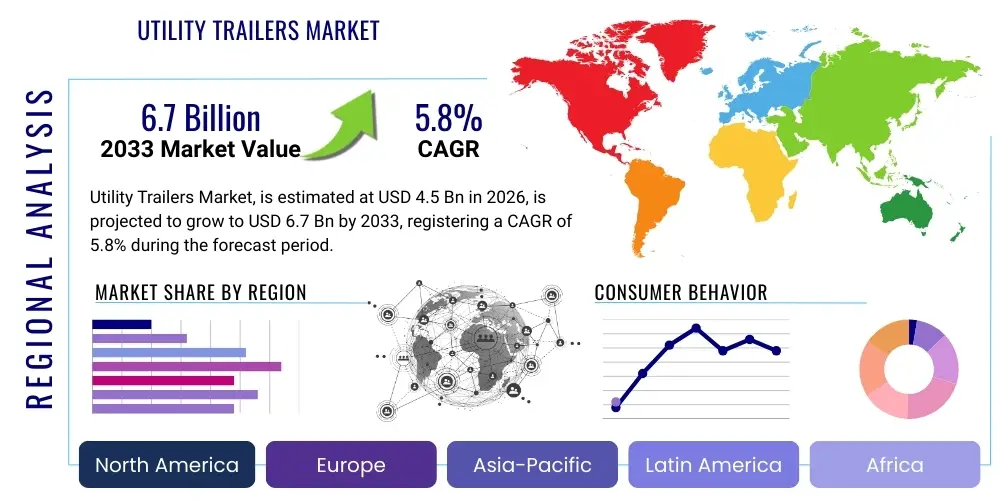

Utility Trailers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438931 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Utility Trailers Market Size

The Utility Trailers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by robust growth in the construction and landscaping sectors globally, coupled with increasing recreational activities and the accelerating adoption of lightweight, durable trailer solutions for commercial applications. The market size reflects the combined value of various trailer types, including open utility, enclosed cargo, and specialized equipment haulers, catering to both professional and consumer needs across diverse economic landscapes.

Utility Trailers Market introduction

The Utility Trailers Market encompasses the manufacturing, distribution, and sale of non-motorized vehicles designed to be towed by a powered vehicle, primarily used for hauling goods, equipment, or materials. These trailers are fundamental assets across numerous industries, serving as critical logistical tools for transporting items efficiently over short to medium distances. Products range significantly in size, material composition, load capacity, and design specialization, from simple single-axle open trailers suitable for personal use and light landscaping tasks, to heavy-duty tandem and triple-axle flatbeds utilized extensively in commercial construction and large-scale agricultural operations. The product description spans galvanized steel units offering high durability to advanced aluminum trailers favored for their lightweight structure and fuel efficiency advantages. Major applications include residential landscaping, professional construction site mobilization, agricultural harvesting support, general logistics, and recreational vehicle (RV) or motorsport equipment transport.

The primary benefits offered by utility trailers revolve around enhanced operational flexibility and expanded payload capacity for towing vehicles, circumventing the need for larger, more expensive trucks for every haul. They provide a cost-effective solution for transporting tools, bulk materials, and specialized machinery, thereby improving productivity for small businesses and independent contractors. Furthermore, the inherent modularity allows users to match the trailer type—such as enclosed for security or flatbed for oversized equipment—to specific job requirements. Driving factors behind market expansion include intensified investment in infrastructure development globally, particularly in emerging economies, steady growth in the residential housing market requiring landscaping and construction support services, and the rising popularity of outdoor recreational activities like camping and ATV riding, which necessitate reliable transport solutions.

The technological evolution within this sector, focusing on improved suspension systems, advanced braking capabilities, integrated lighting solutions, and the incorporation of durable, lighter materials like high-grade aluminum alloys, significantly contributes to market buoyancy. Manufacturers are continuously innovating to meet increasingly stringent safety regulations and consumer demands for improved performance and longevity. The market is highly fragmented but driven by key players who leverage optimized manufacturing processes and extensive dealer networks to capture both domestic and international demand, ensuring that utility trailers remain an indispensable component of the modern supply chain and service economy.

Utility Trailers Market Executive Summary

The Utility Trailers Market demonstrates robust business trends characterized by a decisive shift toward lighter, more fuel-efficient designs, particularly aluminum construction, driven by rising fuel costs and environmental regulations focused on reducing vehicular emissions. Business activity is heavily influenced by cyclical economic factors, with construction and infrastructure spending acting as primary indicators of market health; steady growth in the e-commerce sector is also increasing demand for smaller, specialized enclosed trailers for final-mile logistics and regional distribution centers. Furthermore, the proliferation of rental fleets, catering to temporary or project-specific hauling needs, represents a significant distribution channel trend, offering accessibility to consumers who cannot justify outright purchase, thereby stabilizing demand across different economic cycles.

Regionally, North America maintains its dominance due to high rates of recreational vehicle ownership, substantial government spending on public works, and a deeply ingrained DIY (Do-It-Yourself) culture that relies heavily on personal hauling capabilities. Conversely, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, primarily fueled by rapid urbanization, massive infrastructure projects in countries like India and China, and the corresponding acceleration in commercial transport needs. European markets are characterized by stringent regulatory environments regarding trailer weight and dimensions, leading to a strong focus on high-quality, specialized trailers compliant with regional standards, often utilizing advanced telematics for fleet management and security.

Segment trends reveal that the enclosed trailer category is experiencing accelerated growth, driven by increased requirements for secure transportation of sensitive equipment, tools, and valuable cargo across various service industries, including mobile workshops and specialized contractors. Within material segmentation, while steel trailers remain prevalent due to their cost-effectiveness and durability for heavy-duty tasks, the aluminum segment is commanding higher growth rates due to its advantageous weight reduction, which directly impacts fuel consumption and maximum permissible towing capacity. The medium-duty capacity segment, frequently utilized by small to medium-sized enterprises (SMEs) in construction and landscaping, continues to form the core demand base, exhibiting resilience and steady expansion.

AI Impact Analysis on Utility Trailers Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Utility Trailers Market commonly revolve around themes of autonomous towing compatibility, enhanced operational efficiency through data analytics, and the application of machine vision for improved cargo security and load balancing. Users are keen to understand how traditional, non-powered assets like trailers can leverage AI tools. Key concerns often include the timeline for integrating smart features, the cost implications for standard utility trailers, and how AI can ensure compliance with increasingly complex load securement regulations. Expectations center on AI contributing to preventive maintenance schedules, optimizing routing when combined with fleet management systems, and facilitating safer, more streamlined towing experiences, especially concerning blind-spot monitoring and automated coupling/uncoupling processes.

The integration of AI technology, while not directly altering the fundamental physical structure of the utility trailer itself, profoundly impacts the surrounding ecosystem, transforming how these assets are managed, maintained, and operated within a connected logistics framework. AI algorithms process real-time sensor data—often gathered from integrated IoT devices on the trailer (such as pressure sensors, GPS trackers, and temperature monitors)—to provide actionable insights. This predictive capability moves maintenance schedules from reactive failure correction to proactive component replacement, significantly minimizing downtime and extending the asset lifespan, a critical factor for high-utilization commercial fleets. Furthermore, AI-driven route optimization, accounting for trailer dimensions, weight constraints, and road conditions, ensures maximum efficiency and reduced fuel consumption across the supply chain, ultimately enhancing the financial viability of trailer ownership and operation across diverse applications.

Future iterations of utility trailer usage will heavily rely on AI for safety enhancements and regulatory adherence. Advanced AI camera systems mounted on the trailer can analyze cargo securement in real-time, alerting the operator to potential load shifts or compliance breaches before transport begins. Similarly, in the context of emerging autonomous driving technology, AI plays a pivotal role in ensuring the trailer communicates seamlessly with the autonomous tractor unit, managing stability control and anti-sway features dynamically based on real-time environmental inputs and vehicle dynamics. This foundational integration ensures that utility trailers remain viable and necessary components even as the transportation industry pivots toward higher levels of automation, cementing AI as a key enabling technology rather than a direct manufacturing component.

- AI-powered predictive maintenance reduces downtime by scheduling component replacement based on usage and sensor data analysis.

- Machine learning algorithms enhance load securement monitoring through real-time camera and sensor feedback, ensuring regulatory compliance.

- AI facilitates seamless communication and dynamic stability management between the utility trailer and autonomous or semi-autonomous towing vehicles.

- Data analytics optimize fleet utilization, routing efficiency, and inventory tracking for trailers within large commercial operations.

- Deep learning systems improve theft prevention and asset tracking by recognizing anomalous movement patterns or unauthorized detachment.

DRO & Impact Forces Of Utility Trailers Market

The Utility Trailers Market is fundamentally shaped by a confluence of Drivers (D), Restraints (R), and Opportunities (O), creating distinct Impact Forces that influence strategic direction and overall market trajectory. Key drivers include sustained global growth in residential and commercial construction activities, directly correlating with the need for equipment transport and material hauling solutions, alongside the significant expansion of professional landscaping and grounds maintenance services, particularly in mature economies. Furthermore, the persistent rise of the e-commerce sector necessitates increased regional and localized distribution capabilities, favoring flexible, mid-sized transport options like utility trailers. Opportunities are centered on technological innovation, such as integrating advanced telematics and IoT systems for enhanced asset management, capitalizing on the increasing demand for high-strength, lightweight aluminum trailers to improve fuel economy, and exploring the niche market for electric vehicle (EV) compatible trailers with optimized aerodynamics and minimal drag profiles. Collectively, these forces mandate continuous innovation in material science and digital integration.

Restraints, however, pose structural challenges to market growth. Primary among these are the volatility and escalation of raw material costs, specifically steel and aluminum, which directly impact manufacturing margins and end-user pricing, potentially delaying purchasing decisions, especially for smaller contractors. Stringent regulatory hurdles pertaining to permissible trailer dimensions, weight classifications, and mandatory safety features (such as advanced braking and lighting standards), vary significantly by region and country, complicating global market entry and product standardization efforts for manufacturers. Moreover, the cyclical nature of the housing and construction markets introduces demand instability, requiring manufacturers to manage production capacities carefully to avoid inventory gluts or shortages during economic fluctuations. These restraining forces necessitate robust supply chain management and flexible pricing strategies to maintain competitiveness.

The overall impact forces are propelling the market toward greater specialization and higher quality standards. The need for durability and reliability in commercial applications drives investment in corrosion-resistant coatings and advanced welding techniques, establishing quality as a major differentiation factor. The rising focus on sustainability pushes manufacturers toward using recyclable materials and developing trailers that reduce the total carbon footprint of the towing operation. This interplay of demand from thriving end-use sectors (Drivers) counterbalanced by cost pressures and regulatory complexity (Restraints) results in a dynamic market environment where technological adaptation (Opportunities) becomes crucial for long-term strategic success. The market structure is shifting, favoring manufacturers that can rapidly implement smart manufacturing processes and offer value-added digital services alongside the physical trailer product.

Segmentation Analysis

The Utility Trailers Market segmentation provides a granular view of demand patterns, categorizing the market based on intrinsic product characteristics and functional applications. Critical segmentation variables include the trailer type, such as Open, Enclosed, or Flatbed configurations, which reflect the primary purpose of transport—whether maximum accessibility or weather protection is required. Further analysis is conducted based on Axle Type (Single, Tandem, or Triple), directly correlating to load capacity and stability, and Material utilized in construction (Steel, Aluminum, or Composites), influencing durability, weight, and price point. The most significant segmentation is by application, which details the diverse end-use sectors including Construction, Landscaping, Agriculture, and Recreation, each presenting unique demands regarding structural strength and specialized features.

The dominant segment by Type remains the Open Utility Trailer, valued for its versatility, lower cost, and ease of loading, making it a staple for general hauling, yard work, and light construction tasks. However, the fastest-growing segment is Enclosed Trailers, driven by the increasing need for secure, weather-protected transport of sensitive tools, high-value commercial equipment, and inventory for mobile service providers. Regarding Material, aluminum trailers, despite their higher initial cost, are rapidly gaining market share over traditional steel due to their superior resistance to corrosion, significantly lighter weight profile contributing to better fuel efficiency, and the ability to tow heavier payloads legally, especially important in regions with strict weight limits. This shift reflects a long-term investment philosophy focused on operational expenditure reduction.

Analyzing segmentation by Application reveals that the Construction segment maintains the largest market share globally, inextricably linked to economic development and infrastructure projects, requiring heavy-duty equipment carriers and specialized job-site transport. Concurrently, the Landscaping/Grounds Maintenance segment exhibits consistent, stable growth, fueled by both residential and commercial property maintenance contracts. Understanding these segments is vital for manufacturers to tailor product lines—for instance, offering galvanized steel for construction ruggedness or lightweight tandem-axle models for the landscaping industry—ensuring alignment between product capabilities and specific end-user requirements for optimized market penetration and customer satisfaction within specialized niches.

- Type: Open Utility Trailers, Enclosed Cargo Trailers, Flatbed Trailers, Dump Trailers, Tilt Trailers, Specialized Equipment Trailers

- Axle Type: Single Axle, Tandem Axle, Triple Axle

- Material: Steel Utility Trailers, Aluminum Utility Trailers, Composite/Hybrid Utility Trailers

- Application: Construction and Industrial, Landscaping and Grounds Maintenance, Recreation and Personal Use, Agricultural Hauling, Logistics and Fleet Operations, Government and Municipal Use

- Load Capacity: Light Duty (Under 3,500 lbs), Medium Duty (3,500 lbs to 10,000 lbs), Heavy Duty (Over 10,000 lbs)

Value Chain Analysis For Utility Trailers Market

The Value Chain for the Utility Trailers Market initiates with Upstream Analysis, primarily focusing on the sourcing and processing of core raw materials, predominantly steel (mild steel, galvanized steel, and high-strength low-alloy steel) and aluminum alloys. The stability of the supply chain is highly dependent on commodity markets, with material volatility directly impacting the cost of goods sold. Key upstream activities involve sheet metal forming, welding consumables supply, and sourcing components such as axles, tires, braking systems, and coupling mechanisms. Manufacturers engage in complex procurement strategies, often relying on geographically diverse suppliers to mitigate risk and achieve cost efficiencies. The subsequent phase involves specialized manufacturing processes, including cutting, welding, chassis assembly, painting/galvanizing, and quality control, culminating in the final utility trailer unit ready for distribution.

The Downstream Analysis focuses on the critical distribution channel and sales phase. Direct and indirect channels are both pivotal. Indirect distribution, leveraging extensive dealer networks, remains the dominant method, particularly for high-volume and geographically dispersed sales. Dealers provide localized inventory, financing options, maintenance services, and critical customer support, enhancing the overall value proposition. However, an increasing trend involves direct-to-consumer (D2C) sales, particularly facilitated by e-commerce platforms and digital showrooms, allowing specialized or smaller manufacturers to bypass traditional intermediaries, offering competitive pricing and greater customization options. The efficiency of the downstream segment is highly reliant on streamlined logistics for shipping large, bulky products and effective inventory management across the dealer footprint to meet fluctuating seasonal demand from end-users.

The profitability across the value chain is determined by optimizing efficiency at each stage, from negotiating favorable material contracts upstream to providing comprehensive after-sales services downstream. Aftermarket services, including parts replacement, repair, and periodic maintenance, contribute significantly to the total lifetime value generated by a utility trailer. Furthermore, the role of financing institutions in facilitating purchases for both dealers and end-users forms an integrated part of the value delivery system. Manufacturers who successfully integrate forward (e.g., offering proprietary service contracts) or backward (e.g., controlling specialized component manufacturing) often achieve higher margins and superior market control, ensuring a robust and resilient flow of products from raw input to the final commercial application.

Utility Trailers Market Potential Customers

The Utility Trailers Market serves a vastly diverse range of End-User/Buyers, categorized into commercial entities, governmental bodies, and individual consumers, all requiring dependable hauling capacity for specific tasks. Commercial potential customers form the largest segment, predominantly comprising professional contractors across sectors such as general construction, specialized trade services (plumbing, electrical, roofing), and heavy equipment rental companies. These users prioritize durability, high payload ratings, and specific features tailored to job site requirements, such as ramp gates, enclosed security, and integrated tool storage systems. Landscaping and grounds maintenance professionals are another core demographic, demanding trailers designed for hauling mowers, trimmers, bulk mulch, and soil, emphasizing reliability and ease of loading/unloading large machinery frequently. These professional buyers base purchasing decisions heavily on return on investment, trailer longevity, and manufacturer warranty support.

Beyond traditional commercial users, the market addresses the burgeoning needs of the logistics and localized distribution sector, fueled by the expansion of e-commerce, which utilizes smaller, often enclosed utility trailers for urban delivery and hub-to-spoke distribution optimization where maneuverability is key. Agricultural operations, including large-scale farming and specialty crop producers, rely on utility trailers for transporting feed, harvest materials, and specialized small equipment between fields and storage facilities, demanding robust construction capable of handling demanding terrain and heavy, irregular loads. Government agencies, including municipal parks departments, road maintenance crews, and utility companies, represent a stable customer base, procuring standard and highly customized trailers under multi-year contracts, prioritizing longevity and compliance with strict safety standards for public use.

Finally, the recreational and personal use customer segment, while often purchasing lower-capacity models, contributes significantly to market volume. This includes outdoor enthusiasts, homeowners, and motorsport hobbyists who use utility trailers for transporting ATVs, snowmobiles, personal watercraft, camping gear, and assisting with DIY home improvement projects. These buyers often emphasize aesthetics, user-friendliness, and lightweight construction for easy storage and towing behind standard passenger vehicles or SUVs. The market, therefore, requires manufacturers to maintain a diversified product portfolio that simultaneously addresses the heavy-duty, commercial-grade requirements of professional entities and the versatile, lightweight demands of the private consumer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Load Trail, Big Tex Trailers, PJ Trailers, M.H. Eby, Aluma, East Manufacturing, Trail King Industries, Wabash National, Utility Trailer Manufacturing, Kaufman Trailers, Sure-Trac, Felling Trailers, Premier Trailer Mfg., Top Hat Industries, Continental Cargo, RC Trailers, Wells Cargo, Featherlite Trailers, Interstate Trailers, Forest River Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Utility Trailers Market Key Technology Landscape

The Utility Trailers Market, while relying on fundamental mechanical principles, is rapidly integrating sophisticated technological components focused on safety, efficiency, and smart asset management. A cornerstone of the evolving landscape is the advancement in material science, particularly the wider adoption of high-strength aluminum alloys and galvanized steel treatments, enhancing structural integrity while simultaneously reducing curb weight. This lightweighting technology is crucial for optimizing fuel efficiency for the towing vehicle and increasing the net payload capacity, addressing regulatory and environmental concerns regarding vehicle weights and emissions. Furthermore, welding and bonding technologies are advancing to accommodate hybrid material construction (steel chassis with aluminum decking), maximizing both durability and weight savings, requiring specialized manufacturing equipment and quality assurance protocols within production facilities.

In terms of functional safety, the technology landscape is heavily influenced by mandates for improved braking and lighting systems. Key technological features now routinely include advanced electric and hydraulic disc brakes for superior stopping power and anti-lock braking systems (ABS), particularly on higher-capacity commercial trailers, ensuring stability during emergency maneuvers. Integrated LED lighting systems are replacing traditional incandescent bulbs, offering greater longevity, reduced power consumption, and enhanced visibility. Moreover, the integration of advanced suspension technologies, such as independent torsion axles or air ride systems, is becoming prevalent in specialty trailers, providing smoother rides, protecting sensitive cargo, and improving tire wear, thereby lowering long-term operating costs for fleet owners who demand higher levels of performance and cargo protection.

Perhaps the most transformative technological shift is the incorporation of Internet of Things (IoT) and telematics solutions, fundamentally changing the operational management of utility trailer fleets. IoT devices, including embedded GPS trackers, humidity/temperature sensors, and tire pressure monitoring systems (TPMS), allow real-time data collection on the trailer's location, utilization, and health status. This connectivity enables sophisticated fleet management platforms to monitor asset deployment, detect theft, schedule preventative maintenance based on actual usage rather than fixed intervals, and ensure cargo condition compliance (especially important for refrigerated or climate-sensitive loads). This digital convergence positions the utility trailer as a connected asset within the broader smart logistics ecosystem, providing fleet managers with unprecedented control and visibility over their non-powered assets.

Regional Highlights

- North America (United States, Canada, Mexico): North America is the undisputed leader in the Utility Trailers Market, commanding the largest revenue share, primarily driven by substantial residential construction activity, significant investment in infrastructure renewal projects, and a high rate of personal recreational use, including boating, camping, and powersports. The region benefits from a well-established and highly fragmented manufacturing base, offering a vast array of specialized and general-purpose trailers. The demand here is skewed toward medium to heavy-duty trailers for commercial applications and a large volume of light-duty trailers for the vast private consumer market. The United States market, in particular, is highly receptive to aluminum trailers due to the emphasis on fuel economy and the desire to maximize legal payload limits. The regulatory environment is relatively standardized, although state-specific variances exist regarding weight limits and braking requirements.

- Europe (Germany, UK, France, Italy, Spain): The European market is characterized by stricter regulatory frameworks concerning size, weight, and mandatory safety features, which drives demand for high-quality, often galvanized, and expertly engineered trailers. While the market size is substantial, growth is steady, focusing on specialization, such as highly optimized equipment trailers for agricultural machinery and construction tools. Germany and the UK lead in demand, spurred by industrial output and robust construction sectors. The adoption of smart trailer technology, including advanced lighting and brake compliance systems, is faster in Europe compared to other regions, reflecting the continent's commitment to road safety and fleet efficiency standards.

- Asia Pacific (China, India, Japan, South Korea): APAC is projected to be the fastest-growing region during the forecast period. This explosive growth is attributable to massive governmental and private sector investments in infrastructure development, rapid urbanization, and the corresponding industrial expansion across major economies like China and India. The demand initially focuses on cost-effective, heavy-duty steel trailers for construction and logistics. However, as regulatory standards mature and environmental awareness increases, there is a nascent but growing shift toward higher quality, more durable, and potentially aluminum-based products, particularly in developed markets like Japan and South Korea. Increased domestic manufacturing capacity is also transforming the region into a global export hub for basic utility models.

- Latin America (Brazil, Argentina, Mexico): The Latin American market exhibits moderate growth, intrinsically linked to the fluctuating economic stability and commodity cycles within key economies such as Brazil. Demand is dominated by the agricultural sector, which relies heavily on utility trailers for bulk commodity transport and farm equipment movement. The market is highly price-sensitive, often favoring basic, durable steel construction over advanced features or lightweight materials. Infrastructure development, particularly road network expansion, continues to drive localized demand for robust hauling solutions, yet regulatory compliance and standardized manufacturing practices remain less unified than in North America or Europe.

- Middle East and Africa (MEA): The MEA region presents unique dynamics, with demand concentrated in energy-rich Gulf Cooperation Council (GCC) countries experiencing significant construction booms related to mega-projects and diversification efforts (e.g., Saudi Arabia's Vision 2030). These projects demand specialized, heavy-capacity flatbed and equipment trailers. In parts of Africa, demand is foundational, supporting basic logistics and agricultural needs. Extreme climate conditions necessitate specialized materials and coatings resistant to heat, sand, and corrosion. Market growth is heavily influenced by capital expenditure cycles in the oil and gas sector and government infrastructure spending initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Utility Trailers Market.- Load Trail

- Big Tex Trailers

- PJ Trailers

- M.H. Eby

- Aluma

- East Manufacturing

- Trail King Industries

- Wabash National

- Utility Trailer Manufacturing

- Kaufman Trailers

- Sure-Trac

- Felling Trailers

- Premier Trailer Mfg.

- Top Hat Industries

- Continental Cargo

- RC Trailers

- Wells Cargo

- Featherlite Trailers

- Interstate Trailers

- Forest River Inc.

Frequently Asked Questions

Analyze common user questions about the Utility Trailers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Utility Trailers Market?

The Utility Trailers Market is projected to experience a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven by increasing construction spending and greater demand for commercial hauling solutions. This growth trajectory indicates stable expansion across key application segments globally.

Which material segment is growing the fastest in the utility trailer market?

The Aluminum Utility Trailers segment is experiencing the fastest growth. This acceleration is due to the inherent benefits of aluminum, including reduced trailer weight, which improves fuel economy and allows for higher legal payloads, alongside superior corrosion resistance compared to traditional steel models.

What are the primary factors restraining growth in the utility trailers sector?

The key restraints affecting market expansion are the persistent volatility and rising costs of raw materials, such as steel and aluminum, which pressures manufacturing margins. Additionally, varying regional regulatory standards regarding trailer weights and safety compliance complicate global production and distribution efforts.

How is AI impacting the management of utility trailer fleets?

AI's impact is focused on optimizing asset management through telematics and IoT integration, enabling predictive maintenance based on sensor data analysis, enhancing security through geo-fencing and real-time tracking, and improving load stability monitoring to ensure regulatory adherence and operational safety.

Which regional market holds the largest share and why?

North America currently holds the largest market share in the Utility Trailers Market. This dominance is attributed to high commercial demand stemming from robust construction and logistics sectors, coupled with significant consumer demand driven by a strong culture of recreational vehicle usage and home maintenance activities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Open Utility Trailers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Utility Trailers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Single Axle utility trailer, Small Boat Trailer, Kit Trailers with less than 3000 lbs GVW), By Application (Utility, Construction, Industrial, Commercial, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Utility Trailers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Open Utility, Dump Trailers, Tow Dolly, Enclosed Trailers), By Application (Utility, Light Commercial Use, Personal Use, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager