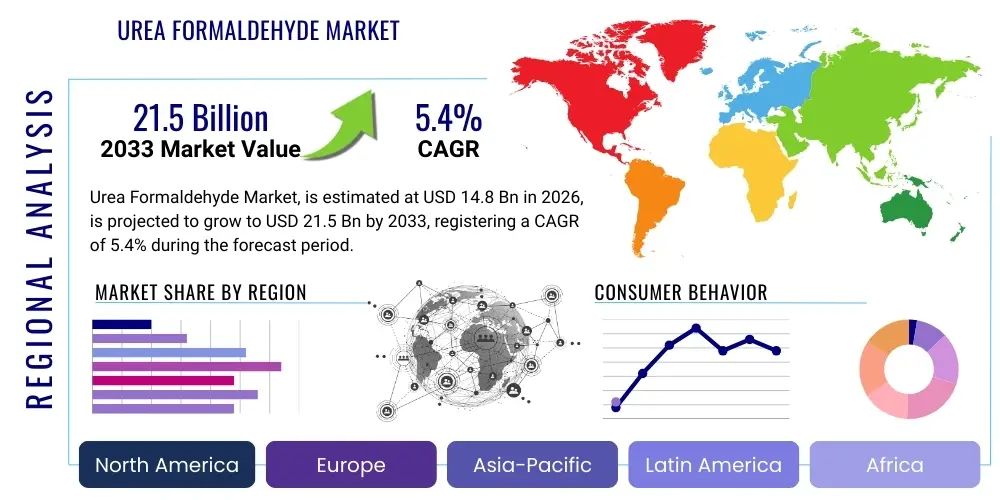

Urea Formaldehyde Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435706 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Urea Formaldehyde Market Size

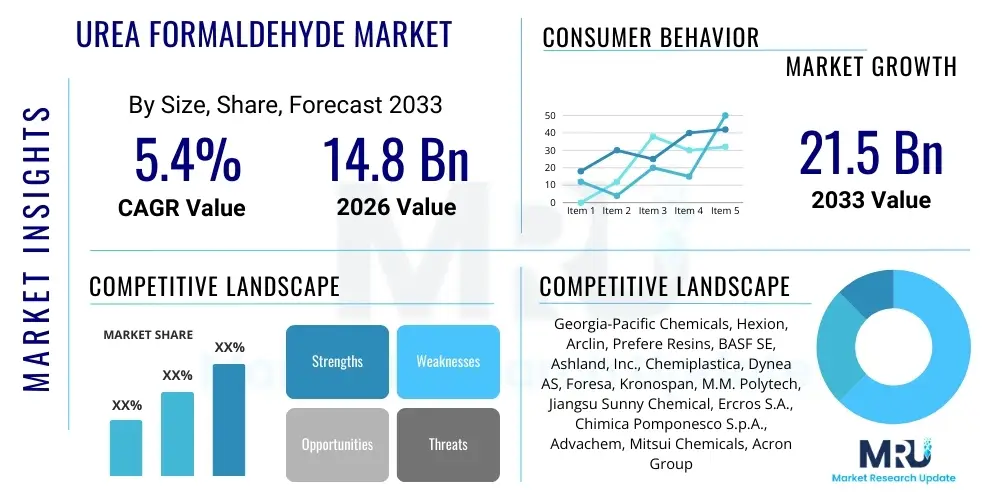

The Urea Formaldehyde Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.4% between 2026 and 2033. The market is estimated at $14.8 Billion in 2026 and is projected to reach $21.5 Billion by the end of the forecast period in 2033.

Urea Formaldehyde Market introduction

Urea Formaldehyde (UF) resin, also known as urea-methanal, is a thermosetting polymer or resin created through the polycondensation reaction of urea and formaldehyde. This product is highly valued in industrial applications due to its cost-effectiveness, high tensile strength, high hardness, resistance to heat, and excellent water solubility during the initial synthesis stage. UF resins are intrinsically transparent and offer good bonding characteristics, making them indispensable components in sectors reliant on strong, durable, and moldable materials. The primary commercial products are in the form of adhesives, molding compounds, and coatings, which serve diverse manufacturing needs globally. The market growth is fundamentally tied to the health of the construction and automotive sectors, where UF products are critical components for structural integrity and aesthetic finishing.

The primary applications of Urea Formaldehyde are overwhelmingly concentrated in the wood products industry, where it functions as the dominant adhesive for manufacturing composite panels such as particleboard, medium-density fiberboard (MDF), and plywood. Its rapid curing time and strong bonding capabilities under heat and pressure make it the preferred choice for mass production in furniture and construction materials. Beyond wood composites, UF resins are utilized in agricultural fertilizers (as a slow-release nitrogen source), electrical device casings due to their dielectric strength, and textile finishing to impart wrinkle resistance. The versatility of UF resins in customizing properties—such as viscosity and cure time—allows manufacturers to tailor products for very specific end-use requirements, ranging from decorative laminates to rigid foam insulation.

Key driving factors accelerating the expansion of the Urea Formaldehyde market include the rapid urbanization and infrastructure development, particularly across emerging economies in Asia Pacific, which fuels demand for wood-based panels and furniture. Furthermore, the inherent benefits such as the low cost of raw materials (urea and formaldehyde are high-volume commodity chemicals) and the proven reliability of UF resins in demanding applications sustain their competitive advantage over alternative adhesives like polyurethane or phenol-formaldehyde. However, the market dynamics are increasingly shaped by stringent environmental regulations, particularly concerning formaldehyde emissions, which mandate continuous innovation towards low-emission UF resin formulations (LFE-UF) to maintain market viability and public health compliance.

Urea Formaldehyde Market Executive Summary

The Urea Formaldehyde market's trajectory is characterized by robust growth in the Asia Pacific region, driven by unparalleled construction activity and escalating demand for housing and commercial spaces, positioning APAC as the undisputed regional market leader. Business trends are largely focused on optimization strategies, including backward integration by major chemical producers to secure raw material supply (formaldehyde and methanol feedstock) and achieve economies of scale. Segment trends indicate a significant push towards specialized, high-performance UF derivatives, specifically those designed for low-emission applications, as regulatory bodies worldwide intensify scrutiny over Volatile Organic Compound (VOC) releases from wood composite materials. While the traditional adhesives segment maintains market dominance by volume, the molding compounds segment is showing promising growth supported by the automotive and electrical industries requiring durable, heat-resistant, and aesthetically pleasing plastic components.

The transition toward sustainable manufacturing practices is a pervasive theme impacting major industry players, necessitating substantial investment in R&D to reformulate UF resins with reduced free formaldehyde content, often achieved through adjustments to the urea-to-formaldehyde molar ratio or the incorporation of formaldehyde scavengers. This shift, while initially costly, is creating a competitive differentiation favoring companies that successfully navigate the complex regulatory landscape, particularly in highly regulated markets such as North America and Europe. Supply chain resilience has also emerged as a critical business imperative, influenced by fluctuating prices of natural gas (a key input for methanol/formaldehyde production) and geopolitical instability affecting international trade flows of both raw materials and finished composite products, compelling localized production models in strategic geographical hubs.

Regionally, while Asia Pacific drives volume, North America and Europe lead in terms of technological advancement and adherence to the strictest quality standards (e.g., TSCA Title VI in the US, E1/E0 standards in Europe). This regulatory environment necessitates different product mixes across regions; for instance, specialized, water-resistant modified UF resins (MUF) are gaining traction in outdoor and high-humidity applications in developed markets. Segmentally, the slow-release fertilizer application, although niche compared to adhesives, represents a high-value growth opportunity, driven by global food security concerns and the need for efficient nutrient delivery systems that minimize environmental runoff. Overall, the market remains fundamentally strong, underpinned by its essential role in construction, but its future growth is inextricably linked to the successful industrial adoption of greener chemistry principles and superior product performance.

AI Impact Analysis on Urea Formaldehyde Market

Common user inquiries regarding AI's influence on the Urea Formaldehyde market frequently center on three critical areas: optimization of the complex exothermic polymerization process, predictive maintenance of large-scale chemical reactors, and sophisticated demand forecasting. Users seek confirmation on whether AI can enhance the current batch or continuous manufacturing processes by minimizing variability in the synthesis reaction, thereby ensuring consistent product quality (critical for regulatory compliance, such as minimizing free formaldehyde). Furthermore, there is significant interest in utilizing machine learning algorithms to predict future demand accurately across diverse end-use sectors (construction vs. automotive), allowing producers to optimize raw material procurement (urea and formaldehyde supply chain) and inventory management, ultimately improving operational efficiency and reducing waste in a highly commodity-driven industry.

The application of Artificial Intelligence and Machine Learning (ML) within the chemical manufacturing vertical is already demonstrating potential to revolutionize the production of Urea Formaldehyde. By deploying sensors and real-time data analysis across the manufacturing train, AI systems can monitor parameters such as temperature, pressure, pH levels, and reactant ratios with unparalleled precision. ML models can identify subtle correlations between these inputs and the final resin properties, enabling dynamic process adjustments that optimize polymerization yield, reduce batch cycle times, and critically, stabilize the critical molar ratio to consistently produce lower-emission resins required by the market. This predictive quality control minimizes off-specification material and reduces the costly need for rework or disposal.

In addition to process optimization, AI systems are crucial for enhancing safety and minimizing unplanned downtime in UF production plants. Predictive maintenance algorithms analyze vibration data, thermal signatures, and operational statistics from pumps, reactors, and distillation units to predict equipment failure far in advance. This allows maintenance teams to transition from reactive or time-based schedules to condition-based servicing, significantly increasing plant reliability and asset longevity. Furthermore, AI-driven simulation tools are assisting R&D efforts by virtually testing thousands of complex chemical formulations (e.g., testing different formaldehyde scavengers or urea derivatives) without extensive, resource-intensive laboratory trials, accelerating the development cycle for next-generation, high-performance, and sustainable UF products.

- AI-Driven Process Optimization: Real-time control of polymerization temperature and reactant molar ratios to ensure high-quality, low-emission resin production.

- Predictive Maintenance: Utilization of machine learning on sensor data to forecast equipment failures, minimizing unexpected shutdowns in large chemical reactors.

- Supply Chain Optimization: Enhanced demand forecasting models incorporating economic indicators and regional construction trends to optimize urea and formaldehyde inventory.

- Accelerated R&D: Simulation tools based on AI to model and test new low-formaldehyde formulations, reducing laboratory time and associated costs.

- Quality Consistency: Automated monitoring systems that detect deviations in resin properties (viscosity, cure time) and automatically trigger corrective action to maintain batch homogeneity.

- Energy Efficiency: Optimization of heating and cooling cycles within the exothermic reaction process to reduce overall energy consumption per unit of resin produced.

DRO & Impact Forces Of Urea Formaldehyde Market

The Urea Formaldehyde market is simultaneously propelled by robust construction demand (Driver) and constrained by stringent health and safety mandates regarding formaldehyde emissions (Restraint), creating a highly dynamic environment. The primary driving force is the global population growth and ensuing infrastructure requirements, which mandate large volumes of affordable wood composites, where UF resins hold a dominant competitive position due to their cost efficiency and favorable performance profile. Conversely, the continuous tightening of governmental regulations, particularly the imposition of extremely low permissible exposure limits (PEL) for free formaldehyde, significantly complicates manufacturing processes and necessitates costly modifications to formulation chemistry, acting as a powerful restraint. The primary Opportunity lies in the development and commercialization of bio-based or ultra-low-formaldehyde emitting (ULFE) resins that satisfy both performance requirements and stringent green building certifications. These opposing forces—driven growth versus regulatory pressure—are the dominant impact forces shaping innovation and investment decisions across the value chain.

Drivers: The unparalleled growth in the construction and housing sectors, especially in the developing markets of Asia Pacific and Latin America, dictates a high, consistent demand for engineered wood products (MDF, particleboard). UF resins are inherently cost-effective compared to alternatives like melamine-formaldehyde or isocyanates, making them the default choice for budget-sensitive, high-volume applications. Furthermore, the increasing adoption of RTA (Ready-to-Assemble) furniture, which relies heavily on MDF and particleboard for structure, provides a strong, predictable consumer pull for UF adhesives. The established and mature manufacturing technology, coupled with the readily available, globally traded raw materials (urea and formaldehyde), ensures supply chain feasibility and encourages sustained market participation.

Restraints: The most significant restraint is the documented toxicity and carcinogenicity associated with free formaldehyde emissions, which has led to sweeping regulatory action globally, including standards set by the Environmental Protection Agency (EPA) in the US (TSCA Title VI) and the European Union’s REACH legislation. Compliance requires manufacturers to invest heavily in specialized production facilities and use high-purity, often more expensive, raw materials, driving up production costs and complexity. Moreover, the inherent vulnerability of standard UF resins to hydrolysis in high-humidity environments limits their use in exterior or high-moisture structural applications, creating market limitations that favor specialized moisture-resistant alternatives.

Opportunities: The major opportunities are centered on innovation and diversification. The push for green building materials creates a lucrative niche for advanced, sustainable UF formulations, including hybrid resins that blend UF with melamine or phenol to enhance moisture resistance (MUF/PF) while maintaining low emissions. Furthermore, the application of UF resins as micronutrient encapsulation agents in the agricultural sector, providing slow-release fertilizer benefits, represents a high-growth, non-construction market segment. Companies that successfully develop robust, cost-competitive bio-based alternatives to traditional formaldehyde feedstock will capture substantial market share, aligning their product portfolios with long-term sustainability mandates.

Segmentation Analysis

The Urea Formaldehyde market is meticulously segmented based on end-use application, product form, and geographical region, reflecting the diverse requirements of consuming industries. The application segmentation clearly delineates the market dominance of wood adhesives, which utilize UF resins for binding wood fibers and particles into composite panels, accounting for the vast majority of consumption volume. However, the market is also significantly influenced by the molding compounds segment, which caters primarily to the electrical, appliance, and dinnerware industries requiring rigid, heat-stable, and glossy finishes. The continuous need for specialized characteristics, such as water resistance, flame retardancy, and low volatility, further drives granular segmentation by product form, including liquid resins, powder resins, and highly modified specialty resins.

Analyzing the segmentation by product form reveals that liquid resins are the most consumed format, particularly for large-scale wood panel production, favored for their ease of mixing and application within automated manufacturing lines. Conversely, powdered UF resins hold strategic importance in smaller-scale operations, remote locations, or specific applications requiring extended shelf life and reduced transportation weight. The trend within the application segmentation is toward high-specification composite materials; for example, low-density MDF (LDF) and specialty oriented strand board (OSB) often require customized UF formulations that enhance specific mechanical properties while rigidly adhering to low-emission benchmarks. This segmentation complexity dictates that key players must maintain flexible production facilities capable of switching between standard commodity resins and customized specialty compounds based on fluctuating regional market demand.

The segmentation structure highlights the market’s reliance on capital expenditure cycles within the construction industry. When residential construction peaks, demand for standard particleboard adhesive surges. When automotive production accelerates, demand for UF molding compounds used in interior trim components and switchgear increases. Therefore, market participants must utilize sophisticated econometric models to forecast demand across these divergent segments. Furthermore, geographical segmentation remains crucial, as regulatory frameworks dramatically alter the product mix; for instance, European markets primarily demand E0/E1 standard resins, while segments in regions with fewer environmental restrictions may still prioritize cost over emission standards, demanding volume production of general-purpose UF adhesives.

- By Application:

- Wood Adhesives (Plywood, Particleboard, MDF, OSB)

- Molding Compounds (Electrical fittings, Dinnerware, Appliance parts)

- Coatings (Industrial finishes, Paints)

- Textile Finishing (Wrinkle resistance, Stiffness)

- Fertilizer (Slow-release nitrogen source)

- Abrasives

- Paper Impregnation

- By Product Type:

- Liquid Resins (Aqueous Solutions)

- Powdered Resins (Dry Powders)

- Modified Urea Formaldehyde (MUF, Melamine-Urea-Formaldehyde)

- By End-Use Industry:

- Building and Construction (Residential and Commercial)

- Furniture and Cabinets

- Automotive (Interior components)

- Electrical and Electronics

- Agriculture

- Textiles

Value Chain Analysis For Urea Formaldehyde Market

The Urea Formaldehyde value chain initiates at the upstream level with the production of key feedstocks: urea and formaldehyde. Urea is predominantly derived from ammonia, which relies heavily on natural gas as a primary source, making UF production costs highly susceptible to volatility in global energy markets. Formaldehyde is produced via the catalytic oxidation of methanol, another commodity chemical. The stability and efficient sourcing of methanol and ammonia are paramount to maintaining cost-competitive production of UF resins, positioning major integrated chemical companies with control over these upstream inputs at a significant competitive advantage. This upstream control ensures predictable supply and mitigates risks associated with third-party feedstock price fluctuations, a critical factor given the commodity nature of UF resins.

The midstream stage involves the synthesis and processing of the raw materials into various forms of UF resin, including liquid solutions and dry powders, tailored for specific customer specifications such as viscosity, molar ratio, and curing characteristics. This manufacturing stage requires specialized, continuous or batch reaction facilities and significant chemical engineering expertise to manage the exothermic polymerization reaction and ensure the consistency of the final product, especially concerning regulatory benchmarks for free formaldehyde content. The high capital expenditure required for synthesis plants creates substantial barriers to entry, concentrating market power among a few large-scale producers globally who have optimized their reaction conditions for maximum yield and minimum waste, incorporating technologies like methanol recovery and heat integration.

The downstream segment encompasses distribution, sales, and the end-user application. UF resins, particularly the liquid variety, have relatively short shelf lives and require carefully managed logistics, necessitating efficient, localized distribution channels. Direct sales channels are often employed when supplying large volume customers (e.g., major composite panel manufacturers) who require technical support and just-in-time delivery. Indirect channels involve distributors or specialized chemical traders, particularly for powdered resins or smaller customers in niche markets such as abrasives or textile finishing. The final point in the value chain involves the end-users—furniture makers, builders, and textile processors—whose demand elasticity and compliance requirements ultimately dictate product specifications and price negotiation power throughout the entire chain.

Urea Formaldehyde Market Potential Customers

The primary consumers and buyers of Urea Formaldehyde resins are large-scale manufacturers operating within the engineered wood products sector. These customers include producers of medium-density fiberboard (MDF), particleboard, plywood, and oriented strand board (OSB), who utilize UF resins as the fundamental binder for wood fibers and chips. Procurement decisions by these manufacturers are driven by several key criteria: the resin’s cost-per-unit-volume, its technical compatibility with high-speed pressing machinery, and its ability to meet stringent governmental emissions standards (e.g., meeting TSCA Title VI certification for US market access). Given the immense volume of material consumed, securing long-term contracts with major composite panel producers is critical for UF suppliers, often requiring highly customized, technical solutions and reliable supply logistics.

A secondary, yet significant, customer base resides within the molding compounds segment, encompassing manufacturers of electrical components, appliance casings, and high-durability plastic housewares. These buyers prioritize specific physical properties such as dielectric strength, resistance to heat and scratching, and surface finish aesthetics over simple cost minimization. The UF resin suppliers serving this segment must focus on delivering high-purity, standardized molding powders, often requiring specialized additives or colorants. For these customers, consistency of batch quality and compliance with international standards (e.g., ISO certifications) is non-negotiable, as component failure can have severe consequences in electrical and automotive applications.

Other vital potential customers are agricultural companies and fertilizer blenders. UF resins, particularly in the form of urea-formaldehyde concentrates (UFC) or stabilized fertilizer grades, are bought for their slow-release nitrogen properties, offering agronomic benefits like reduced nutrient runoff and sustained plant feeding. These buyers seek products that offer high nitrogen content and predictable degradation rates in soil. Furthermore, the textile industry purchases UF resins for finishing purposes (primarily for wrinkle resistance), and paint and coatings manufacturers utilize UF derivatives as cross-linking agents to improve the hardness and durability of industrial coatings. These diverse end-users emphasize the need for UF suppliers to maintain specialized technical sales teams capable of addressing highly varied performance requirements across different industrial domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.8 Billion |

| Market Forecast in 2033 | $21.5 Billion |

| Growth Rate | 5.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Georgia-Pacific Chemicals, Hexion, Arclin, Prefere Resins, BASF SE, Ashland, Inc., Chemiplastica, Dynea AS, Foresa, Kronospan, M.M. Polytech, Jiangsu Sunny Chemical, Ercros S.A., Chimica Pomponesco S.p.A., Advachem, Mitsui Chemicals, Acron Group, Capital Resin Corporation, Chemique Adhesives, Metadynea |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Urea Formaldehyde Market Key Technology Landscape

The Urea Formaldehyde market’s technological landscape is dominated by advancements focused on two critical areas: optimizing the synthesis process for lower formaldehyde emissions and enhancing the functional performance characteristics of the resultant resins. Traditional UF synthesis relies on standardized batch or continuous reactors utilizing mild heat and acidic catalysis; however, modern manufacturing employs highly automated systems with advanced control loops to precisely manage the urea-to-formaldehyde molar ratio (U:F ratio). The technological shift is fundamentally driven by the need to operate at very high U:F ratios (e.g., 1.1:1 to 1.3:1) compared to older, high-emission resins, thereby minimizing residual, or 'free,' formaldehyde after curing. Advanced technologies include in-line sensors and computer-aided reaction management systems that ensure polymerization stops precisely when the desired degree of condensation and low free formaldehyde level is achieved, which is paramount for compliance with global standards like CARB/TSCA.

A critical innovation involves the incorporation of sophisticated formaldehyde scavenging technologies, which chemically bind any remaining free formaldehyde within the resin formulation both before and after application. These scavengers, often amines or specialty urea derivatives, are integrated into the resin solution during the final stages of synthesis or added immediately prior to application at the wood panel mill. Furthermore, there is growing technological emphasis on developing Modified Urea Formaldehyde (MUF) resins, where melamine or phenol is co-polymerized with UF. This modification significantly improves the resin’s resistance to moisture and hydrolysis, extending the applicability of UF-based adhesives into higher-performance segments, though at a higher cost. These technological refinements ensure that UF resins can compete effectively against more expensive structural adhesives in moderately humid environments.

Future technological developments are keenly focused on bio-based substitutes and highly efficient delivery systems. Research into substituting petrochemically derived formaldehyde with bio-based alternatives, such as those derived from lignin or agricultural waste, aims to create truly sustainable, green UF resins. Additionally, advancements in spray drying technology allow manufacturers to produce highly stable, reactive powdered UF resins with optimized particle size distribution, which offers logistical advantages, particularly for export markets and remote manufacturing sites. The deployment of ultrasonic mixing and specialized nozzle systems at the point of application within composite panel mills also ensures better penetration and uniform distribution of the resin, maximizing bonding strength while minimizing overall resin usage, thereby optimizing material efficiency and reducing final product cost.

Regional Highlights

The global Urea Formaldehyde market exhibits pronounced regional variations driven by construction cycles, regulatory stringency, and local feedstock availability. Asia Pacific (APAC) dominates the global market both in terms of production capacity and consumption volume, primarily fueled by the sustained, rapid industrialization and massive urban development projects underway in China, India, and Southeast Asian nations. The high demand for affordable housing and infrastructure creates a constant, massive requirement for engineered wood products like particleboard and MDF. While cost competitiveness remains high in APAC, governments are gradually adopting stricter emission standards, pushing local manufacturers toward cleaner UF technologies.

North America and Europe represent mature markets characterized by low-to-moderate growth but high-value consumption. These regions are the global benchmarks for regulatory compliance, enforcing the strictest emission standards (e.g., TSCA Title VI in the US and E0/E1 standards in Europe). This stringent environment mandates that UF suppliers in these regions focus almost exclusively on high-performance, ultra-low-formaldehyde emitting (ULFE) or specialty modified resins (MUF), commanding higher prices and requiring significant investment in advanced manufacturing technology. The focus here is less on volume and more on developing specialized products for niche segments like structural applications and high-end furniture.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions experiencing moderate growth. LATAM's market expansion is tied to recovering residential construction, particularly in Brazil and Mexico, creating steady demand for standard UF adhesives. MEA shows promising growth potential, driven by infrastructure development related to oil wealth diversification in the Gulf Cooperation Council (GCC) countries and urbanization in South Africa and Nigeria. Market development in MEA often involves the importation of resins or finished goods, although local production capacity is gradually being established, focusing on meeting the immediate needs of large-scale construction projects and local manufacturing hubs.

- Asia Pacific (APAC): Market leader by volume; driven by China, India, and ASEAN nations' construction boom. Focus on balancing cost-efficiency with increasingly strict local emission regulations.

- North America: High-value market focused on strict compliance (TSCA Title VI). Strong demand for specialty, ultra-low-emitting UF resins for residential furniture and cabinets.

- Europe: Mature market characterized by advanced technology adoption (E0/E1 standards). Significant demand in Germany, Poland, and Italy for MUF resins in furniture and interior design applications.

- Latin America (LATAM): Emerging growth market, particularly in Brazil and Mexico, driven by residential construction and furniture manufacturing expansion.

- Middle East & Africa (MEA): Growth driven by large-scale infrastructure projects (e.g., Saudi Arabia, UAE) and increasing local capacity development to serve localized construction material needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Urea Formaldehyde Market.- Georgia-Pacific Chemicals

- Hexion

- Arclin

- Prefere Resins

- BASF SE

- Ashland, Inc.

- Chemiplastica S.p.A.

- Dynea AS

- Foresa

- Kronospan

- M.M. Polytech

- Jiangsu Sunny Chemical Co., Ltd.

- Ercros S.A.

- Chimica Pomponesco S.p.A.

- Advachem

- Mitsui Chemicals, Inc.

- Acron Group

- Capital Resin Corporation

- Chemique Adhesives & Sealants Ltd.

- Metadynea LLC

Frequently Asked Questions

Analyze common user questions about the Urea Formaldehyde market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the current demand for Urea Formaldehyde resin?

The primary driver is the engineered wood products industry, where UF resins are used as essential, cost-effective adhesives in the manufacturing of particleboard, medium-density fiberboard (MDF), and plywood for furniture and residential construction. Secondary drivers include molding compounds for electrical components and slow-release nitrogen fertilizers in agriculture.

How is regulatory pressure impacting the future formulation of Urea Formaldehyde resins?

Stringent global regulations, such as the US TSCA Title VI and European E0/E1 standards, necessitate a continuous shift toward low-formaldehyde emitting (LFE) and ultra-low-formaldehyde emitting (ULFE) resins. Manufacturers are adapting by increasing the urea-to-formaldehyde molar ratio and incorporating formaldehyde scavengers to ensure compliance and market access.

Which geographical region holds the largest market share for Urea Formaldehyde?

Asia Pacific (APAC) currently holds the largest market share due to unparalleled growth in the construction sector, particularly in high-volume, cost-sensitive wood panel production in economies like China, India, and Southeast Asia. This region drives global volume consumption.

What are the key technological advancements expected to shape the Urea Formaldehyde market?

Key technological shifts involve the development of highly customized Modified Urea Formaldehyde (MUF) resins to enhance moisture resistance, the integration of advanced sensors for real-time process control (aided by AI), and R&D efforts focused on commercializing bio-based substitutes for formaldehyde feedstock to improve sustainability.

How does the cost structure of Urea Formaldehyde production relate to global commodity prices?

The cost structure is highly sensitive to commodity prices, as the two main feedstocks, urea (derived from ammonia) and formaldehyde (derived from methanol), are influenced by global natural gas and crude oil prices. Fluctuations in these energy feedstocks directly impact the profitability and pricing stability of UF resin manufacturers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Amino Resin Market Size Report By Type (Urea-Formaldehyde (UF), Melamine-Formaldehyde (MF), Melamine-Urea Formaldehyde (MUF)), By Application (Paints and Coatings, Textile, Adhesives & Sealants, Other Applications), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Urea Formaldehyde Concentrate (UFC) Market Size Report By Type (UFC 85, UFC 80, UFC 75), By Application (UF Resins, Fertilizers, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Wood Adhesives Market Statistics 2025 Analysis By Application (Flooring & Plywood, Furniture & Subcomponents, Windows & Doors), By Type (Urea Formaldehyde Resin Adhesive Glue Agent, Melamine Resin Adhesive Glue Agent), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Urea Formaldehyde Resin Market Statistics 2025 Analysis By Application (Composite Panel Products, Electrical Plastic Product, Industrial Abrasives), By Type (Urea Formaldehyde Resin Power, Urea Formaldehyde Resin Solution), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Thermoset Plastic Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Phenolic Resin, Urea Formaldehyde Resin, Formaldehyde Resin, Unsaturated Polyester Resin, Others), By Application (Plywood, Coating, Automobile Industry, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager