Ultrafine MicroSilica Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431865 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Ultrafine MicroSilica Market Size

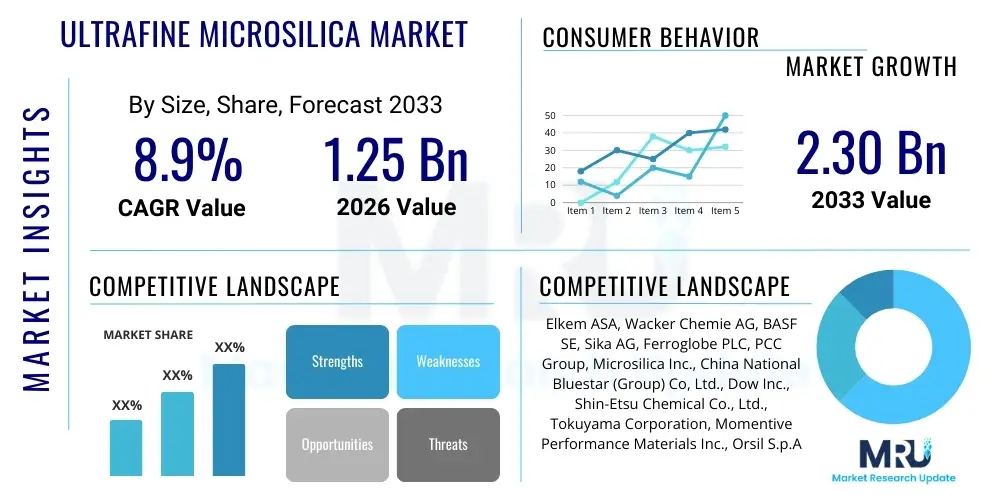

The Ultrafine MicroSilica Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.30 Billion by the end of the forecast period in 2033.

Ultrafine MicroSilica Market introduction

The Ultrafine MicroSilica market encompasses the production, distribution, and application of highly refined silicon dioxide (SiO2) particles, characterized by an average particle size significantly below 1 micron (often in the range of 10 nm to 500 nm). This material is primarily generated as a byproduct of silicon and ferrosilicon alloy production, though increasingly, precipitated and fumed silica processes are utilized to achieve specialized ultrafine grades tailored for high-performance applications. The unique morphology, high specific surface area, and pozzolanic reactivity of Ultrafine MicroSilica make it an indispensable additive in modern material science, driving demand across critical infrastructure and specialized manufacturing sectors.

Ultrafine MicroSilica functions primarily as a high-performance binder, filler, and reinforcing agent. In construction, it significantly enhances concrete durability, compressive strength, and resistance to chloride penetration, crucial for marine structures and infrastructure requiring extended service life. Beyond construction, its key applications span high-performance coatings, advanced refractory materials, and specialized polymer composites where traditional fillers fail to meet stringent requirements for thermal stability and mechanical integrity. The material’s ability to act as a rheology modifier further cements its importance in various complex chemical formulations, including oil well cementing and high-quality paints.

The market growth is fundamentally driven by global infrastructural development, particularly in emerging economies, and the stringent regulatory environment demanding materials that offer superior longevity and environmental performance. The pursuit of sustainable construction practices, coupled with technological advancements leading to the development of tailored surface-modified ultrafine silica, ensures continued expansion. Furthermore, the rising adoption of specialized silicones and elastomers in the automotive and electronics industries, where Ultrafine MicroSilica serves as a critical reinforcing component, acts as a primary economic engine fueling market expansion.

Ultrafine MicroSilica Market Executive Summary

The global Ultrafine MicroSilica market is experiencing robust growth, propelled by sustained investment in high-strength concrete infrastructure and increasing technological integration in advanced materials. Business trends indicate a shift towards specialized, surface-modified silica tailored for niche applications, moving beyond bulk construction uses into high-margin sectors such as electronics encapsulation, high-temperature ceramics, and specialized medical device coatings. Key market players are prioritizing vertical integration and strategic partnerships to secure raw material supply chains (ferrosilicon production waste) and enhance distribution efficiency, particularly in Asia Pacific, which dominates both production and consumption.

Regionally, the Asia Pacific (APAC) region stands as the undisputed leader, driven by massive infrastructure projects in China, India, and Southeast Asian nations, coupled with a booming electronics and semiconductor manufacturing base demanding high-purity silica. North America and Europe, while representing mature markets, show steady growth primarily due to stringent durability standards in construction and the expansion of the Electric Vehicle (EV) battery manufacturing ecosystem, where silica is used in separators and specialized casings. Latin America and the Middle East and Africa (MEA) are emerging as high-potential markets, spurred by urbanization and significant oil and gas sector investments requiring specialized cementing formulations.

Segment trends highlight the dominance of the Construction industry application, followed closely by Polymer Modification and Refractory Materials. Within product types, densified silica fume remains the largest volume segment due to its ease of handling and widespread use in concrete, although the high-purity, precipitated ultrafine silica segment is projected to register the fastest CAGR, reflecting its adoption in high-tech manufacturing. Consolidation among small and medium-sized producers is anticipated as compliance with quality standards (especially ASTM and EN norms) becomes more rigorous, favoring larger, technologically capable suppliers.

AI Impact Analysis on Ultrafine MicroSilica Market

Common user questions regarding AI's impact on the Ultrafine MicroSilica market revolve around three primary themes: how AI can optimize the highly energy-intensive production process (especially energy saving in furnace operations), whether AI can accelerate the discovery and testing of new silica formulations for performance concrete and polymers, and how supply chain volatility, which significantly affects this byproduct-driven market, can be mitigated through predictive analytics. Users are keen to understand if AI can democratize access to customized silica grades by enabling rapid material property prediction based on input raw material composition, thereby reducing costly physical R&D cycles and enhancing quality control in real-time, especially considering the variability inherent in silicon byproduct streams.

The adoption of Artificial Intelligence, particularly in process optimization and predictive modeling, is set to revolutionize the efficiency and quality control within the Ultrafine MicroSilica manufacturing lifecycle. AI-driven systems are being deployed to monitor furnace temperatures, gas composition, and collection efficiency in silicon production facilities, directly impacting the yield and quality consistency of the resulting silica fume. By analyzing complex data streams from sensors, AI algorithms can predict optimal reaction parameters, leading to significant reductions in energy consumption and minimizing off-specification material. This predictive capability translates directly into higher purity grades and reduced operational costs, crucial for maintaining competitiveness in a price-sensitive commodity market.

Furthermore, AI and Machine Learning (ML) models are increasingly utilized in the R&D phase to accelerate material formulation discovery. In the concrete and polymer industries, where precise rheology and long-term durability are critical, ML algorithms can process vast datasets correlating silica particle size distribution, surface treatment chemistry, and final mechanical performance. This allows manufacturers and end-users to virtually test thousands of mixtures, rapidly identifying the optimal ultrafine silica grade required for specific performance targets (e.g., extremely low permeability concrete or high-temperature-resistant polymers). This shift from traditional trial-and-error methodologies to AI-guided development drastically shortens the time-to-market for specialized, high-value silica products.

- AI optimizes furnace operations, reducing energy costs and enhancing the consistency of byproduct silica fume generation.

- Machine Learning predicts optimal concrete and polymer formulations, accelerating R&D for high-performance materials using ultrafine silica.

- Predictive analytics enhances supply chain resilience by forecasting raw material (ferrosilicon production) output and managing inventory variability.

- Computer vision and sensor integration enable real-time quality control of particle size distribution and purity during processing.

- AI aids in simulating the long-term durability and leaching performance of concrete enhanced with ultrafine microsilica, crucial for regulatory compliance.

DRO & Impact Forces Of Ultrafine MicroSilica Market

The Ultrafine MicroSilica market dynamics are governed by a complex interplay of strong drivers related to infrastructure needs, significant restraints linked to raw material dependency and logistics, and pervasive opportunities derived from advanced materials science. The dominant impact forces shaping the market trajectory include urbanization and regulatory mandates for sustainable construction, which amplify demand, while the cyclical nature of the silicon industry and the high initial investment required for sophisticated processing technologies act as counterbalancing restrictions. Navigating these forces requires strategic sourcing and targeted innovation in specialized, non-construction applications.

Primary drivers fueling market expansion include the global imperative for durable and seismic-resistant infrastructure, demanding high-performance concrete (HPC). Ultrafine MicroSilica is essential for meeting these demanding specifications. However, the market faces significant restraints, notably the reliance on the byproducts of the metallurgical silicon and ferrosilicon industries. This dependency subjects the silica market to the highly volatile pricing and production cycles of the metals sector. Furthermore, the extremely fine particle size necessitates specialized handling, storage, and logistical solutions to prevent dusting and ensure uniform dispersion, adding operational complexity and cost.

Opportunities for high-value growth are emerging from the application of ultrafine silica in lithium-ion battery technology, where it enhances thermal stability and mechanical integrity of components, and in high-precision biomedical and cosmetic sectors requiring ultra-pure grades. The inherent impact forces are manifesting as a strong push toward product differentiation—where high-purity, surface-functionalized silica commands a premium—and a strategic pull towards localized production in major consumption hubs (like APAC) to mitigate international freight and logistical bottlenecks associated with bulky, high-volume materials.

The core market force is the trade-off between volume-driven construction demand (requiring standard silica fume) and margin-driven advanced materials demand (requiring specialized precipitated or fumed silica). Environmental regulations regarding the disposal of silicon byproducts further impact market supply dynamics; in some regions, mandated collection enhances availability, while in others, environmental compliance costs restrain small producers.

Segmentation Analysis

The Ultrafine MicroSilica market is segmented primarily based on product type, grade, application, and geography, reflecting the vast difference in quality requirements across its end-user industries. The product type segmentation distinguishes between high-volume byproduct silica fume and lower-volume, higher-purity manufactured options like precipitated and fumed silica. Grade segregation is crucial, differentiating between technical-grade silica used in construction and high-purity grades required for specialized electronics and medical applications. The application landscape is diverse, ranging from dominant sectors like construction and refractory materials to high-growth areas like polymers, sealants, and coatings.

The dominance of the construction sector is attributed to the material’s critical role in enhancing concrete properties, specifically reducing permeability and increasing resistance to chemical attack. However, the fastest growth is anticipated in the non-construction segments, driven by material innovation in the automotive and aerospace sectors. For instance, the use of ultrafine silica in advanced rubber compounds significantly improves tire wear resistance and fuel efficiency, aligning with sustainability goals. Segmentation by region confirms Asia Pacific's leadership due to rapid industrialization and infrastructure development, necessitating robust supply chain planning tailored to regional construction standards and material specification requirements.

Market analysts constantly monitor the shift within the application segments. While construction provides market stability and volume, the pharmaceutical and cosmetic segments offer high profitability due to stringent quality control and high-purity demands. This dual-market structure necessitates distinct manufacturing processes and distribution channels for suppliers, emphasizing the strategic importance of accurate segmentation for targeted marketing and product development efforts.

- By Product Type:

- Silica Fume (Microsilica)

- Precipitated Ultrafine Silica

- Fumed Ultrafine Silica

- By Grade:

- Technical Grade (Construction, Refractory)

- High Purity Grade (Electronic, Pharmaceutical)

- By Application:

- Concrete and Construction

- Refractory and Ceramics

- Polymer Modification and Rubber

- Oil and Gas (Well Cementing)

- Coatings, Adhesives, and Sealants

- Others (Cosmetics, Pharmaceuticals, Electronics)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Mexico)

- Middle East and Africa (GCC Countries, South Africa)

Value Chain Analysis For Ultrafine MicroSilica Market

The value chain for Ultrafine MicroSilica is inherently complex due to its dual nature: being both a byproduct (Silica Fume) and a manufactured product (Precipitated/Fumed Silica). The upstream segment is dominated by raw material suppliers, chiefly metallurgical producers of silicon and ferrosilicon alloys, who generate silica fume as a waste stream. Critical considerations at this stage involve the consistency of the furnace operation, which dictates the quality and quantity of the crude silica fume. For manufactured silica, the upstream focus shifts to sourcing high-purity silicon tetrachloride or sodium silicate precursors, demanding stringent quality checks to ensure the final ultrafine product meets technical or high-purity specifications.

The processing stage involves collecting, processing, and modifying the crude material. For silica fume, this involves densification, classification, and potentially surface modification to improve dispersion and handling. For manufactured silica, sophisticated chemical reactions, thermal treatments, and particle size control technologies are employed. This transformation stage adds the most significant value, turning a raw byproduct into a specialized additive. Midstream activities include formulation and compounding, where the ultrafine silica is incorporated into specialized products such as high-performance concrete admixture blends, polymer masterbatches, or specialized coatings systems, often done by large admixture companies or dedicated compounders.

The downstream distribution channel is critical due to the material's handling challenges. Direct channels are commonly used for high-volume customers, particularly large infrastructure projects or major industrial manufacturers (cement companies, large refineries), ensuring technical support and bulk delivery (silo or specialized bagging). Indirect distribution relies heavily on regional chemical distributors and specialized material traders who manage smaller volumes and provide last-mile delivery to niche users in coatings, rubber, or ceramics. Effective inventory management and minimizing moisture exposure during transit are paramount concerns across both direct and indirect networks to maintain product efficacy.

Ultrafine MicroSilica Market Potential Customers

Potential customers for Ultrafine MicroSilica span a wide array of industrial sectors, predominantly revolving around entities that require enhanced material strength, durability, and specialized rheological control. The largest consumption base lies within the civil engineering and heavy construction sectors, specifically concrete producers, admixture manufacturers, and government infrastructure agencies responsible for bridges, dams, and tunnels that demand extended service life and resistance to aggressive environments like saltwater or freeze-thaw cycles. These buyers prioritize high-volume supply reliability and compliance with concrete standards (e.g., ASTM C1240).

A secondary, high-value customer base includes manufacturers specializing in refractory materials, such as producers of high-temperature furnace linings, ceramic kilns, and insulation products. These buyers utilize the material for its high thermal stability and ability to reduce porosity, leading to superior heat management and extended refractory component lifespan. Additionally, the polymer and composites industry represents a rapidly growing customer segment, including rubber manufacturers (tires, seals), and plastics compounders who use ultrafine silica as a nano-filler to significantly improve mechanical strength, scratch resistance, and dimensional stability of final products.

Niche but highly profitable buyers include companies in the oil and gas sector requiring specialized drilling and well-cementing chemicals, where ultrafine silica prevents gas migration and enhances cement slurry stability under high-pressure, high-temperature (HPHT) conditions. Furthermore, electronics manufacturers use high-purity grades for semiconductor encapsulation and thermal management pastes, while pharmaceutical and cosmetic companies utilize specific grades as glidants, anti-caking agents, and thickening agents, demanding exceptionally rigorous purity certification and traceability protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.30 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Elkem ASA, Wacker Chemie AG, BASF SE, Sika AG, Ferroglobe PLC, PCC Group, Microsilica Inc., China National Bluestar (Group) Co, Ltd., Dow Inc., Shin-Etsu Chemical Co., Ltd., Tokuyama Corporation, Momentive Performance Materials Inc., Orsil S.p.A., US Silica Holdings, Inc., Pyro-Silo Oy, Rescon AS, Silicor Materials, Applied Material Solutions, Engineered Carbons, Cabot Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultrafine MicroSilica Market Key Technology Landscape

The technological landscape of the Ultrafine MicroSilica market is defined by advancements in processing, particle engineering, and dispersion methods, all aimed at achieving higher purity, better functionality, and enhanced integration into complex matrices. For silica fume derived from metallurgical processes, key technological innovations focus on optimizing the collection process, primarily through sophisticated baghouse filtration systems and electrostatic precipitators, to capture the ultrafine particles efficiently and consistently. Furthermore, sophisticated densification technologies (pelletizing, slurrying) are vital to reduce the high volume-to-weight ratio, simplifying logistics and minimizing environmental dust hazards during handling and application, which is a major logistical and safety consideration for high-volume users.

In the domain of synthetic ultrafine silica (precipitated and fumed), the technology focuses heavily on precise particle size and surface chemistry control. Fumed silica production utilizes advanced flame hydrolysis reactors to ensure mono-dispersed, non-porous particles in the nanometer range, crucial for applications requiring maximum reinforcement (e.g., silicone elastomers). For precipitated silica, innovations center on reaction parameters (pH, temperature, concentration) to tailor porosity and surface area, often involving post-treatment chemical functionalization, such as silane coupling agents, to make the hydrophilic silica compatible with hydrophobic organic matrices like polymers and specialized coatings, thereby enhancing end-product performance and integration efficiency.

Current research efforts are concentrated on developing high-performance surface modification techniques that allow for universal dispersion across different end-user matrices, leveraging nanotechnology principles. Technologies like mechanochemical activation and plasma treatment are being explored to alter surface charges and bonding sites, creating ‘smart’ silica that reacts optimally within specific formulations. Furthermore, the integration of real-time spectral analysis and AI-driven quality assurance systems within the production line represents a pivotal technological shift, ensuring that the physical and chemical specifications of the ultrafine material consistently meet the increasingly stringent requirements of advanced manufacturing industries, particularly in electronics and high-end construction.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market volume due to unparalleled levels of infrastructure development, especially in China, India, and Southeast Asia. The region is the largest producer of ferrosilicon, guaranteeing a stable supply of silica fume. Rapid urbanization, coupled with high demand from the booming electronics and automotive (EV manufacturing) sectors requiring high-purity synthetic silica, cements APAC’s position as both the manufacturing and consumption epicenter.

- North America: Characterized by a mature construction market prioritizing durability and sustainable infrastructure refurbishment rather than entirely new builds. Growth is driven by specialized applications, particularly in the oil and gas sector (deep-sea well cementing) and the automotive sector's increasing use of high-performance elastomers and polymer composites utilizing functionalized ultrafine silica. Stringent environmental regulations favor high-quality, long-lasting construction materials.

- Europe: Exhibits steady growth fueled by the region's focus on decarbonization and renovation projects, necessitating ultra-high-performance and low-permeability concrete for marine and critical civil structures. Regulatory pressure, such as the REACH initiative, drives demand for high-purity, environmentally compliant materials. The European market is also a significant consumer of specialized fumed and precipitated silica for high-end coatings and sealants.

- Latin America (LATAM): An emerging market experiencing increased investment in infrastructure, particularly in Brazil and Mexico. The market is highly susceptible to commodity pricing fluctuations but shows strong potential due to urbanization and regional investments in oil and mining infrastructure, demanding specialized cement additives for challenging geological conditions.

- Middle East and Africa (MEA): Growth is primarily concentrated in the GCC nations, driven by megaprojects and diversification away from oil economies. The severe, hot climate in the region necessitates concrete additives that provide superior resistance to sulfate attack and high temperatures, making ultrafine microsilica indispensable for longevity in coastal and desert environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultrafine MicroSilica Market.- Elkem ASA

- Wacker Chemie AG

- BASF SE

- Sika AG

- Ferroglobe PLC

- PCC Group

- Microsilica Inc.

- China National Bluestar (Group) Co, Ltd.

- Dow Inc.

- Shin-Etsu Chemical Co., Ltd.

- Tokuyama Corporation

- Momentive Performance Materials Inc.

- Orsil S.p.A.

- US Silica Holdings, Inc.

- Pyro-Silo Oy

- Rescon AS

- Silicor Materials

- Applied Material Solutions

- Engineered Carbons

- Cabot Corporation

- Nippon Electric Glass Co., Ltd.

- Aerosil India Private Limited

- PQ Corporation

Frequently Asked Questions

Analyze common user questions about the Ultrafine MicroSilica market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Ultrafine MicroSilica and standard industrial silica?

Ultrafine MicroSilica, typically less than 500 nanometers (silica fume), is characterized by its extremely high surface area and pozzolanic reactivity. Standard industrial silica is much coarser, primarily functioning as an aggregate or bulk filler without the high reactivity required for strength enhancement in concrete or reinforcement in polymers.

Which application segment drives the highest volume demand for Ultrafine MicroSilica?

The Construction and Civil Engineering sector drives the highest volume demand, specifically for producing high-performance concrete (HPC). Ultrafine MicroSilica significantly improves the concrete’s compressive strength, density, and resistance to chemical ingress, critical for marine and long-span structures.

How does the volatility of the ferrosilicon industry affect the Ultrafine MicroSilica supply chain?

Ultrafine MicroSilica (Silica Fume) is a direct byproduct of ferrosilicon production. Therefore, market supply is intrinsically linked to the cyclical demand and production volumes of the metallurgical industry, leading to price and supply volatility when ferrosilicon output changes.

What is the projected fastest-growing market segment for Ultrafine MicroSilica?

The fastest growth is anticipated in specialized, high-purity synthetic grades used in advanced materials, specifically in Polymer Modification (for automotive and aerospace composites) and specialized battery components, driven by technological adoption and strict performance requirements.

What geographical region is expected to lead market growth through 2033?

The Asia Pacific (APAC) region is projected to maintain its leadership and fastest growth trajectory, driven by massive public infrastructure investment, rapid urbanization, and expansion in electronics and high-tech manufacturing across countries like China, India, and Vietnam.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager