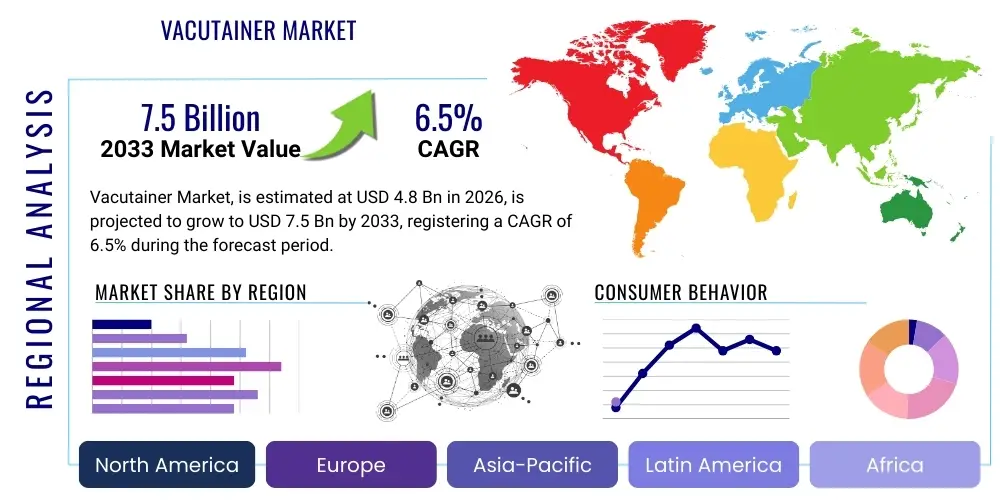

Vacutainer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438343 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Vacutainer Market Size

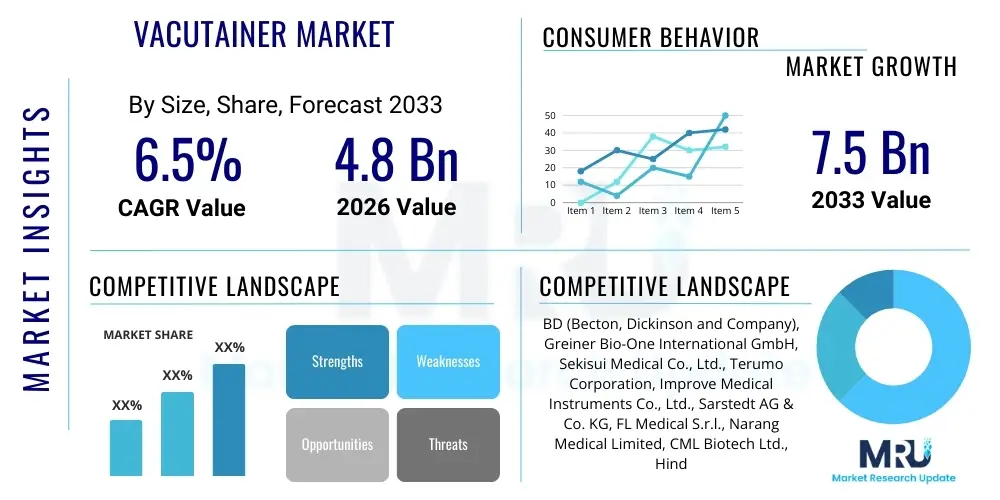

The Vacutainer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Vacutainer Market introduction

The Vacutainer Market encompasses the global trade of evacuated blood collection systems, primarily consisting of blood collection tubes, needles, holders, and adapters. These systems are essential diagnostic tools utilized across hospitals, clinics, diagnostic laboratories, and blood banks globally for the safe, efficient, and standardized collection of biological fluid samples, predominantly venous blood. The fundamental product, the evacuated tube, maintains a vacuum, ensuring a precise volume of blood is drawn directly into the tube, thus minimizing the risk of contamination and enhancing sample quality for subsequent analysis. These tubes are often pre-dosed with specific additives—anticoagulants (like EDTA, Heparin), coagulants, or preservatives—required for different types of tests, ranging from hematology and clinical chemistry to specialized genetic sequencing.

The widespread adoption of Vacutainer systems is driven by the imperative for increased safety for both patients and healthcare professionals, primarily through the reduction of needlestick injuries via retractable and safety-engineered components. Furthermore, the inherent standardization offered by these evacuated systems ensures sample integrity, which is critical for accurate and reliable diagnostic results. Major applications include routine health checkups, disease screening (infectious diseases, chronic conditions), therapeutic drug monitoring, and monitoring patient responses to treatment. The market benefits significantly from the rising global prevalence of chronic diseases, necessitating frequent blood testing, coupled with the expansion of diagnostic infrastructure in developing economies and the continuous innovation in specialized tube chemistries for advanced molecular diagnostics.

Key factors propelling market expansion include favorable regulatory frameworks promoting safety devices, increasing awareness regarding laboratory error reduction, and the transition away from traditional open collection methods. Advances in tube materials, such as the shift towards polyethylene terephthalate (PET) tubes, offer enhanced stability and reduced potential for sample interaction compared to glass. The market dynamics are highly influenced by volume procurement strategies adopted by large hospital chains and centralized laboratories, demanding cost-effective, high-quality, and robust supply chains to meet the growing demands of clinical testing worldwide.

Vacutainer Market Executive Summary

The Vacutainer Market is characterized by stable, moderate growth, underpinned by non-discretionary demand stemming from global healthcare expansion and increased diagnostic testing volumes. Business trends indicate a strong emphasis on safety-engineered devices (e.g., safety-lock holders and winged collection sets) driven by occupational health and safety regulations, particularly in North America and Europe. Consolidation among key manufacturers is observed as they seek to vertically integrate supply chains and expand their geographical footprint, especially into high-growth Asia Pacific markets. Furthermore, companies are investing heavily in specialized tubes (e.g., cell-free DNA collection tubes, tubes optimized for proteomics) to cater to emerging high-complexity molecular diagnostics, moving beyond basic clinical chemistry products and commanding higher margins in niche segments. The shift towards automated pre-analytical systems in major laboratories further necessitates the use of standardized Vacutainer products compatible with high-throughput machinery.

Regionally, North America remains the largest revenue generator, largely due to high healthcare expenditure, sophisticated diagnostic infrastructure, and stringent regulatory adherence to safety standards. However, the Asia Pacific (APAC) region is poised for the fastest growth, driven by massive investments in public health infrastructure, increasing insurance penetration, and the rising burden of non-communicable diseases requiring extensive screening. Countries like China and India are transitioning rapidly toward standardized evacuated systems, fueled by government initiatives to modernize diagnostic labs. European markets maintain robust demand, primarily focusing on advanced materials and ergonomic designs, although growth rates are relatively mature compared to APAC.

Segment trends highlight the dominance of the serum separator tubes (SSTs) and EDTA tubes due to their indispensable roles in clinical chemistry and hematology, respectively. However, the fastest growth is anticipated in specialized collection tubes, particularly those designed for genetic testing and liquid biopsy applications, reflecting the ongoing revolution in personalized medicine. In terms of end-users, diagnostic laboratories and hospitals account for the overwhelming majority of procurement, with a notable growth trajectory observed in standalone diagnostic centers prioritizing efficiency and sample management. The continuous pressure on healthcare providers to improve turnaround times and reduce diagnostic errors sustains the demand for high-quality, reliable Vacutainer products.

AI Impact Analysis on Vacutainer Market

Users frequently inquire whether Artificial Intelligence (AI) will render traditional blood collection obsolete, focusing on the potential for AI-driven non-invasive diagnostics and automation in phlebotomy. Key themes center around whether AI can improve pre-analytical quality assurance, optimize laboratory workflow management, and assist in automating the phlebotomy process itself, thereby reducing human error associated with sample collection and handling. Concerns often revolve around data integration—specifically, how data derived from smart vacutainer systems (e.g., time stamps, temperature logs) can be integrated into Laboratory Information Systems (LIS) and analyzed by AI algorithms to flag potential sample rejections before processing. Expectations are high regarding AI’s ability to predict and prevent pre-analytical errors, which account for the majority of laboratory issues, thereby indirectly enhancing the value and reliability of the Vacutainer system itself, rather than replacing it.

The primary impact of AI in the Vacutainer market is not in displacing the physical collection tube, which remains the vessel for biological material, but in optimizing the ecosystem surrounding it. AI integration focuses on enhancing the pre-analytical phase, ensuring that the collected sample, held within the Vacutainer tube, is handled, transported, and logged optimally. For instance, AI algorithms can analyze real-time operational data from smart tracking systems applied to collection tubes, assessing variables like time-to-centrifugation or temperature excursions during transport, factors critical for preserving sample integrity. This predictive analysis allows laboratories to intervene proactively, minimizing the number of compromised specimens and reducing costs associated with redraws.

Furthermore, AI-driven automation is increasingly applied to sorting and handling collected Vacutainers in high-throughput laboratories. Robotic systems guided by machine vision recognize tube types, prioritize samples based on urgency, and ensure correct placement on analyzers. This level of automation relies entirely on the standardized physical format of the Vacutainer tube, reinforcing its role as the critical physical interface between the patient and the diagnostic machine. As AI improves the efficiency and reliability of downstream analysis, the demand for high-quality, standardized input (i.e., the Vacutainer sample) is intensified, solidifying the market's foundational role in diagnostic medicine.

- AI-driven pre-analytical error detection minimizes sample rejection rates.

- Integration of smart tracking data with AI algorithms optimizes sample logistics and integrity monitoring.

- Automation of tube sorting and handling in high-volume labs via machine vision systems.

- AI assists in predicting optimal collection schedules and phlebotomy team allocation based on patient flow.

- Enhanced quality assurance metrics derived from analyzing collection and handling metadata linked to Vacutainer barcodes.

- Development of specialized Vacutainers with embedded sensors compatible with AI-enabled data capture platforms.

DRO & Impact Forces Of Vacutainer Market

The Vacutainer market is propelled by increasing global healthcare infrastructure development, mandatory implementation of safety-engineered devices, and the escalating incidence of chronic and infectious diseases requiring frequent diagnostic monitoring. However, restraints include intense pricing pressure due to bulk purchasing by large hospital groups, the challenge of disposing of biological waste safely, and the regulatory complexity inherent in medical device manufacturing. Opportunities abound in the development of specialized, high-margin tubes for advanced diagnostics like liquid biopsy and genomic testing, coupled with penetration into emerging economies where standardization of collection protocols is still nascent. These internal dynamics are further influenced by external impact forces such, as stringent regulations (like OSHA standards for sharps safety), technological advancements in pre-analytical automation, and the global push towards universal healthcare coverage, all collectively shaping market growth trajectory and competitive landscape.

The primary driver is the sheer volume of diagnostic testing performed globally, directly correlated with population aging and expansion of diagnostic services. Safety regulations, particularly the Needlestick Safety and Prevention Act in the U.S. and similar directives worldwide, mandate the use of safety-engineered collection devices, creating a sustained demand for premium-priced safety Vacutainer systems. Conversely, the market faces significant restraint from the mature nature of the core product segment, leading to intense commoditization and subsequent pricing negotiations, particularly in tenders managed by governmental bodies or large Group Purchasing Organizations (GPOs). Furthermore, the long replacement cycles for phlebotomy equipment and the high cost of compliant disposal procedures can marginally slow adoption rates in resource-constrained settings.

Key opportunities lie in innovating beyond standard collection tubes. The growth in personalized medicine demands collection systems optimized for sensitive analytes like circulating tumor DNA (ctDNA) or specialized immune cells, offering manufacturers a pathway to higher profitability. Geographical expansion into rapidly growing APAC and Latin American markets, coupled with establishing strong supply chains, presents another crucial avenue for revenue growth. The overall impact forces suggest a market moving towards greater standardization, increased safety consciousness, and technological integration, where successful players must balance high quality and regulatory compliance with cost-effective manufacturing and logistics to maintain competitive advantage.

Segmentation Analysis

The Vacutainer market is segmented based on the product type (collection tubes, needles, holders, and collection sets), additive type (EDTA, Heparin, Serum Separator, Fluoride), material (Glass, PET), application (clinical chemistry, hematology, immunology, microbiology), and end-user (hospitals, diagnostic laboratories, blood banks). This segmentation highlights the complexity of the market, where different tube additives serve highly specialized diagnostic functions, and the choice of material impacts factors like shelf-life and interaction with the sample. The dominance of general diagnostic applications contrasts with the rapid growth seen in high-end, specialized testing segments, influencing R&D strategies and pricing structures across the industry. The segmentation by end-user reflects procurement scale and required product sophistication, with large centralized labs prioritizing compatibility with automated systems.

- By Product Type:

- Blood Collection Tubes (Evacuated Tubes)

- Serum Collection Tubes

- Plasma Collection Tubes

- Whole Blood Collection Tubes

- Specialized Tubes (e.g., Trace Elements, Molecular Diagnostics)

- Blood Collection Needles and Syringes

- Holders and Adapters

- Safety-Engineered Devices (Winged Sets)

- Blood Collection Tubes (Evacuated Tubes)

- By Additive Type:

- EDTA Tubes

- Heparin Tubes (Lithium, Sodium, Ammonium)

- Coagulant/Clot Activator Tubes (Serum Separator Tubes - SSTs)

- Sodium Fluoride/Oxalate Tubes

- ACD Tubes (Acid Citrate Dextrose)

- Other Specialized Additives

- By Material:

- Glass Tubes

- Plastic Tubes (PET)

- By Application:

- Clinical Chemistry

- Hematology

- Immunology

- Coagulation Studies

- Microbiology

- Molecular Diagnostics and Personalized Medicine

- By End-User:

- Hospitals and Clinics

- Diagnostic Laboratories (Independent and Centralized)

- Blood Banks

- Research and Academic Institutes

Value Chain Analysis For Vacutainer Market

The Vacutainer market value chain initiates with upstream activities involving the sourcing of specialized materials, primarily high-grade plastic resin (PET) and glass, along with crucial chemical additives (anticoagulants, stabilizers). Manufacturing is a highly automated process characterized by stringent quality control to ensure precise vacuum levels and additive concentration in each tube. Key upstream challenges include maintaining material purity and managing the volatile costs of petrochemical derivatives used in plastic tubes. The expertise in chemical formulation and sterilization techniques represents a significant barrier to entry, ensuring that major established players maintain a competitive edge due to proprietary manufacturing processes and robust intellectual property surrounding tube additives.

The midstream phase focuses on assembly, sterilization, packaging, and logistics management. Given the high-volume, low-margin nature of many standard Vacutainer products, efficiency in mass production and robust quality assurance (QA) protocols are critical. Companies often utilize automated assembly lines to minimize human contact and ensure the integrity of the vacuum seal. Distribution, both direct and indirect, forms the downstream segment. Direct sales are common for large volume buyers, such as major hospital networks and centralized diagnostic laboratory chains, allowing manufacturers to manage pricing and maintain strong client relationships. Indirect sales involve partnerships with specialized medical device distributors and wholesalers who possess regional expertise and extensive reach, particularly in fragmented markets or developing countries.

The final layer involves the flow of products to the end-users—hospitals, clinics, and laboratories. Effective distribution relies on complex inventory management systems due to the large product portfolio (varying by size, color code, and additive). Furthermore, customer service and technical support related to usage protocols and compatibility with automated laboratory equipment are vital for maintaining customer loyalty. The entire value chain is heavily regulated; compliance with FDA, CE, and ISO standards is non-negotiable at every stage, from material procurement to final deployment and post-market surveillance. Efficiency optimization within this chain directly impacts the final product cost and market competitiveness.

Vacutainer Market Potential Customers

The primary customers for Vacutainer systems are entities involved in patient care and clinical diagnostics, demanding high-volume, reliable, and standardized blood collection tools. Hospitals, particularly large tertiary and teaching hospitals, represent a foundational customer segment due to their comprehensive range of services, high patient throughput, and integration of specialized departments like oncology and critical care, all requiring extensive blood diagnostics. These institutions typically purchase through centralized procurement departments or GPOs, prioritizing long-term contracts, volume discounts, and guaranteed supply reliability, often favoring manufacturers who offer a complete suite of blood collection products, including safety devices and custom-labeled options.

Independent and centralized diagnostic laboratories form the second largest and arguably the fastest-growing customer base. These labs, operating as high-throughput testing centers, necessitate Vacutainer systems that are fully compatible with sophisticated automated pre-analytical and analytical machinery. Their purchasing decisions are driven less by clinical preference and more by technical compatibility, error reduction capabilities, and overall cost per test. The demand from these labs is increasingly focused on standardized color-coding systems and robust barcoding capabilities to ensure seamless integration into laboratory information systems (LIS) and maximize operational efficiency. Specialized reference labs, focusing on complex testing like genomics, require highly specialized and sometimes custom-formulated tubes.

Other crucial segments include blood banks and plasma centers, which utilize specialized Vacutainer tubes for donor screening and component preparation, focusing particularly on large-volume collection sets and specific anticoagulant types (like Citrate Phosphate Dextrose). Public health clinics, governmental health initiatives, and research institutions also constitute significant potential customers, especially during large-scale public health screenings or clinical trials. For all customer segments, the critical decision factor remains the balance between product quality (ensuring sample integrity) and adherence to local and international safety standards to protect phlebotomy staff.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BD (Becton, Dickinson and Company), Greiner Bio-One International GmbH, Sekisui Medical Co., Ltd., Terumo Corporation, Improve Medical Instruments Co., Ltd., Sarstedt AG & Co. KG, FL Medical S.r.l., Narang Medical Limited, CML Biotech Ltd., Hindustan Syringes & Medical Devices Ltd., Gosvami Healthcare Pvt. Ltd., Trivitron Healthcare, Qunxing Medical Group, AdvaCare Pharma, Cardinal Health, QIAGEN N.V., Nipro Corporation, Roche Diagnostics, Sysmex Corporation, McKesson Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vacutainer Market Key Technology Landscape

The core technology surrounding the Vacutainer market centers on maintaining vacuum integrity and optimizing tube additive functionality. Technological advancements are focused primarily on two areas: materials science and safety engineering. In materials science, the shift from conventional glass tubes to polyethylene terephthalate (PET) plastic tubes has been a significant development. PET tubes offer superior shatter resistance, lighter weight, and improved shelf life, although manufacturers must employ specialized coatings to ensure barrier properties are maintained and gasses (like CO2) do not permeate, which would compromise the vacuum and potentially affect pH-sensitive tests. This transition demands specialized, high-precision injection molding and coating techniques to maintain strict tolerance levels.

Safety engineering represents the other critical technological landscape. Innovations here include the widespread integration of retractable needles and self-sheathing mechanisms in blood collection sets to prevent needlestick injuries, adhering to global occupational safety standards. Furthermore, advancements in specialized additives are crucial. For molecular diagnostics, manufacturers are developing proprietary preservative solutions within the tubes (e.g., cell-free DNA stabilizing agents) that prevent cellular degradation or lysis, allowing samples to be stored and transported without refrigeration for extended periods—a crucial requirement for remote sample collection and advanced genetic testing protocols. This chemical technology requires extensive R&D investment and regulatory approval, differentiating market leaders.

Finally, technology integration with laboratory automation is paramount. This involves standardizing tube dimensions, color-coding, and barcode readability (2D barcodes) to ensure flawless compatibility with high-speed automated track systems and robotic sample handling equipment. The integration of Radio-Frequency Identification (RFID) tags in premium Vacutainer systems is an emerging technology, enabling automated inventory tracking, improved temperature monitoring, and enhanced data logging directly linked to the patient record, significantly reducing manual data entry errors and enhancing overall pre-analytical quality assurance in modern laboratories.

Regional Highlights

Geographical analysis reveals stark contrasts in market maturity and growth dynamics across different regions, influenced by healthcare expenditure, regulatory environment, and disease prevalence. North America, encompassing the United States and Canada, leads the global market in terms of revenue share. This dominance is attributed to highly advanced diagnostic infrastructure, mandatory implementation of expensive safety-engineered devices driven by strict OSHA and local regulations, and high per capita healthcare spending. The large presence of key market players and a robust focus on sophisticated, high-end molecular diagnostic tubes further solidifies its leading position. The emphasis here is less on volume growth and more on technological upgrades and premium pricing strategies.

Europe constitutes the second largest market, characterized by mature healthcare systems, centralized tendering processes in countries like the UK and France, and strong demand for both standard and specialized products. Regulatory compliance with the Medical Device Regulation (MDR) has enforced rigorous quality and safety standards, driving manufacturers to upgrade product lines. The region shows robust adoption of plastic tubes and advanced automation compatible systems. However, heterogeneous reimbursement policies across various European nations occasionally lead to fragmented purchasing patterns.

Asia Pacific (APAC) is projected to be the fastest-growing market during the forecast period. This rapid expansion is fueled by massive governmental and private investment in establishing and modernizing hospitals and diagnostic laboratories, particularly in populous nations such as China, India, and Southeast Asia. The transition from traditional blood collection methods to standardized evacuated systems is accelerating, driven by increasing health awareness and rising prevalence of chronic diseases. While price sensitivity remains a key factor, the sheer volume demand and the improving regulatory landscape focused on quality control are opening substantial opportunities for both global leaders and local manufacturers. Latin America and the Middle East & Africa (MEA) are emerging regions, where infrastructure development and increased public access to diagnostics are gradually boosting the demand for foundational Vacutainer products, although growth is often constrained by economic volatility and reliance on imported goods.

- North America: Dominant market share due to stringent safety regulations, high healthcare spending, and early adoption of molecular diagnostic specialized tubes. Key focus on safety-engineered devices and automation integration.

- Europe: Mature market with steady demand, driven by sophisticated diagnostic networks and compliance with EU MDR standards. Strong adoption of automation-compatible plastic tubes.

- Asia Pacific (APAC): Fastest growing region, fueled by infrastructure development, rising chronic disease burden, and transition towards standardized collection systems in China and India. Price competitiveness is essential for market penetration.

- Latin America: Growth driven by expanding universal health coverage and increasing diagnostic capacity, focusing primarily on cost-effective standard tube sets.

- Middle East and Africa (MEA): Emerging markets with moderate growth, dependent on governmental health initiatives and foreign investment in specialized medical infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vacutainer Market.- BD (Becton, Dickinson and Company)

- Greiner Bio-One International GmbH

- Sekisui Medical Co., Ltd.

- Terumo Corporation

- Improve Medical Instruments Co., Ltd.

- Sarstedt AG & Co. KG

- FL Medical S.r.l.

- Narang Medical Limited

- CML Biotech Ltd.

- Hindustan Syringes & Medical Devices Ltd.

- Gosvami Healthcare Pvt. Ltd.

- Trivitron Healthcare

- Qunxing Medical Group

- AdvaCare Pharma

- Cardinal Health

- QIAGEN N.V.

- Nipro Corporation

- Roche Diagnostics

- Sysmex Corporation

- McKesson Corporation

Frequently Asked Questions

Analyze common user questions about the Vacutainer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Vacutainer market?

Market growth is predominantly driven by the surging global prevalence of chronic diseases requiring frequent blood monitoring, the mandatory adoption of safety-engineered blood collection devices mandated by occupational health regulations (reducing needlestick injuries), and significant investments in expanding and modernizing diagnostic laboratory infrastructure worldwide, particularly in emerging economies.

How do specialized Vacutainer tubes contribute to modern molecular diagnostics?

Specialized Vacutainer tubes are crucial for modern diagnostics as they contain proprietary chemical stabilizers (e.g., for cfDNA or specialized immune cells) necessary to maintain the integrity of sensitive biomarkers during collection, transport, and storage. This preservation is essential for accurate results in applications like liquid biopsy and advanced genomic sequencing, allowing for personalized medicine approaches.

Which geographical region holds the largest market share and why is APAC growing fastest?

North America currently holds the largest market share due to its established healthcare infrastructure, high safety compliance standards (mandating premium devices), and high expenditure on diagnostics. Conversely, the Asia Pacific (APAC) region is experiencing the fastest growth, driven by rapid healthcare modernization, expanding access to diagnostics, and the large patient pool transitioning from traditional to standardized evacuated collection methods.

What is the significance of the shift from glass to PET plastic Vacutainer tubes?

The transition from glass to PET (Polyethylene Terephthalate) plastic tubes significantly enhances safety by providing shatter resistance, reducing potential biohazard spills. PET tubes also offer a lighter weight and improved consistency in vacuum maintenance, leading to longer shelf life and better integration with high-speed automated sample processing systems in modern centralized laboratories.

What technological innovations are impacting the pre-analytical phase of the Vacutainer market?

Key technological impacts include the integration of safety mechanisms (retractable needles), advanced tube coatings to optimize sample stability, and the incorporation of robust tracking technologies such as 2D barcoding and RFID. These innovations ensure accurate sample identification, monitor critical variables during transport, and improve compatibility with automated laboratory tracks, minimizing pre-analytical errors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager