Ultrasonic Atomizer Nozzle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437214 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Ultrasonic Atomizer Nozzle Market Size

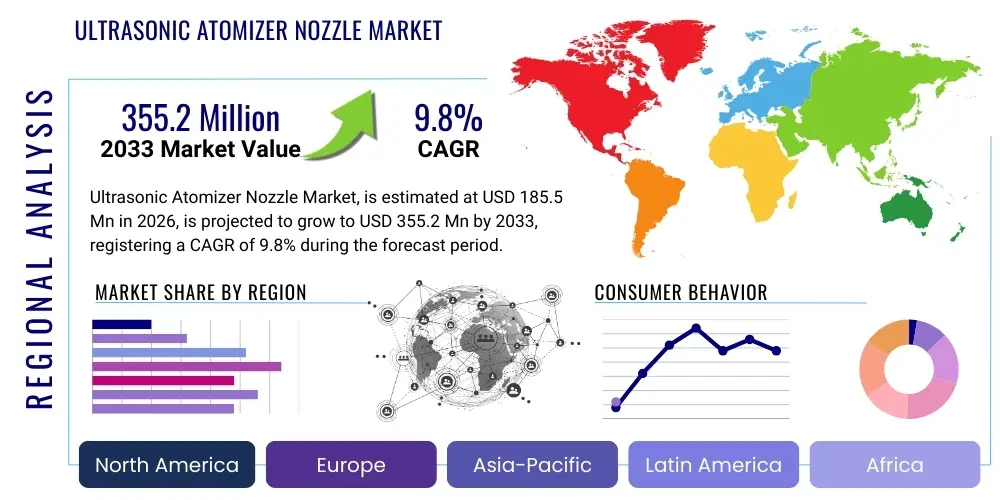

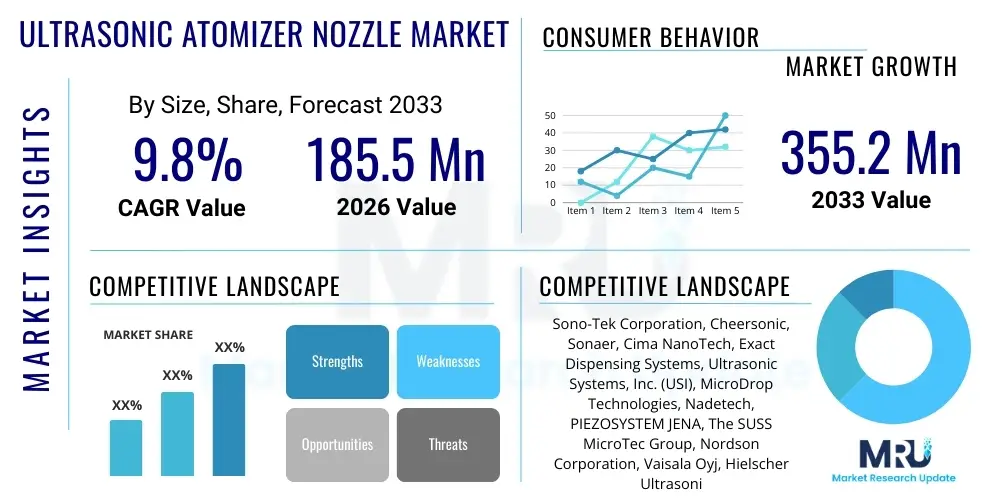

The Ultrasonic Atomizer Nozzle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 185.5 Million in 2026 and is projected to reach USD 355.2 Million by the end of the forecast period in 2033.

Ultrasonic Atomizer Nozzle Market introduction

The Ultrasonic Atomizer Nozzle Market encompasses advanced fluid handling and dispensing technology utilized across diverse industrial, medical, and consumer sectors. These precision instruments employ high-frequency ultrasonic vibrations, typically generated via robust piezoelectric transducers composed of materials such as specialized Lead Zirconate Titanate (PZT) variants, to efficiently atomize liquid streams. This process transforms bulk liquids into extremely fine, uniformly sized droplets without the shear stress or mechanical pressure required by conventional pneumatic or hydraulic spraying methods. The core mechanism involves vibrating a contoured nozzle horn at frequencies usually ranging from 20 kHz up to 150 kHz, creating standing waves in the liquid film that forms on the nozzle tip. When the amplitude of these waves exceeds a critical threshold, the liquid detaches as highly consistent, low-velocity droplets. This inherent gentleness minimizes the risk of clogging, even when handling suspensions containing high concentrations of nanoparticles or delicate biological materials, and significantly enhances material transfer efficiency, often achieving metrics surpassing 95% which is a crucial performance metric in high-cost material applications.

The market’s substantial growth trajectory is underpinned by the increasing complexity of modern manufacturing requirements, particularly those demanding precise thin-film deposition and waste reduction. Major applications driving adoption include the extremely precise coating of pharmaceutical compounds onto implantable medical devices like drug-eluting stents and cardiovascular balloons, where consistent dosage and film uniformity are life-critical parameters. Industrially, ultrasonic atomizers are fundamental to the fabrication of advanced microelectronics, where they apply photoresists, fluxes, and thin-layer encapsulants onto delicate components, including MEMS devices and advanced semiconductor wafers. Furthermore, the technology is pivotal in the renewable energy sector, facilitating the homogeneous deposition of catalyst inks onto membrane electrode assemblies (MEAs) for Proton Exchange Membrane (PEM) fuel cells, and applying active material slurries onto current collectors in lithium-ion battery production. The unique ability of these nozzles to control droplet size distribution (DSD) precisely allows manufacturers to tailor the physical properties of the deposited layer, optimizing device performance and longevity.

The benefits derived from implementing ultrasonic atomizer nozzles are multi-faceted, extending beyond mere precision to encompass economic and environmental advantages. Driving factors include stringent environmental regulations pushing industries towards lower Volatile Organic Compound (VOC) emissions, achievable by using high-solids-content formulations that ultrasonic nozzles can reliably handle. Moreover, the low-velocity spray characteristics of ultrasonic atomization minimize particle rebound and airborne emissions, creating cleaner operational environments and reducing the need for extensive ventilation systems compared to high-pressure atomization techniques. The combination of high material utilization, low maintenance requirements due to non-clogging operation, and the capacity for repeatable, sub-micron layer deposition solidifies the ultrasonic atomizer nozzle as a key enabling technology for industries focused on miniaturization, high-performance materials science, and sustainable manufacturing practices in the forecast period of 2026 to 2033. The trend toward customized, application-specific nozzle geometries optimized for complex rheologies further ensures the market's long-term vitality across niche high-value sectors.

Ultrasonic Atomizer Nozzle Market Executive Summary

The Ultrasonic Atomizer Nozzle Market is currently navigating a dynamic expansion phase, characterized by heightened technological integration and strategic market consolidation aimed at securing high-growth application niches. A primary business trend observed is the aggressive push towards fully automated, integrated coating systems that incorporate advanced robotics and sophisticated software interfaces, shifting the focus from individual nozzle sales to complete system solutions. Market participants are increasingly focusing on specialized product lines tailored to highly specific industries, such as high-purity coatings for aerospace optics or chemically resistant nozzles for aggressive chemical processing, thus diversifying revenue streams beyond traditional electronics manufacturing. Furthermore, cross-industry collaboration between ultrasonic hardware providers and materials science companies is intensifying, ensuring nozzle compatibility with novel, proprietary functional materials like perovskites or specialized conductive polymers necessary for next-generation devices. Competitive maneuvering includes strategic Intellectual Property (IP) development around self-cleaning mechanisms and advanced frequency modulation techniques to maintain market differentiation and control over key technological aspects, influencing pricing power in specialized segments.

Regionally, the market exhibits a distinct global imbalance in terms of growth rates and maturity levels. The Asia Pacific (APAC) region continues its ascendancy as the dominant consumer and production hub, largely fueled by national strategic investments in advanced manufacturing infrastructure, notably in semiconductor foundry construction and large-scale battery gigafactories. This region demands high-throughput, industrial-scale ultrasonic systems capable of 24/7 reliability. Conversely, North America and Europe, while representing mature markets, maintain dominance in the high-value, low-volume segment, particularly within highly regulated spaces like medical device coating and specialized military/aerospace applications. The focus here is less on sheer volume and more on achieving unparalleled precision and compliance with stringent quality assurance protocols, driving demand for R&D-grade equipment. Latin America and the Middle East and Africa (MEA) remain smaller, nascent markets whose growth is strongly correlated with localized industrialization efforts, particularly in the basic industrial coating and HVAC sectors, although MEA shows emerging interest in energy sector applications related to infrastructure protection and solar power deployment.

Analysis of segment trends reveals that the High-Frequency (>100 kHz) Nozzle segment is outpacing general market growth, reflecting the ubiquitous industry requirement for finer droplets and thinner film deposition in microelectronics and ophthalmic coatings. This segment commands premium pricing due to the technical complexity involved in manufacturing stable, high-frequency transducers and requires highly precise electronic drivers. Concurrently, the application segment relating to Energy and Fuel Cells, specifically electrode coating for high-capacity batteries, is projected to witness transformative demand acceleration. This growth is driven by massive global capital deployment towards electrification and sustainable energy systems, requiring specialized ultrasonic nozzles capable of handling abrasive, high-solids battery slurries without compromising precision. This trend underscores the role of ultrasonic technology as a critical infrastructure component enabling the global energy transition and validates the market’s pivot towards specialized, high-performance industrial applications where deposition consistency directly correlates with end-product efficiency and lifespan.

AI Impact Analysis on Ultrasonic Atomizer Nozzle Market

A central theme emerging from user inquiries regarding AI adoption focuses on leveraging machine learning (ML) and computer vision for automating and perfecting the delicate coating process. Users frequently ask about the capabilities of AI to instantaneously compensate for manufacturing variables such as subtle fluctuations in ambient temperature, minor pressure changes in fluid lines, or natural degradation of the piezoelectric transducer performance over time. The fundamental concern is moving beyond reactive quality control, where defects are identified post-production, to a proactive, predictive control model. Specifically, ML algorithms are sought after for their potential to analyze spectral data from inline sensors, correlating complex fluidic behaviors and acoustic signatures with deposition quality metrics, thereby enabling preemptive adjustments to the nozzle operating parameters—such as adjusting power amplitude or resonant frequency—before a coating defect manifests. This shift from manual calibration to autonomous self-optimization is deemed essential for achieving the six-sigma levels of reliability required in advanced semiconductor and medical device manufacturing environments.

The implementation of Artificial Intelligence models, particularly Deep Learning frameworks applied to visual and acoustic data streams, significantly augments the operational performance and economic viability of ultrasonic coating lines. Computer vision systems equipped with ML models can analyze high-resolution images of the spray plume or the resulting film thickness profile in real-time, identifying minuscule variations indicative of potential flaws, such as "cobwebbing" or non-uniform coverage. These models offer a far superior and faster assessment compared to traditional human inspection or simple threshold-based monitoring systems. By quantifying the coating quality, the AI system feeds correction vectors back to the nozzle controller and the motion control system, ensuring that the coating robot trajectory or the flow rate is modulated instantly. This closed-loop system architecture ensures that, even if the properties of the liquid material drift (e.g., due to solvent evaporation over time), the deposition process remains robustly aligned with the desired thickness tolerance, drastically improving yield rates and minimizing the wastage of expensive functional materials, thereby delivering substantial operational savings and competitive advantage to adopters.

Furthermore, the long-term impact of AI extends critically into the realm of system maintenance and design evolution. Predictive maintenance (PdM) powered by AI involves training models on the acoustic and thermal signatures emitted by the piezoelectric stack and the electronic driver. These subtle, non-visible patterns can accurately predict the onset of material fatigue or component failure weeks or months in advance, facilitating just-in-time replacement scheduling. This predictive capability eliminates catastrophic failures that would otherwise halt high-volume production lines. Looking forward, Generative AI is expected to play a transformative role in customized nozzle development. By inputting target fluid parameters (viscosity, surface tension) and desired droplet size distributions, AI could iterate and design optimal nozzle geometries—the horn taper, the manifold design, and the fluid path—significantly accelerating the R&D cycle and leading to the creation of ultra-specialized atomizer heads for emerging applications in micro-fluidics and biological printing, further solidifying the technology's dominance in precision dispensing and ensuring that systems are optimized for specific, complex rheological challenges before physical prototyping even begins.

- AI enables real-time, closed-loop feedback systems for automatic adjustment of spray parameters (frequency, power, flow rate) based on sensory input, guaranteeing consistent output.

- Machine learning models enhance Quality Control (QC) by utilizing computer vision to identify microscopic coating defects and non-uniformity across complex geometries instantaneously.

- Predictive maintenance analytics forecast transducer component fatigue and failure by analyzing subtle acoustic and thermal signatures, maximizing operational uptime and reducing unplanned downtime costs.

- Generative design tools assist in optimizing customized nozzle geometry for specific fluid rheologies and target droplet size distributions in specialized R&D and manufacturing applications.

- Improved material utilization and waste reduction achieved through AI-driven optimization of dispensing patterns, robot path planning, and dynamic compensation for material property drift in high-value processes.

DRO & Impact Forces Of Ultrasonic Atomizer Nozzle Market

The market is predominantly influenced by the compelling technological and economic advantages offered by ultrasonic systems, which address modern manufacturing’s persistent challenges concerning waste, precision, and sustainability. The primary driver is the accelerating trend of device miniaturization across electronics and medical fields, requiring highly uniform coatings below 10 microns, achievable only through the fine droplet control of ultrasonic nozzles. Coupled with this is the escalating cost of specialized functional materials, such as precious metal catalyst inks in fuel cells or high-purity photoresists in semiconductors, making the high material transfer efficiency (MTE) of ultrasonic atomization an essential economic imperative rather than a mere preference. These efficiency gains, ranging from 50% to over 90% savings compared to traditional methods, offer a rapid Return on Investment (ROI), particularly for capital-intensive high-volume manufacturers. The resulting positive impact force compels industries to transition toward ultrasonic solutions to maintain competitiveness and adhere to increasingly strict resource management mandates worldwide, particularly in regions enforcing stringent environmental standards regarding material utilization and solvent usage.

Notwithstanding the strong drivers, several notable restraints impede broader market penetration, particularly among Small and Medium Enterprises (SMEs). The substantial initial capital expenditure required for purchasing and installing a complete ultrasonic coating system, which often includes complex motion control systems, high-precision metering pumps, and advanced electronic drivers, remains a significant barrier. Furthermore, the specialized knowledge base necessary for effective operation and maintenance—requiring expertise in acoustics, fluid dynamics, and piezoelectric technology—creates a reliance on highly skilled technical staff or external vendor support. This complexity can deter potential users accustomed to simpler, conventional spraying technologies. Another technical restraint involves the limitations in handling extremely high-viscosity fluids or slurries with significantly large particle sizes that exceed the acoustic cavitation threshold capacity of the nozzle, although continuous R&D is pushing these boundaries through improved fluid manifolds, self-cleaning pulsed systems, and advanced transducer designs capable of higher power output to atomize challenging liquids.

The market opportunities are substantial and are primarily located within emerging technological frontiers. The explosive growth in the Electric Vehicle (EV) battery sector presents a massive, high-volume application for ultrasonic coating of anodes and cathodes, aiming to enhance battery performance and longevity through precise active material deposition. Similarly, the advancement of Additive Manufacturing (AM), where ultrasonic nozzles are used to accurately dispense functional materials layer-by-layer for specialized 3D printing, opens doors to highly customized, high-margin niche markets. Furthermore, the global push towards next-generation solar energy technologies, requiring precise deposition of novel materials like perovskites, offers sustained growth avenues. These opportunities, underpinned by continuous research in transducer materials and AI integration for enhanced process control, mitigate the restraint of high cost by demonstrating clear, long-term technical and economic superiority, reinforcing the strong overall positive impact force shaping the market trajectory and ensuring continuous investment in application-specific hardware customization.

Segmentation Analysis

The Ultrasonic Atomizer Nozzle Market is comprehensively segmented across several critical dimensions, enabling a granular view of specific technological demands and application areas. This segmentation, particularly by Frequency Type, directly corresponds to the required droplet size and, consequently, the target film thickness of the end-product. The technological segmentation is essential because the physics governing the atomization process dictate that a specific frequency is inherently optimized for a particular fluid rheology and desired outcome. For example, the adoption rate of high-frequency nozzles is a clear indicator of the market's increasing dedication to micro-coating applications, demonstrating the industry's shift away from bulk coating towards precision layer deposition, a trend that is critically relevant for investors and strategic planning across the manufacturing supply chain.

Within the Application segment, the distribution of market revenue reflects the historical and current demands of major industrial consumers. While Electronics Manufacturing historically holds a dominant share due to the early adoption of ultrasonic fluxing and photoresist application, the Energy & Fuel Cells category is poised for the most dramatic proportional growth due to global decarbonization efforts. The precise coating required for catalyst-coated membranes (CCMs) in hydrogen fuel cells and the high-volume needs for uniform electrode slurry deposition in Gigafactories necessitate robust, high-power ultrasonic systems. Conversely, the Medical Devices segment, while smaller in volume, demands the highest degree of quality assurance and precision (often utilizing specialized, disposable, or high-purity nozzles), driving significant innovation in materials compatibility and sterilization protocols, which in turn commands a premium price structure for specialized medical nozzles focused on compliance and patient safety.

The segmentation by Power Output is crucial for understanding system scalability and throughput capacity. Low Power systems (typically <10W) are predominantly utilized in laboratory environments, R&D settings, and clinical applications where micro-liters of fluid need to be dispensed with accuracy, often on a non-continuous basis. Medium Power systems (10W-50W) serve pilot production lines or moderate-volume industrial applications such as general industrial coating and smaller-scale electronic assembly. High Power systems (>50W) are engineered for heavy, continuous industrial operation, such as the high-speed coating of large-area substrates like solar panels or the continuous electrode production lines found in modern battery factories. This power stratification reflects the spectrum of end-user needs, from bench-top experimental setups to fully industrialized, automated coating tunnels, providing manufacturers with clear pathways for product specialization and targeting specific market segments based on operational scale and investment capacity.

- By Frequency Type

- Low Frequency (20 - 60 kHz): Suitable for high-volume, general industrial coating, and large particle suspensions, offering flexibility and robustness.

- Standard Frequency (60 - 100 kHz): Balanced performance for most fluxing, humidification, and moderate-precision thin-film applications requiring stable droplet generation.

- High Frequency (> 100 kHz): Essential for ultra-fine droplet sizes (sub-10 µm), critical for advanced electronics, medical micro-dosing, and nano-material deposition demanding the highest level of precision.

- By Application

- Medical Devices (Stent Coating, Catheter Coatings, Pharmaceutical Nebulizers, Drug Delivery Systems requiring bio-compatible coatings)

- Electronics Manufacturing (Fluxing Printed Circuit Boards, Photoresist Coating on Wafers, MEMS Fabrication, Display Panel Coating, requiring highly uniform sub-micron layers)

- Industrial Coating (Glass Anti-reflective Coatings, Textile Functionalization, Protective Industrial Finishes, demanding high MTE for large substrates)

- Energy & Fuel Cells (Battery Electrode Coating, Catalyst Ink Deposition for PEM Fuel Cells, Solar Cell Thin-Film Fabrication, focused on high-throughput material handling)

- Humidification and Aromatherapy (High-purity liquid atomization for HVAC and consumer sectors, prioritizing longevity and quiet operation)

- Food Processing and Flavoring (Precision flavoring application and ingredient dispensing, requiring high sanitary standards)

- By Power Output

- Low Power (< 10W): R&D, laboratory, and high-precision clinical applications where minute volumes of expensive fluids are used.

- Medium Power (10W - 50W): Pilot production, medium-scale industrial coating, and specialized fluxing operations offering a balance of throughput and precision.

- High Power (> 50W): High-throughput, continuous industrial manufacturing (e.g., large-scale battery and solar panel lines) requiring maximum durability and sustained output.

Value Chain Analysis For Ultrasonic Atomizer Nozzle Market

The robust value chain for the Ultrasonic Atomizer Nozzle Market commences with highly technical upstream activities centered on material science and component fabrication. The most critical component is the piezoelectric transducer, typically manufactured using precise ceramic formulations like modified PZT, which requires rigorous quality control during synthesis and polarization to ensure stable acoustic performance and longevity under high cyclic stress. Upstream providers are highly specialized, often producing components for other high-tech fields like medical ultrasound or military sensors. Following transducer production, specialized machining companies handle the creation of the titanium or stainless steel nozzle horns and fluid delivery manifolds. These components must be machined to extremely fine tolerances to support the high-frequency vibrations and ensure fluidic pathways minimize turbulence. The supply of sophisticated power electronics, including high-frequency generators and control systems necessary to drive the transducers, forms another specialized segment of the upstream value chain, requiring deep expertise in resonant circuit design, digital signal processing for amplitude and frequency control, and robust power management solutions.

The midstream of the value chain is dominated by the core nozzle manufacturers who perform final assembly, acoustic tuning, and application-specific calibration. These Original Equipment Manufacturers (OEMs) invest heavily in R&D to develop proprietary nozzle geometries, self-cleaning features (e.g., internal flushing or pulsed operation), and integrated control software. Differentiation at this stage relies heavily on Intellectual Property (IP) surrounding acoustic efficiency and fluid handling for challenging liquids, such as high-solids content slurries or volatile organic solvents, ensuring their systems outperform generic solutions in critical parameters like DSD and MTE. Distribution channels are highly varied, reflecting the customer base’s technical needs. Direct sales channels are preferred for major industrial clients (e.g., semiconductor foundries, leading pharmaceutical companies) requiring custom-engineered, fully automated coating systems, ensuring personalized application support and application-specific calibration conducted by the OEM’s expert field engineers.

Indirect distribution relies on a network of established regional distributors, system integrators, and value-added resellers (VARs) who combine the nozzle technology with complementary components such as robotic platforms, inert atmosphere glove boxes, high-precision metering pumps, and ventilation systems to create comprehensive coating lines for smaller industrial clients and academic research labs. The downstream component emphasizes installation, rigorous acceptance testing, maintenance, and expert technical support, activities that are indispensable due to the precision and complexity of the equipment. Value is added post-sale through comprehensive application engineering services, where vendor experts assist clients in optimizing critical process variables like fluid viscosity, nozzle height, and sweep speed to achieve the desired film characteristics for a specific material and substrate combination. As the market pivots towards Industry 4.0, downstream value addition increasingly includes software updates, remote diagnostics capabilities, and predictive maintenance contracts managed via secure cloud platforms, ensuring peak system performance and maximizing client throughput across geographically dispersed global operations and reinforcing customer lock-in through superior service provision.

Ultrasonic Atomizer Nozzle Market Potential Customers

The most critical segment of end-users for ultrasonic atomizer nozzles includes high-technology manufacturers demanding superior precision and material efficiency in their production processes. Leading companies in the Semiconductor and Microelectronics fabrication space represent a foundational customer base. These firms rely on ultrasonic technology for critical steps such as applying photoresists onto silicon wafers, dispensing precise volumes of flux during printed circuit board assembly (PCBA), and coating advanced Micro-Electro-Mechanical Systems (MEMS) devices. These buyers are characterized by their stringent quality requirements, necessitating nozzles capable of sub-micron uniformity and high repeatability, and they often invest in premium, high-frequency systems integrated with sophisticated robotic platforms to maximize production yield and minimize defect rates in their extremely sensitive manufacturing environments where slight variations can lead to multi-million dollar losses. Their purchasing decisions are driven by total cost of ownership (TCO) weighed against process control reliability.

A rapidly expanding and highly regulated customer group is the Medical Device and Pharmaceutical manufacturing industry. Customers in this domain, including manufacturers of drug-eluting stents, orthopaedic implants, and specialized surgical tools, procure ultrasonic nozzles for the precise deposition of therapeutic drug coatings and biocompatible polymers. The primary drivers for these customers are regulatory compliance, assurance of coating consistency across complex 3D structures (like stent scaffolding), and minimizing material waste of often extremely expensive pharmaceutical agents. Furthermore, pharmaceutical companies utilize these nozzles in specialized nebulizers and inhalers, requiring highly controlled aerosol generation for controlled drug delivery to the lungs. This segment prioritizes validated systems, cleanroom compatibility, extensive documentation regarding material compatibility and process repeatability, often favoring vendors with established track records and ISO certifications relevant to medical device manufacturing.

The third major potential customer base is deeply entrenched in the global clean energy transition, specifically within the Electric Vehicle (EV) and Fuel Cell manufacturing ecosystems. Key customers include large-scale battery producers (Gigafactories) and automotive original equipment manufacturers (OEMs) investing in their own component supply chains. These entities require high-throughput, robust ultrasonic systems capable of continuously depositing highly abrasive, high-solids lithium slurry inks onto vast rolls of current collector foil, often operating at speeds exceeding conventional coating methods. Similarly, fuel cell developers rely on these nozzles to achieve uniform catalyst loading on proton exchange membranes, a critical factor determining the efficiency and lifespan of the fuel cell stack. For these energy-focused customers, the core buying criteria revolve around scalability, durability against abrasive inks, and the efficiency of material utilization, making high-power, industrial-grade ultrasonic systems the essential tooling for mass production aimed at lowering the cost per kilowatt-hour of energy storage devices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Million |

| Market Forecast in 2033 | USD 355.2 Million |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sono-Tek Corporation, Cheersonic, Sonaer, Cima NanoTech, Exact Dispensing Systems, Ultrasonic Systems, Inc. (USI), MicroDrop Technologies, Nadetech, PIEZOSYSTEM JENA, The SUSS MicroTec Group, Nordson Corporation, Vaisala Oyj, Hielscher Ultrasonics GmbH, Applied Nanotech, Inc., Zenith Spray Systems, Spraying Systems Co., Optosolve, Inc., Precision Valve & Automation (PVA), Shanghai Cheersonic Ultrasonic Equipment Co., Ltd., Fisnar Inc., SMT Selective Soldering, Meggitt Sensing Solutions, Telsonic Ultrasonics, MKS Instruments, Sonics & Materials Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultrasonic Atomizer Nozzle Market Key Technology Landscape

The technological evolution defining the ultrasonic atomizer nozzle market is fundamentally tied to the principles of acoustic physics and advanced material engineering, focusing intensely on refining the piezoelectric components and the associated power control systems. Modern nozzle designs are increasingly incorporating proprietary transducer assemblies, often using multilayer piezoelectric ceramics to achieve higher operational efficiency and enhanced durability under continuous high-power operation, particularly necessary for industrial coating throughput. A critical area of development involves the acoustic coupling mechanism between the transducer stack and the metallic horn; manufacturers are developing advanced joining techniques (e.g., specialized brazing or bonding) to minimize energy losses and ensure consistent vibration amplitude across the entire nozzle tip surface. Furthermore, the material selection for the nozzle tip itself is paramount, requiring exotic alloys like high-grade titanium, specialized stainless steels, or chemically inert ceramics to withstand increasingly aggressive industrial solvents, high-pH slurries (common in battery manufacturing), and elevated operating temperatures found in specialized coating processes, thereby guaranteeing chemical compatibility and minimizing cross-contamination.

In parallel with hardware advancements, the most transformative technological progress is occurring in the realm of electronic control. Next-generation ultrasonic generators employ Digital Signal Processing (DSP) and Field-Programmable Gate Arrays (FPGAs) to execute sophisticated frequency modulation routines. These systems can dynamically track the nozzle’s resonant frequency, which can naturally shift due to thermal changes or fluid loading, ensuring the system consistently operates at peak efficiency for optimal atomization. This capability allows for highly stable droplet generation over prolonged periods, which is vital for maintaining coating uniformity in sensitive applications like solar cell manufacturing or medical drug delivery. Moreover, manufacturers are integrating complex flow sensors, real-time visualization systems, and high-speed acoustic monitoring directly into the nozzle control loop. These integrated sensors provide instantaneous feedback on fluid delivery and spray characteristics, feeding data back to the DSP controller to perform micro-adjustments in power and frequency, maintaining perfect process control regardless of minor environmental or material variations and setting a new benchmark for system responsiveness.

Future technology is heavily focused on connectivity, miniaturization, and enhancing versatility. The rise of micro-dosing applications, particularly in genomics, drug screening, and in-vitro diagnostics, necessitates the development of highly miniaturized, low-power nozzles capable of dispensing micro-liter volumes with sub-micron precision, often requiring custom acoustic focusing methods to manage the minuscule liquid volumes. Connectivity via Industrial Internet of Things (IIoT) protocols is becoming standard, enabling seamless integration of ultrasonic systems into factory-wide monitoring networks, allowing remote process control, predictive diagnostics, and centralized data logging essential for compliance and continuous process improvement across distributed manufacturing sites. Finally, a significant emerging technology involves multi-axis atomization platforms and array systems, where multiple nozzles are operated synchronously with independent control parameters, allowing for the concurrent deposition of different materials or the creation of functional gradient layers on complex three-dimensional surfaces, positioning the technology as an essential tool for advanced multi-material additive manufacturing and customized fabrication requiring layer-by-layer functional differentiation.

Regional Highlights

- Asia Pacific (APAC): APAC represents the epicenter of market growth, characterized by exponential demand originating from its dominant position in global high-tech manufacturing. The strategic concentration of semiconductor fabrication facilities, large-scale OLED and quantum dot display panel production, and the most aggressive rollout of Electric Vehicle battery Gigafactories globally, ensures continuous high demand for both high-precision and high-throughput ultrasonic coating systems. Governmental incentives and vast investments in national technology infrastructure in countries like China, South Korea, and Taiwan drive continuous capacity expansion and technological adoption, solidifying APAC’s revenue leadership and making it the primary regional consumer of high-power, industrial-grade nozzles.

- North America: The North American market is defined by quality-driven demand, heavily concentrated in the highly regulated medical device, aerospace, and advanced R&D sectors. The region commands a premium price structure due to the requirement for the highest-specification nozzles, often featuring proprietary materials for biocompatibility and compliance with stringent FDA regulations for implantable devices. Innovation is high, focused on integrating AI and advanced automation into ultrasonic processes to reduce labor dependency and maximize precision in low-volume, high-value component manufacturing, supporting a mature but technology-intensive market base.

- Europe: Europe exhibits strong and diversified growth, largely propelled by its leadership in environmental technology and industrial automation. Demand is robust from the automotive supply chain for precision battery coating and catalyst deposition in hydrogen systems, especially in Germany, France, and Scandinavia. Furthermore, the established base of precision engineering companies requires ultrasonic systems for advanced industrial coatings, such as hydrophobic and scratch-resistant layers on consumer and industrial goods, driven by strict EU directives favoring sustainable, low-waste manufacturing techniques and high material efficiency.

- Latin America (LATAM): LATAM remains an underdeveloped market, primarily focused on baseline industrial applications like textile coating, basic electronics assembly, and general industrial humidification. Market expansion relies heavily on foreign direct investment (FDI) into the manufacturing sectors of key economies like Brazil and Mexico. The opportunity lies in the eventual localized production of renewable energy components and pharmaceutical goods, requiring specialized, yet potentially cost-effective, ultrasonic solutions as local regulatory environments mature and industrial capacity increases.

- Middle East and Africa (MEA): Growth in the MEA region is narrowly focused but significant in specific sectors. Demand is emerging from industrial infrastructure projects requiring high-performance corrosion-resistant coatings, often applied to large surfaces, where ultrasonic technology offers material savings and environmental compliance advantages. The region’s energy sector (oil, gas, and solar) is also beginning to investigate high-efficiency coating methods, driven by government diversification strategies and investments in large-scale renewable energy farms, which are expected to slowly increase demand for durable, industrial-grade nozzles over the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultrasonic Atomizer Nozzle Market.- Sono-Tek Corporation

- Cheersonic

- Sonaer

- Cima NanoTech

- Exact Dispensing Systems

- Ultrasonic Systems, Inc. (USI)

- MicroDrop Technologies

- Nadetech

- PIEZOSYSTEM JENA

- The SUSS MicroTec Group

- Nordson Corporation

- Vaisala Oyj

- Hielscher Ultrasonics GmbH

- Applied Nanotech, Inc.

- Zenith Spray Systems

- Spraying Systems Co.

- Optosolve, Inc.

- Precision Valve & Automation (PVA)

- Shanghai Cheersonic Ultrasonic Equipment Co., Ltd.

- Fisnar Inc.

- SMT Selective Soldering

- Meggitt Sensing Solutions

- Telsonic Ultrasonics

- MKS Instruments

- Sonics & Materials Inc.

Frequently Asked Questions

Analyze common user questions about the Ultrasonic Atomizer Nozzle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of ultrasonic atomizer nozzles over traditional pressure spray nozzles?

The primary benefit is superior material transfer efficiency (often exceeding 95%) and the ability to produce highly uniform, low-velocity, non-clogging fine droplets. This precision significantly minimizes overspray and material waste, making it critical for high-cost materials used in microelectronics and medical coating applications, delivering uniform film thickness without mechanical shear.

How does the frequency of the ultrasonic nozzle relate to the resulting droplet size?

Frequency and droplet size are inversely related. Nozzles operating at high frequencies (typically >100 kHz) generate the smallest droplets (often sub-10 microns) necessary for ultra-thin film deposition and micro-dosing. Conversely, lower frequencies (20-60 kHz) are used for larger industrial droplets and higher flow rates in applications like humidification or general coating, optimizing for volume over minimum size.

In which industries is the highest proportional growth expected for ultrasonic atomizer nozzles?

The highest proportional growth is projected within the Energy sector, specifically driven by the necessity for precise and scalable electrode coating in Electric Vehicle (EV) batteries and the homogeneous deposition of catalyst inks in hydrogen fuel cell manufacturing, followed closely by continuous growth in advanced semiconductor fabrication segments demanding higher precision.

What are the main fluid constraints when using ultrasonic atomization technology?

Optimal ultrasonic atomization requires careful management of fluid properties, especially viscosity and surface tension, which influence droplet formation. While highly versatile, the technology is constrained by the maximum size and concentration of particulate matter within a slurry, which, if too large, can dampen the acoustic wave or cause physical wear on the nozzle tip, necessitating specialized power inputs or cleaning systems.

How is Artificial Intelligence (AI) fundamentally changing the operation of ultrasonic coating systems?

AI is enabling a transition to autonomous, self-optimizing systems. Through real-time sensor fusion and machine learning, AI corrects process parameters dynamically, compensating for environmental or material property drifts, thereby guaranteeing maximum coating uniformity and providing crucial predictive maintenance alerts to prevent catastrophic equipment failure, significantly boosting system reliability and yield.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager