Ultrapure Water Purification Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439549 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Ultrapure Water Purification Systems Market Size

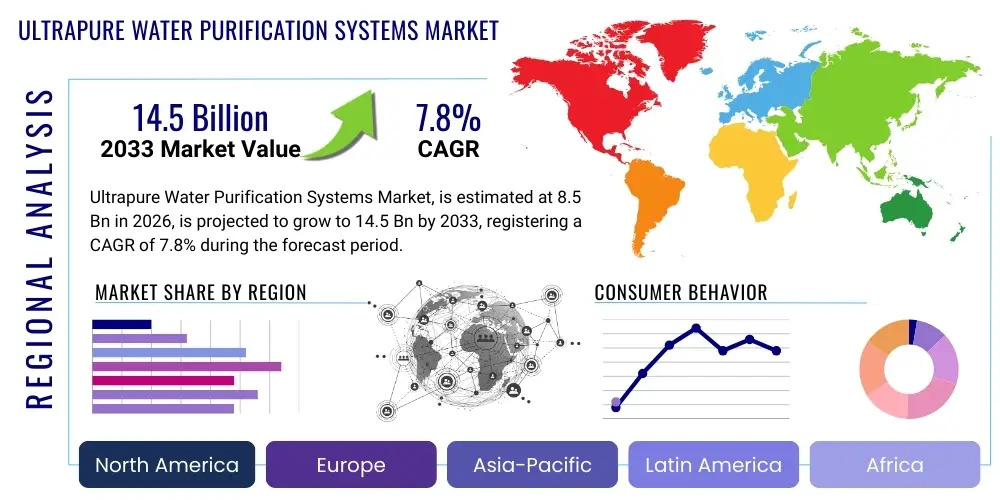

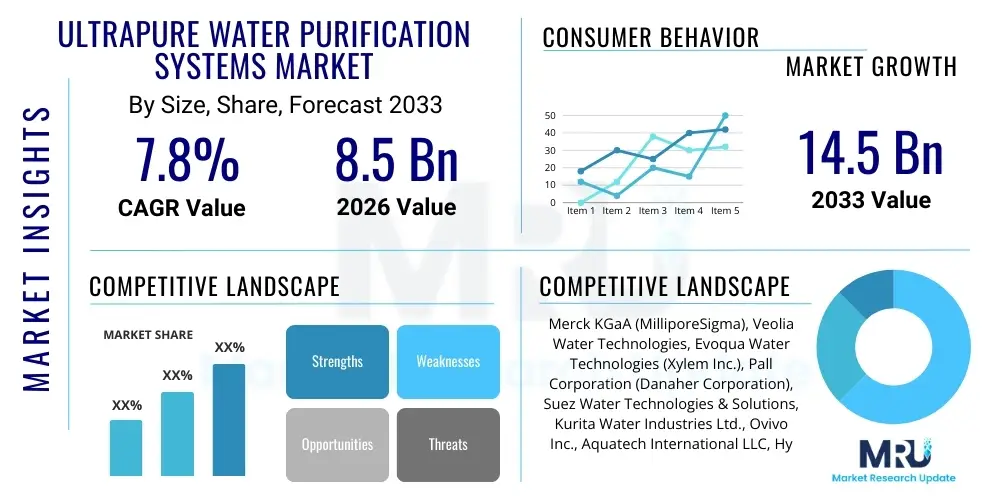

The Ultrapure Water Purification Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 8.5 billion in 2026 and is projected to reach USD 14.5 billion by the end of the forecast period in 2033.

Ultrapure Water Purification Systems Market introduction

Ultrapure water (UPW) purification systems are engineered to produce water of exceptional purity, virtually free of organic and inorganic compounds, dissolved gases, suspended particulates, and microorganisms. This level of purity is critical for a multitude of advanced industrial processes where even trace contaminants can lead to significant product defects, operational failures, or safety hazards. The demand for such meticulously processed water stems from the increasing sophistication of manufacturing processes, particularly in high-tech sectors that require precise environmental control and material integrity.

These sophisticated systems typically involve a multi-stage treatment process, integrating various technologies such as reverse osmosis (RO), ion exchange (IX), electro-deionization (EDI), ultraviolet (UV) sterilization, and advanced filtration techniques. Each stage serves a specific purpose, incrementally reducing impurities to achieve the stringent quality standards of UPW. The design and complexity of an UPW system are highly dependent on the source water quality and the specific purity requirements of the end application, making customization a significant aspect of market offerings. The integration of advanced control systems and sensors ensures real-time monitoring and consistent output quality.

Major applications for ultrapure water purification systems span across vital industries, most notably semiconductors, pharmaceuticals, biotechnology, power generation (especially nuclear and thermal), and data centers. In the semiconductor industry, UPW is indispensable for chip manufacturing processes, including wafer cleaning and etching, where particles as small as nanometers can compromise device performance. For pharmaceutical and biotechnology firms, UPW is crucial for sterile manufacturing, active pharmaceutical ingredient (API) production, and laboratory research, preventing microbial contamination and ensuring product efficacy. The fundamental benefits these systems offer include enhanced product quality, increased manufacturing yields, reduced operational downtime, and compliance with rigorous regulatory standards, thereby driving their indispensable adoption across these high-value sectors.

Ultrapure Water Purification Systems Market Executive Summary

The Ultrapure Water Purification Systems Market is characterized by robust business trends driven by technological advancements and the escalating demands of high-precision industries. A prominent trend involves the shift towards modular and integrated purification solutions, which offer greater flexibility, easier installation, and reduced footprint, catering to both established and emerging manufacturing facilities. Digitalization is also a critical accelerator, with advanced automation, real-time monitoring, and predictive maintenance capabilities becoming standard offerings, enhancing operational efficiency and system reliability. Furthermore, sustainability concerns are increasingly influencing product development, leading to the emergence of systems designed for improved water recovery rates and lower energy consumption, aligning with global environmental objectives and corporate sustainability mandates.

Regionally, the market exhibits dynamic growth patterns. The Asia Pacific (APAC) region is poised for significant expansion, primarily fueled by the burgeoning semiconductor manufacturing capabilities in countries like Taiwan, South Korea, China, and Japan, coupled with rapid industrialization and increasing investments in pharmaceutical and biotechnology sectors. North America and Europe, while mature markets, continue to demonstrate steady demand, driven by stringent regulatory frameworks, continuous innovation in life sciences, and the modernization of existing industrial infrastructure. Latin America and the Middle East & Africa (MEA) are emerging as promising markets, buoyed by expanding industrial bases and growing awareness regarding water quality for critical applications, albeit from a lower base.

Segmentation trends reveal a sustained dominance of the semiconductor industry application, which accounts for the largest share of the ultrapure water purification systems market due to the extremely high purity requirements for microelectronic component fabrication. The pharmaceutical and biotechnology sectors are also experiencing substantial growth, driven by increasing R&D activities, the production of biologics, and the need for sterile environments. From a technology perspective, integrated systems combining reverse osmosis, electro-deionization, and ion exchange continue to lead, with a growing emphasis on more energy-efficient and chemical-free polishing technologies. The continuous innovation across these segments underscores the market's resilience and its vital role in supporting critical global industries.

AI Impact Analysis on Ultrapure Water Purification Systems Market

User questions regarding the impact of AI on Ultrapure Water Purification Systems often revolve around improving operational efficiency, enhancing water quality consistency, enabling predictive maintenance, and optimizing energy consumption. There is considerable interest in how AI can move UPW systems beyond traditional automation to truly intelligent, self-optimizing operations that minimize human intervention and maximize resource utilization. Key themes include the potential for AI to detect subtle anomalies in water quality parameters before they become critical issues, to dynamically adjust system parameters in real-time based on varying source water conditions or demand fluctuations, and to predict equipment failures, thereby reducing costly downtime and extending asset lifespans. Users are keen to understand if AI can significantly lower the total cost of ownership through smart resource management and proactive problem-solving, thereby making UPW systems more robust and economically viable.

- Predictive Maintenance: AI algorithms analyze sensor data from pumps, membranes, and other components to predict potential failures, enabling proactive maintenance and minimizing unscheduled downtime for UPW systems.

- Process Optimization: Machine learning models continuously monitor and analyze various operational parameters such as flow rates, pressure, conductivity, and temperature to dynamically adjust treatment stages for optimal performance and efficiency, even with fluctuating source water quality.

- Real-time Quality Control: AI-powered analytics rapidly detect minute deviations in water purity, allowing for immediate corrective actions to maintain stringent ultrapure water quality standards, preventing costly product contamination in sensitive industries like semiconductors.

- Energy Efficiency: AI optimizes energy-intensive processes like pumping and filtration by learning demand patterns and adjusting operational modes to reduce power consumption without compromising water quality or supply, contributing to lower operational costs.

- Autonomous Operation: Advanced AI integration facilitates increasingly autonomous UPW systems that can self-diagnose issues, make adaptive adjustments, and even self-clean or regenerate certain components, leading to reduced human oversight and operational complexity.

- Resource Management: AI enhances the management of consumables such as chemicals and resins by predicting optimal dosing and regeneration cycles, thereby reducing waste and extending the lifespan of critical components within the purification process.

- Data-driven Insights: AI platforms aggregate and analyze vast amounts of operational data, providing operators with actionable insights into system health, performance trends, and areas for improvement, fostering continuous optimization and innovation.

DRO & Impact Forces Of Ultrapure Water Purification Systems Market

The Ultrapure Water Purification Systems market is primarily driven by the relentless growth and stringent quality requirements of end-user industries such as semiconductors, pharmaceuticals, and power generation. The rapid expansion of semiconductor manufacturing, particularly for advanced chips, necessitates water with virtually zero contaminants, pushing demand for highly sophisticated UPW systems. Similarly, the increasing complexity of pharmaceutical and biotechnology products, including biologics and vaccines, mandates extremely pure water for manufacturing and research, adhering to strict regulatory guidelines like cGMP. Furthermore, global industrial expansion, coupled with advancements in material science and nanotechnology, continuously elevates the demand for ultra-pure process water, fueling market growth. Technological innovations, including more efficient membrane technologies and smart monitoring systems, also contribute significantly by enhancing the performance and reducing the operational footprint of these systems.

However, the market faces significant restraints that could impede its growth trajectory. The most notable challenges include the high initial capital investment required for establishing advanced UPW systems, which can be prohibitive for smaller enterprises or those in developing regions. Operational costs, primarily associated with energy consumption for pumping and filtration, as well as the periodic replacement of expensive consumables like membranes and resins, also pose a considerable burden. The complexity of system maintenance, requiring specialized technical expertise and precise calibration, further adds to the operational challenges. Additionally, the generation and disposal of wastewater concentrate from purification processes, which can be saline or contain chemical residues, present environmental compliance and cost concerns for operators.

Despite these restraints, substantial opportunities exist within the market. Emerging economies, particularly in Southeast Asia and Latin America, are investing heavily in industrial infrastructure, creating new avenues for UPW system deployment as their high-tech sectors mature. The growing global focus on sustainable manufacturing and green initiatives presents an opportunity for manufacturers to develop more water-efficient and environmentally friendly systems, leveraging technologies that minimize waste and energy use. Furthermore, continuous advancements in materials research and nanotechnology will likely necessitate even higher purity water in the future, fostering demand for next-generation purification solutions. The trend towards modular and compact UPW systems also caters to industries requiring flexible and scalable solutions, opening up new market segments. The competitive landscape is influenced by several impact forces including the bargaining power of buyers, who demand high performance and cost-effectiveness, and the bargaining power of suppliers of critical components such as membranes and resins. The threat of new entrants is moderate due to the high capital requirements and technological expertise needed, while the threat of substitutes is low given the indispensable nature of UPW for critical applications. The intensity of competitive rivalry remains high among established players, driving continuous innovation and service improvement.

Segmentation Analysis

The Ultrapure Water Purification Systems market is comprehensively segmented to provide a granular understanding of its diverse components and applications. These segmentations typically encompass the technology employed, the end-use application, and the various components that constitute a complete system. Each segment exhibits unique growth drivers and market dynamics, reflecting the specific needs and operational environments of different industries. Understanding these segments is crucial for market participants to tailor their offerings and strategic approaches, addressing the varied demands for water purity, volume, and system complexity across the global industrial landscape.

- By Technology:

- Reverse Osmosis (RO)

- Ion Exchange (IX)

- Electrodionization (EDI)

- Ultraviolet (UV) Sterilization

- Filtration (Microfiltration, Ultrafiltration, Nanofiltration)

- Degasification

- Advanced Oxidation Processes (AOP)

- By Application:

- Semiconductor & Electronics

- Pharmaceutical & Biotechnology

- Power Generation (Thermal & Nuclear)

- Data Centers

- Research Laboratories

- Others (e.g., Chemical Industry, Aerospace)

- By Component:

- Pre-treatment Units (e.g., Multimedia Filters, Carbon Filters, Softeners)

- Primary Purification Units (e.g., RO Systems, EDI Modules)

- Polishing Units (e.g., Mixed-Bed Ion Exchangers, UV Sterilizers, Ultrafilters)

- Distribution & Recirculation Systems

- Monitoring & Control Systems (e.g., Sensors, PLCs, Software)

- Pumps and Valves

- Storage Tanks

- By System Type:

- Standard Systems

- Customized Systems

- Portable Systems

- Centralized Systems

- By Water Quality Standard:

- ASTM Type I, Type II, Type III

- JIS K 0557 A1-A4

- ISO 3696 Grade 1, Grade 2, Grade 3

- SEMI F53-0200 (for Semiconductor)

Value Chain Analysis For Ultrapure Water Purification Systems Market

The value chain for the Ultrapure Water Purification Systems market is characterized by a complex interplay of various stages, beginning with the sourcing of specialized components and extending through manufacturing, distribution, installation, and post-sales support to the end-user. Upstream activities involve a diverse range of suppliers providing critical raw materials and components such as high-performance membranes (RO, UF, MF), ion exchange resins, specialized pumps, UV lamps, filters, sensors, and control system electronics. The quality and availability of these components are paramount, directly influencing the performance and reliability of the final UPW system. Strong relationships with these specialized suppliers are essential for manufacturers to ensure consistent quality and manage costs effectively.

Midstream activities primarily encompass the design, engineering, and manufacturing of complete ultrapure water purification systems. This stage involves significant R&D investment to innovate and integrate various technologies—such as reverse osmosis, electro-deionization, and mixed-bed ion exchange—into cohesive, efficient, and often customized solutions. System integrators play a crucial role here, combining components from various suppliers to create a holistic purification plant that meets specific end-user requirements regarding water quality, volume, and operational footprint. The assembly and testing phases are critical for ensuring that the manufactured systems comply with stringent industry standards and client specifications, ready for deployment in highly sensitive environments.

Downstream analysis focuses on the distribution channels and the ultimate end-users. Distribution primarily occurs through a mix of direct sales channels, where manufacturers engage directly with large industrial clients, and indirect channels involving a network of specialized distributors, value-added resellers, and system integrators. These intermediaries often provide localized sales, technical support, and installation services, particularly for smaller projects or in regions where direct presence is less feasible. The end-users, predominantly found in the semiconductor, pharmaceutical, biotechnology, and power generation sectors, rely on these systems for critical processes, making robust after-sales service, including maintenance contracts, consumables supply, and technical support, a vital part of the value proposition. The effectiveness of these distribution and service networks significantly influences market penetration and customer satisfaction.

Ultrapure Water Purification Systems Market Potential Customers

Potential customers for Ultrapure Water Purification Systems primarily encompass industries where water quality is a paramount factor for product integrity, operational efficiency, and regulatory compliance. The semiconductor industry stands as the largest and most demanding end-user, requiring UPW for every stage of chip manufacturing, including wafer cleaning, etching, and dicing, where even minuscule impurities can lead to device failure. These manufacturers continuously invest in advanced UPW systems to keep pace with shrinking chip geometries and increasing purity specifications, making them a consistent and high-value customer segment globally.

The pharmaceutical and biotechnology sectors represent another critical customer base. Companies involved in the production of active pharmaceutical ingredients (APIs), biologics, vaccines, and sterile injectable solutions depend on UPW for process water, cleaning-in-place (CIP), and laboratory applications. Stringent regulatory bodies like the FDA and EMA mandate specific water quality standards (e.g., USP Purified Water, Water for Injection), compelling pharmaceutical manufacturers to invest in robust and compliant UPW systems to ensure product safety, efficacy, and consistency. Research and development laboratories within these industries also require UPW for sensitive analytical testing and experimental protocols.

Beyond these two dominant sectors, power generation plants, especially those operating thermal and nuclear facilities, are significant consumers of UPW to prevent scaling, corrosion, and fouling in boilers and turbines. This ensures optimal operational efficiency and extends the lifespan of critical infrastructure. Data centers and advanced electronics manufacturing also increasingly rely on UPW for cooling systems and sensitive equipment cleaning, preventing contamination and ensuring reliable operation. Furthermore, specialized chemical industries, aerospace manufacturing, and advanced materials research laboratories also constitute important niche markets, requiring ultrapure water for various precision processes and product development.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 billion |

| Market Forecast in 2033 | USD 14.5 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA (MilliporeSigma), Veolia Water Technologies, Evoqua Water Technologies (Xylem Inc.), Pall Corporation (Danaher Corporation), Suez Water Technologies & Solutions, Kurita Water Industries Ltd., Ovivo Inc., Aquatech International LLC, Hydro-Logic International (A Pentair Company), Pure Water Group, BWT Aktiengesellschaft, Lenntech B.V., GEA Group AG, Thermax Limited, Aqua-Chem, Inc., WABAG Group, Parker Hannifin Corporation, Ultrapure & Industrial Services (UPIS), WaterProfessionals®, Marlo, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultrapure Water Purification Systems Market Key Technology Landscape

The Ultrapure Water Purification Systems market is characterized by a dynamic and evolving technology landscape, driven by the continuous quest for higher purity, greater efficiency, and reduced operational costs. At its core, the technology relies on a multi-stage approach combining various physical and chemical separation methods. Reverse Osmosis (RO) remains a foundational technology, effectively removing dissolved salts, organic molecules, and particles from the incoming water. This stage often utilizes advanced membrane materials that offer improved rejection rates and resistance to fouling, thereby extending membrane lifespan and reducing maintenance frequency. Subsequent purification steps frequently employ Electrodionization (EDI), which uses electricity to continuously remove ions without the need for chemical regeneration, presenting an environmentally friendly and cost-effective alternative to traditional ion exchange beds.

Beyond these primary stages, polishing technologies are crucial for achieving the extremely low levels of impurities required for ultrapure water. Ion Exchange (IX) resins, particularly mixed-bed ion exchangers, are indispensable for removing trace ionic contaminants to parts per trillion levels. Ultraviolet (UV) sterilization systems are widely integrated to disinfect water and oxidize organic compounds, especially when combined with advanced oxidation processes (AOPs) that utilize UV light in conjunction with chemical oxidants like hydrogen peroxide to break down stubborn organic molecules. Furthermore, various microfiltration, ultrafiltration, and nanofiltration membranes are employed at different stages to remove particulates, colloids, and macromolecules, ensuring complete removal of suspended matter and microorganisms.

The latest technological advancements are increasingly focused on intelligent control and monitoring systems. These incorporate sophisticated sensors for real-time measurement of parameters such as resistivity, TOC (Total Organic Carbon), pH, and particle counts, enabling immediate adjustments and proactive maintenance. Automation and digitalization play a pivotal role, with Programmable Logic Controllers (PLCs), Supervisory Control and Data Acquisition (SCADA) systems, and increasingly AI-powered analytics optimizing system performance, predicting maintenance needs, and ensuring compliance. Modular system designs are also gaining traction, offering flexibility, scalability, and ease of installation for diverse industrial requirements. These technological innovations collectively contribute to the enhanced reliability, sustainability, and cost-effectiveness of ultrapure water production.

Regional Highlights

- North America: This region is a mature market, characterized by significant investment in the pharmaceutical, biotechnology, and advanced electronics sectors. Strict regulatory frameworks, particularly in pharmaceuticals, drive continuous demand for high-quality UPW systems. Innovation in water treatment technologies and the presence of leading global players further solidify its market position.

- Europe: Europe represents a robust market with stringent environmental regulations and a strong emphasis on sustainability in industrial processes. Countries like Germany, France, and the UK are major hubs for pharmaceutical manufacturing, precision electronics, and research, maintaining a consistent demand for state-of-the-art UPW systems. The region also leads in adopting energy-efficient and chemically less intensive purification technologies.

- Asia Pacific (APAC): APAC is the fastest-growing market for ultrapure water purification systems, primarily due to the rapid expansion of the semiconductor industry in countries like Taiwan, South Korea, China, and Japan. Massive investments in new fabrication plants (fabs) and the burgeoning pharmaceutical and biotechnology sectors across the region are significant drivers. Rapid industrialization and urbanization in emerging economies within APAC also contribute to the rising demand.

- Latin America: This region is an emerging market for UPW systems, driven by growing investments in pharmaceutical manufacturing, food & beverage processing, and industrial development in countries like Brazil and Mexico. While starting from a smaller base, increasing industrialization and rising quality standards are expected to fuel steady growth in demand for ultrapure water solutions.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth, with demand primarily stemming from power generation projects, petrochemical industries, and nascent pharmaceutical sectors. Water scarcity issues in some parts of the region also emphasize the importance of high-efficiency water treatment and reuse technologies, creating opportunities for advanced purification systems as industrial sectors expand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultrapure Water Purification Systems Market.- Merck KGaA (MilliporeSigma)

- Veolia Water Technologies

- Evoqua Water Technologies (Xylem Inc.)

- Pall Corporation (Danaher Corporation)

- Suez Water Technologies & Solutions

- Kurita Water Industries Ltd.

- Ovivo Inc.

- Aquatech International LLC

- Hydro-Logic International (A Pentair Company)

- Pure Water Group

- BWT Aktiengesellschaft

- Lenntech B.V.

- GEA Group AG

- Thermax Limited

- Aqua-Chem, Inc.

- WABAG Group

- Parker Hannifin Corporation

- Ultrapure & Industrial Services (UPIS)

- WaterProfessionals®

- Marlo, Inc.

Frequently Asked Questions

What is ultrapure water and why is it essential?

Ultrapure water (UPW) is water that has been treated to the highest levels of purity, removing all dissolved solids, organic compounds, dissolved gases, and microorganisms. It is essential in industries like semiconductor manufacturing, pharmaceuticals, and power generation because even trace contaminants can critically compromise product quality, process efficiency, or equipment integrity.

Which industries are the primary consumers of ultrapure water purification systems?

The primary consumers of ultrapure water purification systems are the semiconductor and electronics industry, pharmaceutical and biotechnology companies, power generation facilities (especially thermal and nuclear plants), and data centers for specialized cooling and humidification processes. Research laboratories also represent a significant segment.

What are the key technologies used in ultrapure water purification systems?

Key technologies include Reverse Osmosis (RO) for initial desalination, Ion Exchange (IX) for polishing, Electrodionization (EDI) for continuous deionization without chemical regeneration, Ultraviolet (UV) sterilization for disinfection and TOC reduction, and various filtration methods (e.g., microfiltration, ultrafiltration) for particulate removal. Advanced oxidation processes are also used for stubborn organic contaminants.

What challenges does the Ultrapure Water Purification Systems market face?

The market faces challenges such as the high initial capital investment required for these sophisticated systems, significant operational costs primarily due to energy consumption and consumables replacement (membranes, resins), the complexity of maintenance requiring specialized expertise, and issues related to wastewater management from the purification processes.

How is AI impacting the efficiency and operation of UPW systems?

AI is significantly enhancing UPW system efficiency by enabling predictive maintenance, optimizing process parameters in real-time, improving quality control through advanced anomaly detection, and reducing energy consumption by dynamically adjusting operations based on demand and source water conditions. This leads to more reliable, cost-effective, and autonomous systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager