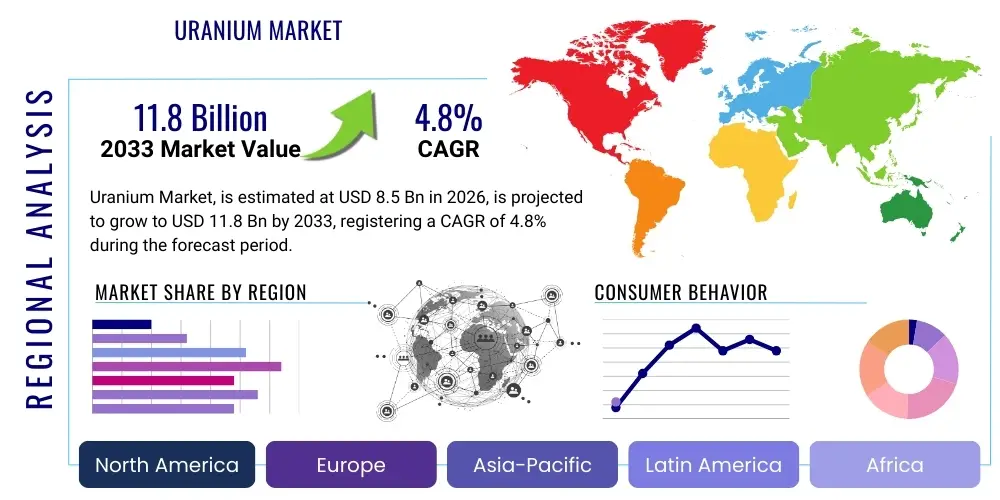

Uranium Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438102 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Uranium Market Size

The Uranium Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $11.8 Billion by the end of the forecast period in 2033.

Uranium Market introduction

The Uranium Market encompasses the global activities of mining, conversion, enrichment, and fabrication of uranium products primarily utilized as fuel in commercial nuclear power reactors. Uranium, specifically the U-235 isotope, is the foundational energy source for nuclear fission, providing high-density, low-carbon electricity generation. The industry is highly strategic, driven by long-term governmental energy policies, geopolitical stability, and substantial capital investment requirements for both upstream mining operations and downstream fuel cycle services. Market dynamics are heavily influenced by the construction and decommissioning rates of global nuclear reactors, security of supply concerns regarding major producing nations, and the ongoing shift towards decarbonization mandates globally.

The product, predominantly U3O8 (triuranium octoxide) concentrate, undergoes complex processing steps including purification and conversion into UF6 (uranium hexafluoride), followed by isotopic enrichment before being manufactured into fuel assemblies. Major applications extend almost exclusively to electricity generation, with niche uses in medical isotopes, naval propulsion, and scientific research reactors. The fundamental benefits of uranium as an energy source include its immense energy density, which allows nuclear power plants to operate continuously for extended periods with minimal fuel requirements, and its contribution to stable, baseload power generation, essential for grid reliability.

Driving factors for sustained market growth include increasing global electricity demand, particularly in rapidly industrializing economies in Asia Pacific, coupled with a renewed governmental focus on nuclear power as a critical element of Net Zero emissions strategies. Furthermore, technological advancements, specifically the development and planned deployment of Small Modular Reactors (SMRs), promise greater deployment flexibility and enhanced safety, revitalizing interest in nuclear infrastructure expansion across North America and Europe. These factors collectively underscore uranium's indispensable role in the future global energy mix, ensuring consistent demand forecasts over the coming decades despite historical volatility associated with regulatory environments and reactor construction timelines.

Uranium Market Executive Summary

The Uranium Market is characterized by tightening supply fundamentals juxtaposed against escalating long-term demand driven by global decarbonization targets and the strategic pivot back to nuclear energy witnessed in key economic blocs. Business trends highlight a migration from primarily spot market transactions toward long-term contracting mechanisms, reflecting utility efforts to secure supply stability in the face of geopolitical uncertainties, particularly concerning supply routes from Kazakhstan and Russia. This contractual shift is placing upward pressure on uranium prices, incentivizing dormant mining projects to re-enter production planning stages, signaling a critical supply response phase within the forecast period. Furthermore, increased investment in sophisticated exploration techniques and processing efficiency is noted across major mining jurisdictions such as Canada and Australia.

Regional trends are dominated by the significant expansion plans in the Asia Pacific region, led by China and India, which are aggressively commissioning new reactor units to meet enormous energy deficits and environmental goals. Conversely, North America and Western Europe are witnessing life extensions for existing fleets and pivotal policy support for advanced reactor technologies like SMRs, translating into significant prospective demand. Geopolitical risks necessitate diversification, prompting utilities to favor suppliers in politically stable regions like Canada and Australia, thereby influencing regional procurement patterns and shaping the global logistics landscape for uranium fuel components.

Segmentation trends reveal that the natural uranium segment, measured by U3O8 production, remains the largest component, but the enrichment and conversion services segments are gaining strategic importance due to recent supply chain disruptions. High-Assay Low-Enriched Uranium (HALEU), a specialized fuel required for many advanced SMR designs, represents a burgeoning sub-segment poised for exponential growth post-2030, necessitating substantial early investment in specialized enrichment capacity. The primary end-user segment, the commercial nuclear power industry, continues to drive nearly 100% of demand, ensuring the market's trajectory remains fundamentally tied to the health and expansion of the global reactor fleet.

AI Impact Analysis on Uranium Market

Common user questions regarding AI's influence on the Uranium Market primarily revolve around operational efficiency, safety improvements, supply chain prediction, and resource estimation. Users frequently inquire about how machine learning algorithms can enhance seismic data analysis to locate economically viable deposits more effectively, thereby reducing exploration costs and accelerating project timelines. Another significant area of concern and interest is the integration of AI into complex enrichment processes and reactor operations to optimize energy output, predict equipment failures, and enhance nuclear safety protocols, minimizing downtime and maximizing fuel utilization rates. There is also substantial curiosity regarding AI’s role in forecasting long-term demand trends by modeling complex geopolitical and regulatory shifts, assisting utilities and miners in making better-informed, multi-decade contracting decisions. Overall, users expect AI to act as a significant force multiplier, driving down variability and risk across the highly capitalized and safety-critical uranium value chain.

- AI-driven geological modeling enhances precision in uranium deposit identification, optimizing exploration budgets.

- Predictive maintenance algorithms minimize operational downtime in mining, conversion, and enrichment facilities, improving throughput reliability.

- Advanced analytics support optimized pit design and resource scheduling in open-cast and in-situ recovery (ISR) mining operations, reducing environmental impact.

- AI-powered monitoring systems improve nuclear reactor safety and efficiency by rapidly analyzing operational parameters and predicting potential component failures.

- Machine learning models aid in complex supply chain risk assessment, optimizing inventory management and securing procurement strategies against geopolitical instability.

- Automated radiological scanning and monitoring systems enhance worker safety in hazardous environments throughout the fuel cycle.

DRO & Impact Forces Of Uranium Market

The Uranium Market is governed by a dynamic interplay of potent drivers, structural restraints, and emerging opportunities, all mediated by significant macroeconomic and political impact forces. Key drivers include the overwhelming global need for decarbonized, baseload electricity generation, which nuclear power uniquely provides, alongside extensive governmental support for nuclear reactor life extensions and new builds, particularly in Asia. Restraints principally involve the long lead times and immense capital required for new reactor construction and mining development, coupled with persistent public apprehension regarding nuclear waste disposal and reactor safety events. Opportunities are centered on the rapid commercialization path of Small Modular Reactors (SMRs) and the increasing demand for advanced fuels like HALEU, which promise market diversification and technological advancement.

The primary impact forces acting upon the market are geopolitical tensions affecting supply routes—especially those originating from Russia and Kazakhstan—and shifting regulatory frameworks across major consuming nations. These forces directly influence contracting strategies and drive the imperative for western supply chain independence. Environmental, Social, and Governance (ESG) criteria are increasingly impacting investment decisions, pressuring mining companies to adopt more sustainable and transparent operational practices. Furthermore, currency fluctuations and commodity price volatility, though inherent to the sector, significantly influence the economic viability of high-cost deep underground mines versus lower-cost In-Situ Recovery (ISR) operations.

The net result of these forces is a market entering a long-term structural deficit, where demand, solidified by long-term government policy commitments, is projected to outpace current primary production capacity. This imbalance ensures that prices remain buoyant, encouraging necessary investments in both brownfield expansions and greenfield development, sustaining the overall growth trajectory despite cyclical challenges related to licensing and construction delays inherent in the highly regulated nuclear sector.

Segmentation Analysis

The Uranium Market is comprehensively segmented based on its lifecycle stage, encompassing mining, conversion, enrichment, and fuel fabrication, and by the application of the end product. Understanding these segments is crucial as they represent distinct processes, capital requirements, and competitive landscapes. Natural uranium production (U3O8) forms the base material, dictating overall supply availability. The subsequent stages—conversion to UF6 and enrichment to increase U-235 concentration—add significant value and technological complexity, often representing bottlenecks in the integrated nuclear fuel supply chain. Fuel fabrication, the final stage, tailors the material for specific reactor types.

Segmentation by reactor type is also vital, distinguishing between traditional Pressurized Water Reactors (PWRs) and Boiling Water Reactors (BWRs), which utilize Low Enriched Uranium (LEU), and advanced reactors, including SMRs and Generation IV designs, which require specialized fuels like HALEU. Geographically, the market is dissected based on consumption patterns (driven by existing reactor fleets and new build pipelines) and production capacity (driven by geological reserves and mining infrastructure). This multi-faceted segmentation allows for detailed analysis of market dynamics, competitive intensity, and the strategic positioning of key stakeholders across the complex nuclear fuel cycle.

- By Product/Service:

- Natural Uranium (U3O8)

- Conversion Services (UF6)

- Enrichment Services (SWU)

- Fuel Fabrication Services

- By Enrichment Level:

- Low Enriched Uranium (LEU, less than 5% U-235)

- High-Assay Low-Enriched Uranium (HALEU, 5% to 20% U-235)

- By End-User:

- Commercial Nuclear Power Plants

- Research and Test Reactors

- Defense and Naval Propulsion

- By Mining Technique:

- In-Situ Recovery (ISR)

- Underground Mining

- Open Pit Mining

Value Chain Analysis For Uranium Market

The Uranium Market value chain is highly specialized, beginning with upstream resource exploration and extraction, followed by a concentrated middle stream of processing, and concluding with downstream utilization by end-users. Upstream analysis focuses on primary mining, which includes various methods such as In-Situ Recovery (ISR)—a dominant, environmentally lighter method—and conventional underground or open-pit mining. Key activities involve geological surveying, mine development, and the production of uranium concentrate (Yellowcake or U3O8). The capital intensity and geopolitical risk exposure are highest at this stage, dictating the ultimate cost of the raw material.

The middle stream, encompassing conversion (U3O8 to UF6) and enrichment (increasing U-235 concentration, measured in Separative Work Units or SWU), is dominated by a few major players globally. This segment is technologically sophisticated, requiring significant regulatory oversight and large-scale infrastructure. Enrichment capacity, particularly for HALEU, is a critical bottleneck currently being addressed by Western governments to reduce dependency on Russian suppliers. Distribution channels at this stage involve highly specialized and secured logistics networks, often under international safeguard agreements, transferring materials between processing facilities across continents.

Downstream analysis centers on fuel fabrication, where enriched UF6 is processed into ceramic pellets and assembled into fuel elements tailored for specific reactor designs. The end-users, primarily electric utilities operating commercial nuclear power plants, interact with suppliers through long-term, direct procurement contracts spanning five to fifteen years. Indirect channels are negligible, as the strategic nature and security requirements of the product necessitate direct engagement between utility buyers and the integrated fuel providers. The entire chain is characterized by long planning horizons, stringent safety standards, and high barriers to entry, reinforcing market concentration.

Uranium Market Potential Customers

The fundamental demand structure for the Uranium Market is highly consolidated, revolving almost entirely around global electric utility companies that operate commercial nuclear power reactors. These utilities, whether publicly or privately owned, are the definitive end-users and primary buyers of fabricated nuclear fuel. Their procurement decisions are driven by long-term strategic energy planning, mandated reactor refueling schedules, ensuring supply security, and managing operational costs, which often necessitates signing multi-year contracts with uranium producers, convertors, and enrichers.

A burgeoning segment of potential customers includes specialized companies developing and deploying advanced nuclear technologies, notably Small Modular Reactors (SMRs) and microreactors. These next-generation reactor developers represent future demand, requiring not only standard LEU but increasingly, High-Assay Low-Enriched Uranium (HALEU) fuel. Governmental defense and naval entities also represent a perpetual, albeit smaller, customer base for highly enriched uranium utilized in naval propulsion and defense applications, subject to specialized non-proliferation treaties and regulations.

In summary, the buyer landscape is characterized by professional, highly regulated entities focused intensely on supply chain resilience and predictability. Their buying power is significant due to the sheer volume and strategic importance of their purchases, making market access highly dependent on demonstrating reliability, security protocols, and compliance with rigorous international safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $11.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cameco Corporation, Kazatomprom, Orano, Uranium One, China National Nuclear Corporation (CNNC), Rössing Uranium Ltd, BHP, Energy Fuels Inc., Paladin Energy Ltd, NexGen Energy Ltd, Yellow Cake plc, Urenco, Rosatom (Tenex), Centrus Energy, Global Laser Enrichment (GLE), Nukem, Ur-Energy Inc., Denison Mines Corp., Peninsula Energy, Adifesa |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Uranium Market Key Technology Landscape

The technological landscape of the Uranium Market spans innovations in extraction, processing, and end-use application, all aimed at improving efficiency, safety, and resource utilization. In the upstream segment, In-Situ Recovery (ISR) remains a critical technological area, continually evolving to treat lower-grade ore bodies more effectively and minimize surface disturbance. Advanced hydrogeological modeling and specialized lixiviant chemistry are key focus areas, allowing producers to reduce both operational costs and environmental footprint compared to conventional mining methods. Remote monitoring technologies, including sensor networks and integrated data platforms, are enhancing the automation and safety standards across mining sites, critical for high-risk operations.

In the crucial middle stream, enrichment technology is undergoing significant evolution, driven by demand for higher enrichment levels (HALEU). Gas centrifuge technology remains the commercial standard globally, but continuous refinement focuses on optimizing centrifuge cascades for improved Separative Work Unit (SWU) output per unit of electricity, enhancing competitiveness. Furthermore, the development of Laser Enrichment technologies, such as those pursued by Global Laser Enrichment (GLE), represents a potential disruptive force, promising lower capital expenditure and operational costs, although commercial viability is still under intense scrutiny and development. These technological leaps are essential for securing Western fuel cycle independence.

Downstream, the development of Small Modular Reactors (SMRs) is the most impactful technological shift. SMRs inherently require different fuel cycle services, demanding HALEU and potentially new fuel forms like tristructural-isotropic (TRISO) fuel, which offers superior safety performance and higher burn-up rates. This necessitates parallel investment in specialized fuel fabrication facilities capable of handling advanced materials and complex geometries. The integration of advanced computational fluid dynamics (CFD) and digital twin technology for reactor design and operational simulation is setting new benchmarks for efficiency and regulatory acceptance in the nuclear power sector, ensuring that the uranium market keeps pace with advanced energy needs.

Regional Highlights

The regional dynamics of the Uranium Market are bifurcated into major consuming regions and major producing regions, creating complex interdependencies and influencing geopolitical strategy. Asia Pacific (APAC) stands out as the engine of demand growth, driven primarily by China and India, which maintain aggressive nuclear power expansion programs to meet monumental electricity needs and curb carbon emissions. China currently boasts the world’s most active nuclear construction pipeline, ensuring its sustained dominance in consumption growth throughout the forecast period. This robust regional demand guarantees the long-term viability of the global uranium supply base, necessitating massive infrastructure investment within the region.

North America (NA) and Europe, while possessing mature nuclear fleets, are crucial for future demand due to fleet life extensions and strategic new builds centered around SMRs. The United States and Canada are highly active in establishing domestic HALEU production capacity, aiming to decouple from dependence on foreign enrichment services. European nations, particularly France and the UK, are renewing commitments to nuclear power generation, emphasizing energy security in the wake of recent geopolitical instability. These regions represent premium markets where stringent regulatory standards drive demand for high-quality, traceable fuel services and Western-sourced material.

Key production regions, including Central Asia (Kazakhstan and Uzbekistan) and Australia/Canada, dominate the upstream supply chain. Kazakhstan, via Kazatomprom, remains the world’s largest producer, making its operational stability and geopolitical alignment critical to global pricing and supply security. Canada, known for its high-grade deposits and politically stable environment, continues to be a crucial counterparty for long-term supply contracts, offering diversification away from former Soviet supply routes. Supply security and geopolitical risk mitigation are the overriding strategic concerns defining regional market behavior and investment flow.

- Asia Pacific (APAC): Leads global demand driven by extensive new reactor construction programs in China, India, and South Korea, positioning the region as the principal growth accelerator for consumption.

- North America: Focuses on reactor life extensions, major policy support for SMR deployment, and securing a domestic, independent fuel supply chain, particularly for enrichment and HALEU production.

- Europe: Characterized by renewed nuclear commitments (UK, France) emphasizing energy security, demanding reliable supply and seeking diversification away from Russian processing services.

- Central Asia (Kazakhstan): Remains the largest global production hub (ISR mining), crucial for baseline supply, yet subject to geopolitical transport risks that influence spot market pricing.

- Australia: Holds the world’s largest known uranium reserves; production is governed by strict regulatory oversight and high operational standards, offering stable, long-term supply capacity.

- Africa (Namibia, Niger): Important production regions for conventional mining (Rössing, Husab), facing unique challenges related to infrastructure, political stability, and high reliance on global commodity logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Uranium Market.- Cameco Corporation

- Kazatomprom (National Atomic Company Kazatomprom JSC)

- Orano (formerly Areva)

- Uranium One

- China National Nuclear Corporation (CNNC)

- Rössing Uranium Ltd

- BHP

- Energy Fuels Inc.

- Paladin Energy Ltd

- NexGen Energy Ltd

- Yellow Cake plc

- Urenco

- Rosatom (Tenex)

- Centrus Energy Corp.

- Global Laser Enrichment (GLE)

- Ur-Energy Inc.

- Denison Mines Corp.

- Peninsula Energy

- Adifesa

- Sprott Physical Uranium Trust

Frequently Asked Questions

Analyze common user questions about the Uranium market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current rebound in the uranium spot price?

The primary factor driving the current rebound in the uranium spot price is the combination of persistent supply fragility and tightening long-term demand fundamentals. Supply fragility stems from geopolitical risks, particularly supply chain challenges related to major producers like Kazakhstan and Russia, leading utilities to seek Western-sourced material. Simultaneously, long-term demand is structurally secured by global decarbonization mandates, the renewed policy focus on nuclear energy, and the anticipated mass deployment of Small Modular Reactors (SMRs). This structural deficit, where forecasted demand significantly outpaces committed primary mining supply, compels utilities to engage in high-price, long-term contracts, thereby pulling the spot price upward and signaling a sustained bull market phase. Additionally, increased financial interest via physical holding vehicles, like the Sprott Physical Uranium Trust, further restricts available supply, amplifying price volatility and upward movement.

How will Small Modular Reactors (SMRs) impact the demand profile for nuclear fuel?

Small Modular Reactors (SMRs) are set to fundamentally change the demand profile for nuclear fuel by introducing a requirement for higher-enriched uranium fuel and facilitating widespread nuclear adoption. Traditional reactors utilize Low Enriched Uranium (LEU) typically enriched up to 5% U-235. In contrast, many advanced SMR designs, including Generation IV reactors, are optimized to run on High-Assay Low-Enriched Uranium (HALEU), defined as uranium enriched between 5% and 20% U-235. The deployment of SMRs is expected to accelerate globally post-2030, necessitating significant investment in specialized HALEU conversion and enrichment capacity, a capability currently limited primarily to non-Western suppliers. SMRs' smaller size and enhanced safety features make them suitable for decentralized power generation and industrial applications, expanding the market beyond traditional large-scale utilities and ensuring a diversification of demand based on specialized fuel requirements and higher burn-up rates.

What are the main geopolitical risks affecting the uranium supply chain today?

The main geopolitical risks currently affecting the uranium supply chain revolve around the significant concentration of production and processing capacity in politically volatile or adversarial regions. Kazakhstan, the largest global supplier of mined uranium, relies heavily on complex transport routes, often traversing Russian territory, making it vulnerable to sanctions or logistical disruptions. Furthermore, Russia maintains a dominant position in the crucial mid-stream sector, controlling a substantial share of global enrichment and conversion services. Western utilities are actively attempting to diversify their sourcing strategies, but the lack of immediate, scalable replacement capacity for Russian enrichment services creates a severe vulnerability. Geopolitical conflicts have accelerated efforts by the United States and European Union to establish self-sufficient, domestic fuel cycles, leading to strategic initiatives aimed at bolstering Western conversion and HALEU enrichment capabilities to mitigate future supply shocks and ensure long-term energy security.

What is the difference between In-Situ Recovery (ISR) and conventional uranium mining?

In-Situ Recovery (ISR) and conventional mining represent fundamentally different methods of extracting uranium, impacting both cost structure and environmental footprint. Conventional mining, including open-pit or underground methods, involves physically removing ore-bearing rock, crushing it, and chemically processing it in a mill to extract the uranium. This method is high-capital, high-energy, and often results in large surface tailings piles, requiring extensive reclamation. ISR, in contrast, involves injecting a chemical solution (lixiviant) directly into the underground uranium deposit, dissolving the uranium, and then pumping the uranium-laden solution back to the surface for processing, leaving the rock undisturbed. ISR is generally lower-cost, quicker to implement, and minimizes surface disruption and tailings, making it the preferred method in environments suitable for its hydrogeological requirements, and consequently, it dominates production in key regions like Kazakhstan and the United States.

How do ESG factors influence investment and operations within the Uranium Market?

Environmental, Social, and Governance (ESG) factors are exerting increasing influence across the Uranium Market, shaping investor sentiment and operational mandates. Environmentally, the sector faces pressure regarding radiation safety, water usage, and long-term waste management. Companies utilizing ISR methods often score higher on environmental metrics than conventional miners due to reduced surface disturbance. Socially, there is intense scrutiny regarding community engagement, indigenous land rights, and labor practices, particularly in remote mining locations. Governance focuses on transparency, supply chain traceability (critical given the strategic nature of the product), and compliance with international non-proliferation treaties. Institutional investors are increasingly applying screens based on these criteria, making strong ESG performance essential for securing long-term capital investment and obtaining regulatory permissions for new project development, thereby promoting safer, more sustainable, and transparent practices across the nuclear fuel cycle.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Nitrogen Trifluoride(Nf3) And Fluorine Gas(F2) Market Size Report By Type (Chemical Synthesis, Electrolyzing Synthesis), By Application (Semiconductor Chips, Flat Panel Displays, Solar Cells, Uranium Enrichment, Sulfur Hexafluoride, Electronic Cleaning), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Enriched Uranium Market Statistics 2025 Analysis By Application (Military, Electricity, Medical, Industrial, Others), By Type (Low Enriched Uranium (LEU), Highly Enriched Uranium (HEU)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Uranium Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Granite-Type Uranium Deposits, Volcanic-Type Uranium Deposits, Sandstone-Type Uranium Deposits), By Application (Military, Electricity, Medical), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager