Vacuum Deaerators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438021 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Vacuum Deaerators Market Size

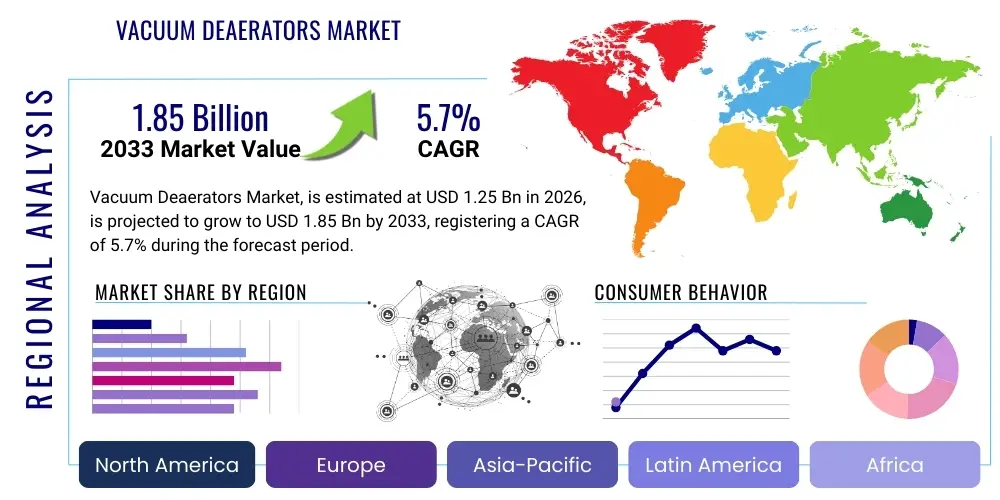

The Vacuum Deaerators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.7% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the stringent regulatory mandates across developed and developing economies aimed at preventing corrosion in industrial boiler systems and pipelines, coupled with the increasing demand for high-purity water in sensitive applications like pharmaceuticals and electronics manufacturing.

Market expansion is particularly noticeable in regions undergoing rapid industrialization and modernization of existing infrastructure. Vacuum deaerators offer superior performance in removing dissolved gases, predominantly oxygen and carbon dioxide, from boiler feedwater, safeguarding capital equipment, and improving overall thermal efficiency. The shift towards sustainable operational practices and energy conservation further drives the adoption of advanced deaeration technologies that minimize chemical consumption and maximize system reliability. Investments in new power generation facilities, specifically combined cycle plants, also contribute significantly to the market valuation over the projected timeline.

Vacuum Deaerators Market introduction

The Vacuum Deaerators Market encompasses systems designed to remove non-condensable dissolved gases, primarily oxygen, from liquids such as boiler feedwater, process water, or beverages, thereby preventing corrosion, scaling, and ensuring product quality. Vacuum deaerators utilize the principle that gas solubility decreases significantly when liquid temperature is maintained slightly below the saturation temperature and subjected to a vacuum. This process is crucial in high-pressure steam systems where even minute concentrations of oxygen can cause rapid and catastrophic pitting corrosion in boilers, steam lines, and heat exchangers. Major applications span thermal power generation, oil and gas processing, chemical manufacturing, food and beverage production, and specialized industries like semiconductors where ultra-pure water is mandatory.

The product portfolio generally includes spray-type, tray-type, and membrane deaerators, each suited for specific pressure and capacity requirements. Key benefits derived from implementing vacuum deaeration include enhanced system efficiency, extended lifespan of expensive boiler equipment, reduced maintenance costs associated with corrosion repair, and improved process control through precise management of dissolved gas levels. Furthermore, unlike pressure deaerators, vacuum systems often operate at lower temperatures, resulting in reduced thermal stress on the feedwater systems, making them highly suitable for certain industrial environments requiring moderate-temperature operation.

The market is predominantly driven by the continuous need for efficiency improvements in energy-intensive industries and the rising global emphasis on asset integrity management. Tightening environmental and operational safety regulations mandate the adoption of best available technologies for corrosion mitigation. Moreover, the robust expansion of the pharmaceutical and cosmetic industries, which rely heavily on purified water for their processes, acts as a significant demand catalyst. Technological advancements, such as the integration of smart sensors and IoT capabilities for real-time monitoring and performance optimization, are further contributing to the market's dynamic growth profile.

Vacuum Deaerators Market Executive Summary

The global Vacuum Deaerators Market is experiencing robust expansion, underpinned by critical business trends focusing on industrial automation, sustainability, and efficiency maximization across infrastructure sectors. A notable business trend involves manufacturers integrating advanced materials and modular designs to reduce installation time and footprint, appealing to clients undertaking facility upgrades or space-constrained projects. Furthermore, strategic collaborations between deaerator system providers and engineering, procurement, and construction (EPC) firms are becoming prevalent, ensuring seamless integration of deaeration technology into large-scale industrial projects, particularly in the burgeoning power and chemical sectors. Competitive focus is shifting toward offering comprehensive service packages, including predictive maintenance analytics, leveraging smart technologies to enhance operational uptime.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market due to massive investments in new thermal power plants, rapid expansion of the manufacturing base (especially chemicals and textiles), and urbanization necessitating substantial water treatment infrastructure upgrades. North America and Europe, characterized by established industrial sectors, show strong demand for upgrading aging deaeration systems to comply with stricter efficiency standards and adopting energy-saving models like zero-oxygen discharge systems. Government incentives supporting clean energy and infrastructure modernization in these developed regions fuel the replacement cycle, maintaining their significant market share despite slower organic industrial growth compared to APAC.

In terms of segmentation, the Tray-Type Deaerator segment maintains a dominant market share owing to its high efficiency and reliability in large-scale boiler feedwater applications, though the Membrane Deaerators segment is projected to exhibit the highest CAGR due to its minimal steam consumption, small physical footprint, and suitability for high-purity processes in the electronics and life sciences industries. Application-wise, the Power Generation sector remains the largest consumer, necessitated by high-pressure boiler operations, while the Chemical & Petrochemical segment is rapidly expanding, driven by complex processing requirements that demand precise control over fluid chemistry. The shift towards customized, application-specific deaeration solutions is a key segment trend shaping future product development.

AI Impact Analysis on Vacuum Deaerators Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and vacuum deaeration systems predominantly revolve around enhancing predictive maintenance, optimizing energy consumption, and ensuring ultra-high water quality consistency. Users frequently ask: "Can AI minimize the steam required for effective deaeration?" or "How can machine learning models predict boiler tube corrosion related to residual oxygen levels?" The core theme users explore is the transition from reactive maintenance based on periodic checks to a proactive, data-driven operational paradigm. Concerns center on the security of IoT-connected systems and the accuracy of AI algorithms in interpreting complex fluid dynamics and temperature variations, particularly under fluctuating load conditions common in industrial settings. Expectations are high regarding AI's potential to dramatically reduce operational expenses (OPEX) by optimizing vacuum pump operation and reducing chemical dosing requirements.

AI's primary influence is manifesting through the integration of sophisticated monitoring systems that analyze multivariate data streams—including inlet/outlet oxygen levels, temperature, pressure differentials, and vacuum pump performance. Machine learning algorithms process this data to create accurate digital twins of the deaerator system, allowing for precise anomaly detection far earlier than traditional SCADA systems. This predictive capability translates directly into minimizing unscheduled downtime, extending the Mean Time Between Failures (MTBF) for critical components, and ensuring uninterrupted industrial processes, which is paramount in sectors like continuous chemical manufacturing.

Furthermore, AI algorithms are crucial for optimizing the complex control loop inherent in vacuum deaeration. By dynamically adjusting vacuum levels and, where applicable, supplementary heating based on real-time fluctuating feedwater quality and boiler demand, AI ensures maximum deaeration efficiency while minimizing parasitic energy consumption by the vacuum pumps and ancillary equipment. This optimization is particularly valuable in industrial plants running variable loads, ensuring consistent water quality regardless of operational demands, thereby reducing the risk of oxygen-induced corrosion and maximizing the lifespan of the entire steam generation infrastructure.

- AI enables real-time, predictive maintenance schedules for vacuum pumps and sensors.

- Machine Learning optimizes vacuum pressure and temperature control, minimizing energy usage.

- Digital twins created by AI simulate performance under various load conditions, aiding design validation.

- AI enhances residual oxygen measurement accuracy and provides automated calibration alerts.

- Improved process optimization leads to reduced reliance on supplementary corrosion inhibitors.

- Automated fault detection minimizes system downtime and operational errors.

DRO & Impact Forces Of Vacuum Deaerators Market

The Vacuum Deaerators Market is shaped by a confluence of influential forces, encapsulated by strong Drivers and compelling Opportunities, balanced against specific Restraints. The key driver is the global emphasis on protecting valuable capital assets—specifically industrial boilers and high-pressure steam systems—from oxygen-induced corrosion, which is a major cause of failure and inefficiency in thermal processes. This necessity is further amplified by stringent regulatory compliance demanding high standards for water quality in critical processes. Opportunities arise from the increasing adoption of membrane technology due to its chemical-free operation and low energy profile, particularly attractive in the electronics and pharmaceutical industries requiring ultra-pure water. The market also benefits from the push toward facility modernization in established economies, replacing older, less efficient systems with smart, automated vacuum deaerators.

However, the market faces significant restraints, primarily the high initial capital investment required for sophisticated vacuum deaerator systems compared to simpler, albeit less efficient, chemical dosing solutions or conventional thermal deaerators. Furthermore, the operational complexity associated with maintaining the high vacuum necessary for optimal performance, coupled with the reliance on skilled technical personnel for maintenance and troubleshooting, acts as a barrier to adoption in some smaller industrial installations or developing regions with limited technical infrastructure. The market penetration is also slightly affected by cyclical fluctuations in capital spending within the power generation and heavy manufacturing sectors.

The collective impact forces favor moderate to strong growth. Drivers like industrial asset integrity management, regulatory pressure, and energy efficiency mandates provide sustained baseline demand. The increasing accessibility and competitive pricing of advanced sensors and IoT components reduce the long-term operational costs, effectively mitigating some of the initial investment restraints. The major impact is observed in the value proposition shift: manufacturers are increasingly marketing vacuum deaerators not merely as corrosion prevention tools but as core components of integrated energy management systems, promising significant long-term return on investment (ROI) through enhanced thermal efficiency and reduced chemical consumption, securing steady forward momentum in market adoption.

Segmentation Analysis

The Vacuum Deaerators Market is comprehensively segmented based on Type, Application, and Operating Capacity, providing a nuanced view of industry dynamics and specialized demand areas. Segmentation by Type differentiates between the primary structural and operational designs, essential for matching the technology to specific industrial requirements, such as handling fluctuating loads or requiring ultra-low oxygen residuals. Application segmentation highlights the diverse end-user base, ranging from massive power plants to sensitive beverage production facilities, each demanding tailored solutions regarding material compatibility, purity levels, and operational pressures. Capacity segmentation allows for analysis based on plant size and throughput, critical for manufacturing and procurement decisions across the globe.

- By Type:

- Spray-Type Vacuum Deaerators

- Tray-Type Vacuum Deaerators

- Packed Column Deaerators

- Membrane Deaerators

- By Application:

- Power Generation (Thermal, Combined Cycle)

- Chemical & Petrochemical Processing

- Oil and Gas (Upstream & Downstream)

- Pharmaceuticals and Biotechnology

- Food & Beverage Industry

- Water Treatment (Municipal & Industrial)

- Pulp & Paper

- By Operating Capacity:

- Low Capacity (Up to 50 T/H)

- Medium Capacity (50 T/H to 200 T/H)

- High Capacity (Above 200 T/H)

Value Chain Analysis For Vacuum Deaerators Market

The Value Chain for the Vacuum Deaerators Market begins with the Upstream Analysis, which involves the sourcing and processing of core raw materials such as specialized high-grade steel (stainless steel and carbon steel, resistant to corrosion and high pressure), vacuum pump components (e.g., liquid ring pumps, ejectors), and control instrumentation. Suppliers of specialized internal components, including trays, packing materials, and proprietary nozzles, hold significant bargaining power, particularly if their components are patented or offer superior performance characteristics essential for achieving low oxygen guarantees. Quality assurance at this stage is crucial, as the performance and longevity of the final system depend heavily on the metallurgy and precision engineering of the sourced parts.

Moving through the manufacturing and assembly phase, original equipment manufacturers (OEMs) focus on system design, pressure vessel fabrication, and integration of complex control systems and heat exchangers. Distribution channels are varied: Direct sales models are common for high-capacity, custom-engineered projects, involving direct engagement between the manufacturer's sales engineering team and the end-user (e.g., a power plant developer). This ensures precise technical specification fulfillment. Indirect channels leverage specialized industrial distributors, system integrators, and EPC contractors, especially for standardized or smaller-capacity units used in general industrial applications or packaged boiler systems. These indirect partners provide local installation support, immediate spare parts access, and crucial after-sales service.

The Downstream Analysis involves installation, commissioning, and comprehensive after-sales support, which is critical for maintaining equipment efficacy and minimizing lifecycle costs. EPC firms and specialized local service providers handle installation and integration into existing plant infrastructure. The end-users (potential customers) drive demand based on mandatory asset protection and water quality requirements. Customer service, including long-term maintenance contracts, monitoring services (increasingly leveraging IoT/AI), and spare parts supply, constitutes a major revenue stream for OEMs and significantly impacts customer retention and market reputation. The successful completion of the value chain is measured by the sustained ability of the deaerator to meet stringent oxygen residual guarantees consistently over its operational life.

Vacuum Deaerators Market Potential Customers

The core group of potential customers for vacuum deaerators comprises large industrial operators who utilize steam generation or complex fluid handling processes where dissolved gases are detrimental to equipment or product quality. This segment is dominated by the Power Generation sector, specifically thermal power plants (coal, gas, nuclear) and utility companies that require massive volumes of deaerated feedwater to prevent boiler tube failure and catastrophic outages. These buyers prioritize reliability, high throughput capacity, and compliance with strict operational safety standards, often leading to procurement of high-capacity, custom-engineered tray-type or hybrid deaerators.

A secondary, yet rapidly growing, customer segment includes process-intensive industries such as Chemical and Petrochemical producers. These facilities use deaeration not just for boiler protection, but also to remove gases from process streams that could interfere with chemical reactions, product stability, or trigger undesirable side reactions. The Pharmaceutical and Biotechnology sectors represent a highly attractive niche, demanding ultra-high purity water (WFI—Water for Injection) where dissolved oxygen removal is critical for quality control and regulatory compliance, making compact and highly efficient membrane deaerators the preferred technology in this domain.

Furthermore, the Food & Beverage industry, including breweries, soft drink manufacturers, and juice processing plants, constitutes a steady stream of buyers. In this application, deaeration is crucial for extending shelf life, preserving flavor, and preventing oxidation of sensitive ingredients. These customers typically require smaller to medium-capacity units that adhere to stringent sanitary design principles. The diversity of end-users—from continuous operation plants requiring constant service to batch processors needing flexible, modular units—dictates varied purchasing criteria, but the universal need is minimizing corrosion and maximizing water quality efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | CAGR 5.7% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens, GE Water & Process Technologies, Veolia Water Technologies, Spirax Sarco, Thermax Limited, Hydro-Thermal Corporation, R.P. Adams Company, Inc., Cannon Water Technology, LLC, Watson Marlow Fluid Technology Group, Clark-Reliance Corporation, Cochrane Engineering, Aqua-Chem, Inc., Wessels Company, Graham Corporation, Aerzen USA, Deaerator Systems Company (DSC), Kansas City Deaerator Company, Inc., Penn Separator Corporation, SPX Flow, Inc., Alfa Laval AB |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vacuum Deaerators Market Key Technology Landscape

The technology landscape of the Vacuum Deaerators Market is defined by continuous evolution focusing on efficiency, purity attainment, and reduced operational footprint. Traditional technologies such as tray-type deaerators remain dominant in high-capacity boiler feedwater applications due to their proven reliability and ability to handle large flow rates, but modern innovations have focused on optimizing tray design, materials, and steam scrubbing sections to minimize residual oxygen levels to parts per billion (ppb) thresholds. A significant technological advancement involves the integration of advanced control systems utilizing sophisticated Proportional-Integral-Derivative (PID) controllers and Model Predictive Control (MPC) strategies. These systems allow dynamic adjustment of vacuum pump speed and heating medium supply based on predictive analysis of inlet water conditions and fluctuating steam demand, leading to substantial energy savings and consistent performance.

The emerging technological front is dominated by Membrane Deaeration systems. These systems utilize gas-permeable, non-porous membranes (often hollow fiber) to physically separate dissolved gases from the liquid stream under vacuum, without requiring a temperature increase or steam injection. This chemical-free, low-energy approach is revolutionizing high-purity applications, particularly in the electronics and pharmaceutical sectors where thermal stability and zero contamination are paramount. While membrane systems generally have lower throughput than large conventional deaerators, their modularity and ability to achieve extremely low dissolved gas concentrations (often below 5 ppb) make them highly competitive in specialized niches.

Furthermore, the incorporation of Industry 4.0 principles, including Internet of Things (IoT) sensors and Artificial Intelligence (AI) analytics, is fundamentally changing how these systems are operated and maintained. New-generation deaerators are equipped with smart sensors that monitor critical parameters like dissolved oxygen, pH, conductivity, and vacuum integrity in real-time. This connectivity enables remote monitoring, automated diagnostics, and predictive failure analysis for high-value components like vacuum pumps and critical valves. This technological shift optimizes operational expenditure, extends equipment life, and ensures tighter adherence to process specifications, driving higher value and adoption among technologically advanced industrial clients.

Regional Highlights

Regional dynamics play a crucial role in shaping the Vacuum Deaerators Market, reflecting varied industrial development levels, regulatory environments, and capital investment cycles. Asia Pacific (APAC) represents the powerhouse of growth, driven by massive infrastructure spending in countries like China, India, and Southeast Asia, focusing on expanding power generation capacity (both conventional and renewable backup systems) and rapid industrialization in sectors like chemicals, textiles, and electronics manufacturing. The need to establish new industrial facilities compliant with modern efficiency standards creates sustained demand for new installations. Furthermore, the rising awareness of water treatment and asset preservation in emerging economies fuels the adoption of high-performance deaerators.

North America and Europe constitute mature markets characterized by replacement cycles and technological upgrades. Demand in these regions is heavily influenced by stringent environmental regulations, prompting industries to invest in highly efficient, low-footprint systems, such as advanced membrane deaerators, to minimize energy consumption and meet strict water quality discharge standards. The focus here is less on new capacity and more on integrating smart technologies (IoT, AI) into existing infrastructure to maximize operational lifespan and reduce OPEX. The concentration of sophisticated pharmaceutical and biotechnology manufacturing in Europe and North America drives consistent demand for ultra-pure water deaeration solutions.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions offering significant long-term potential. LATAM's market is driven by mining, oil and gas, and food processing industries, requiring robust and durable deaeration equipment. The MEA region, particularly the Gulf Cooperation Council (GCC) states, sees demand stemming from substantial investments in petrochemical refining, desalination plants, and industrial water management, often involving large-scale projects requiring high-capacity, specialized vacuum deaerator units designed to operate reliably in challenging high-temperature environments.

- Asia Pacific (APAC): Highest growth rate; driven by power plant expansion, chemical manufacturing, and electronics industry investment (e.g., China, India, South Korea).

- North America: Market maturity; focus on infrastructure modernization, regulatory compliance, and adoption of smart, energy-efficient membrane systems (e.g., USA, Canada).

- Europe: Replacement and upgrade market; strong demand from specialized sectors like pharmaceuticals and biotechnology, adhering to strict environmental standards (e.g., Germany, UK, Italy).

- Middle East and Africa (MEA): Growth driven by petrochemical projects, oil and gas infrastructure development, and desalination plants (e.g., Saudi Arabia, UAE).

- Latin America (LATAM): Steady growth fueled by mining, heavy industry, and food processing sectors (e.g., Brazil, Mexico).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vacuum Deaerators Market.- Siemens

- GE Water & Process Technologies (Suez Water Technologies)

- Veolia Water Technologies

- Spirax Sarco

- Thermax Limited

- Hydro-Thermal Corporation

- R.P. Adams Company, Inc.

- Cannon Water Technology, LLC

- Watson Marlow Fluid Technology Group

- Clark-Reliance Corporation

- Cochrane Engineering

- Aqua-Chem, Inc.

- Wessels Company

- Graham Corporation

- Aerzen USA

- Deaerator Systems Company (DSC)

- Kansas City Deaerator Company, Inc.

- Penn Separator Corporation

- SPX Flow, Inc.

- Alfa Laval AB

Frequently Asked Questions

Analyze common user questions about the Vacuum Deaerators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a vacuum deaerator in industrial processes?

The primary function of a vacuum deaerator is the highly efficient removal of dissolved gases, specifically oxygen and carbon dioxide, from boiler feedwater or process water by exposing the liquid to a high vacuum environment, thereby mitigating internal system corrosion and preventing equipment damage.

How do vacuum deaerators compare to traditional thermal deaerators in terms of efficiency and operating cost?

Vacuum deaerators typically offer superior efficiency in achieving very low residual oxygen levels (often below 5 ppb) and consume significantly less or no steam for heating compared to thermal deaerators, resulting in lower operational energy costs, especially for systems where water heating is undesirable or impractical.

Which application segment holds the largest share in the Vacuum Deaerators Market?

The Power Generation segment, including conventional thermal and combined cycle power plants, holds the largest market share. This is due to the absolute necessity of ultra-low oxygen feedwater to protect high-pressure boiler systems and turbines from rapid corrosion and subsequent failure.

What technological advancement is expected to drive the highest growth rate in the market?

Membrane deaeration technology is expected to drive the highest CAGR. Its minimal footprint, chemical-free operation, and ability to achieve ultra-high water purity (crucial for pharmaceutical and electronics manufacturing) positions it as the key growth catalyst moving forward.

What are the key corrosion issues prevented by effective vacuum deaeration?

Effective vacuum deaeration prevents catastrophic pitting corrosion caused by dissolved oxygen, and acidic corrosion resulting from carbon dioxide forming carbonic acid, thereby significantly extending the service life of boilers, heat exchangers, and associated pipeline infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager