UN T75 ISO Tank Containers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434258 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

UN T75 ISO Tank Containers Market Size

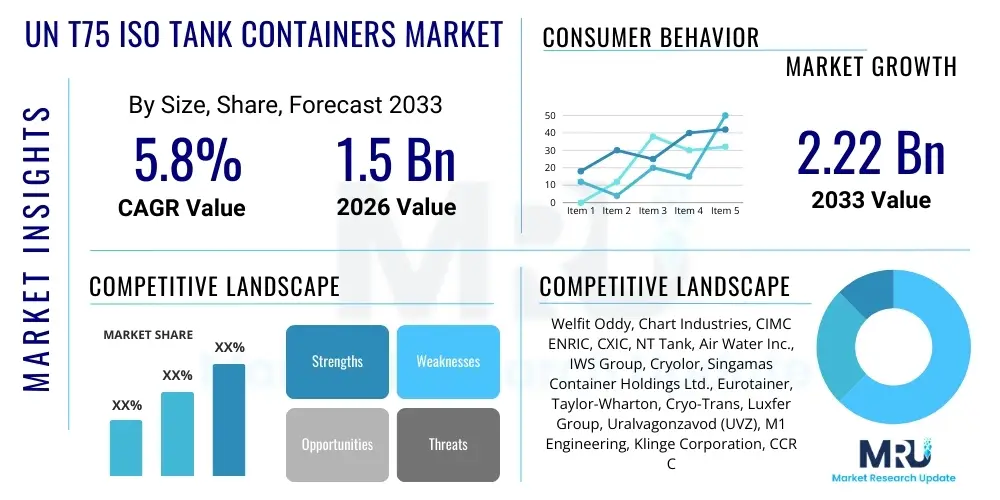

The UN T75 ISO Tank Containers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.22 Billion by the end of the forecast period in 2033.

UN T75 ISO Tank Containers Market introduction

The UN T75 ISO tank container market encompasses specialized intermodal tanks designed primarily for the safe and efficient transportation of refrigerated liquefied gases, characterized by extremely low temperatures (cryogenic liquids). These tanks adhere to the stringent T75 designation under the UN Recommendations on the Transport of Dangerous Goods, which mandates high-quality vacuum insulation systems, specific test pressures, and material compatibility standards suitable for substances such as Liquefied Natural Gas (LNG), Liquid Nitrogen (LIN), Liquid Oxygen (LOX), and Liquid Argon (LAR). The T75 standard ensures maximum thermal efficiency and structural integrity, critical for maintaining the cryogenic state of the contents over extended transport routes, often spanning continents via maritime, rail, and road networks. The technical design involves a robust stainless steel inner vessel supported within a protective mild steel outer frame, separated by a high-vacuum insulation layer, minimizing heat leakage and preventing phase change during transit.

The fundamental benefits driving the adoption of T75 tanks center on enhanced safety, reduced cargo loss, and superior logistical flexibility compared to traditional bulk transport methods. Due to their adherence to global ISO standards (20-foot footprint), these containers seamlessly integrate into existing intermodal logistics infrastructure, facilitating door-to-door delivery with minimal transloading. Major applications span the energy sector, where T75 tanks are crucial for small-scale LNG distribution and bunkering operations; the industrial sector, supporting manufacturing processes reliant on technical gases; and the healthcare industry, transporting medical oxygen and laboratory gases. The standardized nature of these containers reduces handling costs and simplifies regulatory compliance across international borders, making them indispensable assets in global supply chains for high-value and temperature-sensitive gases.

Key driving factors include the escalating global demand for cleaner energy sources like LNG, necessitating efficient distribution solutions to areas lacking pipeline infrastructure. Furthermore, the tightening of global safety regulations concerning the transport of dangerous goods, particularly cryogenic substances, pushes operators toward certified and reliable T75 containers. The expanding industrial manufacturing base in emerging economies, coupled with increased investment in specialized gas production facilities, fuels the requirement for a resilient and scalable transport fleet. Technological advancements in vacuum insulation techniques and material science also contribute to the market growth by improving tank performance and extending holding times, thereby enhancing operational efficiency for logistics providers.

UN T75 ISO Tank Containers Market Executive Summary

The global market for UN T75 ISO Tank Containers is undergoing significant transformation, primarily propelled by rapid expansion in cross-border LNG trade and robust regulatory emphasis on safety compliance in chemical and gas transport. Current business trends indicate a strong shift towards leasing models rather than outright purchase, driven by the desire of chemical producers and logistics operators to maintain capital flexibility while accessing the latest, safest tank specifications. Asia Pacific remains the central growth engine, especially due to accelerated infrastructure development and the increasing adoption of LNG as a transitional fuel source in countries like China, India, and Southeast Asian nations. This regional dominance is further reinforced by the concentration of major global manufacturing and cryogenic gas production facilities within the region, creating intense localized and international transport demand.

Regionally, the market dynamics reflect a dual focus: established markets like North America and Europe prioritize fleet modernization, integrating telematics and IoT solutions for enhanced operational transparency and predictive maintenance. Conversely, emerging markets focus on volume acquisition to meet basic industrial and energy needs. Segment trends highlight LNG as the fastest-growing application area, followed closely by the transport of high-purity industrial gases essential for semiconductor and aerospace manufacturing. The increasing complexity of supply chains mandates greater investment in advanced tracking and monitoring systems, which are now becoming standard features rather than optional enhancements, thus influencing procurement decisions across all key geographies.

Critical business challenges include navigating the volatile pricing of raw materials, particularly specialized stainless steel alloys required for the inner shell, and managing skilled labor shortages for maintenance and repair operations. However, the market is capitalizing on opportunities presented by the global pivot toward hydrogen infrastructure. Although current T75 tanks are optimized for lower-temperature cryogenic gases, the technological groundwork laid in this sector positions key manufacturers favorably to adapt designs for liquid hydrogen transport, signaling a promising long-term revenue stream. Successful market participants are focusing their strategic efforts on developing lighter, more durable insulation materials and strengthening their global maintenance networks to offer comprehensive turnkey solutions to gas distributors and shipping lines.

AI Impact Analysis on UN T75 ISO Tank Containers Market

Common user inquiries concerning AI in the T75 market frequently revolve around how artificial intelligence can enhance safety protocols, optimize complex international shipping logistics, and contribute to predictive asset management, thereby maximizing container lifespan and minimizing downtime. Users are keen to understand if AI can effectively process the massive datasets generated by modern IoT-enabled tanks—data pertaining to pressure, temperature fluctuations, GPS location, and historical maintenance records—to provide actionable insights beyond basic human analysis. Key concerns often focus on the cybersecurity risks associated with integrating sophisticated AI systems into critical transport infrastructure and the potential displacement of traditional logistics planning roles.

The core theme emerging from these inquiries is the expectation that AI integration will fundamentally shift the operational paradigm from reactive maintenance and static route planning to proactive risk management and dynamic supply chain optimization. Specifically, AI algorithms are being leveraged to analyze weather patterns, port congestion, and regulatory changes in real-time, allowing operators to dynamically adjust shipping routes and schedules, significantly reducing transit times and fuel consumption. This optimization not only improves profitability but also enhances the integrity of the transported cryogenic cargo by ensuring it spends less time in potentially adverse conditions, thereby satisfying user demands for enhanced reliability.

Furthermore, AI is instrumental in developing digital twins of T75 containers. These virtual models simulate the effects of stress, vibration, temperature extremes, and aging on the tank structure and insulation system. By utilizing machine learning, these models can predict the exact moment a component—such as a relief valve or a specific section of the vacuum jacket—is likely to fail, enabling maintenance teams to intervene before a critical safety incident occurs. This shift toward predictive maintenance drastically improves safety standards, which is paramount for high-pressure, cryogenic vessels, and fulfills the industry’s need for superior asset longevity and compliance traceability across the entire lifecycle of the tank.

- AI algorithms enable predictive maintenance by analyzing sensor data to forecast potential mechanical failures in valves, insulation systems, and pressure gauges, minimizing unexpected downtime.

- Advanced machine learning optimizes complex multimodal logistics routes, accounting for real-time port congestion, regulatory compliance checks, and adverse weather conditions to ensure timely delivery of cryogenic cargo.

- AI-driven risk assessment tools monitor operational parameters continuously, identifying deviations from safe operating thresholds and instantly alerting personnel to prevent potential catastrophic pressure releases or thermal breaches.

- Implementation of digital twinning allows operators to simulate and test various operational scenarios and structural stresses on the T75 tanks virtually, extending the effective lifespan of the assets and optimizing design modifications.

- Natural Language Processing (NLP) is used to streamline regulatory reporting and documentation processes, automatically generating compliance logs based on journey data collected by onboard telematics systems.

DRO & Impact Forces Of UN T75 ISO Tank Containers Market

The market is defined by a dynamic interplay of potent drivers, structural restraints, and compelling strategic opportunities, all converging to shape the trajectory of specialized cryogenic logistics. The most dominant impact force is the inexorable rise in global energy demand, specifically the transition toward cleaner fuels, which has solidified LNG’s position as a crucial traded commodity. This necessitates continuous investment in the T75 fleet to support the growing small-scale LNG and bunkering segments. Coupled with this is the non-negotiable requirement for adherence to stringent international safety regulations (IMO, ADR, RID), which favors new, compliant, and well-maintained T75 containers over older, less specialized equipment, thereby stimulating fleet renewal cycles and market growth. However, this growth is tempered by significant capital expenditure requirements associated with T75 production, as manufacturing involves specialized, high-tolerance welding and sophisticated vacuum insulation technology, creating substantial barriers to entry for new competitors.

Drivers emphasize external market pressures, primarily the expansion of the industrial gas market in Asia Pacific, driven by semiconductor and electronics manufacturing demanding vast quantities of high-purity nitrogen and oxygen, which are optimally transported in T75 units. Opportunities, conversely, focus on forward-looking technological and strategic advancements. The most significant opportunity lies in the nascent but rapidly accelerating hydrogen economy. As global efforts pivot toward liquid hydrogen (LH2) transport—a product requiring even lower temperatures than LNG—manufacturers with proven T75 expertise are uniquely positioned to leverage this knowledge base to develop next-generation LH2 containers, potentially opening a massive new market segment post-2030. The increasing adoption of telematics and smart tank technology, enabling real-time condition monitoring and digital traceability, further serves as a key enabler for efficiency gains and enhanced safety compliance, attracting sophisticated logistics partners.

Restraints are primarily economic and logistical. The T75 manufacturing process is highly sensitive to the global pricing and availability of high-grade stainless steel (often specialized austenitic grades), which introduces cost volatility and can delay production schedules. Furthermore, the specialized nature of these containers means that maintenance and repair often require highly skilled technicians and specialized facilities, creating bottlenecks in global logistics chains, particularly in remote or developing regions. The primary impact forces stabilizing and driving the market include regulatory enforcement, which mandates high standards, and technological innovation focused on improving thermal performance and reducing tare weight, which collectively ensure that specialized T75 tanks remain the preferred method for safe and efficient cryogenic gas transport worldwide.

- Drivers:

- Surging global demand for Liquefied Natural Gas (LNG) supporting small-scale distribution and bunkering operations.

- Strict enforcement of international regulations (IMO, ADR, RID) governing the safe transport of hazardous cryogenic materials.

- Expansion of industrial manufacturing sectors (electronics, steel, chemicals) increasing demand for high-purity industrial gases.

- Technological advancements in vacuum insulation leading to extended holding times and reduced operational losses.

- Restraints:

- High initial acquisition cost and specialized manufacturing requirements for T75 containers, leading to significant capital outlay.

- Volatile pricing and supply chain complexities related to high-grade stainless steel and specialized raw materials.

- Need for highly skilled personnel and specialized depots for maintenance, testing, and repair of cryogenic equipment.

- Economic slowdowns or geopolitical instability impacting international trade volumes and logistics demand.

- Opportunities:

- Anticipated growth in the liquid hydrogen (LH2) transport sector, leveraging T75 technology foundations for ultra-cryogenic applications.

- Integration of advanced telematics, IoT sensors, and predictive analytics for enhanced operational efficiency and preventative safety maintenance.

- Expansion of leasing and rental services, offering flexible procurement models to specialized logistics operators.

- Development of lighter composite and hybrid materials to reduce tare weight and increase payload capacity.

Segmentation Analysis

The UN T75 ISO Tank Containers Market is comprehensively segmented based on the type of gas transported, reflecting the specific technical demands and regulatory nuances associated with each cryogenic substance, and by the end-use application, which defines the primary commercial sector utilizing these specialized transport vessels. Understanding these segmentations is critical for market participants, as the design specifications—such as internal pressure rating, inner shell material composition, and valve configuration—can vary substantially between a tank optimized for LNG (methane) versus one intended for medical oxygen (LOX). The primary segmentation criteria highlight the concentration of demand in high-growth areas, particularly within the energy transition infrastructure.

Segmentation by Gas Type reveals a dominant share held by LNG transport, reflecting its status as a foundational element of global energy supply chains, especially in regions transitioning away from coal or lacking pipeline access. Industrial gases, including Nitrogen, Oxygen, and Argon, collectively form the second major segment, driven by their pervasive use across manufacturing, metallurgy, and food processing industries. Segmentation by Application demonstrates that the Energy Sector (primarily LNG and associated gases) consumes the largest share of the market, driven by both large-scale international trade and smaller regional distribution networks, including maritime bunkering services. The Chemicals and Petrochemicals sector is another vital consumer, using T75 tanks for the movement of various cold-chain precursors and specialty reactants that must be maintained at low temperatures.

Strategic analysis of these segments indicates that while LNG provides the volume growth, the Specialty Gases segment (serving advanced manufacturing like semiconductors and aerospace) commands higher profit margins due to the requirement for ultra-high purity materials and specialized internal surface finishes, demanding premium T75 specifications. Future segmentation shifts are anticipated to favor products compatible with greener fuels, pushing manufacturers to invest heavily in R&D targeting liquid hydrogen, which will eventually form its own high-value segment within the overall cryogenic transport market, necessitating a specialized class of T75 or T75-derived tank designs. Geographical segmentation further emphasizes the rapid infrastructural investments underway across the Asia Pacific region, solidifying its leading position in overall segmental demand.

- By Gas Type:

- Liquefied Natural Gas (LNG)

- Liquid Nitrogen (LIN)

- Liquid Oxygen (LOX)

- Liquid Argon (LAR)

- Other Cryogenic Industrial Gases (e.g., Ethylene, CO2)

- By Application:

- Energy and Fuel Distribution (Small-Scale LNG, Bunkering)

- Chemical and Petrochemical Industry

- Manufacturing and Metallurgy

- Healthcare and Pharmaceutical (Medical Gases)

- Food and Beverage (Cryogenic Freezing and Processing)

Value Chain Analysis For UN T75 ISO Tank Containers Market

The value chain for UN T75 ISO Tank Containers is intricate, involving specialized upstream suppliers, technologically advanced manufacturers, complex logistics operators, and diverse downstream end-users. The upstream segment is dominated by specialized material suppliers, primarily providers of high-specification stainless steel alloys (304L, 316L) required for the inner vessel due to their cryogenic tolerance and corrosion resistance, alongside suppliers of critical components such as high-vacuum systems, multi-layer insulation foils (MLI), and precision pressure relief devices. The procurement of these high-quality, certified raw materials is crucial, as any compromise in material quality directly impacts the safety and regulatory compliance of the final product. Suppliers in this segment face pressure regarding quality control, material certification traceability, and the management of long lead times for specialized metal orders, influencing overall manufacturing speed.

The manufacturing stage is central, involving highly specialized fabrication techniques, including orbital welding and non-destructive testing, essential for ensuring the integrity of the inner tank and the vacuum annulus. Manufacturers often serve two primary distribution channels: direct sales to major multinational gas producers who manage their proprietary fleets, and sales to large global leasing companies, which act as intermediaries by acquiring vast fleets and then renting them out to smaller or specialized logistics firms and end-users. Leasing companies play a crucial role in injecting flexibility and liquidity into the market, as they manage the compliance, maintenance schedules, and fleet turnover, effectively mitigating capital risk for smaller operators. Direct distribution ensures personalized customization and long-term service agreements for large anchor clients.

The downstream analysis involves the operational and logistical aspects carried out by tank operators (shipping lines, rail carriers, road haulers) and the final utilization by end-users (e.g., LNG power plants, steel mills, hospitals). Operational efficiency at this stage is highly reliant on robust maintenance networks and efficient intermodal transfer points (ports, rail yards). The increasing use of indirect channels—leasing firms—means that manufacturers must maintain strong relationships with these financial intermediaries. Ultimately, the value captured at the end of the chain is derived from the safe, reliable, and timely delivery of high-value cryogenic gases, where the T75 container serves as the primary asset enabling this sophisticated international trade.

UN T75 ISO Tank Containers Market Potential Customers

The primary customers for UN T75 ISO tank containers are entities involved in the production, distribution, and consumption of bulk cryogenic liquefied gases, spanning across global energy, industrial, and specialized healthcare sectors. The most significant customer base comprises the major multinational industrial gas companies—such as Air Liquide, Linde, and Air Products—who operate extensive global supply chains and require large, standardized fleets of T75 tanks to move their products between production facilities and customer sites worldwide. These major players typically demand custom-built tanks tailored to specific purity standards and often prefer direct procurement combined with long-term maintenance contracts, prioritizing reliability, and global regulatory conformance above all else.

A secondary, yet rapidly expanding, customer segment includes international shipping and logistics companies that specialize in multimodal transport of dangerous goods. These firms often work through large tank leasing corporations, preferring operational flexibility and lower capital outlay through rental agreements. Their requirement is for versatile, globally certified tanks that can be efficiently integrated into existing rail, road, and maritime logistics networks. Furthermore, the specialized nature of small-scale LNG (ssLNG) distribution has created a vital customer base among regional energy distributors, independent power producers, and maritime bunkering service providers who need T75 containers to deliver fuel to off-grid industrial customers or ships in ports lacking pipeline access.

Finally, specialized segments such as advanced electronics manufacturers (for cooling and inert atmospheres), research institutions, and large-scale medical facilities (hospitals and oxygen suppliers) represent key end-users. While their individual fleet size may be smaller than that of industrial gas giants, they require high-specification tanks, often leased, with rigorous traceability and compliance records. The buying decisions across all these customer groups are heavily influenced by the tank’s insulation performance (holding time), compliance with regional and international standards, and the manufacturer's ability to provide swift, certified global maintenance and parts support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.22 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Welfit Oddy, Chart Industries, CIMC ENRIC, CXIC, NT Tank, Air Water Inc., IWS Group, Cryolor, Singamas Container Holdings Ltd., Eurotainer, Taylor-Wharton, Cryo-Trans, Luxfer Group, Uralvagonzavod (UVZ), M1 Engineering, Klinge Corporation, CCR Containers, Fusion Tanks, CS Leasing, Suretank Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

UN T75 ISO Tank Containers Market Key Technology Landscape

The technological landscape of the UN T75 ISO Tank Containers market is primarily characterized by advancements in thermal management, materials science, and digital integration, all aimed at enhancing safety, extending holding times, and improving operational visibility. The critical technology remains the highly efficient Vacuum Super Insulation (VSI) system, which minimizes heat transfer into the cryogenic cargo. Modern VSI systems utilize proprietary combinations of high-vacuum environments maintained between the inner and outer shells, along with specialized multi-layer reflective insulation (MLI) comprising numerous layers of reflective aluminum foil and low-conductivity spacers. Continuous innovation focuses on optimizing the MLI stack and achieving ultra-high vacuum levels during manufacturing, which directly translates to longer statutory holding times and reduced product boil-off, a crucial metric for high-value cryogenic liquids.

In materials science, the trend is towards the adoption of lighter, higher-strength stainless steel alloys for the inner vessel to maximize payload capacity without compromising structural integrity or corrosion resistance. Manufacturers are exploring advanced austenitic steel grades that offer superior mechanical properties at cryogenic temperatures. Simultaneously, the outer frame (skelton) is increasingly benefiting from design optimization and the use of high-tensile steel, reducing the overall tare weight of the container, which is vital for maximizing profitability in intermodal transport where weight restrictions are rigidly enforced. Furthermore, the development of robust, non-metallic composite materials is being researched for non-load bearing components, potentially contributing to further weight reduction and improved thermal separation between the inner and outer shells.

Digitalization represents the most transformative current technological wave. Integration of IoT sensors and advanced telematics hardware is rapidly becoming standard. These systems monitor critical parameters such as internal pressure, liquid level, temperature, and GPS location in real-time. This connectivity allows operators to remotely track the condition of the cargo and the physical state of the tank, facilitating compliance documentation and enabling sophisticated predictive maintenance routines powered by cloud-based analytics platforms. The convergence of secure wireless transmission protocols, low-power sensor technology, and mandatory regulatory demands for asset traceability is fundamentally enhancing the operational intelligence and safety profile of the entire T75 fleet globally.

Regional Highlights

The global demand for UN T75 ISO Tank Containers exhibits distinct regional patterns, driven by varying levels of industrialization, energy consumption dynamics, and regulatory environments. Asia Pacific (APAC) currently dominates the market, contributing the largest share of revenue and volume. This dominance is intrinsically linked to the region’s massive industrial base—including manufacturing, metallurgy, and electronics production—which requires substantial volumes of industrial gases (LIN, LOX, LAR). Crucially, the region is central to the future of the LNG trade, with major consumers like China and India rapidly building out small-scale LNG infrastructure and supply chains to decentralize energy access and mitigate environmental concerns. Regulatory compliance across diverse national standards, however, remains a persistent challenge in this high-growth region, necessitating manufacturer flexibility.

North America and Europe represent mature markets characterized by stringent safety regulations and high technological adoption rates. In North America, demand is driven by the domestic chemical and petrochemical sectors, utilizing T75 tanks for specialized chemical intermediates and the robust interstate transport of industrial gases generated by large-scale air separation units. Europe, meanwhile, focuses heavily on fleet modernization, driven by mandatory safety upgrades and the integration of advanced tracking and monitoring systems to comply with EU directives on the transport of dangerous goods (ADR/RID). European growth is also supported by cross-border trade in specialty and medical gases, where T75 tanks are indispensable for maintaining high purity and cold chain integrity over long distances.

Latin America, the Middle East, and Africa (MEA) are emerging regions offering significant growth potential, although starting from a smaller base. MEA's market expansion is directly correlated with investment in new oil and gas processing facilities and infrastructure projects, requiring industrial gases and specialized chemical transport. Latin America is seeing gradual uptake, often driven by the expansion of mining and local manufacturing centers. In these regions, the emphasis is often on cost-effectiveness and durability, with leasing models becoming highly popular as operators seek to minimize initial capital expenditure while accessing certified, high-quality T75 assets necessary for participation in international supply chains. Future growth across all regions will be fundamentally linked to the speed of energy transition initiatives and the implementation of hydrogen pilot programs.

- Asia Pacific (APAC): Leads the market due to robust industrial expansion, significant investment in LNG import/distribution infrastructure, and high demand from electronics and metallurgy sectors for industrial gases.

- North America: Characterized by high operational standards, strong market integration of telematics, and demand driven by large chemical production and domestic industrial gas distribution networks.

- Europe: Focuses on fleet modernization, strict adherence to ADR/RID regulations, and substantial cross-border trade in medical and specialty cryogenic gases; pioneering advanced logistics technology adoption.

- Middle East & Africa (MEA): Growth tied to hydrocarbon processing, infrastructure development, and increasing energy demand, favoring reliable, certified T75 tanks supplied often via international leasing agreements.

- Latin America: Developing market with opportunities in mining, localized manufacturing expansion, and regional energy distribution projects utilizing small-scale LNG solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the UN T75 ISO Tank Containers Market.- Chart Industries

- CIMC ENRIC

- Welfit Oddy

- CXIC

- NT Tank

- Air Water Inc.

- Cryolor

- IWS Group

- Singamas Container Holdings Ltd.

- Eurotainer

- Taylor-Wharton

- Cryo-Trans

- Luxfer Group

- M1 Engineering

- Klinge Corporation

- CCR Containers

- Fusion Tanks

- CS Leasing

- Suretank Group

- Uralvagonzavod (UVZ)

Frequently Asked Questions

Analyze common user questions about the UN T75 ISO Tank Containers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between UN T75 and other ISO tank specifications?

The T75 specification is uniquely designated for the transport of refrigerated liquefied gases (cryogenic liquids), requiring superior vacuum insulation systems and specialized inner vessel materials to maintain ultra-low temperatures, unlike standard T11 or T14 tanks used for non-cryogenic hazardous or non-hazardous liquids.

How does the integration of IoT technology impact the safety and operational efficiency of T75 tanks?

IoT sensors provide real-time monitoring of critical parameters like pressure, temperature, and location, enabling operators to predict maintenance needs, prevent thermal breaches, optimize routing, and ensure mandatory compliance tracing, thereby maximizing asset uptime and safety standards.

Which geographical region is the current leader in UN T75 ISO Tank Container demand and growth?

Asia Pacific (APAC) currently leads the market, driven by massive infrastructure investments in small-scale LNG distribution networks and rapid expansion in industrial sectors requiring high volumes of cryogenic industrial gases, such as nitrogen and oxygen.

What major regulatory frameworks govern the international transport of T75 containers?

International transport is governed by regulatory frameworks including the International Maritime Dangerous Goods (IMDG) Code for sea transport, the European Agreement concerning the International Carriage of Dangerous Goods by Road (ADR), and the Recommendations on the Transport of Dangerous Goods (UN Model Regulations).

What role does the emerging liquid hydrogen economy play in the future trajectory of the T75 market?

The technical expertise developed for T75 cryogenic transport provides a crucial foundation for designing and manufacturing next-generation tanks capable of handling liquid hydrogen (LH2), which is stored at even lower temperatures (-253°C), positioning T75 manufacturers favorably for future high-value energy logistics segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager