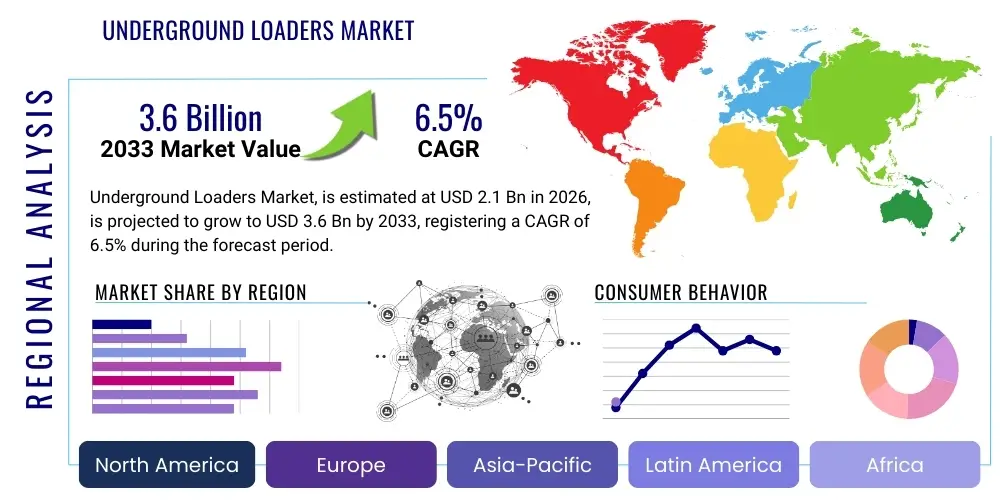

Underground Loaders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436427 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Underground Loaders Market Size

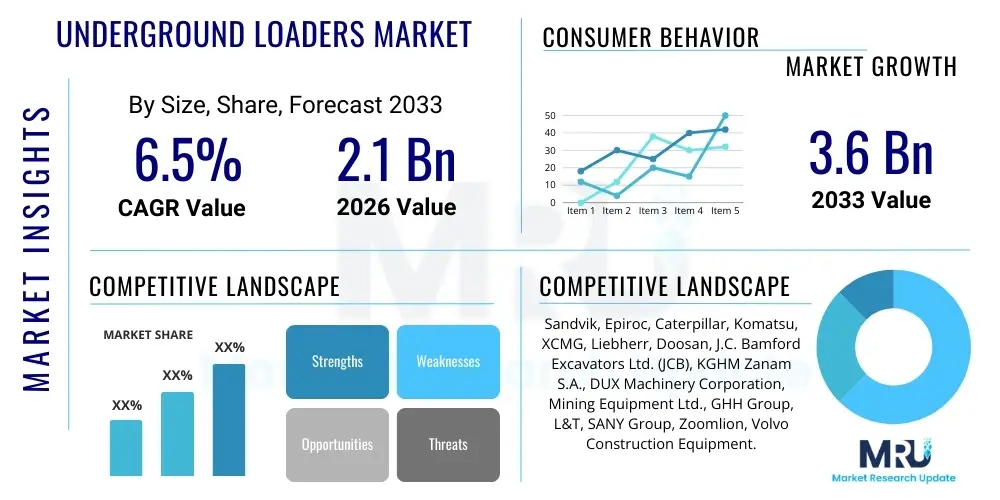

The Underground Loaders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.6 Billion by the end of the forecast period in 2033.

Underground Loaders Market introduction

The Underground Loaders Market encompasses heavy machinery designed specifically for excavation, loading, hauling, and dumping materials in confined subterranean environments such as mines and tunnels. These specialized machines, primarily including Load-Haul-Dump (LHD) loaders and Scoop Trams, are indispensable for maximizing productivity and ensuring safety in operations where space and ventilation are major constraints. They feature compact designs, robust structures, and often incorporate advanced emission control technologies, particularly diesel-electric or fully electric powertrains, to manage air quality underground. The primary application spans metal mining (gold, copper, iron ore), non-metal mining (coal, potash), and increasingly complex large-scale tunneling and infrastructure projects globally.

The core benefits of modern underground loaders include enhanced operational efficiency, reduced labor costs through automation and remote capabilities, and improved safety standards due to features like collision avoidance systems and enclosed operator cabins. The market's evolution is heavily influenced by the deepening of mines, which necessitates more powerful and efficient equipment capable of operating in harsher conditions, alongside the global push toward sustainability, driving the demand for battery-electric vehicles (BEVs). The technological shift toward electrification is a major product development trend, addressing environmental regulations and improving operational uptime by reducing heat generation compared to traditional diesel engines.

Driving factors propelling market expansion include the sustained global demand for critical minerals required for green energy transition technologies (such as copper and nickel), robust infrastructure spending, and the necessity for mining companies to optimize their underground fleets to maintain competitive production costs. Furthermore, advancements in digital mining technologies, allowing for integration with mine management systems, predictive maintenance, and autonomous operation, are accelerating the replacement cycle of older machinery, solidifying the loader's role as a core asset in modern mining operations.

Underground Loaders Market Executive Summary

The Underground Loaders Market is witnessing a significant paradigm shift driven by stringent environmental regulations and the critical need for operational efficiency in deep mines. Business trends point toward consolidation among original equipment manufacturers (OEMs) focusing on delivering integrated fleet management solutions and modular designs that allow for flexible customization based on mine geometry. The most compelling business driver is the rapid transition from conventional diesel loaders to battery-electric LHDs, which offer superior ventilation cost savings and lower total cost of ownership (TCO) in the long run, positioning electrification as the core competitive advantage for market leaders like Sandvik and Epiroc. Strategic investments in after-market services and digital optimization packages are also crucial for maintaining long-term customer relationships and revenue stability.

Regionally, the market dynamic is dominated by established mining hubs such as North America and Australia, which are early adopters of automation and electric loaders due to high labor costs and existing infrastructure supporting sophisticated technology deployment. However, the Asia Pacific region, particularly China and India, presents the highest growth potential, fueled by massive domestic infrastructure development and the increasing mechanization of traditionally labor-intensive coal and non-metal mines. Latin America, rich in copper and gold reserves, continues to be a crucial market, focusing primarily on high-capacity loaders suitable for large-scale operations, although adoption rates of full automation remain variable depending on local investment capacity and regulatory frameworks.

In terms of segmentation, the high-capacity segment (Over 10 Tons) commands the largest market share by revenue, essential for bulk material movement in deep hard-rock mines. However, the 5-10 Ton capacity segment is projected to exhibit the fastest growth, favored in medium-sized operations and specialized tunneling projects requiring versatility. The most significant segment trend is the overwhelming demand for LHD Loaders over traditional Scoop Trams due to their superior maneuverability, ergonomic design, and higher compatibility with advanced automation packages. End-user demand remains highest within the Metal Mining sector, which provides the necessary capital intensity for adopting next-generation, high-cost electric and autonomous machinery.

AI Impact Analysis on Underground Loaders Market

User queries regarding the impact of Artificial Intelligence (AI) on Underground Loaders commonly revolve around themes of autonomous operation, predictive maintenance accuracy, and safety implications. Key concerns frequently raised include the reliability of AI decision-making systems in dynamic, unstructured underground environments, the necessary infrastructure upgrades (like high-bandwidth wireless networking) required for deployment, and the potential displacement of skilled human operators. Users are highly interested in how AI can optimize loading patterns and truck cycles to reduce fuel consumption (or battery drain) and minimize tire wear. Expectations are high concerning AI's role in real-time geological analysis and adapting loader behavior to changing rock density or tunnel contours, moving beyond simple programmed automation to true cognitive autonomy.

The integration of AI into underground loader operations is rapidly transforming productivity benchmarks. AI algorithms leverage data from multiple sensors—Lidar, cameras, inertial measurement units (IMUs)—to create precise digital twins of the mine environment, enabling fully autonomous cycles from muck pile penetration to dumping. Furthermore, AI-driven diagnostics are moving maintenance from reactive to prescriptive, analyzing vibration data, fluid analysis, and performance metrics to predict component failure with unprecedented accuracy, thereby dramatically reducing unplanned downtime, which is exceptionally costly in subterranean operations.

Beyond vehicle control and maintenance, AI enhances safety protocols by processing complex sensory data faster than human operators, facilitating immediate risk assessment. This includes identifying unauthorized personnel in the blast zone, detecting potentially unstable ground conditions, and managing traffic flow of multiple autonomous and manned vehicles simultaneously in congested tunnels. This transition necessitates new skill sets for remote supervisors and maintenance personnel, shifting the focus from manual operation to data interpretation and system management.

- AI enables full autonomous loading and hauling cycles, optimizing bucket fill factors and minimizing cycle times.

- Predictive Maintenance powered by machine learning analyzes component telemetry to forecast failures, minimizing costly unplanned operational stoppages.

- Real-time situational awareness and collision avoidance systems are significantly enhanced through AI-driven sensor fusion.

- Optimization of energy consumption (diesel or battery) via AI routing and dynamic speed control based on gradient and load.

- AI algorithms assist in remote tele-operation by filtering environmental noise and providing enhanced visualization cues to the surface operator.

DRO & Impact Forces Of Underground Loaders Market

The dynamics of the Underground Loaders Market are shaped by powerful Drivers promoting growth, necessary Restraints curbing adoption, and strategic Opportunities offering long-term expansion potential. The primary driver is the accelerating trend of mining digitalization and automation, essential for reaching resources in deeper, more challenging orebodies while adhering to strict safety standards. Concurrently, the increasing global demand for battery minerals (lithium, cobalt, copper, nickel) has spurred capital expenditure in hard-rock mining sectors, directly increasing the procurement of high-capacity and technologically advanced loaders. These forces are amplified by the necessity to counteract rising labor costs and the scarcity of skilled subterranean operational personnel, making autonomous machinery an economic imperative rather than a luxury.

Conversely, significant restraints hinder widespread deployment, primarily centered around the substantial initial capital investment required for high-tech autonomous and electric fleets, especially concerning charging infrastructure and secure underground communication networks. Furthermore, the inherent conservatism within the mining industry, coupled with complex regulatory approval processes for new technology deployment in varied geological settings, slows down market penetration. The reliance on highly complex software and sensor arrays also introduces new operational risks, including cybersecurity vulnerabilities and the requirement for highly specialized maintenance technicians, which can be difficult to source in remote mining locations.

Opportunities for market stakeholders lie predominantly in the refinement of battery technology, aiming for longer operational shifts and faster charging cycles, making electric loaders viable for all mining types. Additionally, the proliferation of subscription-based or Equipment-as-a-Service (EaaS) models reduces the high initial financial barrier for smaller mining companies, promoting faster technology adoption. Impact forces are currently dominated by the electrification push (high positive impact) and global commodity price volatility (high moderate impact). The electrification force requires manufacturers to rapidly innovate, while commodity cycles dictate the cyclical nature of mining capital expenditure, acting as a crucial external constraint on immediate purchase decisions.

Segmentation Analysis

Segmentation of the Underground Loaders Market provides critical insights into purchasing trends and technological preferences across diverse mining and tunneling applications. The market is primarily segmented based on the machine’s power source (diesel, electric/battery), capacity (tonnage), and the specific end-user industry. Analyzing these segments helps OEMs tailor their product offerings, focusing R&D efforts on areas demonstrating the highest growth potential, such as the battery-electric LHD segment, which caters directly to the sustainability goals of major mining corporations.

Capacity segmentation is particularly revealing, as the move toward deeper and larger-scale operations globally necessitates increasingly powerful equipment. While the mid-capacity segment (5-10 Tons) historically offered flexibility for development and production, the Over 10 Tons segment is driven by efficiency metrics in massive block caving and high-production panel mining. End-user segmentation confirms the dominance of hard-rock metal mining as the largest consumer of underground loaders due to the demanding nature of the material handling and the high investment capacity inherent in gold, copper, and platinum operations.

The most important evolving segmentation is the adoption rate of technology, specifically the separation between manned, remote-controlled, and fully autonomous loaders. While fully autonomous solutions are currently premium offerings concentrated in advanced jurisdictions like North America and Australia, the demand for remote-controlled loaders is widespread, offering a cost-effective solution for worker safety in hazardous areas across nearly all geographies. This technological divergence is creating distinct sub-markets within the capacity and end-user segments, forcing manufacturers to offer a scalable technology stack.

- By Type:

- LHD (Load-Haul-Dump) Loaders

- Scoop Trams

- By Capacity:

- Under 5 Tons

- 5-10 Tons

- Over 10 Tons

- By Power Source:

- Diesel

- Electric (Tethered)

- Battery Electric Vehicle (BEV)

- By End-User:

- Metal Mining (Gold, Copper, Nickel, Iron Ore)

- Non-Metal Mining (Potash, Salt, Industrial Minerals)

- Coal Mining

- Construction and Tunneling

Value Chain Analysis For Underground Loaders Market

The value chain for the Underground Loaders Market is characterized by a high degree of integration between upstream component suppliers and downstream end-users, managed predominantly by a few global OEMs. The upstream phase involves the procurement of specialized components such as heavy-duty axles, sophisticated powertrain systems (especially high-density batteries and electric motors), hydraulic systems, and advanced sensor technology for automation. Dependency on high-quality component suppliers, particularly those providing robust telematics and AI processing units, dictates the final performance and reliability of the loaders. OEMs maintain strong, often proprietary, relationships with these suppliers to ensure technological consistency and secure specialized part availability, a crucial competitive factor in the high-cost machinery segment.

The core value creation lies in the manufacturing and assembly phase, where OEMs like Caterpillar, Sandvik, and Epiroc design and integrate these specialized components into the compact, highly durable frames required for underground operations. This stage also includes the development and deployment of proprietary software and control systems crucial for remote operation and autonomy. OEMs invest heavily in R&D to optimize machine footprints, enhance fuel efficiency (or battery longevity), and incorporate sophisticated safety features, adding significant value before the product reaches the distribution channel. Direct distribution, where the OEM sells and supports the equipment using their own global network, is the prevalent model due to the technical complexity and high cost of the machinery.

The downstream segment focuses heavily on post-sale services, including maintenance, repairs, parts supply, and digital service contracts (telematics and fleet management software). Direct channels ensure that highly trained service technicians, often specialized in the OEM’s unique automation systems, are deployed for support, maximizing machine uptime. Indirect channels are used sparingly, often through certified regional dealers in smaller, developing markets. The relationship with end-users, predominantly large mining companies, is long-term and consultative, emphasizing TCO optimization, training, and continuous technology upgrades, demonstrating that the service component is as crucial as the physical asset in this capital-intensive market.

Underground Loaders Market Potential Customers

The primary consumers and buyers in the Underground Loaders Market are large-scale mining corporations and major infrastructure development agencies involved in complex subterranean projects. These customers operate under demanding economic pressures, necessitating equipment that offers high throughput, exceptional durability, and stringent safety compliance. Within the mining sector, gold, copper, and iron ore producers represent the most significant customer base, as these commodities often require extensive hard-rock mining methods where LHD loaders are foundational to the production process. These large entities possess the necessary capital expenditure budgets to invest in premium, high-automation, and electric loader fleets, viewing them as strategic assets for long-term productivity gains and environmental compliance.

A secondary, yet rapidly expanding, segment of potential customers includes smaller and mid-tier mining companies focused on critical minerals, particularly those engaging in deep and narrow-vein mining operations. While these customers may be more sensitive to initial costs, their accelerating need for mechanized solutions to address safety risks and improve efficiency in confined spaces drives the demand for smaller, versatile LHDs and reliable remote-control systems. Financing solutions and flexible leasing options provided by OEMs are increasingly tailored to address the financial constraints and shorter operational timelines characteristic of these mid-sized players.

Furthermore, government agencies and private consortiums involved in large-scale civil engineering and infrastructure projects, such as metropolitan tunnel construction, high-speed rail lines, and hydro-power generation tunnels, constitute a distinct and valuable customer segment. These customers prioritize machine reliability and low emissions, especially when working near urban centers. The equipment specifications here often emphasize compactness, maneuverability, and electric power sources to manage ventilation challenges unique to construction environments, differentiating their procurement requirements from those in mineral extraction operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.6 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik, Epiroc, Caterpillar, Komatsu, XCMG, Liebherr, Doosan, J.C. Bamford Excavators Ltd. (JCB), KGHM Zanam S.A., DUX Machinery Corporation, Mining Equipment Ltd., GHH Group, L&T, SANY Group, Zoomlion, Volvo Construction Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Underground Loaders Market Key Technology Landscape

The technological evolution of the Underground Loaders Market is fundamentally centered on three pillars: autonomy, electrification, and connectivity. Autonomy systems represent a substantial leap, moving from basic remote control to sophisticated, programmed operations capable of dynamic decision-making in real-time, leveraging LiDAR, high-definition cameras, and advanced inertial navigation systems (INS). Key OEMs are developing proprietary navigation software that minimizes human intervention and allows a single operator to manage multiple units simultaneously from a surface control room. This transition requires extremely ruggedized onboard computing power capable of processing massive datasets under harsh subterranean conditions, significantly enhancing the operational safety profile by removing personnel from high-risk zones.

Electrification, specifically the rise of Battery Electric Vehicles (BEVs), is the single most transformative technology currently reshaping the product landscape. BEV loaders utilize high-capacity lithium-ion or lithium-iron phosphate battery packs, eliminating exhaust emissions entirely and dramatically reducing the need for costly and complex underground ventilation systems, which are major operational expenses in deep mining. Manufacturers are focusing R&D efforts on battery thermal management systems (BTMS) and rapid charging solutions, such as battery swapping technologies, to maximize machine utilization and achieve parity with the operational endurance of traditional diesel loaders. This technology not only addresses environmental concerns but also provides a quieter, cooler working environment, even for manned operations.

Connectivity and digital integration, facilitated by robust underground Wi-Fi or 5G networks, underpin the successful deployment of both autonomy and electric power. Modern loaders are equipped with advanced telematics that transmit vast amounts of data regarding machine health, production metrics, and operational efficiency back to surface servers. This connectivity enables predictive maintenance, real-time fleet management, and deep data analysis through integrated Enterprise Resource Planning (ERP) and Mine Management Systems. Furthermore, the development of standardized protocols for communication between equipment from different vendors is gaining traction, crucial for optimizing mixed-fleet operations within complex mining ecosystems.

Regional Highlights

- North America: This region stands as a leader in the adoption of cutting-edge technology, particularly automation and battery-electric loaders. Driven by high labor costs, stringent safety regulations enforced by bodies like MSHA (Mine Safety and Health Administration), and the presence of highly technical mining operations, North American miners prioritize TCO savings derived from reduced ventilation requirements and increased uptime through autonomy. Major copper, gold, and potash mines in Canada and the United States are critical early adopters, frequently piloting new generation equipment from major OEMs. The market demand here focuses on high-capacity units and seamless integration with existing digital infrastructure.

- Europe: The European market is heavily influenced by strict environmental directives and the drive toward carbon neutrality, making it a strong proponent of the BEV segment. Key markets like Scandinavia (Sweden and Finland), with significant iron ore and base metal mining operations, are global benchmarks for electric underground mining. While the total market size may be smaller than APAC, the market value is extremely high due to the premium placed on highly efficient, low-emission machinery and the extensive use of remote and semi-autonomous systems tailored for narrow-vein mining applications. Regulations strongly favor innovative safety features and environmental performance.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by massive coal mining activities (though transitioning) and rapid urbanization leading to extensive tunneling and infrastructure construction in countries like China and India. The demand in APAC is twofold: high volume demand for affordable, mid-range capacity diesel loaders in developing areas, and accelerating demand for advanced electric and autonomous loaders in technologically mature markets like Australia. Australia, with its vast iron ore and gold reserves, mirrors North America's trend toward high automation and electrification, acting as a crucial regional innovation hub, while Southeast Asia focuses more on basic mechanization to replace manual labor.

- Latin America (LATAM): This region is essential due to its immense reserves of copper (Chile, Peru) and gold. The market is defined by the requirement for extremely rugged, high-capacity loaders capable of operating efficiently in deep, high-production mines. While cost sensitivity remains a factor, the pressure to maximize ore extraction drives the acceptance of advanced machinery. Adoption of full automation is still nascent compared to North America, but remote control technology for deep shaft and block caving applications is widespread. OEMs often tailor service models to address the logistical challenges of operating in remote mountainous and desert environments characteristic of the region.

- Middle East and Africa (MEA): The MEA market, while varied, is focused primarily on mechanization and capacity expansion in gold (West Africa, South Africa) and phosphate mining. South Africa traditionally dominated the regional market but faces operational challenges. The growth opportunity lies in the introduction of modern, robust loaders to replace aging fleets and improve safety standards. Adoption rates for electrification are slower due to energy infrastructure constraints in many areas, meaning reliable, high-efficiency diesel models still dominate, though interest in modular and easy-to-maintain equipment is high.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Underground Loaders Market.- Sandvik

- Epiroc

- Caterpillar

- Komatsu

- XCMG

- Liebherr

- Doosan

- J.C. Bamford Excavators Ltd. (JCB)

- KGHM Zanam S.A.

- DUX Machinery Corporation

- Mining Equipment Ltd.

- GHH Group

- L&T

- SANY Group

- Zoomlion

- Volvo Construction Equipment

- Kawasaki Heavy Industries

- John Deere (Hitachi partnership)

- Toro Company

Frequently Asked Questions

Analyze common user questions about the Underground Loaders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards Battery Electric Vehicles (BEVs) in underground loading?

The primary drivers are the elimination of noxious diesel emissions, which significantly reduces the substantial operational cost associated with underground ventilation systems, along with the lower maintenance requirements and reduced heat generation of electric powertrains.

How does automation technology enhance safety in underground mining operations?

Automation, utilizing remote control and autonomous systems, removes human operators from high-risk environments such as blast areas and unstable ground zones. Additionally, systems incorporate AI-driven collision avoidance and real-time environment monitoring to prevent accidents.

Which capacity segment of underground loaders is expected to show the highest growth?

While the Over 10 Tons segment dominates revenue, the 5-10 Tons capacity segment is projected to show the fastest growth rate. This is due to its versatility, suitability for mid-sized mines, and high adoption in complex urban tunneling and infrastructure projects globally.

What are the main constraints hindering the widespread adoption of autonomous loaders?

Key constraints include the high initial capital investment required for both the equipment and the necessary secure, high-bandwidth underground communication infrastructure (Wi-Fi/5G), along with regulatory hurdles and the need for specialized technical expertise for maintenance.

Which geographical region leads the global market in terms of technological adoption of underground loaders?

North America and Australia are the leading regions for technological adoption, primarily due to their high labor costs and advanced mining operations, which necessitate immediate deployment of high-cost, fully autonomous, and battery-electric underground loader fleets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager