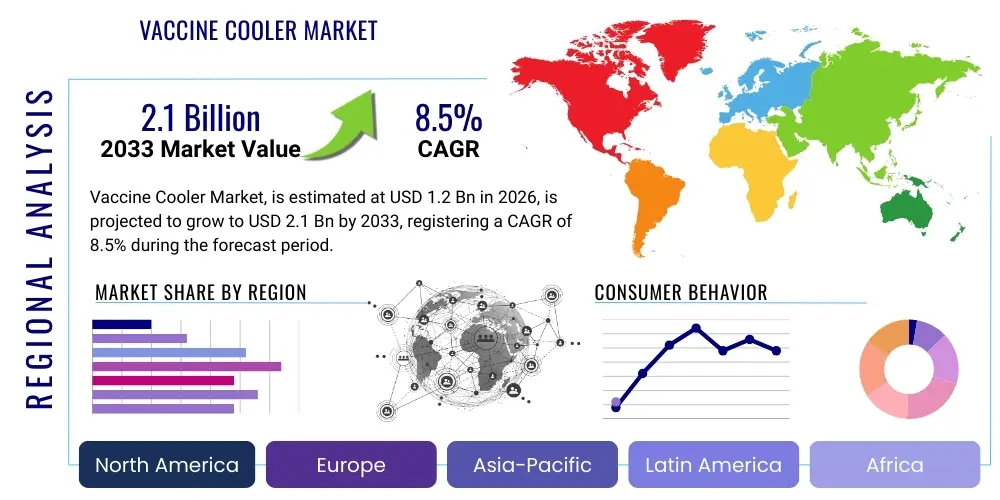

Vaccine Cooler Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437039 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Vaccine Cooler Market Size

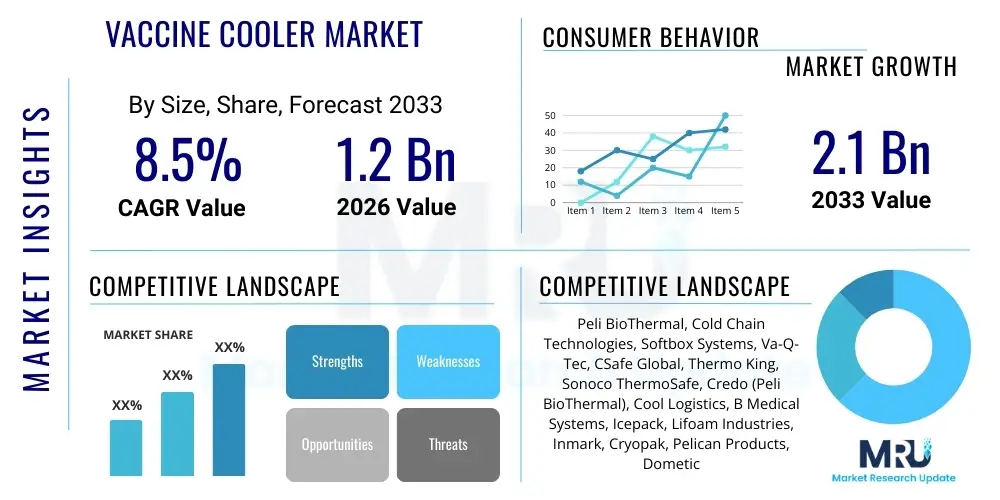

The Vaccine Cooler Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.1 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by intensified global immunization initiatives, the complex logistics required for distributing temperature-sensitive biologics, and increasing governmental investments in strengthening public health infrastructure, particularly in developing economies. The demand spans across various cold chain levels, from centralized storage facilities to last-mile delivery points, emphasizing the critical role of reliable cooling technology in maintaining vaccine efficacy and preventing wastage across diverse climatic zones and operational environments. Regulatory scrutiny surrounding vaccine stability further necessitates the adoption of advanced, certified cooling solutions.

Vaccine Cooler Market introduction

The Vaccine Cooler Market encompasses specialized thermal packaging and portable refrigeration devices designed to maintain vaccines within a specific, narrow temperature range, typically between +2°C and +8°C, during transport, temporary storage, and deployment in field settings. These products are foundational components of the global cold chain logistics system, ensuring that life-saving vaccines retain their potency from the point of manufacture to the moment of administration. The primary objective is to mitigate the risk of thermal excursions, which can render biological products ineffective, leading to significant financial losses and, more importantly, undermining public health efforts. Given the critical nature of these products, vaccine coolers are subject to stringent performance standards and certifications mandated by international bodies like the World Health Organization (WHO) and regional regulatory agencies.

The product portfolio includes passive coolers, which rely on insulating materials and Phase Change Materials (PCMs) or ice packs, and active coolers, which utilize mechanical or thermoelectric refrigeration units for precise temperature control over extended periods. Major applications span mass immunization campaigns, emergency response scenarios, routine pediatric vaccination schedules, and specialized distribution of novel vaccines, such as those requiring ultra-cold storage environments. The inherent benefits of these devices—portability, reliability in extreme conditions, and compliance with storage protocols—drive their pervasive adoption globally. Furthermore, the increasing complexity of modern vaccine types, including mRNA and viral vector platforms that demand meticulous temperature management, is escalating the requirement for sophisticated, monitored cooling solutions that offer advanced insulation and extended hold times under varying ambient conditions.

Key driving factors include unprecedented global efforts to achieve universal immunization coverage, the escalating production and distribution of high-value, temperature-sensitive vaccines (including flu, pneumococcal, and emerging disease vaccines), and significant public and private investments aimed at eradicating vaccine-preventable diseases. The logistical challenges associated with reaching remote and underserved populations, particularly in low and middle-income countries (LMICs), necessitate durable and energy-efficient cooling equipment. Moreover, technological advancements in materials science, leading to the development of higher-performance insulation like Vacuum Insulated Panels (VIPs), and the integration of IoT-enabled monitoring systems are reinforcing market growth by offering greater thermal stability and real-time visibility into the cold chain status. This shift towards smart, interconnected cooling solutions is paramount for ensuring accountability and quality assurance throughout the intricate vaccine distribution network.

Vaccine Cooler Market Executive Summary

The Vaccine Cooler Market is experiencing dynamic growth, characterized by significant technological shifts towards enhanced thermal performance and digitalization. Business trends highlight increasing mergers and acquisitions (M&A) among specialized cold chain providers and material science companies, driven by the need to integrate advanced insulation technologies and smart monitoring capabilities into standard product offerings. Manufacturers are focusing heavily on developing passive coolers with extended hold times—often exceeding 100 hours—to tackle distribution bottlenecks in areas lacking consistent power infrastructure. Investment is also surging in compliant packaging solutions for both standard refrigerated (+2°C to +8°C) and deep-freeze (-20°C or below) applications, catering to the evolving pharmaceutical pipeline. Furthermore, governmental procurement strategies are shifting towards performance-based standards, favoring suppliers who can demonstrate proven efficacy through WHO Performance, Quality, and Safety (PQS) prequalification, thereby raising the barrier to entry for lower-quality manufacturers.

Regionally, the market presents stark contrasts in maturity and growth trajectory. North America and Europe represent mature markets, where demand is stable and driven primarily by replacement cycles, regulatory compliance, and the need for precision cooling in specialized pharmaceutical logistics. The primary growth impetus, however, stems from the Asia Pacific (APAC) and Middle East & Africa (MEA) regions. In APAC, expanding vaccination programs, rapid urbanization, and significant infrastructural gaps in rural areas necessitate high volumes of durable, reliable coolers for last-mile delivery. MEA is a critical expansion zone, supported heavily by international aid organizations and governmental initiatives focused on strengthening the "last meter" of the cold chain, often requiring ultra-portable and passive cooling solutions resilient to harsh ambient temperatures. Latin America is also showing robust adoption due to increasing investments in healthcare access and the regional consolidation of major pharmaceutical logistics hubs, demanding high-capacity, traceable transit coolers.

Segment trends reveal a sustained dominance of the passive cooler segment due to its cost-effectiveness, simplicity, and vital role in remote distribution, though the active cooler segment is projected to exhibit the highest CAGR, propelled by the rising necessity for mechanical precision and controlled freezing/thawing capabilities in high-volume transit applications. By end-user, the government/public sector remains the largest consumer, primarily due to large-scale procurement through global health organizations (like UNICEF and GAVI) and national immunization programs. However, the private logistics and pharmaceutical sector is rapidly increasing its market share, driven by outsourcing specialized cold chain management and the transport of expensive, sensitive biologics that require proprietary, highly monitored packaging solutions. Material science advancements, particularly in Phase Change Materials (PCMs) optimized for specific temperature ranges, are transforming segment performance, offering tailored thermal profiles that minimize the reliance on traditional water ice packs and expand the usability of passive solutions.

AI Impact Analysis on Vaccine Cooler Market

User queries regarding the impact of Artificial Intelligence (AI) on the Vaccine Cooler Market primarily revolve around four key themes: optimizing complex cold chain logistics, ensuring proactive temperature compliance, minimizing vaccine wastage, and enhancing supply chain visibility. Users are concerned about how AI can integrate sensor data from individual coolers into larger predictive models to anticipate thermal excursions or mechanical failures before they occur, especially in challenging environments. There is a high expectation that AI algorithms will revolutionize route planning for mobile vaccination clinics and complex cross-border shipments, taking into account real-time environmental data, traffic conditions, and cooler capacity, thereby optimizing fuel consumption and maximizing operational efficiency. Furthermore, users seek clarity on how machine learning models can audit vast streams of temperature data generated across millions of shipments to identify systemic weaknesses in specific cooler types or distribution nodes, moving the industry from reactive compliance checks to proactive quality management and ensuring the integrity of the cold chain remains uncompromised from the centralized warehouse to the point of inoculation.

- AI enables predictive maintenance of active cooling units by analyzing performance metrics (e.g., compressor efficiency, power consumption) to anticipate failures.

- Machine Learning (ML) algorithms optimize complex, multi-modal cold chain routes, minimizing transit time and reducing the risk of temperature breaches.

- AI integrates real-time IoT sensor data from coolers with external factors (weather forecasts, traffic density) to provide dynamic, preventative thermal management alerts.

- Predictive analytics driven by AI minimizes vaccine inventory risk and wastage by accurately forecasting demand and ensuring optimal cooler deployment across regions.

- Computer vision and ML are used for automated quality control of cooler manufacturing and sealing processes, improving insulation integrity and adherence to regulatory standards.

DRO & Impact Forces Of Vaccine Cooler Market

The dynamics of the Vaccine Cooler Market are dictated by a powerful interplay of Driving Factors, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and technological trajectory. The primary Driver is the increasing frequency and scale of global immunization programs, coupled with the rigorous regulatory demands imposed by organizations like the WHO and national health authorities, which mandate strict adherence to cold chain protocols for temperature-sensitive biologics. This is amplified by the sheer volume of new, highly specialized vaccines (including those related to endemic and pandemic threats) entering the pharmaceutical pipeline, often requiring novel, precise temperature controls. The imperative for reaching geographically dispersed populations, especially in low-infrastructure settings, necessitates continuous innovation in durable and efficient cooling technologies, further propelling market expansion and technological adoption.

Conversely, significant Restraints challenge rapid market growth. The most prominent constraint is the high initial capital investment required for procurement of WHO PQS-qualified coolers, particularly advanced active cooling systems and high-performance passive solutions utilizing Vacuum Insulated Panels (VIPs), which possess specialized handling requirements. Operational maintenance costs, especially the servicing of complex mechanical units in remote locations, also pose a considerable burden on public health budgets. Furthermore, the stringent and evolving regulatory compliance landscape can sometimes slow the adoption of novel, untested technologies, demanding lengthy qualification and testing periods. Finally, infrastructure gaps, including unreliable power grids and poorly developed transport networks in critical emerging markets, limit the widespread efficacy of electricity-dependent active cooling solutions, forcing a reliance on passive alternatives that may offer shorter temperature hold times.

Despite these restraints, substantial Opportunities exist for market participants. The rapid expansion of gene therapy and specialized biopharmaceuticals, many of which require ultra-cold storage (e.g., -60°C to -80°C), opens entirely new, high-value segments for specialized ultra-low temperature coolers. Secondly, the integration of Internet of Things (IoT) sensors and cloud computing for real-time temperature monitoring offers massive scope for value-added services, turning cooling devices into smart, data-generating assets that enhance supply chain transparency and accountability. Finally, governmental and philanthropic funding directed toward pandemic preparedness and global health security continues to channel significant financial resources into cold chain infrastructure development, offering lucrative long-term contracts for suppliers who can provide integrated, scalable, and sustainable cooling solutions suitable for mass deployment and rapid response logistics. These impact forces collectively underscore the market's trajectory towards high-tech, precision-controlled, and digitally monitored cooling solutions.

Segmentation Analysis

The Vaccine Cooler Market is meticulously segmented based on Product Type, End-User, and Temperature Range, reflecting the diverse requirements across the global cold chain. Product segmentation differentiates between passive systems (relying on insulation and coolants like ice packs or PCMs) and active systems (utilizing mechanical or thermoelectric refrigeration units). Passive coolers dominate volume sales due to their portability and operational simplicity, essential for last-mile delivery, whereas active coolers command higher value due to their precision and capacity, primarily used in centralized distribution centers or high-volume transit logistics. Temperature Range segmentation is critical, separating standard refrigerated coolers (+2°C to +8°C) from specialized deep-freeze (below -20°C) and ultra-low temperature (ULT, below -60°C) containers, a growing segment driven by novel mRNA vaccines.

The end-user segmentation highlights the primary consumption channels. The Government/Public Sector segment, encompassing national health ministries, UNICEF, WHO, and non-governmental organizations (NGOs), constitutes the largest purchasing bloc, driven by large-scale immunization campaigns and bulk procurement agreements focusing on reliability and WHO PQS qualification. Conversely, the Pharmaceutical & Biotech Companies and Private Healthcare Providers segments are growing rapidly, characterized by a demand for premium, highly traceable, and often customized cooling solutions required for clinical trials, specialized drug distribution, and patient-specific therapies. Understanding these segmentation nuances is vital for market players to tailor product development and distribution strategies, ensuring compliance with varied regulatory environments and optimizing performance for specific logistical challenges, such as extended hold times in tropical climates or sustained cooling capacity in busy urban centers.

- By Product Type:

- Passive Coolers (Insulated boxes, cold boxes)

- Active Coolers (Compressor-based, Thermoelectric)

- By Temperature Range:

- Refrigerated (+2°C to +8°C)

- Freezer (Below -20°C)

- Ultra-Low Temperature (ULT, Below -60°C)

- By Material Type:

- Hard Coolers (Plastic, Metal)

- Soft Coolers (Fabric, Flexible Insulation)

- Specialized Containers (Vacuum Insulated Panels - VIP)

- By End-User:

- Government/Public Sector (National Health Programs, NGOs, Aid Agencies)

- Pharmaceutical & Biotech Companies

- Hospitals, Clinics, & Vaccination Centers

- 3rd Party Logistics (3PL) & Specialty Couriers

Value Chain Analysis For Vaccine Cooler Market

The value chain for the Vaccine Cooler Market is characterized by a high degree of specialization and stringent quality control, commencing with the sourcing of specialized raw materials. Upstream analysis focuses intensely on the procurement of high-performance insulating materials, such as polyurethane foam, Expanded Polystyrene (EPS), and proprietary materials like Vacuum Insulated Panels (VIPs), which are crucial for determining thermal performance and hold time. Additionally, the reliable supply of Phase Change Materials (PCMs)—specifically tailored to melt and freeze at precise temperatures to maintain the vaccine environment—is paramount. Manufacturers must also secure advanced electronic components, including IoT sensors, data loggers, and temperature monitoring systems, which are increasingly integrated into both passive and active units. The high cost and limited sourcing of these specialized materials, coupled with strict material certification requirements, represent key leverage points in the upstream segment, demanding stable supplier relationships and robust quality auditing processes to ensure manufacturing consistency.

The midstream phase involves complex manufacturing, assembly, and rigorous testing. Manufacturing requires specialized molding and fabrication techniques to ensure airtight seals and optimal insulation integrity, particularly for VIP-based containers. Every batch of vaccine coolers, especially those intended for public health use, must undergo extensive testing to meet global standards, such as the WHO PQS prequalification, which certifies performance under extreme ambient conditions. This testing often necessitates significant R&D investment and dedicated testing facilities, differentiating high-quality manufacturers from generic suppliers. The integration of advanced features, such as remote monitoring hardware and connectivity solutions, adds layers of complexity to the assembly process, requiring highly trained technical staff and sophisticated calibration procedures before products are cleared for distribution. Quality control throughout this stage is non-negotiable, as performance failures can lead to catastrophic vaccine losses.

Downstream analysis highlights complex distribution channels. Distribution often follows two primary pathways: indirect and direct sales. The indirect channel is dominated by large-scale procurement agencies (like UNICEF Supply Division and regional government tenders), which utilize global logistics partners (3PLs) and specialized cold chain providers for large-volume shipping into developing countries. This pathway prioritizes proven reliability, volume capacity, and competitive pricing. The direct sales channel involves manufacturers supplying specialized, high-value coolers directly to pharmaceutical companies, advanced hospitals, and clinical trial sponsors, where the focus is on customization, real-time data integration, and compliance with proprietary storage protocols. Specialized cold chain logistics providers play a crucial role across both channels, offering services such as temperature mapping, qualification, and validation, ensuring the product maintains its integrity through varied and challenging transport environments up to the crucial last-mile delivery point.

Vaccine Cooler Market Potential Customers

Potential customers for vaccine coolers span a broad ecosystem focused on public health, clinical care, and specialized pharmaceutical logistics, with purchasing decisions heavily influenced by regulatory compliance and operational requirements for cold chain integrity. The primary and largest end-user segment is the Government and Public Health sector, which includes national and regional health ministries responsible for national immunization programs (NIPs), alongside major global aid organizations such as the World Health Organization (WHO), the United Nations Children's Fund (UNICEF), and GAVI, the Vaccine Alliance. These customers require high-volume, extremely durable, and PQS-qualified passive and active coolers capable of performing reliably in diverse and often harsh climatic conditions for extended periods, focusing heavily on total cost of ownership and logistical scalability rather than proprietary features.

The second major customer group includes Pharmaceutical and Biotechnology Companies. These entities require coolers primarily for transporting high-value clinical trial materials, initial commercial batches of new vaccines, and specialized patient-specific therapies. Their demand is characterized by a need for ultra-precision temperature control, validated packaging solutions, and advanced data logging capabilities to ensure end-to-end traceability and compliance with Good Distribution Practice (GDP). This sector often drives the demand for innovative, high-specification packaging, including Ultra-Low Temperature (ULT) containers and active cooling solutions with redundant systems, where the value of the payload far outweighs the cost of the packaging. Specialized 3rd Party Logistics (3PL) providers and specialized courier companies dedicated to biopharma transport act as intermediaries but are also significant direct purchasers, investing in a fleet of coolers that meet diverse client requirements, requiring flexibility and high certification standards across their asset base.

Finally, direct healthcare providers, including large hospital networks, regional vaccination centers, pharmacies, and mobile clinics, constitute another essential segment. While their individual purchasing volumes might be smaller than governmental entities, their collective demand for smaller, highly portable, and user-friendly coolers for daily routine vaccinations and localized deployment is substantial. The key purchasing criteria for this segment revolve around ease of use, internal organization, rapid cooling recovery time, and compliance with local health department mandates. The growth of specialized retail pharmacy chains offering immunization services is further expanding this customer base, driving demand for mid-sized, reliable, and easily monitored cold box solutions that integrate seamlessly into existing clinical workflows and storage facilities, ensuring maximum accessibility to critical immunizations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Peli BioThermal, Cold Chain Technologies, Softbox Systems, Va-Q-Tec, CSafe Global, Thermo King, Sonoco ThermoSafe, Credo (Peli BioThermal), Cool Logistics, B Medical Systems, Icepack, Lifoam Industries, Inmark, Cryopak, Pelican Products, Dometic Group, Thermal Control Products, Sofrigam, Berlinger & Co., Zodiac Aerospace |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vaccine Cooler Market Key Technology Landscape

The technological landscape of the Vaccine Cooler Market is defined by continuous innovation in thermal physics, materials science, and digital integration, primarily focused on extending hold times, improving temperature accuracy, and enhancing supply chain traceability. Central to passive cooling advancements are Vacuum Insulated Panels (VIPs), which utilize near-vacuum conditions within thin, rigid panels to achieve exceptional thermal efficiency, offering significantly lower thermal conductivity than traditional foams. VIP technology allows manufacturers to produce coolers with thinner walls, increasing internal capacity while maintaining required temperature stability for several days, an essential factor for remote and last-mile logistics where resupply points are scarce. Further refining passive systems is the widespread adoption of Phase Change Materials (PCMs). Unlike traditional water ice, PCMs solidify and melt at precise temperatures (+5°C, -20°C, etc.), eliminating the risk of accidental freezing or overheating of sensitive vaccines, providing an engineered thermal buffer that significantly enhances payload safety and operational reliability across varying ambient temperatures, standardizing the preparation and conditioning process.

In the realm of active cooling systems, the focus is on optimizing power consumption, redundancy, and electronic control. Advanced active coolers frequently employ highly efficient compressor-based refrigeration systems combined with sophisticated microprocessor controls that ensure temperature stability within fractions of a degree, making them suitable for high-value or ultra-sensitive pharmaceutical shipments. A rapidly emerging technology is the integration of thermoelectric cooling (Peltier effect) in smaller, highly portable active units, favored for clinical settings due to their quiet operation and absence of moving mechanical parts requiring complex maintenance. However, the most transformative technological shift is the widespread implementation of IoT (Internet of Things) devices. These sensors are integrated directly into cooler walls or packaging inserts, recording temperature, humidity, GPS location, and even impact data in real-time. This connectivity allows manufacturers and logistics providers to monitor the cold chain continuously via cloud-based platforms, providing immediate alerts for thermal excursions, enabling rapid intervention, and generating verifiable audit trails essential for regulatory compliance and quality assurance in global distribution networks.

Furthermore, technology development is heavily centered on user interface and operational simplicity. Innovations include ‘cool-down’ indicators and visual cues that simplify the conditioning process of passive coolants, minimizing human error in preparation, which is a major historical cause of vaccine wastage. For Ultra-Low Temperature (ULT) requirements, the market is seeing increased development in liquid nitrogen dry shippers and specialized mechanical freezers capable of maintaining temperatures below -70°C, optimized for air freight and long-haul road transport. These specialized units integrate advanced insulating materials with highly reliable, often dual-redundancy, refrigeration cycles to ensure mission-critical stability for novel vaccines and high-value biological samples. Future technological evolution is expected to focus on sustainable cooling methods, utilizing natural refrigerants and optimizing battery technology to further reduce the carbon footprint and reliance on complex, often fossil-fuel-dependent, cold chain infrastructure, aligning market offerings with growing global commitments to environmental, social, and governance (ESG) standards, especially within the pharmaceutical and logistics industries.

Regional Highlights

- North America: This region is characterized by a mature market with high regulatory standards (FDA compliance) and strong adoption of advanced, integrated cooling solutions. Demand is driven by specialty pharmaceutical logistics, sophisticated clinical trials requiring precise temperature control (especially ULT), and stringent state-level regulations regarding vaccine handling. The emphasis is on high-value active and specialized passive VIP containers that offer data logging and real-time monitoring capabilities. Replacement cycles and the complexity of transporting advanced biologics sustain demand, leading to high average selling prices for sophisticated cooling technology.

- Europe: The European market demonstrates robust demand, governed by strict European Medicines Agency (EMA) Good Distribution Practice (GDP) guidelines. Key drivers include consolidated pharmaceutical manufacturing hubs and extensive cross-border logistics requiring validated transit packaging. The market shows a strong preference for sustainable and reusable cooling solutions, often involving advanced PCMs and highly durable passive containers to meet environmental directives while ensuring thermal integrity across varying continental climates. Eastern European expansion of immunization programs also contributes to the rising adoption of WHO PQS-certified products.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by vast population size, expanding public health budgets, and significant last-mile logistics challenges across diverse geographies, ranging from dense urban centers to remote islands. Government initiatives to improve immunization coverage (e.g., India, China, Indonesia) necessitate massive procurement of basic yet highly durable passive coolers for field operations. The adoption of smart, monitored cold chain solutions is accelerating in commercially significant markets (Japan, South Korea, Australia) to manage high-value imports and exports of sensitive biopharmaceuticals.

- Latin America: This region exhibits moderate but steady growth, driven by regional health organization partnerships (e.g., PAHO) and national efforts to decentralize healthcare access. Demand focuses on robust, mid-capacity cold boxes suitable for long-haul ground transport and effective against high ambient temperatures, requiring efficient PCM usage. Political stability and economic fluctuations can impact public sector procurement, leading to a reliance on international funding and aid for major cold chain modernization projects, yet the presence of localized pharmaceutical manufacturing also fuels demand for specialized logistics coolers.

- Middle East and Africa (MEA): MEA represents a mission-critical market, highly reliant on passive cooling technology due to severe heat, unreliable power access, and challenging terrain for last-mile delivery. The market is predominantly supplied through WHO/UNICEF procurement, emphasizing high-performance, long-hold-time passive cold boxes and vaccine carriers that meet stringent PQS standards. Significant investment through aid programs focuses on capacity building, training in cold chain management, and the implementation of reliable remote temperature monitoring to safeguard immunization efforts in low-resource settings against heat stress and accidental thermal excursion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vaccine Cooler Market.- Peli BioThermal

- Cold Chain Technologies

- Softbox Systems

- Va-Q-Tec

- CSafe Global

- Thermo King

- Sonoco ThermoSafe

- B Medical Systems

- Credo (Peli BioThermal)

- Cool Logistics

- Icepack

- Lifoam Industries

- Inmark

- Cryopak

- Pelican Products

- Dometic Group

- Thermal Control Products

- Sofrigam

- Berlinger & Co.

- Zodiac Aerospace (Safran)

Frequently Asked Questions

Analyze common user questions about the Vaccine Cooler market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between active and passive vaccine coolers?

Passive coolers rely on specialized insulation (like VIPs) and cold packs (PCMs or ice) to maintain temperature without external power, ideal for short-term and last-mile delivery. Active coolers use electrical power (battery or external) for mechanical or thermoelectric refrigeration, offering continuous, precise temperature control for high-volume or long-duration transit.

Why is WHO PQS prequalification important for vaccine cooler procurement?

WHO PQS (Performance, Quality, and Safety) prequalification certifies that vaccine coolers meet globally recognized performance standards for reliability, durability, and thermal stability under specific ambient conditions. It is mandatory for manufacturers supplying public health campaigns, NGOs, and global aid organizations like UNICEF and GAVI, assuring product effectiveness in challenging environments.

How is the rise of mRNA vaccines influencing the cooler market?

mRNA vaccines, which often require Ultra-Low Temperature (ULT) storage (down to -80°C), are driving significant demand for highly specialized ULT coolers, including advanced dry shippers and mechanically refrigerated containers. This segment requires stringent data logging and validated cold chain management, pushing technological innovation in insulation and cooling systems.

What role do Phase Change Materials (PCMs) play in modern vaccine coolers?

PCMs are non-toxic substances engineered to maintain a specific temperature range (+5°C or -20°C) by absorbing or releasing heat during phase transition, providing a stable thermal buffer. They are crucial for passive coolers, preventing vaccines from freezing or overheating, offering a safer and more consistent alternative to standard water ice packs.

Which geographical region is currently experiencing the highest growth in demand for vaccine cooling technology?

The Asia Pacific (APAC) and Middle East & Africa (MEA) regions are exhibiting the highest growth rates. This acceleration is due to extensive governmental investment in expanding national immunization programs, significant logistical challenges in reaching remote populations, and increasing international aid focused on strengthening cold chain infrastructure in these regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager