Underwater Exploration Robots Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433270 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Underwater Exploration Robots Market Size

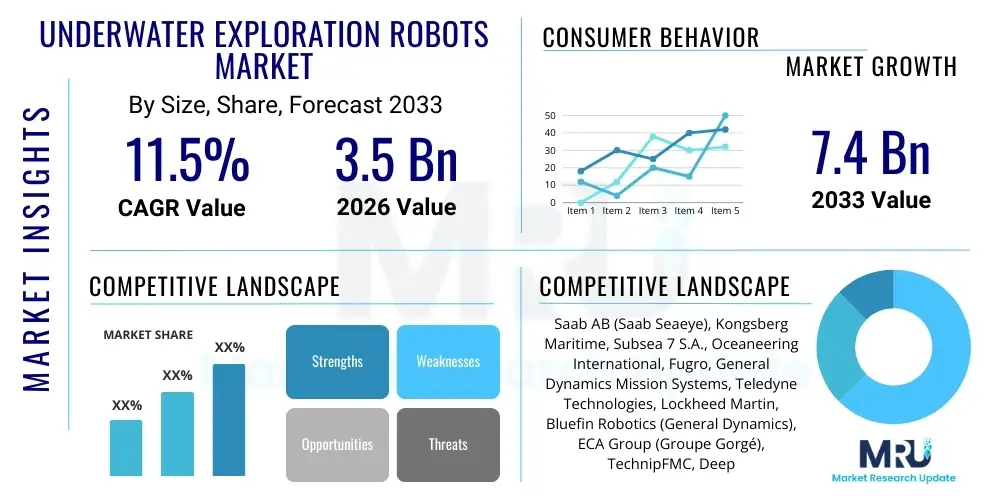

The Underwater Exploration Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 7.4 Billion by the end of the forecast period in 2033.

Underwater Exploration Robots Market introduction

The Underwater Exploration Robots Market encompasses sophisticated remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) designed for complex operations in marine environments, spanning depths from shallow coastal waters to the abyssal zone. These specialized robotic systems are crucial for gathering scientific data, inspecting subsea infrastructure, performing mapping and surveying tasks, and executing critical defense and security missions. Key products include heavy-duty work-class ROVs used in offshore energy, observation-class ROVs employed for inspection, and long-endurance AUVs utilized for large-scale seabed mapping. The integration of advanced sensor technologies, high-definition imaging systems, and precise navigation capabilities defines the current state-of-the-art in this domain.

Major applications of underwater exploration robots are broadly distributed across several high-growth sectors. The oil and gas industry relies heavily on work-class ROVs for pipeline inspection, deep-sea drilling support, and maintenance operations, crucial for ensuring the integrity and safety of vast subsea networks. Concurrently, the burgeoning offshore renewable energy sector, particularly wind farm construction and maintenance, drives demand for robotic inspection of underwater foundation structures. Beyond industrial use, these robots are fundamental to oceanography, marine biology research, and environmental monitoring, allowing scientists to study deep-sea ecosystems without human intervention, thus protecting fragile environments and enhancing data accuracy.

The primary benefits derived from using these advanced robots include significantly improved operational safety by removing human divers from hazardous deep-sea environments, reduced operational costs associated with maintenance and surveying tasks, and enhanced data acquisition capabilities. Driving factors for market expansion include escalating global investment in offshore oil and gas exploration in ultra-deep waters, the rapid expansion of offshore wind and tidal energy infrastructure, and increasing geopolitical tensions necessitating advanced maritime security and surveillance technologies. Furthermore, technological advancements in battery life, communication systems (acoustic and optical), and autonomous decision-making algorithms are continually boosting the efficiency and reach of these robotic platforms.

Underwater Exploration Robots Market Executive Summary

The Underwater Exploration Robots Market is characterized by robust technological innovation, competitive consolidation, and strong demand acceleration driven primarily by the energy and defense sectors. Business trends indicate a marked shift towards hybrid systems that combine the endurance of AUVs with the real-time control capabilities of ROVs, offering enhanced flexibility for complex missions. Furthermore, leasing and RaaS (Robotics-as-a-Service) models are gaining traction, lowering the initial capital expenditure for smaller operators and stimulating broader market adoption, especially in emerging marine research institutions and localized environmental monitoring efforts. This economic dynamic is fostering collaboration between traditional robotics manufacturers and specialized software developers focused on data processing and predictive maintenance.

Regional trends highlight North America and Europe as the dominant markets, largely due to extensive established offshore oil and gas infrastructure, significant government funding for deep-sea research, and substantial investment in offshore wind energy projects. The Asia Pacific region, however, is emerging as the fastest-growing market, propelled by naval modernization efforts in countries like China, India, and Japan, coupled with intense deep-sea mining exploration activities and growing commitments to monitoring coastal marine resources. Operational requirements in extreme environments, such as the Arctic regions, are driving specialized demand for ice-capable and ultra-deepwater systems, fostering innovation in material science and thermal management within robotic designs.

Segment trends emphasize the sustained dominance of the Remotely Operated Vehicle (ROV) segment in terms of revenue, predominantly driven by work-class systems essential for heavy construction and maintenance in the offshore energy sector. Nonetheless, the Autonomous Underwater Vehicle (AUV) segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by increasing applications in hydrographic surveying, persistent monitoring, and anti-submarine warfare (ASW). The defense and security application segment is experiencing significant growth, mandating the integration of sophisticated payload systems, including advanced sonar, passive acoustic sensors, and non-lethal countermeasure systems, tailored for intelligence, surveillance, and reconnaissance (ISR) missions.

AI Impact Analysis on Underwater Exploration Robots Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Underwater Exploration Robots Market center around how AI enhances autonomy, improves data processing efficiency, and mitigates communication constraints in subsea environments. Users frequently question the reliability of AI algorithms in harsh, unpredictable conditions, focusing on the ability of machine learning to handle sensor drift, unexpected debris, and pressure variations autonomously. Key expectations include AI-driven improvements in navigation accuracy, particularly simultaneous localization and mapping (SLAM) without relying solely on acoustic transponders, and the development of cognitive robots capable of making real-time, high-stakes decisions concerning mission re-planning or anomaly detection. Concerns often revolve around regulatory frameworks for autonomous defense systems and the complexity of training robust deep learning models using sparse or biased deep-sea datasets.

The integration of AI, machine learning (ML), and deep learning (DL) is fundamentally transforming underwater robotics from simple controlled machines into sophisticated cognitive platforms. AI enables AUVs to achieve true mission-level autonomy, moving beyond pre-programmed paths to dynamic decision-making based on environmental stimuli and mission objectives. This includes optimized power management for extended endurance, intelligent path planning to avoid obstacles or leverage currents efficiently, and automated feature recognition essential for precise inspection tasks such as crack detection in pipeline welds. Furthermore, ML algorithms are critical for rapidly processing the massive volumes of heterogeneous data—sonar imagery, optical photos, water chemistry readings—collected during missions, transforming raw data into actionable insights instantaneously, which significantly accelerates scientific discovery and industrial response times.

The adoption of edge computing and specialized neural processing units (NPUs) onboard robots allows for computationally intensive tasks, like real-time object classification and anomaly reporting, to occur underwater, minimizing reliance on bandwidth-limited acoustic communication back to the surface vessel. This capability is paramount for deep-sea operations where latency is prohibitive. AI also plays a crucial role in predictive maintenance (PdM) for the robots themselves, analyzing sensor data on motor performance, battery health, and mechanical stress to predict potential failures, thereby maximizing uptime and mission success rates, especially in remote, hard-to-access locations.

- AI-Driven Autonomy: Enables real-time, dynamic mission planning and adaptive navigation, significantly extending operational range and efficiency.

- Intelligent Data Processing: Utilizes machine learning for rapid classification, anomaly detection, and automated feature extraction from vast sensor datasets (sonar, visual).

- Enhanced SLAM Capabilities: Improves simultaneous localization and mapping in GPS-denied environments through advanced visual and acoustic algorithms.

- Predictive Maintenance (PdM): Analyzes operational telemetry to forecast component failures, reducing downtime and lowering total cost of ownership.

- Cognitive Robotics: Allows robots to execute complex tasks, such as autonomous intervention or site selection, based on learned environmental parameters and sensor fusion.

- Optimized Energy Management: AI dynamically adjusts propulsion and sensor usage to maximize battery life and mission duration in long-endurance AUVs.

DRO & Impact Forces Of Underwater Exploration Robots Market

The Underwater Exploration Robots Market is driven by strong imperatives stemming from global energy demands and maritime security requirements, while facing persistent operational and technological constraints. Key drivers include the relentless expansion of the offshore oil and gas industry into deeper, more challenging environments, making manned intervention impractical, coupled with the rapid, global scaling of offshore renewable energy infrastructure, particularly wind farms requiring constant inspection. Opportunities are expanding significantly into nascent sectors such as deep-sea mining, which necessitates precise mapping and collection capabilities, and sophisticated environmental monitoring, fueled by regulatory requirements for tracking climate change indicators and marine biodiversity. These factors collectively push the market forward, compelling manufacturers to produce more robust, autonomous, and capable systems.

Restraints primarily involve the high initial procurement cost associated with advanced robotic systems, including specialized sensors, high-power thrusters, and proprietary control software, which can be prohibitive for smaller organizations or academic institutions. Furthermore, the inherent technological challenges of the deep-sea environment, specifically limited underwater communication bandwidth (reliance on acoustic methods), extreme pressures, and harsh corrosion factors, significantly complicate system design and operational logistics. The lack of globally standardized regulatory frameworks for highly autonomous subsea systems and the requirement for highly skilled technical personnel to operate and maintain these complex vehicles also serve as critical constraints on market penetration and rapid scalability.

The impact forces influencing the market are profound and multi-layered. Economic forces, such as fluctuating crude oil prices, directly impact capital expenditure in the offshore industry, creating cyclic demand for work-class ROVs. However, sustained public and private investment in climate change mitigation and marine resource management provides a stabilizing counter-force, driving demand for observation-class AUVs. Societal and regulatory forces, especially concerning environmental protection (e.g., monitoring protected marine areas) and workplace safety (eliminating human risk in deep waters), strongly favor robotic solutions. Technology innovation is the most significant accelerating force, with rapid developments in sensor miniaturization, battery energy density, and computational processing power continually expanding the functional envelope of these underwater explorers, promising longer missions and greater intervention capabilities.

Segmentation Analysis

The Underwater Exploration Robots Market is strategically segmented based on crucial attributes including operational class, propulsion mechanism, depth rating, application area, and regional geography. This detailed segmentation allows market participants to tailor their offerings precisely to the specialized needs of sectors ranging from subsea construction to oceanic research. The classification by type, typically Remotely Operated Vehicles (ROVs) and Autonomous Underwater Vehicles (AUVs), reflects the fundamental dichotomy between telerobotic intervention capabilities and endurance-focused autonomous surveying missions. Segmentation by application highlights the shift in demand drivers, with defense, oil & gas, and renewable energy sectors being the primary revenue generators, each requiring unique specifications regarding payload capacity, navigation precision, and operational redundancy.

Further granular analysis is achieved through segmentation by depth rating (shallow, deep, and ultra-deep water), which directly correlates with the material science and pressure hull design requirements of the robotic system. Shallow water systems (up to 300 meters) are common in aquaculture and coastal security, while ultra-deepwater systems (over 3,000 meters) are specialized for deep-sea mining and frontier scientific research, demanding complex tether management and high-reliability components. The overall market segmentation provides clarity on where capital investment is flowing, indicating a strategic preference for AUVs in survey and mapping tasks due to their efficiency, while high-value intervention tasks remain the domain of robust, tethered work-class ROVs, ensuring predictable and reliable power delivery and control feedback.

- By Type:

- Remotely Operated Vehicles (ROVs)

- Observation Class

- Work Class

- Heavy Duty Class

- Autonomous Underwater Vehicles (AUVs)

- Torpedo/Cigar Shaped

- Glider AUVs

- Hybrid ROV/AUV Systems

- Remotely Operated Vehicles (ROVs)

- By Depth:

- Shallow Water (Up to 300 meters)

- Deep Water (300 to 3,000 meters)

- Ultra-Deep Water (Above 3,000 meters)

- By Application:

- Oil & Gas (Inspection, Repair, and Maintenance - IRM)

- Defense & Security (Mine Countermeasures, ISR)

- Scientific Research & Oceanography

- Offshore Renewable Energy (Wind, Tidal)

- Subsea Telecommunications

- Deep-Sea Mining & Salvage

- By Component:

- Hardware (Thrusters, Sensors, Cameras, Navigation Systems)

- Software (Control Systems, Data Processing, AI/Autonomy)

- Services (Leasing, Maintenance, Training)

Value Chain Analysis For Underwater Exploration Robots Market

The value chain for the Underwater Exploration Robots Market begins with upstream activities focused heavily on specialized technology development and component manufacturing. This stage involves sophisticated R&D for critical components such as high-density battery packs optimized for deep-sea use, high-reliability pressure hulls (often titanium or specialized composite alloys), advanced thruster systems, and highly sensitive sensor payloads (including multi-beam sonar, synthetic aperture sonar, and chemical sensors). Key upstream suppliers include specialized manufacturers of high-power electronics, fiber-optic and electrical cable systems for tethers, and developers of proprietary navigation software. Innovation in this segment dictates the performance envelope of the final product, emphasizing modularity and power efficiency.

Midstream activities involve the actual assembly, integration, and final testing of the robotic systems. Leading market players purchase components and integrate them into complete, certified ROV and AUV platforms, often requiring extensive sea trials and certification checks to meet stringent industrial (e.g., DNV) and military standards. This phase is characterized by complex systems integration, ensuring that the sensor suite, control software, propulsion system, and power management work cohesively under extreme deep-sea conditions. Distribution channels are varied, incorporating direct sales to large end-users like national navies and major oil & gas operators, and indirect channels such as specialized maritime technology distributors, value-added resellers (VARs), and strategic partnerships with offshore service providers who bundle the robotic system with operational crews and support vessels.

Downstream activities center on deployment, operations, data management, and aftermarket services. The rise of Robotics-as-a-Service (RaaS) has fundamentally shifted the downstream focus, where many operators prefer to lease highly capable systems bundled with expert crew rather than purchase them outright. Services include ongoing maintenance, critical component repair, and software updates, which are essential due to the demanding operational environment. Direct channels are prevalent in large defense contracts or significant infrastructure projects where the manufacturer provides dedicated long-term support. Indirect channels, through specialized marine surveying companies or offshore service contractors, focus on providing data analysis and operational expertise, translating raw sensor data into actionable engineering or scientific reports for the ultimate end-user.

Underwater Exploration Robots Market Potential Customers

The primary potential customers and end-users of Underwater Exploration Robots are concentrated in industries that possess critical subsea assets or require extensive data acquisition in marine environments. The largest and most consistent buyers are the global energy giants, including major International Oil Companies (IOCs) and National Oil Companies (NOCs), who utilize work-class ROVs extensively for the Inspection, Repair, and Maintenance (IRM) of subsea infrastructure, including pipelines, risers, and wellheads, particularly in deep and ultra-deep waters. These customers demand high reliability, heavy-lift capabilities, and precise manipulation skills from the robotic systems to ensure asset integrity and operational longevity, making them central to the ROV segment's revenue stream.

A rapidly expanding customer base is the international defense and security community, including navies and coast guards worldwide. These organizations rely heavily on specialized AUVs and observation-class ROVs for critical missions such as Mine Countermeasures (MCM), anti-submarine warfare (ASW) training, harbor security, and Intelligence, Surveillance, and Reconnaissance (ISR). Their requirements emphasize stealth, high endurance, robust communications security, and the capability to integrate specialized non-lethal and lethal payloads, driving demand for advanced, militarized versions of existing commercial platforms. Government funding and strategic modernization plans often stabilize demand in this segment, shielding it somewhat from commodity price fluctuations.

Furthermore, oceanographic research institutions, environmental monitoring agencies, and governmental survey bodies (like national hydrographic offices) represent a significant customer segment for medium-to-long-endurance AUVs and specialized observation ROVs. These customers prioritize data quality, sensor payload flexibility (for chemical, biological, and physical oceanography), and extended mission life for large-scale seabed mapping, habitat monitoring, and climate change studies. Finally, emerging sectors such as offshore renewable energy companies (developing wind and wave farms) and early-stage deep-sea mining consortia are increasingly becoming high-potential customers, requiring bespoke robotic solutions tailored for construction verification, foundation scour monitoring, and resource exploration and harvesting in new deep-sea frontiers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 7.4 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saab AB (Saab Seaeye), Kongsberg Maritime, Subsea 7 S.A., Oceaneering International, Fugro, General Dynamics Mission Systems, Teledyne Technologies, Lockheed Martin, Bluefin Robotics (General Dynamics), ECA Group (Groupe Gorgé), TechnipFMC, Deep Ocean Engineering, Inc., VideoRay LLC, DOF Subsea AS, Helix Energy Solutions Group, Inc., L3Harris Technologies, BAE Systems, Schilling Robotics (TechnipFMC), Houston Mechatronics, Inc. (HMI). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Underwater Exploration Robots Market Key Technology Landscape

The Underwater Exploration Robots market is defined by several cutting-edge technologies that enhance operational performance, endurance, and data quality. Central to this landscape is the advancement in battery technology, primarily high-capacity Lithium-Ion cells and, increasingly, alternative energy sources like fuel cells (e.g., Aluminum-Oxygen or Solid Oxide Fuel Cells) used in long-endurance AUVs to achieve mission durations lasting weeks or months, significantly reducing the need for support vessel time. Concurrently, highly efficient, fault-tolerant electric thrusters and magnetic coupling systems are replacing traditional hydraulic systems in many modern ROVs and AUVs, boosting energy efficiency, reducing maintenance complexity, and mitigating the risk of hydraulic leaks that can pollute the marine environment.

Sensor technology constitutes another major driver of innovation. Multi-beam echo sounders, side-scan sonar, and particularly Synthetic Aperture Sonar (SAS) provide unprecedented high-resolution imagery and mapping capabilities, crucial for detailed seabed surveys and precise target identification, especially in environments with poor water visibility. Integration of advanced inertial navigation systems (INS) coupled with Doppler Velocity Logs (DVLs) and Kalman filtering algorithms ensures highly accurate navigation (sub-meter positioning) in the absence of reliable acoustic positioning or GPS signals. The convergence of these robust sensing and navigation technologies allows for repeatable, high-precision inspections critical for infrastructure monitoring.

Furthermore, the shift towards modular, open-architecture hardware and software platforms is simplifying integration and reducing time-to-market for new capabilities. Standardization efforts, such as the emergence of common communication protocols and interface standards, allow end-users to interchange specialized sensor payloads easily. Crucially, the growth of tetherless communication methods, leveraging optical modalities (blue/green lasers) for high-bandwidth, short-range data transmission, often complementing robust but low-bandwidth acoustic modems for long-range communication, is unlocking new operational paradigms, especially for swarms of cooperative AUVs operating in coordinated reconnaissance missions.

Regional Highlights

- North America: Dominates the market, driven by substantial investment in deep-water offshore oil and gas exploration in the Gulf of Mexico, coupled with significant defense spending by the US Navy on advanced autonomous systems for surveillance and MCM operations. The region benefits from a robust technology ecosystem and leading academic research institutions pioneering next-generation AI and subsea robotics.

- Europe: A strong market leader, particularly in the adoption of robots for offshore renewable energy (OWF inspection and maintenance) in the North Sea. Countries like Norway and the UK have long-established expertise in maritime technology and prioritize environmental monitoring and complex subsea construction projects, maintaining high demand for both work-class ROVs and scientific AUVs.

- Asia Pacific (APAC): The fastest-growing regional market, fueled by increasing naval fleet modernization (especially China, Japan, and South Korea), growing reliance on subsea telecommunications cable inspection due to massive data traffic, and heightened interest in early-stage deep-sea mining exploration in the Pacific Ocean. Governments in this region are heavily investing in indigenous AUV development programs.

- Latin America: Characterized by major deep-water projects, particularly off the coasts of Brazil (pre-salt reserves) and Mexico. Demand is primarily driven by National Oil Companies (NOCs) requiring specialized, deep-rated ROVs for drilling support and IRM activities, though economic instability can occasionally restrain market growth acceleration.

- Middle East and Africa (MEA): Growth is primarily centered on the Arabian Gulf and parts of West Africa, driven by essential oil and gas infrastructure inspection and repair. The market here focuses heavily on reliable, desert-hardened robotic systems capable of operating in challenging shallow and medium-depth waters near coastal production facilities and strategic maritime choke points.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Underwater Exploration Robots Market.- Saab AB (Saab Seaeye)

- Kongsberg Maritime

- Subsea 7 S.A.

- Oceaneering International

- Fugro

- General Dynamics Mission Systems

- Teledyne Technologies

- Lockheed Martin

- Bluefin Robotics (General Dynamics)

- ECA Group (Groupe Gorgé)

- TechnipFMC

- Deep Ocean Engineering, Inc.

- VideoRay LLC

- DOF Subsea AS

- Helix Energy Solutions Group, Inc.

- L3Harris Technologies

- BAE Systems

- Schilling Robotics (TechnipFMC)

- Houston Mechatronics, Inc. (HMI)

- iXblue (recently acquired by Exail)

Frequently Asked Questions

Analyze common user questions about the Underwater Exploration Robots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between an ROV and an AUV in operational terms?

An ROV (Remotely Operated Vehicle) is tethered to a surface vessel, controlled in real-time by a human pilot, and primarily used for intervention, heavy lifting, and complex maintenance requiring continuous power supply and real-time feedback. Conversely, an AUV (Autonomous Underwater Vehicle) operates independently without a tether, relying on pre-programmed instructions and onboard AI/navigation systems, making it ideal for long-duration surveying, mapping, and reconnaissance missions where endurance is paramount.

How does the expansion of offshore renewable energy affect the demand for underwater exploration robots?

The global shift toward offshore renewables, particularly massive offshore wind farms, is a critical growth driver. These installations require constant, repeatable, and high-precision inspection of their foundations (monopiles, jackets, floaters) and subsea cables to ensure structural integrity and prevent scour. This mandates specialized observation-class ROVs and highly accurate AUVs equipped with advanced sonar and optical sensors for inspection, repair, and monitoring (IRM) activities throughout the asset's lifespan.

Which technological advancements are most critical for achieving true deep-sea autonomy in AUVs?

Achieving true deep-sea autonomy hinges on three critical technologies: high-energy density power systems (like fuel cells) for extended endurance; sophisticated AI-driven navigation systems (SLAM using acoustic and visual sensors) to maintain precise location without GPS; and robust low-bandwidth, high-latency acoustic communication protocols combined with onboard edge computing to enable real-time decision-making without constant surface oversight, allowing the robot to adapt to unforeseen environmental changes.

What are the primary challenges limiting the widespread deployment of underwater exploration robots?

The main challenges are the extreme operational costs, encompassing high initial hardware investment and the expense of specialized support vessels and expert operational crews. Technologically, the restrictive physics of the underwater environment—severe pressure, limited optical visibility, and the low bandwidth of acoustic communication—continue to restrict mission complexity and the rate of data retrieval, requiring significant compensatory technological development.

Which regions demonstrate the fastest growth potential for the Underwater Exploration Robots Market and why?

The Asia Pacific (APAC) region exhibits the highest growth potential. This rapid expansion is primarily driven by massive governmental investments in naval modernization and maritime domain awareness, coupled with the rapid development of deep-sea infrastructure related to energy and telecommunications (subsea cables). Furthermore, regional exploration of potential deep-sea mineral resources and increasing efforts toward comprehensive marine environmental monitoring fuel the rising adoption of advanced AUV and ROV systems across key economies like China, India, and Japan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager