Underground Utility Cable Locators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433292 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Underground Utility Cable Locators Market Size

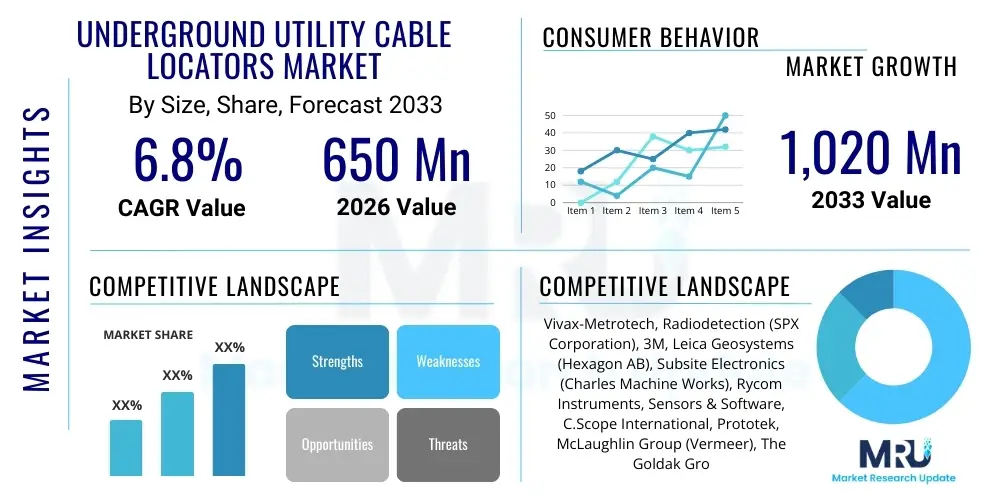

The Underground Utility Cable Locators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,020 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by stringent government regulations mandating accurate utility mapping before excavation, coupled with massive global investments in critical infrastructure renewal and expansion, particularly in developing economies. The increasing complexity and density of buried infrastructure necessitate advanced localization technologies to prevent costly and dangerous utility strikes.

Underground Utility Cable Locators Market introduction

The Underground Utility Cable Locators Market encompasses specialized electronic devices designed to non-invasively detect, trace, and map the precise location and depth of buried metallic and non-metallic utility lines, including power cables, telecommunication conduits, gas pipelines, and water mains. These instruments operate primarily using electromagnetic induction (for metallic lines) or Ground Penetrating Radar (GPR) technology (for both metallic and non-metallic lines). The core product involves a transmitter that applies a signal to the utility line and a receiver that detects the resultant electromagnetic field or radar reflections, providing accurate positional data to the operator.

Major applications span across construction, telecommunications, electricity distribution, water management, and oil and gas sectors, where damage prevention is paramount for safety, operational continuity, and financial stability. The key benefits derived from using these locators include significant reduction in utility strikes, protection of personnel, minimized excavation costs, and faster project completion times due to improved pre-construction planning. Furthermore, the adoption of digital mapping capabilities and integration with GIS systems enhances the overall efficiency and data management for utility companies and contractors.

Key driving factors accelerating market growth include escalating urbanization requiring continuous mapping updates, aging infrastructure necessitating precise repair and replacement, and a growing global emphasis on worker safety standards and liability reduction associated with accidental damage to vital underground services. Technological advancements, such as multi-frequency capabilities, improved signal processing, and integration with GPS/GNSS, further enhance the accuracy and versatility of modern cable locating equipment, pushing market boundaries towards more sophisticated and integrated solutions.

Underground Utility Cable Locators Market Executive Summary

The Underground Utility Cable Locators Market is experiencing robust expansion driven by global infrastructure modernization programs and stringent regulatory frameworks enforcing "locate before you dig" protocols. Business trends indicate a strong shift towards the adoption of integrated GPR-electromagnetic systems, enabling contractors to locate a broader spectrum of utilities, including non-metallic pipes and fiber optic cables, which are otherwise invisible to traditional electromagnetic methods. Manufacturers are focusing heavily on developing user-friendly interfaces, enhanced depth accuracy, and cloud-connectivity features to streamline fieldwork and data management. Strategic partnerships between locator manufacturers and GIS software providers are crucial for offering comprehensive utility mapping solutions, enhancing the overall value proposition in the market ecosystem.

Regionally, North America and Europe maintain dominance, primarily due to well-established regulations, high infrastructure density, and substantial spending on utility maintenance and replacement. However, the Asia Pacific region is poised for the fastest growth, fueled by rapid urbanization, massive public and private investments in telecommunication networks (especially 5G), and electrification projects across countries like China, India, and Southeast Asia. Emerging markets in Latin America and the Middle East and Africa are also showing accelerated adoption driven by large-scale energy and water infrastructure development, requiring reliable location technologies for project execution and asset protection.

Segmentation trends highlight the increasing preference for advanced locator types, particularly sophisticated electromagnetic locators with automated features and Ground Penetrating Radar (GPR) units. While the traditional power utility segment remains a significant consumer, the telecommunication sector, propelled by fiber optic deployment, is becoming a primary growth engine. Components analysis shows robust demand for sophisticated receiver units capable of multi-frequency detection and data logging, reflecting the industry's need for higher accuracy, traceability, and compliance documentation required by utility owners and governing bodies.

AI Impact Analysis on Underground Utility Cable Locators Market

Common user questions regarding AI's influence typically revolve around how artificial intelligence can improve detection accuracy, automate the interpretation of complex subsurface data, and reduce reliance on highly skilled human operators. Users frequently ask about the integration of machine learning algorithms to filter out noise, distinguish between different types of utilities in dense environments, and predict utility paths based on surrounding geographical and historical data. Key concerns often focus on the required computational power, the cost of AI-enabled systems, and the reliability of automated interpretations compared to expert human analysis. Overall, users anticipate that AI will transition utility location from a reactive detection process to a proactive, predictive mapping discipline, drastically enhancing safety and efficiency.

The integration of AI and Machine Learning (ML) is beginning to revolutionize data processing within the utility locating domain, particularly for Ground Penetrating Radar (GPR) data which traditionally requires extensive expertise for interpretation. AI algorithms can be trained to recognize patterns indicative of pipes, cables, or non-utility subsurface structures, drastically reducing the time needed for analysis and improving the reliability of detection in cluttered or challenging soil conditions. Furthermore, AI assists in optimizing signal processing in electromagnetic locators by automatically adjusting frequency settings and filtering out electromagnetic interference (EMI) noise, thereby enhancing the signal-to-noise ratio and depth penetration capability, leading to fewer false positives and more confident locates.

Beyond detection, AI facilitates advanced data fusion by combining locator data (depth, position) with GIS layers, satellite imagery, and historical maintenance records to create comprehensive, predictive digital twins of the subsurface environment. This predictive capability allows operators to assess risk zones automatically and generate optimal survey routes. The deployment of autonomous or semi-autonomous locating robots equipped with AI-driven sensing platforms is an emerging area, promising continuous, high-speed mapping of large infrastructure corridors without continuous human intervention, thereby addressing labor shortages and enhancing mapping scalability.

- AI enhances GPR data interpretation through automated pattern recognition and anomaly detection.

- Machine learning improves electromagnetic noise filtering and optimizes frequency selection for better signal accuracy.

- Predictive analytics model potential utility routes based on historical infrastructure data and environmental factors.

- Automated risk assessment based on AI-analyzed subsurface complexity reduces human error and improves safety protocols.

- AI facilitates the fusion of locating data with GIS systems to generate highly accurate, real-time subsurface utility maps.

DRO & Impact Forces Of Underground Utility Cable Locators Market

The Underground Utility Cable Locators Market is principally driven by regulatory mandates, notably "One Call" or "811" requirements across major global markets, making pre-excavation location services compulsory to prevent significant damage and injury. Restraints include the high initial capital investment required for advanced locating equipment, particularly GPR systems, and the necessity for specialized training and certification to operate complex multi-frequency and digital locators effectively. Opportunities are centered on the rapid technological shift toward multi-sensor systems, data integration with Building Information Modeling (BIM) and GIS platforms, and the untapped potential in developing economies where utility mapping is nascent but accelerating due to infrastructure megaprojects. Impact forces, such as the constant evolution of utility materials (e.g., non-metallic pipes) and the increasing frequency of extreme weather events necessitating rapid, accurate damage assessment, exert pressure on manufacturers to deliver more resilient and versatile locating solutions.

Segmentation Analysis

The Underground Utility Cable Locators Market is comprehensively segmented based on technology type, the specific application sector, and the component structure of the equipment. This segmentation allows for precise market sizing and strategic development, highlighting areas of rapid innovation such as Ground Penetrating Radar (GPR), which addresses the limitations of traditional electromagnetic (EM) methods in locating non-conductive utilities. The primary market consumption is driven by essential services, specifically the electricity and telecommunication sectors, due to the high consequence and frequency of damage risks associated with these utilities. Geographically, segmentation provides critical insights into regulatory compliance levels and infrastructure investment trends, dictating the regional demand for varying technological sophistication levels. Understanding these segments is vital for manufacturers positioning their product portfolios, ranging from affordable entry-level electromagnetic locators for basic metallic lines to high-end GPR units integrated with advanced positioning systems for complex urban environments.

- By Type:

- Electromagnetic Locators (EM)

- Ground Penetrating Radar (GPR)

- Other Advanced Locating Technologies (e.g., Acoustic)

- By Application (End-Use Industry):

- Telecommunication (Fiber optic, copper cable mapping)

- Electricity & Power Distribution

- Water & Wastewater Management

- Oil & Gas Pipelines

- Transportation Infrastructure (Roads, Rail)

- Construction & Surveying

- By Component:

- Transmitters (Signal Generators)

- Receivers (Wand/Detection Units)

- Accessories (Probes, Clamps, Cables, Software)

Value Chain Analysis For Underground Utility Cable Locators Market

The value chain for the Underground Utility Cable Locators Market commences with upstream activities involving core technology research and development, particularly focusing on sensor technology, signal processing algorithms, and advanced material sourcing for durable hardware components. Key suppliers include specialized electronics manufacturers providing high-frequency antennas, robust digital signal processors (DSPs), and high-resolution display units. Innovation at this stage is crucial, as the performance and accuracy of the final product are heavily dependent on the quality and sophistication of these specialized components, driving competition among semiconductor and sensor providers to offer smaller, faster, and more sensitive detection technology optimized for subsurface environments.

Downstream activities involve the crucial stages of manufacturing, assembly, and rigorous calibration and testing, often followed by direct sales or distribution through specialized channels. The distribution network is bifurcated into direct sales channels, favored by large enterprise clients (major utility companies) seeking tailored solutions, training, and long-term service contracts, and indirect channels relying on specialized distributors, rental companies, and regional equipment dealers who possess localized expertise and access to small-to-midsize contractors. These distributors often add value through localized training, technical support, and rapid access to parts and repair services, which are critical given the demanding field conditions under which the equipment operates.

The effectiveness of the value chain is highly reliant on post-sale services, including software updates, calibration certifications, and ongoing technical support, as regulatory compliance often requires locators to be calibrated annually. Direct channel sales maximize manufacturer margins and control over customer experience but demand significant investment in regional service infrastructure. Indirect channels provide broader market reach and penetration into diverse geographical areas and smaller contracting firms, making the dealer network an indispensable link in achieving widespread market adoption, particularly in regions where complex regulatory training is often provided at the distributor level.

Underground Utility Cable Locators Market Potential Customers

Potential customers, or the end-users and buyers of underground utility cable locators, primarily include professional contractors specializing in excavation, horizontal directional drilling (HDD), and general civil engineering. These entities are directly responsible for compliance with "One Call" laws and bear the immediate risk and liability associated with utility strikes, making accurate location technology essential for operational continuity and liability management. Their procurement decisions are heavily influenced by the equipment's accuracy, ease of use, durability, and compliance capabilities, often preferring integrated systems that provide geo-referenced data output.

Major utility owners, including electric power companies, national telecommunication providers, municipal water authorities, and large gas pipeline operators, represent another significant customer base. These organizations purchase locators for internal use by their maintenance and engineering departments for planned repair work, infrastructure surveying, and asset management documentation. Their focus is often on high-precision, robust equipment capable of logging extensive data for audit trails and integration into proprietary GIS databases, driving demand for technologically advanced and highly reliable GPR and multi-frequency EM locators suitable for complex environments.

Additionally, regulatory bodies, government public works departments, and specialized surveying and mapping firms constitute a niche but important customer segment. Surveying firms utilize these locators to provide subsurface utility engineering (SUE) services, mapping and designating utility infrastructure for construction planning projects. Their requirements emphasize extremely high levels of accuracy, certification standards, and interoperability with professional surveying equipment, such as total stations and GNSS receivers, ensuring that the collected utility data meets established professional engineering standards for quality level determination.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,020 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vivax-Metrotech, Radiodetection (SPX Corporation), 3M, Leica Geosystems (Hexagon AB), Subsite Electronics (Charles Machine Works), Rycom Instruments, Sensors & Software, C.Scope International, Prototek, McLaughlin Group (Vermeer), The Goldak Group, Ridgid (Emerson), Cable Detection Ltd, Hilti, IDS GeoRadar (Hexagon AB), T&T Tools, Ditch Witch, MetroTech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Underground Utility Cable Locators Market Key Technology Landscape

The core technology landscape is bifurcated between electromagnetic (EM) induction and Ground Penetrating Radar (GPR), with continuous innovation enhancing the capabilities of both platforms. EM locators utilize multi-frequency signal transmission (low, medium, and high frequencies) to adapt to varying ground conditions and utility types, improving coupling efficiency and depth accuracy. Recent advancements in EM technology focus heavily on digital signal processing (DSP) to automatically reject interference from surrounding electromagnetic noise, especially prevalent in congested urban settings. Furthermore, integration of high-precision GNSS modules directly into the receiver unit allows for simultaneous location and geo-referencing, streamlining the mapping workflow and enhancing data quality for immediate use in GIS systems and digital construction models.

Ground Penetrating Radar (GPR) systems represent the high-growth segment, crucial for locating non-metallic utilities like plastic pipes, concrete ducts, and fiber optic conduits without tracer wires. Modern GPR systems feature multi-channel and array antennae configurations, allowing for 3D mapping and enhanced subsurface visualization. Key technological shifts include the application of ultra-wideband (UWB) radar technology for better resolution and depth penetration, often paired with sophisticated software algorithms (including basic AI/ML) to automate interpretation of hyperbolas, thereby simplifying the user experience and decreasing the high skill threshold traditionally required to operate GPR effectively in demanding applications.

The market is increasingly characterized by sensor fusion, where EM locators and GPR units are often used complementarily or integrated into single hardware platforms to leverage the strengths of each technology. Furthermore, advancements in data connectivity, including Bluetooth and Wi-Fi capabilities, enable real-time data synchronization with cloud platforms and remote diagnostics, moving the industry toward a digitally integrated subsurface utility management ecosystem. This integration minimizes manual data entry errors, ensures regulatory compliance through traceable documentation, and facilitates the creation of a persistent digital record of all located infrastructure, significantly impacting lifecycle asset management.

Regional Highlights

- North America: This region holds the largest market share due to stringent safety regulations (e.g., 811 Call Before You Dig), extensive aging infrastructure requiring constant maintenance and replacement, and high adoption rates of advanced GPR and multi-frequency EM technologies. Significant capital expenditure in pipeline safety and fiber optic deployment reinforces demand.

- Europe: Europe is characterized by regulatory harmonization (EU standards) and substantial investments in smart city projects and digitalization of utility networks. Germany, the UK, and France are key markets, showing high demand for precise mapping tools to handle dense, centuries-old urban utility networks, driving the adoption of high-resolution GPR systems.

- Asia Pacific (APAC): Expected to register the highest CAGR, driven by rapid urbanization, massive infrastructure development in telecommunications (5G rollout) and electrification projects, particularly in China and India. While price sensitivity exists, safety regulations are tightening, leading to accelerated technology adoption, shifting from basic tools to professional-grade locators.

- Latin America (LATAM): Growth is steady, supported by investments in oil and gas infrastructure and modernization of power grids. Brazil and Mexico are leading the market, though infrastructure project funding can be volatile, influencing the purchasing cycles for high-end equipment.

- Middle East and Africa (MEA): This region is witnessing substantial demand fueled by large-scale energy projects and utility expansions in the GCC countries. The requirement for locating utilities in challenging soil and sand conditions drives specific demand for robust GPR systems and specialized electromagnetic locators designed for extreme environmental resilience.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Underground Utility Cable Locators Market.- Vivax-Metrotech

- Radiodetection (SPX Corporation)

- Leica Geosystems (Hexagon AB)

- Subsite Electronics (Charles Machine Works/The Toro Company)

- 3M

- Rycom Instruments

- Sensors & Software Inc.

- C.Scope International Ltd.

- Prototek

- McLaughlin Group (Vermeer Corporation)

- The Goldak Group

- Ridgid (Emerson Electric Co.)

- Cable Detection Ltd.

- Hilti Corporation

- IDS GeoRadar (Hexagon AB)

- T&T Tools

- Ditch Witch (The Toro Company)

- MetroTech

- GeoModel, Inc.

- Zond Systems Inc.

Frequently Asked Questions

Analyze common user questions about the Underground Utility Cable Locators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Underground Utility Cable Locators Market?

The market is primarily driven by global regulatory mandates, such as "Call Before You Dig" programs (like 811 in the U.S.), which legally require the accurate location and marking of all buried utilities before any excavation to prevent strikes, minimize downtime, and ensure public safety.

How are Ground Penetrating Radar (GPR) systems different from traditional Electromagnetic (EM) locators?

EM locators detect conductive, metallic utilities by sensing the electromagnetic field generated by a transmitter or natural currents. GPR systems, conversely, use radar pulses to detect changes in subsurface material properties, making them essential for locating non-metallic utilities, such as plastic pipes or fiber conduits without tracer wires, which EM systems cannot detect alone.

Which industry segment is expected to witness the highest adoption rate of advanced locating technology?

The Telecommunication segment is experiencing the highest growth in advanced technology adoption, particularly GPR and multi-frequency EM locators, driven by the massive global rollout of 5G networks, which necessitates extensive and accurate mapping of newly buried, high-density fiber optic cable infrastructure.

What is the significance of integrating GNSS/GPS with modern utility locators?

Integrating Global Navigation Satellite Systems (GNSS) or GPS allows the utility locator to record the precise geographical coordinates (longitude, latitude, elevation) of the detected utility in real-time. This geo-referenced data is crucial for creating accurate digital maps, enhancing data integrity for GIS systems, and satisfying professional surveying standards.

What major constraints hinder the widespread adoption of high-end utility locating equipment?

The primary constraints include the significant initial capital expenditure required for advanced systems, particularly high-resolution GPR units, and the persistent need for highly skilled and certified operators to accurately interpret complex data outputs, especially in dense or electromagnetically noisy environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager