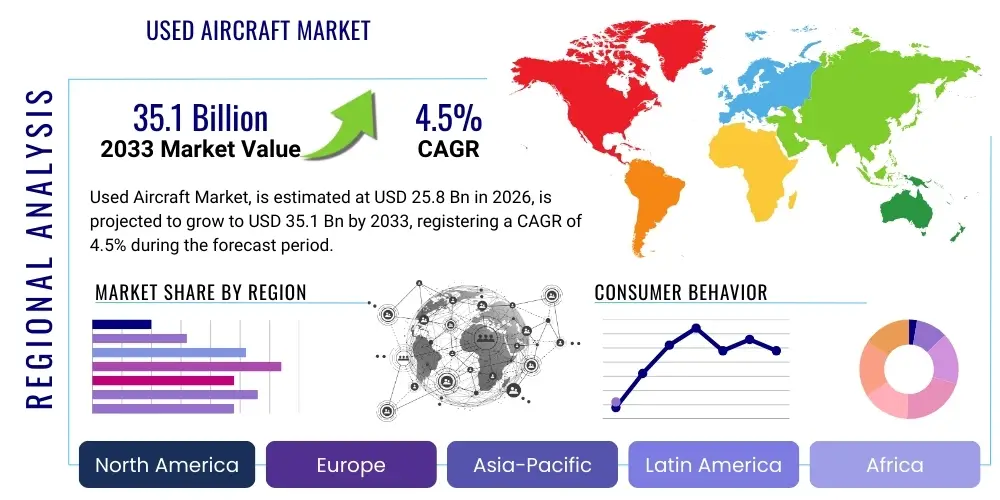

Used Aircraft Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437185 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Used Aircraft Market Size

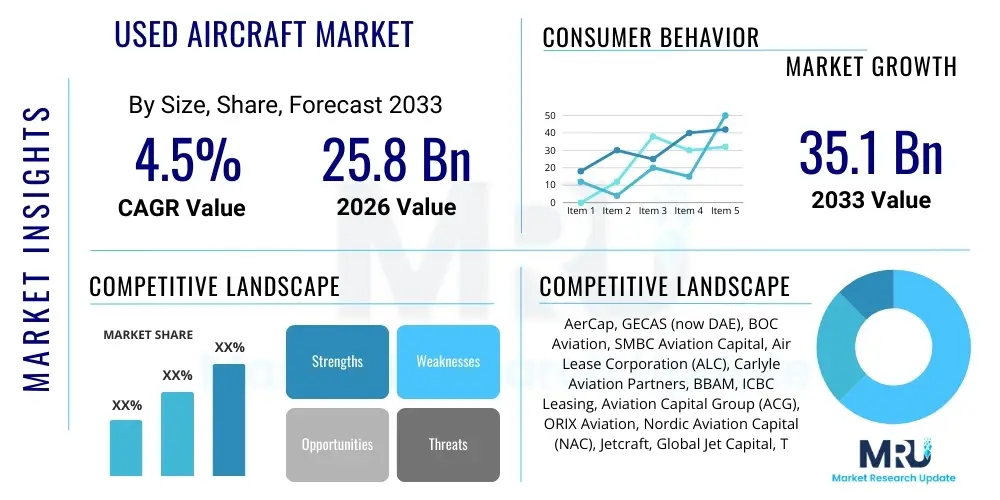

The Used Aircraft Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 25.8 Billion in 2026 and is projected to reach USD 35.1 Billion by the end of the forecast period in 2033.

Used Aircraft Market introduction

The Used Aircraft Market encompasses the trade and transactions involving pre-owned commercial, private, and military aircraft. This segment is driven primarily by the strong demand from budget-conscious airlines, freight operators, and fractional ownership companies seeking cost-effective alternatives to new aircraft acquisition. The market benefits from the inherently long service life of modern aircraft, robust maintenance regimes, and standardized certification processes, ensuring that older fleets remain viable assets. Key products include narrow-body jets, wide-body jets, regional jets, and various types of general aviation aircraft, catering to diverse operational needs from passenger transport to specialized cargo logistics. The sustained economic viability of these assets fuels a consistent secondary market.

Major applications of used aircraft span commercial passenger services, particularly in emerging economies where capital investment for new fleets is prohibitive, and dedicated air cargo transport, which often utilizes older, high-capacity wide-body platforms. Additionally, the business jet sector sees significant transaction volumes in the used market, offering immediate availability and lower capital expenditure for corporations and high-net-worth individuals. The primary benefits include faster deployment compared to the extensive lead times for new aircraft, reduced financial risk, and the ability to meet short-term capacity demands efficiently. These factors establish the used aircraft segment as a critical component of global aviation infrastructure.

Driving factors for this market include the global expansion of low-cost carriers (LCCs) who rely heavily on affordable, proven aircraft models; fluctuating fuel prices that make certain efficient, albeit older, models attractive; and the cyclical nature of aircraft replacement programs by major airlines. Furthermore, the specialized leasing market plays a crucial role by providing liquidity and standardized structures for the transfer of ownership or operational control. The robustness of maintenance, repair, and overhaul (MRO) infrastructure worldwide also guarantees the continued airworthiness and extended service life of these assets, further reinforcing market stability and growth projections throughout the forecast period.

Used Aircraft Market Executive Summary

The Used Aircraft Market is characterized by accelerating business trends centered around fleet modernization, asset valuation transparency, and the increasing role of financial leasing entities. Current business trends indicate a strong preference for late-model, fuel-efficient narrow-body aircraft, particularly the Airbus A320 family and Boeing 737 series, reflecting their high liquidity and operational commonality. The market has also seen heightened activity in asset-backed securitization (ABS) transactions involving used aircraft portfolios, diversifying funding sources and providing stability to asset prices. The primary challenge remains the regulatory complexity associated with cross-border aircraft registration and airworthiness certification, which impacts transaction timelines and overall market velocity. Strategic decisions by major lessors to divest older assets are continuously replenishing market supply.

Regionally, the Asia Pacific (APAC) market, particularly China and India, exhibits the highest growth potential, driven by rapid urbanization, expanding middle classes, and the proliferation of new regional routes demanding immediate capacity deployment. North America and Europe remain mature markets, serving as primary sources for well-maintained, mid-life aircraft supply, largely due to major flag carriers upgrading to next-generation models. The Middle East and Africa (MEA) region is focusing on acquiring specialized used cargo aircraft to bolster logistics capabilities. Regional trends confirm that emerging economies are the net buyers, while established Western markets are net sellers, creating a vital circulatory system for global aviation assets.

Segmentation trends highlight the dominance of the commercial aircraft segment, specifically the narrow-body sector, due to their versatility and suitability for short-to-medium haul routes, which constitute the backbone of global air travel. In the smaller general aviation segment, the demand for used business jets remains consistently robust, valuing immediate availability and proven performance over the technological advances of new models. The market is further segmented by age profile, with 'mid-life' aircraft (8-15 years old) commanding premium valuations due to their optimal balance of remaining service life and depreciated acquisition cost. The leasing segment continues to grow its market share, often preferring younger used aircraft (less than 10 years old) for their stable residual values and attractiveness to a wide lessee base.

AI Impact Analysis on Used Aircraft Market

User inquiries regarding AI's influence in the Used Aircraft Market frequently center on predictive maintenance scheduling, automated valuation models (AVM), and the optimization of spare parts inventory. Key concerns revolve around the trustworthiness and standardization of AI-driven asset appraisals, and how deeply learning algorithms can accurately forecast residual values amidst unpredictable economic shifts and regulatory changes. Users expect AI to reduce the subjective elements inherent in traditional aircraft inspections and appraisals, leading to faster, more transparent transactions. The prevailing expectation is that AI will primarily enhance due diligence processes, minimizing risks associated with asset quality and future operational costs, thereby increasing buyer confidence and market liquidity.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming several operational and financial facets of the used aircraft industry. AI-powered tools are now capable of processing vast datasets, including flight cycles, maintenance logs, operational environment data, and component performance metrics, to create sophisticated digital twins. This allows lessors and buyers to obtain highly accurate, real-time assessments of an aircraft's true condition and remaining economic life, moving beyond traditional scheduled inspections. This predictive capability significantly reduces unplanned downtime and lowers the cost of ownership, making older aircraft assets more attractive investments.

Furthermore, in the financial segment, AI algorithms are being deployed to refine pricing and trading strategies. By incorporating macroeconomic indicators, geopolitical risk factors, fleet renewal cycles of major operators, and historical transaction data, AI provides significantly improved forecasting accuracy for residual values. This transparency and accuracy benefit both sellers, by maximizing asset disposition value, and buyers, by ensuring fair pricing. While the physical maintenance aspects (MRO) benefit from diagnostic AI, the most profound impact is observed in risk assessment, valuation, and optimization of portfolio management for aircraft lessors and financiers.

- Automated Valuation Models (AVM): AI algorithms leverage large datasets to provide real-time, objective aircraft valuations, replacing subjective human appraisals.

- Predictive Maintenance Optimization: AI analyzes sensor data and flight history to forecast component failures, shifting MRO from reactive to proactive, extending aircraft life.

- Enhanced Due Diligence: ML systems rapidly audit complex maintenance records (logbooks), identifying discrepancies or anomalies that might affect airworthiness or resale value.

- Supply Chain Efficiency: AI optimizes inventory management for used aircraft parts, ensuring critical spares are available, reducing grounding time, and increasing asset utilization.

- Residual Value Forecasting: Advanced analytics predict long-term asset depreciation with greater accuracy, crucial for lease structuring and investment decisions.

- Fraud Detection: AI tools analyze documentation provenance and transaction patterns to identify potential fraudulent activities in cross-border aircraft sales.

- Optimization of Trading Platforms: Machine learning enhances matching algorithms on online trading platforms, efficiently connecting sellers and niche buyers globally based on specific fleet requirements.

DRO & Impact Forces Of Used Aircraft Market

The Used Aircraft Market is influenced by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), creating significant market impact forces. The primary drivers include the consistent growth of global air travel demand, particularly in developing nations, coupled with the need for immediate, affordable fleet additions by low-cost carriers (LCCs). This robust demand profile ensures a stable baseline for secondary market transactions. Opportunities are heavily centered on technological adoption, specifically the integration of data analytics and blockchain for enhancing transparency in maintenance records and ownership transfer, addressing one of the market's historical challenges. These forces collectively shape the investment appetite and operational strategies across the aviation ecosystem.

Key restraints significantly tempering market growth involve the increasing complexity of environmental regulations, notably noise reduction standards and emissions mandates (such as CORSIA), which accelerate the phase-out of older, less efficient aircraft models. Furthermore, the volatility in global economic conditions and geopolitical tensions often lead to financing difficulties and increased insurance premiums, impacting the liquidity of high-value used assets. The sheer cost and time involved in major maintenance checks (C-Checks and D-Checks) for aging aircraft also act as a substantial restraint, occasionally making the cost of sustaining older fleets comparable to acquiring newer ones, especially when fuel efficiency is factored in.

The impact forces dictate cyclical market movements. The introduction of highly fuel-efficient next-generation aircraft (like the A320neo and B737 MAX) generates a powerful cascade effect, pushing current generation aircraft (A320ceo/B737 NG) into the used market sooner, thereby increasing supply and generally moderating prices for mid-life jets. Conversely, global economic shocks or manufacturing delays for new aircraft lead to an unexpected surge in demand for used aircraft, demonstrating the market’s inherent function as a crucial buffer. The longevity of successful models and the standardized regulatory oversight applied by bodies like the FAA and EASA are fundamental positive impact forces that underpin the global tradeability of these high-value assets.

The Used Aircraft Market is a highly capital-intensive environment where market efficiency hinges on global standardization and the availability of sophisticated financing instruments. Effective navigation requires stakeholders to balance the need for low acquisition costs with the long-term operational expenses tied to fuel consumption and mandatory regulatory compliance. Successfully leveraging the market means capitalizing on the supply influx generated by new technology cycles while mitigating the risks associated with residual value uncertainty and stringent operational requirements.

Segmentation Analysis

The Used Aircraft Market is primarily segmented based on aircraft type, end-user, and application, reflecting the diverse requirements of the global aviation sector. Segmentation by aircraft type is the most critical determinant of market dynamics, differentiating between commercial transports (which drive the bulk of transaction value), business jets, and general aviation aircraft. The commercial segment is further delineated by narrow-body, wide-body, and regional jets, each possessing unique transaction velocities and valuation profiles driven by route demand and operational economics. This structured segmentation allows analysts and investors to target specific market niches based on capital deployment strategies and risk tolerance. Understanding these layers is crucial for forecasting liquidity and identifying emerging growth areas within the secondary market.

Segmentation by end-user differentiates between various types of buyers: legacy airlines, low-cost carriers (LCCs), cargo operators, leasing companies, and private/corporate entities. Leasing companies, in particular, play a dual role, acting as major buyers of younger used aircraft and primary sellers of older assets nearing the end of their lease terms, thus acting as market intermediaries that stabilize transaction volumes. Application-based segmentation separates passenger transport from cargo transport and specialized roles (e.g., military conversion, aerial firefighting), where specialized demand can drive premium pricing for specific airframes regardless of age. The interplay between these segments is dynamic, often seeing passenger aircraft converted for cargo use, representing a key value-chain extension.

The overall market trajectory is heavily influenced by the relative health of these sub-segments. For instance, strong growth in e-commerce directly fuels the demand for used wide-body cargo conversions, elevating the values of models like the Boeing 767 and 747. Conversely, economic downturns tend to hit the general aviation and business jet segments first, prompting an increase in the supply of used private aircraft. Strategic segmentation analysis confirms that the narrow-body commercial segment remains the most resilient and liquid sector, offering the greatest stability and the lowest residual risk for financiers and lessors operating in the secondary market.

- By Aircraft Type:

- Narrow-Body Aircraft (e.g., A320 Family, B737 NG/MAX)

- Wide-Body Aircraft (e.g., B777, A330, B747)

- Regional Aircraft (e.g., Embraer E-Jets, Bombardier CRJ)

- Business Jets (Light, Midsize, Large Cabin)

- General Aviation (Piston, Turboprop)

- By End-User:

- Airlines (Legacy, LCCs)

- Leasing Companies

- Cargo Carriers

- Corporate/Private Owners

- Government/Military

- By Application:

- Passenger Transport

- Cargo Transport

- Special Missions (e.g., Medevac, Aerial Survey)

- By Age Profile:

- Young (0-7 Years)

- Mid-Life (8-15 Years)

- End-of-Life (16+ Years)

Value Chain Analysis For Used Aircraft Market

The value chain of the Used Aircraft Market is complex and multi-layered, beginning with the original equipment manufacturers (OEMs) who initiate the asset life cycle, followed by the primary operators and financial institutions. Upstream activities are dominated by major airlines and lessors selling or remarketing their assets, typically after 8 to 15 years of service, driven by fleet renewal programs. This stage involves meticulous technical inspection, preparation of comprehensive maintenance records (which are critical for establishing value), and ensuring compliance with all airworthiness directives. The efficiency of this upstream process directly dictates the speed and quality of assets entering the secondary market, requiring specialized technical expertise in asset management and regulatory adherence.

The midstream segment involves crucial intermediaries, primarily aircraft lessors and specialized trading houses, who acquire assets, often manage necessary maintenance and modification (such as passenger-to-freighter conversions), and structure financing deals. This segment adds significant value by de-risking the asset for potential buyers through standardized refurbishment and certification. Downstream activities involve the final transaction to the new operator—be it a low-cost carrier, a startup airline, or a fractional ownership provider—and the subsequent entry into service. Distribution channels are predominantly indirect, heavily relying on brokers, specialized aviation consultants, and major global leasing companies that possess the networks and financial capabilities to handle multi-million-dollar transactions across jurisdictions.

Direct sales, though less common for high-value commercial jets, occur when an airline sells directly to another carrier. However, the indirect distribution route via major lessors (like AerCap, GECAS, SMBC Aviation Capital) or reputable brokers is preferred due to the complexities of cross-border transfers, legal structuring, and technical due diligence. These intermediaries provide crucial liquidity and ensure market stability, acting as trusted facilitators between asset divestors (large legacy carriers) and asset acquirers (emerging market airlines). The robust MRO (Maintenance, Repair, and Overhaul) sector acts as a vital parallel service chain, guaranteeing the continued operational viability and certified status of used aircraft throughout their economic life.

Used Aircraft Market Potential Customers

The primary customers in the Used Aircraft Market are highly diversified, reflecting different operational needs and capital limitations. Low-cost carriers (LCCs) from high-growth regions like Southeast Asia, Latin America, and Eastern Europe represent a significant customer base. These carriers favor proven, depreciated aircraft models, such as the Boeing 737 Next Generation or Airbus A320ceo, which offer high reliability and operational commonality at a fraction of the cost of new jets. The acquisition of used aircraft allows LCCs to rapidly expand their route networks and capacity without the substantial debt burden or long delivery lead times associated with new purchases, making immediate availability a key purchasing driver.

Another major segment of potential customers includes specialized cargo operators and dedicated freighter conversion companies. As e-commerce surges globally, there is sustained demand for older wide-body aircraft, such as the B767 and A330, for conversion from passenger to dedicated freighter configuration. These assets are often purchased in their mid-to-end-of-life stage, offering decades of service potential in the high-demand cargo sector. Furthermore, regional airlines seeking turboprops or smaller regional jets for feeder routes often look exclusively to the used market, where specialized, cost-effective models are readily available for immediate deployment into niche air service markets.

Aircraft leasing companies are both key suppliers and major customers. They frequently purchase younger used aircraft (under 10 years old) to maintain a diversified, high-quality portfolio that attracts premium lessees globally. Finally, high-net-worth individuals and corporate flight departments constitute the core buyer base for used business jets. For these entities, the ability to bypass the multi-year waitlist for new models and acquire a well-maintained, large-cabin jet immediately, often at a substantial discount, is the decisive factor. The purchasing decision is ultimately driven by a critical analysis of remaining service life, required investment in maintenance, and long-term residual value preservation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.8 Billion |

| Market Forecast in 2033 | USD 35.1 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AerCap, GECAS (now DAE), BOC Aviation, SMBC Aviation Capital, Air Lease Corporation (ALC), Carlyle Aviation Partners, BBAM, ICBC Leasing, Aviation Capital Group (ACG), ORIX Aviation, Nordic Aviation Capital (NAC), Jetcraft, Global Jet Capital, Textron Aviation, Gulfstream Aerospace. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Used Aircraft Market Key Technology Landscape

The technological landscape of the Used Aircraft Market is increasingly focused on enhancing asset integrity, improving transactional efficiency, and extending the economic life of airframes through advanced maintenance techniques. One of the most significant technological advancements is the shift towards comprehensive digital record-keeping, often utilizing secure, distributed ledger technologies like blockchain. This technology allows for the creation of immutable and transparent digital logbooks for maintenance, repair, and overhaul (MRO) history, significantly reducing the time and risk associated with technical due diligence during sales and transfers. Transparent record-keeping directly boosts asset confidence and, consequently, residual values, mitigating a major historical hurdle in the secondary market.

Furthermore, the application of sophisticated sensor technology and the Internet of Things (IoT) in modern aircraft, even older models retrofitted with these capabilities, generates vast amounts of real-time operational data. This data is leveraged by AI and machine learning platforms to facilitate predictive maintenance. Instead of relying purely on fixed flight hour intervals, operators can proactively address potential component failures, minimizing unscheduled downtime and optimizing maintenance spending. This technological shift is pivotal in making mid-life and older aircraft competitive against newer, highly automated models by significantly lowering the operational variability and long-term MRO costs.

The MRO sector itself is undergoing a transformation driven by advanced manufacturing and inspection technologies. Non-Destructive Testing (NDT) techniques, including advanced ultrasonics and phased array inspections, along with the increasing use of robotic systems for large-scale inspection and repair, ensure the structural integrity of aging airframes is maintained to the highest safety standards. Additionally, the rapid development in aircraft component repair technology, including advanced welding and additive manufacturing (3D printing) for non-critical parts, provides cost-effective solutions for parts obsolescence, ensuring the longevity and continued airworthiness of used aircraft fleets globally.

Regional Highlights

The Used Aircraft Market exhibits significant geographical differentiation driven by varying economic growth rates, airline saturation levels, and fleet renewal cycles across regions. North America holds a substantial share of the global used aircraft inventory, particularly in the mid-life and end-of-life categories. Major US and Canadian carriers consistently execute large-scale fleet modernization programs, supplying the global secondary market with well-maintained, high-quality Boeing and Airbus narrow-bodies. The region’s advanced financial infrastructure and robust leasing industry facilitate complex cross-border transactions, positioning North America as a vital source and technological hub for the global trade of pre-owned assets. The demand within North America itself is robust for business jets and specialized cargo aircraft.

Europe, similar to North America, acts as a major supplier of used aircraft, largely due to stringent environmental policies pushing the premature retirement of older, less fuel-efficient aircraft. However, Eastern European and certain periphery EU carriers represent a strong demand segment for affordable, proven jets to expand regional connectivity. The European market is characterized by complex regulatory harmonization efforts (EASA) which ensure a high standard of airworthiness for all assets originating from the region, making European used aircraft highly desirable globally. The strength of European aircraft lessors, particularly in Ireland, further reinforces its central role in the global leasing and secondary sales ecosystem.

The Asia Pacific (APAC) region is projected to register the fastest growth in terms of demand for used aircraft. Rapid economic expansion, combined with the emergence of numerous LCCs and startup airlines across China, India, and Southeast Asia, creates an immense appetite for readily available, lower-cost aircraft to meet soaring passenger traffic. These carriers often purchase mid-life narrow-bodies directly from North American and European airlines and lessors. The challenge in APAC lies in developing sufficient MRO capacity and specialized technical expertise to manage the influx of aging aircraft, although regional MRO hubs (e.g., Singapore, China) are rapidly expanding to support this growing fleet. Latin America and the Middle East & Africa (MEA) represent distinct markets. Latin America seeks affordable regional and narrow-body jets, while the MEA region often focuses on acquiring larger, high-capacity wide-body jets, often for cargo conversion or long-haul routes subsidized by government or national wealth funds. The MEA region is also increasingly becoming a transit and MRO hub for assets moving between Europe/North America and Asia.

- North America: Leading supplier of used, mid-life aircraft; strong domestic demand for business jets; mature leasing and financing ecosystem; high influence on global pricing benchmarks.

- Europe: Significant supplier base driven by fleet renewal and environmental mandates; strong demand from Eastern Europe and regional carriers; major hub for technical inspection and certification (EASA).

- Asia Pacific (APAC): Highest demand growth, particularly driven by Low-Cost Carriers (LCCs) in China, India, and Southeast Asia; focus on narrow-body acquisition for capacity expansion; rapid development of regional MRO facilities.

- Latin America: Consistent buyer of regional and mid-life narrow-body jets; market influenced by currency volatility and need for operational flexibility; high requirement for robust aftermarket support.

- Middle East & Africa (MEA): Growing demand for wide-body cargo conversions and long-haul capable passenger jets; strategic hub development in key economies; increasing importance of regional leasing ventures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Used Aircraft Market. These companies include major lessors, financial institutions, specialized trading houses, and major brokers whose activities dictate market liquidity and pricing. Their strategic asset management decisions, portfolio diversification, and disposition strategies are central to understanding market supply and demand dynamics across all segments.- AerCap

- GECAS (now integrated with AerCap and parts acquired by DAE)

- BOC Aviation

- SMBC Aviation Capital

- Air Lease Corporation (ALC)

- Carlyle Aviation Partners

- BBAM

- ICBC Leasing

- Aviation Capital Group (ACG)

- ORIX Aviation

- Nordic Aviation Capital (NAC)

- Jetcraft

- Global Jet Capital

- Textron Aviation

- Gulfstream Aerospace

- Bombardier

- Airbus Group

- Boeing Capital Corporation

- Mitsubishi UFJ Lease & Finance

- Standard Chartered Aviation Finance

Frequently Asked Questions

Analyze common user questions about the Used Aircraft market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current trend regarding the residual value of used narrow-body jets?

The residual value of current generation (CEO) narrow-body jets, such as the A320ceo and B737-800, remains strong due to sustained demand from LCCs and cargo conversion companies. However, the introduction of next-generation (NEO/MAX) models creates long-term downward pressure, leading to stable, but slowly declining, residual values for older types, stabilizing mid-life prices.

How does the shift to Sustainable Aviation Fuel (SAF) impact the used aircraft market?

The growing mandate for SAF encourages the retirement of the oldest, least fuel-efficient aircraft models, potentially increasing the supply of end-of-life assets. However, modern mid-life aircraft are generally compatible with SAF blends, mitigating immediate obsolescence risks and preserving their near-term operational value.

Which region is expected to be the largest buyer of used commercial aircraft?

The Asia Pacific (APAC) region, driven by developing economies like India and Southeast Asia, is projected to be the largest buyer due to exponential air traffic growth, fleet expansion requirements for new LCCs, and a greater necessity for immediate, cost-effective capacity acquisition.

What role does blockchain technology play in used aircraft transactions?

Blockchain is being adopted to create secure, immutable digital records of an aircraft's full maintenance history and ownership chain. This transparency reduces technical due diligence time and costs, enhancing trust, streamlining cross-border transactions, and bolstering the resale confidence of assets.

What is the difference between a dry lease and a wet lease in the context of used aircraft acquisition?

A dry lease involves the lessor providing only the used aircraft, requiring the lessee to provide its own crew, maintenance, and insurance. A wet lease (ACMI) includes the aircraft, crew, maintenance, and insurance, offering a comprehensive, short-term operational solution often utilizing older assets for surge capacity needs.

Why are cargo conversions critical for the wide-body used aircraft market?

Cargo conversions significantly extend the economic life of older wide-body jets (like the B767, B747, A330) after their passenger service ends. Given the high capital cost of new freighters and the global boom in e-commerce logistics, conversions create a highly profitable secondary market segment, sustaining demand for depreciated airframes.

How do global interest rate fluctuations affect the pricing of used aircraft?

Rising global interest rates increase the cost of capital for lessors and buyers, making aircraft financing more expensive. This often reduces the purchasing power for new aircraft, indirectly bolstering the demand for cheaper used aircraft. However, it simultaneously increases the cost of refinancing existing lease portfolios.

What is the significance of the retirement of the Boeing 747 in the used market?

The retirement of the Boeing 747 fleet marks the departure of one of the largest available passenger aircraft from core fleets. While passenger versions are phased out, their specialized freighter versions (747-8F and conversions) continue to dominate the heavy lift cargo sector, driving premium prices for well-maintained cargo variants in the used market.

What are the primary factors determining the depreciation rate of a used aircraft?

Primary depreciation factors include engine cycles/hours remaining, regulatory compliance status (e.g., noise stage compliance), required expenditure on the next major maintenance check (D-Check), operational commonality with in-production models, and the overall macroeconomic demand for air travel capacity.

Which aircraft leasing companies dominate the supply side of the used commercial jet market?

Major lessors such as AerCap, BOC Aviation, SMBC Aviation Capital, and Air Lease Corporation (ALC) are the primary suppliers. Their portfolio management decisions, involving the systematic sale or transition of mid-life aircraft to next-tier operators, define the volume and quality of assets entering the secondary market.

How is predictive maintenance technology influencing the valuation of older aircraft?

Predictive maintenance systems, driven by AI, allow buyers to accurately estimate future MRO costs and reduce unscheduled downtime. This increased operational certainty mitigates risk associated with aging assets, potentially slowing their depreciation and enhancing their attractiveness to secondary market operators.

What is the typical age range considered ‘mid-life’ for commercial jets in the used market?

Mid-life typically spans aircraft aged between 8 and 15 years. This segment is highly valued as these assets offer substantial remaining service life, high operational reliability, and are available at a significantly depreciated cost compared to new deliveries, offering optimal value for LCCs.

What distinguishes the market for used business jets from used commercial aircraft?

The used business jet market is less cyclical and more sensitive to immediate availability and individual wealth fluctuations. Transactions prioritize cabin amenities and low flight hours rather than fleet commonality or route profitability, and the acquisition process is often faster and less complex than commercial airline transactions.

What are the key risks associated with purchasing end-of-life used aircraft?

Key risks include the high capital expenditure required for mandatory heavy maintenance checks (D-Checks), potential compliance issues with emerging environmental regulations, difficulty sourcing increasingly obsolete spare parts, and very limited long-term residual value preservation beyond part-out potential.

How does the availability of replacement engines impact used aircraft market liquidity?

Engine availability is paramount. Aircraft models with high-demand engines (e.g., CFM56, V2500) that have robust MRO support and readily available spares enjoy higher liquidity and better residual values, as engine overhaul costs are often the largest single expense in an aircraft’s mid-life operation.

What percentage of global commercial aircraft transactions involve leasing entities?

Leasing entities are involved in a substantial majority of global aircraft transactions, estimated to be over 50% of the active commercial fleet. Their dominance in the secondary market, both as buyers and sellers, ensures transactional standardization and provides necessary capital fluidity.

Define the term 'Part-Out' in the context of the used aircraft market.

Part-out refers to the dismantling of an end-of-life aircraft to harvest valuable components (engines, landing gear, avionics) for resale as used serviceable material (USM). This process is often a strategic financial decision when the residual value of the parts exceeds the aircraft’s remaining operational value.

Are there specialized brokerage services for high-value used wide-body jets?

Yes, transactions involving high-value, used wide-body jets (like B777s or A330s) are almost exclusively handled by specialized aviation brokers and investment banks who manage the complex technical, legal, and financial due diligence required for multi-jurisdictional asset transfers.

How do geopolitical tensions influence the trade flows of used aircraft?

Geopolitical tensions can trigger immediate changes in trade flows through sanctions or export restrictions, severely impacting the marketability of used aircraft to sanctioned regions. This forces lessors to reposition assets, affecting global supply distribution and potentially concentrating supply in less restrictive markets.

What is the typical time frame for a used narrow-body jet transaction, including technical due diligence?

A typical used narrow-body jet transaction, from Letter of Intent (LOI) to final delivery, usually takes between 3 to 6 months, heavily dependent on the complexity of the technical due diligence (MRO records review) and the required time for repositioning or immediate maintenance checks.

What is the current demand outlook for used regional jets (e.g., Embraer and Bombardier models)?

Demand for used regional jets is mixed. Older models face stiff competition from newer turboprops and larger narrow-body jets. However, late-model, fuel-efficient regional jets remain highly attractive for point-to-point services in geographically constrained or developing markets.

How important is the availability of financing options for the growth of the used aircraft market?

Financing availability is critical; without access to specialized debt instruments, buyers, especially smaller airlines, cannot acquire high-value assets. The robustness of export credit agencies and specialized aviation finance houses directly correlates with market liquidity and transaction volumes.

What impact does a global economic recession have on used aircraft pricing?

A recession initially increases the supply of used aircraft as struggling airlines shed capacity, leading to a temporary drop in market prices. Simultaneously, it increases demand from LCCs and budget operators seeking affordable fleet expansions as the market stabilizes at lower acquisition costs.

What are the key technical specifications required for passenger-to-freighter (P2F) conversion candidates?

P2F conversion candidates must have favorable structural characteristics (e.g., floor beam strength, door placement), sufficient remaining economic life, readily available certification programs (STCs), and, critically, comprehensive, clean maintenance records to support the conversion investment.

How do OEMs (Original Equipment Manufacturers) participate in the used aircraft segment?

OEMs participate by providing essential maintenance support, parts supply, and technical assistance for their older airframes. Some, like Boeing and Airbus, also have dedicated financing arms that manage and remarket used aircraft to maintain control over fleet transitions and residual values of their products.

What is the primary driver for LCCs to choose used aircraft over new models?

The primary driver is capital cost efficiency and immediate availability. LCCs maximize their return on investment by acquiring proven, depreciated aircraft at lower financial outlay, allowing for quicker capacity deployment and reduced per-seat ownership costs compared to new deliveries.

In the context of the used market, what defines a 'green time' engine?

A 'green time' engine refers to an engine that has significant remaining operational life (cycles or flight hours) before its next mandatory heavy shop visit. These engines command a premium price in the used parts market as they offer immediate, low-risk replacement options for grounded aircraft.

How are environmental regulations, such as those related to noise, affecting the market?

Stricter Chapter 4 and Stage 5 noise regulations require older aircraft to be retrofitted with hush kits or retired. This accelerates the removal of very old assets (e.g., B727s, older B737-200s) from service in high-compliance regions, pushing them into less regulated markets or to part-out facilities.

Which aircraft type exhibits the highest liquidity in the secondary market?

The narrow-body jet segment, specifically the Airbus A320 and Boeing 737 families, maintains the highest liquidity. Their operational commonality, large installed base, and diverse global operator list ensure consistent buyer interest and predictable residual values.

What is the average time lag between a new aircraft entering service and its first appearance on the used market?

The first wave of new commercial aircraft typically appears on the used market after approximately 7 to 10 years, when initial lease terms expire, and major airlines begin their first significant fleet turnover or re-leasing decisions.

How does the quality of maintenance records influence the final transaction price?

Maintenance records quality is paramount; poor or incomplete documentation can reduce an aircraft's value by 10% to 20% or even render it untradeable. Comprehensive, accurate, and digitized records reduce transactional risk, justifying higher asset pricing and attracting premium buyers.

Do fractional ownership programs significantly impact the used business jet market supply?

Yes, fractional ownership companies regularly cycle out their aging jets, contributing a significant, steady supply of well-maintained, medium-time aircraft to the secondary business jet market. This structured divestment stabilizes supply volume in that niche segment.

What is the primary challenge faced by lessors when selling end-of-life assets?

The primary challenge is finding buyers willing to take on the substantial financial burden of the upcoming final D-Check or major life-limited parts (LLP) retirement, forcing lessors to often choose between expensive maintenance investment or a low-value part-out decision.

Which developing country shows the most potential for growth in used aircraft acquisitions?

India demonstrates the highest potential, driven by deregulation, explosive domestic air travel growth, and a high reliance on existing narrow-body fleets, necessitating continuous, affordable capacity injection sourced predominantly from the used global market.

What specialized skills are essential for used aircraft brokers and analysts?

Essential skills include deep technical knowledge of airframe and engine configurations, expertise in aviation law and cross-border registration processes, complex financial modeling for lease structuring and residual value assessment, and strong global network connections.

Why is the Boeing 737 Next Generation (NG) still highly sought after in the used market despite the MAX introduction?

The 737 NG remains popular due to its established reliability, global operational commonality, lower acquisition cost compared to the MAX, robust MRO infrastructure worldwide, and the fact that it is generally fully depreciated, offering a strong operational cost advantage.

How do governments influence the demand for specialized used aircraft?

Governments are key buyers of specialized used aircraft (e.g., C-130s, older regional jets) for military transport, maritime patrol, aerial surveying, or VIP transport, driving demand in specific, non-commercial segments that value proven reliability over cutting-edge technology.

What are 'lease return conditions' and their impact on market transactions?

Lease return conditions are contractual requirements specifying the aircraft’s minimum technical state (e.g., engine time remaining, required maintenance status) at the end of the lease. Non-compliance can result in substantial financial penalties or extended maintenance time, significantly impacting the asset's immediate resale value.

How is the retirement of older Wide-Body jets (A380, B747) affecting the overall market?

The retirement of very large aircraft creates a surplus of unique, specialized parts and components for the USM (Used Serviceable Material) market. While the airframes themselves have limited resale value, the high demand for large engines and avionics components from these types sustains a dedicated part-out sub-segment.

What is the role of technical inspectors in the used aircraft acquisition process?

Technical inspectors conduct meticulous physical and records inspections (due diligence), verifying the aircraft’s current condition against maintenance logs, airworthiness directives, and contract specifications. Their reports are foundational to the final valuation and transaction risk assessment.

How does the market differentiate between a "mid-life" and an "end-of-life" business jet?

For business jets, "mid-life" generally means the aircraft has substantial airframe and engine time remaining before mandatory overhauls. "End-of-life" implies the next major overhaul (e.g., 12-year inspection or engine hot section) is imminent, which often makes the cost of compliance outweigh the market value.

What are the key drivers for the secondary market sale of used turboprop aircraft?

Used turboprops are driven by demand from regional carriers requiring short-field performance, low operating costs on short routes, and superior fuel efficiency compared to small regional jets, making them ideal for challenging terrain and developing regional networks.

How are new technologies like Augmented Reality (AR) being used in MRO for used aircraft?

AR is utilized by MRO technicians to overlay digital instructions, technical diagrams, and historical repair data directly onto the physical aircraft components during inspection and maintenance, speeding up complex tasks and reducing errors associated with records analysis on older airframes.

What market segment is most vulnerable to economic downturns?

The used business jet and general aviation segments are most vulnerable, as corporate and private spending on non-essential, high-value assets is typically the first to be reduced during economic uncertainty, leading to increased supply and depressed pricing.

What metrics are most important for buyers when assessing a used aircraft engine?

The most crucial metrics are cycles remaining to the next shop visit (CSN), hours remaining to the next shop visit (TSN), time since last overhaul (TSLH), and the total cost projection for the next heavy engine maintenance event (shop visit cost).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager