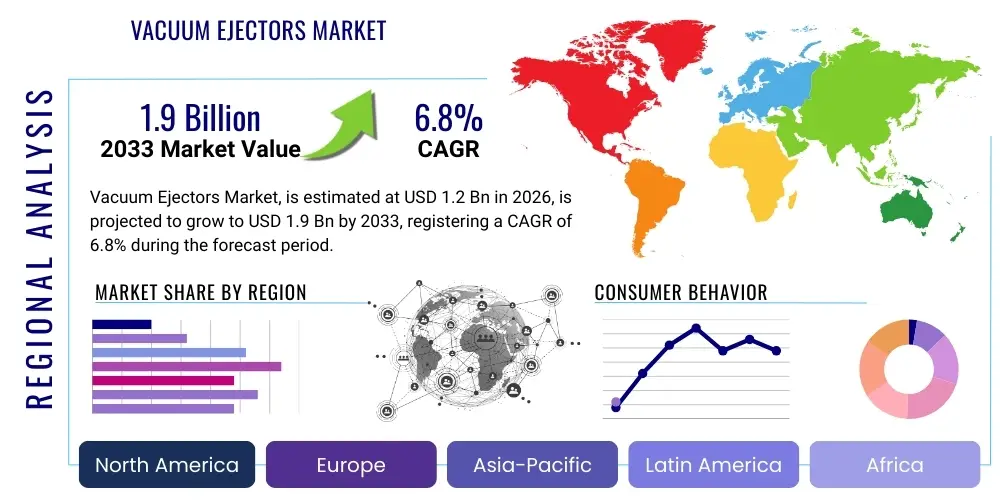

Vacuum Ejectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438216 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Vacuum Ejectors Market Size

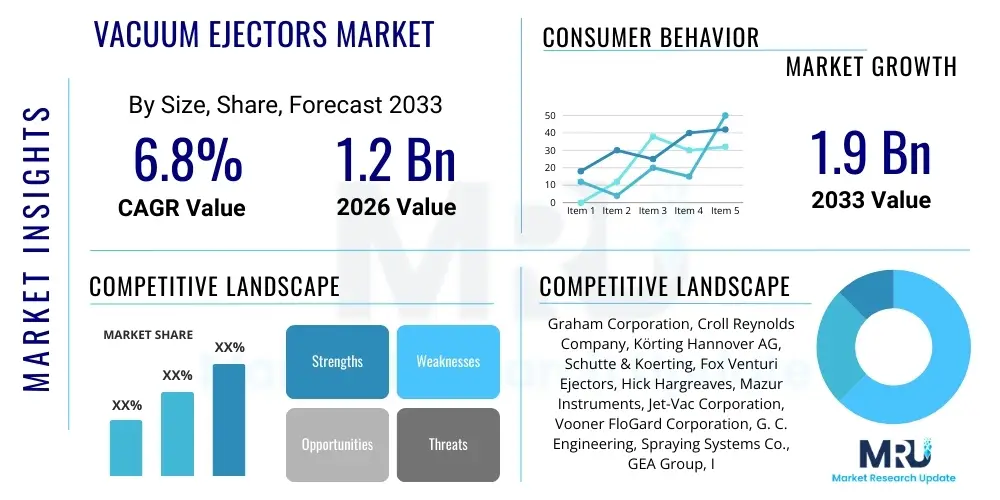

The Vacuum Ejectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033.

Vacuum Ejectors Market introduction

The Vacuum Ejectors Market encompasses devices that use the Venturi effect to create vacuum pressure efficiently, primarily by leveraging a high-velocity motive fluid—such as steam, air, or gas—to entrain and discharge the suction fluid. These systems are favored in industrial settings requiring robust, low-maintenance vacuum generation, especially in environments where conventional mechanical pumps are unsuitable due to harsh conditions, explosive risks, or specific fluid compatibility requirements. Their lack of moving parts translates into high reliability and reduced operational complexity, making them essential components across diverse manufacturing and processing sectors.

Key applications for vacuum ejectors span the chemical processing industry (CPI), pharmaceuticals, power generation, refining, and food and beverage manufacturing. In chemical plants, ejectors are vital for distillation, crystallization, degassing, and drying processes where precise vacuum control is paramount for product quality and process efficiency. The inherent design simplicity allows for customization across a wide range of operating pressures and capacities, addressing nuanced industrial demands from deep vacuum requirements to large-volume suction tasks. Furthermore, the ability to handle corrosive, abrasive, or contaminated process streams without internal damage is a significant benefit driving their sustained adoption.

Driving factors for market expansion include the global increase in energy-intensive chemical and petrochemical production, necessitating efficient vacuum systems for solvent recovery and reaction optimization. The growing emphasis on industrial efficiency and safety standards further promotes the use of steam ejectors, particularly in environments where solvent vapor recovery is critical for compliance. Technological advancements focusing on optimizing nozzle geometry and integrating hybrid systems (ejector-liquid ring pump combinations) are also enhancing overall system performance and energy efficiency, broadening the applicability of vacuum ejectors in complex, modern industrial installations worldwide.

Vacuum Ejectors Market Executive Summary

The Vacuum Ejectors Market exhibits robust growth driven by accelerating industrialization across Asia Pacific and stringent process safety regulations globally, particularly within the chemical and power sectors. Business trends indicate a strong shift towards multi-stage ejector systems and hybrid configurations that promise greater energy efficiency and deeper vacuum levels, mitigating traditional concerns regarding steam consumption. Strategic collaborations focusing on digitalization and predictive maintenance integration into vacuum systems are emerging as key competitive differentiators, aiming to optimize uptime and operational costs for end-users. Leading manufacturers are focusing on material science innovations to enhance resistance to corrosive media, thereby extending the lifespan and applicability of ejectors in harsh environments.

Regionally, the Asia Pacific continues to dominate market expansion due to massive investments in downstream oil and gas infrastructure, pharmaceutical manufacturing capacity expansion, and high demand from the rapidly growing electronics sector for vacuum drying processes. North America and Europe, characterized by mature industrial bases, demonstrate steady growth, primarily fueled by retrofitting old mechanical pump systems with modern, reliable ejectors and stringent environmental mandates requiring efficient waste heat utilization, often facilitated by steam ejector technology. The Middle East and Africa (MEA) are witnessing notable uptake, specifically within the expanding petrochemical and desalination plants, where high-capacity vacuum generation is essential for core operations.

Segment trends highlight the dominance of steam ejectors, attributed to their low initial cost and widespread availability of steam utility in large industrial complexes, though air ejectors are gaining traction in smaller, decentralized applications and those sensitive to moisture contamination. Within the application segment, the chemical and petrochemical sectors remain the largest consumers, utilizing ejectors for crucial separation and pressure reduction tasks. The development of advanced materials such as corrosion-resistant alloys for critical components is vital for market traction, ensuring reliable performance under extreme temperature and pressure conditions inherent in these high-stakes industries, thus supporting long-term market sustainability.

AI Impact Analysis on Vacuum Ejectors Market

User queries regarding AI in the Vacuum Ejectors Market frequently revolve around predictive maintenance schedules, optimization of motive fluid consumption (especially steam), and integration of smart diagnostics to detect performance degradation early. Users are concerned about whether AI can truly enhance the efficiency of mechanically simple devices like ejectors and what the cost-benefit ratio is for adopting such advanced monitoring systems. The core expectations center on using AI-driven analytics to move beyond reactive maintenance, allowing industrial operators to maintain optimal vacuum levels with minimal energy waste and reduced manual intervention. The analysis confirms a strong user interest in leveraging machine learning algorithms to model complex thermodynamic behaviors within multi-stage ejector systems, ensuring peak performance under varying load conditions, thereby bridging the gap between simple mechanical design and intelligent operational management.

- AI enables predictive maintenance scheduling by analyzing sensor data (pressure, temperature) to anticipate nozzle erosion or blockage.

- Machine learning algorithms optimize motive fluid flow rates (steam/air) dynamically based on real-time process vacuum demand, maximizing energy efficiency.

- Digital twins powered by AI simulate ejector performance under extreme conditions, aiding in optimal design and material selection.

- AI integrates ejector performance data with overall plant control systems, allowing for holistic process optimization and throughput enhancement.

- Automated diagnostics identify subtle drops in ejector efficiency immediately, preventing costly system failures or product quality issues.

- Smart monitoring reduces the necessity for frequent manual inspections, leading to lower operational expenditures (OPEX) and improved worker safety.

- AI assists in complex troubleshooting by providing root cause analysis for sudden vacuum fluctuations in multi-stage systems.

DRO & Impact Forces Of Vacuum Ejectors Market

The Vacuum Ejectors Market dynamics are shaped by key drivers such as escalating demand from processing industries (refining, chemical, power), restraints including high utility consumption and competition from advanced mechanical pumps, and opportunities arising from hybrid system development and specialized materials utilization. The primary driving force remains the inherent reliability, simplicity, and capability of ejectors to handle aggressive process gases and vapors, environments where conventional rotating equipment often fails. However, the operational expenditure associated with the constant need for high-pressure motive fluid, particularly steam, serves as a significant restraint, pushing industries toward more energy-efficient vacuum alternatives. The market impact forces emphasize technological advancement in nozzle design and system integration to overcome efficiency limitations, ensuring ejectors maintain relevance in a cost-conscious industrial landscape.

Key drivers include the global trend of capacity expansion in petrochemical and fine chemical production, requiring dependable vacuum for complex distillation and reaction processes. Furthermore, regulatory mandates focusing on emissions control and solvent recovery, especially in pharmaceutical and specialty chemical manufacturing, favor the use of steam ejectors for efficient handling of volatile organic compounds (VOCs). The low capital expenditure (CAPEX) and minimal maintenance requirement inherent to ejector systems make them highly attractive for new plant installations or rapid capacity scale-ups. This reliability is critical in continuous processing industries where unplanned downtime results in massive financial losses, thus cementing the ejector's position as a robust vacuum solution.

Restraints are primarily linked to the relatively lower energy efficiency compared to modern mechanical vacuum pumps, particularly liquid ring and dry screw technologies, especially in deep vacuum applications. The dependence on a readily available high-pressure motive fluid (steam or air) limits their use in remote locations or facilities without robust utility infrastructure, adding complexity to system design. Opportunities lie in the increasing adoption of hybrid vacuum systems, pairing ejectors with mechanical pumps (e.g., steam ejector-liquid ring pump systems) to combine the robustness of ejectors with the efficiency of pumps, achieving optimal performance across varying load ranges. The expanding use of high-performance materials resistant to ultra-corrosive chemicals also opens new niche applications for ejectors in demanding environments, offering significant potential for market differentiation and specialized growth.

Segmentation Analysis

The Vacuum Ejectors Market is broadly segmented based on Type, Motive Fluid, Stage, Application, and End-User Industry. This segmentation reflects the diverse range of operational requirements across various industrial settings, from high-capacity steam ejectors utilized in power plants to small, precise air ejectors employed in handling equipment. Understanding these segments is crucial for manufacturers to tailor product specifications, materials, and marketing strategies to meet specific industry needs. The key differentiating factors include the level of vacuum required, the volume of gases to be handled, the chemical nature of the process stream, and the availability of utility resources (steam, water, compressed air) at the operational site, all of which dictate the optimal ejector configuration and material choice.

The Type segment is essential as it categorizes ejectors by their primary structural design, such as jet ejectors, steam ejectors, and vacuum pumps, recognizing that while often used interchangeably, differences exist in design principles for optimizing flow and pressure dynamics. The segmentation by Motive Fluid (Steam, Air, Water, Gas) directly impacts operational costs and system integration, with steam remaining dominant in large industrial complexes due to its high efficiency in deep vacuum applications. Stage segmentation (Single-Stage, Multi-Stage) is critical for addressing varying vacuum depth requirements, where multi-stage systems are necessary to achieve ultra-low pressures for complex chemical reactions or precision drying processes, thereby driving differential adoption rates across end-user industries.

- By Type:

- Jet Ejectors

- Steam Ejectors (The largest segment)

- Air Ejectors

- By Motive Fluid:

- Steam

- Air/Compressed Gas

- Liquid (Water/Oil)

- By Stage:

- Single-Stage Ejectors

- Multi-Stage Ejectors

- By Application:

- Distillation

- Degassing and Deaeration

- Crystallization

- Drying

- Evaporation

- Filtration

- Vacuum Packaging and Conveying

- By End-User Industry:

- Chemical & Petrochemical

- Power Generation (Condenser Vacuum)

- Pharmaceutical

- Food & Beverage

- Oil & Gas (Refining)

- Plastics & Rubber

- Textiles

- By Material:

- Carbon Steel

- Stainless Steel (304, 316, Duplex)

- Special Alloys (Hastelloy, Titanium)

- Non-Metallic (Graphite, PTFE Lined)

Value Chain Analysis For Vacuum Ejectors Market

The value chain for the Vacuum Ejectors Market begins with upstream activities focused on the sourcing and processing of specialized raw materials, primarily high-grade stainless steel, specialized nickel alloys (like Hastelloy), and non-metallic materials (such as PTFE and graphite) required for corrosion resistance. This stage involves sophisticated material testing and machining to ensure that the critical components, especially the motive fluid nozzles and diffusers, meet stringent geometric and metallurgical specifications necessary for achieving peak vacuum efficiency. Effective upstream management ensures cost control and the ability to manufacture ejectors capable of withstanding the high temperatures and pressures characteristic of their operating environments, particularly in multi-stage steam systems.

The midstream phase involves the design, manufacturing, and assembly of the ejector systems. Given that many ejector systems are custom-engineered based on the client's specific process conditions (suction pressure, discharge pressure, capacity), advanced computational fluid dynamics (CFD) modeling is crucial during the design phase to optimize efficiency and minimize motive fluid consumption. Manufacturing involves precise casting, forging, and machining of components, followed by rigorous quality control and performance testing, often witnessed by end-users or third-party inspectors. Manufacturers must maintain high standards of precision, as minute deviations in nozzle geometry can drastically impact performance and operational costs, making technological superiority in manufacturing a major competitive advantage.

Downstream analysis focuses on distribution channels, installation, commissioning, and post-sales service. Distribution relies heavily on specialized industrial equipment distributors and engineering procurement and construction (EPC) contractors who integrate ejector systems into larger plant projects. Direct sales are common for customized, high-value installations to large petrochemical or power generation clients, requiring direct technical consultation. Indirect channels, such as regional distributors, manage standard product sales and after-market services, including spare parts and system overhaul kits. The long operational lifespan of ejectors makes reliable service and maintenance support a crucial factor in customer relationship management and maximizing equipment uptime throughout the product lifecycle.

Vacuum Ejectors Market Potential Customers

Potential customers for vacuum ejectors are predominantly large-scale industrial operators requiring reliable and continuous vacuum generation for critical unit operations. These end-users typically prioritize system longevity, resistance to aggressive chemical media, and minimal maintenance requirements over initial capital outlay. The core buyer group includes global chemical manufacturers involved in polymerization, solvent recovery, and specialized synthesis, as well as major refining companies utilizing ejectors in crude distillation units and vacuum gas oil processes. These clients often purchase complex, multi-stage systems that are highly customized to specific operational parameters, demanding a high level of engineering support from the vendor.

Another significant customer segment is the power generation industry, particularly coal-fired and nuclear power plants, where steam ejectors are indispensable for maintaining vacuum in condensers, a critical function for maximizing turbine efficiency and overall plant output. The pharmaceutical and biotechnology sectors are also major buyers, using high-purity materials in ejector construction for sterile processes like freeze-drying, evaporation of solvents, and vacuum distillation. For these customers, compliance with strict regulatory standards (e.g., FDA, GMP) and avoidance of contamination are paramount considerations, driving demand for specific metallic or lined ejector materials and validated performance documentation.

Emerging markets for vacuum ejectors include the rapidly expanding desalination and wastewater treatment sectors, where vacuum is utilized for evaporation and purification processes. Furthermore, the industrial refrigeration and air conditioning industry employs ejectors in specific cooling cycles. The purchasing decision in all these sectors is heavily influenced by total cost of ownership (TCO), operational reliability, and the vendor's ability to provide prompt technical support and spare parts across the projected 20-30 year operational life span of the industrial facility, underscoring the importance of post-installation service contracts and engineering expertise.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Graham Corporation, Croll Reynolds Company, Körting Hannover AG, Schutte & Koerting, Fox Venturi Ejectors, Hick Hargreaves, Mazur Instruments, Jet-Vac Corporation, Vooner FloGard Corporation, G. C. Engineering, Spraying Systems Co., GEA Group, IDEX Corporation, Gardner Denver (Ingersoll Rand), Nash Engineering, TLV Co., Ltd., Flowserve Corporation, Sterling Sihi GmbH, Fuji Electric Co., Ltd., Dekker Vacuum Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vacuum Ejectors Market Key Technology Landscape

The core technology of vacuum ejectors, rooted in the Venturi principle, remains fundamentally unchanged, but the current technological landscape is characterized by advanced computational optimization and sophisticated material engineering aimed at improving efficiency and extending operating range. Key advancements involve Computational Fluid Dynamics (CFD) modeling, which allows manufacturers to precisely simulate motive fluid flow paths and mixing zones within the ejector. This enables the design of highly optimized nozzles and diffusers, maximizing momentum transfer and minimizing energy dissipation, thereby significantly reducing the consumption of expensive motive fluids like high-pressure steam. Modern ejectors increasingly integrate highly specialized materials to combat erosion and corrosion, crucial factors in determining system longevity when handling aggressive chemicals or high-velocity vapors. The use of duplex stainless steels, Hastelloy, and specialized ceramic liners for critical components is becoming standard practice in high-demand industrial sectors.

A significant technological shift is the development and adoption of sophisticated multi-stage and hybrid vacuum systems. Multi-stage ejectors, often incorporating condensers between stages, allow for achieving extremely deep vacuum levels necessary for complex pharmaceutical synthesis and high-purity chemical production, while simultaneously reducing the load on the subsequent ejector stages. Hybrid systems represent the pinnacle of current technology, pairing the robust reliability of the initial ejector stages (which handle corrosive vapors and high temperatures) with the high efficiency of mechanical vacuum pumps (like liquid ring or dry screw pumps) in the final stages. This integrated approach leverages the strengths of both technologies, offering optimal performance, lower operating costs, and operational flexibility across varied process loads, addressing the market's need for both ruggedness and efficiency.

Furthermore, the integration of smart monitoring and Internet of Things (IoT) capabilities is transforming ejector operation from a purely passive mechanism into a data-rich component. Modern systems are increasingly equipped with high-precision pressure and temperature sensors linked to centralized control systems. These sensors provide real-time performance data, allowing operators to detect subtle changes in efficiency caused by fouling or wear. This data is often fed into AI-driven diagnostic platforms, enabling predictive maintenance and dynamic optimization of motive fluid supply, ensuring the ejector system consistently operates at its design point. This digitalization enhances reliability and is particularly relevant in critical applications within the power and petrochemical industries where stable vacuum is non-negotiable for safety and productivity.

Regional Highlights

The global Vacuum Ejectors Market exhibits distinct growth patterns influenced by regional industrial maturity, regulatory frameworks, and capital investment cycles, requiring tailored strategies for market penetration and expansion. Asia Pacific, driven by large-scale manufacturing expansion, remains the primary growth engine, while established markets in North America and Europe prioritize efficiency upgrades and high-specification, customized solutions. The Middle East and Africa present high-potential opportunities tied directly to large energy projects and infrastructure development, particularly within desalination and refining, demanding robust, high-capacity vacuum solutions suited for extreme climatic conditions and corrosive environments, highlighting regional disparities in demand profile.

- Asia Pacific (APAC)

- North America

- Europe

- Latin America

- Middle East and Africa (MEA)

The APAC region holds the largest market share and is expected to exhibit the highest CAGR during the forecast period. This dominance is attributed to rapid industrialization, substantial foreign direct investment into manufacturing sectors, and aggressive expansion of chemical, petrochemical, and pharmaceutical industries, particularly in China, India, and Southeast Asian nations. Governments in these regions are actively promoting self-sufficiency in refining and processing capabilities, leading to continuous construction of new, large-scale industrial complexes that rely heavily on reliable vacuum ejector systems for distillation, polymerization, and solvent recovery processes. Furthermore, increasing energy demand drives expansion in power generation capacity, where steam jet ejectors are critical for maintaining condenser vacuum in thermal power plants. The competitive landscape in APAC is characterized by both global players establishing local manufacturing bases and strong indigenous suppliers offering cost-effective solutions, fueling both volume and capacity growth in this dynamic region.

North America represents a mature, high-value market characterized by stringent safety standards and a strong focus on operational efficiency and environmental compliance. Market growth here is primarily fueled by the modernization of aging infrastructure, replacement of less efficient mechanical systems, and significant activity in the specialty chemicals and advanced pharmaceutical manufacturing sectors. The shale gas revolution has spurred growth in the downstream petrochemical industry, necessitating customized ejector systems capable of handling specific, often aggressive, process streams resulting from gas processing. Adoption rates for hybrid vacuum systems are notably high in this region, as end-users seek to combine the reliability of ejectors with the energy savings of modern mechanical pumps to achieve optimal total cost of ownership (TCO). Demand is concentrated among major refining companies and large chemical corporations headquartered in the US and Canada, valuing high-quality, engineered-to-order solutions and long-term service agreements.

The European market for vacuum ejectors is driven by regulatory pressures favoring energy efficiency and reduced emissions, alongside robust demand from the fine chemical, biotechnology, and food & beverage industries. Europe is a leader in implementing advanced process technologies, pushing demand for highly precise and customized ejector solutions, often manufactured from exotic alloys to ensure long-term stability and compliance with REACH regulations regarding substance handling. While the growth rate is moderate compared to APAC, the average selling price (ASP) of ejector systems is typically higher, reflecting the demand for advanced materials, sophisticated controls, and adherence to strict ATEX directives for explosive environments. Western European nations, particularly Germany, France, and the UK, maintain strong manufacturing bases, leading to steady replacement cycles and investment in technological upgrades, especially in the areas of solvent recovery and waste heat utilization schemes involving ejector technology.

Latin America presents a developing market with significant potential, heavily influenced by cyclical investments in the oil and gas (refining), mining, and primary chemical manufacturing sectors, particularly in Brazil and Mexico. The market is sensitive to macroeconomic stability and commodity prices, which directly impact investment decisions in new capital projects. Demand for vacuum ejectors is often linked to major government or private sector initiatives in large infrastructure projects where robustness and simple maintenance are prioritized due to logistical challenges in accessing specialized maintenance services. While cost sensitivity is higher than in North America or Europe, the need for reliable equipment in corrosive mining and basic chemical environments drives steady demand for well-engineered, robust ejector solutions capable of operating reliably under demanding conditions, often supplied through international distributors and EPC firms managing regional projects.

The MEA region is experiencing substantial growth in the vacuum ejectors market, primarily dictated by massive investments in petrochemical complexes, oil refining capacity expansion, and the critical development of desalination plants. Ejectors are vital in these sectors for process vacuum and high-capacity steam jet vacuum refrigeration systems, particularly effective in hot climates. The large-scale nature of these infrastructure projects necessitates high-volume, reliable steam ejector systems. The market is concentrated in the Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE, Qatar) due to abundant oil and gas resources and the strategic push toward developing downstream industries. The key challenge in MEA is the need for systems designed to withstand high ambient temperatures and manage corrosive seawater use, driving demand for specialized construction materials like super duplex stainless steel and titanium, thus generating high-value sales opportunities for specialized vendors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vacuum Ejectors Market.- Graham Corporation

- Croll Reynolds Company

- Körting Hannover AG

- Schutte & Koerting

- Fox Venturi Ejectors

- Hick Hargreaves

- Mazur Instruments

- Jet-Vac Corporation

- Vooner FloGard Corporation

- G. C. Engineering

- Spraying Systems Co.

- GEA Group

- IDEX Corporation

- Gardner Denver (Ingersoll Rand)

- Nash Engineering

- TLV Co., Ltd.

- Flowserve Corporation

- Sterling Sihi GmbH

- Fuji Electric Co., Ltd.

- Dekker Vacuum Technologies

Frequently Asked Questions

Analyze common user questions about the Vacuum Ejectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary motive fluid used in industrial vacuum ejectors?

The most common motive fluid is high-pressure steam, especially in large-scale chemical processing, refining, and power generation facilities, due to its effectiveness in achieving deep vacuum levels and the general availability of steam utility on-site. Compressed air is also widely used in lower-capacity, decentralized applications.

How do multi-stage vacuum ejectors differ from single-stage systems?

Multi-stage ejector systems utilize a series of two or more ejector stages, often separated by intercondensers, to gradually reduce the pressure and compress the suction fluid. This configuration allows for achieving significantly deeper vacuum levels (lower absolute pressures) compared to a single-stage system, which is typically limited to moderate vacuum requirements.

What are the main advantages of using a vacuum ejector over a mechanical vacuum pump?

Key advantages include superior reliability due to the absence of moving parts, high tolerance for handling corrosive, dirty, or abrasive process vapors, low maintenance costs, and reduced explosion risk. Ejectors are often the preferred choice in harsh chemical environments or applications requiring minimal downtime, despite their higher utility consumption.

Which industrial sectors are the major end-users driving the Vacuum Ejectors Market growth?

The Chemical and Petrochemical sector is the largest end-user, relying on ejectors for crucial processes like distillation, evaporation, and crystallization. Significant demand also comes from Power Generation (condenser vacuum maintenance) and the Pharmaceutical industry, which requires reliable vacuum for drying and solvent recovery.

How does AI technology impact the operational efficiency of existing vacuum ejector installations?

AI primarily impacts ejector efficiency through predictive maintenance and real-time optimization. Machine learning analyzes performance data to anticipate component wear or fouling, ensuring preventative action is taken. Furthermore, AI algorithms dynamically adjust motive fluid supply to maintain optimal vacuum levels under varying load conditions, minimizing energy waste.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Vacuum Ejectors Market Size Report By Type (Single Stage Vacuum Ejector, Multi-Stage Vacuum Ejector), By Application (Electronics, Process Industry, Refining, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Vacuum Ejectors Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ѕіnglе Ѕtаgе Vасuum Ејесtоr, Мultі-Ѕtаgе Vасuum Ејесtоr), By Application (Electronics, Process Industry, Refining, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Vacuum Ejectors Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Single Stage Vacuum Ejector, Multi-Stage Vacuum Ejector), By Application (Consumer Electronics, Process Industry, Refining), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager