Umbrella Stroller Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431978 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Umbrella Stroller Market Size

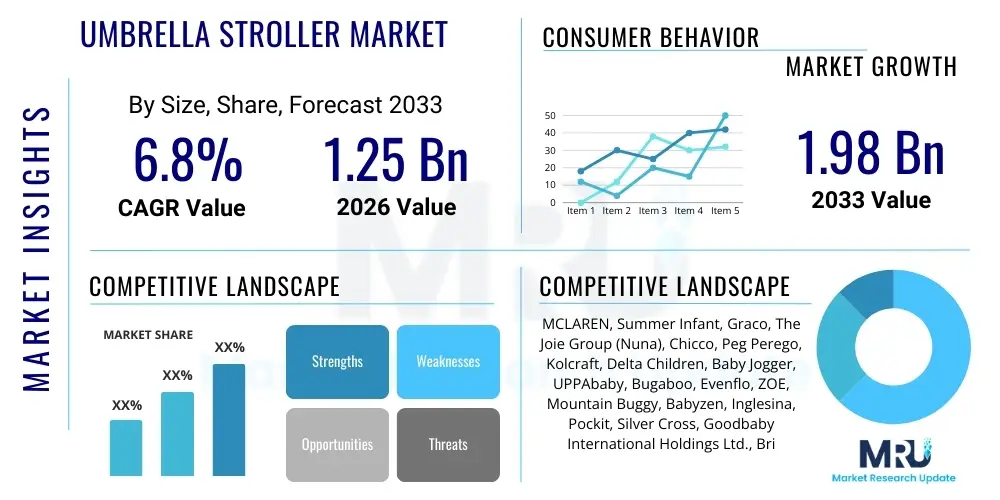

The Umbrella Stroller Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.98 Billion by the end of the forecast period in 2033.

Umbrella Stroller Market introduction

The Umbrella Stroller Market encompasses the specialized segment of child mobility solutions defined by their lightweight construction, highly compact, vertical folding mechanism, and inherent design suitability for travel and urban environments. These products serve a critical niche, offering parents a pragmatic alternative or complement to heavier, multi-functional travel systems. Characterized by frames typically manufactured from aluminum or advanced composite materials, the fundamental value proposition of the umbrella stroller lies in its exceptional portability, allowing for convenient storage in small apartment spaces, car trunks, and overhead compartments on public transport. The evolution of this market has moved beyond purely basic models, now incorporating enhanced ergonomic features, improved safety restraints, and premium textiles, directly responding to modern parental demands for convenience without significant compromise on comfort or durability. This blend of practicality and engineered lightness ensures its sustained relevance in the global baby gear landscape, particularly among demographics prioritizing ease of movement and logistical efficiency.

Major applications for umbrella strollers are highly correlated with parental mobility and travel frequency. They are the preferred choice for airline travel due to their compliant dimensions and gate-check ease, facilitating smoother transitions through airports and reducing the stress associated with family logistics. Furthermore, they are indispensable for city living, where navigating crowded sidewalks, narrow store aisles, and utilizing subways or buses necessitates a slender, easily folded conveyance. The inherent benefits extend beyond mere size; the simplicity of the quick-fold feature dramatically reduces user frustration, a significant selling point in high-stress scenarios like loading children into cars or managing luggage. Market expansion is substantially fueled by macroeconomic factors such as increasing female participation in the global workforce, leading to a greater demand for efficient, high-performance baby products that minimize logistical friction for busy, dual-income households. Moreover, the global proliferation of low-cost carriers and increasing family tourism drives the necessity for reliable, easily portable gear, directly boosting the addressable market size for travel-focused umbrella stroller models.

The sustained growth trajectory is underpinned by key driving factors including continuous innovation in material science, which allows manufacturers to achieve record-low weights while improving structural integrity and safety performance. Alongside technological drivers, demographic trends, particularly the high rates of urbanization worldwide, dictate the need for space-saving products, making the compact nature of umbrella strollers a crucial market differentiator. Regulatory compliance also acts as a subtle growth driver; as safety standards become stricter, older, non-compliant models are gradually phased out, necessitating consumer replacement with newer, certified products. Brands that successfully marry rigorous safety compliance with aesthetic appeal and advanced features—such as extended sun canopies with high UPF ratings, improved single-hand folding mechanisms, or enhanced wheel suspension—are strategically positioned to capture market share, transforming what was once a budget-focused segment into a sector capable of supporting premium pricing tiers, thus significantly increasing the overall market valuation projected for the end of the forecast period in 2033.

Umbrella Stroller Market Executive Summary

The Umbrella Stroller Market is poised for significant expansion, underpinned by converging business trends, nuanced regional developments, and distinct segmental growth patterns. The core business strategy observed across leading manufacturers involves a dual-focus approach: first, optimizing supply chain resilience and global distribution networks to maintain cost competitiveness in the basic segment; and second, aggressive investment in research and development to drive premiumization. This premiumization trend involves integrating advanced ergonomic design, utilizing sustainable and lightweight composites, and offering enhanced comfort features that traditionally belonged only to full-sized strollers, thereby justifying higher price points and increasing profit margins. Strategic collaborations between stroller manufacturers and travel accessory companies, as well as consolidation activities aimed at acquiring specialized material technology patents, are also key features defining the current competitive landscape, particularly in highly regulated markets such as North America and Western Europe. The shift towards robust e-commerce capabilities is accelerating, requiring companies to invest in highly accurate visual product representations and streamlined returns processes to match the physical inspection capabilities of traditional retail environments, thus driving omni-channel integration.

Regionally, the market presents a dichotomy of maturity and rapid expansion. North America and Europe represent established markets characterized by high per capita spending on durable juvenile products and stringent consumer protection expectations. Growth in these regions is primarily volume-driven through replacements, upgrades, and innovation-led purchases of certified, premium lightweight models. Conversely, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly modernizing retail infrastructures, increasing urbanization rates compelling the purchase of compact gear, and rising disposable incomes among the expanding middle class in populous nations such as China, India, and Indonesia. These developing markets are rapidly moving away from unbranded or substandard products towards certified, internationally recognized brands, often seeking value-for-money umbrella strollers that combine durability with multi-use functionality, effectively making APAC the focal point for future market volume expansion and manufacturing optimization efforts.

Segmental analysis highlights that the single umbrella stroller segment retains its dominance by volume, driven by first-time parents and the need for short-term, portable solutions. However, the double umbrella stroller segment, especially tandem configurations optimized for narrow spaces, is experiencing disproportionately high growth as families seek lightweight solutions for siblings or multiples without incurring the bulk of traditional double strollers. Furthermore, distribution trends confirm that while mass merchandisers capture the majority of the basic segment sales, specialized baby stores and direct-to-consumer online channels are critical for the higher-margin premium and technologically advanced models. The imperative for manufacturers remains centered on balancing compliance with diverse global safety standards with the continuous pressure to innovate foldable, ultra-light structures, ensuring that operational efficiency across the entire value chain remains competitive amidst fluctuating material costs, geopolitical trade tensions, and global shipping complexities, maintaining a favorable market outlook throughout the forecast period.

AI Impact Analysis on Umbrella Stroller Market

User generated content and market inquiries about AI's role in the Umbrella Stroller domain overwhelmingly center on enhancing proactive safety features and optimizing parental decision-making through smart diagnostics. Analysis reveals a high degree of interest in integration points where Artificial Intelligence can provide non-intrusive safety layers, such as pressure sensors linked to machine learning algorithms capable of detecting if a child has been inadvertently left in the stroller, providing immediate alerts to a paired device. Furthermore, consumers anticipate AI being used to personalize product recommendations beyond simple demographics, analyzing lifestyle data (e.g., frequency of air travel, average distance walked, typical environment) to suggest the mathematically optimal lightweight model tailored to their specific use case. The consensus concern, however, revolves around how to implement these smart features without adding prohibitive weight, complexity, cost, or requiring complex maintenance and frequent battery charging, thereby fundamentally contradicting the core design philosophy of simplicity and portability inherent to the umbrella stroller segment.

On the operational side, AI is already exerting a transformative impact through predictive supply chain management and manufacturing optimization. Advanced machine learning models are analyzing vast datasets, including seasonal sales patterns, historical logistics performance, global shipping delays, and real-time inventory levels across various geographic nodes, to create highly accurate and dynamic demand forecasts. This allows umbrella stroller manufacturers to precisely time the production and distribution of specific colorways and models, minimizing both expensive overstock situations and critical stock-outs during peak travel seasons, significantly improving capital efficiency and reducing obsolescence. Additionally, in large-scale manufacturing facilities, AI-powered visual inspection systems are being deployed on assembly lines. These systems use high-definition cameras and deep learning algorithms to instantaneously check frame integrity, weld consistency, fabric placement, and component seating, ensuring every unit adheres to stringent international safety standards with a level of precision and speed unattainable by traditional human inspection processes, thereby enhancing overall product reliability significantly.

Looking ahead, the next phase of AI integration is expected to focus on micro-level user experience enhancements that respect the stroller’s lightweight mandate. This includes developing lightweight, embedded chipsets that can power basic autonomous functionalities, such as adaptive wheel locks that automatically engage with greater force on inclines or if the parent releases the handle, significantly improving safety without adding bulk. Environmental sensors, powered by low-energy AI processing, could eventually be integrated to adjust canopy position based on real-time solar intensity and UV index readings, optimizing child protection. Generative AI is rapidly becoming an indispensable tool in the design process, allowing research and development teams to quickly simulate and stress-test thousands of design variations for folding mechanisms and material resilience based on synthesized data from parental feedback and regulatory compliance requirements, leading to faster, safer, and more ergonomic product iterations across the entire portfolio. This strategic application ensures technological advancement supports the core value proposition: safety, lightness, and convenience.

- Enhanced predictive demand forecasting and inventory optimization using machine learning algorithms. This ensures manufacturers meet peak demand during holiday and travel seasons without excessive warehousing costs or supply bottlenecks.

- AI-driven personalized product recommendations and virtual shopping assistance on Direct-to-Consumer (D2C) platforms, improving conversion rates by aligning specific stroller features (e.g., suspension type, fold size) with unique parental lifestyles and needs.

- Application of computer vision in manufacturing for automated quality control and defect detection, ensuring high structural integrity of lightweight frames and components to consistently meet rigorous global safety benchmarks.

- Potential integration of low-power sensor technology for basic child safety monitoring (e.g., movement detection and forgotten child alerts), enhancing parental peace of mind during travel and quick stopovers.

- Generative AI utilized extensively in Research and Development (R&D) for rapid prototyping, simulation, and ergonomic optimization based on synthesized user feedback data, accelerating the time-to-market for innovative, ultra-light designs.

- Optimized logistics routing and freight consolidation using AI to minimize shipping costs and environmental footprint, crucial for maintaining competitive pricing in this volume-driven, cost-sensitive consumer goods segment.

- Development of adaptive features such as AI-assisted braking systems that react based on inertia and slope detection, improving safety performance without adding cumbersome mechanical weight.

DRO & Impact Forces Of Umbrella Stroller Market

The operational landscape of the Umbrella Stroller Market is perpetually shaped by a dynamic combination of drivers, restraints, and opportunities (DRO), all interacting under the influence of broader socioeconomic and regulatory impact forces. Key drivers fundamentally revolve around the acceleration of modern parental lifestyles, characterized by increased urbanization, higher rates of global and domestic family travel, and a pervasive requirement for multi-functional, space-saving baby gear suitable for smaller living quarters. The superior convenience factor of a lightweight, quick-folding stroller is paramount for families navigating public spaces, apartment living, and adhering to strict airline baggage policies. Furthermore, the increasing trend of parents purchasing specialized gear for specific purposes, rather than relying exclusively on a single, all-purpose system, significantly drives the demand for cost-effective, dedicated umbrella models, ensuring consistent volume growth across most developed and rapidly developing global markets.

The primary restraints acting as friction against market expansion are heavily rooted in regulatory complexity and inherent design limitations. Compliance with diverse, often non-harmonized, international safety standards (such as mandatory five-point harness systems, specific wheel lock designs, structural stability tests, and stringent material non-toxicity requirements) requires significant recurring investment in sophisticated testing and certification processes, which invariably raises production costs and slows down the international market entry for smaller, specialized manufacturers. Design constraints dictate that, to remain ultra-light and compact, umbrella strollers must sacrifice certain luxury or utility features like extensive under-seat storage, robust all-terrain suspension, or complex adjustable seating configurations, leading some consumers to opt for heavier, feature-rich compact fold systems instead. Moreover, the fierce price competition, particularly acute in the mass-market segment where marginal profitability is low, limits the financial capacity for substantial and sustained R&D investments aimed at radical, non-material-based innovation.

Opportunities for sustained growth are strongly centered on material innovation, digital integration, and targeted segment development. The most compelling opportunity lies in the continuous development and industrial adoption of next-generation sustainable composite materials that offer a superior strength-to-weight ratio, allowing manufacturers to create lighter, safer, and environmentally conscious products that can command a significant premium price point. Furthermore, specializing in niche segments, such as ultra-compact models that comply with 'carry-on' luggage dimensions (not just gate-check), or designing ruggedized umbrella strollers optimized for light trails or cobblestone urban environments, offers distinct avenues for product differentiation and margin improvement. The overarching impact forces include demographic shifts (urban migration, falling average household size), global economic conditions (which heavily influence parental disposable income elasticity of demand for secondary baby gear), technological leaps in polymer and textile engineering, and critical changes in global trade regulations, which collectively dictate the feasibility, cost-effectiveness, and ultimate consumer acceptance of new umbrella stroller designs in the international marketplace.

Segmentation Analysis

The Umbrella Stroller Market is meticulously segmented across multiple critical axes—product configuration, foundational materials, certified weight handling capacity, and retail distribution method—each revealing distinct market behaviors and providing actionable insights for strategic planning and competitive positioning. The product type segmentation distinctly separates the high-volume Single Umbrella Stroller category, which addresses the most common mobility needs of families with one young child, from the high-growth Double Umbrella Stroller category. Double strollers, whether configured in tandem (front-to-back) for easier navigation through standard doorways or side-by-side for equal visibility, cater to a specialized, less price-sensitive consumer group seeking compact solutions for multiple young children, and thus exhibit different price elasticity and longer replacement cycles than single units, requiring specialized marketing efforts focused on multi-child families.

Material type segmentation highlights the technological progression within the industry, which directly correlates with price and performance. The legacy Steel Frame segment, while durable and low-cost, is increasingly ceding market share to the Aluminum Frame category, which offers a significantly superior combination of structural strength and critical weight reduction—a primary purchasing criteria. The emerging Composite/Advanced Alloy Frame segment, often utilizing specialized aerospace-grade composites or high-tensile plastics, represents the premium tier, appealing strongly to affluent, brand-conscious consumers demanding the absolute lightest structure with maximum long-term durability, often incorporating advanced shock absorption properties. Analysis by certified weight capacity further distinguishes between standard lightweight models, typically designed for infants up to 35 lbs and aggressively focused on extreme portability for travel, and high-weight capacity models (35 lbs and above), which appeal to parents seeking extended product lifespan and enhanced robustness for older, heavier toddlers, often intentionally sacrificing some level of compactness for increased utility and prolonged use.

Finally, the segmentation based on distribution channel is critical for understanding market reach, logistical requirements, and brand positioning across different consumer touchpoints. The Offline Channel, comprising large volume Mass Merchandisers, specialized regional Baby Stores, and Department Stores, remains vital for generating high unit volumes and allowing the crucial consumer interaction with the physical product (testing the fold, assessing maneuverability, feeling the weight). Conversely, the Online Channel, driven by global e-commerce giants (e.g., Amazon) and brand-specific Direct-to-Consumer (D2C) websites, is rapidly increasing its market share, fueled by convenience, competitive pricing, extensive customer reviews, and access to niche, premium models. Companies are strategically balancing these channels, using online platforms for highly detailed product education, inventory transparency, and personalized marketing, while relying on brick-and-mortar locations for immediate fulfillment and critical customer service that requires tangible demonstration, necessitating a fully integrated omni-channel approach for maximizing sales efficiency and geographical penetration.

- Product Type:

- Single Umbrella Strollers: Dominant in volume, focused on essential convenience, ultra-portability, and affordability for one child.

- Double Umbrella Strollers (Tandem and Side-by-Side): High growth potential, catering to families with multiples or closely aged siblings requiring minimal footprint mobility solutions; commands a higher average selling price.

- Material Type:

- Aluminum Frame: Standard modern material, balancing lightweight design with necessary structural rigidity; currently holds the highest market share by value.

- Steel Frame: Cost-effective, heavy-duty option primarily found in the basic, budget segment; prevalent in price-sensitive emerging markets.

- Composite/Advanced Alloy Frame: Premium segment material offering maximum lightness, superior tensile strength, and enhanced durability; utilized in high-end, travel-optimized models.

- Weight Capacity:

- Standard Weight (Up to 35 lbs): Optimized for travel and extreme lightness, typically targeting younger infants and short-term utility.

- High Weight Capacity (35 lbs and above): Provides extended use for growing toddlers, focusing on long-term durability and robust construction over maximal weight savings.

- Distribution Channel:

- Offline (Specialty Stores, Department Stores, Mass Merchandisers): Essential for physical inspection, drives high volume in the basic segment, and ensures broad retail presence.

- Online (E-commerce Platforms, Company Websites): Fastest growing channel; preferred for convenience, competitive pricing, detailed product reviews, and access to unique brand-specific models.

Value Chain Analysis For Umbrella Stroller Market

The Umbrella Stroller Market value chain begins with rigorous Upstream Analysis, centered on sourcing and procurement of specialized lightweight inputs. This foundational stage is dominated by securing high-quality, certified lightweight materials, including aerospace-grade aluminum tubes, specialized polymer resins for hinges, and high-performance technical fabrics for seating and canopies. Manufacturers must constantly navigate volatile global commodity markets while ensuring material traceability and compliance with strict international toxicity and safety regulations (e.g., REACH in Europe). The focus at this phase is on establishing deep, risk-mitigating, long-term relationships with certified tier-one suppliers to guarantee material consistency, which is fundamental to achieving both required product lightness and necessary safety performance. Furthermore, design innovation and R&D activities, involving advanced computer-aided design (CAD) and simulation to perfect the complex, yet instantaneous folding mechanisms, constitute a major cost center and key competitive differentiator in the upstream segment, setting the standard for product performance and ergonomics.

Midstream activities involve the fabrication and assembly processes, which are highly labor-intensive and capital-intensive, concentrated predominantly in high-volume manufacturing hubs across Asia (e.g., China, Vietnam, Indonesia). Key production processes include precision tube bending, automated welding, non-toxic powder coating of frames, and complex textile cutting, stitching, and final assembly. Efficient manufacturing requires highly optimized assembly lines to handle the high volume necessary for this category while maintaining extremely strict quality control—a critical checkpoint where defects, particularly in locking systems or frame stability, can lead to catastrophic safety issues, expensive product recalls, and severe brand damage. Logistical efficiency within the factory and in regional storage centers is vital to minimize inventory holding costs, especially given the high volume and physically bulky, though lightweight, nature of the final product packaging and its high sensitivity to seasonal demand fluctuations.

The Downstream phase is characterized by sophisticated, multi-channel distribution strategies. The indirect channel, leveraging large volume Mass Merchandisers and Large Specialty Baby Chains, requires complex vendor management, substantial promotional support, and the operational capacity to handle large, often seasonally concentrated, purchase orders. These retail partners provide broad market visibility and wide geographical coverage but typically demand substantial margin concessions. Conversely, the Direct channel, utilizing branded e-commerce platforms and potentially flagship stores, is highly advantageous for manufacturers, granting higher control over pricing, immediate access to vital consumer data, and the ability to maintain a premium brand perception, maximizing profitability on high-end, innovative models. The selection of the optimal distribution channel fundamentally affects pricing strategy, inventory deployment across global regions, and customer relationship management effectiveness. Crucially, efficient final-mile logistics, minimizing shipping damage, and a robust, rapid reverse logistics system for efficiently handling returns are critical success factors in the downstream value chain, directly influencing overall consumer satisfaction, brand loyalty, and the operational sustainability in this competitive consumer goods sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.98 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MCLAREN, Summer Infant, Graco, The Joie Group (Nuna), Chicco, Peg Perego, Kolcraft, Delta Children, Baby Jogger, UPPAbaby, Bugaboo, Evenflo, ZOE, Mountain Buggy, Babyzen, Inglesina, Pockit, Silver Cross, Goodbaby International Holdings Ltd., Britax. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Umbrella Stroller Market Potential Customers

The core customer segment for Umbrella Strollers is highly defined by lifestyle and necessity, consisting primarily of experienced parents and first-time caregivers with infants and toddlers, typically aged six months to three years, who are either frequent travelers or residents of high-density urban areas. These buyers are acutely focused on functional benefits, viewing the umbrella stroller not as a primary system replacement but as an essential tool for enhanced logistical efficiency. Urban customers require superior maneuverability in small spaces and seamless compatibility with public transit, making frame width, folding speed, and stand-alone capability non-negotiable criteria. Travel-oriented customers, conversely, prioritize minimal weight and adherence to airline baggage dimensions (often seeking models designated as 'cabin-friendly' or exceptionally easy to gate-check), demanding robust durability to withstand the rigors of airport handling and diverse terrain encountered on vacation. This segment is highly reliant on online reviews and demonstrated folding videos before making a final purchase decision.

A secondary, influential demographic comprises grandparents and auxiliary caregivers who require a reliable, easy-to-use stroller for occasional duty or spontaneous outings. This group often seeks models featuring simplified, intuitive locking and folding mechanisms, coupled with lighter weights to accommodate physical limitations and avoid strain, generally prioritizing ease of operational mechanics over the absolute latest technological features. Purchase decisions among this group are frequently driven by direct recommendations from the parents or the practical need for a cost-effective, durable item to remain permanently at their residence or vacation home. For both primary and secondary users, robust safety certifications (e.g., JPMA certified in the US) are prerequisite trust signals, influencing brand selection significantly across all price points, reinforcing the fact that structural reliability, material non-toxicity, and compliance are valued above all non- essential aesthetic or digital features in this utilitarian product category.

Beyond individual consumers, institutional buyers represent a consistent, albeit smaller, specialized revenue stream that demands industrial-grade quality. This includes commercial entities in the hospitality and entertainment sectors, such as major theme parks, large resort complexes, cruise lines, airports, and large museums that maintain substantial inventories of rental strollers for their patrons. These commercial customers prioritize industrial-level durability, high resistance to vandalism, ease of cleaning (often requiring fully machine-washable fabrics and simple wipe-down surfaces), standardized fleet components for efficient maintenance, and robust construction to endure heavy, continuous public use and rapid sanitization turnover. Their purchasing criteria focus rigorously on long-term Total Cost of Ownership (TCO) and rapid repair cycles rather than individual aesthetic appeal, often resulting in bulk orders of mid-range, highly reliable umbrella stroller models optimized for heavy commercial use and minimal downtime.

Umbrella Stroller Market Key Technology Landscape

The technological evolution of the Umbrella Stroller Market is predominantly driven by advancements in material science and precision mechanical engineering, rather than highly sophisticated electronics, adhering to the core ethos of lightness and simplicity. The primary technological focus remains achieving the critical "magic ratio" of maximum durability combined with minimum possible weight. This is executed through the utilization of proprietary aluminum alloys, such as those used in aerospace applications, carbon fiber composites, and advanced, stress-tested polymer composites for high-wear components like wheel housings, hinges, and structural joints. Continuous R&D efforts are dedicated to reducing the density of these materials while simultaneously enhancing their tensile strength, enabling the creation of ultra-lightweight strollers (often under 5 kg) that still meet stringent crash and impact resistance safety standards globally, positioning material innovation as the definitive competitive battlefield in the premium segment.

Mechanical innovation centers heavily on optimizing the complex, yet instantaneous fold function—the signature characteristic of the umbrella stroller design. Modern advancements include patented one-hand, self-standing, and single-motion folding technology that utilizes complex internal linkages, carefully calibrated springs, and robust locking systems, allowing the parent to collapse and secure the unit instantly while attending to the child or managing luggage. This engineering achievement significantly reduces the operational burden on parents during transitions. Furthermore, wheel and suspension technology has seen subtle but impactful refinements: moving away from traditional air tires, manufacturers now employ durable, maintenance-free, lightweight polyurethane or high-density EVA foam tires, sometimes paired with minimal shock-absorbing springs or proprietary frame flex designs, specifically engineered to provide a smooth, comfortable ride on hard urban surfaces without adding unnecessary bulk or maintenance requirements often associated with heavier systems.

In terms of user-facing technology, textile and fabric innovation plays an increasingly significant role, driven by consumer demand for comfort, hygiene, and sustainability. High-performance, technical fabrics are crucial, offering specialized features like enhanced UV protection (UPF 50+ certification for canopies), superior breathability through 3D mesh backing for temperature regulation in warmer climates, and antimicrobial treatments for enhanced hygiene management. Furthermore, sustainable manufacturing practices are increasingly leveraging technology; the adoption of recycled PET (rPET) fabrics and closed-loop material cycles addresses growing consumer demand for environmentally conscious juvenile products, particularly in European markets. The subtle, yet crucial, integration of advanced safety technology—such as mechanical features ensuring the seat cannot accidentally recline or high-visibility reflective piping—continues to be refined, ensuring the product's lightweight nature never compromises the critical requirement for child security and parental confidence during daily use and rigorous travel scenarios.

Regional Highlights

The regional analysis of the Umbrella Stroller Market reveals diverse consumption patterns influenced by economic development, regulatory stringency, and prevailing lifestyle norms regarding child rearing and travel frequency. North America, characterized by high disposable income and significant geographical distances necessitating frequent car travel, exhibits high demand for durable, multi-functional umbrella strollers that can withstand diverse road conditions and rigorous use. Consumers here prioritize extended use and high load capacity, often seeking models suitable for heavier toddlers up to 50 lbs. The regulatory environment (governed primarily by the Consumer Product Safety Commission, CPSC) is fiercely monitored, ensuring that only highly compliant, rigorously tested products penetrate the market. The competitive strategy focuses heavily on brand differentiation through extensive guarantees, robust recall preparedness, and integration with efficient mass-market and specialized retail chains, utilizing sophisticated, demand-driven logistics networks to cover the vast territory efficiently.

Europe represents a highly segmented, mature, and discerning market, driven by dense urban populations, strong environmental consciousness, and an emphasis on sophisticated design aesthetics. European safety standards (EN 1888) are arguably the most challenging globally, dictating precise design choices and material procurement, fostering a culture of high-quality, lightweight manufacturing focused on structural performance. Countries in Western Europe, particularly the UK, Germany, and France, show immense demand for premium, ultra-compact "cabin-size" strollers suitable for compliant air travel and seamless integration with complex public transportation networks. The market is also heavily influenced by fashion trends, with consumers showing a distinct preference for muted, sophisticated color palettes and certified eco-friendly or organic fabric options, which significantly elevates the average selling price in the premium segment compared to volume-driven regions.

Asia Pacific (APAC) stands as the undeniable future growth center, primarily due to the sheer size of the urbanizing young population and the rapid rise of middle-class consumer segments in major economies like China and India. The market here operates on a dual-tiered structure: a massive, price-sensitive segment drives volume sales of basic, functional, steel-framed models, while a rapidly expanding affluent segment demands imported, international brands that signal status and offer superior, internationally certified safety standards. Infrastructure development, particularly in transportation hubs and modernized shopping malls, fuels the necessity for portable baby gear. Latin America and the Middle East & Africa (MEA) are emerging regions, offering substantial untapped potential but currently constrained by economic volatility, high import tariffs, and underdeveloped e-commerce and specialized retail infrastructure. Growth in these regions is heavily reliant on tourism recovery, sustained economic stability, and increasing consumer education regarding the long-term benefits of specialized, certified baby products, which gradually encourages a crucial shift away from informal or substandard alternatives towards compliant umbrella strollers.

- North America (USA, Canada): Dominant market share by value; emphasis on high safety standards (ASTM), large weight capacity, extended product lifecycles, and high reliance on integrated e-commerce and mass-merchandiser logistics.

- Europe (Germany, UK, France, Italy): Focus on stringent regulatory compliance (EN standards), superior design aesthetics, and sustainability; strong demand for ultra-compact, cabin-friendly buggies for dense urban living and frequent international travel.

- Asia Pacific (China, India, Japan, ASEAN): Fastest growth potential due to explosive urbanization and large young populations; dual-market structure with high volume in the basic segment and rapid growth in imported premium and highly featured compact brands.

- Latin America (Brazil, Mexico, Argentina): Emerging market characterized by high price sensitivity, reliance on local manufacturing, and gradual infrastructural improvements; consumer decisions strongly influenced by regional economic stability and domestic pricing competitiveness.

- Middle East and Africa (MEA): Growth driven by high birth rates and increasing travel and tourism activity; demand concentrated in high-income urban centers and luxury retail hubs, particularly for high-end, heat-resistant models with superior sun protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Umbrella Stroller Market.- MCLAREN

- Summer Infant

- Graco

- The Joie Group (Nuna)

- Chicco

- Peg Perego

- Kolcraft

- Delta Children

- Baby Jogger

- UPPAbaby

- Bugaboo

- Evenflo

- ZOE

- Mountain Buggy

- Babyzen

- Inglesina

- Pockit

- Silver Cross

- Goodbaby International Holdings Ltd.

- Britax

Frequently Asked Questions

Analyze common user questions about the Umbrella Stroller market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Umbrella Stroller Market?

The Umbrella Stroller Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.8% between the years 2026 and 2033, driven primarily by increasing global family travel, pervasive urbanization, and the continuous introduction of lightweight, highly portable, and certified safety-compliant models.

What are the primary factors driving the demand for umbrella strollers?

Primary drivers include the imperative need for extremely lightweight and compact mobility solutions for airline travel and navigating complex urban environments, the rapid adoption of specialized secondary baby gear, and the continuous innovation in material science that significantly reduces product weight while simultaneously enhancing durability and safety performance.

How do safety regulations affect the manufacturing of umbrella strollers?

Rigorous global safety standards, such as those imposed by ASTM (US), EN (Europe), and CPSC, significantly impact manufacturing by mandating complex, precision-engineered design features (e.g., highly secure locking mechanisms, five-point harnesses), strict material non-toxicity choices, and extensive recurrent third-party testing protocols, which invariably increases production complexity and operational cost.

Which distribution channel holds the largest share of the market?

The offline distribution segment, primarily dominated by specialized baby stores and large mass merchandisers, continues to hold the largest market share by volume. This is attributed to consumer preference for physically inspecting the stroller’s functionality, foldability, and actual weight before committing to a purchase, especially for higher-end models where physical testing is crucial for satisfaction.

What distinguishes a premium umbrella stroller from a basic model?

Premium umbrella strollers differentiate themselves through superior construction utilizing advanced aluminum or composite frames for extreme lightness, the inclusion of enhanced safety features like better wheel suspension and high UPF-rated canopies, and sophisticated, single-hand folding mechanisms, justifying a significantly higher price point than basic, steel-framed budget models.

What role does material technology play in market competition?

Material technology is crucial as competition centers on achieving the optimal strength-to-weight ratio. Manufacturers utilizing proprietary lightweight alloys (like aerospace aluminum) and high-grade polymer composites gain a strong competitive edge by producing strollers that are both safer under high load and easier for parents to transport, directly supporting the market trend of premiumization.

Is the Asia Pacific region expected to lead market growth?

Yes, the Asia Pacific region is forecasted to exhibit the highest CAGR due to rapid urbanization, substantial increases in disposable income among the burgeoning middle class, and the sheer size of the young population base in populous economies like China and India, fueling both volume and value sales, especially in the imported brand segment.

How is AI primarily impacting the Umbrella Stroller industry?

AI's primary impact is operational, specifically optimizing the supply chain through advanced predictive demand forecasting to manage inventory efficiently and reduce costs. Future impacts involve integrating low-power AI modules for enhanced child safety monitoring and utilizing generative AI for accelerated design iterations and structural optimization.

When is the umbrella stroller typically purchased by parents?

Umbrella strollers are most commonly purchased as a secondary, supplemental stroller after the child outgrows the bulkier infant travel system, usually around six months to one year of age, or specifically in immediate preparation for planned air travel or intensive urban excursions where lightness is paramount.

What are the typical weight limitations for ultra-light umbrella strollers?

Ultra-light umbrella strollers are typically certified for children weighing up to 35 lbs (approx. 15 kg). Models designed for longer-term use or specialized needs often fall into the high weight capacity segment, safely accommodating toddlers up to 50 lbs or more, often requiring a slightly more robust frame.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager