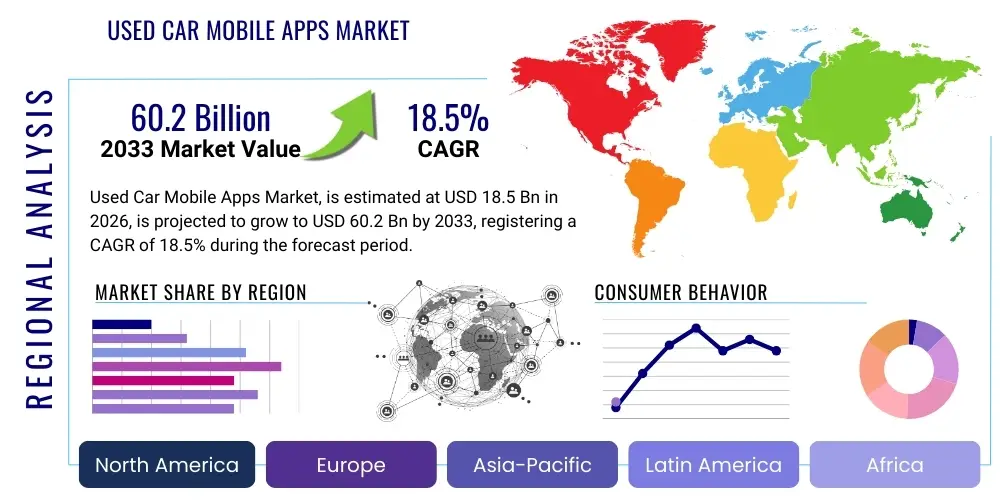

Used Car Mobile Apps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437526 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Used Car Mobile Apps Market Size

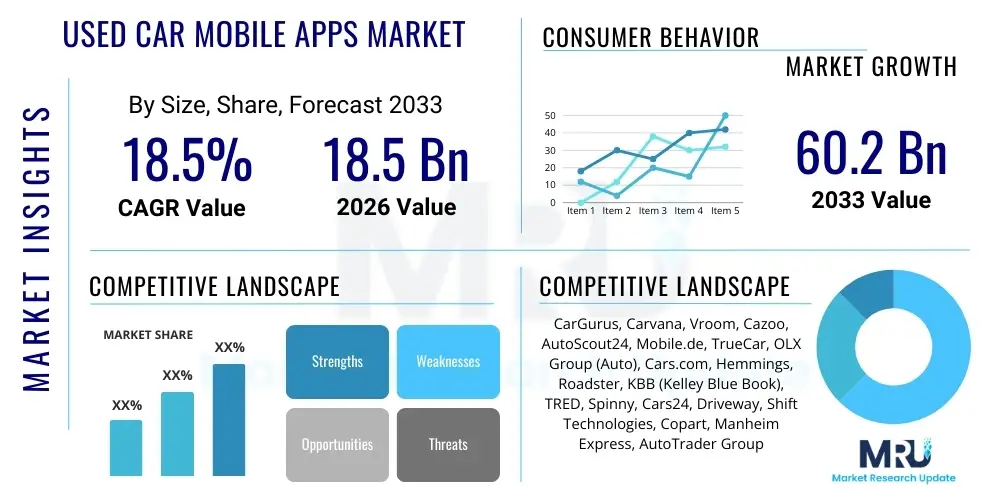

The Used Car Mobile Apps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 60.2 Billion by the end of the forecast period in 2033.

Used Car Mobile Apps Market introduction

The Used Car Mobile Apps Market encompasses digital platforms designed specifically for the transaction, discovery, and management of pre-owned vehicles through smartphone applications. These platforms revolutionize the traditional used car buying experience by providing users with extensive searchable databases, high-resolution images, detailed vehicle histories, pricing analytics, and streamlined communication tools between buyers and sellers. The core product offering includes advanced search filters, virtual tours, financing calculators, and secure payment gateways, making the process of purchasing a used car more transparent and convenient than physical dealerships alone. The proliferation of mobile internet access and the increasing comfort level of consumers conducting high-value transactions online are foundational to this market's growth, fundamentally shifting consumer behavior towards digital channels for automotive purchases.

Major applications of these mobile apps span across consumer-to-consumer (C2C) listings, business-to-consumer (B2C) dealership inventory management, and ancillary services such as insurance aggregation, financing pre-approval, and vehicle inspection services. For consumers, the primary benefit is unparalleled access to a diverse inventory spanning geographical boundaries, coupled with tools that democratize information, thereby reducing informational asymmetry often associated with used car transactions. For dealers and private sellers, these apps offer expansive reach, low-cost marketing avenues, and sophisticated data tools to optimize pricing and inventory turnover. The inherent transparency and the ability to compare multiple options quickly are significant advantages driving user adoption globally.

Driving factors contributing to the market expansion include the increasing cost of new vehicles, leading consumers to seek affordable alternatives; the global transition towards digital retail platforms; and significant venture capital investment fostering continuous innovation in app functionality and user experience. Furthermore, the development of robust secure digital identities and transactional security protocols has built necessary consumer trust for large purchases via mobile devices. The integration of advanced features such as augmented reality (AR) for virtual inspections and AI-driven pricing algorithms further solidify the value proposition of these mobile applications in the automotive ecosystem.

Used Car Mobile Apps Market Executive Summary

The Used Car Mobile Apps Market is characterized by robust digital transformation, driven primarily by evolving consumer preferences for transparent, efficient, and remote transaction processes. Key business trends include the consolidation of platforms, where leading applications acquire smaller regional players to expand their geographical reach and enhance their service offerings, especially concerning integrated financing and logistical support. Technology adoption remains paramount, with significant investments directed toward enhancing search relevancy, leveraging machine learning for fraud detection, and improving the overall user interface (UI) and user experience (UX) to maintain competitive advantage in a crowded digital marketplace. Furthermore, successful models increasingly focus on providing end-to-end solutions, moving beyond mere listing services to manage the entire sales lifecycle, from initial search to final title transfer.

Regionally, North America and Europe maintain dominance, benefiting from high digital literacy rates, established automotive markets, and robust regulatory frameworks supporting digital commerce. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by explosive smartphone penetration, a rapidly expanding middle class, and the emerging acceptance of used vehicle ownership as a viable economic choice. Countries like India and China are witnessing intense competition and localized innovation tailored to unique regional preferences, such as integrating local digital payment methods and multilingual support. Latin America and the Middle East and Africa (MEA) are emerging markets exhibiting accelerating adoption rates, albeit constrained currently by varying levels of digital infrastructure maturity and consumer trust in online transactional security.

Segment trends reveal a shift towards hybrid models that cater both to C2C and B2C segments simultaneously, maximizing inventory diversity. Segmentation based on platform type indicates that dealer-focused apps offering certified pre-owned (CPO) vehicles are gaining traction due to perceived quality assurance, contrasting with the high volume, high variety C2C marketplaces. Device type segmentation underscores the overwhelming dominance of smartphone applications, necessitating optimized mobile-first design strategies. The fastest-growing service segment is adjacent services, particularly instantaneous financing pre-approvals and comprehensive digital inspection services, which significantly reduce the friction points traditionally associated with used car purchasing.

AI Impact Analysis on Used Car Mobile Apps Market

User inquiries regarding AI's influence in the Used Car Mobile Apps Market frequently center on pricing accuracy, personalized vehicle recommendations, and the automation of customer service interactions. Users are keen to understand how AI-driven algorithms can ensure fair market pricing, mitigating the risk of overpaying or undervaluing vehicles. Common concerns revolve around data privacy and the transparency of the recommendation engine. Expectations are high regarding the integration of AI for predictive maintenance alerts and advanced fraud detection mechanisms, anticipating a future where mobile apps offer hyper-personalized, trustworthy, and efficient purchasing experiences, moving beyond simple keyword matching to genuine predictive purchasing assistance.

- Enhanced Dynamic Pricing: AI algorithms analyze millions of data points (mileage, condition, regional demand, seasonality) to offer real-time, highly accurate vehicle valuations, benefiting both sellers and buyers by ensuring competitive pricing.

- Personalized Recommendation Engines: Machine learning models study user search history, viewing patterns, and demographic data to recommend highly relevant vehicles, improving conversion rates and user satisfaction.

- Fraud Detection and Security: AI systems monitor listing behavior and transaction patterns to identify and flag fraudulent postings, fake reviews, or suspicious seller activities, dramatically enhancing platform security and user trust.

- Automated Customer Support (Chatbots): Natural Language Processing (NLP) integrated into chatbots provides instant, 24/7 support for common queries regarding vehicle specifications, financing options, and scheduling test drives, reducing operational costs.

- Augmented Reality (AR) Inspections: AI processes visual data from smartphone cameras, enabling users to perform preliminary remote damage assessments or visualize the car in their environment, improving the digital inspection process.

- Predictive Maintenance Insights: Utilizing historical vehicle data, AI can predict future maintenance needs and associated costs, offering buyers a more comprehensive view of long-term ownership expenses.

DRO & Impact Forces Of Used Car Mobile Apps Market

The Used Car Mobile Apps Market is highly influenced by a dynamic interplay of driving factors (D), inherent restraints (R), and latent opportunities (O), creating complex impact forces. The primary drivers include the accelerated digital adoption globally, particularly among younger demographics who prefer mobile-first transactions, coupled with the economic appeal of used vehicles over expensive new counterparts. However, growth is inherently restrained by persistent challenges related to building and maintaining consumer trust, primarily concerning vehicle condition verification and transactional security, especially in peer-to-peer (C2C) environments. Significant opportunities arise from integrating sophisticated financial technologies (FinTech) for instant loan approval and expanding value-added services such as certified vehicle warranties and delivery logistics.

Key impact forces shaping this market include technological innovation pressure, which mandates continuous investment in AI, AR, and data analytics to remain competitive. Furthermore, regulatory scrutiny regarding consumer data protection (e.g., GDPR) and fair transaction practices is intensifying, forcing platforms to invest heavily in compliance and transparency measures. Economic cycles also exert a powerful influence; during economic downturns, demand for used cars surges, directly benefiting these mobile platforms, while periods of strong economic growth might temper demand slightly but increase expectations for quality and convenience.

The successful navigation of these forces requires platforms to focus strategically on mitigating the core restraint of trust through robust digital certification processes and enhanced buyer protection policies. Leveraging the opportunity presented by FinTech integration allows platforms to capture a larger share of the transaction value beyond just the listing fee, transforming them into comprehensive automotive marketplaces rather than simple classifieds. The resultant impact is a market characterized by rapid innovation, intense price competition, and a focus on delivering seamless, trustworthy, end-to-end purchasing experiences that align with modern consumer expectations for digital convenience.

Segmentation Analysis

The Used Car Mobile Apps Market is systematically segmented based on various defining characteristics, enabling targeted strategic planning and market analysis. Key segmentation dimensions include the Platform Type, which distinguishes between applications primarily serving dealers (B2C) versus those facilitating direct transactions between consumers (C2C). Further refinement occurs through the Operating System utilized (iOS, Android, and others), reflecting the diverse technological ecosystem in which these apps operate. Critical analysis is also applied based on the Service Model (such as listing, full-transaction, or hybrid models) and the vehicle category (e.g., standard passenger cars, luxury vehicles, or commercial vehicles), allowing stakeholders to pinpoint high-growth niche markets and develop specialized app features catering to specific user needs and transaction complexities.

- By Platform Type:

- Dealer-Focused (B2C) Applications

- Consumer-to-Consumer (C2C) Marketplaces

- Hybrid Models

- By Operating System:

- Android

- iOS

- Others (e.g., Web-based Progressive Web Apps (PWAs))

- By Service Model:

- Listing/Classified Model (Information only)

- Full Transaction Model (Includes financing, inspection, logistics)

- Auction Model

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Luxury and High-End Vehicles

- Commercial Vehicles (Trucks, Vans)

- By Revenue Model:

- Subscription Fees (for dealers)

- Transaction Commissions

- Advertising Revenue

- Value-Added Services (e.g., premium listings, inspection fees)

Value Chain Analysis For Used Car Mobile Apps Market

The value chain for the Used Car Mobile Apps Market begins with upstream activities focused heavily on data acquisition, processing, and technology development. Upstream participants include vehicle history providers (like CarFax or AutoCheck), third-party data aggregators supplying pricing benchmarks, and core technology developers specializing in mobile application infrastructure, cloud services, and AI/ML capabilities essential for robust search and personalization. This phase determines the accuracy, reliability, and functionality of the platform, serving as the foundational layer upon which user trust is built, necessitating stringent data governance and security protocols.

Midstream activities are characterized by the core operations of the mobile app platform itself, involving listing management, user interaction, virtual inspection tools, and customer relationship management (CRM) systems. Distribution channels are predominantly direct, meaning the app acts as the direct interface between the service provider (the platform) and the end-user (buyer or seller). Indirect channels may include partnerships with financial institutions for integrated loan services or logistics companies for vehicle delivery. Efficiency in the midstream hinges on seamless UX/UI design and the capacity to handle high transaction volumes securely and rapidly.

Downstream activities involve the final stages of the transaction, encompassing secured payment processing, logistical fulfillment (vehicle pickup/delivery), post-sale support, and warranty activation. The ability of the mobile app platform to seamlessly integrate these downstream services defines its competitive edge, transforming a simple listing service into a comprehensive e-commerce solution. This integration, often managed through APIs and strategic partnerships, is crucial for realizing the full value proposition of a digital marketplace, ultimately improving customer retention and fostering repeat business within the circular automotive economy.

Used Car Mobile Apps Market Potential Customers

The primary customer base for the Used Car Mobile Apps Market is highly diverse, segmented broadly into individual consumers and commercial entities such as authorized dealerships and independent used car brokers. Individual consumers represent the largest segment, particularly tech-savvy millennials and Generation Z who prioritize convenience, price transparency, and the ability to conduct research and purchases remotely without high-pressure sales tactics. These buyers are typically sensitive to pricing and value access to detailed vehicle history reports and independent reviews, making the information richness provided by mobile apps highly attractive for their purchasing decisions.

The secondary customer segment comprises established automotive dealerships and independent used car resellers. For these commercial buyers and sellers, the mobile apps serve as critical business tools for inventory management, lead generation, and competitive pricing analysis. Dealerships leverage B2C-focused apps to maximize market exposure, manage online reputation, and streamline their digital sales funnel. They require robust enterprise features, including bulk listing capabilities, integration with existing dealership management systems (DMS), and real-time performance analytics to optimize their used car operations efficiently.

A burgeoning third segment includes financial institutions and insurance companies who utilize these platforms indirectly. They act as integrated service providers, leveraging the app's user traffic to offer instant financing and insurance quotes directly at the point of decision, often becoming strategic partners of the core mobile platforms. Ultimately, the potential customer universe encompasses anyone seeking to transact a pre-owned vehicle, demanding a blend of digital efficiency, transactional security, and comprehensive informational transparency, driving platforms to continually enhance trust features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 60.2 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CarGurus, Carvana, Vroom, Cazoo, AutoScout24, Mobile.de, TrueCar, OLX Group (Auto), Cars.com, Hemmings, Roadster, KBB (Kelley Blue Book), TRED, Spinny, Cars24, Driveway, Shift Technologies, Copart, Manheim Express, AutoTrader Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Used Car Mobile Apps Market Key Technology Landscape

The technological infrastructure supporting the Used Car Mobile Apps Market is highly advanced, utilizing a confluence of cutting-edge digital tools to enhance user experience and transactional security. Central to this landscape are robust cloud computing platforms, essential for managing vast inventories, handling large volumes of user data, and ensuring scalability to accommodate rapid market growth and fluctuating demand spikes. Furthermore, sophisticated application programming interfaces (APIs) are crucial for seamless integration with third-party services, including banking systems for instant financing, government databases for title verification, and logistics providers for delivery scheduling, transforming the app into a true ecosystem hub.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly becoming a mandatory feature rather than a differentiator. These technologies power dynamic pricing algorithms that adjust vehicle values in real-time based on market conditions and inventory levels, alongside personalized recommendation engines that filter millions of listings down to highly relevant options for individual users. Furthermore, advanced data analytics capabilities are leveraged by platform operators to gain deeper insights into consumer behavior, optimize marketing spend, and predict future inventory needs, thereby improving operational efficiency for associated dealerships.

Emerging technologies such as Blockchain are being piloted to create immutable, decentralized records of vehicle ownership, maintenance history, and accident reports, directly addressing the core market constraint of trust and transparency. Simultaneously, Augmented Reality (AR) features are being incorporated, allowing buyers to digitally inspect vehicle flaws or visualize how a car would look parked in their driveway using their smartphone camera. The successful deployment of these technologies requires continuous investment in mobile security protocols to protect sensitive financial and personal data from increasingly sophisticated cyber threats, maintaining the overall integrity of the digital marketplace.

Regional Highlights

The global Used Car Mobile Apps Market exhibits distinct operational characteristics and growth patterns across key geographic regions, reflecting varied levels of digital maturity, regulatory environments, and consumer affinity for digital transactions. North America, particularly the United States, represents a mature yet highly competitive market, characterized by large-scale, well-funded players focusing heavily on end-to-end purchasing models, including proprietary reconditioning centers and guaranteed buy-back programs. High consumer disposable income, coupled with sophisticated digital infrastructure and a culture of seamless mobile commerce, drives rapid innovation in areas like instant financing and vehicle home delivery services.

Europe presents a diverse market structure, with strong localized platforms dominating individual national markets, though cross-border platforms are increasingly gaining traction, particularly in Western Europe. The market is highly regulated, necessitating compliance with strict data privacy standards (GDPR) and consumer protection laws. Germany and the UK are key contributors, showcasing high utilization rates of apps for research and listing purposes, though the final stages of the transaction often still involve physical inspection, suggesting a hybrid model of digital discovery and physical closure remains prevalent.

The Asia Pacific (APAC) region is the engine of future growth, driven by colossal populations, explosive mobile connectivity growth, and a rapidly expanding cohort of first-time car buyers seeking affordable options. China and India are focal points, where localized giants have emerged, offering integrated ecosystems that often include adjacent services like peer-to-peer sharing and mechanic booking. The market here is characterized by fierce competition, low commission rates, and a preference for mobile payments, demanding highly localized content and business models tailored to unique regulatory landscapes and cultural buying preferences.

- North America: Dominant market share; focus on full-stack e-commerce models (e.g., Carvana model); mature digital adoption; high investment in logistics and proprietary inventory management.

- Europe: Fragmented but large market; strong presence of localized platforms (e.g., Mobile.de, AutoScout24); emphasis on regulatory compliance and data protection (GDPR); growing cross-border inventory listings.

- Asia Pacific (APAC): Highest CAGR; driven by India and China; immense growth potential fueled by smartphone proliferation; intense localization required for payment methods and language support.

- Latin America (LATAM): Emerging market; growth constrained by economic volatility and varying levels of digital trust; rising adoption in urban centers like Brazil and Mexico; focus on C2C platforms initially.

- Middle East and Africa (MEA): Nascent growth; concentrated primarily in the GCC nations (UAE, KSA) due to high digital literacy and income levels; growth often tied to foreign investment and rapid urbanization projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Used Car Mobile Apps Market.- CarGurus

- Carvana

- Vroom

- Cazoo

- AutoScout24

- Mobile.de

- TrueCar

- OLX Group (Auto)

- Cars.com

- Hemmings

- Roadster

- KBB (Kelley Blue Book)

- TRED

- Spinny

- Cars24

- Driveway

- Shift Technologies

- Copart

- Manheim Express

- AutoTrader Group

- Droom

- Dubizzle

- Sleek Motors

- Cinch (Constellation Automotive Group)

Frequently Asked Questions

Analyze common user questions about the Used Car Mobile Apps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the rapid expansion of the Used Car Mobile Apps Market?

The market expansion is fundamentally driven by high consumer demand for transactional transparency, the economic necessity of buying cheaper used vehicles, and global smartphone saturation. Furthermore, advanced AI tools now provide trustworthy pricing data and detailed vehicle histories, significantly overcoming traditional trust barriers associated with used car purchasing.

How does the segmentation by Platform Type (B2C vs. C2C) influence market dynamics?

B2C (Dealer-Focused) platforms offer higher assurance through certified pre-owned options and integrated services like warranties and financing, attracting customers willing to pay a slight premium for quality. Conversely, C2C (Consumer-to-Consumer) platforms facilitate direct transactions, offering potentially lower prices but requiring higher risk assessment and due diligence from the buyer. Hybrid models are increasingly merging these benefits.

Which geographical region holds the highest growth potential for used car mobile apps?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to massive mobile internet penetration, large and growing middle-class populations, and the swift adoption of digital commerce solutions for high-value transactions in key markets like India and Southeast Asia.

What role does AI technology play in enhancing the user experience on these apps?

AI technology is crucial for optimizing the user journey. It powers dynamic pricing mechanisms for fairness, runs sophisticated recommendation engines for personalization, and utilizes machine learning for robust fraud detection, ensuring a more efficient, trustworthy, and tailored experience for buyers and sellers.

What are the primary challenges restraining the growth of digital used car marketplaces?

The main restraints include the inherent difficulty in guaranteeing vehicle condition remotely (the 'trust factor'), regulatory complexities surrounding cross-state or cross-country transactions, and the need for significant capital investment to build reliable, scalable logistics infrastructure for vehicle inspection and delivery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager