Used and Refurbished Medical Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433852 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Used and Refurbished Medical Devices Market Size

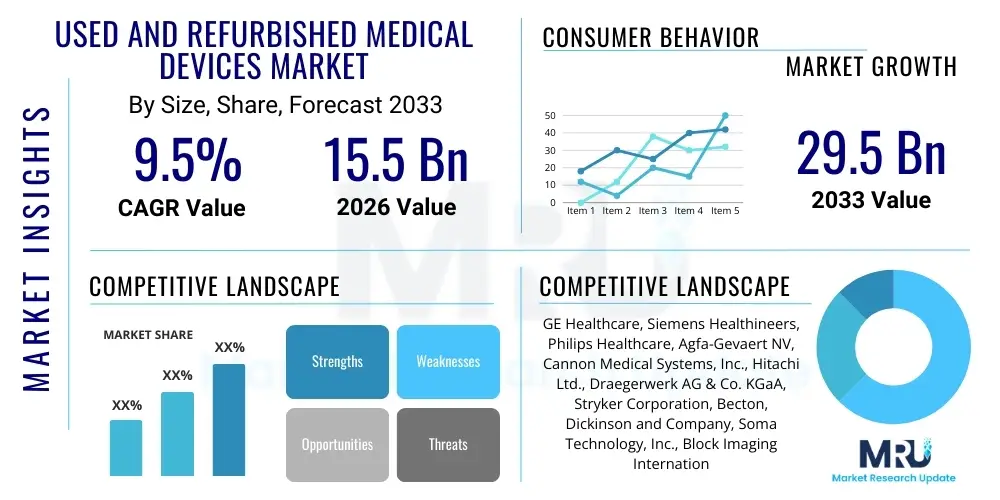

The Used and Refurbished Medical Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 29.5 Billion by the end of the forecast period in 2033.

Used and Refurbished Medical Devices Market introduction

The Used and Refurbished Medical Devices Market encompasses the trade, repair, and secondary placement of pre-owned medical equipment that has been restored to meet original equipment manufacturer (OEM) specifications or recognized regulatory standards. This market segment is crucial for bridging the gap between escalating healthcare infrastructure costs and the increasing global demand for advanced medical diagnostics and therapeutic technologies, particularly in developing economies and budget-constrained institutions. These devices, ranging from high-value imaging systems like MRI and CT scanners to essential patient monitoring equipment, undergo rigorous verification, calibration, and cosmetic refurbishment processes before re-entry into the supply chain, ensuring functionality and patient safety comparable to new equipment. The rising focus on circular economy principles and sustainable healthcare practices further validates the importance of the refurbishment ecosystem.

The primary product categories driving market growth include sophisticated diagnostic imaging equipment, which typically represents a significant capital expenditure for healthcare providers. Refurbishment programs offer a cost-effective alternative, extending the operational life of assets and democratizing access to high-fidelity diagnostic tools. Major applications span cardiology, oncology, neurology, and general surgery, where the reliability of equipment directly impacts patient outcomes. The integrity of the refurbishment process, often involving specialized third-party refurbishers or OEM service divisions, is paramount, requiring strict adherence to ISO standards and regional regulatory mandates such as the FDA's guidance in the United States or CE marking requirements in Europe.

The core benefits associated with utilizing refurbished devices include substantial cost savings, typically 30% to 70% less than new systems, facilitating faster return on investment for healthcare facilities. Key driving factors include the pressure on hospitals to manage operational expenditures effectively, the accelerated replacement cycles of technology in developed markets leading to a consistent supply of relatively modern used devices, and global initiatives aimed at improving healthcare accessibility in resource-limited settings. Furthermore, environmental consciousness regarding electronic waste reduction supports the sustainability narrative of the refurbishment industry, making it an increasingly appealing solution for healthcare procurement specialists focused on both economic and ecological viability.

Used and Refurbished Medical Devices Market Executive Summary

The Used and Refurbished Medical Devices Market demonstrates robust expansion, fundamentally driven by financial prudence among healthcare providers worldwide and sustained technological innovation leading to frequent equipment upgrades. Business trends indicate a consolidation within the refurbishment sector, with Original Equipment Manufacturers (OEMs) increasingly formalizing their certified pre-owned programs to capture market share, thereby guaranteeing quality control and service support, mitigating previous concerns related to uncertified third-party refurbishers. The emphasis on stringent quality assurance protocols, coupled with the establishment of transparent pricing models, is enhancing customer confidence. Furthermore, leasing and rental models for refurbished equipment are gaining traction, offering flexible financial pathways for smaller clinics and mobile diagnostic units, solidifying market stability and predicting consistent growth over the forecast period.

Geographically, North America and Europe currently represent the most established markets, characterized by high rates of technological obsolescence and well-defined regulatory frameworks that support the legal and safe trade of used devices. However, the Asia Pacific (APAC) region is poised for the most rapid expansion, fueled by massive government investments in healthcare infrastructure development, rapidly growing patient volumes, and the necessity to deploy affordable advanced technology quickly. Countries such as India, China, and Southeast Asian nations are crucial demand centers, focusing on acquiring refurbished high-end diagnostic tools to enhance regional healthcare capabilities without incurring prohibitive costs associated with purchasing entirely new fleets. Latin America and MEA are similarly demonstrating strong demand, driven by healthcare privatization and efforts to modernize outdated hospital infrastructure.

Segment trends highlight Diagnostic Imaging as the leading segment by device type, given the high unit cost and long operational lifespan of equipment like MRI, CT, and X-ray systems, making refurbishment economically highly viable. Within end-users, hospitals remain the predominant consumers, though specialized diagnostic centers and ambulatory surgical centers are rapidly increasing their procurement of refurbished equipment to contain capital expenditure budgets. The fastest-growing product category is projected to be minimally invasive surgical systems and complex laboratory equipment, where the integration of advanced technologies necessitates frequent upgrades but also creates a reliable supply stream of modern used systems entering the secondary market.

AI Impact Analysis on Used and Refurbished Medical Devices Market

Common user questions regarding AI's impact on the Used and Refurbished Medical Devices Market typically revolve around how artificial intelligence affects device lifespan, the complexity of refurbishment, and the valuation of used equipment. Users frequently inquire about whether AI-driven diagnostics increase the obsolescence rate of older hardware, or conversely, if AI algorithms can be implemented retroactively to enhance the functionality and lifespan of existing refurbished systems. Key themes summarize the concerns regarding predictive maintenance capabilities facilitated by AI, which could revolutionize the service life estimation of used devices, potentially driving up their resale value by guaranteeing future reliability. Expectations are high that AI will streamline the certification and quality assurance process for refurbishers, making the secondary market more trustworthy and efficient.

The integration of AI poses both opportunities and challenges for the refurbishment industry. On one hand, AI tools can drastically improve the efficiency of quality control checks, automatically detecting subtle failures or calibration drifts in complex equipment far beyond human capacity. This enhanced quality assurance validates the integrity of the refurbishment process, building greater consumer confidence in high-value secondary market assets. Furthermore, AI-driven predictive maintenance models allow refurbishers to accurately forecast component failure rates, enabling proactive replacement during the restoration process, thereby offering customers extended warranties and reduced operational downtime post-acquisition.

Conversely, the increasing embeddedness of proprietary AI software in modern medical devices presents licensing and data security hurdles for refurbishers. Ensuring that the refurbished system complies with contemporary data privacy regulations (like HIPAA or GDPR) and that necessary software licenses are transferable or replaceable is a critical, complex undertaking. Devices whose value is heavily tied to sophisticated software algorithms might face accelerated functional obsolescence if those algorithms are frequently updated or replaced in new models, complicating the refurbishment and resale of the older hardware. However, successful integration of advanced AI analytics into the refurbishment workflow will be a defining competitive factor, enabling providers to offer superior, certified pre-owned devices.

- AI-Driven Predictive Maintenance: Enhances reliability assessment and proactive component replacement, improving the warranty viability of refurbished devices.

- Automated Quality Assurance: Utilizes machine learning to accelerate and standardize testing protocols, ensuring refurbished devices meet strict regulatory compliance thresholds faster.

- Optimized Inventory and Sourcing: AI algorithms forecast demand for specific equipment types and aid in sourcing high-quality used devices efficiently based on market needs and residual value.

- Software Recertification Challenges: AI software licensing and intellectual property transfer complexity pose significant hurdles during the refurbishment lifecycle.

- Enhanced Functionality Post-Refurbishment: Potential for retrofitting older hardware with modernized, AI-enabled analytical capabilities, extending technological relevance.

- Data Wipe and Security Compliance: AI tools assist in ensuring complete and auditable data sanitization, crucial for compliance when reselling pre-owned equipment.

DRO & Impact Forces Of Used and Refurbished Medical Devices Market

The Used and Refurbished Medical Devices Market is propelled by strong economic drivers centered around cost optimization and global healthcare expansion, yet it faces substantial resistance primarily stemming from perceptions of quality risk and complex regulatory navigation. The primary driver remains the compelling value proposition: providing advanced medical technology at significantly reduced costs, directly addressing budget constraints faced by hospitals in both emerging and established economies. Opportunities are abundant, specifically in standardizing international refurbishment protocols and expanding specialized services for high-demand devices like robotic surgery systems. These market forces collectively shape a dynamic environment where affordability and accessibility compete directly against concerns of equipment integrity and lifecycle management, creating a strategic imperative for transparency and certification.

Key restraining factors include pervasive skepticism regarding the longevity and maintenance requirements of non-new equipment, often driven by aggressive marketing from new equipment manufacturers. Furthermore, the lack of globally harmonized regulations for refurbishment creates significant barriers to cross-border trade, forcing refurbishers to adapt their processes based on fragmented regional standards, escalating operational complexity and overheads. The impact forces are currently favoring growth, as economic pressures on healthcare systems are intensifying post-pandemic, making cost-saving measures via refurbished equipment procurement strategically vital. Additionally, the increasing environmental focus on minimizing e-waste strongly supports the market's underlying ethical and sustainability arguments.

The convergence of technological advancement and global demand creates an ongoing need for high-quality, reliable, yet affordable medical devices. The challenge is converting potential opportunity into tangible market growth by overcoming the inherent risks associated with quality inconsistency. OEMs’ commitment to certified programs acts as a crucial positive impact force, lending credibility and professional support to the secondary market. Successfully navigating the regulatory maze and ensuring robust quality control protocols are essential for capitalizing on the strong underlying demand for cost-effective healthcare solutions globally, influencing the overall market trajectory favorably despite inherent complexities.

Segmentation Analysis

The Used and Refurbished Medical Devices Market is highly fragmented and segmented across various dimensions, including product type, application, and end-user, reflecting the diverse landscape of healthcare infrastructure and financial capabilities globally. The comprehensive segmentation strategy allows stakeholders to precisely analyze high-growth niches, such as specialized diagnostic imaging or specific surgical tools. Product classification typically separates high-value, complex electronic devices from simpler, non-electronic equipment, with the former dominating market revenue due to the high capital cost savings refurbishment offers. Analysis by application helps identify therapeutic areas, like cardiology or orthopedics, that exhibit the highest procurement rates for pre-owned systems, guiding inventory stocking decisions for major refurbishing firms.

From an end-user perspective, hospitals remain the cornerstone of demand, driven by their extensive requirements for fleet replacement and volume purchasing. However, the rapidly evolving landscape of healthcare delivery sees increasing demand originating from non-hospital settings, including specialized clinics, ambulatory surgical centers, and diagnostic laboratories. These smaller entities often have stricter budget constraints but still require state-of-the-art technology to remain competitive, making certified refurbished devices an ideal procurement solution. The inherent structure of the market, segmented by sourcing (OEM vs. third-party refurbishers), also provides crucial insights into quality benchmarks and service guarantees.

Understanding these segments is essential for strategic planning, particularly in identifying regulatory hotspots and regional demand fluctuations. For instance, while high-end MRI systems drive revenue in developed markets, basic monitoring and surgical equipment might see higher volume growth in emerging economies. The robust market segmentation ensures that all aspects of the value chain, from decommissioning and sourcing to final sales and long-term service agreements, are comprehensively analyzed to provide actionable market intelligence regarding product mix optimization and geographical expansion strategies.

- By Product Type:

- Diagnostic Imaging Equipment (MRI Systems, CT Scanners, X-ray Systems, Ultrasound Systems, PET Scanners, Mammography Systems)

- Cardiology Equipment (Defibrillators, ECG Systems, Stress Testing Systems, Pacemakers)

- Operating Room & Surgical Equipment (Anesthesia Machines, Electrosurgical Units, Surgical Navigation Systems, Endoscopy Equipment)

- Patient Monitoring Devices (Vital Signs Monitors, Pulse Oximeters, Multi-Parameter Monitors)

- Medical Laboratory Equipment (Analyzers, Centrifuges, Sterilizers, Microscopes)

- Others (Ventilators, Dialysis Equipment, Hospital Furniture)

- By Device Type (Classification):

- Used

- Refurbished

- By End-User:

- Hospitals and Clinics

- Diagnostic and Imaging Centers

- Ambulatory Surgical Centers (ASCs)

- Medical Research and Academic Institutions

- Specialty Clinics (Cardiology, Oncology)

- By Source:

- Original Equipment Manufacturers (OEMs)

- Third-Party Refurbishers

Value Chain Analysis For Used and Refurbished Medical Devices Market

The value chain for the Used and Refurbished Medical Devices Market is complex and distinct from the new equipment market, commencing with the upstream sourcing and decommissioning of existing devices. Upstream activities involve identifying, acquiring, and de-installing used equipment, often through trade-in programs, hospital asset disposal auctions, or leasing company returns. The critical first step is a thorough technical assessment and documentation of the device's operational history and condition. This initial phase dictates the feasibility and cost of the refurbishment process. Sourcing from reputable institutions or through OEM trade-ins provides higher quality stock, which minimizes the refurbishment input cost, thereby maximizing profit margins downstream.

The middle stage of the value chain involves core refurbishment and certification, where acquired devices are transferred to specialized facilities. This crucial phase includes cleaning, repair, replacement of worn parts (often using OEM-certified components), recalibration, and software upgrades. Refurbishers must strictly adhere to regulatory standards (e.g., FDA requirements for labeling and safety) and ensure the final product meets specified functional criteria. Quality control and rigorous testing are non-negotiable elements. The distinction between OEM refurbishers and third-party companies becomes most apparent here, impacting the level of standardization and warranty offered on the final refurbished product, which directly influences downstream sales potential.

Downstream activities center on distribution, sales, and post-sales support. Distribution channels are typically a mix of direct sales (especially for high-value items sold by OEMs to large hospital networks) and indirect sales through specialized medical equipment distributors and brokers who target smaller clinics or international markets. Post-sales support, including installation, training, and ongoing service contracts, is critical for establishing credibility. Given the used nature of the equipment, robust warranties and reliable maintenance services are key differentiators. The complexity of international shipping and regulatory clearances adds another layer of sophistication to the distribution and logistics phase, particularly in serving emerging markets where demand is high but infrastructure can be challenging.

Used and Refurbished Medical Devices Market Potential Customers

Potential customers for used and refurbished medical devices are primarily institutions and practitioners who prioritize capital expenditure efficiency while maintaining high standards of clinical quality. Hospitals, particularly those operating in public healthcare systems or facing stringent budget limitations, constitute the largest segment of potential buyers. These facilities require continuous access to advanced diagnostic and treatment tools but must carefully manage large capital investments. Procurement decisions in major hospital networks often favor certified refurbished equipment for fleet replacement or expansion in non-critical areas, where the cost savings outweigh the perceived risk associated with pre-owned devices.

Beyond traditional hospital settings, a significant and rapidly expanding customer base includes specialized diagnostic and imaging centers, independent laboratories, and ambulatory surgical centers (ASCs). These entities often operate with leaner financial structures than large hospitals and rely on quick, efficient deployment of technology. For instance, a new ASC focused on orthopedic procedures might acquire a refurbished C-arm or anesthesia machine to reduce startup costs dramatically, accelerating their time to profitability. The ability of refurbished equipment suppliers to offer flexible financing and immediate availability makes them highly attractive to this agile segment of the healthcare market.

Furthermore, government-funded health programs, non-governmental organizations (NGOs) involved in global health initiatives, and medical teaching institutions represent key buyers. NGOs frequently procure refurbished equipment for deployment in humanitarian missions or remote clinical settings where durability and affordability are paramount. Academic centers find refurbished devices suitable for training purposes and non-patient research labs, where the latest model is not strictly necessary, but functional integrity is required. The common denominator among all potential customers is the strategic balance between advanced functionality, cost containment, and verified reliability, making certified refurbishment a compelling procurement strategy across the entire healthcare ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 29.5 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GE Healthcare, Siemens Healthineers, Philips Healthcare, Agfa-Gevaert NV, Cannon Medical Systems, Inc., Hitachi Ltd., Draegerwerk AG & Co. KGaA, Stryker Corporation, Becton, Dickinson and Company, Soma Technology, Inc., Block Imaging International, Inc., Integrity Medical Systems, Inc., US Med Equipment, Inc., Amber Diagnostics, Inc., Avante Health Solutions, DRE Medical, Inc., Pacific Medical, Inc., Venture Medical, Inc., Radiology Oncology Systems, Inc., LBN Medical ApS |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Used and Refurbished Medical Devices Market Key Technology Landscape

The technology landscape for the Used and Refurbished Medical Devices Market is defined less by the creation of new primary hardware and more by the sophisticated processes required for restoration, verification, and regulatory compliance. Key technologies utilized involve advanced diagnostic testing platforms capable of mimicking intense clinical usage to stress-test refurbished systems, ensuring performance metrics align with original specifications. Non-destructive testing techniques, coupled with highly specialized calibration tools, are essential for restoring sensitive components, particularly in high-resolution imaging devices like MRI systems, where magnetic field homogeneity and radiofrequency coil integrity must be flawlessly restored. Furthermore, specialized data sanitization technologies, complying with strict privacy regulations, are paramount to completely wipe previous patient data, ensuring compliance upon resale.

Software management presents a critical technological challenge. Modern medical devices rely heavily on proprietary operating systems and advanced clinical applications. Refurbishers must possess the technological capabilities, often requiring OEM authorization, to update, reinstall, and validate these software packages. This includes licensing verification and ensuring the software version installed remains compatible with current hospital networks and interoperability standards (e.g., DICOM). The increasing shift toward cloud-based health records and network integration means refurbished devices must also incorporate modern networking capabilities and robust cybersecurity features, requiring technological expertise beyond simple hardware repair.

In addition to hardware and software restoration, logistics and tracking technologies play a crucial role. Advanced inventory management systems utilize RFID and detailed serialization tracking to maintain a comprehensive lifecycle record for each refurbished unit, documenting all repairs, component replacements, and test results. This technological transparency is vital for establishing trust and complying with traceability requirements mandated by regulatory bodies. Future technology integration focuses heavily on AI and IoT sensors embedded during the refurbishment process, which can monitor the device's health proactively after installation, enhancing the value proposition and minimizing downtime risk for the end-user.

Regional Highlights

- North America: North America, particularly the United States, represents a mature and dominant market for used and refurbished medical devices. The region benefits from a robust ecosystem characterized by high capital expenditure in healthcare, leading to frequent turnover of technologically advanced equipment. Strict regulatory oversight by the FDA, coupled with strong OEM certified pre-owned programs, ensures high quality and consumer confidence. The major driver is the need for cost containment within large hospital systems and the rapid expansion of Ambulatory Surgical Centers (ASCs) seeking affordable, high-quality alternatives to new equipment purchases. The availability of sophisticated refurbishment technology and a transparent legal framework support significant intra-regional trade.

- Europe: Europe is the second-largest market, exhibiting steady growth fueled by aging healthcare infrastructure in several nations and persistent budgetary pressures across national health services (NHS, etc.). Demand is diversified, with Western Europe focusing on high-end imaging and diagnostic systems, while Eastern European countries show increasing demand for basic surgical and monitoring equipment. The complexity arises from varying regulatory standards across EU member states, although adherence to CE marking requirements facilitates cross-border refurbishment trade. Sustainability mandates promoting circular economy models are also structurally supporting the expansion of the refurbishment sector across the continent.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by massive public and private investment in healthcare expansion, particularly in populous countries like China, India, and Southeast Asia. The demand is predominantly cost-driven; refurbished equipment offers the most viable path to rapidly modernize hospitals and expand access to advanced diagnostics (e.g., CT, MRI) in underserved areas. Regulatory frameworks are rapidly evolving, moving towards greater standardization to ensure device safety, a key factor that will accelerate market acceptance and growth. Increased patient volumes and medical tourism further intensify the need for quick, affordable technology deployment.

- Latin America: This region presents a strong demand market characterized by limited healthcare budgets and often high tariffs on imported new equipment. Refurbished devices offer a crucial economic pathway for healthcare providers in countries such as Brazil, Mexico, and Argentina to acquire modern technology. Challenges include inconsistent regulatory enforcement and reliance on international sourcing, often necessitating detailed compliance checks based on the device's country of origin. The market is primarily served by independent distributors and specialized importers focused on essential diagnostic and therapeutic systems.

- Middle East and Africa (MEA): The MEA market is highly heterogeneous. The Gulf Cooperation Council (GCC) countries demonstrate high procurement rates, driven by ambitious healthcare modernization projects and privatization, focusing on high-end refurbished systems (e.g., advanced surgical robots and imaging). In contrast, African nations are driven by humanitarian aid and the need for durable, easily maintainable basic medical equipment, often sourced through international relief organizations. Growth in Africa is heavily reliant on establishing reliable local service and maintenance infrastructure for the refurbished devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Used and Refurbished Medical Devices Market.- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Agfa-Gevaert NV

- Cannon Medical Systems, Inc.

- Hitachi Ltd.

- Draegerwerk AG & Co. KGaA

- Stryker Corporation

- Becton, Dickinson and Company (BD)

- Soma Technology, Inc.

- Block Imaging International, Inc.

- Integrity Medical Systems, Inc.

- US Med Equipment, Inc.

- Amber Diagnostics, Inc.

- Avante Health Solutions

- DRE Medical, Inc.

- Pacific Medical, Inc.

- Radiology Oncology Systems, Inc.

- LBN Medical ApS

- Shared Imaging

Frequently Asked Questions

Analyze common user questions about the Used and Refurbished Medical Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between "used" and "refurbished" medical devices, and why does this distinction matter?

The distinction is vital for quality assurance and warranty. A "used" device is sold as-is, often with minimal testing and no guaranteed repairs. A "refurbished" device, conversely, has been systematically inspected, repaired, calibrated, and certified by an OEM or qualified third-party refurbisher to meet predefined performance and safety standards, often accompanied by a warranty. Certification guarantees regulatory compliance and operational reliability, justifying a higher price point than basic used equipment.

How do regulatory bodies, such as the FDA and EU authorities, treat refurbished medical devices?

Regulatory bodies typically hold refurbished devices to the same safety and effectiveness standards as new devices. The FDA provides specific guidance on the refurbishment and remarketing of medical devices, requiring documented quality systems and rigorous adherence to original manufacturer specifications, particularly concerning labeling and software maintenance. Compliance ensures the secondary market does not compromise patient safety and facilitates legitimate international trade.

What are the key financial benefits of acquiring refurbished medical imaging equipment over new systems?

The primary financial benefit is substantial capital cost reduction, frequently offering savings of 30% to 70% compared to new equipment. This allows healthcare facilities, especially those with limited budgets, to upgrade technology faster, improve diagnostic capabilities, and achieve a quicker return on investment. Furthermore, purchasing refurbished systems often reduces lead times, allowing for rapid facility expansion or replacement of failed systems without extensive procurement delays.

Do refurbished medical devices suffer from accelerated technical obsolescence?

While all technology faces obsolescence, certified refurbishment programs actively mitigate this risk. Reputable refurbishers often upgrade software and key components to extend the useful life and ensure current interoperability (e.g., network compatibility). The decision to refurbish is generally made for equipment categories, like fixed imaging systems, where the core hardware remains functionally relevant for many years, even if minor software updates are required.

What role do Original Equipment Manufacturers (OEMs) play in the refurbished medical devices market?

OEMs play a pivotal role by formalizing the secondary market through "Certified Pre-Owned" programs. These programs lend significant credibility, offering guarantees that the refurbishment process utilizes genuine parts and is performed by trained technicians according to proprietary standards. OEM involvement assures potential buyers of quality, enhances service availability, and directly competes with independent third-party refurbishers by providing higher certainty and extended official warranties.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager