USB RFID Reader Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434653 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

USB RFID Reader Market Size

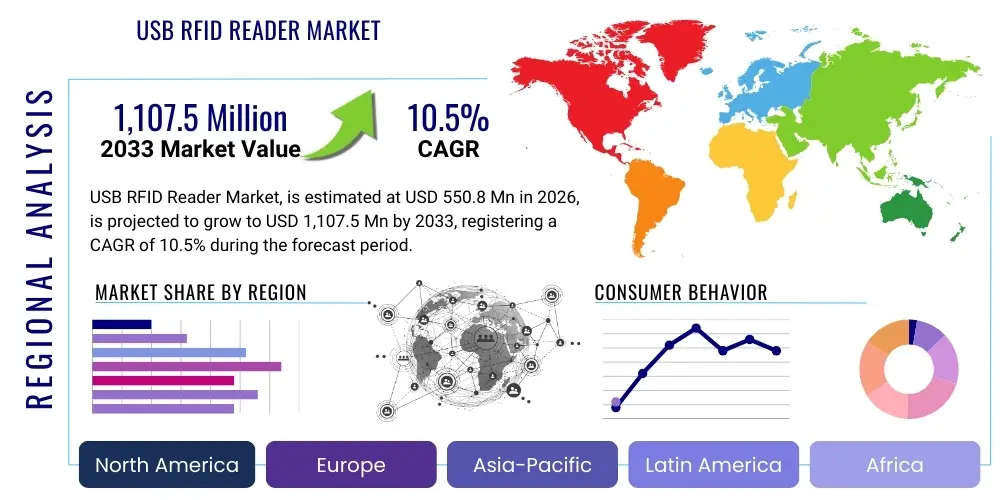

The USB RFID Reader Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 550.8 Million in 2026 and is projected to reach USD 1,107.5 Million by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating global need for automated data capture solutions across high-volume sectors like retail, logistics, and healthcare, where ease of integration and high reliability are paramount. The market trajectory reflects a crucial shift towards plug-and-play identification systems that minimize setup complexity and operational downtime, making USB connectivity the preferred choice for desktop and mobile integration points.

Market valuation growth is underpinned by advancements in reader performance, particularly the ability to handle various frequency bands (HF, UHF, LF) within a compact, bus-powered form factor. Furthermore, the increasing adoption of cloud-based inventory management systems necessitates reliable, accessible data input devices, placing USB RFID readers at the nexus of physical asset tracking and digital infrastructure. Regional market dynamics, particularly rapid technological uptake in Asia Pacific coupled with stringent compliance mandates in North America and Europe regarding supply chain transparency, contribute significantly to the accelerating market size projection.

USB RFID Reader Market introduction

The USB RFID Reader Market encompasses devices designed to read and write data to RFID tags using a standard Universal Serial Bus (USB) interface for power and data transmission. These readers serve as essential components in automated identification and data capture (AIDC) ecosystems, providing a seamless bridge between physical items equipped with transponders and digital host systems, such as PCs, laptops, or specialized kiosks. The primary product description includes compact, often desktop or handheld-sized units, supporting various protocols including ISO 14443 and EPC Global standards, and are valued for their simplicity, portability, and ease of deployment without requiring proprietary power supplies or extensive networking infrastructure. Key features often include multi-protocol support, high reading accuracy, and robust driver compatibility across major operating systems (Windows, Linux, macOS).

Major applications of USB RFID readers span across critical business operations, notably in point-of-sale (POS) systems for accelerated checkout processes in retail, access control and secure identification for corporate offices, document tracking in libraries and archival centers, and high-frequency inventory management in laboratories or pharmaceutical settings. Their application in verifying personnel credentials and controlling physical access points, particularly in secure environments, highlights their versatility beyond typical inventory functions. The simplicity of the USB interface allows for immediate integration into existing IT infrastructures, reducing the total cost of ownership (TCO) compared to network-connected or proprietary reading hardware, thereby expanding their market penetration into small and medium-sized enterprises (SMEs).

The core benefits driving market expansion include unparalleled plug-and-play functionality, low maintenance requirements, and standardized connectivity, which democratizes access to RFID technology. Driving factors encompass the rising global emphasis on real-time data accuracy, the demand for enhanced security protocols in identification, and the regulatory push for traceable product lifecycles, especially in the food and drug industries. Furthermore, the proliferation of specialized vertical applications, such as integrating RFID readers with clinical trial management systems or high-security government installations, continues to stimulate technological advancements and market growth, ensuring the USB RFID reader remains a foundational tool in modern data intelligence systems.

USB RFID Reader Market Executive Summary

The USB RFID Reader Market demonstrates strong growth momentum, primarily fueled by rapid business trends emphasizing digital transformation and supply chain optimization across industrialized nations and emerging economies. Key business trends include the modularization of enterprise solutions, where standardized interfaces like USB facilitate the quick deployment of AIDC hardware, aligning with agile IT strategies and decentralized operational models. There is a palpable shift towards readers offering enhanced data encryption capabilities and multi-factor authentication integration, catering to the growing need for data security compliance (e.g., GDPR, HIPAA). Furthermore, manufacturers are focusing on miniaturization and ruggedization to support mobile and industrial applications, resulting in higher average selling prices (ASPs) for specialized, high-performance units designed for harsh environments or complex regulatory frameworks, thereby boosting overall market valuation.

Regional trends indicate North America and Europe maintain dominance, driven by early adoption of sophisticated inventory systems and robust regulatory frameworks supporting RFID deployment in pharmaceutical traceability and high-value retail. However, the Asia Pacific region is poised for the fastest growth, largely attributed to rapid industrialization, massive investments in smart infrastructure (smart factories, smart cities), and the expansive deployment of retail chains seeking efficiency gains through automated processes. Latin America and the Middle East & Africa (MEA) are emerging markets, showing increasing interest primarily in logistics and security applications, though adoption speed is often constrained by infrastructure readiness and initial investment costs. Geopolitical factors influencing global supply chains have also accelerated the regionalized manufacturing and adoption of these readers to enhance localized tracking capabilities.

Segmentation trends highlight the increasing demand for Ultra High Frequency (UHF) readers due to their long reading range capabilities, making them ideal for large-scale logistics and warehousing operations, dominating the application landscape in terms of volume and revenue. Concurrently, High Frequency (HF) readers maintain strong relevance in secure access control and payment systems due to their short-range, secure data transfer characteristics, particularly in banking and government ID applications. The technology segment is witnessing a surge in integration with Near Field Communication (NFC) protocols, further blurring the lines between traditional RFID readers and modern mobile connectivity solutions, responding directly to consumer-driven trends utilizing mobile devices for identity and transaction verification, which necessitate reliable USB connectivity for backend processing systems.

AI Impact Analysis on USB RFID Reader Market

User queries regarding AI's influence on the USB RFID Reader market frequently center on how machine learning enhances data processing speed, predictive maintenance of reader hardware, and the integration of advanced recognition algorithms. Common concerns revolve around whether AI necessitates significant hardware upgrades, the feasibility of real-time anomaly detection in large-scale RFID data streams, and how AI can improve read reliability in challenging environments (e.g., dense metal environments). Users are generally seeking confirmation that AI integration will lead to proactive inventory insights, rather than just reactive data collection, particularly concerning shelf-level inventory accuracy and theft prevention, thereby optimizing the utility of the collected RFID tag data. The central expectation is that AI will transform raw RFID data into actionable business intelligence, thus significantly elevating the value proposition of the readers themselves.

The impact of Artificial Intelligence on the USB RFID Reader market is transformative, shifting the device from a mere data capture tool to an intelligent data gateway. AI algorithms, often running either edge devices connected via USB or in cloud backends, are increasingly used to filter noise, correct read errors, and contextualize large volumes of tag data generated by these readers. For instance, AI can analyze temporal and spatial patterns of tag reads to identify suspicious movements or predict stock-outs with high accuracy, thereby maximizing operational efficiency beyond simple check-in/check-out functions. This enhanced analytical capability drives demand for more robust and faster USB interfaces (such as USB 3.0 or higher) capable of handling continuous, high-throughput data streams necessary for real-time AI processing.

Furthermore, AI is instrumental in optimizing the performance parameters of the readers themselves. Machine learning models can be employed to automatically tune frequency settings, power output, and antenna configurations based on the surrounding environment and the density of tags being interrogated, ensuring optimal reading performance without manual intervention. This level of automation significantly reduces deployment complexity and maintenance costs, addressing a key constraint in large-scale RFID deployments. The synergy between high-speed USB readers and AI-powered backend systems creates a closed-loop intelligence infrastructure, positioning the USB RFID reader as a critical, foundational endpoint for next-generation smart automation systems, enhancing theft detection, optimizing labor resources, and providing granular insights into asset movement.

- AI enhances data interpretation accuracy by filtering environmental noise and correcting transient read errors.

- Predictive analytics driven by AI optimizes inventory management, enabling real-time stock level monitoring and demand forecasting based on RFID data.

- Machine Learning models allow for dynamic tuning of USB reader parameters (e.g., power output, frequency selection) for optimal performance in diverse environments.

- AI facilitates real-time anomaly detection, significantly improving security and loss prevention systems connected via USB readers.

- Integration supports advanced asset tracking workflows by contextualizing asset location and movement history derived from reader inputs.

DRO & Impact Forces Of USB RFID Reader Market

The USB RFID Reader Market is influenced by a dynamic interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. Key drivers include the universal standardization and simplicity of the USB interface, making these readers easy to integrate across diverse operational technology (OT) and information technology (IT) environments, coupled with the mandatory requirement for item-level tagging in sectors like pharmaceuticals and apparel. Restraints predominantly involve the inherent limitations of RFID technology, such as reading challenges in metal-dense or liquid-rich environments, potential data security concerns related to unauthorized tag access, and the necessity of high initial investment in tags and infrastructure, especially for widespread deployment. Opportunities arise from the convergence of RFID with IoT and cloud platforms, the rising demand for contactless payment solutions utilizing NFC/HF protocols, and the potential for these devices to become primary interfaces for industrial maintenance logs and personalized customer experiences in retail. These forces collectively shape the market's growth trajectory and competitive landscape.

The core Impact Forces affecting this market include technological standardization, which drives interoperability and mass production, thereby lowering unit costs, and regulatory compliance requirements, which necessitate the deployment of proven tracking technologies like RFID. Economic impact forces, such as the increasing costs of labor and the global push for manufacturing automation, amplify the demand for automated data capture solutions provided by USB readers. Competitive forces are strong, focusing on miniaturization, multi-frequency support, and software integration capabilities (driverless operation, seamless SDKs). Social forces related to consumer privacy and data security mandate continuous improvement in reader authentication features, while environmental factors encourage sustainable inventory practices enabled by precise RFID tracking. The market is thus highly responsive to both internal technological progression and external regulatory and economic stimuli.

Segmentation Analysis

The USB RFID Reader Market is comprehensively segmented based on technology, frequency band, end-use application, and component type, reflecting the diverse requirements of modern industries adopting automated data capture. Segmentation by frequency band—Low Frequency (LF), High Frequency (HF), and Ultra High Frequency (UHF)—is critical, as each band serves distinct purposes, ranging from short-range identification (HF/LF) used in access control to long-range asset tracking (UHF) prevalent in logistics. The component type segmentation often differentiates between fixed desktop readers, portable handheld devices, and specialized OEM modules integrated into other equipment (e.g., medical devices or kiosks). Understanding these segments is crucial for strategic planning, allowing vendors to tailor product development and market messaging to address specific operational needs, ensuring maximum market penetration across diverse vertical sectors demanding compliance and operational efficiency.

- By Frequency Band:

- Low Frequency (LF) 125 kHz / 134 kHz

- High Frequency (HF) 13.56 MHz (including NFC)

- Ultra High Frequency (UHF) 860-960 MHz

- By Read Range:

- Short Range (typically under 10 cm)

- Mid Range (10 cm to 1 meter)

- Long Range (over 1 meter)

- By Product Type:

- Desktop Readers/Writers

- Handheld/Mobile Readers (connecting via USB cable/OTG)

- Embedded/OEM Modules

- By Application:

- Inventory Management and Asset Tracking

- Access Control and Security Systems

- Point of Sale (POS) and Retail Operations

- Document and Library Management

- Industrial Automation and Logistics

- Healthcare and Pharmaceutical Tracking

Value Chain Analysis For USB RFID Reader Market

The Value Chain of the USB RFID Reader Market begins with Upstream Analysis, focusing on the procurement and fabrication of essential components. This stage involves suppliers of specialized microchips (transceivers, microcontrollers), antenna elements, printed circuit boards (PCBs), and casing materials. Key upstream activities are characterized by rigorous component testing, miniaturization efforts, and securing reliable supply sources for semiconductors, which are often subject to global market volatility. Efficient sourcing and stable partnerships with chip manufacturers are critical success factors here, influencing the final product cost and performance specifications, particularly regarding multi-protocol support and processing speed. The reliance on highly specialized semiconductor firms underscores the technical complexity inherent in the manufacturing process for robust and highly sensitive reader hardware.

Midstream activities involve the design, assembly, and integration of the core reader unit. This includes embedding the RFID chip, designing optimized antennas tailored for specific frequency ranges, developing proprietary firmware and device drivers, and ensuring rigorous quality control (QC) procedures, particularly focused on USB interface stability and electromagnetic compatibility (EMC). Manufacturers must invest heavily in R&D to provide seamless software development kits (SDKs) and robust API support, ensuring easy integration with diverse third-party enterprise resource planning (ERP) and warehouse management systems (WMS). The standardization of the USB interface significantly simplifies the final assembly and testing phases compared to network-connected readers, allowing for higher volume production and greater scalability in manufacturing processes to meet rising global demand.

Downstream Analysis primarily covers Distribution Channels and the ultimate delivery to end-users. Distribution often follows both Direct and Indirect models. Direct sales cater to large enterprise clients requiring customized solutions and integration support, often handled by the reader manufacturer's dedicated sales force. Indirect channels involve partnerships with specialized Value-Added Resellers (VARs), system integrators, and broad-line industrial distributors who package the USB readers with complementary software and installation services. The selection of distribution channel is often dictated by the target application—generic retail POS systems often utilize indirect e-commerce platforms, whereas specialized industrial automation solutions rely heavily on dedicated integrators offering bespoke deployment support and maintenance contracts. Effective after-sales support and ongoing driver updates are paramount in the downstream segment to ensure long-term customer satisfaction and market retention.

USB RFID Reader Market Potential Customers

The primary End-Users/Buyers of USB RFID Readers are organizations across various sectors that require reliable, accessible, and non-disruptive methods for data capture and asset identification. The largest customer bases reside in the retail sector, specifically large apparel chains and grocery stores utilizing readers for rapid point-of-sale operations, inventory cycle counting, and loss prevention at exit points. The healthcare sector represents a significant growth area, with hospitals and pharmaceutical firms employing these readers for tracking surgical instruments, managing drug inventories to ensure compliance, and securely identifying patients or personnel using HF/NFC badges integrated with clinical systems. These users value the compact nature and easy connectivity of USB readers for deployment near workstations or mobile cart setups, minimizing infrastructure overhaul costs while maximizing efficiency.

Another crucial segment comprises logistics and supply chain management companies, which rely on long-range UHF USB readers connected to specialized workstations for receiving verification, shipment sorting, and dock door management. These users require readers capable of handling high throughput and integrating swiftly with complex WMS interfaces, often favoring ruggedized units capable of withstanding industrial environments. Furthermore, governments and corporate enterprises form a stable customer base, primarily utilizing HF-based readers for secure building access control, employee time and attendance systems, and secure document archival. Educational institutions and libraries also continue to be staple consumers, using USB readers for automated book lending and material management systems, leveraging the low cost and simplicity of the devices to digitize traditional manual processes.

The expanding scope of IoT applications is also generating new customer demographics, including specialized manufacturing operations and utility companies that integrate OEM USB RFID modules into industrial PCs or proprietary monitoring equipment for real-time tracking of components or maintenance history logging. These niche customers prioritize the small form factor and robust operating system compatibility offered by the USB standard. Ultimately, any organization transitioning from manual barcode scanning to automated identification processes, seeking quick deployment, and prioritizing desktop or mobile workforce connectivity represents a potential customer for USB RFID readers across all frequency bands and product types.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.8 Million |

| Market Forecast in 2033 | USD 1,107.5 Million |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Impinj, Inc., Zebra Technologies Corporation, Alien Technology, HID Global, RFIdeas, SATO Holdings Corporation, Nordic ID, Datalogic S.p.A, FEIG ELECTRONIC GmbH, Convergence Systems Limited (CSL), ThingMagic (JADAK), TSL Technology, Shenzhen Chainway Information Technology, CAEN RFID, Keonn Technologies, ID Tech, Synel Industries, Mojix, Laird Connectivity, Times-7 Research. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

USB RFID Reader Market Key Technology Landscape

The technological landscape of the USB RFID Reader market is characterized by continuous innovation aimed at enhancing interoperability, speed, and form factor flexibility. A primary focus lies on achieving multi-protocol and multi-frequency reading capabilities within a single device, allowing readers to seamlessly interact with various tag standards (e.g., EPC Global Gen2 V2, ISO 14443, FeliCa) essential for global supply chain applications and multi-national operations. The transition from older USB standards to USB 3.0 and USB-C is critical for supporting the high data transfer rates required for dense reader environments where thousands of tag reads must be processed per second, especially in advanced logistics sorting facilities. Furthermore, advancements in power management allow these devices to operate efficiently solely on bus power, extending battery life when connected to mobile computing platforms and eliminating the need for bulky external power adapters.

Firmware and software development kits (SDKs) represent another vital technological domain. Modern USB readers feature sophisticated embedded processing capabilities and come equipped with robust SDKs that offer cross-platform compatibility (Windows, Android, iOS via OTG) and simplified application programming interfaces (APIs). This standardization minimizes the development effort required by system integrators, accelerating deployment cycles. Key technological advancements also include improved anti-collision algorithms, which are essential for accurately reading high densities of tags simultaneously without interference, optimizing throughput, and ensuring data integrity in challenging retail or warehouse environments where items are often stacked closely together. The ability of the reader to rapidly switch between protocols and frequencies while maintaining a stable USB connection is a paramount engineering challenge being aggressively addressed by leading market innovators.

Furthermore, the integration of Near Field Communication (NFC) technology, which operates within the HF band, is fundamentally reshaping the market, often requiring USB connectivity for desktop enrollment and verification systems. NFC capability in USB readers facilitates secure identification and contactless payment integration, particularly relevant in government ID applications and corporate security. There is also a concerted effort in developing driverless or native Human Interface Device (HID) readers, which emulate keyboard input, simplifying deployment in environments where installing specialized drivers is restricted, significantly lowering the barrier to entry for small businesses. The overall technological thrust is towards creating intelligent, highly integrated, and universally compatible peripherals that can handle the complexity of modern, interconnected identification demands efficiently.

Regional Highlights

The global distribution of the USB RFID Reader market exhibits distinct regional dynamics driven by varying levels of technological maturity, regulatory frameworks, and sector-specific investment patterns. North America stands as a dominant market force, characterized by high adoption rates in sophisticated retail operations, advanced logistics networks, and demanding healthcare facilities. The region benefits from stringent regulatory environments, particularly FDA mandates for drug traceability, which necessitates reliable RFID deployment, and robust intellectual property protections encouraging sustained innovation among key regional players. The early and widespread implementation of enterprise systems (ERP, WMS) capable of integrating easily with USB-based data capture devices further solidifies North America's leading position, focusing heavily on UHF long-range applications.

Europe represents another mature and high-value market, primarily driven by strong industrial automation sectors and high compliance standards for security and data privacy (GDPR). European countries show a higher propensity for High Frequency (HF) readers in applications such as secure physical access control, smart card applications, and standardized industrial maintenance tagging protocols. The continent’s dense distribution network and widespread commitment to Industry 4.0 initiatives mean USB readers are essential components in automated manufacturing lines and centralized supply chain hubs. However, market growth in Europe is steady rather than explosive, reflecting the already high saturation of basic AIDC technologies, compelling growth to focus on advanced, multi-frequency, and highly secure reader solutions.

Asia Pacific (APAC) is projected to be the fastest-growing market globally, fueled by rapid economic expansion, massive governmental investment in smart city projects, and the explosive growth of e-commerce and logistics infrastructure, particularly in China, India, and Southeast Asian nations. The region is characterized by high volume manufacturing and supply chain complexity, making UHF RFID readers crucial for efficiency gains. The lower manufacturing costs and increasing local production capabilities contribute to rapid market penetration. Conversely, Latin America and the Middle East & Africa (MEA) are emerging markets, displaying substantial potential linked to modernization of retail sectors, large-scale infrastructural projects, and increasing demand for robust security solutions. Adoption in these regions is accelerating, though sometimes hampered by fluctuating currency values and slower regulatory alignment with global RFID standards, predominantly favoring initial deployment in governmental security and oil/gas asset tracking applications.

- North America: Market leader due to mature retail infrastructure, pharmaceutical traceability mandates (FDA), and high investment in advanced warehouse automation utilizing high-speed UHF USB readers.

- Europe: Strong focus on HF applications for secure access, smart card integration, and robust adoption within the industrial sector driven by Industry 4.0 initiatives and data privacy regulations (GDPR).

- Asia Pacific (APAC): Highest projected growth rate, spurred by massive e-commerce expansion, manufacturing base growth, and governmental smart infrastructure projects requiring large-scale UHF deployment.

- Latin America (LATAM): Emerging market driven by modernization of retail and logistics sectors; growing demand for basic inventory management systems using cost-effective USB solutions.

- Middle East & Africa (MEA): Growth centered on governmental security, oil and gas asset management, and burgeoning retail logistics, focusing on rugged and reliable desktop reader solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the USB RFID Reader Market, covering their product portfolios, strategic partnerships, recent developments, and market positioning relative to technological innovation and global reach. These companies are instrumental in setting industry standards and driving advancements in miniaturization, multi-frequency capability, and software integration across diverse application sectors.- Impinj, Inc.

- Zebra Technologies Corporation

- Alien Technology

- HID Global

- RFIdeas

- SATO Holdings Corporation

- Nordic ID

- Datalogic S.p.A

- FEIG ELECTRONIC GmbH

- Convergence Systems Limited (CSL)

- ThingMagic (JADAK)

- TSL Technology

- Shenzhen Chainway Information Technology

- CAEN RFID

- Keonn Technologies

- ID Tech

- Synel Industries

- Mojix

- Laird Connectivity

- Times-7 Research

- Honeywell International Inc.

- Checkpoint Systems (CCL Industries Inc.)

- ADESTO Technologies

- Acreo Swedish ICT

- Omni-ID (HID Global)

Frequently Asked Questions

Analyze common user questions about the USB RFID Reader market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of a USB RFID reader over a network-connected (Ethernet/WiFi) reader?

USB RFID readers offer significant advantages in terms of plug-and-play simplicity, lower initial cost, and direct power supply via the host device, eliminating the need for complex network configurations and external power adapters. They are ideal for desktop use, point-of-sale integration, and environments requiring mobility or rapid deployment without infrastructure modification. Additionally, driverless (HID) USB models further simplify deployment by mimicking standard keyboard input.

Which frequency band (LF, HF, or UHF) is best suited for retail inventory management using USB readers?

Ultra High Frequency (UHF) readers (860-960 MHz) are generally best suited for retail inventory management due to their longer reading ranges (up to several meters) and ability to read many tags simultaneously (anti-collision). However, High Frequency (HF) readers (13.56 MHz, including NFC) are often preferred for specific tasks like secure POS transactions or item-level identification where short-range security and regulatory compliance (ISO 14443) are paramount.

How is the security of data handled by USB RFID readers, and what role does encryption play?

Data security in USB RFID readers relies heavily on the capabilities of the RFID tag protocols and the reader's firmware. Modern readers support encrypted communication between the tag and the reader (e.g., using AES encryption in EPC Gen2 V2 tags). Furthermore, the security is enhanced by ensuring the USB connection is secure and often utilizing specialized SDKs that handle data transmission securely from the reader to the host application, preventing unauthorized interception during the data capture phase.

Are USB RFID readers compatible with mobile operating systems like Android and iOS, and what is required for connectivity?

Yes, many modern USB RFID readers are compatible with mobile operating systems, primarily through USB On-The-Go (OTG) or USB-C connectivity. This requires the mobile device to support OTG functionality and the reader manufacturer to provide compatible drivers or an SDK for the respective mobile OS (Android, or specialized Apple-approved external device interfaces) to ensure seamless data transmission and power management, supporting mobile inventory and asset tracking applications.

What are the key technical specifications potential buyers should consider when selecting a USB RFID reader?

Buyers must consider the supported frequency band (LF, HF, UHF) relevant to their tags, the maximum reading range necessary for the application (short, mid, or long), the maximum read rate (tags per second) to handle high-volume environments, and the compatibility of the SDK/APIs with existing enterprise software (ERP, WMS). Additionally, the physical form factor (desktop, handheld, embedded) and the specific USB standard (2.0, 3.0, or C) for required data throughput are crucial selection criteria.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager