United States Stainless Steel Tableware and Kitchenwares Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432576 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

United States Stainless Steel Tableware and Kitchenwares Market Size

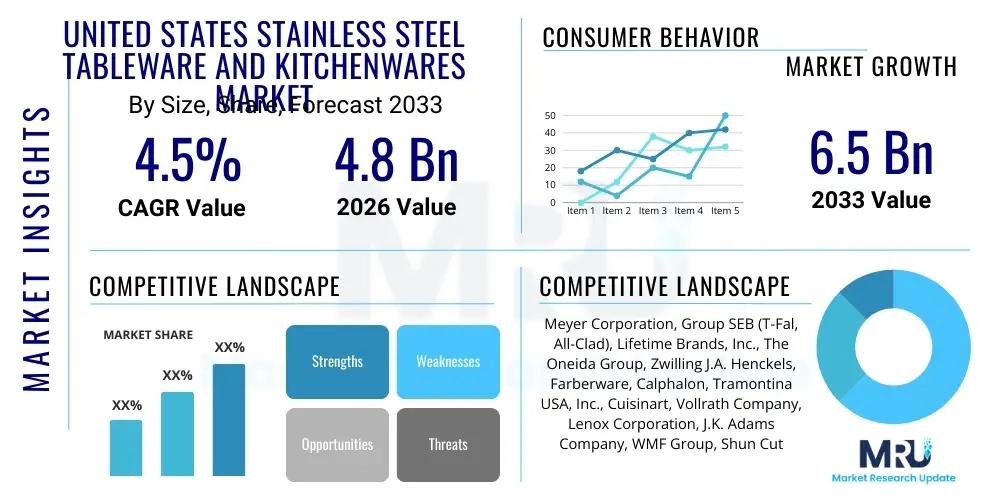

The United States Stainless Steel Tableware and Kitchenwares Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by sustained consumer demand for durable, hygienic, and aesthetically pleasing kitchen solutions, coupled with robust growth in the residential construction and hospitality sectors across major metropolitan areas and developing suburban regions. Furthermore, the increasing trend of professional home cooking, fueled by media influence and focus on culinary aesthetics, significantly boosts the replacement and premium upgrade cycles for existing stainless steel inventory.

United States Stainless Steel Tableware and Kitchenwares Market introduction

The United States Stainless Steel Tableware and Kitchenwares Market encompasses a wide range of essential household and commercial products, including flatware, cutlery, pots, pans, serving utensils, and various specialized cooking tools manufactured primarily from high-grade stainless steel alloys (such as 18/10, 18/8, and 18/0 compositions). These products are characterized by their superior durability, corrosion resistance, non-reactivity with foods, and inherent hygienic properties, making them indispensable in both residential and professional culinary environments. Major applications span residential kitchens, upscale dining establishments, quick-service restaurants, institutional cafeterias, and specialized catering operations. The primary market drivers include the consistent replacement demand, urbanization leading to increased household formation, focus on food safety standards (which stainless steel inherently supports), and the ongoing shift towards premium, multi-ply clad cookware that enhances thermal conductivity and cooking performance. The key benefit of stainless steel remains its unmatched longevity and ease of maintenance, providing high lifetime value to the consumer.

United States Stainless Steel Tableware and Kitchenwares Market Executive Summary

The US Stainless Steel Tableware and Kitchenwares market is currently undergoing significant evolution, marked by a pronounced shift toward premiumization and sustainable manufacturing practices, influencing key business and regional trends. Business trends highlight heightened competition among domestic manufacturers and international brands, particularly in the e-commerce space, where direct-to-consumer models leverage digital marketing to showcase design innovation and material quality (e.g., fully clad construction). Segmentation trends show the cookware sub-segment dominating in terms of value, driven by consumer willingness to invest in higher-priced, multi-clad pots and pans, while the flatware segment focuses heavily on design aesthetics and ergonomic improvements. Geographically, high population density areas, particularly the Northeast and Pacific regions, exhibit stronger demand for premium, imported goods, reflecting higher disposable incomes and cultural emphasis on dining experiences. Conversely, the growth in the Southern and Western states is heavily tied to rapid housing development and the expansion of casual dining chains, driving volume sales for mid-range, durable kitchen implements. Successful market penetration strategies increasingly rely on transparent sourcing, emphasizing ethical labor practices, and the utilization of recycled stainless steel content to align with evolving American consumer values regarding environmental stewardship and supply chain integrity.

AI Impact Analysis on United States Stainless Steel Tableware and Kitchenwares Market

Common user questions regarding AI's impact on the stainless steel tableware and kitchenwares market center on how artificial intelligence can optimize manufacturing precision, personalize product recommendations, and enhance supply chain resilience, rather than replacing the physical product itself. Users are concerned about the implementation costs of advanced automation, the ethical implications of data collection for personalized marketing, and the potential for AI-driven logistics to reduce lead times and improve inventory management. Key themes emerging from these inquiries involve leveraging AI for predictive maintenance in stamping and polishing facilities, automating quality control inspection using computer vision to detect microscopic flaws in finishes, and utilizing machine learning algorithms to forecast demand spikes based on seasonal changes, culinary trends, and influencer marketing campaigns. Consumers expect AI to indirectly lead to higher quality products through enhanced manufacturing consistency and more relevant purchasing experiences via sophisticated e-commerce platforms that curate product sets based on usage history and stated cooking preferences.

- AI-driven optimization of stamping and deep drawing processes, reducing material waste and energy consumption in the forging of cookware and flatware.

- Implementation of Computer Vision systems for real-time quality inspection during finishing (polishing, etching, electroplating), ensuring defect-free surfaces and uniform consistency in 18/10 stainless steel products.

- Machine Learning algorithms deployed for predictive demand forecasting, optimizing inventory levels of different product lines (e.g., specialized cutlery versus general cookware sets).

- AI-powered personalized shopping experiences on D2C platforms, recommending specific cookware sets based on user demographics, cooking style, and existing kitchen appliance inventory.

- Utilization of AI in logistics and supply chain management to anticipate raw material (nickel, chromium, iron ore) price fluctuations and optimize freight routes for imported finished goods.

- Development of smart manufacturing floors employing robotic process automation (RPA) for complex assembly tasks, such as attaching handles to multi-ply cookware bases, enhancing operational efficiency and worker safety.

DRO & Impact Forces Of United States Stainless Steel Tableware and Kitchenwares Market

The market dynamics are governed by a complex interplay of internal and external forces, summarized by robust drivers focused on durability and aesthetic appeal, alongside restraining factors such as intense material price volatility and high consumer preference for alternative materials like ceramic or cast iron in niche segments. The primary drivers include the inherent long-term cost-effectiveness and hygiene benefits of stainless steel, mandatory food safety regulations in commercial settings necessitating NSF-certified products, and the persistent growth of the US residential sector, fueling new household formation and replacement purchases. Opportunities are particularly strong in the premium segment through technological innovations such as induction-compatible, multi-layer bonded construction, and the expansion into specialized eco-friendly and lightweight stainless steel accessories catering to outdoor and minimalistic consumer lifestyles. However, the market faces significant headwinds from fluctuating costs of key raw materials (nickel and chromium), which directly impacts manufacturing margins, and the market saturation in basic tableware categories, intensifying price wars. Impact forces emphasize increasing regulatory scrutiny regarding recycled content claims and the necessity for robust branding to differentiate products in a highly competitive retail landscape, pushing manufacturers toward advanced electroplating techniques for unique aesthetic finishes and enhanced resistance to scratching.

Segmentation Analysis

The United States Stainless Steel Tableware and Kitchenwares market is strategically segmented based on product type, application (end-user), and distribution channel, providing a granular view of consumer behavior and market penetration across various sectors. The product type segmentation captures the distinction between items requiring thermal performance (cookware) and those focused primarily on aesthetic and functional handling (tableware and kitchen tools). Application segmentation clearly divides the demand generated by institutional and commercial entities from that generated by individual households, reflecting different volume requirements and quality compliance standards (e.g., NSF certification). Distribution channels highlight the ongoing shift in purchasing dynamics, emphasizing the growing importance of digital platforms and specialty kitchen stores over traditional mass merchandisers, especially for high-value premium items. Understanding these segments is crucial for manufacturers to tailor their production volumes, pricing strategies, and marketing campaigns effectively, focusing resources where the highest margin or volume growth potential exists.

- By Product Type:

- Stainless Steel Cookware (Pots, Pans, Skillets, Stockpots, Pressure Cookers)

- Stainless Steel Tableware/Flatware (Forks, Knives, Spoons, Serving Sets)

- Stainless Steel Kitchen Tools and Accessories (Spatulas, Ladles, Tongs, Whisks)

- Stainless Steel Storage Containers and Bakeware

- By Application/End-User:

- Residential (Household use, Giftware)

- Commercial (Hotels, Restaurants, Cafes, Institutional Settings, Hospitals)

- By Distribution Channel:

- Offline Channels (Supermarkets/Hypermarkets, Specialty Stores, Department Stores, Wholesalers)

- Online Channels (E-commerce Platforms, Company-Owned Websites, Third-Party Retailers)

Value Chain Analysis For United States Stainless Steel Tableware and Kitchenwares Market

The value chain for stainless steel tableware and kitchenwares begins with upstream activities focused on the extraction and processing of raw materials, primarily nickel, chromium, and iron ore, which are crucial for producing specific grades of stainless steel coils and sheets (e.g., 304/18/8 or 430/18/0). Upstream analysis involves major global metal suppliers and domestic service centers specializing in slitting and blanking the steel coils, preparing them for precision manufacturing. Manufacturers then engage in midstream processing, which includes critical operations such as hot and cold rolling, deep drawing, stamping, forging, multi-ply cladding (for high-end cookware), precision polishing, and specialized surface treatments like sandblasting or non-stick coating application. The complexity of the manufacturing phase, particularly for multi-clad induction-compatible cookware, significantly impacts the final product cost and performance, making technological investment in machinery essential. Distribution channels form a crucial part of the downstream segment, where products move through various conduits, including direct-to-consumer (D2C) online sales, indirect routes via large mass merchandisers (Walmart, Target), specialty kitchen retailers (Williams Sonoma, Sur La Table), and institutional suppliers who cater specifically to the HORECA (Hotel, Restaurant, Catering) sector. The balance between direct sales, which offers higher margins and immediate customer feedback, and traditional wholesale distribution, which ensures broad geographic reach, is a key strategic decision for market players.

United States Stainless Steel Tableware and Kitchenwares Market Potential Customers

The potential customer base for stainless steel tableware and kitchenwares in the United States is broad and diverse, extending across both consumer and commercial segments, distinguished by purchasing volume, quality requirements, and budget constraints. Residential end-users represent the largest volume segment, driven by new household formation, home renovations, wedding registries, and general replacement cycles. Within the residential segment, there is a clear distinction between the mass market consumer seeking durable, budget-friendly sets (often procured through big-box retailers or hypermarkets) and the affluent, culinary-focused consumer who prioritizes premium, brand-name, fully clad cookware and specialized flatware designs, often purchased through luxury department stores or specialty online retailers. Commercial customers, comprising the entire HORECA sector—including large hotel chains, independent fine dining restaurants, fast-casual restaurants, and institutional buyers like schools and hospitals—constitute the key segment for high-volume, rugged, and compliance-certified (NSF/ANSI Standard 2) products. These buyers prioritize industrial strength, resistance to commercial dishwashing cycles, and consistent availability of replacement pieces, frequently engaging directly with wholesale institutional distributors rather than retail channels. Furthermore, specialized buyers such as catering companies and professional culinary schools represent niche customers who require bespoke, high-performance equipment that can withstand extremely intensive daily use, reinforcing the demand for high-gauge stainless steel alloys.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Meyer Corporation, Group SEB (T-Fal, All-Clad), Lifetime Brands, Inc., The Oneida Group, Zwilling J.A. Henckels, Farberware, Calphalon, Tramontina USA, Inc., Cuisinart, Vollrath Company, Lenox Corporation, J.K. Adams Company, WMF Group, Shun Cutlery, Fissler GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

United States Stainless Steel Tableware and Kitchenwares Market Key Technology Landscape

The technological landscape in the US stainless steel market is defined by advancements primarily focused on enhancing thermal performance, optimizing manufacturing precision, and improving surface durability and finish. The most critical technological advancement in the cookware segment is the widespread adoption of multi-ply cladding, specifically tri-ply, five-ply, and seven-ply construction, where layers of highly conductive metals like aluminum or copper are fully bonded between internal and external layers of magnetic stainless steel. This technology ensures rapid, uniform heat distribution and maintains compatibility with modern induction cooktops, addressing a major limitation of traditional single-layer stainless steel. Precision manufacturing techniques, including hydroforming and high-pressure deep drawing, are increasingly utilized to create seamless cookware bodies and flatware with complex ergonomic shapes, minimizing weak points and enhancing structural integrity. Furthermore, surface treatment technologies are evolving; manufacturers are deploying advanced electroplating processes to achieve unique, aesthetically appealing finishes (e.g., matte black, gold, or copper-toned accents) on flatware while maintaining the corrosion resistance of the underlying stainless steel. Digital twinning and 3D simulation tools are also becoming instrumental in the design phase, allowing companies to virtually test the thermal dynamics and ergonomic comfort of new product designs before committing to expensive physical prototyping, speeding up time-to-market for innovative, performance-driven kitchenware.

Regional Highlights

- Northeast Region (New York, Massachusetts, Pennsylvania): Characterized by high density and established culinary traditions, this region exhibits strong demand for high-end, imported stainless steel flatware and specialized gourmet kitchen tools. The market is driven by affluent urban consumers, a concentrated density of fine dining establishments, and a robust gift-registry culture, favoring premium European and Japanese brands known for meticulous craftsmanship and superior material quality, often resulting in higher average transaction values.

- Pacific West Coast (California, Washington, Oregon): This dynamic region is marked by high adoption rates of sustainable and health-conscious consumer products. Demand for stainless steel kitchenwares is driven by both rapid residential expansion and a strong focus on culinary innovation. Consumers here prioritize functional design, eco-friendly production methods (using recycled steel), and induction-compatible technology, reflecting the region's early adoption of electric and smart kitchen appliance technologies.

- Southeast Region (Florida, Georgia, North Carolina): Market growth in the Southeast is significantly correlated with explosive population growth and widespread commercial development, particularly in the hospitality sector. This region drives high volume sales for mid-range, durable stainless steel cookware and utility items required by expanding hotel chains, resort complexes, and new suburban households, emphasizing resilience against humidity and commercial-grade cleaning agents.

- Midwest Region (Illinois, Texas, Ohio): A balanced market with strong representation across both residential and commercial segments. Texas, in particular, acts as a major distribution and industrial hub, supporting strong B2B sales to institutional buyers (schools, corporate cafeterias). Residential demand remains stable, focusing on reliable, functional stainless steel sets offered primarily through mass market retailers and major department store chains, with price point sensitivity often higher than in coastal areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the United States Stainless Steel Tableware and Kitchenwares Market.- Meyer Corporation

- Group SEB (All-Clad, T-Fal)

- Lifetime Brands, Inc.

- The Oneida Group

- Zwilling J.A. Henckels

- Calphalon (Newell Brands)

- Tramontina USA, Inc.

- Vollrath Company

- Cuisinart (Conair Corporation)

- Farberware (Meyer Corporation)

- Lenox Corporation

- Tupperware Brands Corporation (Select Stainless Lines)

- Fissler GmbH

- WMF Group (A brand of Group SEB)

- Shun Cutlery (Kai USA Ltd.)

- OXO (Helen of Troy)

- Norpro Inc.

- Gourmia

- J.K. Adams Company

- T-Fal (Group SEB)

Frequently Asked Questions

Analyze common user questions about the United States Stainless Steel Tableware and Kitchenwares market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for premium stainless steel cookware in the US?

The increasing consumer preference for professional-grade culinary results at home, coupled with the widespread adoption of induction cooktops, drives demand for premium, multi-ply clad stainless steel cookware known for superior heat distribution, durability, and induction compatibility.

How is the growth of e-commerce affecting stainless steel kitchenware sales?

E-commerce platforms are accelerating market growth by providing direct-to-consumer (D2C) channels, enabling brands to showcase design innovation, offer personalized bundles, and leverage advanced visual content, significantly reducing reliance on traditional brick-and-mortar specialty stores for premium products.

Which stainless steel grades are most common for US kitchenwares, and why?

The most common grades are 18/10 (304 series, high nickel content for maximum corrosion resistance and polish) used for premium flatware and inner cooking surfaces, and 18/0 (430 series, magnetic) often used for the exterior bases of clad cookware to ensure induction compatibility.

What are the key differences between residential and commercial stainless steel purchases?

Commercial purchases prioritize rugged construction, high gauge thickness, ease of cleaning, NSF certification for food safety, and low cost per unit volume, while residential purchases often focus more on aesthetic design, ergonomic comfort, and advanced features like multi-ply cladding for performance.

How do fluctuating raw material prices impact US stainless steel market players?

Volatility in the prices of nickel and chromium, essential alloying elements, directly increases manufacturing costs. Companies mitigate this through hedging strategies, optimizing inventory cycles, and implementing advanced production automation to offset material expense with efficiency gains.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager