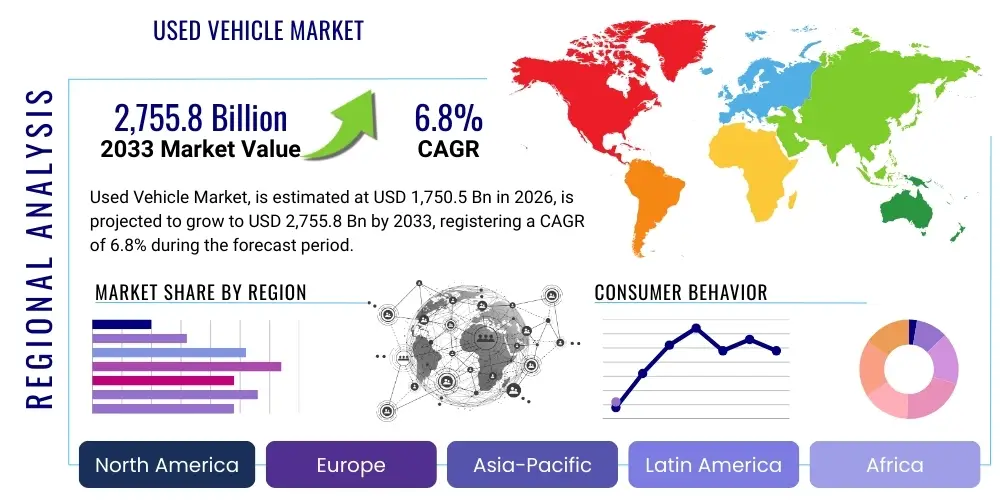

Used Vehicle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437533 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Used Vehicle Market Size

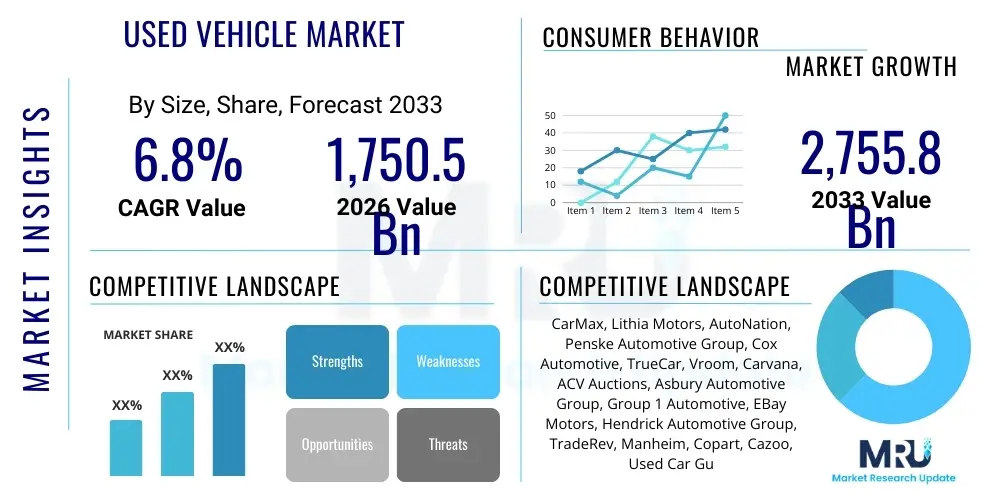

The Used Vehicle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1,750.5 billion in 2026 and is projected to reach USD 2,755.8 billion by the end of the forecast period in 2033.

Used Vehicle Market introduction

The Used Vehicle Market encompasses the trade, distribution, and sale of pre-owned automotive assets, ranging from passenger cars (sedans, SUVs, hatchbacks) to commercial vehicles (trucks, vans). This mature yet highly dynamic market serves as a critical economic component, offering affordable mobility solutions to consumers globally, especially in emerging economies where new vehicle purchases may be prohibitive. The product description involves diverse inventory, defined by factors such as age, mileage, condition, and service history. Key applications of used vehicles include personal transportation, ride-sharing services, last-mile delivery logistics, and business fleet replacement strategies, highlighting the versatility and essential nature of this market segment across various socio-economic groups.

Major driving factors fueling the expansion of this market include the rising average transaction price of new vehicles, leading to greater demand elasticity for lower-cost alternatives. Additionally, the increasing penetration of digital platforms and online marketplaces has significantly improved transparency, accessibility, and consumer trust, streamlining the transaction process and expanding geographical reach. The shift in consumer preference toward private ownership post-pandemic, coupled with increased supply from shorter new-vehicle replacement cycles in developed markets, further propels market growth. The principal benefits derived from the used vehicle market are enhanced affordability, immediate availability (contrasting new vehicle order backlogs), and reduced depreciation risk, making it an economically prudent choice for a significant portion of the global population.

Used Vehicle Market Executive Summary

The global used vehicle market exhibits strong foundational growth, primarily driven by macroeconomic factors such as rising inflation impacting new vehicle affordability and the subsequent expansion of the consumer base for pre-owned assets. Business trends indicate a fundamental shift towards certified pre-owned (CPO) programs, championed by Original Equipment Manufacturers (OEMs) and major dealership networks, enhancing quality assurance and commanding premium pricing. Furthermore, technology adoption, including advanced Vehicle History Reports (VHRs) and sophisticated AI-driven pricing algorithms, is professionalizing the market structure and attracting significant venture capital investment into digital retail ecosystems. The continued development of omnichannel sales models, integrating physical inspection centers with expansive online inventory, remains a central theme in market evolution.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid urbanization, increasing disposable incomes in countries like India and China, and the emergence of structured dealership formats replacing informal peer-to-peer (P2P) transactions. North America and Europe maintain dominance in market value, characterized by high vehicle turnover rates, established CPO frameworks, and advanced regulatory environments ensuring consumer protection. Segment trends highlight that the SUV and crossover segments maintain their robust popularity in the used market, mirroring new vehicle trends, while the supply of used electric and hybrid vehicles is beginning to significantly increase, creating novel challenges and opportunities related to battery health assessment and valuation. The shift toward sustainable mobility solutions is incrementally penetrating the pre-owned segment, requiring new analytical tools for residual value determination.

AI Impact Analysis on Used Vehicle Market

Users frequently inquire about how Artificial Intelligence (AI) will revolutionize pricing accuracy, enhance the online purchasing experience, and ensure vehicle reliability in the used car sector. Key concerns center around the fairness of AI-driven valuation models, the ability of AI to detect undisclosed vehicle damage or maintenance issues, and the integration of AI tools by consumers versus large dealerships. Analysis shows users expect AI to primarily reduce informational asymmetry, improve inventory management efficiency for sellers, and personalize recommendations for buyers. The central theme emerging is the expectation that AI will standardize the often-subjective valuation process, leading to greater consumer trust and facilitating seamless digital transactions through automated appraisal and predictive maintenance insights.

- AI-Powered Dynamic Pricing: Utilizing machine learning algorithms to analyze real-time market data (demand, supply, seasonality, competitor pricing) for optimized, location-specific valuation and instantaneous pricing adjustments.

- Enhanced Fraud Detection and Transparency: Deploying AI and computer vision models to rapidly analyze vehicle images, historical records, and repair invoices, identifying inconsistencies or potential fraudulent activity in listings.

- Personalized Recommendation Engines: Using AI to process buyer search histories, demographic data, and stated preferences to suggest highly relevant vehicle matches, accelerating the purchase decision funnel.

- Predictive Maintenance and Reliability Scores: Developing models to predict future maintenance needs and assign reliability scores based on vehicle specifics (model, mileage, driving patterns), increasing consumer confidence in older inventory.

- Automated Customer Service (Chatbots/Virtual Agents): Implementing AI-driven conversational interfaces for immediate query resolution regarding inventory availability, financing options, and scheduling test drives.

DRO & Impact Forces Of Used Vehicle Market

The Used Vehicle Market is fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Major drivers include the increasing disposable income in emerging markets, the affordability gap created by high new vehicle prices, and the superior transparency offered by digital platforms which mitigates historical consumer distrust. These forces collectively boost demand across various economic strata. Conversely, restraints predominantly involve inconsistent regulatory frameworks concerning vehicle standards and emissions in some regions, the risk associated with battery degradation in used electric vehicles (a growing concern), and potential fluctuations in interest rates affecting finance availability. Successfully navigating these impact forces requires adaptability and significant investment in quality assurance and technological infrastructure.

Opportunities for expansion are abundant, centered around the rapid institutionalization of the market, particularly the proliferation of CPO programs which assure quality and drive higher transaction volumes. The advent of subscription models for used vehicles presents a new revenue stream, appealing to consumers seeking flexibility over outright ownership. Furthermore, the global semiconductor shortage, while initially restricting new vehicle supply, has long-term positive impact forces on the used market by sustaining high residual values and channeling budget-conscious buyers into pre-owned segments. Strategic differentiation through ancillary services, such as enhanced warranties and financing packages, will determine competitive advantage among major market participants, ensuring sustained growth and market consolidation.

Segmentation Analysis

Segmentation analysis of the Used Vehicle Market reveals diverse consumer behaviors and operational dynamics across different dimensions, including source of sale, vehicle type, fuel type, and end-user base. Understanding these segments is crucial for strategic pricing, inventory management, and targeted marketing efforts. The market is increasingly polarizing between professional dealer-led transactions (offering assurance and financing) and cost-effective, but riskier, customer-to-customer (C2C) transactions, often facilitated by online listing platforms. Moreover, shifts in consumer environmental consciousness are beginning to subtly influence demand across traditional gasoline/diesel vehicles versus the slowly emerging electric/hybrid used car segment.

The segmentation by Vehicle Type remains highly sensitive to prevailing new car trends; the dominance of Sport Utility Vehicles (SUVs) and Crossovers is pronounced globally due to their perceived utility and safety features. Geographically, segmentation by fuel type varies significantly, with developed nations seeing faster adoption of used electric vehicles, while many developing economies still rely heavily on conventional gasoline and diesel engines due to infrastructure limitations and lower immediate purchase costs. Professional dealers are prioritizing inventory acquisition in high-demand segments to maximize profit margins, whereas C2C platforms serve a broader spectrum of lower-value or niche vehicles.

- Source of Sale:

- Franchise Dealers (CPO Programs)

- Independent Dealers

- Peer-to-Peer (C2C) Sales

- Auction Houses

- Vehicle Type:

- Hatchback

- Sedan

- SUV/Crossover

- Luxury Vehicles

- Light Commercial Vehicles (LCV)

- Fuel Type:

- Gasoline

- Diesel

- Electric (EV)

- Hybrid

- End-User:

- Individuals/Households

- Businesses/Fleet Operators (Including Ride-Sharing)

Value Chain Analysis For Used Vehicle Market

The Value Chain for the Used Vehicle Market is structurally complex, primarily involving procurement (upstream), reconditioning and certification (mid-stream), and sales and financing (downstream). Upstream analysis focuses on vehicle sourcing, which is highly diversified, including trade-ins at new car dealerships, lease returns, fleet decommissioning, and direct purchases from private sellers. Efficiency in procurement, driven by accurate automated appraisal tools, directly impacts the initial cost basis. The mid-stream activities, particularly comprehensive mechanical and cosmetic reconditioning, are vital for value addition, with CPO programs setting the benchmark for quality and increasing consumer willingness to pay a premium.

Downstream processes center on effective distribution channels and supporting services. Distribution can be classified as direct (franchise or independent dealer sales, online marketplaces directly connecting buyers/sellers) and indirect (auctions serving as intermediaries). The proliferation of digital platforms has heavily influenced the indirect distribution model, providing real-time bidding and logistics coordination. Critical supporting services, such as inventory financing, consumer loans, warranty provision, and insurance packages, are integrated throughout the sales process, significantly enhancing transaction feasibility and profitability. Optimizing logistics, from vehicle transport to regulatory documentation, is key to minimizing cycle time and maximizing capital turnover.

Used Vehicle Market Potential Customers

The potential customer base for the Used Vehicle Market is exceptionally broad, spanning multiple socio-economic and demographic groups globally. End-users primarily consist of budget-conscious individual consumers, including first-time car buyers, students, and low-to-middle income households, for whom the affordability and lower depreciation rate of a used car make it the most viable mobility option. These buyers prioritize reliability and low maintenance costs, often relying on structured financing options provided by dealers or third-party lenders. The digital tools for remote inspection and vehicle history checks are crucial engagement points for this segment.

Beyond individual consumers, a substantial portion of the market is driven by commercial demand. Businesses and fleet operators, including burgeoning ride-sharing services and small to medium-sized enterprises (SMEs) requiring delivery or service vehicles, represent key buyers. These entities often purchase vehicles in bulk, focusing on maximizing total cost of ownership (TCO) efficiency and seeking out reliable, well-maintained fleets. Furthermore, high-income consumers sometimes purchase late-model, low-mileage used luxury or specialized vehicles (e.g., specific sports cars) to bypass the long waiting times associated with new high-demand models, demonstrating the market's appeal across all income brackets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,750.5 Billion |

| Market Forecast in 2033 | USD 2,755.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CarMax, Lithia Motors, AutoNation, Penske Automotive Group, Cox Automotive, TrueCar, Vroom, Carvana, ACV Auctions, Asbury Automotive Group, Group 1 Automotive, EBay Motors, Hendrick Automotive Group, TradeRev, Manheim, Copart, Cazoo, Used Car Guys, Spinny, Cars24 |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Used Vehicle Market Key Technology Landscape

The technology landscape for the Used Vehicle Market is undergoing rapid digital transformation, driven by the need for greater efficiency, valuation accuracy, and consumer trust. Central to this landscape are advanced data analytics and valuation software, utilizing vast datasets on sales history, depreciation curves, and market liquidity to generate real-time, highly accurate appraisals (often known as Instant Cash Offers or ICOs). This data-driven approach minimizes risk for dealers and provides transparency to sellers. Furthermore, the integration of blockchain technology is being explored to create immutable, secure vehicle history records (VHRs), thereby eliminating odometer fraud and ensuring tamper-proof documentation regarding ownership, repairs, and maintenance.

Complementing these data-centric tools are visualization and inspection technologies essential for online sales. High-resolution 360-degree interior and exterior imagery, often captured via automated scanning booths, provides consumers with a virtual inspection capability mirroring a physical visit. Furthermore, telematics integration, while nascent in the used sector, is becoming crucial, enabling remote diagnostics and verification of vehicle health prior to sale, especially for newer used models. The technology ecosystem also relies heavily on Customer Relationship Management (CRM) tools customized for high-volume automotive sales cycles, facilitating lead management, finance application processing, and post-sale follow-up, ensuring an efficient, streamlined customer journey in an omnichannel environment.

Regional Highlights

Regional dynamics play a crucial role in shaping the global Used Vehicle Market, largely influenced by varying economic conditions, regulatory frameworks, and consumer preferences regarding vehicle ownership and size. North America, particularly the United States, represents a mature and highly structured market, dominated by large dealer groups and robust online platforms. This region benefits from high average disposable income, leading to frequent vehicle replacement cycles (often 3-5 years) which ensure a constant, high-quality supply of low-mileage used cars. Consumer trust is relatively high due to established certification programs and standardized vehicle history reporting.

Asia Pacific (APAC) is characterized by immense potential and heterogeneity. Countries like India and China are witnessing explosive growth, transitioning from predominantly informal C2C transactions to organized, institutionalized dealer structures supported by significant digital investment. Economic growth in ASEAN nations fuels demand for affordable mobility, making used vehicles essential. However, Europe demonstrates a focus on regulatory compliance, with stringent emissions standards (e.g., Euro 6) influencing the trade-in value of older diesel vehicles and accelerating the transition towards used hybrid and smaller gasoline cars. Latin America and MEA continue to face challenges regarding consistent supply quality and financing availability, though digitalization is gradually improving transparency and formalizing sales channels.

- North America: Market leader in value, characterized by high vehicle turnover, sophisticated online sales platforms, and the maturity of Certified Pre-Owned (CPO) programs backed by major OEMs.

- Asia Pacific (APAC): Fastest-growing region, driven by rapid urbanization, increasing middle-class disposable income, and the institutionalization of the used car market (e.g., rise of organized players in India and China).

- Europe: Focus on regulatory adherence, with a strong demand for used compact cars and crossovers. The transition to used EVs is accelerating in Scandinavian countries and Western Europe, posing valuation challenges.

- Latin America: Growing reliance on used imports due to cost constraints, with localized markets benefiting from improved financing accessibility, though facing infrastructure limitations for digitalization.

- Middle East and Africa (MEA): Highly fragmented market, with strong regional hubs (UAE) serving as significant re-export centers for vehicles destined for surrounding African and Asian countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Used Vehicle Market.- CarMax

- Lithia Motors

- AutoNation

- Penske Automotive Group

- Cox Automotive (Manheim, Autotrader, Kelley Blue Book)

- TrueCar

- Vroom

- Carvana

- ACV Auctions

- Asbury Automotive Group

- Group 1 Automotive

- EBay Motors

- Hendrick Automotive Group

- TradeRev (KAR Auction Services)

- Copart

- Cazoo (European market)

- DriveTime

- Spinny (Indian market)

- Cars24 (Asian market)

- Sina Technology (China)

Frequently Asked Questions

Analyze common user questions about the Used Vehicle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current high valuation of used vehicles globally?

The primary driver is the prolonged supply chain disruption in the new vehicle market, specifically the semiconductor shortage, which restricted new car production. This scarcity shifted consumer demand and inflated residual values across nearly all segments of the used vehicle inventory, sustaining high prices.

How significant is the role of digital platforms in the future of used vehicle sales?

Digital platforms are foundational to future market growth. They enhance transparency through instant online appraisals, sophisticated vehicle history reports, and seamless omnichannel financing options. This shift is lowering transactional friction and increasing market efficiency significantly.

What are the primary risks associated with purchasing a used Electric Vehicle (EV)?

The main risk involves battery health and degradation, as battery replacement is a high-cost component. Specialized diagnostics for evaluating remaining battery capacity and establishing standardized valuation methods for used EVs are critical areas currently being addressed by industry stakeholders.

Which segmentation strategy yields the highest profit margin in the used car market?

The Certified Pre-Owned (CPO) segmentation, primarily managed by franchise dealers, yields the highest gross profit margins. CPO vehicles command a premium due to manufacturer-backed warranties, rigorous inspection standards, and comprehensive reconditioning, ensuring superior quality and consumer confidence.

How does the increasing interest rate environment affect the Used Vehicle Market?

Rising interest rates increase the overall cost of vehicle financing, slightly dampening consumer purchasing power, especially for budget-sensitive buyers. While this may cool down demand for high-end used models, it simultaneously reinforces the core appeal of used cars as a necessary, affordable alternative to prohibitively expensive new vehicles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager