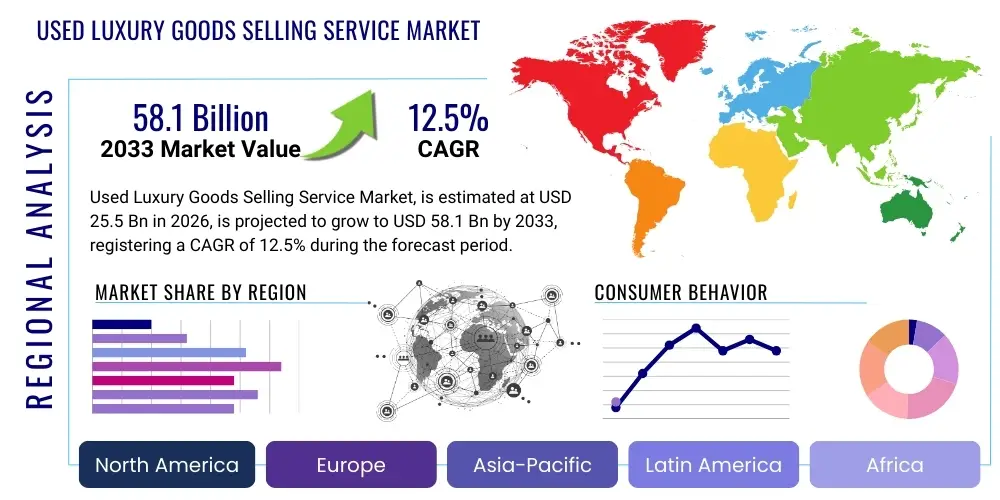

Used Luxury Goods Selling Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436268 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Used Luxury Goods Selling Service Market Size

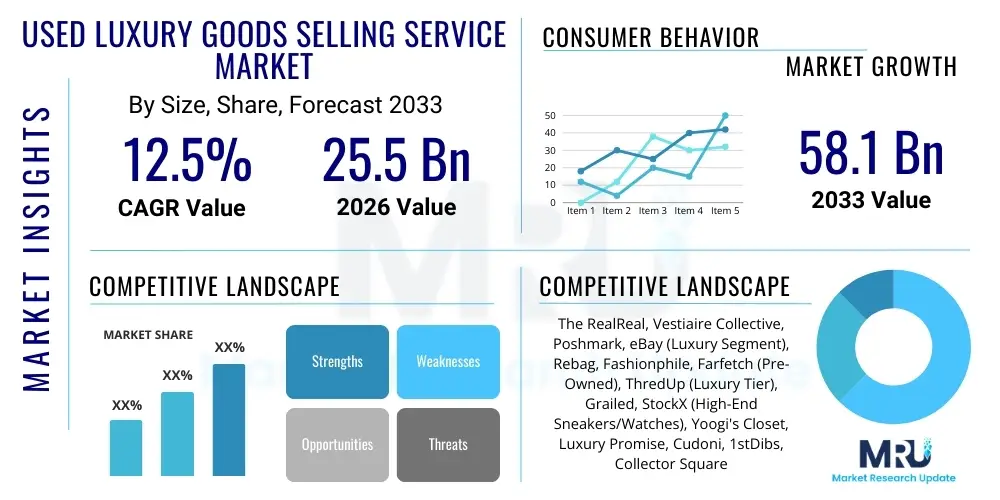

The Used Luxury Goods Selling Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 58.1 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by increasing consumer acceptance of circular fashion models, technological advancements in product authentication, and the growing economic incentive for both sellers and buyers in the high-value luxury sector. The professionalization of the resale infrastructure, encompassing logistics, digital merchandising, and secure payment systems, provides a strong foundation for sustained double-digit growth.

The valuation reflects the increasing volume of high-end items, including designer handbags, luxury watches, fine jewelry, and couture apparel, transacted through specialized third-party services. These services mitigate the risks associated with peer-to-peer sales, such as fraud and authentication uncertainty, thereby commanding a significant market share. Furthermore, the market size calculation accounts for the shift from traditional pawn shops and unorganized local consignment stores to globally integrated digital platforms offering standardized valuation, condition grading, and international shipping capabilities.

Used Luxury Goods Selling Service Market introduction

The Used Luxury Goods Selling Service Market encompasses the ecosystem of professional platforms, agencies, and consignment services that facilitate the resale of high-value pre-owned luxury items, ensuring authenticity, fair valuation, and secure transactions. These services bridge the gap between initial luxury item ownership and the secondary market, providing streamlined logistical support, expert authentication processes, and optimized pricing algorithms. Key product categories driving this market include iconic designer handbags, premium Swiss watches, fine diamond jewelry, and high-end ready-to-wear apparel. The primary applications involve extending the lifecycle of premium assets, providing sustainable consumption alternatives, and unlocking capital for original owners who seek to liquidate their investments.

Major driving factors include the escalating focus on environmental, social, and governance (ESG) criteria among younger, affluent consumers who prioritize sustainability and circularity in their purchasing decisions. Economically, the market is bolstered by the attractive price points for buyers seeking access to high-end brands below retail price, and for sellers, the ability to recoup a substantial portion of their initial investment through professionally managed channels. Technological advancements in digital marketplaces, particularly robust mobile applications and enhanced visual merchandising tools, have significantly lowered the barriers to entry and improved the user experience, fueling rapid market acceleration across key geographic regions.

Used Luxury Goods Selling Service Market Executive Summary

The Used Luxury Goods Selling Service Market is characterized by vigorous growth, driven fundamentally by the convergence of digital transformation and sustainability imperatives within the affluent consumer base. Business trends indicate a strong move towards integrated omni-channel models, where online platforms are establishing physical authentication hubs and boutique storefronts to enhance customer trust and logistical efficiency. Consolidation activities, often involving major resale platforms acquiring smaller regional specialists or partnering with primary luxury brands (brand-to-resale initiatives), are reshaping the competitive landscape. Authentication technology, leveraging AI and machine learning combined with human expertise, represents a critical differentiator and a core investment area for market leaders, substantially improving confidence in high-value transactions.

Segment trends highlight the dominance of the Online Channel, driven by global reach and operational scalability, although the Direct Purchase model (where the platform buys inventory outright) is gaining traction due to its appeal to sellers seeking immediate liquidity. Geographically, North America and Europe currently represent the highest market values due to established luxury consumption patterns and sophisticated digital infrastructure. However, Asia Pacific (APAC), particularly China, shows the highest growth potential, fueled by a rapidly expanding wealthy middle class and increasing cultural acceptance of secondary ownership. The jewelry and watches segment continues to hold the highest average transaction value (ATV), while the handbag segment contributes the largest volume of transactions, reflecting its strong liquidity and enduring demand.

AI Impact Analysis on Used Luxury Goods Selling Service Market

User queries regarding the impact of Artificial Intelligence on the Used Luxury Goods Selling Service Market frequently revolve around three core themes: the reliability of AI-driven authentication, the accuracy and fairness of automated pricing models, and the potential for personalized inventory curation. Consumers and sellers are highly concerned about the integrity of the authentication process, asking how AI systems can detect increasingly sophisticated counterfeit items and whether reliance on algorithms reduces human oversight. There is also significant interest in AI's role in dynamic pricing, specifically whether machine learning models can accurately reflect micro-market fluctuations, brand retention value, and seasonal demand more effectively than human appraisers, ensuring optimal returns for sellers and competitive pricing for buyers. Furthermore, users seek clarity on how AI enhances the platform experience, such as generating personalized recommendations based on past purchasing behavior and predictive trend analysis.

AI is fundamentally transforming the operational efficiency and integrity of luxury resale services. Machine learning algorithms analyze vast datasets of historical transaction prices, brand performance, condition metrics, and current fashion trends to provide highly accurate, real-time pricing recommendations, moving platforms away from static valuation methods. This precision minimizes inventory risk for direct purchase models and maximizes seller satisfaction in consignment arrangements. Crucially, AI-powered image recognition and analysis tools are being integrated into authentication workflows, scanning item photographs for subtle discrepancies in stitching, logos, and materials compared to authenticated reference databases. This dual system, combining AI screening with human verification, dramatically speeds up the authentication process while significantly reducing the margin of error, bolstering consumer trust in the secondary market ecosystem.

Beyond pricing and authentication, AI optimizes logistical planning and customer engagement. Predictive analytics forecasts inventory turnover rates, helping platforms manage storage and fulfillment requirements more efficiently. On the customer-facing side, natural language processing (NLP) improves search functionality and customer service chatbots, providing immediate responses regarding item availability, condition reports, and selling policies. The personalization driven by AI ensures that potential buyers are presented with curated selections that align precisely with their stated preferences and observed browsing behavior, increasing conversion rates and enhancing the overall perceived value of the luxury resale service.

- AI-driven dynamic pricing optimizes asset valuation based on real-time market indicators and historical data.

- Machine learning algorithms enhance authentication accuracy through sophisticated image analysis and counterfeit detection.

- Predictive analytics supports inventory management, forecasting optimal stock levels and turnover timing.

- Natural Language Processing (NLP) improves customer experience through advanced search and service automation.

- Personalized marketing and inventory curation increase buyer engagement and platform conversion rates.

DRO & Impact Forces Of Used Luxury Goods Selling Service Market

The Used Luxury Goods Selling Service Market is influenced by a compelling set of market forces, where sustainability concerns and digital advancements act as primary drivers, countered by persistent authentication challenges and high operational costs. The overwhelming desire for sustainable consumption among younger, wealthier demographics fuels demand, positioning resale as an ethically responsible alternative to fast fashion and even new luxury purchasing. Furthermore, the professionalization of the selling process, facilitated by robust digital platforms offering insurance and global logistics, removes friction for sellers and encourages high-value transactions. This momentum is slightly constrained by the complexity and cost associated with maintaining high-integrity authentication teams and combating increasingly sophisticated counterfeit networks, which require continuous investment in technological countermeasures.

Opportunities for growth are centered around market expansion into high-potential regions like Asia Pacific, particularly tapping into emerging wealthy populations in Southeast Asia who are highly digitally integrated but may lack established physical luxury resale infrastructure. The increasing acceptance of fractional ownership models and rental services, closely linked to the resale ecosystem, presents avenues for expanding the total addressable market. Furthermore, strategic partnerships between established luxury brands (Original Equipment Manufacturers or OEMs) and resale platforms offer substantial growth potential, integrating the secondary market directly into the brand experience, validating the items, and increasing consumer confidence exponentially. These impact forces collectively create a dynamic, high-growth environment characterized by technological innovation and evolving consumer ethics.

Segmentation Analysis

The Used Luxury Goods Selling Service Market is highly segmented, primarily delineated by the operational model of the service provider, the specific category of luxury item handled, and the channel through which the transaction is completed. Segmentation is crucial as it dictates the required expertise, logistical requirements, and target seller/buyer demographics for each service provider. Service models range from high-margin, high-control Direct Purchase (buyout) services to lower-risk Consignment models and hybrid approaches. Product segmentation demonstrates varying levels of liquidity, with handbags and watches exhibiting the strongest secondary market value retention, requiring specialized authentication teams for each category. Finally, the channel distinction between Online platforms, which offer vast selection and geographic reach, and Offline boutiques, which prioritize sensory experience and immediate trust, defines customer interaction models.

- Service Type:

- Consignment Model

- Direct Purchase (Buyout) Model

- Hybrid Model

- Product Type:

- Handbags and Accessories

- Jewelry and Watches

- Apparel (Ready-to-Wear, Vintage)

- Footwear (Luxury Sneakers, Designer Shoes)

- Selling Channel:

- Online Platforms (E-commerce, Apps)

- Offline Boutiques and Physical Stores

- Seller Type:

- Individual Sellers (C2C facilitated)

- Professional Resellers (B2C)

- Brand Partners (Brand-to-Resale)

Value Chain Analysis For Used Luxury Goods Selling Service Market

The value chain for the Used Luxury Goods Selling Service Market begins with Upstream activities centered on inventory acquisition, which involves sourcing from individual sellers, professional dealers, or through brand partnerships. This phase is critical and demands efficient intake processes, including initial submission, valuation, and negotiation. Downstream activities involve processing the item for sale, encompassing high-resolution photography, detailed condition reporting, professional cleaning or repair (if necessary), and most critically, multi-point authentication conducted by certified experts and supported by AI tools. The efficiency and reliability of these processes directly impact seller payout times and buyer confidence.

The distribution channel is predominantly digitized, leveraging sophisticated e-commerce platforms (Direct Channel) that offer global reach and seamless user experience. Indirect channels may include partnerships with established luxury department stores or curated physical consignment shops that offer a localized, high-touch sales environment. Key value additions within the chain include the authentication stamp, which significantly raises the item’s value, and the provision of secure logistics, including insured shipping and escrow services. Optimized payment processing and robust return policies further solidify the perceived reliability of the service provider, completing the full transaction cycle from sourcing to final delivery and customer service resolution.

Used Luxury Goods Selling Service Market Potential Customers

The primary customers in the Used Luxury Goods Selling Service Market are twofold: the sellers (liquidity providers) and the buyers (end-users/consumers). Sellers are typically high-net-worth individuals or affluent consumers seeking to monetize underutilized luxury assets, upgrade their collections, or participate in sustainable consumption cycles. These sellers prioritize transparency, high payout rates, speed of transaction, and the security guaranteed by a reputable service provider. They often utilize consignment models for maximum return or direct purchase models for immediate cash flow. Professional resellers, including small boutiques and specialized dealers, also utilize these services for inventory turnover and expanding their sourcing reach.

Buyers represent a diverse group, ranging from aspirational consumers seeking access to premium brands at a reduced cost to seasoned collectors searching for rare, vintage, or discontinued items not available in primary retail channels. Collectors prioritize provenance documentation, authenticated condition reports, and access to exclusive, curated inventory, often utilizing platforms specializing in high-end watches and jewelry. A significant cohort of modern buyers is driven by conscious consumption, viewing the purchase of used luxury goods as an ethical choice aligned with circular economy principles. These end-users demand a retail-quality experience, including professional packaging, verified authenticity, and reliable post-sale support, mirroring the experience of purchasing new luxury items.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 58.1 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The RealReal, Vestiaire Collective, Poshmark, eBay (Luxury Segment), Rebag, Fashionphile, Farfetch (Pre-Owned), ThredUp (Luxury Tier), Grailed, StockX (High-End Sneakers/Watches), Yoogi's Closet, Luxury Promise, Cudoni, 1stDibs, Collector Square, Lampoo, LuxeDH, WGACA, Xupes, Watchfinder & Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Used Luxury Goods Selling Service Market Key Technology Landscape

The technological landscape of the Used Luxury Goods Selling Service Market is centered on three core pillars: authentication, platform infrastructure, and customer engagement tools. Authentication technology heavily relies on a hybrid approach, integrating machine learning and computer vision to analyze product images and metadata against extensive historical databases to flag potential counterfeits with high speed. This technology, often proprietary, is crucial for maintaining market integrity. Furthermore, blockchain technology is emerging as a critical tool for digital provenance, allowing platforms to create immutable records of ownership transfer and authentication certificates, thereby enhancing transparency and long-term asset value retention for buyers and sellers of ultra-high-value items like watches and heritage jewelry.

Platform infrastructure necessitates scalable cloud computing environments capable of handling massive volumes of high-resolution image data and transactional throughput, especially during peak seasons. Advanced inventory management systems, often customized to track unique item serialization and condition reports across global warehouses, are essential for operational efficiency. Financial technologies (FinTech) are also vital, facilitating secure, multi-currency payment processing and offering streamlined instant payout options for sellers utilizing the direct purchase model, improving liquidity and service appeal.

Customer engagement is optimized through sophisticated web and mobile applications utilizing data analytics for personalized merchandising and predictive trend reporting. High-quality visual content management, including interactive 360-degree views and detailed video condition reports, replaces the tactile experience of luxury shopping. Technologies such as augmented reality (AR) are beginning to be piloted, allowing customers to virtually try on items like jewelry or accessories, significantly reducing return rates and enhancing the remote purchasing experience for luxury items where physical inspection is traditionally paramount. The successful deployment of these integrated technologies is the primary determinant of competitive advantage in this rapidly evolving digital resale space.

Regional Highlights

Geographic analysis reveals distinct consumption patterns and operational maturity across key global regions. North America dominates the Used Luxury Goods Selling Service Market in terms of current market size and technological innovation. The region benefits from a high concentration of sophisticated, well-funded digital platforms, high rates of consumer willingness to sell and purchase pre-owned goods, and a mature logistical infrastructure that supports rapid processing and shipping. The cultural shift towards sustainable luxury consumption is particularly pronounced here, driving robust demand across all major product categories, especially designer handbags and high-end apparel. Market leaders in North America often set the global standard for AI-driven authentication and dynamic pricing strategies, leading to high transaction volumes and high average selling prices (ASPs).

Europe, driven by nations with strong heritage luxury markets such as France, Italy, and the UK, represents the second largest market. European consumers often exhibit a greater appreciation for vintage and heritage pieces, leading to strong performance in the rare watches, fine jewelry, and vintage couture segments. The regulatory environment in the EU, particularly concerning e-commerce and consumer protection, ensures high standards for authentication and transparency, which bolsters consumer confidence. Regional growth is bolstered by platforms specializing in intra-European resale, catering to the nuanced, brand-specific tastes of diverse national markets while also attracting cross-border sales from the Middle East and Asia.

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This growth is primarily fueled by the rapid expansion of the affluent class, particularly in China, South Korea, and Japan, coupled with high digital adoption rates. While cultural barriers to used goods consumption have historically been higher in some parts of APAC, this perception is rapidly diminishing among younger generations who are highly influenced by global sustainability trends and celebrity culture. Key challenges in APAC include navigating complex cross-border logistics and establishing localized trust in authentication processes. However, dedicated regional platforms and the expansion of global leaders into these markets are successfully addressing these issues, particularly by emphasizing traceability and technological assurance.

- North America: Market leader defined by high consumer acceptance, mature digital infrastructure, and rapid adoption of AI for pricing and authentication. Strong market for handbags, watches, and contemporary apparel.

- Europe: High value in vintage, heritage luxury items, and fine jewelry. Market growth supported by strong consumer protection regulations and established luxury brand history.

- Asia Pacific (APAC): Fastest growing region, driven by expanding affluent populations, high digital penetration, and increasing cultural acceptance of resale, especially in China and South Korea.

- Latin America (LATAM): Emerging market characterized by high demand for imported luxury goods and growing local platforms focused on accessible luxury resale and secure local transactions.

- Middle East and Africa (MEA): Growth driven by high purchasing power in GCC nations, focusing primarily on high-value items like luxury watches and fine jewelry. Authentication and secure international logistics are paramount concerns in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Used Luxury Goods Selling Service Market.- The RealReal

- Vestiaire Collective

- Poshmark

- eBay (Luxury Segment)

- Rebag

- Fashionphile

- Farfetch (Pre-Owned)

- ThredUp (Luxury Tier)

- Grailed

- StockX (High-End Sneakers/Watches)

- Yoogi's Closet

- Luxury Promise

- Cudoni

- 1stDibs

- Collector Square

- Lampoo

- LuxeDH

- WGACA

- Xupes

- Watchfinder & Co.

Frequently Asked Questions

Analyze common user questions about the Used Luxury Goods Selling Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the substantial growth in the Used Luxury Goods Selling Service Market?

The primary drivers include the shift towards circular fashion and sustainable consumption practices among consumers, coupled with significant technological advancements, particularly in AI-driven authentication and streamlined global e-commerce logistics, which build robust buyer trust.

How do luxury resale platforms ensure the authenticity of pre-owned items?

Platforms utilize a hybrid authentication methodology that combines the expertise of human specialists with advanced AI and machine learning tools for detailed image analysis. Emerging technologies like blockchain are also being adopted to create immutable digital provenance records.

Which product segment holds the highest value retention in the resale market?

High-end watches and iconic designer handbags generally demonstrate the strongest value retention and highest average transaction values (ATVs) due to their enduring brand status, limited production runs, and strong investment appeal.

What is the difference between Consignment and Direct Purchase models for sellers?

The Consignment model offers sellers potentially higher payout rates once the item sells, while the Direct Purchase (buyout) model provides immediate liquidity, as the platform purchases the item outright, assuming inventory risk for a faster transaction.

What is the expected impact of Artificial Intelligence on pricing in this market?

AI facilitates dynamic, real-time pricing by analyzing current market demand, item condition, historical sales data, and micro-trends, leading to more competitive and accurate valuations that benefit both sellers (optimal returns) and buyers (fair prices).

The acceleration of the Used Luxury Goods Selling Service Market is intrinsically linked to the broader digitalization of retail and the cultural re-evaluation of ownership versus access. As environmental consciousness continues to rise, especially among Millennial and Gen Z affluents, the resale market transitions from a niche alternative to a foundational component of the overall luxury sector. Investment in operational excellence, particularly in swift and flawless authentication processes, remains paramount for maintaining customer confidence and achieving market leadership.

Market segmentation analysis confirms that specialized platforms catering to specific product categories, such as high-end watches or vintage couture, often achieve higher margins and greater collector loyalty due to deep vertical expertise. The shift toward hybrid service models is notable, allowing platforms flexibility to address diverse seller needs—offering immediate payment for high-demand items and consignment for rarer, high-margin pieces. Geographically, while established Western markets provide stability and volume, the exponential growth projected in APAC emphasizes the need for localized operational strategies and partnerships to capitalize on new wealth generation.

The competitive landscape is increasingly defined by technological capability rather than just inventory size. Companies that successfully integrate AI for valuation and fraud detection, while also leveraging sophisticated digital marketing tools to curate unique buyer experiences, are poised for long-term dominance. Furthermore, strategic alliances between traditional luxury houses and leading resale platforms are expected to legitimize the secondary market further, facilitating cleaner inventory cycles and expanding the addressable market size significantly by bringing first-hand trust into the second-hand domain. This maturation of the ecosystem suggests a durable and sustainable growth trajectory well into the next decade.

The complexity inherent in managing a global inventory of unique, high-value items necessitates robust cloud architecture and sophisticated Enterprise Resource Planning (ERP) systems tailored for the resale context. Unlike standard retail, every SKU in the used luxury market is essentially unique, requiring individual tracking, documentation (including photographic evidence of condition), and precise authentication steps. Effective management of this complexity is a core differentiator, minimizing errors and mitigating the substantial financial risks associated with counterfeit goods entering the supply chain. Continuous investment in data security and privacy protocols is equally critical, especially as platforms handle sensitive financial data and high-net-worth customer profiles across international jurisdictions.

Regarding market access and entry strategies, firms are increasingly focusing on vertical integration or deep strategic partnerships. Integrating logistics providers specializing in high-security transport for items like jewelry and watches ensures reliability. Moreover, the evolution of customer service, moving beyond standard help desks to include expert personal shopping assistants for vintage sourcing or investment advice, enhances the luxury appeal of the service. These high-touch service elements, though expensive, justify the premium commissions charged by top-tier platforms, solidifying their competitive position against lower-cost, peer-to-peer marketplaces.

The regulatory environment, particularly concerning import duties, VAT, and traceability requirements across different regions, poses an ongoing challenge that successful platforms must expertly navigate. Standardization of condition grading (e.g., A, B+, C classifications) across the industry remains a goal, as discrepancies in grading can lead to consumer disputes and erode trust. Platforms that establish widely recognized, trustworthy grading systems gain a significant competitive edge, allowing buyers to make remote purchasing decisions with greater confidence, thereby accelerating cross-border transactions and increasing overall market liquidity. This dedication to transparent, standardized operational practices is essential for sustained scale in a trust-dependent sector.

Further analysis of the Product Type segmentation reveals nuanced growth patterns. While Handbags and Accessories drive the overall volume and are highly liquid, the Watches and Jewelry segment commands the highest capital value and often attracts investment-oriented buyers. This segment requires specialized expertise, often necessitating the hiring of certified horologists and gemologists, and platforms dedicated to these assets usually feature higher security measures and insurance policies. The Apparel segment, while possessing greater transactional volume than watches, faces challenges related to condition assessment, fluctuating fashion trends, and lower average selling prices compared to hard luxury goods, requiring greater efficiency in processing and warehousing.

The interplay between Online and Offline channels is also becoming increasingly blurred (omnichannel strategy). Leading digital platforms are opening temporary pop-up shops or permanent authentication centers in high-traffic luxury districts. These physical touchpoints serve multiple strategic purposes: they provide a secure drop-off point for sellers, allow potential buyers to inspect high-value items before committing, and significantly enhance brand visibility and trust in an otherwise virtual transaction environment. This blended strategy is particularly effective in high-growth metropolitan areas where consumers still value a tangible connection to the luxury product.

The ongoing threat of counterfeiting remains the most significant restraint on market expansion, demanding continuous and substantial investment in security and anti-fraud measures. This arms race against sophisticated counterfeiters necessitates collaborative efforts across the industry, including information sharing regarding new fraud techniques and investing in shared authentication technologies. Successfully mitigating this risk is not just an operational necessity but a key determinant of the long-term viability and growth potential of the organized used luxury goods selling service market. Consumers are willing to pay a premium for verified authenticity, underscoring its central role in the value proposition.

Opportunities are arising from leveraging the influence of social commerce. Luxury resale platforms are increasingly utilizing influencer marketing and integrated shopping features on social media platforms to reach younger demographics directly where they consume content. This integration shortens the purchase funnel and makes the discovery of pre-owned luxury items more engaging and spontaneous. Furthermore, the development of subscription or rental models for high-end accessories is often facilitated by resale platforms, creating new revenue streams and bringing in customers who may eventually transition into outright buyers in the pre-owned market. These novel business models demonstrate the agility and innovation defining the current market structure.

In terms of technology, Predictive Maintenance and repair technologies are starting to play a role, particularly for complex mechanical goods like luxury watches. Platforms can partner with certified repair centers to offer pre-sale restoration services, enhancing the item's marketability and value retention. This value-added service positions the resale platform not just as a transaction facilitator but as a full-cycle luxury asset manager, providing ongoing care and maintenance guidance to sustain the asset’s longevity and secondary market appeal. Such extended service offerings differentiate leading players and reinforce their expertise within the luxury domain.

The concept of data monetization also provides a strong undercurrent of opportunity. The vast datasets collected by major resale platforms—encompassing historical pricing, brand liquidity, consumer behavior, and geographical demand trends—are highly valuable. Platforms can leverage this proprietary market intelligence to advise luxury brands on primary market production strategy, design longevity, and retail pricing, establishing a symbiotic relationship between the primary and secondary luxury markets. This data loop solidifies the strategic importance of resale services within the broader luxury economy, moving them beyond mere liquidation services to influential market analysts and trend predictors.

The regional analysis of Latin America highlights significant potential, particularly in countries experiencing rapid digitalization and a growing disparity between high local import taxes on new luxury goods and the accessibility of pre-owned items. Platforms entering LATAM must focus on localizing payment methods, overcoming significant logistical hurdles (including customs and security), and building intense seller/buyer trust through transparent, traceable transactions. Growth in MEA is largely concentrated in the GCC states, driven by high disposable income and a demand for ultra-exclusive, high-value hard luxury items. The operational focus here is on establishing specialized, secure vaults for item storage and offering white-glove delivery services commensurate with the value of the items traded.

Finally, the evolution of the seller base is moving towards greater sophistication. High-volume sellers are demanding specialized API integrations and dedicated account management services to facilitate large-scale inventory transfers. This B2C (Business-to-Consumer) aspect of the selling service is gaining prominence, recognizing professional resellers and small boutiques as key liquidity providers. Catering to these professional entities requires distinct pricing models, batch processing capabilities, and advanced reporting tools, further differentiating the high-end platform service from basic consumer-to-consumer (C2C) marketplaces and highlighting the market’s maturation into a comprehensive B2B/B2C ecosystem.

The overall character of the Used Luxury Goods Selling Service Market is defined by a paradox: it is an environmentally conscious, digitally driven sector focused on securing the highest possible yield from tangible, legacy assets. Success relies on balancing the impersonal efficiency of advanced technology (AI pricing, blockchain provenance) with the necessary high-touch, human element required for true luxury service, particularly in authentication and client management. This strategic balance ensures that the service remains attractive to affluent sellers and discerning buyers who demand both trust and convenience in equal measure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager