Unified Communications Headset Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435135 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Unified Communications Headset Market Size

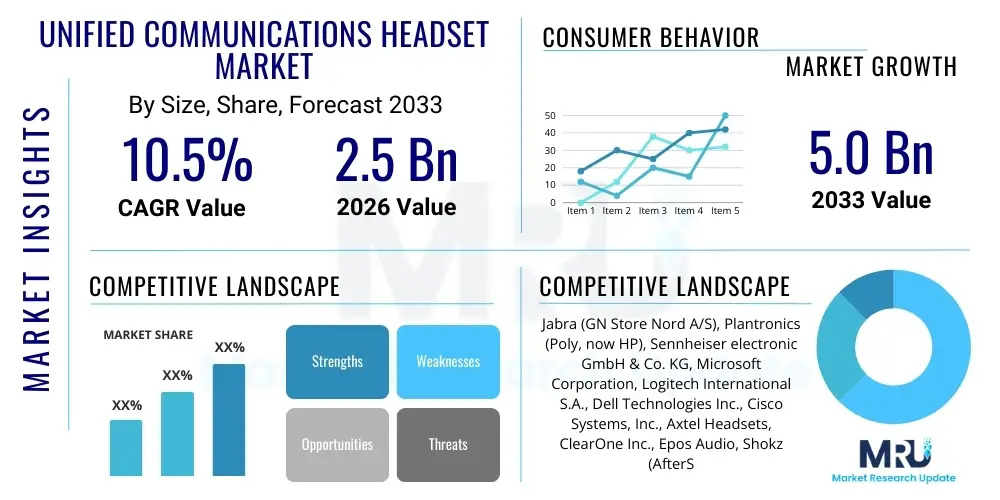

The Unified Communications Headset Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 5.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global paradigm shift towards hybrid work models, the increasing adoption of cloud-based communication platforms such as Microsoft Teams, Zoom, and Cisco Webex, and the critical need for professional-grade audio equipment that ensures clarity and reduces background noise in distributed work environments. Furthermore, continuous technological improvements, particularly in Active Noise Cancellation (ANC) and Artificial Intelligence-driven sound optimization features, are significantly boosting consumer and enterprise spending on high-end UC peripherals.

Unified Communications Headset Market introduction

The Unified Communications (UC) Headset Market comprises specialized audio peripherals designed specifically to integrate seamlessly with professional communication platforms, enhancing voice clarity, collaboration efficiency, and user comfort. These products range from basic wired models suitable for internal desk use to advanced wireless DECT or Bluetooth headsets featuring sophisticated noise-cancellation algorithms, multiple device connectivity, and superior battery life optimized for mobility and remote work. The primary application spectrum covers corporate offices, high-volume contact centers, and increasingly, the expansive segment of remote and hybrid workers who require consistent, enterprise-grade audio quality to participate effectively in virtual meetings and teleconferences.

The core benefits derived from deploying UC headsets include improved meeting productivity due to crystal-clear sound transmission and reception, enhanced ergonomic comfort during long work sessions, and crucially, reduced operational friction caused by poor audio quality which often leads to miscommunication. The seamless interoperability and certification with major UC platforms (e.g., Teams, Zoom, Google Meet) ensure plug-and-play functionality, minimizing IT support overhead and maximizing user adoption across large organizations. This focus on platform integration is a key differentiator from standard consumer headphones, positioning UC headsets as indispensable tools for modern business communication infrastructures.

Key driving factors propelling market growth include the post-pandemic normalization of hybrid work structures, compelling businesses globally to invest heavily in remote infrastructure. Moreover, the accelerating digital transformation initiatives across sectors like finance, healthcare, and education necessitate robust, reliable communication tools. The proliferation of digital contact centers, driven by the demand for improved customer experience, fuels high-volume sales of specialized headsets built for durability and continuous use. Finally, regulatory compliance, particularly in security-sensitive environments requiring secure wireless connections (like DECT), further solidifies the market's trajectory towards sustained expansion and technological sophistication.

Unified Communications Headset Market Executive Summary

The Unified Communications Headset Market is experiencing robust and sustained growth, underscored by profound shifts in organizational operational models and rapid technological innovation focused on audio intelligence. Business trends indicate a decisive transition away from basic audio solutions toward premium, certified wireless headsets equipped with sophisticated noise reduction capabilities, reflecting the enterprise prioritization of meeting quality and employee well-being in hybrid settings. The market’s competitive landscape is defined by intense platform partnerships, where key players continually optimize their products for leading UC software ecosystems, transforming headsets from simple accessories into intelligent communication endpoints. Furthermore, subscription-based models for advanced headset features and device management are gaining traction, providing stable recurring revenue streams for vendors and enhancing security and fleet management capabilities for large corporations.

Regionally, North America and Europe maintain dominance, characterized by high organizational readiness for cloud communication and significant enterprise spending on UC infrastructure upgrades. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by burgeoning contact center operations, rapid urbanization, and increasing penetration of modern communication technologies in emerging economies such as India and Southeast Asia. This regional dynamic is compelling manufacturers to localize supply chains and diversify their product portfolios to address varying price points and connectivity standards across these diverse markets. Infrastructure improvements, particularly the rollout of 5G networks, are expected to further catalyze the adoption of highly mobile, wireless UC solutions across APAC.

Segment-wise, the Wireless segment, particularly Bluetooth 5.0 and beyond, commands the largest market share and is projected to exhibit superior CAGR throughout the forecast period due to the demand for mobility and untethered connectivity in professional environments. Within applications, the Remote/Hybrid Work segment has surpassed traditional Corporate Office demand, solidifying its position as the largest driver of new headset sales, requiring features like superior active noise cancellation and multi-point connectivity. Furthermore, the DECT sub-segment remains crucial for high-density environments like centralized contact centers and sensitive corporate campuses due to its superior security features and optimized wireless range, ensuring that technological diversity remains a core characteristic of the segmented market.

AI Impact Analysis on Unified Communications Headset Market

Common user questions regarding AI's impact on UC headsets center primarily on how Artificial Intelligence can fundamentally improve audio quality, specifically concerning background noise suppression (e.g., keyboard clicking, children, pets) and voice isolation in chaotic environments. Users are also keenly interested in AI’s role in enhancing productivity features, such as real-time transcription, intelligent meeting summaries, and predictive maintenance capabilities for headset hardware. A prevailing concern revolves around data privacy and security, questioning how on-device AI processing of voice data is managed and whether these smart features introduce new vulnerabilities. Overall, the expectation is that AI will transform headsets into proactive, intelligent communication tools, moving beyond mere audio input/output devices to become critical components of cognitive workflow management systems.

The integration of AI and Machine Learning (ML) algorithms is revolutionizing the core functionality of UC headsets, making them indispensable in hybrid and remote settings. ML models running on System-on-Chips (SoCs) embedded within the headset can analyze ambient sounds in real-time, accurately distinguishing between human speech and disruptive background noise, resulting in unparalleled noise cancellation capabilities that far exceed traditional analog techniques. This technological leap enables professionals to maintain high-quality communication regardless of their location—be it a bustling coffee shop, an open-plan office, or a busy home environment. This sophisticated audio intelligence is elevating the user experience and is rapidly becoming a mandatory feature for premium enterprise models.

Beyond audio purity, AI is increasingly being deployed to enhance user productivity and device management. Features like voice presence detection, automatic muting when not speaking, and integration with productivity suites to offer meeting insights (e.g., identifying key speakers, tracking speaking time) are becoming commonplace. Furthermore, AI-driven diagnostics allow IT departments to remotely monitor headset performance, predict hardware failures, and optimize firmware updates, significantly reducing downtime and management costs for large deployments. This evolution positions the UC headset market at the intersection of communication hardware and intelligent software services, driving higher average selling prices (ASPs) and creating new revenue opportunities through software-as-a-service (SaaS) offerings related to device management and acoustic data analytics.

- AI-Powered Noise Suppression: Real-time isolation of human voice from complex background noise using sophisticated neural networks embedded in the headset SoC.

- Intelligent Acoustic Tuning: Automatic optimization of equalization settings based on ambient environment recognition and user voice profile.

- Real-Time Transcription and Summarization: Integration with UC platforms to provide instant meeting documentation, driven by embedded or cloud-assisted AI processing.

- Predictive Maintenance: Use of ML algorithms to analyze headset usage patterns and predict component failures, facilitating proactive device replacement.

- Enhanced Security Protocols: AI used for sophisticated acoustic authentication and anomaly detection to prevent eavesdropping or unauthorized access.

- Contextual Awareness: Headsets use integrated sensors and AI to understand user context (e.g., on a call, in a meeting, focused work) and adjust settings accordingly.

DRO & Impact Forces Of Unified Communications Headset Market

The Unified Communications Headset Market is principally influenced by the sustained demand for high-quality remote communication, positioning the Drivers as the strongest impact force. The shift to permanent hybrid work structures worldwide, coupled with the mandatory integration of robust UC platforms across enterprises, acts as the primary catalyst for sales. Opportunities are emerging predominantly in AI-enhanced features, professional gaming communication solutions, and expansion into developing economies that are rapidly digitizing their business operations. However, the market faces constraints related to intense price competition, particularly in the entry-level segment, and technological friction associated with interoperability challenges between proprietary hardware and competing UC software ecosystems. Managing the balance between premium pricing driven by technology and accessibility required for broad market penetration dictates the strategic priorities of major vendors.

Impact forces are heavily skewed toward high market attractiveness driven by technological evolution and societal shifts. High bargaining power of buyers (large enterprises) forces innovation and competitive pricing, while high bargaining power of suppliers (specialized component manufacturers for advanced ANC chips and sensors) slightly increases production costs but simultaneously raises barriers to entry for new competitors lacking deep supply chain relationships. Substitutes, such as integrated laptop microphones or speakerphones, pose a moderate threat, primarily in non-critical communication scenarios, but fail to deliver the privacy and noise isolation required for professional use. The high capital investment required for R&D in acoustic engineering and certified platform integration ensures the threat of new entrants remains relatively low, reinforcing the market leadership of established specialized audio companies.

The most significant opportunity lies in addressing the evolving needs of the prosumer and small-to-medium enterprise (SME) segments, where demand for enterprise-grade features is increasing but budget constraints are tighter. Developing scalable, cloud-managed services for UC headsets—ranging from asset tracking to personalized sound profiles—presents a pathway for sustained high-margin growth. Conversely, a major constraint is the lifecycle management of legacy technology, specifically the slow phasing out of older wired infrastructure in certain industrial and corporate environments. Successfully navigating these forces requires manufacturers to prioritize robust platform certification, invest heavily in intellectual property related to acoustic AI, and strategically utilize distribution channels to penetrate emerging high-growth regional markets effectively.

- Drivers: Widespread adoption of hybrid work models; proliferation of cloud-based UC platforms (e.g., Teams, Zoom); increasing demand for superior audio quality and noise cancellation; expansion of global contact center infrastructure.

- Restraints: High initial investment cost for premium, feature-rich headsets; intense price competition in the basic/mid-range segment; compatibility issues between diverse operating systems and UC platforms; concerns over cybersecurity and data privacy in wireless transmission.

- Opportunities: Integration of advanced AI/ML for acoustic optimization; growth in specialized vertical markets (e.g., telehealth, virtual education); expansion into untapped emerging markets in APAC and LATAM; development of specialized ergonomic designs for extended use.

- Impact Forces: Strong buyer power (large enterprises), Moderate supplier power (specialized chipsets), Low threat of new entrants (high R&D required), Moderate threat of substitutes (speakerphones), High rivalry among existing competitors (Platform certification wars).

Segmentation Analysis

The Unified Communications Headset market is segmented based on connectivity type (Wired vs. Wireless), application domain (Contact Center, Corporate Office, Remote Work), and the underlying technology platform (DECT, Bluetooth, USB). This structure allows for precise market sizing and strategic targeting, reflecting the varied requirements for mobility, security, and audio fidelity across different end-user environments. The market exhibits a clear trend toward the dominance of wireless solutions, driven by enhanced battery performance and robust connectivity standards like Bluetooth 5.0, yet the wired segment retains significance in environments requiring absolute reliability and regulatory compliance.

- By Type:

- Wired Headsets (USB-A, USB-C, 3.5mm Jack)

- Wireless Headsets (Bluetooth, DECT)

- By Technology:

- DECT Headsets (Digital Enhanced Cordless Telecommunications)

- Bluetooth Headsets (Standard Bluetooth, Bluetooth Low Energy)

- USB Headsets

- By Application:

- Contact Centers

- Corporate Offices (Internal Use)

- Remote/Hybrid Workforces

- Education and Training

- Healthcare and Telehealth

- By Distribution Channel:

- Direct Sales (Large Volume Enterprise Contracts)

- Distributors and Value-Added Resellers (VARs)

- Online Retail (E-commerce Platforms)

- Offline Retail (Consumer Electronics Stores)

Value Chain Analysis For Unified Communications Headset Market

The value chain for UC headsets begins with the upstream segment, dominated by specialized component suppliers providing critical technologies such as advanced microcontrollers (SoCs), high-fidelity acoustic transducers (drivers and microphones), and sophisticated chipsets for Active Noise Cancellation (ANC) and wireless protocols (Bluetooth, DECT). Crucial upstream activities include R&D focusing on miniaturization, power efficiency, and acoustic engineering necessary to achieve professional certification standards. Since the performance of the final product hinges heavily on the quality and integration of these specialized components, manufacturers often forge strategic, long-term partnerships with these niche suppliers to ensure reliable supply and proprietary technology access, thereby maintaining a competitive edge in audio performance.

The midstream involves manufacturing, assembly, and rigorous quality assurance. This stage is characterized by high capital investment in automated assembly lines and compliance testing to meet stringent enterprise durability and safety standards. Integration and certification are paramount here; manufacturers must secure certification from major UC vendors (e.g., Microsoft Teams Certified, Zoom Certified) to ensure optimal functionality and market acceptance. Downstream activities involve market distribution and end-user engagement. Distribution channels are bifurcated: direct sales handle massive corporate tenders and custom integration projects, providing tailored support and deployment services. Indirect sales rely heavily on specialized Value-Added Resellers (VARs) and distributors who bundle headsets with broader UC software and hardware solutions, offering regional market penetration and technical expertise to SMEs.

The post-sale segment, which involves technical support, warranty services, and firmware updates, is becoming increasingly important, especially with the introduction of AI features and cloud management platforms. Direct distribution provides tight control over the customer experience and facilitates direct feedback loops for product improvement. Indirect channels, primarily VARs and enterprise distributors, are critical for installation support and localized servicing. The profitability across the value chain is highest in the upstream component supply and the final branded product marketing (midstream/downstream), particularly for premium models where the intellectual property related to proprietary noise cancellation and software integration justifies higher margins. Effective management of this chain, particularly robust inventory management and swift response to platform updates, is crucial for sustained market leadership.

Unified Communications Headset Market Potential Customers

The primary customers for Unified Communications Headsets are diverse, encompassing any organization or individual dependent on clear, reliable digital voice communication for their core operations. The largest institutional buyer segment is the contact center industry, which demands robust, high-durability headsets designed for continuous, high-volume use, often favoring secure DECT technology for centralized management and wide area coverage within a campus. The second dominant segment includes large enterprises and multinational corporations across finance, technology, and consulting sectors, which invest heavily in certified wireless solutions (Bluetooth/USB dongle) to support their global hybrid workforces, prioritizing features like ANC and seamless integration with corporate communication infrastructure.

The increasing prevalence of remote and decentralized operational models has fundamentally expanded the potential customer base to include small and medium-sized enterprises (SMEs) and individual professional consumers (prosumers). SMEs are increasingly seeking cost-effective, yet reliable, plug-and-play USB or entry-level Bluetooth models to ensure effective participation in video conferencing. The prosumer segment, consisting of freelance consultants, remote managers, and educators, drives demand for aesthetically appealing, multi-function headsets that transition easily between professional calls and personal media consumption, focusing on features like extended battery life and comfortable earcups suitable for all-day wear.

Beyond traditional corporate environments, specialized vertical markets represent significant growth potential. Healthcare organizations utilize UC headsets for telehealth appointments and remote diagnostics, requiring high privacy and antimicrobial features. Educational institutions, especially those employing virtual or hybrid learning models, purchase headsets for both administrative staff and students to ensure clear communication during online classes. Finally, governments and defense agencies constitute a niche, high-value customer base demanding extremely high-security, encrypted communication systems, often driving demand for highly specialized and proprietary DECT or wired solutions that meet rigorous compliance standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Jabra (GN Store Nord A/S), Plantronics (Poly, now HP), Sennheiser electronic GmbH & Co. KG, Microsoft Corporation, Logitech International S.A., Dell Technologies Inc., Cisco Systems, Inc., Axtel Headsets, ClearOne Inc., Epos Audio, Shokz (AfterShokz), VXi Corporation (now Poly), Avaya Inc., Snom Technology GmbH, Mpow, Huawei Technologies Co., Ltd., Xiaomi Corporation, Sony Corporation, Bose Corporation, Kramer Electronics Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Unified Communications Headset Market Key Technology Landscape

The technological landscape of the UC Headset market is characterized by rapid evolution across three major fronts: wireless connectivity optimization, sophisticated acoustic processing, and deep software integration. Wireless technologies are moving beyond standard Bluetooth, with DECT maintaining its importance for secure, high-density environments, while advanced Bluetooth standards (like Bluetooth 5.2 and beyond) are enabling lower latency, greater range, and superior energy efficiency, crucial for all-day usage in remote settings. Furthermore, the adoption of USB-C connectivity simplifies compatibility across modern devices, reducing the complexity associated with dongles and proprietary charging solutions. The integration of advanced power management systems ensures that battery life meets the demands of extended hybrid work schedules, a key purchase criterion for enterprise buyers.

Acoustic processing represents the most dynamic area of innovation, largely driven by the application of Artificial Intelligence. Technologies such as high-definition acoustic transducers, multiple microphone arrays, and specialized digital signal processing (DSP) chips are standard features. However, the differentiation now lies in AI-driven Active Noise Cancellation (ANC) and passive noise isolation improvements. Modern ANC algorithms utilize machine learning to dynamically adjust noise cancellation intensity based on the specific acoustic profile of the environment, offering unparalleled suppression of unpredictable sounds like human chatter and environmental disturbances. Specialized ‘voice focus’ modes ensure that only the user’s speech is transmitted, addressing the core challenge of maintaining professionalism while working outside a controlled office setting.

Finally, deep integration with UC platform software is non-negotiable for market success. Headsets are designed and certified to ensure optimal compatibility, including dedicated physical buttons for platform-specific functions (e.g., Microsoft Teams button, Zoom mute sync). This certification process guarantees hardware-software synchronization, allowing features like volume control and mute status to be reflected accurately across the software interface, minimizing user frustration and IT tickets. Emerging technologies also include sensor fusion, where internal gyroscopes and accelerometers track usage patterns, head orientation, and contextual awareness, feeding data back to the UC application or cloud management system, thereby transforming the headset into an intelligent sensor hub within the digital workspace ecosystem, paving the way for advanced biometric and presence detection capabilities.

Regional Highlights

The Unified Communications Headset Market exhibits distinct growth patterns and maturity levels across different geographic regions, heavily influenced by local IT infrastructure maturity, labor market dynamics, and regulatory environments. North America and Europe currently represent the largest and most mature markets, primarily due to the early and high adoption rates of cloud-based UC solutions, robust enterprise spending power, and a high concentration of multinational corporations driving demand for premium, certified hardware to support large-scale hybrid deployments. These regions prioritize sophisticated features such as top-tier Active Noise Cancellation, advanced security protocols, and integration ease with existing complex IT infrastructure. Competition remains fierce, focusing on product reliability, specialized customer service, and strategic partnerships with UC giants headquartered there.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by explosive growth in contact center outsourcing, rapid digital transformation initiatives across industrial sectors, and significant investment in IT infrastructure modernization in countries like India, China, and Southeast Asia. While price sensitivity is generally higher in APAC compared to Western markets, the sheer volume of emerging corporate and small-business users necessitates substantial headset procurement. This region sees demand for both high-end features tailored for multinational operations and robust, reliable entry-to-mid-range wired and wireless solutions for local market penetration. Government initiatives promoting digital literacy and remote access to services further fuel market expansion, making localized distribution and strong regional partnerships key to unlocking the full potential of this dynamic market.

Latin America (LATAM) and the Middle East and Africa (MEA) present significant, albeit nascent, opportunities. LATAM’s growth is spurred by the increasing necessity for remote educational tools and the expansion of the regional IT services sector, leading to a steady uptake of basic and mid-range wireless headsets. MEA's market expansion is tightly linked to urbanization and significant government investment in smart city projects and enterprise digital infrastructure, particularly in the Gulf Cooperation Council (GCC) countries. However, market adoption in these regions can be volatile, often constrained by varying degrees of internet connectivity reliability and fluctuating currency exchange rates, requiring vendors to adopt flexible pricing and tailored connectivity solutions to effectively capture market share.

- North America: Dominant market share due to early UC adoption, high enterprise spending, and pervasive shift to hybrid work. Focus on premium, Teams/Zoom certified, AI-enhanced wireless headsets.

- Europe: Mature market characterized by stringent data privacy regulations (GDPR) driving demand for secure DECT and high-security wireless solutions. Strong growth fueled by contact center modernization and corporate decentralization.

- Asia Pacific (APAC): Highest CAGR projected, driven by burgeoning contact center industry, rapid SME digitalization, and governmental support for remote connectivity. High demand across all price points, with strong localization needs.

- Latin America (LATAM): Emerging market focused on educational and governmental adoption, showing steady demand for reliable, mid-range wireless and wired solutions. Growth dependent on infrastructure improvement.

- Middle East and Africa (MEA): Growth tied to large-scale infrastructure projects and corporate investment in modernization, particularly in the GCC region. Security and robust connectivity are key buying criteria in sensitive sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Unified Communications Headset Market, focusing on strategic initiatives, product portfolios, recent acquisitions, and platform integration excellence.- Jabra (GN Store Nord A/S)

- Plantronics (Poly, now HP)

- Sennheiser electronic GmbH & Co. KG

- Microsoft Corporation

- Logitech International S.A.

- Dell Technologies Inc.

- Cisco Systems, Inc.

- Axtel Headsets

- ClearOne Inc.

- Epos Audio

- Shokz (AfterShokz)

- VXi Corporation (now Poly)

- Avaya Inc.

- Snom Technology GmbH

- Mpow

- Huawei Technologies Co., Ltd.

- Sony Corporation

- Bose Corporation

- Lenovo Group Limited

- Xiaomi Corporation

Frequently Asked Questions

What is driving the current demand for certified UC headsets over standard consumer headphones?

The primary driver is the need for seamless, reliable interoperability and professional-grade acoustic performance, particularly in hybrid work environments. Certified UC headsets guarantee native integration (plug-and-play functionality, synchronized mute buttons) with enterprise platforms like Microsoft Teams or Zoom, ensuring superior audio quality, advanced noise suppression, and enterprise-level security protocols that consumer headphones generally lack. This compliance reduces technical friction and enhances professional communication effectiveness.

How significant is the shift from wired to wireless technology in the Unified Communications Headset market?

The shift to wireless is highly significant and represents the fastest-growing segment, driven by the demand for mobility and comfort in remote and dynamic office settings. While wired headsets remain crucial for reliability and cost-efficiency in environments like large contact centers, the advanced battery life, secure connectivity (Bluetooth 5.0+ or DECT), and sophisticated on-device processing capabilities of wireless models are accelerating their adoption as the preferred solution for corporate and executive staff globally.

What role does Artificial Intelligence (AI) play in the evolution of UC headsets?

AI is pivotal in transforming acoustic performance and functionality. AI algorithms embedded in modern headsets enable next-generation Active Noise Cancellation (ANC) by distinguishing human speech from complex background noise with high precision. Furthermore, AI facilitates productivity features such as smart mute functions, acoustic anomaly detection, and predictive maintenance, making the headset an intelligent component of the user's digital workflow rather than just an audio output device.

Which segment—Contact Center or Remote/Hybrid Work—holds the largest market potential?

While the Contact Center segment provides a stable, high-volume demand base, the Remote/Hybrid Work segment currently holds the largest market potential and highest growth trajectory. This segment is massive, encompassing all knowledge workers who transitioned to decentralized models post-2020. The need for high-quality, personal audio equipment in non-traditional office spaces has made the remote worker segment the primary driver for technological innovation and sales volume growth in the premium wireless category.

What are the key differences between DECT and Bluetooth technology for professional UC applications?

DECT (Digital Enhanced Cordless Telecommunications) offers superior range, greater bandwidth capacity in high-density environments (less interference), and enhanced security features, making it ideal for large, centralized contact centers or secure corporate campuses. Bluetooth, conversely, excels in mobility, power efficiency, and direct connectivity to multiple personal devices (laptops, phones), making it the preferred choice for individual remote workers and small office environments where flexibility and multi-device support are prioritized over centralized, ultra-secure coverage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager