Utility Carts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434053 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Utility Carts Market Size

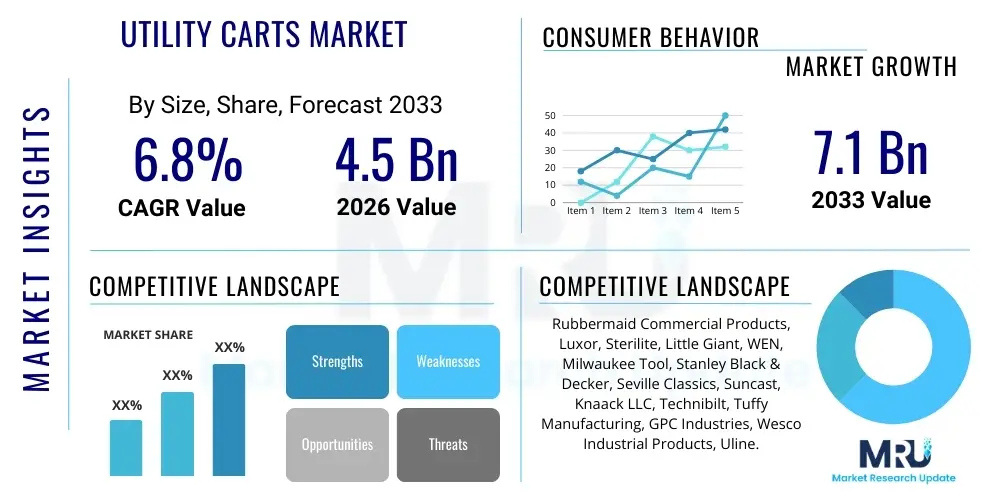

The Utility Carts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $7.1 Billion by the end of the forecast period in 2033.

Utility Carts Market introduction

The Utility Carts Market encompasses the manufacturing, distribution, and sale of material handling equipment designed primarily for transporting goods, tools, and supplies across various short-distance industrial, commercial, and residential environments. These carts are essential components in enhancing operational efficiency by reducing manual labor intensity and streamlining internal logistics. The product range is diverse, including rolling carts, shelf carts, flatbed carts, and specialized service carts, characterized by durability, ergonomic design, and load-bearing capacity tailored to specific application requirements.

Major applications for utility carts span key sectors such as retail for stock replenishment, healthcare for moving medical supplies and equipment, hospitality for housekeeping and maintenance, and manufacturing for assembly line support and tool transport. The fundamental design premise centers on mobility and stability, incorporating features like heavy-duty casters, modular shelving, and often, braking mechanisms. The increasing global focus on workplace safety and efficiency optimization across supply chains acts as a significant catalyst for market expansion, driving demand for technologically advanced and ergonomically designed carts.

The primary benefits derived from the adoption of utility carts include significant improvements in productivity, minimized risk of employee injury associated with manual lifting, and better organization of workspaces. Driving factors propelling this market include the rapid expansion of the e-commerce sector necessitating efficient warehouse and fulfillment operations, rising infrastructure development in emerging economies, and the continuous push towards automation and standardization of material handling processes within institutions and industries globally. Furthermore, advancements in materials science, particularly the use of lighter and stronger polymers and alloys, are allowing manufacturers to produce carts with higher load capacities and extended service life.

Utility Carts Market Executive Summary

The Utility Carts Market is experiencing robust growth driven predominantly by the escalating demand from the logistics and healthcare sectors, which require reliable, hygienic, and scalable transportation solutions. Key business trends indicate a strong shift towards customization, where manufacturers are offering modular designs and smart features, such as integrated charging stations or sensors for inventory management, to cater to specialized industry needs. Competition remains high, forcing manufacturers to focus on supply chain resilience and material innovation, particularly in developing corrosion-resistant and sterilization-compatible carts for the clinical environment, ensuring product differentiation and sustained market relevance amidst global economic fluctuations.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, largely due to rapid industrialization, burgeoning retail infrastructure development, and substantial investment in healthcare facilities in countries like China and India. North America and Europe maintain dominance in terms of market value, characterized by the stringent regulatory standards concerning workplace ergonomics and the high adoption rate of heavy-duty, mechanized utility carts in established manufacturing bases and large commercial enterprises. Geopolitical stability and local manufacturing capabilities often determine the pricing and distribution dynamics within these regions, favoring local suppliers who can offer shorter lead times and localized service support.

Segment trends underscore the rising preference for high-density polyethylene (HDPE) and other composite material carts over traditional metal options in certain environments, owing to their lighter weight, resistance to corrosion, and ease of cleaning, particularly in food service and healthcare applications. The heavy-duty capacity segment is also witnessing substantial growth, fueled by the expansion of large-scale distribution centers and warehouses requiring carts capable of handling significant loads frequently. Technology integration, though nascent, is gaining traction, with connected carts enabling real-time asset tracking and maintenance scheduling, signaling future market evolution towards smart logistics solutions and predictive maintenance models.

AI Impact Analysis on Utility Carts Market

Common user questions regarding AI's impact on the Utility Carts Market center on how artificial intelligence and related technologies, such as IoT and advanced robotics, will transform traditional utility carts into 'smart' assets, or whether robotic automation will completely displace manual carts. Users are particularly concerned about the feasibility of integrating AI for dynamic route optimization, predictive maintenance of cart components (especially casters and braking systems), and automated inventory management directly linked to the cart's location and payload. The key expectation is that AI will enhance efficiency through improved fleet management, minimizing downtime, and providing data-driven insights into material flow, ultimately leading to greater operational efficiency rather than outright replacement of physical utility cart structures.

- AI-powered fleet management systems optimize the allocation and utilization of existing cart inventories within large facilities, minimizing bottlenecks.

- Predictive maintenance algorithms analyze usage patterns and sensor data to forecast potential failures of critical cart components (e.g., bearings, wheels), reducing unexpected operational downtime.

- Integration with IoT sensors allows utility carts to become mobile data nodes, feeding real-time location and payload information into centralized inventory control systems.

- AI facilitates dynamic route planning for personnel utilizing carts in complex environments, such as hospitals or massive warehouses, enhancing traversal efficiency.

- Automated sanitation and sterilization verification processes for carts in sensitive environments (e.g., healthcare) can be monitored and certified using AI and computer vision.

DRO & Impact Forces Of Utility Carts Market

The Utility Carts Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces. Key drivers include the massive growth in global e-commerce necessitating robust, rapid internal logistics solutions, the implementation of stricter occupational health and safety regulations promoting ergonomic equipment use, and the continued need for cost-effective material handling alternatives where full automation is impractical or prohibitively expensive. These factors create a sustained demand foundation, particularly for specialized, high-capacity, and easy-to-maneuver carts across diverse industrial settings globally.

Restraints primarily revolve around the volatile pricing of raw materials, such as steel, aluminum, and certain specialty polymers, which affects manufacturing costs and final product pricing, making substitution with cheaper alternatives possible in price-sensitive markets. Additionally, the increasing capital investment in complete robotic automation and Automated Guided Vehicles (AGVs) in highly sophisticated logistical centers presents a long-term threat to the high-end utility cart segment, potentially capping growth where budgets allow for full modernization. The perceived longevity of traditional carts also slows down replacement cycles, especially in smaller businesses that operate on tighter capital expenditure budgets.

Opportunities for market players are significant, centered on product innovation, particularly the development of lightweight, sustainable materials (eco-friendly plastics or recycled metals), and the integration of smart technologies like GPS tracking and RFID tagging into standard models, moving towards the 'connected utility cart'. Furthermore, untapped potential exists in developing highly specialized utility carts for niche applications, such as temperature-controlled transport for pharmaceutical or food delivery, and modular systems that can adapt quickly to changing operational needs, offering manufacturers pathways for premiumization and market penetration into specialized verticals.

Segmentation Analysis

The Utility Carts Market is comprehensively segmented based on material, load capacity, application, and distribution channel, reflecting the varied functional requirements across different end-use industries. Analyzing these segments provides critical insights into purchasing patterns and technological preferences. The capacity segment, for instance, dictates the engineering requirements, with heavy-duty carts demanding robust frame materials and specialized wheel assemblies, while light-duty carts prioritize maneuverability and aesthetics. The increasing diversification of manufacturing and service sectors globally necessitates tailored segmentation strategies for both product design and targeted marketing efforts.

Material segmentation reveals a dynamic shift, with metal (steel, aluminum) remaining dominant for industrial strength and durability, but plastics (polyethylene, polypropylene) gaining significant market share, especially in environments prioritizing hygiene, such as healthcare and food service, due to their non-corrosive and easy-to-clean properties. Application segmentation clearly delineates between high-volume retail logistics, where speed and stackability are crucial, and specialized industrial settings, where resistance to harsh chemicals or high temperatures dictates material choice and design features. Understanding these granular segment behaviors is essential for strategic planning and optimizing product portfolios for maximum market impact.

- By Material:

- Metal (Steel, Aluminum)

- Plastic (HDPE, Polypropylene)

- Hybrid/Composite Materials

- By Load Capacity:

- Light-Duty (Up to 150 lbs)

- Medium-Duty (151 lbs to 500 lbs)

- Heavy-Duty (Above 500 lbs)

- By End-Use Industry:

- Industrial & Manufacturing

- Healthcare & Pharmaceutical

- Retail & E-commerce Logistics

- Hospitality & Food Service

- Residential & DIY

- By Distribution Channel:

- Offline (Specialty Stores, Retail Chains)

- Online (E-commerce Platforms, Company Websites)

Value Chain Analysis For Utility Carts Market

The Utility Carts market value chain commences with upstream activities involving raw material procurement, primarily steel, aluminum, and various polymers. The efficiency and pricing stability of this initial stage are crucial, as fluctuations in global commodity markets directly impact the final cost structure. Key upstream challenges include securing high-grade, sustainable materials and managing supplier relationships to ensure timely delivery and consistent quality control. Manufacturers often engage in vertical integration or long-term contracts to mitigate risk associated with supply volatility, ensuring a steady stream of inputs for fabrication processes such as stamping, welding, molding, and finishing.

The core manufacturing and assembly stage involves design engineering, fabrication, and quality assurance. This phase focuses heavily on optimizing ergonomic design, structural integrity, and integration of specialized components like high-performance casters and braking systems. Following production, the finished products move into distribution channels. Direct channels involve large manufacturers selling directly to major industrial and retail clients (B2B), offering customization and volume discounts. Indirect channels leverage a network of wholesalers, distributors, e-commerce platforms, and specialty material handling retailers to reach smaller businesses and residential end-users, requiring robust logistical support and inventory management capabilities across these intermediaries.

Downstream activities include marketing, sales, installation (for complex systems), and after-sales service, focusing on durability guarantees and replacement parts availability, particularly for wear-and-tear components like wheels. The consumer experience, facilitated through both online and offline distribution, dictates brand loyalty and repurchase rates. E-commerce platforms have fundamentally reshaped the downstream structure, providing direct access to a global customer base but requiring sophisticated digital marketing and fulfillment logistics. Effective management of the entire chain, from sustainable sourcing upstream to responsive customer service downstream, is paramount for securing a competitive advantage in this mature but evolving market.

Utility Carts Market Potential Customers

Potential customers for utility carts are highly diversified, ranging from large multinational corporations managing complex logistical operations to individual consumers seeking efficient storage and transport solutions within their homes or small workshops. The largest segments of end-users are concentrated in environments requiring frequent movement of supplies or finished goods over short distances, demanding equipment that balances durability, capacity, and maneuverability. Healthcare facilities, including hospitals, clinics, and long-term care centers, represent a substantial buyer group, prioritizing features such as non-porous surfaces, noise reduction capabilities, and specialized configurations for medical waste or linen transport.

The burgeoning e-commerce and retail sectors constitute another critical customer base. Warehouse and distribution centers require heavy-duty, often modular, carts for picking, packing, and sorting operations, focused on maximizing throughput and minimizing physical strain on employees. Retail stores utilize sleek, aesthetically pleasing service and stocking carts that blend into the commercial environment while facilitating efficient shelf replenishment and display setup. The increasing pressure on these sectors to maintain high levels of efficiency and safety fuels consistent demand for technologically improved and ergonomically enhanced utility carts that comply with workplace standards.

Furthermore, educational institutions (universities, schools), hospitality businesses (hotels, resorts), and various service industries (maintenance, construction trades) represent significant, albeit diverse, end-user categories. These buyers typically seek versatility, opting for general-purpose utility carts that can handle varied tasks, from moving audiovisual equipment to cleaning supplies. The residential market, driven by consumers seeking garage organization, gardening assistance, or laundry transport, contributes to the demand for lighter, often foldable or aesthetically designed models, purchased primarily through retail and online distribution channels, demonstrating the wide scope of the target buyer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $7.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rubbermaid Commercial Products, Luxor, Sterilite, Little Giant, WEN, Milwaukee Tool, Stanley Black & Decker, Seville Classics, Suncast, Knaack LLC, Technibilt, Tuffy Manufacturing, GPC Industries, Wesco Industrial Products, Uline. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Utility Carts Market Key Technology Landscape

The technology landscape in the Utility Carts Market is increasingly characterized by advancements in material science and the subtle integration of digital features, shifting the product from a purely mechanical tool to a connected asset. Modern manufacturing employs advanced polymer injection molding techniques to produce carts that are simultaneously lightweight, highly durable, and resistant to chemicals and extreme temperatures, crucial for demanding industrial environments. Furthermore, specialized coating technologies, such as powder coating and galvanization, are widely used on metal carts to enhance resistance against corrosion and wear, significantly extending product lifecycle and reducing the total cost of ownership for end-users operating in high-humidity or corrosive settings.

A significant technological focus is placed on the evolution of mobility components, primarily casters and wheels. The adoption of precision-engineered, non-marking thermoplastic rubber (TPR) and polyurethane casters provides superior silent operation, shock absorption, and enhanced floor protection, which is vital in sensitive environments like hospitals and corporate offices. Specialized wheel designs, including pneumatic tires for rough outdoor terrains and sophisticated swivel mechanisms for tight maneuvering spaces, are constantly being refined to improve operational ergonomics and reduce the physical effort required for cart propulsion and steering, thereby aligning with stringent occupational safety guidelines globally.

Digital technology integration, while not universally pervasive, represents the cutting edge of utility cart innovation. This includes embedding IoT sensors, RFID tags, and Bluetooth Low Energy (BLE) beacons directly into the cart structure to facilitate real-time asset tracking, geofencing, and inventory level monitoring. These 'smart carts' provide valuable data on asset utilization, location, and maintenance needs, allowing for proactive fleet management and seamless integration with existing warehouse management systems (WMS). The power systems for these sensors are often passive or utilize small, high-efficiency battery packs, minimizing the maintenance burden associated with the added technology and enabling operational efficiency improvements across large, complex logistical networks.

Regional Highlights

- North America: This region holds a significant market share, driven by stringent workplace safety standards and high adoption rates of ergonomic and heavy-duty utility carts in the established manufacturing, retail, and healthcare sectors. The US market emphasizes quality, durability, and integration capabilities (e.g., compatibility with standardized bins and shelving systems). Innovation often focuses on premium materials and highly specialized carts for pharmaceutical logistics and advanced manufacturing processes.

- Europe: Characterized by a strong emphasis on sustainability and aesthetic design, the European market shows a high preference for carts manufactured using recycled materials and those adhering to strict EU safety certifications (CE marking). Germany and the UK are key markets, showing robust demand from the healthcare and hospitality sectors, pushing for features like antimicrobial surfaces and quiet operation casters suitable for clinical environments.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region due to rapid urbanization, massive infrastructure projects, and the expansion of the e-commerce giants and associated fulfillment centers in China, India, and Southeast Asia. The focus is often on volume, cost-effectiveness, and meeting the demand for scalable, basic, and medium-capacity carts necessary for large-scale logistical operations and burgeoning retail chains.

- Latin America (LATAM): Market growth in LATAM is moderate but steady, tied primarily to industrial modernization in countries like Brazil and Mexico. Demand is concentrated in the manufacturing and construction sectors, often requiring robust, durable, and cost-efficient utility carts capable of handling demanding operational conditions and infrastructural challenges.

- Middle East and Africa (MEA): Growth in MEA is fueled by significant investments in healthcare infrastructure (especially the GCC nations) and the expansion of the hospitality and tourism sectors. High-quality, often imported, carts are demanded for high-end retail and healthcare facilities, with a growing focus on resistance to high heat and environmental factors prevalent in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Utility Carts Market.- Rubbermaid Commercial Products

- Luxor Workspaces

- Sterilite Corporation

- Little Giant Products (Div. of Bredar)

- Wesco Industrial Products, LLC

- Milwaukee Tool (Techtronic Industries Co. Ltd.)

- Stanley Black & Decker, Inc.

- Seville Classics, Inc.

- Suncast Corporation

- Knaack LLC

- Technibilt LTD

- Tuffy Manufacturing

- GPC Industries

- Uline Inc.

- Akro-Mils (Myers Industries)

- Grip-Rite (ICC)

- Cejka Industrial Inc.

- Global Industrial Company

- Magliner, Inc.

- Pucel Enterprises, Inc.

Frequently Asked Questions

Analyze common user questions about the Utility Carts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the demand for heavy-duty utility carts in the current market?

Demand for heavy-duty utility carts is primarily driven by the expansion of large-scale logistics and e-commerce fulfillment centers, which require handling significantly higher volumes and weights of inventory. Additionally, stricter occupational safety regulations necessitate ergonomic solutions capable of managing large payloads while minimizing physical strain on workers, ensuring operational continuity and regulatory compliance in manufacturing and warehouse environments.

How does the choice of material (metal vs. plastic) influence utility cart purchasing decisions in the healthcare sector?

In the healthcare sector, plastic (HDPE/Polymer) carts are increasingly preferred over traditional metal due to their superior resistance to corrosion, ease of sterilization, and non-porous surfaces that prevent microbial growth, aligning with stringent hygiene protocols. Metal carts are typically reserved for heavy equipment or specialized maintenance tasks where sheer structural load bearing is the paramount requirement, but plastic offers a better sterile and lightweight solution for general medical supplies transport.

What role does IoT and asset tracking technology play in modern utility cart fleet management?

IoT integration transforms standard carts into 'smart assets' by enabling real-time location tracking (geofencing) and usage monitoring via sensors and RFID/BLE tags. This technology allows facility managers to optimize cart allocation, minimize search time, schedule predictive maintenance based on usage data, and seamlessly integrate cart inventory levels with broader Warehouse Management Systems (WMS).

What are the key differences between utility carts optimized for retail environments versus those used in manufacturing facilities?

Retail carts prioritize maneuverability, aesthetic appeal, and compact design for use in customer-facing aisles, often focusing on light-to-medium loads for shelf stocking. Manufacturing facility carts, conversely, emphasize durability, high load capacity (heavy-duty), chemical resistance, and compatibility with standardized industrial bins and tooling, often designed to withstand rigorous operational cycles and harsh industrial conditions.

Which geographical region is expected to demonstrate the highest Compound Annual Growth Rate (CAGR) for utility carts?

The Asia Pacific (APAC) region is projected to register the highest CAGR, primarily fueled by rapid infrastructure development, exponential growth in domestic and cross-border e-commerce logistics, and significant governmental investment in expanding industrial and healthcare facilities across developing economies like China, India, and Southeast Asian countries, driving massive demand for efficient material handling equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager