Underfill Dispensers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431596 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Underfill Dispensers Market Size

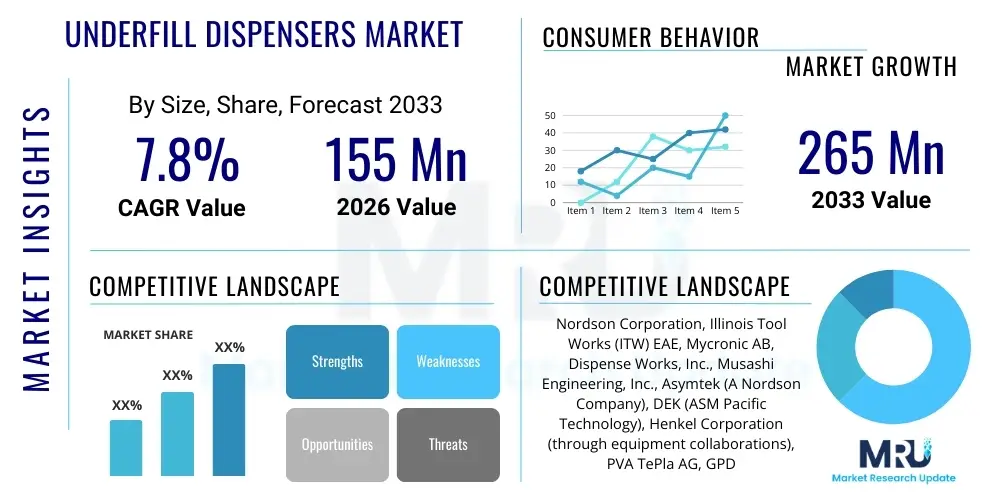

The Underfill Dispensers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 155 Million in 2026 and is projected to reach USD 265 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the relentless miniaturization trend within the semiconductor and advanced electronics manufacturing sectors, particularly the increased adoption of flip-chip and wafer-level packaging technologies, which critically rely on highly precise underfill dispensing processes to ensure structural integrity and thermal management. The escalating demand for high-performance computing components in consumer electronics, automotive systems, and telecommunications infrastructure, specifically 5G devices, necessitates advanced dispensing solutions capable of handling complex geometries and highly viscous underfill materials consistently at high throughputs. The market expansion reflects a crucial shift toward automation and enhanced process control within outsourced semiconductor assembly and test (OSAT) operations and integrated device manufacturers (IDMs) globally. The focus remains on improving yield rates and minimizing defects associated with void formation during the underfilling process, positioning advanced automated dispensing equipment as indispensable capital expenditure for modern electronics fabrication facilities. Furthermore, the expanding use of micro-electromechanical systems (MEMS) and sophisticated sensor packages in industrial and medical applications further solidifies the long-term demand for precise volumetric dispensing systems.

Underfill Dispensers Market introduction

The Underfill Dispensers Market encompasses highly specialized automated equipment designed to deposit precise volumes of liquid epoxy material (underfill) into the minute gaps created between the semiconductor chip (die) and the substrate. This critical process, known as underfilling, is essential for mitigating thermo-mechanical stress, enhancing the reliability of solder joints, and improving the overall operational lifespan of advanced electronic packages, such as Ball Grid Arrays (BGAs), Chip Scale Packages (CSPs), and particularly flip-chip packages. Underfill material application stabilizes the interconnection structure, preventing fatigue failure caused by the coefficient of thermal expansion (CTE) mismatch between the silicon chip and the organic substrate, which is a common challenge in high-power and high-frequency applications. Dispensing technologies employed range from capillary underfill methods, where the liquid material flows by capillary action, to non-capillary methods utilizing specialized nozzle geometries and advanced fluid dynamics controls, often incorporating jetting technologies for ultra-high speed and non-contact deposition. The primary beneficiaries of these dispensers are the semiconductor packaging industry, which includes OSAT providers, IDMs, and companies specializing in advanced packaging solutions for servers, automotive control units, smartphones, and wearable technologies. The fundamental benefits provided by underfill dispensing are superior package protection, improved drop test performance, and enhanced heat dissipation capabilities, all of which are crucial factors driving modern electronic device reliability expectations.

The core objective of underfill dispensing equipment is to achieve volumetric accuracy, high repeatability, and speed across various substrate sizes and chip dimensions, which are increasingly challenging due to the continuous reduction in feature sizes and pitch dimensions. Modern dispensers incorporate sophisticated machine vision systems, closed-loop feedback controls, and temperature regulation mechanisms to manage the rheology of the epoxy materials, ensuring consistent flow and proper fillet formation without introducing voids or air pockets that compromise reliability. Key driving factors propelling this market include the global expansion of 5G infrastructure requiring high-density, reliable components, the explosive growth in automotive electronics (especially ADAS and electric vehicle power management modules), and the persistent consumer demand for slimmer, more powerful mobile devices. These applications demand dispensing equipment that can handle new, complex material chemistries, including low-viscosity, fast-curing underfill epoxies and specialized compounds used in advanced 2.5D and 3D stacking architectures. Furthermore, environmental and regulatory pressures are spurring innovation toward equipment compatible with lead-free soldering processes and environmentally conscious underfill formulations. The technical sophistication required for dispensing across variable production environments—from high-volume manufacturing lines to low-volume, high-mix R&D facilities—necessitates flexible, modular dispensing platforms, driving technological differentiation among key market players. The market continues to evolve toward systems offering greater integration capabilities with upstream and downstream manufacturing processes, such as plasma cleaning and curing ovens, forming a fully automated packaging cell.

Underfill Dispensers Market Executive Summary

The Underfill Dispensers Market is experiencing robust expansion, fundamentally fueled by the paradigm shift towards advanced packaging techniques such as flip-chip and wafer-level packaging across the global electronics supply chain. Current business trends indicate a strong prioritization of high-throughput, automated dispensing systems featuring non-contact jetting technologies, necessitated by the shrinking dimensions of modern semiconductor packages and the increasing complexity of 2.5D and 3D integrated circuits. Manufacturers are heavily investing in systems that offer superior process control through real-time monitoring and predictive maintenance, moving away from manual or semi-automated processes to improve yield rates and reduce operational expenditure (OpEx). Regional trends demonstrate Asia Pacific (APAC), particularly China, South Korea, and Taiwan, maintaining its undisputed dominance, acting as the global hub for semiconductor manufacturing and packaging services (OSATs). The significant capital investments in new fabrication plants and advanced packaging facilities across APAC solidify the region's leading position, while North America and Europe show substantial growth in niche, high-value sectors such as specialized automotive electronics and high-reliability defense and aerospace components. Segment trends highlight that automatic dispensing systems hold the largest market share due to their superior repeatability and speed essential for mass production, while non-capillary underfill (jetting) methods are rapidly gaining traction, particularly for fine-pitch and stacked die applications, displacing traditional capillary methods in high-end markets. The application segment growth is primarily driven by mobile devices and automotive electronics, which demand maximum shock resistance and thermal stability from their embedded microprocessors and memory modules, mandating the use of precision underfill dispensing for long-term reliability.

AI Impact Analysis on Underfill Dispensers Market

User inquiries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) in the Underfill Dispensers Market predominantly center on achieving higher precision, faster process optimization, and enhanced quality control without human intervention. Common questions include how AI algorithms can predict and correct dispensing errors in real-time, whether machine vision systems powered by deep learning can detect microscopic voids or inconsistencies invisible to traditional systems, and how AI can optimize fluid handling parameters for new, experimental underfill materials. Users are particularly keen on leveraging AI for predictive maintenance to minimize unplanned downtime, a major concern in high-volume semiconductor manufacturing. The overarching theme is the expectation that AI integration will transform the dispensing process from a controlled mechanical operation into a self-optimizing, intelligent manufacturing step, leading to zero-defect underfilling and significant reductions in material waste and rework. The summary indicates key user themes are centered around process variability reduction, yield optimization through advanced defect detection, and the development of intelligent feedback loops that automatically adjust dispense volume, speed, and temperature based on real-time sensory data and historical performance patterns across diverse product types.

- AI-driven Predictive Maintenance: Utilizing sensor data to forecast equipment failure (e.g., pump wear, valve blockage), thereby maximizing dispenser uptime and operational efficiency.

- Machine Vision Quality Control (Deep Learning): Deployment of sophisticated AI algorithms to analyze high-resolution images of the dispensed underfill fillet and automatically detect subtle anomalies, voids, or non-uniform flow patterns with greater accuracy than human inspection or standard rule-based vision systems.

- Real-Time Process Optimization: Implementation of ML models to instantaneously adjust dispensing parameters (e.g., pressure, time, temperature, needle height) in response to minor environmental fluctuations or material batch variations, ensuring consistent volumetric accuracy and maximizing yield.

- Automated Recipe Generation: AI tools assisting in the rapid development of optimal dispensing programs for new package designs or materials, significantly reducing the time required for product qualification and process setup.

- Enhanced Traceability and Data Analysis: Using AI to correlate dispensed volume profiles and process logs with downstream reliability testing results, creating a robust feedback loop for continuous manufacturing improvement and detailed historical tracking of individual package quality.

- Robotic Path Planning Optimization: Employing algorithms to determine the most efficient and least vibration-inducing dispensing path over complex PCB layouts, minimizing stress on fragile components and accelerating cycle time.

DRO & Impact Forces Of Underfill Dispensers Market

The dynamics of the Underfill Dispensers Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming critical Impact Forces that dictate strategic investments and technological development within the sector. A principal Driver is the rapid proliferation of advanced semiconductor packaging architectures, such as flip-chip and 3D stacking, necessitated by the demand for higher integration density, superior thermal management, and improved electrical performance in consumer and industrial electronics. This is coupled with the growing necessity for enhanced component reliability in mission-critical applications like autonomous driving systems and high-power military electronics, where component failure is unacceptable. However, significant Restraints exist, notably the substantial initial capital investment required for high-precision, fully automated dispensing equipment, which poses a barrier to entry for smaller manufacturers or those operating on tight margins. Furthermore, the technical complexity associated with ultra-fine pitch dispensing and the successful management of highly thixotropic, fast-curing underfill materials require specialized expertise and rigorous process control, adding to operational overheads. The primary Opportunities lie in the emerging fields of flexible electronics, wearable devices, and bio-medical implants, which demand novel dispensing solutions for highly specialized, flexible substrates and non-traditional packaging formats. The convergence of these forces mandates continuous innovation in fluid mechanics, automation, and real-time sensory feedback, driving the market toward highly intelligent, adaptable dispensing platforms capable of meeting the stringent requirements of next-generation electronic assembly.

Segmentation Analysis

The Underfill Dispensers Market is systematically segmented based on various criteria, including the level of automation, the fundamental dispensing technology utilized, the type of package being processed, and the specific application industry. Understanding these segments is crucial for manufacturers to target specific market niches and allocate resources efficiently for product development. The primary segmentation by Automation Type—Automatic, Semi-automatic, and Manual—reveals the industry's clear trend toward full automation, driven by the need for high volume, high precision, and reduced labor costs, making automatic dispensers the fastest-growing and largest segment. Technology-wise, the market is split into Capillary Underfill Dispensers and Non-Capillary (Jetting) Dispensers; jetting technology is experiencing substantial growth due to its capability for non-contact, ultra-fast, and highly precise deposition, particularly suitable for packages with extremely tight gaps and high component density. Furthermore, the segmentation by Package Type (Flip Chip, BGA, CSP, and WLP) indicates that the demand originating from flip-chip and wafer-level packaging is the highest growth driver, reflecting the current state of advanced semiconductor manufacturing. Finally, application segmentation, covering Mobile Devices, Automotive, Industrial, and Others, confirms the automotive sector's increasing market influence as electronics penetration in vehicles continues to surge globally. Each segment requires specialized equipment tailored to specific material handling requirements, temperature profiles, and throughput expectations, ensuring market diversity and specialized supplier focus across the technological spectrum of electronic packaging.

- By Type of Automation:

- Automatic Dispensers

- Semi-Automatic Dispensers

- Manual Dispensers

- By Technology:

- Capillary Underfill Dispensers (Utilizing gravity and surface tension for flow)

- Non-Capillary/Jetting Dispensers (High-speed, non-contact deposition)

- By Package Type:

- Flip Chip (FC)

- Ball Grid Array (BGA)

- Chip Scale Package (CSP)

- Wafer-Level Packaging (WLP)

- Others (e.g., System-in-Package, 3D Stacks)

- By Application/End-Use Industry:

- Mobile and Consumer Electronics (Smartphones, Tablets, Wearables)

- Automotive Electronics (ADAS, Infotainment, Power Management)

- Industrial and Communication (5G Base Stations, Servers, IoT Devices)

- Aerospace and Defense

- Medical and Healthcare Devices

- By Regional Analysis:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Underfill Dispensers Market

The Value Chain of the Underfill Dispensers Market is a multi-tiered structure beginning with raw material suppliers and culminating in the end-use electronics manufacturers. Upstream analysis focuses on suppliers providing crucial components such as precision fluid handling components (pumps, valves, nozzles), advanced motion control systems (linear motors, robotics), high-resolution machine vision cameras, and specialized software and embedded controllers. These suppliers are critical as the performance and reliability of the dispensing equipment are directly contingent upon the precision and longevity of these constituent parts. Intermediate players in the chain are the Original Equipment Manufacturers (OEMs) of the underfill dispensers themselves, who integrate these specialized components, along with proprietary fluid dynamics and thermal management systems, into a coherent, high-performance automated platform. Downstream analysis involves the direct distribution channel—where OEMs sell directly to major IDMs and large Tier 1 OSATs due to the complexity and high cost of the equipment—and the indirect channel, which involves system integrators or authorized distributors serving smaller electronics assemblers or specific regional markets. The relationship between the OEM and the end-user is often highly collaborative, involving extensive application engineering support and post-installation service, reflecting the capital-intensive nature and critical function of these machines in the semiconductor manufacturing process. This direct interaction helps OEMs rapidly incorporate real-world feedback to improve future dispenser designs, especially concerning compatibility with emerging underfill material chemistries and increasingly complex packaging formats.

The distribution channel for underfill dispensing equipment is predominantly characterized by direct sales and technical support due to the highly specialized nature of the product and the need for application-specific customization. Major semiconductor manufacturers require direct consultation with the OEM to ensure the dispenser seamlessly integrates with existing high-speed production lines, environmental controls, and proprietary manufacturing execution systems (MES). Indirect channels, while less common for flagship, high-throughput automated systems, play a significant role in penetrating smaller, localized markets or specific research institutions where customization requirements might be lower or where regional distributors possess strong local service infrastructure. Key differentiating factors in the value chain include the quality of upstream components, the intellectual property surrounding proprietary jetting and volumetric control technologies held by the OEMs, and the efficiency of the downstream service and support networks. The procurement process for these dispensers is lengthy, involving rigorous technical evaluations and qualification cycles, emphasizing the necessity for strong, trust-based relationships between OEMs and large-scale semiconductor packaging houses. Furthermore, the integration with suppliers of underfill material (epoxy and polymer chemists) is crucial, as the dispenser must be expertly calibrated to handle the specific rheological properties of the chosen material, driving collaboration throughout the supply chain to ensure optimal dispensing results and zero-defect performance in mass production environments.

Underfill Dispensers Market Potential Customers

The primary customers for underfill dispensers are organizations involved in the high-precision assembly and packaging of semiconductor devices, where structural integrity and thermal management are paramount. These include Integrated Device Manufacturers (IDMs) such as Intel, Samsung, and TSMC, who operate their own advanced packaging lines and require the highest caliber of automated dispensing equipment for internal production of microprocessors, memory chips, and custom System-on-Chips (SoCs). Crucially, Outsourced Semiconductor Assembly and Test (OSAT) providers—firms like ASE Technology Holding, Amkor Technology, and JCET Group—represent the largest collective consumer segment. OSATs handle packaging and testing for a multitude of fabless semiconductor companies and IDMs, requiring flexible, high-throughput dispensing platforms capable of processing diverse package types (BGA, CSP, Flip Chip) under strict service level agreements. A rapidly expanding segment of potential customers is found within the Automotive Electronics manufacturers, specifically those producing ADAS control units, autonomous driving processors, and complex power modules. These companies demand exceptionally reliable underfilling to withstand extreme temperature cycling and vibration inherent in vehicular environments. Beyond traditional semiconductor packaging, manufacturers of high-end consumer electronics (e.g., Apple, Huawei) often utilize these dispensers for internal assembly of critical components in premium mobile devices and specialized computing platforms where minimizing package height and maximizing shock resistance are essential design criteria. Finally, specialized customers include aerospace and defense contractors, medical device manufacturers (for highly reliable, miniaturized implants), and research laboratories focused on developing future generations of semiconductor and interconnect technologies. These diverse customer needs drive demand for both ultra-high volume systems and highly flexible, customizable laboratory-scale dispensing platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155 Million |

| Market Forecast in 2033 | USD 265 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nordson Corporation, Illinois Tool Works (ITW) EAE, Mycronic AB, Dispense Works, Inc., Musashi Engineering, Inc., Asymtek (A Nordson Company), DEK (ASM Pacific Technology), Henkel Corporation (through equipment collaborations), PVA TePla AG, GPD Global, EFD (A Nordson Company), Speedline Technologies, Shenzhen Anda Automation, Essemtec AG, Universal Instruments Corporation, FUJI Corporation, ViscoTec Pumpen- u. Dosiertechnik GmbH, DELO Industrial Adhesives (materials partner with system integration), JUKI Corporation, SUSS MicroTec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Underfill Dispensers Market Key Technology Landscape

The technology landscape of the Underfill Dispensers Market is highly advanced and competitive, characterized by continuous innovation aimed at enhancing speed, precision, and material compatibility. The shift from contact dispensing methods to non-contact techniques is the most significant technological trend. Jetting technology, a cornerstone of non-contact dispensing, allows the precise deposition of fluid droplets without physical contact with the substrate, enabling dispensing at higher speeds and over complex, populated boards, which is crucial for fine-pitch and stacked-die applications. Jetting systems use piezoelectric or pneumatic actuation to eject micro-droplets, achieving volumetric accuracies often measured in nanoliters. Furthermore, the reliance on advanced volumetric pumps, such as Positive Displacement Pumps (PCP), is increasing, as these mechanisms ensure highly repeatable dispense volumes regardless of changes in material viscosity or ambient temperature, offering superior control over traditional time-pressure dispensing systems. Modern dispensing platforms are heavily integrated with sophisticated machine vision and laser height sensing systems. These vision systems provide real-time substrate alignment, component recognition, and critical feedback on dispensed material placement and fillet geometry, crucial for ensuring quality assurance and minimizing defects like material run-out or void entrapment.

Another pivotal technological development involves thermal management within the dispensing head and material delivery system. Precise temperature control is essential because underfill epoxies are highly sensitive to temperature variations, which dramatically affect their viscosity and flow characteristics. Dispensers now incorporate advanced thermal regulation systems (often Peltier-based) to maintain material temperatures within a fraction of a degree, ensuring consistent rheology and predictable flow rates for optimal capillary action or jetting performance. Furthermore, integration capabilities are key; modern dispensing equipment is designed to communicate seamlessly with factory automation systems (MES) and upstream processes (like pick-and-place machines and plasma cleaners) and downstream processes (curing ovens), facilitating fully automated, lights-out manufacturing environments. The software powering these machines utilizes complex algorithms for path optimization, fluid dynamics modeling, and adaptive process control. Finally, there is a burgeoning area of research focused on micro-dispensing and multi-material dispensing capabilities, necessary for emerging applications such as micro-LED packaging and highly miniaturized MEMS devices, pushing the boundaries of what is considered "precision fluid delivery" and requiring entirely new nozzle and valve designs optimized for extremely low flow rates and multi-layer deposition patterns.

The next frontier in the technological landscape involves the implementation of robotic process automation (RPA) and autonomous dispensing routines. Advanced dispensers are equipped with complex six-axis robotic arms and highly sophisticated motion control systems that allow them to navigate extremely intricate circuit board landscapes and dispense underfill material around densely packed components without collision or contamination. The use of closed-loop feedback control systems, where sensors continuously monitor parameters like viscosity, material temperature, and dispensing pressure, and automatically adjust the pump speed or valve opening in milliseconds, is standard for premium equipment. This level of real-time control dramatically improves process stability and reduces the impact of external variability, leading to higher yield rates. Furthermore, the development of specialized nozzles and tips, including those with anti-drip features and customizable geometries, caters to the increasing diversity of package sizes and underfill material compositions. The focus on sustainability is also driving technological change, with manufacturers developing systems that minimize material waste and are optimized for faster curing, low-volatile organic compound (VOC) underfills, aligning with stricter environmental regulations. Ultimately, the successful deployment of underfill dispensing technology is characterized by the symbiotic relationship between hardware precision, advanced software control, and material science, all converging to solve the thermo-mechanical reliability challenges of high-density electronic packaging.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for Underfill Dispensers globally, primarily driven by the massive concentration of semiconductor manufacturing, assembly, and testing operations in countries such as China, Taiwan, South Korea, and Japan. This region hosts the majority of global OSAT providers and leading IDMs, leading to unparalleled demand for high-throughput, fully automated dispensing systems to support mass production of consumer electronics (smartphones, PCs) and increasingly, advanced packaging for servers and 5G infrastructure. Government initiatives and significant private sector investments in building new fabrication plants and advanced packaging hubs further solidify APAC's dominance, making it the primary target for equipment suppliers and the global benchmark for production volume and efficiency.

- North America: North America represents a mature yet highly innovative market, characterized by strong demand originating from specialized, high-value sectors, including aerospace, defense, specialized computing (AI/data centers), and advanced medical devices. While production volumes are often lower than in APAC, the demand is for the absolute highest precision and process reliability, often involving highly customized dispensing solutions. The market is driven by technological leadership, particularly in the development and adoption of new packaging technologies (e.g., heterogeneous integration, chiplets) and the use of cutting-edge AI and automation techniques in the dispensing process. Key drivers include defense contracts and the significant R&D spending by leading technology companies in Silicon Valley.

- Europe: The European market for underfill dispensers is robust, focusing primarily on high-reliability automotive electronics, industrial automation, and specialized telecommunications infrastructure. Germany, in particular, is a crucial center for advanced automotive manufacturing, requiring highly reliable dispensing processes for ADAS, engine control units, and electric vehicle power electronics that must withstand harsh operating conditions. The European market prioritizes sustainability and precision engineering, leading to a strong demand for flexible, modular dispensing systems that can handle a high mix of products with stringent quality requirements. Innovation is often concentrated around Industry 4.0 integration, incorporating advanced networking and sensor technologies into the dispensing process.

- Latin America (LATAM): The LATAM region represents a developing market for underfill dispensers, largely focused on electronics assembly for domestic and regional consumer goods and automotive components, particularly in Mexico and Brazil. Demand is primarily driven by local manufacturing facilities supplying global brands, often utilizing mid-range, semi-automatic or older generation automatic equipment. Growth is steady, linked directly to foreign direct investment in manufacturing capabilities and the gradual upgrading of existing assembly lines to handle more complex package types, shifting away from basic SMT towards more advanced packaging required for modern electronics.

- Middle East and Africa (MEA): The MEA market is currently the smallest but exhibits potential growth, primarily concentrated in localized industrial applications, telecommunications infrastructure build-out, and specific defense sectors. Demand often involves specialized, lower-volume, high-reliability dispensing solutions rather than mass-market consumer electronics production. Strategic investments in local manufacturing hubs, particularly in countries focusing on economic diversification and technology infrastructure, could spur future demand for automated dispensing equipment, though the market remains highly dependent on global technology transfer and regional geopolitical stability affecting capital expenditure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Underfill Dispensers Market.- Nordson Corporation

- Illinois Tool Works (ITW) EAE

- Mycronic AB

- Musashi Engineering, Inc.

- Asymtek (A Nordson Company)

- DEK (ASM Pacific Technology)

- PVA TePla AG

- GPD Global

- EFD (A Nordson Company)

- Speedline Technologies

- Shenzhen Anda Automation

- Essemtec AG

- Universal Instruments Corporation

- FUJI Corporation

- ViscoTec Pumpen- u. Dosiertechnik GmbH

- DELO Industrial Adhesives (Technology Partner)

- JUKI Corporation

- SUSS MicroTec

- Dispense Works, Inc.

- AccuPlace

Frequently Asked Questions

Analyze common user questions about the Underfill Dispensers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an underfill dispenser in semiconductor packaging?

The primary function of an underfill dispenser is to apply a precise amount of liquid epoxy underfill material between a semiconductor die and its substrate. This process mechanically couples the components, mitigating thermal stress caused by CTE mismatch, significantly enhancing the reliability and lifespan of critical packages like flip chips, BGAs, and CSPs, especially under thermal cycling or mechanical shock conditions.

Which technological innovation is driving the highest growth in the underfill dispensers market?

Non-contact dispensing, specifically advanced jetting technology, is the leading growth driver. Jetting allows for ultra-high speed and precision dispensing of underfill material without making physical contact with the substrate. This is crucial for handling extremely fine-pitch components and complex, high-density 2.5D and 3D stacked packages that require minimal clearance and maximum speed in manufacturing.

How does the shift to 5G and automotive electronics impact the demand for underfill dispensers?

The shift demands extremely high reliability and thermal stability for embedded components. 5G infrastructure (base stations, core network devices) and automotive ADAS/EV systems use high-power processors and memory modules that generate significant heat. Underfill dispensing is non-negotiable for these applications to ensure the longevity of solder joints under harsh operating conditions, driving strong demand for automated, high-precision dispensing equipment.

What is the main challenge faced when dispensing underfill materials in modern electronics?

The main challenge is achieving defect-free underfilling (void-free) in ultra-fine pitch and low-gap environments. As package gaps shrink below 50 microns, controlling the flow (rheology) of highly viscous underfill material while preventing void entrapment and ensuring consistent material volume repeatability requires sophisticated, temperature-controlled, closed-loop feedback dispensing systems.

What role does Artificial Intelligence play in optimizing the underfill dispensing process?

AI is increasingly used for real-time process control, especially in conjunction with machine vision. AI algorithms analyze live video feedback to detect microscopic defects, automatically adjust dispensing parameters (like pressure and speed) to maintain zero-defect output, and perform predictive maintenance on equipment, thereby optimizing throughput and minimizing material waste in high-volume production lines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager