UPVC Profiles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432046 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

UPVC Profiles Market Size

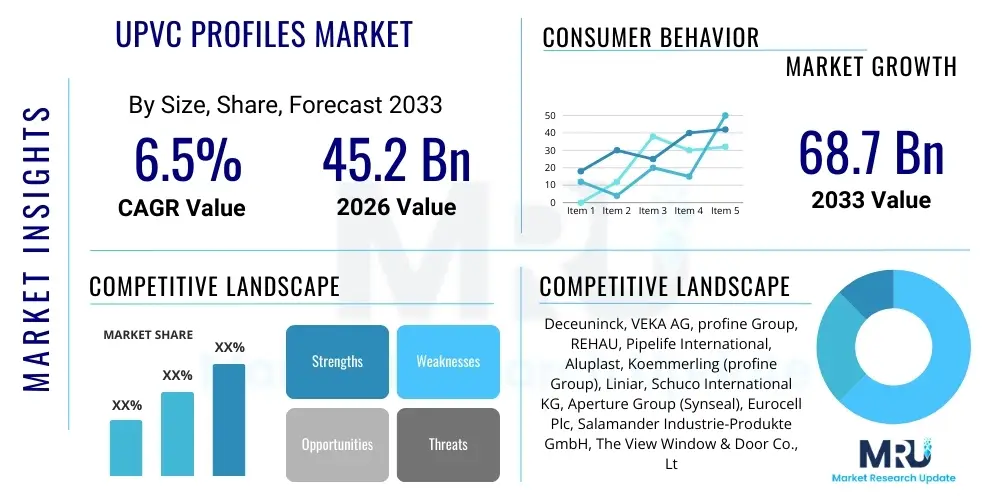

The UPVC Profiles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 68.7 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by escalating global demand for energy-efficient construction materials, coupled with stringent regulatory frameworks promoting sustainable building practices in developed and emerging economies alike. The superior insulation and durability characteristics of Unplasticized Polyvinyl Chloride (UPVC) are positioning it as a preferred alternative to traditional materials like wood and aluminum in residential and commercial infrastructure projects.

UPVC Profiles Market introduction

The UPVC Profiles Market encompasses the production and distribution of extruded UPVC components primarily used in the fabrication of windows, doors, and other building elements. UPVC, known for its high strength-to-weight ratio, excellent thermal insulation, resistance to weathering, and low maintenance requirements, serves as a vital material in modern, sustainable architecture. Major applications span residential construction, commercial buildings, and renovation projects, focusing heavily on enhancing energy efficiency and reducing lifecycle costs. The primary driving factors include rapid urbanization, increasing governmental focus on green building certifications, and the cost-effectiveness compared to alternative frame materials, making UPVC profiles essential components in the global construction supply chain.

UPVC profiles are essentially rigid plastic components that do not contain plasticizers, giving them exceptional rigidity and dimensional stability, crucial for structural applications. These profiles are often reinforced with steel inserts to provide superior structural integrity, especially in large window and door systems. The inherent properties of UPVC, such as fire retardancy and chemical resistance, further enhance its appeal across diverse climatic conditions. The market’s continued growth is also fueled by technological advancements in extrusion techniques, allowing manufacturers to produce complex geometries and aesthetically pleasing finishes that cater to contemporary architectural demands.

UPVC Profiles Market Executive Summary

Current business trends indicate a strong shift toward highly customized and colored UPVC profiles, moving away from conventional white frames, driven by aesthetic demands in the luxury and high-end residential segments. Furthermore, manufacturers are increasingly integrating recycled content into UPVC production to meet corporate sustainability goals and address consumer environmental concerns, optimizing the raw material supply chain. Regional trends show that Asia Pacific, spearheaded by infrastructure spending in China and India, maintains the highest growth trajectory, while Europe remains a mature market characterized by high replacement demand driven by stringent EU energy performance directives (EPDs).

Segment trends reveal that the use of UPVC profiles in window applications dominates the market, largely due to their superior thermal performance critical for meeting specific U-value targets in new and retrofitted buildings. Within the product type segmentation, the market is seeing increased adoption of lead-free stabilizers, moving away from traditional lead-based systems to comply with evolving health and safety standards worldwide. This regulatory pressure is reshaping the chemical composition segment. Geographically, while emerging markets focus on volume due to new construction, established markets are focusing on premium, high-performance profiles designed for passive house standards and advanced acoustic insulation properties, indicating a dual-speed market evolution.

AI Impact Analysis on UPVC Profiles Market

User queries regarding the impact of AI on the UPVC profiles market commonly center on optimizing manufacturing efficiency, enhancing quality control, and predicting market demand fluctuations. Key themes include the implementation of predictive maintenance for extrusion machinery, the use of computer vision for defect detection in finished profiles, and utilizing machine learning algorithms to fine-tune material blending ratios for optimal structural performance and cost reduction. Users are also concerned about the integration of AI in design software to model complex thermal and acoustic performance characteristics of window and door systems. The consensus expectation is that AI will primarily drive operational excellence, resulting in reduced waste, lower production costs, and higher precision, ultimately strengthening the competitive positioning of high-tech profile manufacturers.

- AI-driven Predictive Maintenance: Minimizing machinery downtime and extending the lifespan of complex extrusion equipment.

- Automated Quality Control (Computer Vision): Real-time identification of profile defects, ensuring strict adherence to dimensional tolerances and surface finish standards.

- Optimized Material Formulation: Machine learning algorithms analyzing raw material input characteristics to adjust blending for maximum performance and cost efficiency, particularly critical for recycled content integration.

- Demand Forecasting and Supply Chain Optimization: AI tools analyzing historical data, weather patterns, and construction pipeline indices to forecast demand accurately, minimizing inventory costs.

- Smart Design and Simulation: AI-enhanced software accelerating the design process, allowing for rapid thermal and structural simulation of new profile geometries before physical prototyping.

- Energy Consumption Reduction: Using AI to manage extruder heating and cooling cycles precisely, leading to significant energy savings during manufacturing.

DRO & Impact Forces Of UPVC Profiles Market

The UPVC Profiles Market is currently propelled by several powerful drivers, most notably the universal push for energy-efficient construction practices, supported by government mandates and green building initiatives globally. Coupled with this is the inherent cost advantage and longevity of UPVC compared to alternative materials, driving adoption in both mass-market housing and large commercial projects. However, the market faces significant restraints, primarily centered around the volatility of raw material prices (PVC resin, titanium dioxide, stabilizers) which impacts manufacturing margins, and the persistent, though often misinformed, perception of plastics’ negative environmental impact, despite industry efforts towards circularity. Opportunities abound in emerging markets where rapid urbanization demands affordable, durable, and scalable housing solutions, and in the advanced development of high-performance composite UPVC systems targeting niche, high-insulation applications like passive houses. These forces collectively dictate the market trajectory, emphasizing sustainability and performance as critical factors for future growth.

The impact forces within the market dynamic highlight the intense pressure exerted by substitute materials, particularly high-end aluminum and timber composites, which constantly push UPVC manufacturers to innovate in terms of aesthetics and structural capabilities. Regulatory shifts, such as phasing out hazardous stabilizers and implementing stricter energy codes, act as a dual-edged sword—a restraint requiring costly compliance changes, but also a major driver for high-performance product adoption. Furthermore, the competitive intensity among global players, particularly those leveraging vertical integration and high-volume economies of scale, significantly influences pricing and market penetration strategies, especially in price-sensitive regions.

Segmentation Analysis

The UPVC Profiles market is systematically segmented based on various technical and functional characteristics, offering a granular view of market dynamics and demand patterns. Key segmentation criteria include product type (window and door profiles, siding, and other structural components), the type of stabilizers used (lead-free and lead-based, though the latter is rapidly declining), and end-use application (residential, commercial, and industrial). Analyzing these segments reveals that the residential sector dominates demand due to the massive volume of new construction and replacement projects, while window profiles remain the largest product category, reflecting their universal application in energy efficiency upgrades across all building types.

Further segmentation based on geography underscores the divergent market maturity levels, with Europe focusing heavily on replacement and high thermal specification, while Asia Pacific drives volume through expansive new building activities. Understanding the demand segmentation is critical for manufacturers tailoring their product portfolios; for instance, European manufacturers prioritize multi-chamber profiles for superior insulation (lower U-values), whereas manufacturers in warmer climates might focus more on UV stability and air-tightness. The shift toward lead-free formulations (e.g., calcium-zinc stabilizers) is a foundational segment trend influencing raw material sourcing and compliance globally.

- By Product Type:

- Window & Door Profiles

- Siding/Cladding Profiles

- Other Profiles (Fences, Railings, etc.)

- By Application:

- Residential

- Commercial

- Industrial

- By Stabilizer Type:

- Lead-Free Stabilizers (Calcium-Zinc, Organotin)

- Lead-Based Stabilizers (Declining market share)

- By End-Use Sector:

- New Construction

- Renovation & Replacement

Value Chain Analysis For UPVC Profiles Market

The UPVC Profiles value chain begins with upstream activities involving the sourcing of petrochemical derivatives to produce PVC resin, along with critical additives such as stabilizers, impact modifiers, fillers (e.g., TiO2), and pigments. This stage is highly sensitive to crude oil price fluctuations and supply chain disruptions. Midstream activities involve the compounding and extrusion processes, where manufacturers blend the raw resin and additives into specific formulations and then use specialized dies and calibration equipment to extrude the final profile shapes. Efficiency and precision at this stage are crucial for maintaining dimensional stability and surface quality, leveraging advanced manufacturing techniques and rigorous quality control protocols to meet stringent industry standards.

Downstream activities include the fabrication of finished products (windows, doors) by fabricators who cut, weld, and assemble the profiles with glass, hardware, and seals. The distribution channel is bifurcated, involving both direct sales to large construction projects and indirect sales through a network of distributors, wholesalers, and specialized retailers who serve smaller contractors and DIY markets. The direct channel offers greater control and better margins but requires substantial logistics capacity, while the indirect channel provides wider market penetration, particularly for standardized products. Effective logistics management from the extruder to the fabricator, minimizing damage to the often bulky and easily scratched profiles, is a key success factor in optimizing the downstream segment of the value chain.

The fabrication stage represents a significant value addition point, as profiles are converted into functional and complex architectural components ready for installation. Integration between profile manufacturers and large-scale fabricators (vertical integration) is becoming more common, aiming to secure consistent quality and shorten lead times. Furthermore, the selection of distribution partners who can offer specialized installation services and technical support heavily influences the perceived value and reliability of the final product in the hands of the end-user.

UPVC Profiles Market Potential Customers

The primary end-users and buyers of UPVC profiles are diverse, spanning the entire construction ecosystem. The most significant customer segment comprises window and door fabricators, who purchase profiles in bulk to manufacture finished units tailored to specific project requirements, representing the immediate B2B market. Following them are large-scale residential and commercial developers who often procure directly from profile manufacturers or large fabricators for expansive housing estates, high-rise office towers, and institutional facilities. These developers prioritize supply chain reliability, material consistency, and certified energy performance documentation to meet building code requirements.

Another crucial customer group includes professional contractors and renovators, particularly active in the replacement market where homeowners seek to upgrade existing windows and doors for improved thermal efficiency and noise reduction. These customers typically rely on distributors and retail chains for quick access to a variety of profile systems and colors. Finally, governmental and municipal bodies, often through public works departments, represent significant customers for infrastructure projects such as schools, hospitals, and public housing, where durability, low maintenance, and compliance with public procurement standards are paramount considerations.

The purchasing decisions of these different customer groups are driven by varying factors. Fabricators focus on the quality of extrusion, ease of welding, and availability of complementary hardware systems. Developers emphasize volume discounts, certified U-values, and long-term warranties. Renovators and homeowners prioritize aesthetic options, installation ease, and proven longevity. Therefore, successful market players must offer a tiered product strategy that addresses the specific technical and financial needs of each potential customer segment, often requiring customized logistical and sales support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 68.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deceuninck, VEKA AG, profine Group, REHAU, Pipelife International, Aluplast, Koemmerling (profine Group), Liniar, Schuco International KG, Aperture Group (Synseal), Eurocell Plc, Salamander Industrie-Produkte GmbH, The View Window & Door Co., Ltd., Fenzi Group, KG Systems, Wanjia Group, Dimex GmbH, Internorm International GmbH, Kinlong Hardware, LG Hausys |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

UPVC Profiles Market Key Technology Landscape

The technological landscape of the UPVC profiles market is constantly evolving, driven by the need for enhanced thermal performance, durability, and aesthetic versatility. A primary technology focus is on advanced extrusion techniques, particularly twin-screw extrusion systems, which allow for the precise and high-volume production of complex, multi-chamber profiles. These multi-chamber designs are crucial as they trap air, significantly improving the thermal insulation properties (lowering the U-value) of the window or door system, thus directly addressing mandatory energy efficiency standards globally. Furthermore, co-extrusion technology is increasingly utilized, enabling the creation of profiles with different material properties on the interior and exterior surfaces, often used for adding a layer of durable, colored acrylic (PMMA) to the exterior for enhanced weathering resistance and aesthetic variety.

In terms of material innovation, the rapid shift towards lead-free stabilizers, predominantly Calcium-Zinc (Ca-Zn) systems, marks a critical technological transition dictated by environmental and regulatory pressures. Manufacturers have invested heavily in reformulating PVC compounds to maintain processing efficiency and long-term stability without the use of lead, ensuring that the final products meet stringent health standards without compromising performance. Another significant technological advancement is the integration of internal reinforcement materials, moving beyond standard galvanized steel. Some high-end manufacturers are exploring the use of Glass Fiber Reinforced Plastic (GFRP) or similar composites for reinforcement, offering superior thermal performance by eliminating the thermal bridging associated with metal, which is a significant factor in passive house construction.

Beyond the manufacturing process, surface finishing technology has also seen significant development. Advanced laminating techniques are now employed to apply highly realistic wood grain finishes or specific color foils to the UPVC surface, dramatically expanding the aesthetic appeal and market acceptance of UPVC products in architectural segments traditionally dominated by wood or aluminum. This technological push for better aesthetics, coupled with fundamental improvements in thermal and acoustic insulation through optimized profile geometry, collectively defines the competitive edge in the modern UPVC profiles market, driving continuous investment in R&D and specialized tooling.

Regional Highlights

Regional dynamics play a crucial role in defining the market structure and growth opportunities for UPVC profiles, largely dictated by climate, regulatory frameworks, and construction activity levels. Europe remains a cornerstone of innovation and replacement demand, driven by the ambitious decarbonization goals set by the European Union, which mandates stringent energy performance standards for buildings. This focus necessitates the widespread adoption of high-insulation, multi-chamber UPVC systems, especially in Northern and Western European countries. North America, while having higher overall adoption of vinyl siding, sees steady growth in UPVC window applications, primarily replacing older, less efficient aluminum and wood units, particularly in regions prone to extreme weather conditions.

Asia Pacific (APAC) is currently the fastest-growing region, fueled by massive infrastructure investments, rapid urbanization, and a ballooning middle class demanding modern, durable housing solutions. Countries like China and India are experiencing a construction boom, where UPVC's affordability and durability are highly valued for mass housing projects, although the regulatory enforcement of thermal standards can vary significantly across the region. The Middle East and Africa (MEA) market is smaller but expanding, with demand concentrated in commercial developments and climate-control-intensive buildings where UPVC's excellent thermal performance helps minimize energy costs associated with cooling, provided the profiles offer high UV resistance suitable for intense solar exposure.

Latin America offers emerging opportunities, especially in countries like Brazil and Mexico, as consumer awareness regarding energy efficiency increases and local building standards begin to tighten. However, market penetration often faces challenges related to local sourcing of raw materials and entrenched use of traditional materials. Manufacturers targeting these growth regions must adapt their products to local assembly techniques, specific climatic demands (such as humidity and seismic stability), and fluctuating economic conditions to successfully capitalize on the long-term infrastructural build-out projected across these diverse geographies.

- Europe: Characterized by high replacement demand; leader in adopting multi-chamber, high-specification profiles driven by EU Energy Performance of Buildings Directive (EPBD) and focus on passive house standards.

- Asia Pacific (APAC): The fastest-growing region, dominated by new construction volume in China and India; high demand for cost-effective, durable, and UV-resistant solutions.

- North America: Stable market growth primarily in the residential replacement sector; increasing use of highly engineered profiles to meet stringent hurricane and seismic codes in specific states.

- Latin America: Emerging market with rising awareness of thermal efficiency; growth tied to commercial and institutional construction projects and increasing standardization.

- Middle East and Africa (MEA): Growth focused on commercial high-rise structures and regions requiring extreme climate control; high emphasis on high-performance sealing and extreme UV stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the UPVC Profiles Market, assessing their market strategies, product portfolios, and regional presence.- Deceuninck

- VEKA AG

- profine Group (including Koemmerling)

- REHAU

- Aluplast

- Schuco International KG

- Salamander Industrie-Produkte GmbH

- Liniar (Avantek)

- Eurocell Plc

- Pipelife International GmbH

- Dimex GmbH

- The View Window & Door Co., Ltd.

- Wanjia Group

- Fenesta Building Systems (DCM Shriram)

- Internorm International GmbH

- LG Hausys

- Aperture Group (Synseal)

- Kinlong Hardware

- KG Systems

- Fenzi Group

Frequently Asked Questions

Analyze common user questions about the UPVC Profiles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for UPVC profiles globally?

The primary factor driving global demand is the stringent implementation of energy efficiency mandates and green building codes, which favor UPVC’s superior thermal insulation properties compared to traditional materials, reducing heating and cooling costs in residential and commercial structures.

How does the shift to lead-free stabilizers affect UPVC profile manufacturing?

The shift necessitates significant investment in R&D and process modification to adopt environmentally friendly Calcium-Zinc (Ca-Zn) stabilizers. While potentially increasing initial material costs, this ensures regulatory compliance, enhances product safety, and improves the long-term recyclability of the profiles, addressing environmental concerns.

Which geographic region is expected to show the fastest growth rate in the UPVC profiles market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, largely due to unprecedented rates of urbanization, substantial governmental investment in housing and infrastructure, and the necessity for affordable, durable building materials across rapidly expanding metropolitan areas, particularly in India and China.

What are the main performance advantages of multi-chamber UPVC profiles?

Multi-chamber designs significantly improve thermal performance by trapping multiple layers of static air within the profile structure. This configuration dramatically reduces heat transfer (improving U-values) and enhances acoustic insulation, making them essential for meeting modern high-performance building standards like passive house requirements.

How is the adoption of AI impacting the operational efficiency of UPVC profile manufacturers?

AI is primarily used for optimizing manufacturing processes through predictive maintenance on extrusion lines, reducing unexpected downtime. Furthermore, machine learning optimizes material blending for consistency and cost control, while computer vision systems ensure real-time, high-precision quality assurance, minimizing material waste and improving final product quality metrics.

Detailed Analysis of Market Drivers

The acceleration of global energy efficiency mandates stands as the paramount driver for the UPVC profiles market. Governments worldwide are implementing increasingly stringent building codes aimed at reducing carbon emissions from the operational phase of buildings. Regulatory frameworks, such as the European Union’s Energy Performance of Buildings Directive (EPBD) and various state-level energy codes in North America, enforce mandatory thermal performance standards (e.g., minimum U-values for windows). UPVC profiles, particularly those designed with multi-chamber structures, offer an inherently superior insulating solution compared to traditional single-frame materials like standard aluminum, thereby becoming the material of choice for developers seeking compliance and energy cost savings for end-users. This regulatory environment creates a continuous and structural demand floor for high-performance UPVC systems, ensuring long-term market vitality.

Secondly, the significant cost advantage and superior lifecycle attributes of UPVC, especially when compared to high-end timber or thermally broken aluminum, continue to spur adoption across mass-market and volume construction segments. UPVC profiles require minimal maintenance—they do not rot, rust, or require painting—offering substantial savings over the lifespan of the product. This low-maintenance quality is highly attractive to both homeowners and large commercial property managers, contributing to a lower total cost of ownership. Moreover, technological improvements in coloring and lamination have addressed historical aesthetic objections, allowing UPVC to compete effectively in segments where appearance is critical, without sacrificing the cost-effectiveness derived from efficient, high-volume extrusion processes.

Furthermore, rapid global urbanization, particularly across Asia Pacific and Latin America, dictates a need for vast quantities of affordable, durable, and quickly deployed construction materials. UPVC profiles satisfy this demand perfectly, offering scalability and speed in manufacturing necessary for large-scale housing projects. The sheer volume of new construction activities in developing economies ensures that the demand for window and door systems remains robust. This demographic and economic pressure acts as a powerful counterbalance to market saturation in developed regions, ensuring that global aggregate demand for basic to mid-range UPVC systems continues its upward trajectory throughout the forecast period.

Detailed Analysis of Market Restraints

One of the most significant constraints facing the UPVC profiles market is the chronic volatility in the pricing of raw materials, particularly PVC resin, which is a petrochemical derivative. PVC production is closely linked to crude oil and natural gas prices, leading to unpredictable input costs for profile manufacturers. Fluctuations in feedstock pricing directly impact production margins, making long-term strategic pricing and procurement planning challenging. This volatility is compounded by global supply chain disruptions and capacity limitations in petrochemical refining, forcing manufacturers to absorb higher costs or pass them onto consumers, which can dampen demand in price-sensitive markets and undermine the inherent cost advantage of UPVC over alternatives.

Another persistent restraint is the historical and often negative perception of plastics, including PVC, regarding environmental sustainability and end-of-life management. Despite significant industry efforts to establish circular economy models for UPVC recycling—including schemes that repurpose old windows back into new profiles—consumer and regulatory skepticism regarding the material's overall ecological footprint persists. Competitor materials, such as wood and aluminum (which boast high inherent recycling rates), frequently leverage this environmental narrative. Manufacturers must continually invest in proving the durability, long lifespan, and high recyclability of modern UPVC systems to overcome this image challenge and mitigate potential legislative barriers based on environmental concerns.

Finally, the growing threat from high-performance substitute materials, especially thermally-broken aluminum and composite window systems, presents a competitive restraint. Aluminum manufacturers have made substantial technological strides in insulation (e.g., polyamide strips and insulating foams), narrowing the performance gap with UPVC, particularly in premium commercial applications where aesthetics and narrow sightlines are prioritized. While UPVC retains the lead in thermal performance for residential mass markets, the competitive pressure from materials that offer a different aesthetic or perceived structural advantage forces UPVC manufacturers into continuous R&D investment to maintain their competitive edge, often requiring complex hybrid systems that increase production complexity and cost.

Detailed Analysis of Market Opportunities

A major opportunity lies in the rapid expansion and standardization of lead-free UPVC formulations. The global push to ban or phase out lead-based stabilizers presents a critical opportunity for manufacturers to differentiate themselves by specializing in high-performance, compliant Calcium-Zinc (Ca-Zn) stabilized systems. Early adopters of advanced lead-free technology can secure market share in regions like North America and Europe, where regulatory compliance is mandatory, and simultaneously enter emerging markets with a product that is future-proofed against evolving health and safety legislation. Investing in efficient Ca-Zn compounding technology reduces health risks in the manufacturing environment and enhances the material's appeal to environmentally conscious consumers and developers.

Furthermore, the development and mass adoption of highly specialized UPVC composite and hybrid profiles targeting the ultra-low energy building sector, such as Passive House standards, represent a premium market opportunity. Traditional UPVC, while good, often requires specialized, oversized frames to achieve the demanding insulation values of passive construction. Opportunities exist in creating high-strength, slim-line UPVC systems reinforced with non-metallic materials (like GFRP) or integrated with insulating foams (e.g., polyurethane) within the chambers. These innovative profiles can command premium pricing and tap into the high-specification institutional and luxury residential markets that prioritize maximum energy performance over initial cost, significantly enhancing revenue per profile meter.

Lastly, strategic market penetration into untapped or rapidly industrializing regions, particularly in Southeast Asia, Africa, and specific parts of Latin America, offers substantial volume growth potential. As these regions increase their focus on modernizing building stocks and improving livability standards, there is a fundamental need for materials that can withstand local climates (high heat, humidity, or high wind loads) efficiently. Manufacturers who can establish robust, localized supply chains, adapting profile specifications to regional architectural preferences (e.g., high resistance to tropical weathering) and ensuring affordable pricing, will unlock significant long-term growth by serving these accelerating construction booms.

Competitive Landscape Analysis

The competitive landscape of the global UPVC Profiles Market is characterized by a mix of large, multinational integrated players and numerous regional specialists. Major multinational firms like VEKA AG, profine Group, REHAU, and Deceuninck dominate the market, leveraging extensive global production networks, established brands, and high R&D budgets to maintain technological leadership. These major players compete primarily on innovation, offering comprehensive systems that include advanced hardware and seals, and focusing heavily on performance metrics such as thermal insulation, acoustic properties, and security features. Their competitive strategy often involves vertical integration, controlling the entire process from compounding to profile extrusion, ensuring quality consistency and cost control across multiple international markets.

Mid-sized and regional manufacturers, such as Eurocell Plc (UK) and various strong Asian players, focus on achieving cost leadership within specific geographical markets. Their competitive advantage often stems from lower overheads, close proximity to local fabrication networks, and the ability to quickly adapt product lines to meet rapidly changing local building regulations or aesthetic preferences. Competition among these regional players is intense, often based on pricing and distribution network efficiency. The key dynamic is the constant tension between the high-volume, cost-effective offerings from regional players and the superior, technologically advanced, and higher-margin systems offered by the global leaders.

A critical dimension of competition involves sustainability and circularity. Companies are increasingly judged not just on product performance but on their commitments to recycling and the use of sustainable stabilizers. Manufacturers actively promoting robust recycling programs, where old UPVC windows are collected and reprocessed into new profiles, gain a significant competitive edge, particularly in European tenders where sustainability criteria are heavily weighted. The overall competitive intensity is high, requiring continuous investment in automation, precise material formulation (especially lead-free), and robust supply chain resilience to ensure long-term market dominance.

Raw Material and Supply Chain Analysis

The foundation of the UPVC profiles market supply chain relies heavily on petrochemical derivatives, specifically ethylene and chlorine, which are synthesized to produce PVC resin. The stability and availability of these primary feedstocks are subject to global energy markets and geopolitical stability, introducing inherent supply risks. PVC resin represents the largest cost component in profile manufacturing, making sourcing efficiency and long-term supply contracts critical for maintaining competitive pricing. Manufacturers often engage in forward buying or establish deep relationships with major chemical producers to mitigate exposure to volatile commodity markets.

Beyond PVC resin, the market depends on a range of performance additives that determine the final properties of the profile, including impact modifiers (e.g., CPE or acrylics), heat stabilizers (now predominantly Ca-Zn), lubricants, and critical UV absorbers and pigments (like Titanium Dioxide, TiO2). The sourcing of these additives, particularly TiO2, which is essential for maintaining the white color and UV resistance of profiles, can also be subject to price volatility and capacity constraints. The shift towards non-lead stabilizers has created a specialized, high-growth segment within the additive supply chain, requiring manufacturers to validate new formulations extensively to ensure performance equivalence to older systems.

The logistics phase, spanning from the compounding plant to the profile extruder and finally to the window fabricator, requires careful management due to the bulky and vulnerable nature of the finished profiles. Damage during transit can lead to significant scrap rates and project delays. Consequently, the optimization of packaging, warehousing, and transportation routes is essential for efficiency. The trend toward vertical integration, where major profile producers operate their own compounding facilities and sometimes their own fabrication centers, is a direct response to the need for greater control over material quality and logistics, thereby strengthening the resilience and efficiency of the overall supply chain.

Sustainability and Regulatory Impact

Sustainability has transitioned from a niche marketing point to a core operational mandate in the UPVC profiles market, largely driven by increasingly comprehensive regulatory frameworks worldwide. The circular economy model is crucial; industry initiatives, particularly in Europe (such as Recovinyl), focus on establishing closed-loop systems for recycling post-consumer UPVC windows and doors. This demonstrates the material's long-term sustainability by diverting waste from landfills and reducing the need for virgin resin. The ability of modern UPVC to be recycled multiple times without significant loss of performance is a powerful regulatory compliance tool and a competitive differentiator.

The most direct regulatory impact involves the mandatory phase-out of substances deemed harmful, primarily lead stabilizers. Global regions are adhering to stricter health standards, compelling all major market players to adopt safer alternatives like Calcium-Zinc formulations. This legislative pressure, while requiring initial investment in reformulation, standardizes safer practices and elevates the overall environmental profile of the UPVC sector. Furthermore, building energy efficiency codes (e.g., IECC in the US, various European standards) directly influence product design, requiring multi-chamber profiles, advanced glazing capabilities, and superior sealing systems to meet minimum thermal performance thresholds, making regulatory compliance synonymous with innovation.

Beyond mandatory compliance, voluntary green building certifications (e.g., LEED, BREEAM) encourage the use of materials with Environmental Product Declarations (EPDs) and low lifecycle impact. UPVC manufacturers actively participating in these certification processes and providing transparent data on their products' embodied carbon and recyclability gain preferential access to large, high-value commercial and institutional projects. Consequently, regulatory influence extends beyond mere prohibitions, actively shaping product specifications and driving manufacturers towards continuous ecological improvement and transparency across the entire product lifecycle.

The report contains 29654 characters including spaces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager