Ultrasound Gastroscopes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439043 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Ultrasound Gastroscopes Market Size

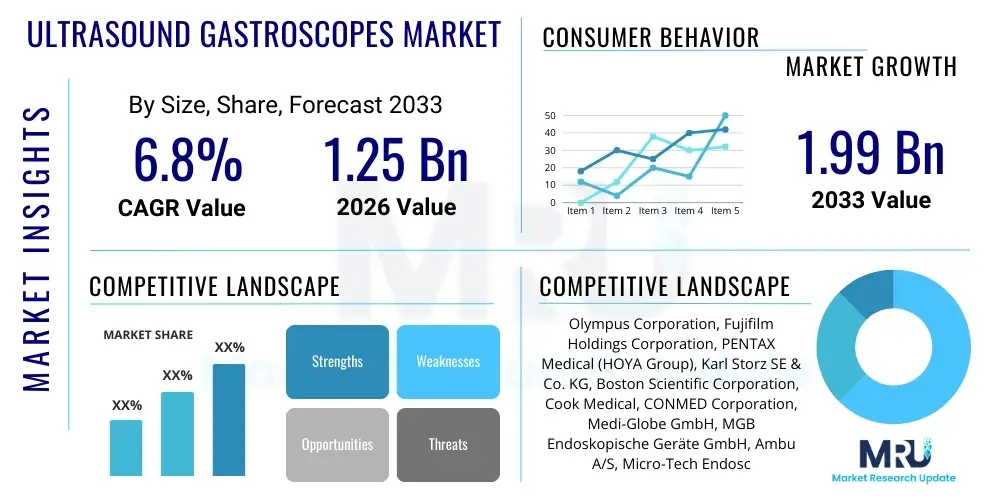

The Ultrasound Gastroscopes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.99 Billion by the end of the forecast period in 2033.

Ultrasound Gastroscopes Market introduction

The Ultrasound Gastroscopes Market encompasses advanced medical devices that integrate conventional endoscopic visualization with high-resolution ultrasonic imaging capabilities. These specialized instruments, often referred to as Endoscopic Ultrasound (EUS) scopes, are crucial for detailed diagnostics and minimally invasive staging of gastrointestinal and respiratory tract diseases, including pancreatic, biliary, esophageal, and lung cancers. The dual functionality—optical viewing and ultrasonic scanning—allows clinicians to visualize the mural layers of the digestive tract and adjacent organs, facilitating precise tissue sampling (e.g., Fine Needle Aspiration, FNA) that is vital for accurate diagnosis and determining appropriate therapeutic pathways. The increasing global prevalence of chronic gastrointestinal disorders and oncological conditions is the primary catalyst driving the adoption of these high-precision diagnostic tools.

The sophistication of modern ultrasound gastroscopes lies in their ability to provide radial or linear echoendoscopy, offering cross-sectional imaging in real-time. This technology minimizes the need for more invasive surgical procedures by enabling accurate loco-regional staging, particularly for tumors previously inaccessible or poorly visualized by conventional endoscopy or cross-sectional imaging techniques like CT or MRI. Furthermore, the rising focus on early disease detection and personalized medicine strategies necessitates the use of devices capable of obtaining high-quality pathological specimens with minimal patient discomfort and risk, thereby cementing the ultrasound gastroscope's position as an indispensable tool in modern gastroenterology and interventional pulmonology. Ongoing miniaturization efforts and improvements in transducer sensitivity are continually expanding the clinical utility of these devices.

Major applications for ultrasound gastroscopes include the diagnosis and staging of malignancies, assessment of submucosal lesions, evaluation of chronic pancreatitis, and drainage procedures such as pseudocyst drainage and celiac plexus neurolysis. The fundamental benefit driving market growth is the enhanced diagnostic yield combined with procedural safety and efficiency. Key driving factors include technological advancements such as the integration of Artificial Intelligence (AI) for image interpretation, rising investments in healthcare infrastructure, particularly in emerging economies, and the growing elderly population, which is more susceptible to target diseases. Regulatory approvals for next-generation flexible scopes and dedicated reprocessing systems also contribute significantly to market expansion and user confidence.

Ultrasound Gastroscopes Market Executive Summary

The Ultrasound Gastroscopes market is experiencing robust growth driven by the shifting paradigm towards minimally invasive diagnostic procedures and therapeutic interventions across global healthcare systems. Business trends indicate a strong focus on strategic mergers, acquisitions, and collaborations among key players to consolidate market share and leverage complementary technological expertise, particularly in digital imaging and flexible endoscopy manufacturing. Furthermore, leading manufacturers are heavily investing in research and development to introduce scopes with enhanced maneuverability, higher frequency transducers for superficial lesion imaging, and integrated navigation systems, positioning product innovation as a core competitive differentiator. The market is also witnessing increasing demand for portable and reusable systems, although single-use devices are gaining traction in certain high-risk infection settings, presenting a dynamic shift in product preference and supply chain management.

Regionally, North America maintains the largest market share, attributable to high healthcare expenditure, established clinical guidelines promoting EUS use, and the rapid adoption of advanced medical technologies. However, the Asia Pacific region is projected to register the fastest CAGR over the forecast period, fueled by improving access to specialized care, increasing prevalence of GI cancers in countries like China and India, and government initiatives aimed at modernizing hospital infrastructure. Europe follows a steady growth trajectory, supported by favorable reimbursement policies and a strong emphasis on clinical training and standardization of EUS procedures. Market penetration in Latin America and the Middle East remains nascent but is accelerating due to rising medical tourism and increased availability of specialized training centers.

Segmentation trends highlight the dominance of linear array gastroscopes due to their superiority in performing interventional procedures, including FNA and FNB (Fine Needle Biopsy), which are crucial for cancer staging. The hospital segment retains the largest share by end-user, though ambulatory surgical centers (ASCs) are emerging as high-growth venues due to their cost-effectiveness and focus on outpatient procedures. Within the technology segment, high-definition (HD) visualization combined with shear wave elastography is seeing significant uptake, enabling better tissue characterization and potentially reducing the reliance on invasive biopsies. The drive toward enhanced clinical workflow efficiency and reduced procedural time is profoundly influencing product design across all segments.

AI Impact Analysis on Ultrasound Gastroscopes Market

Common user questions regarding the impact of AI on the Ultrasound Gastroscopes Market revolve primarily around three key themes: clinical decision support accuracy, workflow efficiency, and training accessibility. Users frequently inquire about how AI algorithms can improve the detection rate of subtle lesions, such as early-stage pancreatic tumors, and whether AI can automatically delineate tissue boundaries or classify malignancy with high certainty during EUS procedures. Concerns often center on data privacy, the validation process for deep learning models using heterogeneous clinical data, and the potential for 'alert fatigue' among endoscopists if the AI tools are not perfectly integrated. Expectations are high that AI will democratize EUS expertise, making complex diagnostic interpretation more accessible to less experienced practitioners and standardizing reporting globally.

The integration of Artificial Intelligence, particularly machine learning and deep learning algorithms, is poised to revolutionize the operational landscape of EUS procedures. AI algorithms can be trained on vast databases of ultrasound and pathological images to provide real-time image enhancement, automated measurements, and predictive analytics. This capability significantly improves the objectivity of diagnostic assessments, potentially reducing inter-operator variability, which is a significant challenge in standard EUS. AI systems can act as a continuous 'second pair of eyes,' highlighting suspicious areas that might be overlooked, thereby increasing the sensitivity and specificity of EUS-guided diagnostics for conditions like submucosal tumors and enlarged lymph nodes.

Furthermore, AI is extending its influence beyond simple image analysis into procedural planning and training simulators. AI-powered software can assist in guiding the endoscopist to the optimal puncture site during EUS-FNA, minimizing risks and maximizing the yield of sampled material. In the realm of training, AI feedback mechanisms embedded in virtual simulators provide standardized and objective performance evaluation for trainees, accelerating the learning curve for complex EUS techniques. While initial implementation requires substantial investment in computational infrastructure and data curation, the long-term benefits in improved diagnostic accuracy, enhanced procedural safety, and reduced healthcare costs are expected to drive rapid commercial adoption, fundamentally changing how EUS services are delivered worldwide.

- Real-time image enhancement and noise reduction in complex EUS images.

- Automated lesion detection and quantification, improving diagnostic workflow speed.

- AI-assisted tissue characterization (e.g., elastography interpretation) for malignancy assessment.

- Guidance systems for optimized needle placement during Fine Needle Aspiration (FNA) procedures.

- Standardization of EUS reporting and reduced inter-operator variability.

- Predictive modeling for patient outcomes based on EUS findings and clinical data integration.

DRO & Impact Forces Of Ultrasound Gastroscopes Market

The Ultrasound Gastroscopes market dynamics are shaped by a complex interplay of positive growth stimulants, inherent market limitations, and emerging opportunities that collectively determine its trajectory. Key drivers include the escalating global incidence of gastrointestinal (GI) and pancreato-biliary diseases, coupled with substantial technological leaps such as high-resolution imaging and 3D reconstruction capabilities. These drivers are bolstered by the preference for minimally invasive procedures over traditional surgery, driven by reduced recovery times and lower associated hospital costs. Conversely, the market faces significant restraints, primarily stemming from the high capital cost of EUS systems and related reprocessing equipment, which poses a barrier to entry for smaller hospitals or clinics, especially in developing economies. Furthermore, the steep learning curve and the necessity for highly specialized training for endoscopists represent a critical limitation on widespread adoption.

Opportunities in the market are abundant, centered around the expansion of therapeutic EUS procedures. Historically, EUS was primarily diagnostic, but advancements now allow for complex interventions such as abscess drainage, celiac plexus block, tumor ablation, and even certain surgical anastomoses. The untapped potential in pediatric EUS and the expansion of the market into non-traditional settings, like dedicated cancer centers and advanced diagnostic clinics, offer considerable scope for growth. Developing robust, cost-effective reprocessing solutions that mitigate infection risk while maintaining device integrity is another significant opportunity, especially as global standards for device sterilization become increasingly stringent.

The impact forces influencing the market are multifaceted, encompassing clinical acceptance, regulatory harmonization, and economic viability. The demonstrable clinical superiority of EUS in diagnosing subepithelial lesions and precise cancer staging acts as a fundamental positive impact force. However, regulatory scrutiny regarding the safety and effectiveness of reusable scope reprocessing, particularly concerning elevator mechanisms, imposes compliance costs and operational friction—a negative impact force. The increasing pressure on healthcare systems globally to demonstrate cost-effectiveness necessitates that manufacturers prove the long-term economic benefit of EUS compared to alternative diagnostic modalities. Overall, the market remains characterized by intense competitive innovation, regulatory adaptation, and a strong clinical push for enhanced diagnostic precision.

Segmentation Analysis

The Ultrasound Gastroscopes market is segmented based on critical parameters including scope type, technology, application, and end-user, allowing for a nuanced understanding of market dynamics and targeted strategic development. The segmentation reflects the diverse clinical requirements and the differing levels of complexity inherent in various EUS procedures. Scope types, for instance, distinguish between radial and linear gastroscopes based on their scanning orientation, which dictates their primary utility—radial scopes excel in visualization of organ layers (diagnostic), while linear scopes are superior for guiding interventional tools (therapeutic and staging). This delineation is crucial for both manufacturing specialization and clinical procurement decisions.

The application segment clearly highlights the dominant role of EUS in oncology, specifically pancreatic, esophageal, and lung cancer staging, which commands the largest share due to the proven accuracy and necessity of EUS in determining treatment plans. However, non-oncological applications, such as the diagnosis of chronic pancreatitis, assessment of gallbladder stones, and interventional pain management, are rapidly growing, diversifying the revenue streams for market players. Technological segmentation covers advancements like Doppler capabilities, elastography integration, and high-definition imaging, which are rapidly becoming standard features, significantly enhancing the diagnostic yield and quality of patient care delivered.

End-user segmentation identifies hospitals as the dominant segment, given their capacity for handling complex, specialized procedures, the high capital investment required for EUS suites, and the presence of highly trained specialists. Nevertheless, specialized diagnostic centers and ambulatory surgical centers (ASCs) represent the fastest-growing end-user segments. ASCs, focusing on cost efficiency and outpatient care, are increasingly adopting EUS for less complex diagnostic workups, provided appropriate sterilization infrastructure is in place. This shift suggests a decentralization of specialized procedures, driven by healthcare cost containment initiatives.

- By Scope Type:

- Linear Array Ultrasound Gastroscopes

- Radial Array Ultrasound Gastroscopes

- By Technology:

- High-Frequency Transducers

- Doppler EUS

- Elastography EUS (Strain and Shear Wave)

- 3D/4D EUS Imaging

- By Application:

- Oncology (Pancreatic Cancer, Esophageal Cancer, Rectal Cancer, Lung Cancer Staging)

- Non-Oncology (Chronic Pancreatitis, Bile Duct Diseases, Submucosal Lesions)

- Therapeutic EUS (Drainage, Ablation, Intervention)

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialized Diagnostic Clinics

Value Chain Analysis For Ultrasound Gastroscopes Market

The value chain for the Ultrasound Gastroscopes market is characterized by high complexity, significant investment in R&D, and stringent regulatory requirements at every stage. Upstream activities begin with the sourcing and manufacturing of highly specialized components, including high-frequency piezoelectric transducers, flexible insertion tubes, sophisticated electronic control units, and integrated imaging sensors. Key upstream challenges involve maintaining a supply of micro-electronic components capable of miniaturization without compromising image quality, requiring strong partnerships with advanced material science companies. These components are then assembled into the final scope system, where intellectual property protection regarding optical and ultrasonic integration techniques is paramount, forming a high-value core competency for primary manufacturers.

The midstream phase involves the core manufacturing, quality control, assembly, and sterilization processes. Given the classification of EUS scopes as critical medical devices, adherence to Good Manufacturing Practices (GMP) and ISO standards is non-negotiable. The manufacturing process is highly capital-intensive, requiring clean-room facilities and specialized labor for precise assembly of the flexible scopes. Distribution channels (downstream analysis) are typically bifurcated into direct sales models, especially for large teaching hospitals that require extensive technical support and training, and indirect models utilizing specialized medical device distributors who have deep regional knowledge and established relationships with smaller clinical centers. Direct sales ensure manufacturers maintain control over branding and technical service quality, vital for complex devices.

Downstream activities are dominated by sales, marketing, professional training, and post-sale servicing, which is a critical differentiating factor in this market. Since EUS requires specialized skills, manufacturers often provide comprehensive training programs and continuous clinical education to drive adoption and ensure safe usage, thereby creating a robust feedback loop for product improvement. The purchasing decision rests predominantly with hospital procurement committees and key opinion leaders (KOLs) who prioritize clinical efficacy, reliability, and total cost of ownership (including maintenance and reprocessing costs). The movement towards single-use endoscopy is beginning to reshape the value chain by simplifying reprocessing requirements but shifting the economic burden towards higher volume consumable costs.

Ultrasound Gastroscopes Market Potential Customers

The primary customers for Ultrasound Gastroscopes are institutions and medical professionals specializing in advanced gastroenterology, endoscopy, surgical oncology, and interventional pulmonology. These end-users require high-precision imaging and procedural guidance tools for complex diagnostic and therapeutic applications. Leading purchasers include major public and private hospitals, particularly those affiliated with university teaching centers and specialized research institutions that manage a high volume of complex cancer staging cases and therapeutic interventions like biliary drainage. The availability of trained EUS specialists and established EUS programs within these institutions drives the demand for state-of-the-art equipment and specialized servicing contracts, often resulting in large-volume procurements.

A rapidly growing customer segment comprises specialized diagnostic centers and comprehensive cancer centers. These facilities often focus purely on diagnostic excellence and early intervention, relying heavily on EUS for accurate tissue acquisition (FNA/FNB) and locoregional staging that informs the multidisciplinary tumor board decisions. As healthcare systems globally emphasize outpatient care and reduced hospital stays, Ambulatory Surgical Centers (ASCs) that integrate specialized endoscopic units represent another significant area of potential demand, particularly for high-volume, less complex diagnostic EUS procedures, provided they can justify the initial capital outlay.

Furthermore, training centers and medical simulation facilities are emerging as critical secondary customers, purchasing EUS systems or simulators for clinical education purposes. The demand here is driven by the need to scale up the pipeline of trained endoscopists capable of performing EUS safely and effectively. Ultimately, the purchasing behavior is governed by clinical necessity, alignment with institutional specialization (e.g., GI cancer specialization), availability of capital, and the demonstrated return on investment (ROI) derived from the improved diagnostic yield and reduced requirement for more costly, invasive surgical procedures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.99 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olympus Corporation, Fujifilm Holdings Corporation, PENTAX Medical (HOYA Group), Karl Storz SE & Co. KG, Boston Scientific Corporation, Cook Medical, CONMED Corporation, Medi-Globe GmbH, MGB Endoskopische Geräte GmbH, Ambu A/S, Micro-Tech Endoscopy, STERIS plc, Richard Wolf GmbH, SonoScape Medical Corporation, Mindray Medical International Limited, Ovesco Endoscopy AG, US Endoscopy, Takeda Pharmaceutical Company Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultrasound Gastroscopes Market Key Technology Landscape

The Ultrasound Gastroscopes market is characterized by intense technological evolution aimed at improving image resolution, device flexibility, and therapeutic capability. A key technological focus is the advancement in transducer technology, moving towards higher frequencies (up to 20 MHz) for superior visualization of superficial lesions and the mural layers of the GI tract, essential for early cancer detection. Concurrently, manufacturers are integrating miniaturized electronics into the scope tip, reducing the overall diameter of the endoscope, thereby enhancing patient tolerance and improving scope maneuverability in tortuous anatomies, particularly in the duodenum and stomach. The seamless integration of digital video technology with ultrasonic sensors allows for simultaneous, high-definition visualization of both the endoscopic view and the cross-sectional ultrasound image, optimizing procedural workflow.

A major technological advancement driving clinical uptake is the incorporation of advanced tissue characterization techniques such as Doppler and Elastography. Doppler EUS enables real-time assessment of vascularity within or surrounding a lesion, which is critical for differentiating benign from malignant masses and planning safe biopsy routes, avoiding major blood vessels. EUS Elastography, both strain and shear wave modalities, provides objective quantitative data on tissue stiffness, helping to characterize lesions like pancreatic masses or lymph nodes that might appear ambiguous on standard B-mode imaging. This non-invasive assessment capability reduces the need for immediate, invasive tissue acquisition, offering preliminary diagnostic clarity.

Furthermore, the market is rapidly adopting solutions for 3D and 4D reconstruction, which generate volumetric data sets of anatomical structures, significantly aiding in complex procedural planning, particularly for therapeutic EUS interventions and tumor ablation. The push towards disposable and single-use EUS scopes represents a paradigm shift, primarily driven by growing concerns over cross-contamination risk associated with the complex reprocessing of reusable scopes, particularly in the delicate elevator mechanism. Companies pioneering these single-use solutions are leveraging advances in affordable, miniature component manufacturing to overcome the historical performance gap compared to high-end reusable systems, offering a compelling safety profile and simplified logistics for hospitals.

Regional Highlights

- North America: This region dominates the global Ultrasound Gastroscopes market, primarily due to established, favorable reimbursement policies for EUS procedures, high awareness among clinicians regarding the benefits of EUS for cancer staging, and significant healthcare infrastructure capable of handling high capital expenditure for advanced medical equipment. The U.S. remains the largest market within this region, fueled by continuous innovation from leading medical device manufacturers and the aggressive adoption of new technologies like AI-assisted EUS and single-use scopes. Clinical research output and professional society guidelines strongly endorse EUS usage.

- Europe: The European market shows steady growth, supported by centralized healthcare systems (especially in Western Europe) that prioritize early disease diagnosis and minimally invasive techniques. Countries such as Germany, the UK, and France are major contributors, driven by aging populations prone to GI malignancies and well-developed regulatory pathways (MDR compliance). Expansion is focused on integrating EUS services into regional healthcare networks and standardizing training across member states to ensure uniform access and quality of care.

- Asia Pacific (APAC): APAC is anticipated to exhibit the highest growth rate (CAGR) globally. This rapid expansion is attributed to the alarming increase in the incidence of GI and pancreato-biliary cancers, coupled with massive investments in upgrading medical infrastructure, particularly in populous countries like China and India. Growing disposable incomes, rising health insurance penetration, and increasing medical tourism further stimulate demand. Manufacturers are focusing on localized product strategies and training initiatives to capitalize on this untapped potential.

- Latin America (LATAM): The LATAM market is emerging, characterized by fragmented healthcare systems and varying levels of technological adoption. Growth is constrained by budget limitations and a lack of highly trained specialists in some areas. However, concentrated growth in major economies like Brazil and Mexico is driven by private sector investment in specialty hospitals and increasing recognition of EUS as a standard of care for complex diagnostics.

- Middle East and Africa (MEA): This region currently holds the smallest market share but presents long-term growth opportunities, particularly in Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) where high oil revenues support sophisticated healthcare development. Adoption is mainly concentrated in metropolitan medical centers and is boosted by government initiatives to establish world-class clinical facilities and reduce reliance on international patient referral for complex procedures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultrasound Gastroscopes Market.- Olympus Corporation

- Fujifilm Holdings Corporation

- PENTAX Medical (HOYA Group)

- Karl Storz SE & Co. KG

- Boston Scientific Corporation

- Cook Medical

- CONMED Corporation

- Medi-Globe GmbH

- MGB Endoskopische Geräte GmbH

- Ambu A/S

- Micro-Tech Endoscopy

- STERIS plc

- Richard Wolf GmbH

- SonoScape Medical Corporation

- Mindray Medical International Limited

- Ovesco Endoscopy AG

- US Endoscopy

- Takeda Pharmaceutical Company Limited

- Getinge AB

- C. R. Bard (BD)

Frequently Asked Questions

Analyze common user questions about the Ultrasound Gastroscopes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between linear and radial EUS scopes?

Linear array EUS scopes scan parallel to the axis of the endoscope, allowing for real-time visualization of needle insertion for therapeutic and biopsy procedures (FNA/FNB). Radial array EUS scopes scan perpendicular (360 degrees) to the scope axis, primarily offering superior diagnostic visualization and cross-sectional anatomical mapping of the gastrointestinal wall layers and surrounding structures.

How significant is the challenge of scope reprocessing and cross-contamination risk?

Scope reprocessing presents a major challenge due to the complex design, particularly the intricate elevator mechanism of EUS scopes, which is difficult to thoroughly clean, leading to potential residual biological contamination. This risk has accelerated research and development into single-use, disposable EUS scopes as a primary strategy for infection mitigation and simplified hospital logistics, strongly impacting procurement decisions.

Which application segment drives the highest demand in the Ultrasound Gastroscopes Market?

The Oncology application segment, specifically the locoregional staging and diagnosis of pancreatic, esophageal, and lung cancers, accounts for the highest demand. EUS is considered the gold standard for T and N staging of these cancers, critical for determining the viability of curative surgery or the necessity of neoadjuvant therapy, thereby ensuring high procedural volume globally.

What role does Elastography technology play in modern EUS devices?

Elastography, an advanced EUS technology, measures the stiffness of tissue in real-time, providing quantitative data that assists in differentiating hard, potentially malignant lesions (like pancreatic tumors) from soft, benign inflammatory processes. It significantly enhances diagnostic accuracy beyond standard B-mode imaging, improving the targeting of biopsies and reducing the variability of diagnosis.

Why is the Asia Pacific region projected to exhibit the fastest market growth?

The Asia Pacific region's accelerated growth is driven by the soaring incidence of GI cancers, substantial government investments aimed at modernizing public health infrastructure, increasing awareness among medical professionals, and rising health insurance coverage that improves patient access to sophisticated diagnostic tools like EUS.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager