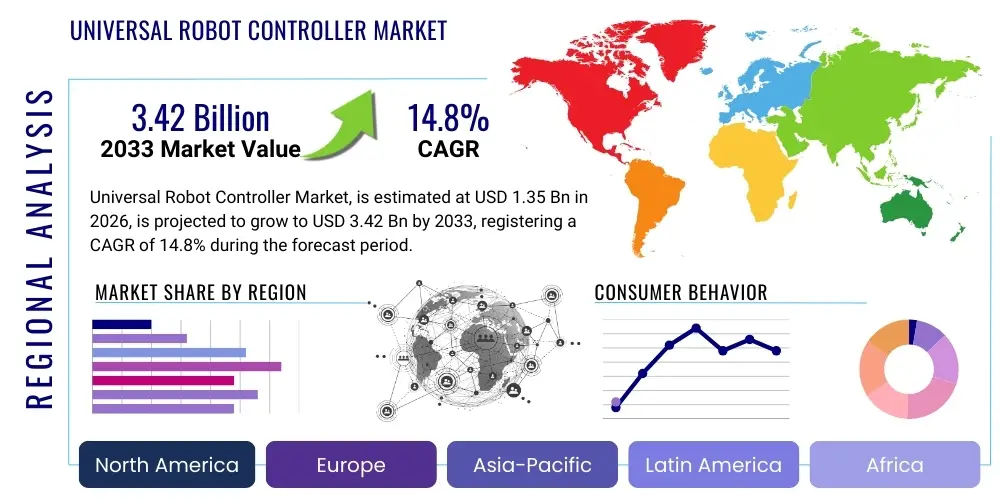

Universal Robot Controller Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436881 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Universal Robot Controller Market Size

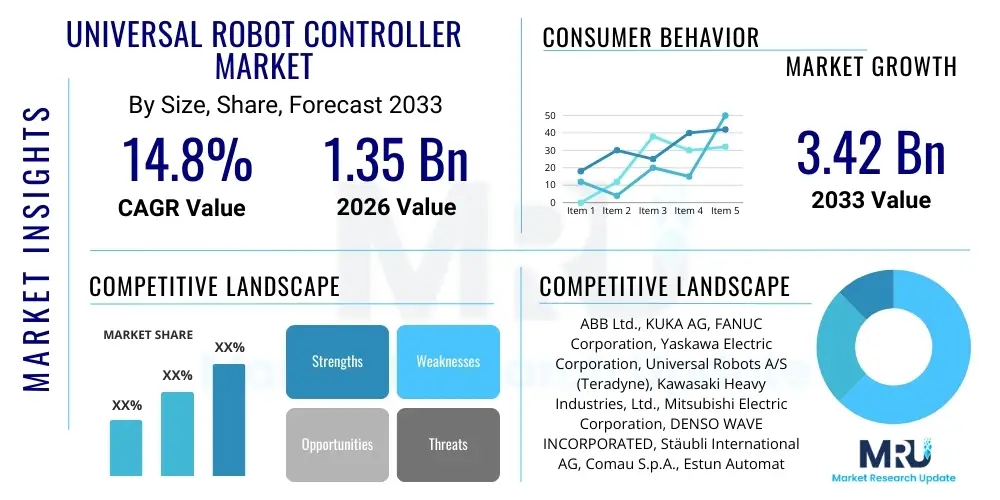

The Universal Robot Controller Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 3.42 Billion by the end of the forecast period in 2033.

Universal Robot Controller Market introduction

The Universal Robot Controller Market encompasses the specialized hardware and software components responsible for governing the motion, trajectory planning, sensor integration, and overall operational logic of universal robots, particularly collaborative robots (cobots). These controllers serve as the brain of the robotic system, translating high-level task commands into precise, real-time motor signals, ensuring safety, repeatability, and seamless interaction within complex manufacturing environments. The core function involves processing inputs from various sources, including vision systems, force-torque sensors, and external programming interfaces, to execute predefined or dynamically generated motion paths with high fidelity. The sophistication of these controllers is rapidly evolving, driven by the demand for easier programming and safer human-robot collaboration.

Major applications for universal robot controllers span across industries requiring high flexibility and short-run production cycles. Key sectors include electronics manufacturing for delicate pick-and-place operations, automotive assembly for quality inspection and component insertion, and logistics/e-commerce for automated sorting and packaging. The inherent benefits of advanced universal controllers include reduced total cost of ownership (TCO) through simplified integration, rapid deployment capabilities, enhanced operational safety, and the ability to handle highly complex tasks via advanced kinematics and proprietary algorithms. Furthermore, the adoption of open architecture controllers is expanding, providing greater flexibility for end-users to customize software stacks and integrate third-party peripheral hardware seamlessly.

Driving factors for market expansion are multifaceted, anchored primarily by the global push towards Industry 4.0 standards and the increasing necessity for automation in mitigating labor shortages. The rapid technological advancements in sensor technology and edge computing capabilities are enabling controllers to process large data volumes in real-time, significantly improving decision-making speed and accuracy. Additionally, favorable regulatory environments in key manufacturing regions that promote the safe deployment of collaborative robots are bolstering market penetration, particularly among Small and Medium Enterprises (SMEs) previously deterred by the complexity and cost associated with traditional industrial robotic systems.

Universal Robot Controller Market Executive Summary

The Universal Robot Controller Market is characterized by robust growth, fueled predominantly by the acceleration of smart factory initiatives and the transition from highly structured industrial robots to flexible, collaborative systems. Current business trends indicate a strong shift towards software-defined control (SDC) architectures, where control logic is increasingly decoupled from proprietary hardware, enabling faster updates, improved interoperability, and the deployment of AI-powered features like predictive maintenance and adaptive path planning. Key technological developments focus on enhancing controller accessibility, resulting in the proliferation of intuitive, graphical user interfaces that reduce the reliance on specialized programming expertise and broaden the application base of universal robots across diverse sectors.

Regionally, Asia Pacific maintains its dominance, driven by massive manufacturing capacities in China, Japan, and South Korea, coupled with significant governmental investment in robotics technology adoption. However, North America and Europe are exhibiting high rates of growth in the high-end segment, primarily in fields requiring stringent safety certifications and complex, mixed-manufacturing environments, leading to high average selling prices for advanced controllers integrating machine vision and force sensing. Segment trends clearly favor controllers designed for collaborative robot applications, reflecting the market’s pivot towards systems that maximize throughput while minimizing required footprint and ensuring operator safety.

The market outlook remains positive, underpinned by continuous product innovation aimed at lowering entry barriers. Companies are heavily investing in integrating 5G capabilities for enhanced wireless control and remote diagnostics, crucial for distributed manufacturing setups. The competitive landscape is intensifying, forcing established industrial automation players to acquire or partner with specialized software firms to quickly incorporate advanced features, ensuring their controller offerings remain competitive against agile, software-focused startups. Overall, the market is moving towards highly networked, intelligent, and flexible control solutions that are integral to the future of automated production.

AI Impact Analysis on Universal Robot Controller Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Universal Robot Controller Market primarily revolve around three core themes: achieving true operational autonomy, enhancing safety protocols in shared workspaces, and optimizing resource utilization through predictive intelligence. Users frequently question how AI algorithms can simplify complex task programming, moving away from explicit coding towards learning-based approaches, especially concerning variable pick-and-place tasks or quality inspection of non-standard parts. Concerns also focus on the reliability and real-time processing requirements of integrating machine learning models directly into the controller hardware (Edge AI) to ensure motion adjustments occur instantaneously, critical for both speed and safety in dynamic environments.

The implementation of AI is fundamentally transforming controller functionality by enabling advanced perception and decision-making capabilities that were previously centralized or absent. AI-powered controllers can utilize reinforcement learning to optimize robot movements dynamically, adjusting trajectories based on real-time feedback from vision systems and tactile sensors, thereby maximizing efficiency and reducing cycle times significantly. This transition shifts the controller’s role from purely kinematic execution to intelligent planning and self-correction, which is vital for high-mix, low-volume manufacturing setups. Furthermore, AI contributes to enhanced system reliability by providing sophisticated predictive maintenance insights, analyzing motor current signatures and vibration data to forecast potential component failures before they lead to costly downtime.

Consequently, the market is experiencing a rapid evolution toward intelligent controllers capable of handling massive streams of sensor data. This integration facilitates true human-robot collaboration (HRC), allowing robots to anticipate human actions and adjust their speed or path proactively, moving beyond simple speed and separation monitoring. Manufacturers are now marketing controllers not just on processing power, but on the sophistication of their integrated AI tools, focusing on features like collision avoidance, autonomous error recovery, and zero-downtime reconfiguration. This focus on intelligence is driving hardware requirements toward high-performance, low-latency processors suitable for running complex neural networks at the edge.

- AI enables real-time adaptive path planning, optimizing energy consumption and cycle time.

- Machine Learning algorithms significantly simplify robot programming through 'teaching by demonstration.'

- Edge AI integration facilitates instantaneous decision-making critical for collaborative safety and speed.

- Predictive Maintenance features leverage AI to analyze operational data, reducing unplanned downtime.

- Enhanced perception through deep learning improves object recognition and handling of unstructured environments.

- AI-driven controllers support advanced Human-Robot Collaboration (HRC) through proactive behavior adjustment.

DRO & Impact Forces Of Universal Robot Controller Market

The Universal Robot Controller Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming significant Impact Forces that dictate its trajectory. Primary drivers include the global imperative for improved manufacturing efficiency, the sustained momentum of the Industry 4.0 paradigm, and the increasing affordability and accessibility of collaborative robots (cobots), which directly rely on sophisticated universal controllers for their operational flexibility. These factors are compounded by persistent labor shortages in skilled and repetitive task domains across developed economies, making automation a necessity rather than merely a competitive advantage. The ability of modern controllers to handle complex tasks with simplified user interfaces further lowers the deployment barrier for new adopters, significantly driving volume growth.

Conversely, the market faces notable restraints, chiefly the high initial investment required for advanced robotic systems and their controllers, which can be prohibitive for smaller enterprises, despite the lowering cost of cobots. Interoperability remains a challenge; while standards are improving, integrating controllers with legacy factory systems (SCADA, MES) often requires substantial custom engineering effort. Furthermore, the perceived complexity of transitioning existing workforces to operate alongside sophisticated robotic systems, coupled with concerns regarding data security and intellectual property protection within connected industrial environments, sometimes slows adoption, particularly in highly regulated industries.

Opportunities for market growth are abundant, centering around technological advancements such as the integration of 5G connectivity for enhanced remote control and distributed manufacturing coordination, and the proliferation of Edge Computing capabilities, allowing more processing power to reside directly within the controller for ultra-low latency response. The expanding scope of applications beyond traditional factory settings, including sectors like healthcare (surgical assistants, lab automation) and agriculture, represents a vast untapped potential. These forces collectively shape the market: technological acceleration demands continuous innovation in controller hardware and software, while market acceptance requires a strong focus on usability, cybersecurity, and adherence to evolving international safety standards (e.g., ISO 10218, ISO/TS 15066). This continuous pressure ensures controllers are becoming smarter, safer, and easier to deploy.

Segmentation Analysis

The Universal Robot Controller market is broadly segmented based on Component, Payload Capacity, Application, and Industry Vertical. Understanding these segmentations is critical for evaluating market maturity and identifying niche growth areas. The component segmentation differentiates between the physical hardware (e.g., dedicated control boxes, industrial PCs, integrated drives) and the crucial software layer (e.g., operating systems, proprietary programming interfaces, motion planning algorithms, and simulation tools). As robotics become more software-centric, the revenue derived from software and service subscriptions related to controller updates, diagnostics, and AI model refinement is rapidly gaining market share against traditional hardware sales, signaling a major structural shift.

Segmentation by payload capacity is directly tied to the robot's capabilities and its intended deployment environment. Controllers for low-payload robots (typically under 5 kg) are optimized for speed, precision, and collaborative safety, often targeting electronics and pharmaceutical industries. Conversely, controllers for high-payload systems (above 10 kg) are engineered for higher power output, torque control, and robust fault tolerance, primarily serving heavy industrial applications such as automotive body shops or complex machining operations. The increasing demand for medium-payload cobots (5-10 kg) in general manufacturing is creating a rapidly expanding middle segment, characterized by high flexibility and ease of redeployment.

Industry vertical segmentation reveals differential adoption rates and specific controller feature requirements. The automotive sector, historically the largest consumer, requires robust controllers capable of complex synchronization (e.g., line tracking). The electronics industry demands ultra-high precision motion control for micro-assembly. Meanwhile, the emerging food and beverage sector requires controllers with high ingress protection (IP) ratings and features optimized for hygienic environments and vision-guided quality checks. The continuous diversification of applications underscores the need for universal robot controllers to offer modularity and extensive customization capabilities to address unique sector-specific challenges, ensuring market penetration across the full spectrum of industrial and service robotics.

- Component:

- Hardware (Control Boxes, Integrated Control Systems, Industrial PCs)

- Software (Operating Systems, Programming Software, Simulation Tools, Diagnostic & Monitoring Tools)

- Payload Capacity:

- Low Payload (Under 5 kg)

- Medium Payload (5 kg to 10 kg)

- High Payload (Above 10 kg)

- Application:

- Material Handling and Logistics (Pick and Place, Palletizing)

- Assembly and Disassembly

- Welding and Soldering

- Processing (Cutting, Grinding, Polishing)

- Inspection and Quality Control

- Industry Vertical:

- Automotive

- Electrical and Electronics

- Metal and Machinery

- Food and Beverage

- Pharmaceuticals and Cosmetics

- Others (Logistics, Education, Research)

Value Chain Analysis For Universal Robot Controller Market

The value chain for the Universal Robot Controller Market begins upstream with the suppliers of critical electronic and mechanical components. This segment includes specialized manufacturers providing high-performance microprocessors, custom-designed ASICs (Application-Specific Integrated Circuits) optimized for real-time kinematic calculations, specialized motor drive components, and advanced sensors (e.g., encoders, force/torque sensors, LiDAR). The quality and availability of these core components directly impact the final performance and cost of the controller unit. Strong relationships with high-tech semiconductor suppliers are paramount, especially given the global volatility in the supply chain for advanced electronics. The selection of real-time operating systems (RTOS) and middleware also occurs predominantly in this upstream phase, setting the architectural foundation for the controller's capabilities.

The midstream phase is dominated by the robot manufacturers and dedicated controller system developers. These entities take the core components and integrate them into a functional, proprietary control system, developing the custom software stack, user interfaces, and safety protocols necessary for robot operation. This stage involves extensive R&D in motion control algorithms, collision detection methodologies, and safety certification processes. The primary distribution channel for the controller itself is typically bundled directly with the robot arm (OEM model). However, an increasing trend involves the development of platform-agnostic controllers, distributed through direct sales to system integrators who customize the robot for specific end-user environments.

The downstream segment involves system integrators, distributors, and the ultimate end-users. System integrators play a vital role, acting as the interface between the core technology and the specific factory floor requirements, providing necessary programming, peripheral integration (e.g., grippers, cameras), and commissioning services. Direct channels are often utilized by major robot manufacturers selling directly to large, sophisticated industrial clients (e.g., Tier 1 automotive suppliers). Indirect channels rely on a network of certified distributors and regional value-added resellers (VARs) who provide localized sales support, training, and ongoing maintenance, particularly crucial for penetrating the SME segment. The effectiveness of the indirect channel heavily influences market reach and service quality after deployment.

Universal Robot Controller Market Potential Customers

The primary potential customers for Universal Robot Controllers are sophisticated manufacturing entities seeking to implement or upgrade automated production lines, placing a high premium on flexibility and safety. Large industrial corporations, particularly those in the automotive, aerospace, and heavy machinery sectors, represent significant buyers, often requiring high-performance controllers capable of managing multiple axes, integrating complex sensor data, and maintaining stringent synchronization across large production cells. These large end-users are typically characterized by their need for scalable, network-enabled controllers that comply with high levels of industrial security standards and offer comprehensive remote diagnostic capabilities through cloud connectivity.

A rapidly expanding customer base is found within the Electrical and Electronics (E&E) and consumer goods industries. These sectors are characterized by frequent product changes and high-mix production demands, making the quick programming and reconfiguration capabilities of universal controllers essential. Customers here prioritize ease-of-use, advanced vision system integration for precision component handling, and compact controller footprints. The rise of e-commerce and logistics further solidifies this customer segment, with distribution centers requiring reliable, high-speed controllers for sorting, kitting, and palletizing tasks, emphasizing uptime and integration with warehouse management systems (WMS).

Crucially, the accessibility and safety features inherent in universal robot controllers have opened up the Small and Medium Enterprise (SME) segment. SMEs, previously excluded by the complexity and cost of traditional robotics, now represent a high-growth customer pool. These buyers seek low-cost, intuitive controllers that enable rapid deployment with minimal in-house expertise. Collaborative controllers designed for immediate human interaction are highly sought after by SMEs aiming to automate monotonous or ergonomically taxing tasks while maintaining flexibility for various job functions within a confined space. This focus on simplified, graphical programming interfaces is a key determinant for penetration in the SME market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 3.42 Billion |

| Growth Rate | 14.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Universal Robots A/S (Teradyne), Kawasaki Heavy Industries, Ltd., Mitsubishi Electric Corporation, DENSO WAVE INCORPORATED, Stäubli International AG, Comau S.p.A., Estun Automation, Siemens AG, Beckhoff Automation, Rockwell Automation, OMRON Corporation, Schneider Electric SE, Nachi-Fujikoshi Corp., Exor International S.p.A., B&R Industrial Automation GmbH, Toshiba Machine Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Universal Robot Controller Market Key Technology Landscape

The technology landscape for Universal Robot Controllers is characterized by a rapid evolution toward software-defined control (SDC) and enhanced integration capabilities, shifting the core value from proprietary hardware boxes to agile software stacks. A major trend is the widespread adoption of Real-Time Operating Systems (RTOS) combined with sophisticated middleware tailored for deterministic motion control, ensuring that critical safety and trajectory planning tasks are executed with guaranteed latency. The focus on SDC allows manufacturers to deploy updates, new features, and security patches remotely, significantly extending the operational lifespan and adaptability of the installed robot base. Furthermore, the integration of advanced path planning algorithms, often leveraging proprietary inverse kinematics solutions, ensures that universal robots can operate efficiently in highly constrained or dynamic three-dimensional workspaces.

Another pivotal technological advancement involves the integration of high-performance computing (HPC) at the edge, specifically optimized for running complex Machine Learning (ML) models. This involves embedding powerful GPUs or specialized AI accelerators directly into the controller unit, enabling immediate processing of data from vision systems (3D cameras, LiDAR) and force-torque sensors without relying on cloud connectivity. This Edge AI capability is crucial for achieving true collaborative safety and adaptability, allowing the robot to recognize irregular objects, adjust grip force dynamically, and respond to human presence in real-time, thereby maximizing cycle efficiency while adhering to strict safety standards such as ISO 10218-1 and ISO/TS 15066. The shift towards open standards, notably OPC Unified Architecture (OPC UA), is also defining the current landscape, promoting seamless vertical and horizontal integration with other Industrial IoT (IIoT) devices and enterprise resource planning (ERP) systems.

Security and connectivity form the third critical pillar of the modern controller landscape. With increasing connectivity required for remote diagnostics and factory networking, robust cybersecurity protocols are essential. Controllers are now designed with embedded security features, including secure boot processes, encrypted communication channels (TLS/SSL), and stringent access controls to protect against unauthorized modification or denial-of-service attacks. Concurrently, the proliferation of 5G technology is enabling controllers to participate effectively in highly distributed manufacturing setups, supporting ultra-reliable low-latency communication (URLLC) for tasks that require real-time synchronization across multiple robotic cells located miles apart. This combination of advanced processing, open communication standards, and robust security architecture is foundational to the next generation of universal robot control systems.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the Universal Robot Controller Market, primarily due to the massive scale of manufacturing operations in China, South Korea, and Japan. China acts as the largest consumer, driven by rapid industrial automation across the electronics, automotive, and general machinery sectors. The high volume adoption, particularly of collaborative robots (cobots), necessitates cost-effective yet highly reliable controllers. Regional growth is further supported by governmental policies favoring smart factory investment and localized supply chains for electronic components.

- North America: Characterized by early adoption of advanced robotics and high labor costs, North America exhibits strong demand for high-end, technologically sophisticated controllers, especially those integrating advanced AI and vision systems. The US market focuses heavily on complex assembly, logistics, and emerging applications in biotechnology and healthcare automation. Emphasis is placed on controllers compatible with strict industrial safety standards and capable of seamless integration with existing high-level enterprise systems.

- Europe: Europe is a mature market driven by the stringent regulatory framework for worker safety and the presence of world-leading automotive and aerospace manufacturers. Germany and Italy are major hubs, demanding highly precise and compliant controllers. European growth is focused on retrofit opportunities and sophisticated HRC solutions, prioritizing controllers that offer comprehensive diagnostics and meet regional energy efficiency mandates. The focus is often on quality and standardization (OPC UA compliance) rather than sheer volume.

- Latin America (LATAM): This region is an emerging market with gradual growth driven by modernization efforts in the automotive and natural resource processing industries (e.g., Brazil and Mexico). Adoption is often cost-sensitive, favoring robust, proven technologies. The market seeks controllers that can withstand challenging environmental conditions and offer long operational lifecycles with minimal maintenance requirements.

- Middle East and Africa (MEA): MEA represents the smallest but fastest-growing regional market, largely propelled by diversification efforts in the UAE and Saudi Arabia to reduce reliance on oil and gas by investing in advanced manufacturing and logistics infrastructure. Demand is concentrated in large, state-sponsored projects requiring cutting-edge, integrated automation solutions, focusing on controllers designed for high throughput and remote management capabilities in often extreme climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Universal Robot Controller Market.- ABB Ltd.

- KUKA AG

- FANUC Corporation

- Yaskawa Electric Corporation

- Universal Robots A/S (Teradyne)

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Electric Corporation

- DENSO WAVE INCORPORATED

- Stäubli International AG

- Comau S.p.A.

- Estun Automation

- Siemens AG

- Beckhoff Automation

- Rockwell Automation

- OMRON Corporation

- Schneider Electric SE

- Nachi-Fujikoshi Corp.

- Exor International S.p.A.

- B&R Industrial Automation GmbH

- Toshiba Machine Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Universal Robot Controller market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of AI in modern Universal Robot Controllers?

AI significantly enhances controller capabilities by enabling adaptive motion planning, advanced predictive maintenance, and real-time decision-making for complex tasks such as dynamic object recognition and safe human-robot collaboration (HRC).

How is the move towards Software-Defined Control (SDC) impacting the market?

SDC is shifting value away from proprietary hardware toward flexible software stacks, allowing for faster feature deployment, easier integration with IT infrastructure (IIoT), and reduced total cost of ownership (TCO) through remote updates and diagnostics.

Which industry vertical is driving the highest demand for Universal Robot Controllers?

While the automotive sector remains a major consumer, the Electrical and Electronics (E&E) and logistics sectors are currently experiencing the fastest growth in demand due to the necessity for flexible, high-precision automation for varied component handling and packaging tasks.

What are the key technological standards driving interoperability in the market?

The primary standard driving interoperability is OPC Unified Architecture (OPC UA), which facilitates seamless vertical communication between the controller and enterprise systems (MES/ERP), and horizontal communication between different manufacturing floor devices.

What is the forecast growth rate (CAGR) for the Universal Robot Controller Market?

The Universal Robot Controller Market is projected to grow robustly at a Compound Annual Growth Rate (CAGR) of 14.8% between 2026 and 2033, driven by global smart manufacturing adoption and collaborative robot proliferation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager