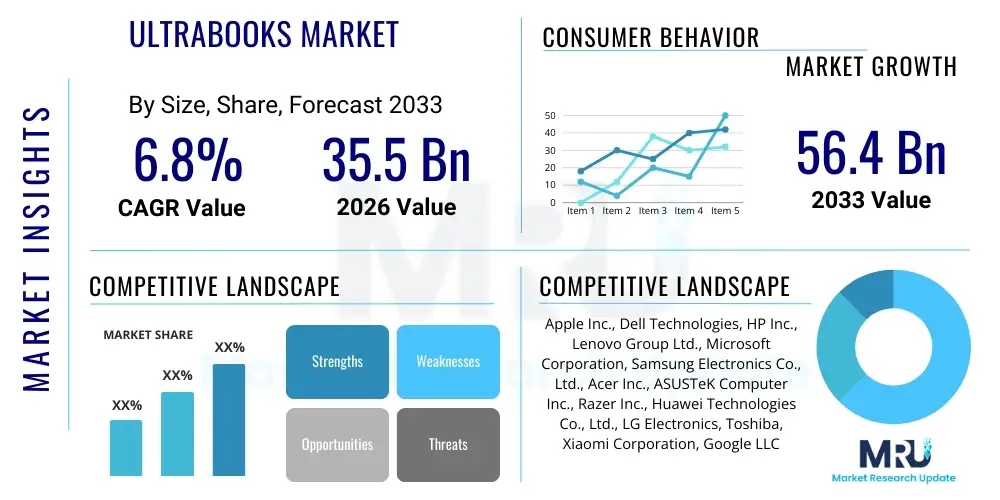

The Ultrabooks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 56.4 Billion by the end of the forecast period in 2033.

Ultrabooks Market introduction

The Ultrabooks market encompasses the segment of premium, high-performance laptops characterized by thin, lightweight designs, extended battery life, and high-quality display and build materials. Defined initially by Intel’s specifications focusing on portability without compromising capability, these devices have evolved into essential tools for professional, educational, and high-end consumer applications. The core design philosophy centers around mobility, often integrating solid-state drives (SSD) for speed and utilizing advanced cooling technologies to maintain performance within sleek chassis.

Major applications for Ultrabooks span corporate environments, creative industries requiring graphical processing power in a portable format, and advanced education where multitasking and long battery life are critical. The inherent benefits include superior user experience, faster boot times, enhanced security features (like biometric authentication), and durability due to premium construction. The miniaturization of components, coupled with advancements in processor efficiency, has allowed Ultrabooks to maintain professional-grade computing power despite their reduced footprint, fueling their adoption across various demographics.

Driving factors for this market expansion include the global shift towards hybrid and remote work models, necessitating powerful yet easily transportable computing solutions. Furthermore, increasing consumer demand for aesthetically pleasing and functionally seamless technology, particularly among younger generations and affluent professionals, strongly supports market growth. Technological upgrades, such as the integration of higher resolution OLED displays, faster RAM standards (LPDDR5), and more efficient CPUs (like those based on 7nm or 5nm architectures), consistently drive replacement cycles and attract new buyers looking for the latest in mobile computing.

Ultrabooks Market Executive Summary

The Ultrabooks market is experiencing robust growth, primarily driven by enterprise modernization initiatives and the accelerating demand for high-end personal computing in the post-pandemic era. Current business trends indicate a strong preference for devices offering superior security and management features, leading manufacturers to heavily invest in features like Trusted Platform Modules (TPM) and integrated enterprise-grade security software. Competition remains fierce among dominant players, focusing on design innovation, optimizing the performance-to-weight ratio, and integrating AI-specific hardware, such as Neural Processing Units (NPUs), to handle complex local machine learning tasks efficiently.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapidly expanding middle-class populations, increasing disposable incomes, and widespread digitalization across emerging economies like India and Southeast Asia. North America and Europe, while mature, maintain their significance due to high adoption rates in corporate sectors and early integration of cutting-edge technology standards. Market strategies are increasingly tailored to regional preferences, with APAC showing high demand for competitive pricing alongside premium features, while Western markets prioritize brand reputation and specialized technical specifications.

Segment trends highlight the dominance of the Consumer segment in terms of volume, although the Commercial/Enterprise segment contributes significantly to average selling prices (ASP) due to requirements for higher specifications and enterprise services. Screen size segmentation shows a continued trend toward 13-inch and 14-inch models, balancing portability and usability. Furthermore, the market for 2-in-1 convertible Ultrabooks is showing promising growth, appealing to users seeking versatile devices that seamlessly transition between traditional laptop functionality and tablet usage, driven by improvements in touch technology and hinge durability.

AI Impact Analysis on Ultrabooks Market

User queries regarding the impact of Artificial Intelligence (AI) on Ultrabooks frequently revolve around processor capabilities, battery efficiency during intensive AI tasks, and the practical implementation of AI-driven features in productivity software. Common concerns include whether current generation Ultrabooks are truly "AI-ready" or if dedicated hardware (NPUs) is necessary, and how AI will improve daily tasks such as video conferencing, noise cancellation, and photo/video editing without significantly increasing heat or reducing mobility. Users are primarily interested in practical, demonstrable performance improvements derived from embedded AI, rather than theoretical capabilities.

The integration of AI hardware, specifically Neural Processing Units (NPUs), is fundamentally reshaping the design and functionality of modern Ultrabooks. These dedicated accelerators offload machine learning workloads from the main CPU and GPU, significantly enhancing efficiency for tasks like real-time language translation, advanced biometric security, and optimized system performance management. This shift allows Ultrabooks to maintain their thin form factor while executing complex AI operations locally, addressing consumer demand for powerful, private, and instantaneous processing capabilities, particularly crucial for hybrid workers utilizing sophisticated collaboration tools.

Furthermore, AI is driving innovation in software optimization and personalization. Operating systems and key applications are leveraging on-device AI to predict user behavior, manage power consumption dynamically, and enhance media quality. For instance, AI algorithms are now optimizing video streams, automatically framing the user during conference calls, and filtering background noise with high precision. This integration elevates the user experience from mere portability to intelligent productivity, cementing the Ultrabook's role as the premier device for modern computing that intelligently adapts to the user's workflow.

- AI-enhanced battery management and power efficiency through predictive workload distribution.

- Integration of Neural Processing Units (NPUs) for accelerated on-device machine learning tasks.

- Improved user security via advanced AI-driven facial recognition and behavioral biometrics.

- Real-time, high-fidelity noise cancellation and background blurring for video conferencing.

- AI-optimized performance tuning for graphic design, video editing, and specialized software acceleration.

- Development of smarter, context-aware operating system features and application management.

DRO & Impact Forces Of Ultrabooks Market

The dynamics of the Ultrabooks market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and market trajectory. A primary driver is the accelerating trend of digital transformation across industries, compelling organizations to equip their workforces with premium, high-mobility devices capable of handling intensive cloud-based applications and remote collaboration tools. This demand is intrinsically linked to the continuous technological refinement in CPU and memory architectures, which enables enhanced performance without increasing the physical volume or thermal output, thereby sustaining the core promise of the Ultrabook concept.

However, the market faces significant restraints, most notably the high average selling price (ASP) associated with these premium devices, which acts as a barrier to entry for price-sensitive consumer segments in emerging economies. Furthermore, component supply chain volatility, particularly regarding advanced displays and high-density memory chips, can impede production and inflate costs. Another critical restraint is the market saturation in highly developed regions where replacement cycles for existing devices may be lengthening due to the incremental nature of performance improvements between generations, making compelling upgrades more challenging.

Opportunities for growth are abundant, particularly in the expansion of 5G connectivity capabilities, which will enhance the utility of Ultrabooks for highly mobile professionals requiring seamless, high-speed internet access globally. The emerging focus on environmental sustainability and the circular economy also presents opportunities for manufacturers to differentiate through highly durable, repairable, and energy-efficient designs, appealing to environmentally conscious corporate procurement policies. Key impact forces include the constant competitive pressure forcing innovation in design (bezel reduction, chassis materials) and integration (AI chips, advanced connectivity), alongside the pervasive influence of operating system ecosystems (Windows, macOS, Chrome OS) which dictates hardware requirements and consumer preference.

Segmentation Analysis

The Ultrabooks market is comprehensively segmented based on its application, screen size, and operating system, providing a detailed view of market structure and consumer preferences. The Application segment differentiates between Commercial/Enterprise and Consumer usage, reflecting distinct demands regarding security, durability, and centralized manageability. Enterprise users prioritize features such as long-term stability, advanced security protocols, and robust technical support, whereas consumer users often emphasize sleek design, multimedia performance, and gaming capabilities within the thin-and-light category.

Segmentation by Screen Size is crucial, defining the balance between portability and screen real estate. The 13-inch models remain the quintessential choice for ultra-portability, favored by frequent travelers, while 14-inch models are rapidly gaining traction, offering a better compromise between productivity and weight. Larger screen sizes, typically 15-inch and above, cater to users who require more screen space for professional tasks like coding or financial modeling but still demand the thin profile characteristic of an Ultrabook, bridging the gap between traditional laptops and highly mobile devices.

Further segmentation by operating system (OS) highlights the established duopoly of Windows (spanning multiple OEMs) and macOS, with a growing, albeit smaller, segment driven by Chrome OS devices. Each OS platform dictates specific hardware requirements and user base loyalty. Windows benefits from widespread enterprise adoption and hardware diversity, while macOS dominates specific creative and high-end consumer niches. Analyzing these segments is vital for manufacturers to tailor their product lineups, ensuring optimal configuration and feature sets for targeted end-user groups.

- By Application

- Commercial/Enterprise

- Consumer

- By Screen Size

- Up to 13 inches

- 14 to 15 inches

- Above 15 inches

- By Operating System

- Windows

- macOS

- Chrome OS

- By Form Factor

- Clamshell Ultrabooks

- 2-in-1 (Convertible/Detachable) Ultrabooks

Value Chain Analysis For Ultrabooks Market

The Ultrabooks value chain is characterized by high technological dependency and significant coordination across specialized tiers, starting with upstream suppliers of high-value components. Upstream analysis focuses on core component manufacturing, primarily involving semiconductor fabrication (CPUs, GPUs, NPUs, memory), advanced display panel production (OLED, high-resolution LCD), and specialized material sourcing (magnesium alloys, carbon fiber for chassis). These component manufacturers, dominated by a few global giants, dictate supply timelines and pricing stability, impacting the final product cost and feature set. Innovation at this stage, particularly in power efficiency and miniaturization, is crucial for the success of the resulting Ultrabooks.

Midstream activities involve Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) who handle assembly, system integration, industrial design, and quality control. This phase is highly competitive, focusing on optimizing manufacturing logistics, implementing rigorous testing standards, and translating innovative designs into mass-market products. OEMs like Dell, HP, and Lenovo invest heavily in R&D to differentiate their offerings through proprietary cooling solutions, keyboard technology, and software integration, transforming standardized components into distinct brand experiences.

Downstream analysis highlights the critical role of distribution channels, encompassing direct sales, indirect channels (retailers, e-commerce platforms), and specialized business-to-business (B2B) resellers. Direct channels, such as manufacturer online stores, allow for greater control over pricing and customer relationship management, often utilized for highly customized or premium models. Indirect channels, including major electronics retailers and large e-commerce giants, provide high volume sales and broad market penetration, relying heavily on effective merchandising and promotional strategies to influence consumer choice in a highly crowded product category.

Ultrabooks Market Potential Customers

Potential customers for Ultrabooks are broadly categorized into specific professional, educational, and affluent consumer demographics who prioritize performance, aesthetic quality, and extreme portability. The largest segment remains the corporate and enterprise sector, including medium to large businesses seeking to standardize their mobile computing fleet with secure, durable, and high-performance machines for executives, traveling sales staff, and specialized remote technical roles. These buyers are motivated by total cost of ownership (TCO), robust service level agreements, and seamless integration with existing IT infrastructure.

The second key group comprises creative professionals, including graphic designers, video editors, photographers, and software developers, who require powerful processing and color-accurate displays for content creation, but also need the flexibility to work from diverse locations. For this group, the balance between high-end specifications (RAM, GPU capability) and thin chassis design is the deciding factor. The trend towards using cloud-based workflows combined with on-device processing capabilities further solidifies the Ultrabook's appeal in this segment, enabling high productivity without the bulk of traditional mobile workstations.

Finally, the high-end consumer and higher education markets represent strong recurring demand. Students and academic professionals often require lightweight devices with exceptional battery life for long days of classes and research, coupled with the computational capacity for data analysis or advanced coursework. Affluent general consumers purchase Ultrabooks based on brand prestige, premium build quality, and superior aesthetic appeal, viewing the device as a lifestyle statement as much as a functional tool. Effective marketing for this segment focuses on design accolades, user experience, and media consumption capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 56.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apple Inc., Dell Technologies, HP Inc., Lenovo Group Ltd., Microsoft Corporation, Samsung Electronics Co., Ltd., Acer Inc., ASUSTeK Computer Inc., Razer Inc., Huawei Technologies Co., Ltd., LG Electronics, Toshiba, Xiaomi Corporation, Google LLC (Chrome OS focus), Dynabook Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultrabooks Market Key Technology Landscape

The technological landscape of the Ultrabooks market is defined by several core innovations aimed at enhancing mobility and performance simultaneously. Central to this is the continuous evolution of processor technology, notably the shift towards smaller manufacturing nodes (e.g., 5nm and 3nm) by major chip makers, allowing for increased transistor density, lower power consumption, and improved integrated graphics performance. The crucial element distinguishing modern Ultrabooks is the integration of high-speed, low-power memory standards, such as LPDDR5/LPDDR5X, which supports demanding application multitasking without significantly impacting battery endurance, thereby maximizing productivity in remote settings.

Display technology is another area experiencing rapid transformation. The transition from traditional IPS LCD panels to Organic Light-Emitting Diode (OLED) and Mini-LED screens is gaining momentum, particularly in premium models. OLED offers superior contrast ratios, true blacks, and faster response times, highly valued by creative professionals and media consumers. Simultaneously, advancements in chassis design utilize lightweight but durable materials like CNC aluminum, magnesium alloys, and specialized carbon fiber composites, ensuring structural integrity while reducing the device's overall weight below the critical 1.5 kg threshold, maintaining the "ultra" aspect of the category.

Furthermore, connectivity and security technologies are pivotal differentiators. Wi-Fi 6E and the nascent adoption of Wi-Fi 7 standards ensure high-speed wireless networking in dense environments, complementing the growing inclusion of 5G cellular modem options for true ubiquitous connectivity. Security technologies, including dedicated Trusted Platform Modules (TPM 2.0) and integrated biometric systems (fingerprint readers and infrared facial recognition), are essential, particularly for enterprise adoption, guaranteeing data protection in highly mobile and distributed work environments against evolving cybersecurity threats.

Regional Highlights

North America: Market Maturity and Innovation Hub

North America holds a substantial share of the Ultrabooks market, driven by high technology adoption rates, the presence of major tech companies, and a strong culture of hybrid work arrangements. The region is characterized by high consumer spending power and a readiness to invest in premium, high-specification models, leading to a higher Average Selling Price (ASP) compared to global averages. Corporate purchasing decisions here are heavily influenced by stringent security requirements and the need for seamless integration with large-scale cloud infrastructure, favoring brands that offer robust enterprise support and advanced security features like proprietary endpoint protection and rigorous data encryption standards. The strong presence of both Microsoft and Apple ensures intense competition and continuous innovation, particularly in integrating AI and optimizing operating systems for the latest hardware.

The competitive focus in North America is shifting toward specialized features, such as advanced thermal management systems to handle high-performance chips, and superior display technologies, including high refresh rate screens for professional tasks and specialized content creation. Furthermore, North American consumers and businesses are early adopters of 5G-enabled Ultrabooks, leveraging the widespread deployment of next-generation wireless networks. This regional market often sets the trend for global technological feature adoption, making it critical for new product launches and market penetration strategies. The replacement cycle, while established, is fueled by attractive trade-in programs and the perceived necessity of owning devices compatible with the latest computing standards, particularly concerning AI acceleration.

Europe: Focus on Sustainability and Regulatory Compliance

The European market for Ultrabooks is mature and exhibits steady, predictable growth, underpinned by strong regulatory frameworks and an increasing emphasis on environmental sustainability. European enterprises prioritize not only performance and security but also the device's adherence to long-term reliability standards and energy efficiency mandates (e.g., EU Ecolabel). This has led to a noticeable preference for manufacturers demonstrating robust commitments to circular economy principles, including modular design for repairability and transparent sourcing of conflict-free materials. Germany, the UK, and France are the largest contributors to regional revenue, primarily driven by professional and financial services sectors.

The market faces diverse language requirements and localized keyboard layouts, necessitating complex SKU management for manufacturers. Furthermore, data privacy regulations, such as GDPR, mandate strict security protocols, making hardware-level encryption and biometric authentication non-negotiable features for enterprise-grade Ultrabooks sold in this region. The consumer segment, especially in Northern and Western Europe, shows strong loyalty to established premium brands, often viewing the purchase as a long-term investment. Competition is intense among top-tier manufacturers, who utilize strong design language and specialized professional services to capture and retain market share within this highly quality-conscious area.

Asia Pacific (APAC): The Growth Engine and Manufacturing Nexus

APAC is projected to be the fastest-growing region in the Ultrabooks market, fueled by rapid urbanization, massive digitalization initiatives across emerging economies (India, Indonesia), and the substantial expansion of the middle class in China. This region is unique due to its immense market size and varied consumer demands, ranging from highly price-sensitive buyers in Southeast Asia to ultra-premium technology enthusiasts in Japan and South Korea. The increasing adoption of mobile work models and the growth of the IT and software development sectors are key demand catalysts, driving volume growth for thin and lightweight devices that cater to an intensely mobile workforce.

China, as both a massive consumer market and a primary manufacturing hub, exerts significant influence on regional trends and global supply chain dynamics. Local brands are competitive, often offering high specifications at aggressive price points, challenging the dominance of traditional Western OEMs. The preference in APAC often leans towards devices optimized for specific localized applications and highly visually appealing designs. Connectivity is paramount, with strong demand for dual-SIM capabilities and robust Wi-Fi connectivity to navigate diverse infrastructural challenges. The market in this region provides significant opportunities for expansion through targeted distribution partnerships and localized marketing strategies emphasizing value proposition alongside cutting-edge technology.

Latin America (LATAM): Recovering Markets and Value Focus

The LATAM Ultrabooks market is generally characterized by slower growth compared to APAC, primarily due to economic volatility and currency fluctuations, which impact import costs and consumer purchasing power. Despite these challenges, there is a clear, consistent demand for premium, durable computing solutions, especially within multinational corporate branches, advanced education institutions, and affluent urban centers like São Paulo and Mexico City. Consumers in this region often prioritize reliability and strong after-sales support, given the higher relative cost of purchasing new technology.

Market penetration relies heavily on strong distribution networks and financing options to make the high-ASP products accessible. The focus here is typically on optimizing the value proposition, meaning that while users demand the thinness and power of an Ultrabook, there is greater sensitivity to price points compared to North America or Europe. The business sector drives the majority of high-end purchases, often upgrading in cycles tied to large enterprise contracts. Government initiatives aimed at digitalizing public services and educational institutions also contribute significantly to episodic demand, focusing on bulk purchasing of rugged and manageable Ultrabooks suitable for deployment in diverse environments.

Middle East and Africa (MEA): Emerging Luxury and Infrastructure Development

The MEA region presents a fragmented but rapidly developing market for Ultrabooks. The Middle Eastern component, particularly the Gulf Cooperation Council (GCC) countries, demonstrates strong demand for luxury and high-performance technology, driven by high per capita income and extensive government investment in technology infrastructure. Ultrabooks are favored in corporate environments, particularly in the oil & gas, finance, and burgeoning technology sectors, where brand prestige and top-tier specifications are highly valued.

Conversely, the African segment is highly diverse, with demand concentrated in key economic centers like South Africa and Nigeria. Market growth in this part of the region is dependent on improving digital infrastructure and increasing access to affordable internet services. While overall penetration is lower, there is significant potential, particularly in the education and entrepreneurial segments, which require reliable, long-lasting mobile computing solutions. Manufacturers focusing on the MEA market must navigate complex logistics and distribution challenges, often partnering with localized system integrators to manage sales, service, and technical support across diverse regulatory environments, ensuring the availability of premium models tailored to the specific demands of both the luxury market and emerging professional sectors.

- North America: Focus on enterprise security, early adoption of 5G, and high ASP.

- Europe: Strong emphasis on sustainability, durability, and adherence to data privacy regulations (GDPR).

- Asia Pacific (APAC): Primary growth driver, characterized by high volume, diverse pricing sensitivity, and fast-growing emerging economies.

- Latin America (LATAM): Value-conscious market, prioritizing reliability and robust financing options for corporate buyers.

- Middle East and Africa (MEA): Fragmented; strong luxury demand in GCC and growing entry-level professional adoption in key African markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultrabooks Market.- Apple Inc.

- Dell Technologies

- HP Inc.

- Lenovo Group Ltd.

- Microsoft Corporation

- Samsung Electronics Co., Ltd.

- Acer Inc.

- ASUSTeK Computer Inc.

- Razer Inc.

- Huawei Technologies Co., Ltd.

- LG Electronics

- Dynabook Inc. (formerly Toshiba's PC business)

- Xiaomi Corporation

- Google LLC (indirectly through Chrome OS partners)

- Micro-Star International Co., Ltd. (MSI)

Frequently Asked Questions

Analyze common user questions about the Ultrabooks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Ultrabooks Market between 2026 and 2033?

The Ultrabooks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period, reflecting sustained demand for high-performance, thin, and lightweight computing devices in both commercial and consumer segments.

How is the integration of AI influencing the Ultrabooks market design and functionality?

AI integration is primarily driving the inclusion of dedicated Neural Processing Units (NPUs) in Ultrabook hardware, enabling faster, more power-efficient execution of on-device machine learning tasks such as advanced video conferencing features, enhanced security, and predictive system performance optimization, fundamentally changing mobile productivity.

Which regional market is expected to exhibit the fastest growth for Ultrabooks?

Asia Pacific (APAC) is anticipated to be the fastest-growing regional market, driven by extensive digitalization across developing economies, expanding middle-class demographics, and high volume adoption in countries like China and India.

What are the primary factors restraining the global adoption of Ultrabooks?

The main restraints include the high Average Selling Price (ASP) associated with premium components, which limits accessibility in price-sensitive markets, and ongoing supply chain volatility concerning critical advanced components such as displays and processors.

What distinguishes an Ultrabook from a traditional high-performance laptop?

Ultrabooks are defined by strict criteria focusing on extreme portability (thinness and lightness), extended battery life, rapid responsiveness (due to SSDs), and utilization of premium materials, distinguishing them from bulkier, though equally powerful, standard laptops.

What is the significance of the 2-in-1 segment within the Ultrabooks market?

The 2-in-1 convertible segment is vital as it caters to increasing user demand for versatility, allowing the Ultrabook to function seamlessly as both a traditional laptop for productivity and a high-end tablet for media consumption and interaction, expanding the addressable market.

How do enterprise demands differ from consumer demands in the Ultrabooks sector?

Enterprise clients primarily demand robust security features (TPM 2.0, robust biometrics), standardized IT manageability, and guaranteed long-term reliability/support, whereas consumers generally prioritize design aesthetics, multimedia performance, and price-to-feature ratio.

Which screen size segment currently holds the largest market share?

While the market is shifting, the 13-inch and 14-inch segment combined remains dominant, as it optimally balances the core Ultrabook requirements of high portability with sufficient screen real estate for demanding professional and personal use.

How is competition driving innovation in Ultrabooks?

Intense competition among leading OEMs is driving continuous innovation in advanced thermal solutions (cooling), battery cell density, chassis material science (lighter alloys), and rapid integration of new processor generations and connectivity standards (Wi-Fi 7, 5G), ensuring performance leaps with every generation.

What role does the operating system play in market segmentation?

The operating system (Windows, macOS, Chrome OS) segments the market by influencing hardware compatibility, application ecosystems, and user loyalty, dictating purchasing behavior in both corporate and creative niches, with Windows maintaining the broadest OEM support.

What key technology advancements are critical for future Ultrabook design?

Critical advancements include the transition to 3nm and smaller processor architectures, widespread adoption of high-refresh-rate OLED and Mini-LED displays, integration of high-bandwidth memory (LPDDR5X), and robust, always-on cellular connectivity (5G/6G).

Why is the Ultrabooks market considered a premium segment?

It is considered premium due to the necessary integration of high-cost components such as specialized low-power CPUs, high-density SSD storage, advanced cooling systems, and the use of expensive lightweight materials (magnesium, carbon fiber) to achieve the stringent thin-and-light specifications.

How important are environmental factors in European Ultrabook purchasing?

Environmental factors, including durability, repairability, and energy efficiency, are becoming increasingly critical in Europe, particularly in large corporate procurement, driven by regulatory pressure and strong consumer preference for sustainable technology solutions aligning with circular economy principles.

What is the primary factor driving demand in the Commercial segment?

Digital transformation initiatives and the global shift toward hybrid work environments are the primary factors, necessitating portable, powerful, and easily manageable devices that can maintain productivity and data security outside traditional office settings.

How does the value chain in the Ultrabooks market manage component supply?

The value chain relies heavily on close, long-term relationships with a few major upstream component suppliers (e.g., Intel, AMD, Samsung for displays/memory), requiring meticulous planning and forecasting to mitigate risks associated with high technological dependency and potential supply bottlenecks.

Are Chrome OS-based devices considered competitive in the Ultrabooks category?

Yes, higher-end Chrome OS devices (Chromebooks) increasingly compete in the entry-level and mid-range Ultrabook segment, offering secure, cloud-centric computing with excellent battery life, making them particularly attractive for the education sector and light-use consumers.

What role does aesthetic design play in consumer choice?

Aesthetic design, encompassing material quality, thinness, keyboard feel, and display quality, plays a critical role, especially in the consumer and creative professional segments, where the device is often seen as a reflection of personal or professional brand image.

How is thermal management addressed in such thin devices?

Thermal management relies on advanced, custom engineering solutions, including vapor chambers, highly efficient heat pipes, and intelligent fan systems, often utilizing AI algorithms to dynamically adjust cooling based on workload, ensuring peak performance without excessive heat in constrained spaces.

What distinguishes the Ultrabooks market in emerging economies?

In emerging economies, the market is characterized by high volume growth potential, significant price sensitivity, and a strong preference for competitive specifications, often requiring OEMs to adapt pricing models and streamline features to meet local affordability thresholds.

What are the opportunities related to 5G integration in Ultrabooks?

5G integration offers the opportunity for truly ubiquitous, high-speed mobile connectivity, enhancing the value proposition for highly mobile professionals who require constant, low-latency access to cloud resources, thereby maximizing the "always-on" utility of the device.

What is the average device replacement cycle in the commercial Ultrabooks segment?

In the commercial segment, the average replacement cycle typically falls between three and four years, driven by depreciation schedules, enterprise hardware refresh policies, and the need to maintain security and compatibility with modern software standards.

What material advancements are utilized to achieve lightness and durability?

Manufacturers extensively use advanced materials like aerospace-grade aluminum alloys, CNC machining for rigidity, and specialized carbon fiber and magnesium alloys, which offer superior strength-to-weight ratios compared to traditional plastics or heavy metals.

How do independent software vendors (ISVs) impact Ultrabook sales?

ISVs influence sales by creating software that necessitates high performance and specific hardware configurations (e.g., specialized graphical processing or AI capabilities), compelling professional users to purchase Ultrabooks optimized for these demanding applications.

What is the role of memory standards like LPDDR5 in market growth?

LPDDR5 (Low Power Double Data Rate 5) memory standards are crucial as they deliver significantly higher bandwidth and lower power consumption than previous generations, directly enabling the high-speed multitasking and energy efficiency essential for maintaining the Ultrabook form factor.

What is the estimated market size for the Ultrabooks market in 2033?

The Ultrabooks Market is projected to reach an estimated value of USD 56.4 Billion by the end of the forecast period in 2033, demonstrating continued strong market expansion driven by innovation and adoption.

How do OEMs differentiate their Ultrabook offerings in a crowded market?

Differentiation occurs through unique industrial design, proprietary software integration (security, performance tuning), optimized keyboard and trackpad technology, advanced thermal solutions, and offering superior after-sales support and warranty packages, particularly for high-end models.

Why is the Ultrabook particularly suitable for creative professionals?

Creative professionals value Ultrabooks due to the combination of powerful, discrete or integrated GPUs, high-resolution and color-accurate OLED displays, and the essential portability needed for client presentations and working efficiently on location.

What are the current trends in display technology for new Ultrabook models?

Current display trends focus on increasing refresh rates (above 90Hz), shrinking bezels (near edge-to-edge designs), and transitioning to OLED or Mini-LED technology to offer perfect blacks, improved energy efficiency, and exceptional color fidelity.

How do geopolitical factors affect the Ultrabooks value chain?

Geopolitical tensions affect the value chain primarily through trade restrictions and tariffs, which can disrupt the supply of critical components (especially semiconductors from Asia) and significantly inflate manufacturing and consumer costs globally, creating market volatility.

What future opportunities exist for niche Ultrabooks segments?

Future opportunities lie in developing highly ruggedized Ultrabooks for field professionals (construction, defense) and ultra-specialized models focused entirely on specific tasks, such as ultra-low-power devices optimized for continuous cloud connectivity and specific vertical applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager