Unfractionated Heparin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432896 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Unfractionated Heparin Market Size

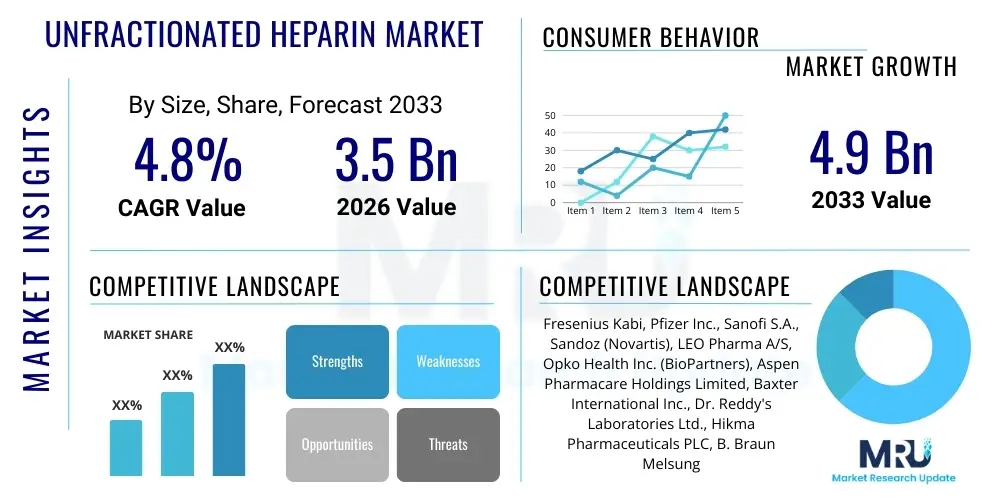

The Unfractionated Heparin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

Unfractionated Heparin Market introduction

The Unfractionated Heparin (UFH) Market is primarily driven by the increasing global prevalence of cardiovascular diseases (CVDs), venous thromboembolism (VTE), and conditions necessitating anticoagulant therapy, such as deep vein thrombosis (DVT) and pulmonary embolism (PE). UFH, a highly effective and rapidly reversible anticoagulant, remains a foundational treatment in critical care settings, including during surgical procedures, dialysis, and in managing acute coronary syndromes. Its versatility, low cost compared to some low-molecular-weight heparins (LMWHs) in certain applications, and established efficacy contribute significantly to its sustained demand. Key applications span across hospitals, surgical centers, and ambulatory settings. Driving factors include an aging population, rising rates of chronic conditions linked to coagulation disorders, and continuous improvements in healthcare infrastructure globally, particularly in emerging economies.

Unfractionated Heparin Market Executive Summary

The Unfractionated Heparin market exhibits strong business resilience, characterized by stable demand driven by essential medical applications and high volume usage in hospital settings. Key business trends involve pharmaceutical manufacturers optimizing purification processes to ensure product safety and address concerns related to raw material sourcing, predominantly porcine intestinal mucosa. Regionally, North America and Europe dominate due to established healthcare systems and high incidences of VTE and cardiac procedures, while the Asia Pacific region is poised for the fastest growth, fueled by expanding healthcare access and increasing awareness of anticoagulant therapy. Segment trends show that the application segment is heavily dominated by hospital use in critical care and surgical prophylaxis, with significant attention being paid to addressing manufacturing standards to mitigate the risk of contamination and ensure consistent potency.

AI Impact Analysis on Unfractionated Heparin Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Unfractionated Heparin market center around optimizing therapeutic drug monitoring (TDM), predicting patient response variability, and enhancing supply chain integrity, particularly given UFH's narrow therapeutic window and risk of heparin-induced thrombocytopenia (HIT). Users frequently ask how AI can refine dosage algorithms to personalize therapy, minimize bleeding risks, and integrate real-time electronic health record (EHR) data to flag potential adverse drug events, thereby improving safety profiles. Furthermore, there is significant interest in utilizing AI and machine learning (ML) for predictive analytics concerning raw material sourcing (porcine mucosa) and manufacturing quality control, ensuring high-purity, standardized UFH production globally.

- AI-driven personalized dosing algorithms minimize adverse drug reactions and optimize time-in-therapeutic-range (TTR) for UFH management.

- Machine learning models predict patient risk of Heparin-Induced Thrombocytopenia (HIT) based on complex clinical profiles and genetic markers.

- Advanced analytics are applied to global supply chains to monitor raw material authenticity, detect potential counterfeits, and ensure purity standards.

- Natural Language Processing (NLP) assists in pharmacovigilance by rapidly analyzing clinical notes and scientific literature related to UFH safety and efficacy.

- AI platforms are used in pharmaceutical research to accelerate the identification of novel anticoagulant monitoring biomarkers, complementing traditional Activated Partial Thromboplastin Time (aPTT) assays.

DRO & Impact Forces Of Unfractionated Heparin Market

The Unfractionated Heparin market is propelled by key drivers such as the rising incidence of thromboembolic disorders and the critical need for effective anticoagulants in emergency and surgical settings, maintaining UFH as a crucial item in hospital formularies. Restraints primarily involve the inherent risk of bleeding complications associated with UFH, competition from Low Molecular Weight Heparin (LMWH) and novel oral anticoagulants (NOACs), and significant challenges related to the consistent sourcing and quality control of animal-derived raw materials, particularly after high-profile contamination incidents. Opportunities reside in developing improved manufacturing standardization protocols, optimizing delivery mechanisms, and leveraging advanced digital health tools for enhanced drug monitoring. The impact forces are significant, driven by stringent regulatory oversight aimed at ensuring product safety and efficacy, alongside constant pressure from clinical guidelines emphasizing patient-specific risk stratification, which dictates the choice between UFH and alternative agents.

Segmentation Analysis

The Unfractionated Heparin market is intricately segmented based on application, end-user, and source of raw material, reflecting diverse therapeutic needs and manufacturing processes within the global healthcare landscape. Application segmentation reveals critical areas of use, with prophylactic treatment and therapeutic intervention constituting the major shares, heavily influenced by surgical volumes and critical care admissions. End-user categorization emphasizes hospitals and critical care units as the dominant purchasing entities due to the necessity of rapid anticoagulation management and frequent monitoring required for UFH. Further segmentation by source addresses supply chain resilience and quality concerns, differentiating between bovine and porcine sources, though porcine sources currently hold a substantial majority due to historical prevalence and yield efficiency.

The segmentation structure provides a granular view necessary for strategic market entry and supply chain planning. The therapeutic application segment, involving high-dose administration for active thrombosis treatment, typically commands higher value per unit volume compared to low-dose prophylactic use, though prophylactic use contributes significantly to overall volume consumption. Understanding the regional preferences for source materials is also vital, as certain geographical markets may impose restrictions or preferences based on cultural or religious dietary laws, impacting manufacturing and distribution strategies for global suppliers.

- By Application:

- Venous Thromboembolism (VTE)

- Pulmonary Embolism (PE)

- Acute Coronary Syndrome (ACS)

- Surgical Prophylaxis

- Dialysis and Extracorporeal Circuits

- By Source:

- Porcine Intestinal Mucosa

- Bovine Lung Tissue (less common)

- By End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Critical Care Units (CCUs)

- Dialysis Centers

Value Chain Analysis For Unfractionated Heparin Market

The Unfractionated Heparin value chain is complex and highly specialized, beginning with the upstream supply of raw animal tissue, predominantly porcine intestinal mucosa, sourced from slaughterhouses globally. This initial stage requires robust infrastructure for collection, freezing, and transport to ensure the quality of the crude heparin material. The midstream involves the crucial process of extraction and purification by specialized pharmaceutical or biotechnology companies. This stage is highly scrutinized due to past contamination issues, necessitating advanced purification techniques, rigorous quality control testing (including nuclear magnetic resonance spectroscopy), and regulatory compliance to produce the final, clinical-grade Active Pharmaceutical Ingredient (API).

Downstream analysis focuses on the formulation, sterile fill-finish operations, and subsequent distribution to end-users. The distribution channel is predominantly indirect, utilizing large pharmaceutical wholesalers and distributors who manage logistics, storage (maintaining stability), and delivery to hospitals and large centralized procurement systems. Direct distribution is less common but occurs occasionally for highly specialized or direct contract government supplies. The market is highly sensitive to efficient distribution to ensure continuous supply in critical care settings, making inventory management and cold chain logistics pivotal factors in maintaining market equilibrium and mitigating regional shortages.

The overall integrity of the value chain is consistently challenged by the fragmented nature of the upstream animal sourcing, which introduces supply volatility and quality risks. Manufacturers must integrate strict vertical quality checks, often extending audits to the slaughterhouse level, to comply with global pharmacopeial standards (USP, EP, JP). Maintaining transparency and traceability throughout the entire process—from crude source to final packaged vial—is a primary objective for both pharmaceutical companies and regulatory bodies worldwide to uphold patient safety and prevent product tampering or adulteration.

Unfractionated Heparin Market Potential Customers

The primary customers for Unfractionated Heparin are institutional buyers, specifically hospitals, specialized critical care units, and governmental procurement agencies operating large healthcare networks. Hospitals, particularly those with high volumes of cardiovascular surgeries, orthopedic procedures, and trauma cases, represent the largest and most frequent buyers. Their demand is driven by the need for immediate, high-efficacy anticoagulation in situations where rapid onset and short half-life (and reversibility) are paramount, such as acute myocardial infarction (AMI) or unstable angina.

Secondary but significant customer segments include dialysis centers and ambulatory surgical centers (ASCs). Dialysis centers rely on UFH or related heparin products to prevent clotting in the extracorporeal circuits during hemodialysis. While ASCs may use LMWHs more frequently for outpatient procedures, UFH remains essential for complex or higher-risk day surgeries, especially those involving immediate intraoperative anticoagulation needs. Procurement decisions within these organizations are typically guided by formulary committees, focusing on cost-effectiveness, proven clinical safety profiles, and supplier reliability.

Furthermore, research institutions and large clinical trial organizations constitute niche potential customers, requiring standardized, high-quality UFH for laboratory studies focused on thrombosis mechanisms, drug development, and comparative effectiveness trials. The buying criteria for these diverse customer groups consistently emphasize product purity, consistent potency measured by anti-Xa activity, and the reputation of the manufacturing partner regarding supply chain integrity and regulatory compliance across major jurisdictions like the FDA and EMA.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fresenius Kabi, Pfizer Inc., Sanofi S.A., Sandoz (Novartis), LEO Pharma A/S, Opko Health Inc. (BioPartners), Aspen Pharmacare Holdings Limited, Baxter International Inc., Dr. Reddy's Laboratories Ltd., Hikma Pharmaceuticals PLC, B. Braun Melsungen AG, Teva Pharmaceutical Industries Ltd., Mylan N.V. (Viatris), Celsus Bio-Intelligence, Bipharma B.V., Nanjing King-Friend Biochemical Pharmaceutical Co., Ltd., Shenzhen Hepalink Pharmaceutical Co., Ltd., Wockhardt Ltd., Troikaa Pharmaceuticals Ltd., Gland Pharma Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Unfractionated Heparin Market Key Technology Landscape

The technological landscape surrounding the Unfractionated Heparin (UFH) market is heavily concentrated on enhancing purification and analytical testing methods to guarantee product safety and prevent adulteration, which remains a primary regulatory concern globally. Modern manufacturing utilizes advanced chromatographic techniques, ultrafiltration, and enzymatic treatments to isolate and purify heparin API from crude mucosal extracts. These techniques are essential for removing impurities, including oversulfated chondroitin sulfate (OSCS) and other contaminants that led to widespread issues in the past. Technological innovation is focused on achieving higher yields of high-purity heparin with specific anti-Xa activity thresholds, which directly impacts therapeutic efficacy.

Crucially, the technological advancements extend into quality control and monitoring. Regulatory bodies mandate sophisticated analytical technologies, such as two-dimensional Nuclear Magnetic Resonance (2D NMR) spectroscopy, to establish a detailed chemical fingerprint of the finished product. This technology allows manufacturers to verify the structure and chemical composition of the heparin molecule, ensuring it meets pharmacopeial standards and confirming the absence of subtle structural modifications indicative of counterfeiting or contamination. This rigorous analytical framework is non-negotiable for market access and underscores the technological investment required by leading manufacturers.

Furthermore, technology plays a pivotal role in clinical administration and management. The proliferation of smart infusion pumps integrated with Dose Error Reduction Software (DERS) and sophisticated Electronic Health Record (EHR) systems enables safer UFH delivery in clinical settings. These systems often incorporate validated nomograms or AI-assisted protocols for real-time monitoring of aPTT and anti-Xa levels, allowing clinicians to rapidly adjust drip rates. This integration of digital technology enhances the clinical utility of UFH by mitigating the risk associated with its narrow therapeutic index and need for frequent laboratory monitoring.

Regional Highlights

Regional dynamics significantly influence the Unfractionated Heparin market structure, driven by varying healthcare expenditures, disease burden, and regulatory stringency. North America, particularly the United States, commands the largest market share. This dominance is attributed to a high prevalence of cardiovascular and peripheral vascular diseases, advanced healthcare infrastructure that supports extensive critical care procedures, and established clinical protocols that frequently mandate the use of UFH in both prophylactic and acute settings. High pharmaceutical spending and rapid adoption of advanced monitoring technologies further cement its leading position. However, this region also faces intense pricing pressure and competition from generic manufacturers and alternative anticoagulants.

Europe represents another mature market, characterized by stringent regulatory environments (EMA guidelines) that prioritize UFH safety and quality. Western European countries exhibit high consumption due to aging populations and well-funded public healthcare systems. Conversely, the Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period. This accelerated expansion is fueled by rapidly improving healthcare access, increasing disposable income in countries like China and India, and a burgeoning patient pool requiring VTE management and cardiovascular interventions. Local manufacturers in APAC are increasingly focusing on scaling production and meeting international quality standards to supply both domestic and export markets.

Latin America and the Middle East & Africa (MEA) markets currently hold smaller shares but present considerable long-term growth opportunities. Growth in these regions is dependent on infrastructure development, the establishment of standardized clinical guidelines, and increased investment in critical care facilities. Challenges include fragmented distribution networks and reliance on imported API. The overall global market balance is shifting toward APAC, necessitating global suppliers to localize manufacturing or forge strategic alliances to navigate diverse regional regulatory and distribution landscapes effectively.

- North America (USA & Canada): Market leadership due to high disease prevalence, advanced critical care infrastructure, and significant expenditure on complex surgical procedures requiring immediate anticoagulation.

- Europe (Germany, UK, France): Mature market defined by strict regulatory adherence to EMA purity standards and consistent demand driven by established geriatric populations and advanced dialysis networks.

- Asia Pacific (China, India, Japan): Fastest-growing region, powered by rapid expansion of hospital infrastructure, rising prevalence of lifestyle-related vascular diseases, and increasing local manufacturing capabilities striving for global quality compliance.

- Latin America (Brazil, Mexico): Emerging growth market characterized by improving healthcare access and increasing demand for cost-effective, essential hospital pharmaceuticals like UFH.

- Middle East & Africa (MEA): Growth driven by healthcare tourism, specialized medical facility investments in the GCC region, and ongoing efforts to combat non-communicable diseases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Unfractionated Heparin Market.- Fresenius Kabi

- Pfizer Inc.

- Sanofi S.A.

- Sandoz (Novartis)

- LEO Pharma A/S

- Opko Health Inc. (BioPartners)

- Aspen Pharmacare Holdings Limited

- Baxter International Inc.

- Dr. Reddy's Laboratories Ltd.

- Hikma Pharmaceuticals PLC

- B. Braun Melsungen AG

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V. (Viatris)

- Celsus Bio-Intelligence

- Bipharma B.V.

- Nanjing King-Friend Biochemical Pharmaceutical Co., Ltd.

- Shenzhen Hepalink Pharmaceutical Co., Ltd.

- Wockhardt Ltd.

- Troikaa Pharmaceuticals Ltd.

- Gland Pharma Limited

Frequently Asked Questions

Analyze common user questions about the Unfractionated Heparin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Unfractionated Heparin market?

The primary driver is the increasing global incidence of cardiovascular diseases (CVDs), venous thromboembolism (VTE), and the resulting high demand for effective, rapidly reversible anticoagulant therapy in critical care, surgical, and dialysis settings worldwide.

How do competition from LMWH and NOACs restrain the UFH market?

Low Molecular Weight Heparins (LMWHs) and Novel Oral Anticoagulants (NOACs) offer advantages like simplified dosing and reduced need for constant monitoring, leading to their preference in outpatient and long-term prophylactic settings, thereby limiting the expansion of UFH consumption outside critical care.

What is the significance of porcine intestinal mucosa sourcing in the UFH supply chain?

Porcine intestinal mucosa is the predominant raw material source for UFH globally. Its significance lies in its large-scale availability and high yield, but it also presents persistent risks related to supply chain integrity, quality control, and potential contamination, mandating stringent regulatory oversight.

Which region is expected to show the highest growth rate in the Unfractionated Heparin market?

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR due to expanding public and private healthcare investments, rapidly improving surgical volumes, and increasing penetration of modern medical treatment protocols across populous nations like China and India.

How does AI technology enhance the safety and effectiveness of Unfractionated Heparin administration?

AI technology significantly enhances UFH safety by utilizing sophisticated algorithms to personalize patient dosing based on real-time clinical parameters, improving the time spent within the narrow therapeutic range (TTR), and predicting the risk of adverse events like Heparin-Induced Thrombocytopenia (HIT).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager