Ultrasonic Passivation Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438934 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Ultrasonic Passivation Systems Market Size

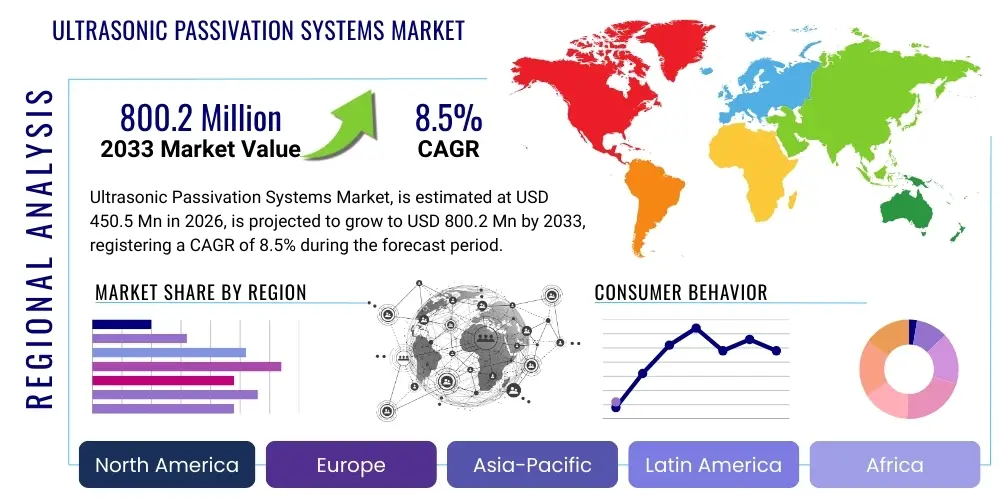

The Ultrasonic Passivation Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $450.5 Million USD in 2026 and is projected to reach $800.2 Million USD by the end of the forecast period in 2033.

Ultrasonic Passivation Systems Market introduction

The Ultrasonic Passivation Systems Market encompasses advanced surface treatment technologies primarily utilized in the precision manufacturing sectors, notably medical devices, aerospace components, and specialized automotive parts. Passivation, a chemical process that enhances the corrosion resistance of metal surfaces, especially stainless steel and titanium alloys, is significantly augmented when coupled with ultrasonic cleaning and agitation. The ultrasonic element ensures complete and uniform removal of free iron and contaminants from the surface, preparing it optimally for the formation of a stable, protective chromium oxide layer. This integrated approach elevates the quality and durability of the finished products, meeting stringent regulatory requirements in highly sensitive applications such as surgical instruments and critical electronic components. The reliability and efficiency offered by these systems are driving their adoption across industries prioritizing material integrity and long-term performance in harsh operating environments.

The primary function of these systems is to automate and control the chemical and physical processes involved in creating a passive layer. Modern ultrasonic passivation systems integrate multiple stages, including alkaline cleaning, specialized acid baths (such as nitric acid or citric acid solutions), thorough rinsing, and drying. The use of high-frequency ultrasonic waves—often ranging from 25 kHz to over 100 kHz—is crucial for penetrating complex geometries, small bores, and intricate threads, ensuring that even microscopic contaminants are dislodged. The precision control over parameters such as temperature, immersion time, chemical concentration, and ultrasonic power density is what differentiates these systems from traditional, less reliable methods. Manufacturers are increasingly focused on energy efficiency and waste minimization, integrating closed-loop chemical management and sophisticated filtration systems to reduce operational costs and environmental impact, further solidifying the market’s growth trajectory.

Major applications of ultrasonic passivation systems span across high-value, critical sectors where component failure due to corrosion is unacceptable. In the medical industry, these systems are indispensable for treating implants, surgical tools, and drug delivery systems, where biocompatibility and sterility are paramount. The aerospace sector uses them extensively for treating engine components, fasteners, and hydraulic parts that operate under extreme stress and temperature variations. Benefits derived from using ultrasonic passivation include drastically improved corrosion resistance, enhanced product lifespan, compliance with global standards (like ASTM A987 and various ISO guidelines), reduced processing time, and superior surface finish quality. Driving factors include the continuous expansion of the medical device manufacturing industry, the increasing complexity of aerospace materials, and the stringent quality mandates imposed by global regulatory bodies, compelling manufacturers to invest in these highly precise and repeatable surface treatment solutions.

Ultrasonic Passivation Systems Market Executive Summary

The Ultrasonic Passivation Systems Market is characterized by robust investment driven by rising demand for high-precision, corrosion-resistant components, particularly within the medical, semiconductor, and aerospace manufacturing sectors. Business trends indicate a strong shift towards fully automated, modular systems that offer enhanced process control and integration capabilities with existing manufacturing lines, minimizing human error and maximizing throughput. Original Equipment Manufacturers (OEMs) are focusing on developing eco-friendly passivation chemistries, such as citric acid alternatives, to replace traditional nitric acid processes, addressing growing regulatory pressures related to hazardous waste management. Furthermore, the market is experiencing consolidation, with key players acquiring specialized technology firms to broaden their service portfolios and regional presence, especially in rapidly industrializing regions where compliance standards are tightening.

Regional trends highlight the dominance of North America and Europe due to the maturity of their medical device and defense industries, coupled with stringent quality assurance standards that mandate the use of advanced passivation techniques. These regions are the primary adopters of high-end, customized ultrasonic systems designed for complex R&D applications and high-volume, regulated manufacturing. However, the Asia Pacific (APAC) region, spearheaded by China, Japan, and South Korea, is exhibiting the fastest growth rate. This acceleration is attributed to the massive growth in electronics manufacturing, the localization of medical device production, and significant government investment in aerospace infrastructure, creating an immense installed base requiring efficient surface treatment solutions. The competitive landscape in APAC is intensifying, with local manufacturers rapidly developing cost-effective alternatives, challenging the established dominance of Western European and North American suppliers while striving to meet international certification requirements.

Segmentation trends reveal that the 'Fully Automatic' system segment dominates the market due to its necessity in large-scale, high-throughput manufacturing environments requiring complete repeatability and traceability of the passivation process. By application, the Medical Devices segment remains the primary revenue driver, given the non-negotiable standards for surgical instruments and implants regarding bio-compatibility and longevity. Technology advancements are also favoring 'Megasonic Passivation Systems' over standard ultrasonic variants in specific high-precision applications, such as semiconductor wafer cleaning and micro-component treatment, where extremely fine particle removal is essential without causing surface damage. The market is also seeing increased demand for specialized passivation solutions tailored for exotic alloys, including nickel-based superalloys and various grades of titanium, driven by specialized needs in the energy and defense sectors, necessitating flexible and adaptable system architectures.

AI Impact Analysis on Ultrasonic Passivation Systems Market

User inquiries regarding the integration of Artificial Intelligence (AI) in ultrasonic passivation systems primarily center on enhancing process control, predicting system failures, and optimizing chemical usage. Key themes emerging from these questions relate to the potential of AI to move passivation from a semi-empirical process to a predictive science. Users are keen to understand how AI algorithms can analyze real-time sensor data—such as temperature fluctuations, ultrasonic bath impedance, chemical concentration levels, and processing time variations—to dynamically adjust system parameters mid-cycle, ensuring perfect uniformity across batches, regardless of minor environmental variances or starting material conditions. Concerns often revolve around the cost of implementing sophisticated sensor arrays and the computational power required to manage large datasets, ensuring the ROI justifies the technological upgrade. Furthermore, there is significant interest in using Machine Learning (ML) to correlate passivation process data with subsequent field performance (e.g., corrosion resistance lifespan) to refine and validate internal process specifications continually.

The practical application of AI is already visible in advanced quality control (QC) and predictive maintenance functionalities within high-end systems. AI-driven vision systems are increasingly being used post-passivation to inspect components for surface defects, incomplete coverage, or residue with much greater accuracy and speed than traditional human inspection or simple automated optical inspection (AOI). For maintenance, ML models analyze operational data (vibration, temperature, power consumption) to predict when critical components, such as ultrasonic transducers or pump seals, are likely to fail. This capability minimizes unscheduled downtime, which is extremely costly in high-throughput manufacturing environments. The adoption of AI fundamentally changes the system from a reactive processing unit to a proactive, self-optimizing work cell. Users are generally expecting AI to reduce material variability and lower the long-term operational costs associated with chemical replenishment and energy consumption, leading to superior final product quality and higher process yield.

Furthermore, AI facilitates advanced reporting and compliance management, which is critical in regulated industries like medical devices and aerospace. AI systems can automatically generate comprehensive digital logs, ensuring every passivation cycle parameter is recorded and verifiable, satisfying strict audit requirements from regulatory bodies such as the FDA or European Medicines Agency (EMA). This level of data integrity significantly reduces the administrative burden and accelerates compliance clearance. The integration of AI tools also supports remote monitoring and diagnostics, allowing system experts to troubleshoot complex issues instantly from anywhere in the world, dramatically improving service response times. The future trajectory involves integrating AI across the entire manufacturing workflow, linking component fabrication data directly to the passivation system's control logic, enabling a truly customized, adaptive treatment based on the component's unique history and metallurgical properties, thus maximizing the efficiency and effectiveness of the ultrasonic treatment process.

- AI-powered predictive maintenance minimizes unscheduled downtime by forecasting component failure (e.g., transducers, pumps).

- Machine Learning (ML) optimizes chemical concentration and replenishment cycles, reducing material waste and operational costs.

- Advanced AI vision systems enhance post-passivation quality control (QC) by detecting microscopic surface imperfections and residues.

- Real-time adaptive process control utilizes AI algorithms to dynamically adjust ultrasonic power and temperature for batch uniformity.

- AI integration facilitates comprehensive digital compliance reporting and traceability for regulated industries (Medical, Aerospace).

- Optimization of energy consumption by analyzing workload patterns and adjusting system standby and operating modes.

DRO & Impact Forces Of Ultrasonic Passivation Systems Market

The Ultrasonic Passivation Systems Market is influenced by a powerful combination of driving factors, constraints, and emerging opportunities, collectively defining the market's trajectory and competitive dynamics. Primary drivers include the increasingly stringent quality and safety regulations imposed by global authorities on finished metal components, particularly those used in medical implants and critical automotive safety systems, necessitating highly repeatable and validated surface treatment processes. The continuous innovation in material science, introducing complex metal alloys like Nitinol and specialized titanium grades that require precise surface preparation, also fuels demand for advanced ultrasonic systems capable of delicate yet thorough cleaning. However, the market faces significant restraints, chiefly the high initial capital expenditure required for sophisticated automated systems and the operational complexity involved in managing hazardous chemical waste (especially when traditional nitric acid baths are used), which necessitates specialized infrastructure and trained personnel. These restraints often slow adoption among smaller or medium-sized enterprises seeking cost-effective solutions.

Opportunities within the market largely revolve around technological shifts towards sustainability and automation. The growing market preference for environmentally friendly processes, specifically citric acid-based passivation, presents a major opportunity for system manufacturers to develop next-generation equipment optimized for these less aggressive yet effective chemistries. Furthermore, the push towards Industry 4.0 and the digitalization of manufacturing provides substantial opportunities for integrating ultrasonic passivation systems with smart factory networks, leveraging IoT sensors and data analytics for performance monitoring and remote diagnostics. Emerging markets, particularly in Asia Pacific, represent untapped potential where the rapid expansion of localized manufacturing hubs requires scalable, high-quality passivation solutions. Market players are strategically positioning themselves to offer modular, scalable systems that can meet the varying production requirements of these growing industrial centers, offering favorable financing options to accelerate adoption.

The impact forces within this market are significant and interconnected. Technological advancements exert a strong positive impact, continually improving system efficiency, energy consumption, and process reliability, thereby increasing the overall value proposition for end-users. Regulatory forces act as both a driver and a constraint; while strict regulations necessitate better passivation, the constant changes in environmental mandates can force expensive equipment retrofitting or replacement. Economic volatility, especially concerning global trade tariffs and supply chain stability, impacts the cost of raw materials and system components, affecting final product pricing. The shift towards miniaturization in electronics and medical devices generates a profound need for megasonic-level cleaning capabilities, compelling research and development investment into ultra-high-frequency transducer technology and precision chemical delivery systems. These forces combine to create a dynamic environment where successful market penetration relies on providing certified, technologically superior, and environmentally compliant solutions that manage both capital and operational expense efficiently.

Segmentation Analysis

The Ultrasonic Passivation Systems Market is systematically segmented based on Type, Application, and Operating Mechanism to provide a granular view of market dynamics and adoption patterns. Segmentation by Type typically separates systems into manual, semi-automatic, and fully automatic configurations, reflecting the spectrum of throughput requirements from laboratory-scale R&D to high-volume manufacturing lines. Application segmentation critically defines the end-user industries, with Medical Devices, Aerospace & Defense, Automotive, and Electronics being the most prominent consumers, each having unique demands regarding surface finish quality and material compatibility. Understanding these segments is vital for manufacturers to tailor their chemical recipes, system architectures, and technical support services to the specific needs of diverse customer groups. The trend favors automated solutions due to the rising cost of skilled labor and the non-negotiable need for process repeatability in certified environments.

- By Type:

- Manual/Benchtop Systems

- Semi-Automatic Systems

- Fully Automatic/Integrated Systems

- By Chemistry Used:

- Nitric Acid Passivation Systems

- Citric Acid Passivation Systems (Eco-friendly alternatives)

- Other Chemistries (e.g., Electrochemical Passivation)

- By Application:

- Medical Devices (Implants, Surgical Tools)

- Aerospace & Defense Components (Engine Parts, Fasteners)

- Automotive Parts (Fuel Injection Systems, Brakes)

- Electronics & Semiconductors (Wafer Carriers, Precision Components)

- General Industrial Manufacturing

- By Operating Mechanism (Frequency):

- Standard Ultrasonic (20 kHz to 40 kHz)

- Megasonic (400 kHz to 1 MHz)

Value Chain Analysis For Ultrasonic Passivation Systems Market

The value chain for the Ultrasonic Passivation Systems Market begins with the upstream segment, which involves the sourcing and production of critical raw materials and components. This includes the manufacturing of specialized ultrasonic transducers, high-grade stainless steel for process tanks, precision pumps, heating elements, and sophisticated electronic control systems (PLCs). Key upstream suppliers are specialized electronics manufacturers, material science companies providing corrosion-resistant alloys, and chemical suppliers providing bulk volumes of nitric, citric, and specialized cleaning agents. The quality and reliability of the transducers are paramount, directly impacting the system's effectiveness and longevity. Price volatility and supply chain stability of electronic components, especially microprocessors and semiconductors used in control units, significantly influence the overall system manufacturing cost and delivery timelines. Strategic partnerships with reliable component suppliers are crucial for maintaining manufacturing cost efficiency and ensuring consistent product quality, especially given the specialized nature of the equipment.

The central manufacturing stage involves system integrators and OEMs who design, assemble, and test the complex multi-stage passivation equipment. This phase adds significant value through proprietary process engineering expertise, software development for automated control, and adherence to specific industry certifications (e.g., CE marking, UL listing). The distribution channel represents the transition from the manufacturer to the end-user. Direct sales channels are frequently employed, especially for large, customized, or highly complex fully automatic systems, enabling manufacturers to provide specialized installation, training, and continuous technical support directly. Indirect channels involve authorized distributors and regional agents, particularly effective for standardized or smaller benchtop systems, allowing broader geographical reach and faster market penetration in regions where local presence is logistically complex. Choosing the appropriate distribution strategy is heavily dependent on the complexity of the sale and the required level of post-installation service, which is substantial in this capital equipment market.

The downstream analysis focuses on the end-users and the after-sales service ecosystem. End-users, such as medical device manufacturers or aerospace primes, implement the system into their production lines. The downstream value is enhanced through continuous service agreements, including calibration, chemical management consultation, and preventive maintenance. Specialized third-party service providers often play a role in maintaining the operational readiness of the equipment and ensuring compliance validation documentation is current. The feedback loop from the downstream users concerning system reliability, chemical consumption rates, and overall throughput performance is critical for manufacturers to drive continuous product improvement and retain market share. Effective management of the entire value chain, from securing high-quality transducers upstream to providing dedicated support downstream, is essential for maximizing profitability and establishing long-term customer relationships within this high-stakes, quality-driven industrial equipment sector. The efficiency of reverse logistics, pertaining to component replacement and system upgrades, also forms an important part of the downstream service offering.

Ultrasonic Passivation Systems Market Potential Customers

The primary customers for Ultrasonic Passivation Systems are large-scale manufacturing enterprises operating within highly regulated and quality-critical industries where component lifespan and corrosion resistance are non-negotiable performance attributes. The largest segment of potential customers resides in the medical device manufacturing sector, including multinational corporations producing orthopedic implants, cardiovascular stents, surgical instrumentation, and drug delivery systems. These entities are mandated by regulatory bodies to utilize validated processes that ensure bio-compatibility and prevent component failure due to surface corrosion within the human body. The need for absolute repeatability and documentation drives them towards fully automated, integrated systems capable of managing complex process recipes and providing complete traceability logs. Their purchasing decisions are heavily influenced by system validation capabilities, adherence to standards like ASTM F86 and F3084, and the total cost of ownership over a typical equipment lifespan.

A second major customer cluster is found within the Aerospace and Defense industry. This includes manufacturers of aircraft engines, landing gear, hydraulic components, and precision fasteners that utilize specialized alloys like various grades of stainless steel and Inconel. Components in this sector operate under extreme environmental conditions, demanding superior surface integrity to prevent stress corrosion cracking and general material degradation. These customers often require systems designed to handle large, complex component geometries and necessitate high levels of security and compliance regarding process control. Military contractors and major aerospace primes, such as suppliers to Boeing, Airbus, and government defense organizations, are consistent buyers of high-capacity, customized ultrasonic passivation solutions that can handle high volumes of mission-critical parts while maintaining exacting dimensional tolerances, where surface alteration must be minimal.

Furthermore, the high-precision Automotive industry, particularly manufacturers of sophisticated fuel injection systems, engine sensors, and anti-lock braking (ABS) components, represents a growing segment of potential customers. The transition towards high-efficiency engines and electric vehicles requires highly durable, corrosion-resistant metallic components, making reliable passivation essential for long-term vehicle performance and safety. Finally, the Electronics and Semiconductor industry utilizes these systems for cleaning and passivating sensitive components like wafer carriers, sputtering targets, and precision tooling used in cleanroom environments. These customers require ultra-high frequency (megasonic) systems to remove sub-micron particulate contamination without damaging sensitive micro-structures. The purchasing criteria across all these sectors emphasize reliability, adherence to industrial quality certifications (e.g., ISO 9001, AS9100, ISO 13485), and the vendor's reputation for process expertise and ongoing technical support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450.5 Million USD |

| Market Forecast in 2033 | $800.2 Million USD |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stoelting Inc., SUSS MicroTec SE, Crest Ultrasonics Corp., UltraClean Systems, Best Technology Inc., Baron Blakeslee, Blue Wave Ultrasonics, Omegasonics, JRI Industries, Automated Compliance Systems (ACS), Sonic Solutions LLC, Forward Technology, Solvay S.A., 3M Company (Specialty Materials Division), Precision Clean Systems, Zenith Ultrasonics, Kaijo Corporation, Branson Ultrasonics (Emerson), Ransohoff (A Division of Cleaning Technologies Group), Clean Manufacturing Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultrasonic Passivation Systems Market Key Technology Landscape

The technological landscape of the Ultrasonic Passivation Systems Market is dominated by innovations aimed at achieving higher precision, greater throughput, and reduced environmental impact. A core technology is the evolution of ultrasonic transducers, moving beyond traditional magnetostrictive and piezoelectric units towards higher efficiency and longer lifespan components. High-frequency systems, specifically Megasonic technology (operating between 400 kHz and 1 MHz), are gaining prominence. Megasonic waves generate extremely fine cavitation bubbles, which are critical for cleaning and passivating micro-components, semiconductor wafers, and delicate medical devices without causing surface erosion or pitting, a major concern with lower-frequency ultrasonic systems. The adoption of advanced transducer design, often coupled with sophisticated frequency sweep generators, ensures uniform acoustic distribution throughout the passivation tank, mitigating the issue of standing waves and cold spots, which can lead to uneven processing and batch failure. This focus on acoustic optimization is fundamental to system performance in critical applications.

Another crucial technological development involves closed-loop process control systems and integrated automation. Modern ultrasonic passivation systems leverage Programmable Logic Controllers (PLCs) and Human-Machine Interfaces (HMIs) to precisely control parameters like temperature, chemical injection, pH levels, and immersion sequences. Advanced systems utilize in-situ sensors, such as conductivity meters and spectrophotometers, to monitor the concentration of the passivation solution in real-time. This real-time data allows for automated dosing and replenishment of chemicals, extending bath life, ensuring consistent chemical activity, and significantly reducing operational expense and hazardous waste generation. Furthermore, robotics and automated material handling systems are standard features in fully automatic units. These systems minimize human contact with harsh chemicals and ensure components move flawlessly through the multi-stage cleaning, rinsing, and drying sequences, reducing the risk of recontamination and damage inherent in manual handling processes.

The shift towards environmentally responsible processing is heavily influencing the technology landscape. Significant R&D effort is focused on developing and optimizing equipment for citric acid passivation, which is less hazardous and easier to dispose of than traditional nitric acid. This requires systems with specific material compatibility for handling citric solutions and highly efficient multi-stage rinsing techniques to ensure complete neutralization and residue removal. Dry technology, such as vacuum drying and specialized hot air knife systems, is also crucial. These drying technologies prevent water spotting and flash rusting after the final rinse, guaranteeing a pristine, passivated surface. Overall, the technology trajectory is centered on digitalization, integrating IoT connectivity for remote diagnostics, and designing modular systems that can be easily scaled or reconfigured to accommodate evolving industry standards and different material requirements, maximizing the flexibility and lifespan of the capital investment.

Regional Highlights

- North America (NA): North America currently holds a significant share of the global Ultrasonic Passivation Systems Market, driven primarily by the robust presence of the medical device manufacturing sector, especially in the United States, which is the world leader in innovation and production of high-value implants and surgical instruments. Strict regulatory oversight from the FDA necessitates the use of validated, high-precision passivation systems to ensure bio-compatibility and product reliability. Furthermore, the substantial and technologically advanced aerospace and defense industrial base demands certified surface treatment for critical components. The regional market benefits from a strong ecosystem of specialized system integrators, advanced materials research, and high adoption rates of automated and AI-integrated systems, maintaining its position as a key market for premium and customized passivation solutions.

- Europe: Europe is a mature and highly influential market, characterized by stringent environmental regulations (such as REACH and various local directives) which are significantly accelerating the adoption of eco-friendly passivation chemistries, particularly citric acid-based systems. Germany, Switzerland, and France are critical hubs, housing major players in the high-end automotive, precision engineering, and medical equipment manufacturing industries. European manufacturers prioritize process validation and energy efficiency, driving demand for technologically sophisticated systems with advanced chemical recycling and waste reduction capabilities. The region's market growth is stable, underpinned by ongoing investments in high-tech manufacturing and the continuous need to meet evolving pan-European quality standards and CE marking requirements, fostering a demand for highly reliable and compliant equipment.

- Asia Pacific (APAC): The Asia Pacific region is projected to register the fastest growth rate during the forecast period, transitioning rapidly from an industrial follower to a global manufacturing powerhouse. The immense expansion of the electronics and semiconductor industry in countries like Taiwan, South Korea, and China drives demand for advanced megasonic passivation systems required for wafer and precision tool cleaning. Moreover, the localization and expansion of medical device manufacturing and significant investments in aerospace infrastructure across China and India are creating substantial opportunities. While cost sensitivity remains a factor, the increasing focus on international export quality standards compels local manufacturers to upgrade from traditional manual cleaning methods to automated, high-quality ultrasonic passivation equipment, creating an immense, burgeoning market for both local and international vendors.

- Latin America, Middle East, and Africa (LAMEA): The LAMEA region represents an emerging market segment with substantial long-term potential, primarily concentrated in localized industrial clusters. Growth in Latin America is tied to the automotive and general industrial sectors, particularly in Brazil and Mexico, which serve as major manufacturing bases. The Middle East, particularly the Gulf Cooperation Council (GCC) countries, is seeing increased adoption linked to ambitious diversification strategies into advanced manufacturing, defense, and localized energy infrastructure, which requires high-quality metal treatment. Adoption rates are generally lower than in North America or Europe, relying on competitive pricing and ease of maintenance, often favoring semi-automatic or modular systems initially, although regulatory requirements are steadily pushing the market toward higher-specification automated solutions for critical applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultrasonic Passivation Systems Market.- Stoelting Inc.

- SUSS MicroTec SE

- Crest Ultrasonics Corp.

- UltraClean Systems

- Best Technology Inc.

- Baron Blakeslee

- Blue Wave Ultrasonics

- Omegasonics

- JRI Industries

- Automated Compliance Systems (ACS)

- Sonic Solutions LLC

- Forward Technology

- Solvay S.A. (Chemical Supplier/Integrator)

- 3M Company (Specialty Materials Division)

- Precision Clean Systems

- Zenith Ultrasonics

- Kaijo Corporation

- Branson Ultrasonics (Emerson)

- Ransohoff (A Division of Cleaning Technologies Group)

- Clean Manufacturing Solutions

- Tira Systems

- Ultrasonics International Corp.

Frequently Asked Questions

Analyze common user questions about the Ultrasonic Passivation Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between ultrasonic and traditional passivation processes?

Ultrasonic passivation integrates high-frequency sound waves (20 kHz to 1 MHz) with the chemical bath to vigorously agitate and clean the component surface. This mechanical agitation ensures contaminants and free iron are removed even from complex internal geometries, leading to a more consistent, thorough, and durable passive oxide layer compared to traditional static immersion methods.

Why are Citric Acid Passivation Systems gaining market share over Nitric Acid systems?

Citric acid systems are preferred due to their superior safety profile and environmental compliance. Citric acid is non-hazardous, biodegradable, and less corrosive, reducing risks associated with handling, storage, and disposal of waste chemicals, thus lowering operational costs and facilitating compliance with global environmental regulations (e.g., OSHA and EPA mandates).

Which industry is the largest end-user segment for Ultrasonic Passivation Systems?

The Medical Device industry is the dominant end-user segment. This is driven by the absolute necessity of ensuring surgical instruments, orthopedic implants, and critical delivery systems possess maximized corrosion resistance and bio-compatibility, conforming strictly to regulatory standards like ISO 13485 and ASTM F86.

How does Megasonic technology differ from Standard Ultrasonic passivation, and where is it applied?

Megasonic technology operates at ultra-high frequencies (400 kHz to 1 MHz), producing smaller, less aggressive cavitation bubbles. This makes it ideal for delicate applications, such as cleaning and passivation of semiconductor wafers, sensitive electronic components, and intricate micro-structures, where standard ultrasonic frequencies might cause surface damage or erosion.

What role does automation play in the Ultrasonic Passivation Systems Market?

Automation (fully automatic systems) is crucial for ensuring process repeatability, traceability, and high throughput. Automated systems minimize human error, precisely control all process parameters (time, temperature, chemistry), and provide necessary digital documentation for regulatory audits, significantly enhancing yield and overall product quality consistency in mass production environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager