Unsweetened Coconut Milk Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436240 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Unsweetened Coconut Milk Market Size

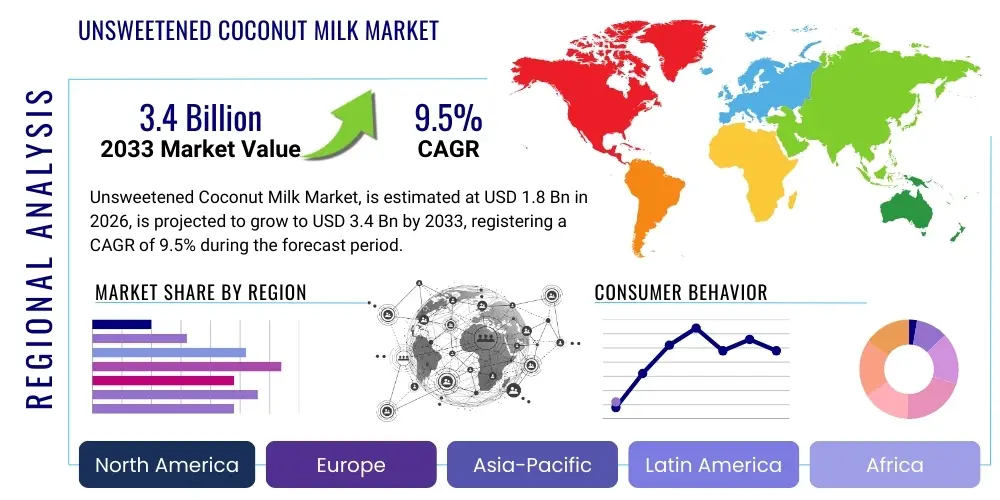

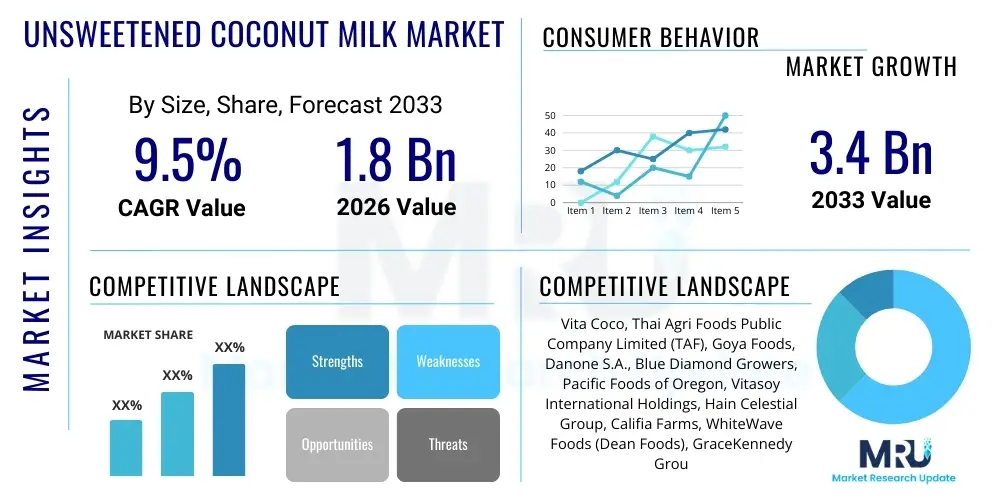

The Unsweetened Coconut Milk Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033.

Unsweetened Coconut Milk Market introduction

The Unsweetened Coconut Milk Market encompasses plant-based milk alternatives derived from the filtered liquid of shredded coconut meat, processed without the addition of sugars or artificial sweeteners. This product category has experienced significant traction globally, driven primarily by evolving consumer preferences toward health-conscious diets, the rising incidence of lactose intolerance, and the mainstream adoption of vegan and flexitarian lifestyles. As a naturally dairy-free and soy-free option, unsweetened coconut milk serves as a versatile substitute in beverages, cooking, and baking, offering a low-calorie profile and medium-chain triglycerides (MCTs).

Major applications of unsweetened coconut milk span across the Food and Beverage industry, notably in coffee creamers, smoothies, breakfast cereals, and culinary preparations where a mild, creamy texture without added sugar is desired. The core benefits driving consumer adoption include its clean label appeal, suitability for ketogenic and paleo diets due to its low carbohydrate content, and perceived digestive advantages over traditional dairy. Its versatility allows manufacturers to position it both as a daily staple and as a specialized functional ingredient, capitalizing on the broader trend of personalized nutrition.

Key driving factors accelerating market expansion include stringent efforts by manufacturers to improve taste and texture parity with dairy, investments in sustainable sourcing practices, and the continuous expansion of retail distribution networks, especially in emerging economies. Furthermore, aggressive marketing campaigns highlighting the nutritional superiority and environmental benefits of plant-based products, coupled with innovation in packaging formats (such as aseptic cartons and ready-to-drink options), are solidifying its position against competing milk alternatives like almond, oat, and soy milk.

Unsweetened Coconut Milk Market Executive Summary

The Unsweetened Coconut Milk Market is characterized by robust growth, driven by key business trends centered around sustainability commitments and product diversification. Manufacturers are heavily investing in vertical integration to secure stable coconut supply chains and enhance traceability, addressing consumer demand for ethical sourcing. Business trends also highlight the proliferation of functional attributes, such as added vitamins (B12, D) and calcium fortification, transforming the product from a simple alternative into a nutritional powerhouse. Furthermore, strategic partnerships between coconut milk producers and major coffee chains or quick-service restaurants are opening up high-volume commercial opportunities, standardizing its use in out-of-home consumption.

Regionally, North America and Europe dominate consumption due to high awareness, disposable incomes, and well-established vegan communities, serving as primary markets for innovation and premium product launches. However, the Asia Pacific (APAC) region is pivotal, not just as the primary source of raw materials (Thailand, Indonesia, Philippines) but also as a rapidly growing consumer base, fueled by urbanization and rising health consciousness. Trends within APAC involve a shift from traditional, highly processed dairy toward cleaner, local plant-based alternatives, potentially positioning APAC as the highest growth market during the forecast period.

Segmentation trends indicate a strong consumer preference for liquid formulation (beverages) over concentrated formats, though concentrated forms maintain significance in the food processing industry. In terms of distribution, mainstream retail channels, particularly supermarkets and hypermarkets, remain crucial, yet the e-commerce segment is witnessing the fastest expansion, catering to convenience and bulk purchasing. The dominance of the unflavored segment persists, but there is an increasing demand for subtle, naturally derived flavored unsweetened variants (e.g., vanilla, chocolate) that maintain the low-sugar profile, illustrating a sophisticated evolution in consumer taste preferences within the dairy alternative category.

AI Impact Analysis on Unsweetened Coconut Milk Market

User queries regarding AI's impact on the Unsweetened Coconut Milk Market frequently center on supply chain resilience, flavor optimization, and consumer personalization. Common concerns include how AI can mitigate the inherent volatility in coconut commodity prices and weather-related supply disruptions, ensuring a consistent volume of high-quality raw material. Users also inquire about AI-driven quality control—specifically, detecting contaminants or inconsistencies in coconut flesh processing. A major theme is the expectation that AI and machine learning will lead to highly specific product recommendations (e.g., coconut milk formulated for specific health conditions like managing blood sugar levels) and optimized flavor profiles that cater precisely to micro-regional tastes, thus minimizing product development failure rates.

- AI-driven Predictive Analytics: Optimizing raw material sourcing from coconut plantations by predicting yield based on environmental data (weather patterns, soil health), leading to better contract negotiations and reduced supply chain costs.

- Automated Quality Control: Implementing machine vision and sensor technology during processing to instantly detect subtle variations in fat content, texture, and microbial load, ensuring stringent product consistency and food safety standards.

- Personalized Formulation: Utilizing machine learning algorithms to analyze consumer genetics, dietary tracking data, and purchase history to develop customized coconut milk formulations optimized for individual nutritional needs or flavor preferences.

- Demand Forecasting Optimization: Employing advanced forecasting models that integrate real-time retail sales data, promotional effectiveness, and external factors (e.g., social media trends, competitor activity) to minimize spoilage and inventory holding costs across the distribution network.

- Process Efficiency Enhancement: Applying AI to optimize ultra-high-temperature (UHT) processing and homogenization steps, reducing energy consumption and maximizing the extraction rate of desirable coconut solids while maintaining nutritional integrity.

- Sustainable Farming Practices: Deploying AI and IoT devices in coconut cultivation to manage water usage, fertilizer application, and pest control, thereby enhancing the sustainability profile and reducing the environmental footprint of raw material production.

- Consumer Trend Identification: Using natural language processing (NLP) to analyze vast amounts of social media chatter, recipe searches, and online reviews to quickly identify nascent flavor trends or ingredient pairing preferences, speeding up the innovation cycle for new product launches.

DRO & Impact Forces Of Unsweetened Coconut Milk Market

The market dynamics for unsweetened coconut milk are shaped by a powerful confluence of health-related drivers and external economic restraints, creating significant impact forces. Key drivers include the exponential rise in global lactose intolerance and diagnosed dairy allergies, compelling consumers to seek readily available and palatable alternatives. Coupled with this is the accelerating global adoption of plant-based diets, fueled by ethical considerations regarding animal welfare and documented environmental benefits of minimizing dairy consumption. These drivers create a sustained upward pressure on demand, supported by endorsements from health organizations and high-profile individuals promoting low-sugar diets.

Restraints, however, pose significant strategic challenges, primarily centered on supply chain volatility. Coconut, being a tropical commodity, is susceptible to unpredictable climate change effects, natural disasters, and geopolitical instability in primary production regions, leading to sharp price fluctuations that compress manufacturer margins. Furthermore, intense competition from other plant-based milk alternatives—particularly oat milk, which is currently favored for its creamy texture in coffee applications—requires continuous differentiation and innovation in formulation. Consumer perception regarding the high saturated fat content of coconut oil, even when offset by MCT benefits, remains a minor deterrent for some health-conscious segments.

Opportunities for market growth are abundant, particularly in product diversification and geographical expansion. There is a strong potential for integrating unsweetened coconut milk into functional foods, such as protein shakes or pre-workout beverages, appealing to the active lifestyle demographic. Developing specialized, high-performance formulations tailored for professional baristas to enhance foamability and texture stability offers a lucrative avenue in the foodservice sector. The overall impact forces suggest that while competitive and supply-side risks exist, the fundamental shift toward cleaner labels and plant-based consumption is a powerful, enduring structural trend that will continue to dictate market expansion and necessitate aggressive investment in sustainable sourcing and innovative processing technologies.

Segmentation Analysis

The segmentation of the Unsweetened Coconut Milk market provides a detailed view of consumer behavior and manufacturer strategies across different product formats, applications, and distribution channels. The primary segmentation distinguishes between the Formulations (liquid, powder, concentrated cream) and the Application sectors (beverages, dairy and desserts, savory dishes). The market is heavily skewed towards the liquid formulation, catering directly to the substitution of dairy milk in daily consumption, necessitating highly efficient aseptic packaging solutions and extended shelf life capabilities.

Further analysis focuses on the distribution landscape, which includes both traditional brick-and-mortar retail (supermarkets, convenience stores) and emerging channels like specialized health food stores and e-commerce platforms. The dominance of the retail segment reflects the consumer habit of purchasing these products for in-home use. However, the rapidly expanding foodservice segment, covering coffee shops, hotels, and institutional catering, represents a critical area for B2B growth, often requiring different bulk packaging and stability characteristics than retail products.

The segmentation based on end-use reveals that direct consumer consumption (beverages) remains the largest segment, but the industrial use of unsweetened coconut milk as a clean-label ingredient in ice creams, yogurts, and prepared foods is growing substantially. Manufacturers utilize detailed segmentation data to tailor marketing campaigns, optimizing product placement, and addressing specific regulatory requirements inherent in different regional markets, particularly concerning fortification and ingredient transparency mandates.

- By Formulation:

- Liquid

- Powder/Aerosol

- Concentrated Cream

- By Application:

- Beverages (Direct Consumption, Smoothies, Coffee & Tea)

- Dairy & Desserts (Yogurt, Ice Cream, Puddings)

- Savory & Culinary (Curries, Soups, Sauces)

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail (E-commerce)

- Health Food Stores

- Food Service (Horeca)

Value Chain Analysis For Unsweetened Coconut Milk Market

The value chain for unsweetened coconut milk begins with upstream analysis, which is highly sensitive to the agricultural sector. This stage involves the cultivation and harvesting of mature coconuts, predominantly in tropical regions of Southeast Asia. Key activities include sourcing, quality inspection based on fat content and freshness, and initial processing steps like shelling and meat extraction. Upstream efficiency and sustainability practices—such as fair trade certifications and regenerative farming—are crucial, as they directly impact the raw material cost and the final product's ethical positioning, which is increasingly valued by Western consumers.

The middle segment of the value chain involves complex manufacturing and processing. This stage includes shredding the coconut meat, extracting the milk, filtration to achieve the desired consistency, and pasteurization or UHT treatment to ensure shelf stability. Manufacturers must employ advanced processing technologies, such as high-pressure processing (HPP) and sophisticated blending equipment, to achieve a smooth, emulsified, and consistent texture without using excessive stabilizers. Packaging, particularly the use of aseptic carton technology, is also a significant cost component at this stage, extending product life and enabling wider distribution.

Downstream analysis focuses on distribution channels, which are characterized by both direct and indirect sales strategies. Indirect channels, utilizing large third-party logistics providers and established retail distributors, dominate due to the product’s high volume and perishable nature. Direct sales, typically through e-commerce or proprietary brand stores, allow for greater margin control and direct consumer feedback. The efficiency of cold chain management or ambient shelf-stable logistics directly influences market reach and inventory costs, making the optimization of distribution a critical area for market players aiming for global penetration.

Unsweetened Coconut Milk Market Potential Customers

The primary customer base for unsweetened coconut milk is diverse, encompassing individuals with specific health requirements and those adhering to lifestyle diets. A core segment consists of consumers suffering from lactose intolerance or dairy allergies, for whom this product offers a natural and readily digestible milk replacement. This demographic values the product's functional health benefits and lack of common allergens like soy and gluten, necessitating clear and prominent labeling regarding allergen status.

A second major segment comprises individuals following plant-based diets, including vegans, vegetarians, and flexitarians, who prioritize ethical and environmental considerations alongside nutrition. These consumers are typically highly informed about ingredient sourcing and often favor brands that demonstrate commitments to sustainability, fair trade, and minimal processing. For this group, unsweetened formulation aligns with the preference for low-sugar, whole-food derived products, making it a staple in their daily consumption.

The emerging potential customers include those adopting specific low-carbohydrate or high-fat diets, such as ketogenic and paleo followers, who seek alternatives with low glycemic indices. Furthermore, the commercial sector, including large institutional buyers (schools, hospitals) and the foodservice industry (coffee chains, bakeries), represents significant B2B customers, purchasing large volumes for industrial use in beverage preparation and food formulation where a neutral, sugar-free, creamy base is essential.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vita Coco, Thai Agri Foods Public Company Limited (TAF), Goya Foods, Danone S.A., Blue Diamond Growers, Pacific Foods of Oregon, Vitasoy International Holdings, Hain Celestial Group, Califia Farms, WhiteWave Foods (Dean Foods), GraceKennedy Group, McCormick & Company, Edward & Sons Trading Co., Turtle Mountain LLC (So Delicious), Ripple Foods, Elmhurst 1925, Trader Joe's, Pureharvest, Earth's Own Food Company, DREAM. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Unsweetened Coconut Milk Market Key Technology Landscape

The manufacturing of high-quality unsweetened coconut milk relies on several critical technological advancements aimed at improving shelf stability, enhancing texture, and maximizing nutritional preservation while adhering to clean label standards. Aseptic processing and Ultra-High-Temperature (UHT) sterilization are foundational technologies, allowing the product to be stored at ambient temperatures for extended periods without compromising food safety. This capability is vital for efficient global distribution and reducing cold chain dependency, which significantly lowers logistical costs. Continuous technological innovation focuses on reducing the thermal load during UHT, thereby minimizing any cooked flavor notes that can detract from the natural taste profile of the coconut milk.

Emulsification and stabilization technologies are equally crucial, especially since unsweetened coconut milk tends to separate naturally due to its high fat content. Manufacturers employ high-pressure homogenization techniques to reduce the size of fat globules and create a stable, smooth emulsion, often using minimal or natural stabilizers like gellan gum or locust bean gum to meet consumer demand for clean labels. Advanced filtration systems, including microfiltration, are also utilized upstream during the milk extraction phase to remove fine solids and impurities, resulting in a cleaner mouthfeel and reducing the need for chemical intervention downstream.

Furthermore, technology is increasingly integrated into the supply chain through advanced digital tracing systems utilizing blockchain. This technology allows consumers and regulators to verify the origin of coconuts, validating sustainability claims and ethical sourcing practices (e.g., non-use of monkey labor), which builds trust and supports premium pricing. The adoption of efficient water recycling and waste management systems in processing plants also contributes to the market's technological landscape, aligning manufacturing practices with the environmental commitments expected by the target consumer base.

Regional Highlights

North America is anticipated to remain the leading market in terms of value consumption for unsweetened coconut milk, largely driven by mature health and wellness trends, high consumer acceptance of dairy alternatives, and robust retail infrastructure. The U.S. consumer base is highly receptive to innovative, functional formulations and clean-label products, sustaining strong demand in both the conventional beverage segment and specialized segments like barista blends and dietary supplements. Furthermore, aggressive marketing and product placement in major national retail chains and coffee houses solidifies this region's dominant status.

Europe represents another high-value market, characterized by stringent regulatory environments regarding food labeling and high consumer demand for organic and Non-GMO verification. Countries such as Germany, the UK, and the Netherlands exhibit high per capita consumption, fueled by environmental consciousness and the widespread acceptance of veganism. Manufacturers in Europe often focus on differentiating their offerings through localized sourcing (where possible for secondary ingredients) and advanced recycling initiatives for packaging, aligning with European mandates for circular economy practices.

The Asia Pacific (APAC) region is critical for both supply and future demand growth. As the global epicenter of coconut production, APAC benefits from lower raw material costs and streamlined processing logistics. While traditional consumption patterns still favor coconut cream and fresh coconut water, rapidly changing dietary habits, particularly in urban areas of China, India, and Southeast Asia, are fueling demand for branded, packaged unsweetened coconut milk as a modern, healthy beverage. This region is projected to register the highest volume growth, transforming from primarily a raw material supplier into a massive consumer market during the forecast period.

- North America (U.S., Canada, Mexico): Dominant market in value; high penetration in foodservice; strong demand for fortified and functional unsweetened varieties.

- Europe (Germany, U.K., France, Italy): High regulatory standards; strong growth driven by ethical consumption and organic certification; competition from oat milk intense.

- Asia Pacific (China, India, Japan, ASEAN): Largest production base; accelerating consumer adoption fueled by urbanization and rising health consciousness; fastest growing market in volume.

- Latin America (Brazil, Argentina): Emerging market with local brands gaining traction; growth tied to rising incomes and westernization of diets.

- Middle East and Africa (MEA): Growth concentrated in urban centers and expatriate communities; increasing awareness of lactose intolerance driving initial market entry for imported brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Unsweetened Coconut Milk Market.- Danone S.A.

- Vita Coco

- Thai Agri Foods Public Company Limited (TAF)

- Blue Diamond Growers

- The Hain Celestial Group, Inc.

- Califia Farms

- Goya Foods

- Pacific Foods of Oregon

- Vitasoy International Holdings

- GraceKennedy Group

- McCormick & Company, Inc.

- Edward & Sons Trading Co.

- Turtle Mountain LLC (So Delicious Dairy Free)

- Pureharvest

- Elmhurst 1925

- Ripple Foods

- WhiteWave Foods (Dean Foods)

- Earth's Own Food Company

- Oatly Group AB (diversified plant milk portfolio impact)

- ChaoZhou Sinuo Food Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Unsweetened Coconut Milk market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Unsweetened Coconut Milk Market?

The primary factor driving market growth is the global surge in dairy intolerance, particularly lactose intolerance, coupled with the increasing consumer adoption of plant-based and low-sugar diets such as veganism and ketogenic lifestyles, making unsweetened coconut milk a highly suitable and versatile dairy substitute.

How does unsweetened coconut milk compare nutritionally to oat milk and almond milk?

Unsweetened coconut milk is generally lower in carbohydrates and calories compared to oat milk, often containing beneficial Medium-Chain Triglycerides (MCTs). While almond milk is also low-calorie, coconut milk typically offers a richer, creamier texture and higher fat content, appealing specifically to keto and paleo diet followers seeking non-dairy options.

Which geographical region holds the largest market share for Unsweetened Coconut Milk?

North America currently holds the largest market share in terms of value due to high consumer awareness, strong purchasing power, and mature retail distribution channels, although the Asia Pacific region is projected to experience the fastest volume growth due to its status as both a production hub and a rapidly expanding consumer market.

What are the main supply chain challenges affecting the production of coconut milk?

The main supply chain challenges involve the inherent volatility of coconut commodity prices, which are highly susceptible to adverse weather conditions, climate change, and geopolitical instability in major production areas like Southeast Asia, leading to inconsistent raw material costs for manufacturers.

What role does technology play in ensuring the quality and stability of unsweetened coconut milk?

Technology plays a crucial role through aseptic packaging (UHT processing) to ensure long shelf life without refrigeration, and advanced homogenization techniques (HPP) to maintain a stable, smooth emulsion, preventing separation and delivering consistent texture preferred by consumers and the foodservice sector.

The market for unsweetened coconut milk continues to exhibit resilient growth, underpinned by fundamental shifts in consumer dietary habits globally. The persistent preference for low-sugar, non-dairy alternatives ensures that this segment maintains a strong competitive position against traditional dairy products and other plant-based substitutes. Furthermore, manufacturers are consistently focused on optimizing their supply chains through strategic investments in sustainable sourcing, particularly in Southeast Asian production hubs, to mitigate the risks associated with raw material price volatility and ensure ethical procurement practices demanded by modern consumers.

Innovation remains central to competitive advantage in this sector. Efforts are concentrated on enhancing the sensory attributes of the product, specifically improving its performance in hot beverages like coffee, which is a major consumption driver in Western markets. The development of specialized barista blends that achieve superior frothing capabilities without added sugars or stabilizers is a key area of research and development. Additionally, the integration of functional ingredients, such as vitamins, minerals, and probiotics, transforms the product into a functional food, further broadening its appeal beyond simple dairy substitution to proactive health management.

Looking ahead, the long-term viability of the Unsweetened Coconut Milk market is dependent on successful navigation of the intensifying competition, particularly from the fast-rising oat milk segment. Strategic market players are diversifying their product offerings, exploring new flavor combinations that retain the "unsweetened" label yet offer enhanced palatability, and expanding into emerging distribution channels, especially e-commerce, which allows for direct engagement and efficient distribution to health-conscious metropolitan consumers worldwide. Regulatory shifts favoring clear and transparent labeling, especially concerning the definition of "unsweetened" and the disclosure of processing aids, will also shape marketing strategies in the coming years.

The segmentation by application reveals robust expansion in the industrial use of unsweetened coconut milk as an ingredient. Food processors increasingly value its neutral taste profile and its ability to provide creaminess and texture in clean-label formulations for ice creams, yogurts, and prepared ready-to-eat meals. This B2B market segment offers stability and volume consistency compared to the often fickle consumer beverage market. As global supply chains recover and stabilize post-pandemic, major brands are prioritizing large-scale production capacity expansions to meet both the escalating retail demand and the growing needs of the industrial food manufacturing sector.

In terms of distribution, while brick-and-mortar retail remains the backbone for bulk consumer sales, the growth rate observed in online retail channels is significant. E-commerce platforms allow brands to reach niche health food markets, offer subscription models for consistent purchase, and manage direct consumer feedback loops efficiently. This shift necessitates investment in digital marketing and robust, efficient cold-chain logistics for perishable products or highly optimized ambient packaging solutions to maintain product quality during transit, reflecting a dual distribution strategy critical for maximizing market penetration across diverse geographical areas.

Geographically, while Western markets drive value and innovation, the focus on sustainable raw material sourcing necessitates a deepened relationship with APAC suppliers. The future market structure involves sophisticated risk management tools, often AI-driven, to hedge against climate-related risks and ensure fair pricing for farmers, which enhances brand reputation and secures long-term supply. The maturation of consumer preferences in APAC itself also means that producers are now focused on marketing high-quality, packaged unsweetened coconut milk within the region, rather than solely exporting raw or semi-processed goods, signaling a fundamental shift in regional value creation dynamics.

The technological evolution in the sector is moving toward functional process enhancements. Beyond standard UHT, technologies like microencapsulation are being explored to potentially integrate more temperature-sensitive functional ingredients, such as specific probiotics or omega-3 fatty acids, without degradation during sterilization. Furthermore, sustainability is driving technology adoption, specifically in optimizing water usage during the coconut milk extraction process and utilizing coconut shell waste products for energy generation or secondary material streams, thereby achieving a near-zero waste processing footprint, which is a significant selling point in environmentally conscious markets.

The role of consumer education cannot be overstated, particularly concerning the fat content of coconut milk. While some consumers avoid it due to saturated fat concerns, proactive messaging centered on the benefits of Medium-Chain Triglycerides (MCTs) and their role in energy metabolism is essential. Brands that successfully communicate the difference between various types of fats and link their product to specialized health benefits (e.g., gut health, brain function) are gaining a competitive edge, transforming perceived restraints into unique selling propositions and contributing significantly to the overall professional and formal discourse surrounding product differentiation.

Competitive dynamics are characterized by aggressive product line extensions and strategic mergers and acquisitions (M&A). Established dairy giants like Danone and international beverage companies are acquiring smaller, innovative plant-based brands to instantly gain market share and expertise in formulation, signifying the mainstreaming of unsweetened coconut milk. This consolidation suggests a future market where a few large, globally diversified food conglomerates control a significant portion of the shelf space, pushing smaller, independent brands to focus heavily on niche segments, premium organic certifications, or specialized local distribution networks to remain viable. Price wars, particularly in mature markets like the U.S. and U.K., are also common, requiring streamlined operational efficiencies to maintain profitability amid intense competition.

In conclusion, the Unsweetened Coconut Milk Market is positioned for sustained and significant growth, structurally supported by socio-demographic changes and technological refinement. Success hinges on a balanced strategy incorporating sustainable upstream practices, advanced processing for quality and stability, and targeted marketing that clearly communicates the product's functional health advantages to diverse global consumer segments, from the health-conscious individual to the industrial food formulator. The strategic integration of digital tools and AI across the value chain will be paramount to navigate commodity risks and optimize responsiveness to dynamic consumer demands, ensuring long-term profitability and market leadership.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager