Untethered Autonomous Underwater Vehicle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436404 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Untethered Autonomous Underwater Vehicle Market Size

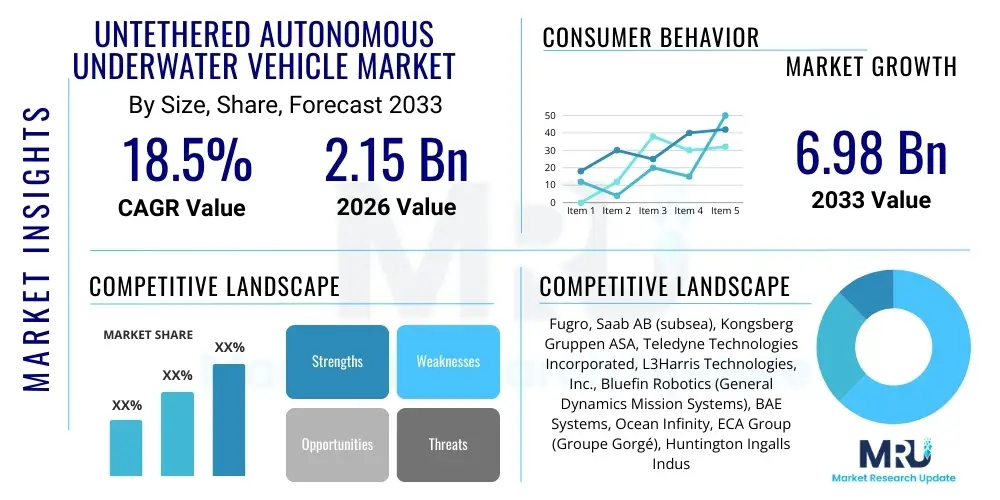

The Untethered Autonomous Underwater Vehicle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $2.15 Billion in 2026 and is projected to reach $6.98 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by escalating geopolitical tensions necessitating advanced maritime surveillance capabilities and the rapidly increasing need for detailed seabed mapping and exploration across deep-sea environments, particularly in the energy and telecommunications sectors.

Untethered Autonomous Underwater Vehicle Market introduction

The Untethered Autonomous Underwater Vehicle (AUV) Market encompasses sophisticated robotic systems capable of navigating and performing complex missions beneath the ocean surface without continuous human control or physical linkage to a mother ship. These vehicles are essential tools across various high-stakes domains, offering superior endurance, depth capabilities, and efficiency compared to their remotely operated vehicle (ROV) counterparts. The primary applications span crucial areas such as military mine countermeasures, hydrocarbon pipeline inspection, deep-sea mining site assessment, and critical habitat mapping for climate science and conservation efforts, making them indispensable assets for both defense and commercial maritime industries.

AUVs are characterized by advanced navigation systems, typically incorporating inertial navigation systems (INS) combined with Doppler Velocity Logs (DVL), coupled with sophisticated sensor payloads including side-scan sonar, synthetic aperture sonar (SAS), and various imaging systems. The benefits derived from deploying untethered AUVs are manifold: reduced operational costs associated with surface vessels, minimized human risk exposure in hazardous underwater environments, and the ability to cover vast survey areas autonomously. Furthermore, their modular design allows for rapid payload customization tailored to specific mission objectives, driving enhanced utility across highly specialized tasks from deep ocean trench exploration to routine infrastructure monitoring.

Key driving factors accelerating market adoption include the increasing global focus on renewable ocean energy sources (like offshore wind farms) requiring detailed environmental baseline surveys, the rapid depletion of shallow-water oil and gas reserves necessitating ultra-deepwater exploration, and continuous technological advancements in battery life and communication capabilities. The ability of modern AUVs to collect high-resolution, georeferenced data sets with minimal acoustic noise pollution further solidifies their pivotal role in modern oceanic governance and resource management, positioning them as fundamental components of the evolving Blue Economy infrastructure worldwide.

Untethered Autonomous Underwater Vehicle Market Executive Summary

The Untethered Autonomous Underwater Vehicle market is undergoing rapid transformation, marked by significant business trends focusing on consolidation, strategic partnerships, and intensified investment in AI-driven data processing capabilities. Major defense contractors are acquiring specialized AUV manufacturers to integrate subsea autonomy into comprehensive maritime defense portfolios, while commercial firms are prioritizing the development of hybrid AUV/ROV systems to maximize mission versatility. The push for extended deployment endurance through novel battery chemistries, such as aluminum-air or fuel cell technologies, is a central technological focus, alongside the implementation of advanced acoustic communication protocols to enable real-time data relay from extreme depths, thereby accelerating the turnaround time for critical operational decisions.

Regionally, North America maintains its dominance due to high defense spending, established oil and gas exploration infrastructure, and the presence of leading technology developers. However, the Asia Pacific region, particularly China, South Korea, and Australia, is poised for the fastest growth, driven by burgeoning naval modernization programs, expanding offshore energy projects, and growing scientific interest in the resource-rich waters of the South China Sea and the Pacific Ocean. Europe continues to be a strong market, supported by stringent environmental regulations requiring high-fidelity mapping and extensive investment in offshore wind and decommissioning activities in the North Sea.

Segment trends reveal a pronounced shift toward larger, deeper-diving AUVs capable of carrying complex, multi-sensor payloads for strategic missions in the Medium and Large Water depth categories. Within the application segmentation, Defense & Security remains the largest revenue contributor, primarily driven by investments in anti-submarine warfare (ASW) and seabed warfare capabilities. Simultaneously, the Commercial Exploration segment, fueled by the accelerating pace of deep-sea mineral prospecting and subsea cable route surveying, is exhibiting the highest growth trajectory. The integration of advanced Synthetic Aperture Sonar (SAS) in the Payload segment is highly sought after, offering unprecedented resolution for detailed seafloor inspection and object detection, thereby setting a new benchmark for operational efficacy and data quality across all end-user sectors.

AI Impact Analysis on Untethered Autonomous Underwater Vehicle Market

User queries regarding AI’s impact on the Untethered Autonomous Underwater Vehicle (AUV) market consistently revolve around autonomy levels, real-time decision-making, and the processing of massive sensor datasets. Key concerns include how AI can enhance mission planning and replanning on the fly, particularly when unexpected obstacles or environmental changes are encountered, and the reliability of AI algorithms in classifying ambiguous objects (e.g., distinguishing between marine life and submerged ordnance). Users are highly interested in AI’s role in optimizing energy consumption and propulsion efficiency, allowing AUVs to remain deployed for extended periods, as well as the immediate benefit of automating the analysis of high-volume data streams generated by Synthetic Aperture Sonar (SAS) and optical sensors, thereby shifting the intelligence from post-mission analysis to in-situ data processing.

The integration of artificial intelligence, particularly machine learning (ML) and deep neural networks (DNNs), is fundamentally transforming the operational capabilities and economic viability of Untethered AUVs. AI enables true autonomy by allowing AUVs to perform complex tasks such as adaptive sampling, obstacle avoidance in cluttered environments (like coral reefs or wreckage), and intelligent target recognition without continuous communication links. This shift elevates AUVs from mere data collection platforms to intelligent, decision-making assets. Furthermore, AI algorithms are critical for sensor fusion, seamlessly integrating data from navigation (INS/DVL), imaging (Sonar/Optical), and environmental sensors to provide a comprehensive, actionable understanding of the underwater environment, drastically reducing mission time and enhancing operational success rates across complex exploration and security tasks.

The future dominance of AUV technology hinges on achieving Level 5 autonomy, which is entirely reliant on robust AI frameworks capable of learning and adapting over extended deployment cycles. This includes developing sophisticated ML models for predictive maintenance, allowing the AUV to self-diagnose hardware anomalies and preemptively adjust mission parameters to ensure successful data recovery. The commercial implication of this AI-driven evolution is profound: it significantly lowers the barrier to entry for complex subsea operations, making high-resolution surveying and monitoring accessible to non-traditional end-users, thus expanding the market footprint beyond traditional defense and major oil and gas players toward sustainable resource management and renewable energy sectors.

- AI-driven real-time target recognition and classification enhances military reconnaissance and mine countermeasures accuracy.

- Machine learning optimizes AUV energy consumption by adjusting propulsion profiles based on predictive hydrodynamic models.

- Deep learning algorithms automate the processing of complex SAS data, reducing the need for extensive human post-processing.

- Adaptive mission planning allows AUVs to autonomously reroute based on unforeseen environmental changes or resource anomalies.

- AI facilitates multi-vehicle cooperation, enabling swarm-based surveying for faster and more comprehensive data acquisition.

- Predictive maintenance implemented via AI monitors system health, minimizing mission failure rates due to component wear.

- Enhanced sensor fusion through ML provides a more coherent and reliable environmental picture for navigation and mapping.

- Natural Language Processing (NLP) integration is simplifying the interaction and command structure for mission controllers.

- AI enables sophisticated acoustic noise mitigation techniques, crucial for covert operations and sensitive environmental monitoring.

DRO & Impact Forces Of Untethered Autonomous Underwater Vehicle Market

The market dynamics of the Untethered Autonomous Underwater Vehicle sector are defined by a powerful interplay of technological drivers, operational restraints, and high-growth opportunities, collectively shaping its trajectory and competitive landscape. The principal driver is the undeniable necessity for persistent, detailed surveillance and mapping capabilities in increasingly deeper and more remote aquatic environments, spurred by heightened geopolitical competition and the expansion of the global offshore energy sector. However, this growth is significantly tempered by critical restraints, primarily the inherent limitations associated with power storage technology, which dictates mission endurance, and the challenges of reliable high-bandwidth underwater communication, hindering real-time control and data transfer. These limitations necessitate continuous investment in specialized infrastructure and technology development, imposing high capital expenditure burdens on market participants.

Opportunities for exponential market expansion lie primarily in the emerging fields of deep-sea mining, where AUVs are essential for environmental impact assessment and resource localization, and the burgeoning telecommunications sector, which relies heavily on AUVs for highly precise surveying and inspection of trans-oceanic cables. Furthermore, the transition toward AUVs capable of functioning as permanent, persistent subsea observatories—conducting autonomous docking, recharging, and data transmission—represents a paradigm shift. The impact forces are predominantly derived from technological innovation, particularly the advancements in solid-state batteries and miniaturized, highly efficient sensor payloads, which drastically improve AUV performance metrics, pushing the boundaries of endurance and data fidelity.

Competitive forces are also intense, driven by the specialized nature of the technology and the high investment required for R&D in deep-sea autonomy. The market is characterized by a mix of large defense conglomerates and highly specialized niche technology providers, leading to frequent mergers, acquisitions, and strategic partnerships aimed at consolidating technological expertise, particularly in areas like advanced image processing and high-accuracy navigation. Regulatory impact forces, particularly those governing environmental protection and marine spatial planning, also play a crucial role, often mandating the use of non-invasive surveying technologies, which inherently favors low-emission, highly accurate AUVs over traditional vessel-based methods, ensuring a sustainable long-term demand for these robotic systems.

Segmentation Analysis

The Untethered Autonomous Underwater Vehicle (AUV) market is comprehensively segmented based on Type, Application, Payload, and Propulsion System, providing granular insights into demand patterns across various operational environments and mission requirements. This structure helps stakeholders understand where technological development and procurement activity are most intense. The Type segmentation, which divides the market based on operational depth (Shallow, Medium, Large Water), directly correlates with the vehicle’s design complexity, battery requirements, and pressure hull specifications, reflecting the high costs associated with deep-sea capable systems. As global energy exploration pushes into ultra-deepwater regions, the demand for Large Water AUVs, capable of operating beyond 3,000 meters, is witnessing accelerated investment and technological refinement.

The Application analysis reveals the dominant role of the Defense & Security sector, which utilizes AUVs for critical tasks such as mine countermeasures (MCM), intelligence, surveillance, and reconnaissance (ISR), and anti-submarine warfare (ASW) training. Parallelly, the fast-growing Commercial Exploration segment includes activities like oil and gas pipeline inspection, offshore platform maintenance, and hydrographic surveying, all of which benefit from the non-invasive, high-speed data acquisition capabilities of autonomous systems. Payload segmentation, differentiating between sonar systems, sensor arrays, and imaging tools, demonstrates the critical function of data quality; advancements in Synthetic Aperture Sonar (SAS) and specialized chemical sensors are particularly influential in driving purchasing decisions across scientific and commercial markets.

The strategic differentiation based on segmentation allows manufacturers to tailor their product offerings precisely to specific end-user needs, whether optimizing for long-duration scientific deployment or high-speed military reconnaissance. This detailed segmentation underscores the market's maturity, where customization and specialized feature sets are key differentiators rather than generalized performance metrics. As new technologies like bio-inspired propulsion systems emerge, the Propulsion System segment—currently dominated by electric thrusters—will see continued innovation aimed at maximizing energy efficiency and minimizing the acoustic signature, crucial for both covert military operations and highly sensitive environmental surveys.

- By Type:

- Shallow Water AUVs (Operational depth up to 1,000 meters)

- Medium Water AUVs (Operational depth 1,000 to 3,000 meters)

- Large Water/Deep Water AUVs (Operational depth exceeding 3,000 meters)

- By Application:

- Defense & Security (MCM, ISR, ASW)

- Scientific Research & Oceanography (Habitat Mapping, Climate Monitoring)

- Commercial Exploration & Survey (Oil & Gas Pipeline Inspection, Offshore Wind)

- Telecommunications (Cable Route Surveying and Inspection)

- Search and Salvage Operations

- By Payload:

- Sonar Systems (Side-Scan Sonar, Multi-Beam Echosounders, Synthetic Aperture Sonar - SAS)

- Imaging Systems (HD Cameras, Laser Scanners)

- Sensor Arrays (Conductivity, Temperature, Depth - CTD, Chemical Sensors, Magnetometers)

- Sampling Tools and Manipulators

- By Propulsion System:

- Electric Thrusters

- Hybrid Systems (Including Fuel Cells)

- Other Novel Propulsion Methods (e.g., Gliders)

Value Chain Analysis For Untethered Autonomous Underwater Vehicle Market

The value chain for the Untethered Autonomous Underwater Vehicle (AUV) market begins significantly upstream with fundamental research and development (R&D) focused on critical enabling technologies such as advanced materials science for pressure hulls, highly efficient power sources (batteries and fuel cells), and sophisticated navigation components (INS, DVLs). Key upstream participants include specialized semiconductor manufacturers, sensor developers (e.g., providers of advanced piezoceramics for sonar transducers), and academic research institutions collaborating on AI and robotics algorithms. The efficiency and cost-effectiveness of the final product are heavily reliant on the seamless integration of these highly specialized, high-cost components, placing intense pressure on intellectual property and supply chain resilience for highly sensitive components like acoustic modems and advanced navigation chips.

Midstream activities involve the complex integration, assembly, and rigorous testing of the AUV platforms. This stage is dominated by established defense contractors and niche AUV specialists who possess the engineering expertise to combine disparate high-tech subsystems into a reliable, certified vehicle. Distribution channels are generally bifurcated: direct sales channels are predominantly used for large, strategic military contracts or major oil and gas infrastructure projects, requiring extensive customization, service agreements, and operator training provided directly by the OEM. Indirect distribution, leveraging specialized regional integrators or leasing companies, often serves smaller scientific research institutions or emerging commercial markets, offering greater flexibility and localized support capabilities.

Downstream market activities are concentrated around operational deployment, data acquisition, and post-mission analysis. This involves specialized subsea services firms, naval fleets, and research vessels that operate the AUVs. The ultimate value delivery is the highly accurate, actionable data generated, which necessitates specialized software for data visualization and interpretation. Direct users (e.g., navies or major energy firms) often maintain proprietary in-house analysis capabilities, while smaller commercial clients frequently rely on the OEM or third-party service providers for high-level data interpretation and reporting. This downstream data analysis ecosystem is increasingly adopting cloud-based platforms and AI tools to manage and exploit the massive volumes of information gathered by modern AUVs.

Untethered Autonomous Underwater Vehicle Market Potential Customers

The primary consumers and end-users of Untethered Autonomous Underwater Vehicles are segmented into governmental, scientific, and commercial entities, each driven by distinct operational needs and regulatory mandates. Governmental buyers, primarily naval forces and coast guard organizations, represent the largest and most strategically significant customer base. Their procurement is focused on high-specification AUVs for strategic defense applications, including Anti-Submarine Warfare (ASW), Mine Countermeasures (MCM), and critical infrastructure protection, demanding vehicles with high reliability, covert operation capabilities (low acoustic signature), and the ability to operate in highly contested maritime zones. National geological surveys and environmental protection agencies also fall under this category, using AUVs for mandated ecosystem monitoring and boundary delineation.

The commercial sector constitutes a rapidly expanding customer group, led by the Oil & Gas industry and the burgeoning Offshore Renewable Energy sector. Oil and gas companies require AUVs for pre-lay survey routes, pipeline inspection, asset integrity monitoring in ultra-deepwater fields, and decommissioning support, valuing endurance and the precision of non-destructive testing payloads. Offshore wind developers utilize AUVs extensively for site assessment, foundation scour monitoring, and cable inspection, prioritizing cost-efficiency and data repeatability. Furthermore, deep-sea mining companies represent an emerging, high-value customer segment, requiring AUVs for detailed environmental baseline studies and geotechnical surveys before initiating extraction operations, demanding specialized sensing capabilities for mineral identification.

Academic and Scientific Research institutions form the third key customer segment, often driving the demand for specialized, smaller, and highly customized AUVs, particularly gliders, designed for long-duration, low-power data collection missions related to oceanography, climate modeling, and marine biology. These customers prioritize longevity, ease of deployment, and the ability to carry unique sensor packages (e.g., biological samplers or hydrophones). The increasing affordability and accessibility of smaller AUV platforms are also opening up the market to private research foundations and specialized non-governmental organizations (NGOs) focused on marine conservation and exploration, contributing to the diversity of end-user requirements and fostering innovation in sensor technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.15 Billion |

| Market Forecast in 2033 | $6.98 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fugro, Saab AB (subsea), Kongsberg Gruppen ASA, Teledyne Technologies Incorporated, L3Harris Technologies, Inc., Bluefin Robotics (General Dynamics Mission Systems), BAE Systems, Ocean Infinity, ECA Group (Groupe Gorgé), Huntington Ingalls Industries (HII), Lockheed Martin Corporation, Atlas Elektronik GmbH, iXblue (Exail), RTsys, Houlder, Graal Tech, Subsea 7, DOF Subsea, Hydroid (Kongsberg), Northrop Grumman Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Untethered Autonomous Underwater Vehicle Market Key Technology Landscape

The technological landscape of the Untethered AUV market is rapidly evolving, driven by the need for enhanced endurance, greater navigational accuracy, and superior data acquisition capabilities in challenging environments. A foundational technology is the Inertial Navigation System (INS), often coupled with Doppler Velocity Logs (DVL), which provides highly accurate navigation data without reliance on external Global Positioning Systems (GPS) signals, which are unavailable subsea. The integration of advanced filter algorithms, such as Kalman filters, is crucial for synthesizing data from multiple sensors to maintain precise positioning over long missions. Furthermore, the shift from traditional lithium-ion batteries to high-energy density alternatives, including specialized fuel cells or next-generation solid-state batteries, is paramount for extending mission duration and expanding the operational envelope of AUVs into remote deep-sea regions.

Payload technology represents another critical area of innovation, particularly the deployment of Synthetic Aperture Sonar (SAS). SAS provides photo-realistic, high-resolution imagery of the seabed, dramatically improving the ability to detect and classify small, submerged objects, which is invaluable for mine countermeasures and detailed infrastructure inspection. Communication technology remains a significant bottleneck; thus, ongoing research focuses on improving acoustic modems, transitioning to higher-frequency communication protocols for better bandwidth, and integrating hybrid communications systems that utilize both acoustic and Blue/Green laser technologies when near the surface. The development of intelligent acoustic networking protocols also allows for coordinated operations among multiple AUVs (swarms), significantly increasing survey coverage efficiency.

Furthermore, the physical design and materials science employed are key technological discriminators. The use of advanced composite materials is increasing to achieve high strength-to-weight ratios, ensuring robust pressure tolerance for deep-diving AUVs while maximizing available space for payload and energy storage. Hydrodynamic shaping is continuously being optimized to reduce drag, directly translating to energy savings and extended range. Finally, sophisticated autonomy architectures, powered by embedded edge computing capabilities, are enabling AUVs to process sensor data locally, make rapid operational decisions, and perform complex tasks like autonomous docking with subsea charging stations, marking a major stride toward permanent, intervention-free subsea monitoring networks.

Regional Highlights

The global Untethered Autonomous Underwater Vehicle (AUV) market exhibits distinct regional dynamics driven by varying levels of defense spending, maturity of offshore energy markets, and environmental research priorities. North America, encompassing the United States and Canada, stands as the market leader, characterized by substantial governmental investment in naval modernization, advanced R&D initiatives centered around AI and autonomy through defense agencies like DARPA, and a robust ecosystem of specialized technology developers and large defense prime contractors. The Gulf of Mexico’s deepwater oil and gas operations also generate consistent demand for sophisticated inspection and survey AUVs, driving technological adoption.

Europe represents a mature and highly innovative market, primarily fueled by the extensive development of offshore wind energy in the North Sea and the necessity for decommissioning aging oil and gas infrastructure. Countries such as Norway, the UK, and Germany are key players, with strong emphasis on AUVs designed for environmental monitoring, hydrographic surveying, and maintaining strict regulatory compliance related to maritime activities. The European Union’s dedicated funding for ocean research and the focus on non-intrusive survey methods ensures sustained high demand for versatile AUV platforms and specialized sensor technologies, positioning the region at the forefront of commercial AUV applications.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to rising geopolitical tensions in the South China Sea, prompting significant naval expenditure on underwater reconnaissance and surveillance capabilities, especially by nations like China, India, and Japan. Simultaneously, massive investments in infrastructure projects, including deep-sea cable laying and exploration for new resource deposits, particularly in Southeast Asia, are driving the commercial procurement of AUVs. This region is rapidly transitioning from reliance on imported technology to fostering indigenous AUV development capabilities, signaling a major future shift in the global competitive landscape.

Latin America, particularly Brazil, with its deepwater Pre-Salt oil discoveries, represents a critical, albeit fluctuating, market segment heavily influenced by commodity prices. Demand here is highly concentrated within the oil and gas sector for reservoir mapping and pipeline monitoring. Finally, the Middle East and Africa (MEA) region, while smaller, is growing due to strategic naval interests in the Arabian Sea and the Red Sea, alongside the slow but steady development of offshore gas fields. MEA regional demand is often met through strategic imports and service contracts with international AUV operators.

- North America: Dominant market share due to high defense budget allocation for subsea warfare technology and extensive deepwater exploration activity in the Gulf of Mexico.

- United States: Key driver of R&D in AI-enabled autonomy and home to major AUV prime contractors and system integrators.

- Europe: High growth sustained by robust offshore wind energy market development, rigorous environmental monitoring standards, and significant decommissioning projects in the North Sea.

- Norway/UK: Centers of excellence for commercial subsea operations, leading the deployment of AUVs for complex infrastructure inspection and maintenance.

- Asia Pacific (APAC): Fastest growing region fueled by escalating naval modernization programs, expanding reliance on strategic maritime infrastructure, and deep-sea resource exploitation interest.

- China: Major investor in both military and scientific AUV research, rapidly advancing indigenous production and deployment capabilities for deep-sea vehicles.

- Japan: Focus on scientific research, tsunami early warning systems, and resource exploration in its Exclusive Economic Zone (EEZ).

- Latin America: Demand concentrated in Brazil’s deepwater oil and gas sector, necessitating high-capability AUVs for surveying and monitoring complex subsea infrastructure.

- Middle East and Africa (MEA): Emerging market driven by strategic choke point surveillance needs and initial investments in Red Sea and Persian Gulf energy exploration projects.

- Australia: Increasing investment in AUVs for maritime border security, hydrographic charting, and monitoring vast oceanic territories.

- Canada: Focus on utilizing AUVs for Arctic exploration, ice monitoring, and environmental data collection in harsh, remote conditions.

- Germany: Strong contribution through specialized sensor technology development and applications in Baltic Sea ordnance disposal and research.

- India: Growing naval strategic procurement emphasizing indigenous development of medium and large-class AUVs for surveillance missions.

- Singapore: Key hub for maritime technology integration and service provision in Southeast Asia, influencing regional commercial deployment standards.

- Russia: Significant state-backed investment in strategic AUV development for deep-sea military and resource exploration applications in the Arctic.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Untethered Autonomous Underwater Vehicle Market.- Fugro

- Saab AB (subsea)

- Kongsberg Gruppen ASA

- Teledyne Technologies Incorporated

- L3Harris Technologies, Inc.

- Bluefin Robotics (General Dynamics Mission Systems)

- BAE Systems

- Ocean Infinity

- ECA Group (Groupe Gorgé)

- Huntington Ingalls Industries (HII)

- Lockheed Martin Corporation

- Atlas Elektronik GmbH

- iXblue (Exail)

- RTsys

- Houlder

- Graal Tech

- Subsea 7

- DOF Subsea

- Hydroid (Kongsberg)

- Northrop Grumman Corporation

Frequently Asked Questions

Analyze common user questions about the Untethered Autonomous Underwater Vehicle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological challenges currently restraining AUV market growth?

The key technological restraints include limited mission endurance, primarily dictated by current battery energy density, and the fundamental difficulty of high-bandwidth, real-time data transmission through water, which prevents true immediate remote control and full data offloading during deep-sea operations. Overcoming these power and communication bottlenecks is crucial for expanding AUV utility.

How are AUVs used in the critical Defense & Security sector?

In the Defense & Security sector, AUVs are vital for Mine Countermeasures (MCM), rapidly detecting and classifying seabed ordnance; Intelligence, Surveillance, and Reconnaissance (ISR); Anti-Submarine Warfare (ASW) training; and monitoring critical maritime infrastructure such as ports and subsea communication cables. Their autonomy and covert operation capabilities make them ideal substitutes for crewed vessels in high-risk zones.

Which geographical region exhibits the highest future growth potential for AUV adoption?

The Asia Pacific (APAC) region is forecast to demonstrate the highest growth trajectory, driven by massive national investment in naval modernization, escalating maritime territorial disputes necessitating enhanced surveillance, and the rapid expansion of offshore commercial activities, including deep-sea resource exploration and extensive subsea cable network deployment across Southeast Asia.

What is the impact of Artificial Intelligence (AI) on AUV mission capabilities?

AI significantly enhances AUV capabilities by enabling genuine operational autonomy, allowing for real-time decision-making, adaptive mission planning, and in-situ data processing. AI algorithms are crucial for sophisticated sensor fusion, intelligent object classification (e.g., distinguishing targets from marine debris), and optimizing energy usage to maximize deployment duration.

What is the difference between an Untethered AUV and a Remotely Operated Vehicle (ROV)?

The main difference lies in control and operational range. An Untethered AUV operates autonomously, following pre-programmed missions or making real-time decisions based on AI, without a physical connection to the surface. Conversely, an ROV is remotely controlled in real-time by an operator on a surface vessel via a tether, which supplies power and high-bandwidth data, but limits its operational range and endurance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager