Vacuum Insulated Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432111 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Vacuum Insulated Glass Market Size

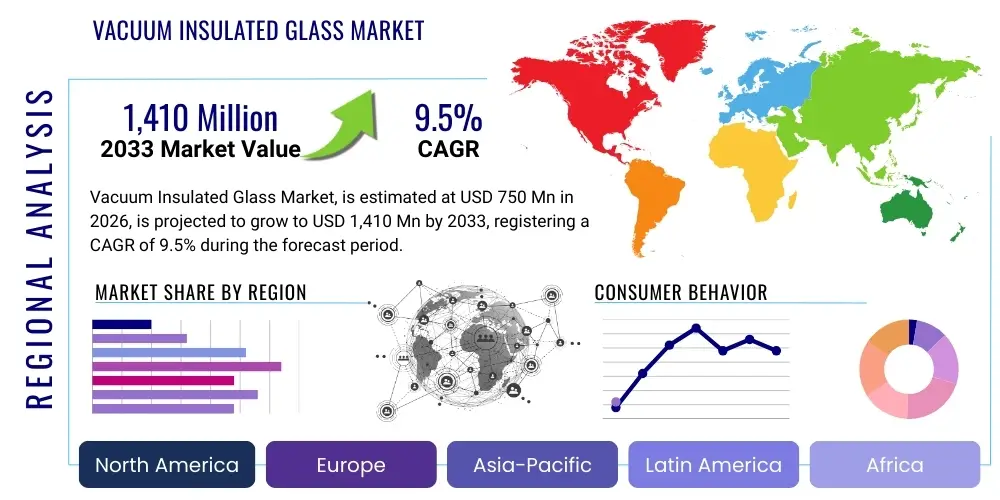

The Vacuum Insulated Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,410 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global focus on energy efficiency in the construction sector, stringent governmental regulations mandating lower building energy consumption, and the inherent superior thermal performance offered by Vacuum Insulated Glass (VIG) compared to traditional double or triple glazing units. The commercial and residential building sectors are increasingly adopting VIG solutions to meet ambitious decarbonization targets, thereby accelerating market trajectory across key geographies.

Vacuum Insulated Glass Market introduction

The Vacuum Insulated Glass (VIG) Market encompasses the manufacturing and distribution of specialized glazing products featuring two or more panes of glass separated by a vacuum space, offering unparalleled thermal insulation performance characterized by extremely low U-values. VIG is a sophisticated fenestration technology designed to dramatically reduce heat transfer, making it a critical component in constructing energy-efficient building envelopes, particularly in regions experiencing extreme temperature variations. Its primary product description centers on its slim profile, lightweight nature, and acoustic dampening capabilities, positioning it as an ideal retrofit solution for historic buildings where maintaining aesthetic integrity is essential, alongside its application in new, highly efficient structures.

Major applications of VIG span across the residential sector, utilized in high-performance windows and skylights; the commercial segment, employed in curtain walls, facades, and refrigerated display cases; and specialized transportation, including high-speed rail and automotive sunroofs where thermal management and weight reduction are paramount. The core benefits derived from VIG adoption include significant energy savings due to reduced reliance on HVAC systems, enhanced occupant comfort through the elimination of cold spots near windows, superior sound insulation properties, and compliance with increasingly stringent green building standards and certifications such as LEED and BREEAM. These superior characteristics ensure VIG's prominence in the push toward net-zero energy construction goals.

Driving factors propelling this market include the global momentum toward climate change mitigation and the resulting policy landscape favoring energy-saving materials. Governments worldwide are implementing mandatory building codes that demand superior thermal performance, effectively phasing out conventional glazing solutions that contribute significantly to building energy losses. Furthermore, the rising costs of energy, combined with growing consumer awareness regarding sustainable living practices, are encouraging investment in premium, long-lifecycle products like VIG. The continuous innovation in edge sealing technology and spacer systems, which enhances the longevity and durability of the vacuum seal, further stabilizes the market's growth trajectory and expands its addressable market.

Vacuum Insulated Glass Market Executive Summary

The Vacuum Insulated Glass market is witnessing robust growth, underpinned by critical business trends focusing on sustainable infrastructure development and advanced material science integration. Key business trends include the convergence of VIG technology with smart glass features, such as electrochromic capabilities, and the move towards automated, high-volume manufacturing processes to address the historic challenge of high production costs. This focus on industrial scalability and product integration is widening the appeal of VIG beyond niche high-end construction into mainstream residential and mid-market commercial projects. Simultaneously, strategic partnerships between glass manufacturers and specialized sealing technology providers are crucial for ensuring product longevity and consistent vacuum quality, which are non-negotiable prerequisites for consumer acceptance and long-term warranties in this highly technical sector.

Regional trends indicate that the Asia Pacific (APAC) region, led by China and Japan, remains the largest market due to aggressive urbanization, massive infrastructure spending, and pioneering governmental energy-saving initiatives, especially in extreme climate zones requiring both high heating and cooling performance. Europe shows the fastest growth rate, fueled by the European Union's Green Deal and the renovation wave strategy, which mandates the upgrade of older building stock with high-efficiency fenestration solutions, making VIG an ideal candidate for retrofitting. North America’s growth is stable, driven primarily by tax credits, incentive programs like Energy Star, and the demand for premium, high-performance homes in regions characterized by severe temperature fluctuations, requiring superior insulation capabilities that VIG provides effectively.

Segmentation trends highlight that the application of VIG in the construction sector, specifically residential and commercial buildings, dominates the market share due to the sheer volume of new construction and renovation activities globally. Within component segmentation, the demand for low-emissivity (low-E) coatings integrated into VIG units is escalating, as these coatings further enhance thermal performance by minimizing radiant heat transfer without compromising visible light transmission. Furthermore, the increasing adoption of VIG in specialized applications, such as cold chain logistics (refrigerated transport and display cases), represents a nascent but rapidly expanding segment, driven by stringent temperature control requirements and the need for energy conservation across the logistics supply chain. The continued development of thin VIG products, which are easier to install and integrate into existing window frames, is also a significant trend reshaping segment dynamics.

AI Impact Analysis on Vacuum Insulated Glass Market

User inquiries regarding AI's influence on the VIG market predominantly revolve around three critical areas: enhancing manufacturing precision, optimizing product design for specific climate needs, and improving supply chain resilience. Users are keen to understand how AI-driven quality control systems can detect micro-defects in the critical edge sealing process, which determines the lifespan of VIG, and whether machine learning algorithms can predict the optimal mix of glass thickness and spacer type for maximum thermal efficiency (lowest U-value) given regional climate data. A central concern is leveraging AI to reduce the current high cost of VIG manufacturing by optimizing material use and minimizing wastage in the complex vacuum production cycle. Furthermore, there is significant interest in using predictive maintenance powered by AI to monitor and maintain the performance of large-scale VIG installations, such as high-rise facades, ensuring long-term energy savings and validating the high initial investment required for VIG technology adoption across major projects globally.

- AI-powered predictive modeling optimizes the structural design of VIG units, calculating thermal stresses and potential failure points under varying climate conditions, leading to enhanced product durability and warranty life.

- Machine learning algorithms significantly enhance quality control during the manufacturing process, specifically identifying minute imperfections in the vacuum cavity and edge seals, ensuring product performance consistency and longevity.

- AI enables demand forecasting and inventory management specific to different VIG specifications (e.g., thickness, low-E coatings), optimizing raw material procurement and reducing production lead times for customized construction projects.

- Robotics integrated with AI vision systems are increasingly utilized for precision assembly and handling of VIG units, minimizing human error and facilitating higher throughput in automated production lines.

- Advanced analytics driven by AI models help optimize the energy consumption of VIG manufacturing facilities, contributing to sustainable production and lowering overall operational costs, thereby addressing the high pricing barrier.

DRO & Impact Forces Of Vacuum Insulated Glass Market

The dynamic landscape of the Vacuum Insulated Glass market is fundamentally shaped by a powerful combination of drivers, restraints, and opportunities, all converging to exert significant impact forces on market trajectory. The paramount driver is the global mandate for superior energy efficiency in buildings, catalyzed by international agreements and national zero-carbon objectives, which necessitates glazing systems with U-values far superior to conventional double-glazing. This driver is amplified by increasing energy costs, which make the long-term operational savings associated with VIG highly attractive to property developers and owners. However, these drivers are tempered by significant restraints, primarily the high initial manufacturing cost associated with maintaining a permanent vacuum seal and the specialized requirements for installation, which can slow broader market penetration, particularly in cost-sensitive developing economies where cheap, albeit less efficient, alternatives prevail. The structural integrity and longevity concerns related to the vacuum seal, although mitigated by technological advancements, still pose a perception challenge in the marketplace.

Conversely, the market is rife with opportunities that promise to overcome current restraints and accelerate adoption. The massive global potential for retrofitting existing inefficient building stock with VIG represents the single largest market opportunity, especially in mature economies like Europe and North America where energy renovation is prioritized. VIG’s slim profile makes it perfectly suited for insertion into existing window frames without extensive structural modifications, providing a high return on investment through energy savings. Furthermore, integrating VIG with smart technologies—such as solar control films or integrated photovoltaic cells—opens up new high-value application niches, appealing to the premium sustainable architecture segment. These opportunities leverage VIG's core strength, which is providing high thermal performance in a minimal thickness, thereby enabling architectural design flexibility that traditional thick triple-glazing units cannot match.

The collective impact forces resulting from these DRO elements are compelling the industry towards innovation, focusing particularly on reducing manufacturing complexity and increasing the scale of production. The primary impact is the intensification of R&D efforts aimed at low-temperature sealing technologies and non-metallic edge sealants to enhance durability and reduce production cycle times, thereby addressing both cost and longevity restraints simultaneously. This technological push, coupled with regulatory impact forces that are steadily tightening performance standards (e.g., minimum R-values for building envelopes), ensures that VIG is transitioning from a specialized product to a mainstream requirement in high-performance construction. The strong governmental push towards green building certification and subsidies acts as a multiplier force, financially incentivizing the adoption of VIG and offsetting the initial capital expenditure hurdle, thus solidifying VIG's role as a cornerstone material for future sustainable cities globally. This comprehensive interplay of high regulatory push and technological innovation guarantees sustained market momentum.

Segmentation Analysis

The Vacuum Insulated Glass market is fundamentally segmented based on factors including component type, application sector, and end-use domain, reflecting the diverse requirements across the construction and refrigeration industries. Component segmentation is vital as it differentiates between basic VIG units and those incorporating advanced features like low-emissivity coatings or specialized interlayer films, which significantly impact thermal performance (U-value) and price point. Application segmentation focuses on distinguishing between the dominant construction use (residential, commercial) and specialized uses, such as transportation and appliances, each demanding tailored VIG specifications regarding size, strength, and sealing integrity. Understanding these segments is crucial for manufacturers to target specific value propositions, whether it is maximizing energy savings in large commercial facades or providing acoustic isolation in high-density residential areas.

The component segment, particularly the inclusion of Low-E coatings, is projected to witness the fastest growth because these coatings minimize radiant heat transfer without diminishing the benefits of the vacuum layer, offering a holistic solution for managing both conductive and radiative heat losses. In terms of end-use, the commercial building segment maintains the largest market share due to the vast surfaces requiring glazing in modern architecture (e.g., skyscrapers, office complexes), where even marginal U-value improvements translate into substantial operational cost reductions. Furthermore, the segmentation analysis confirms the strong link between government energy policies and segment growth; regions with strict mandates for retrofitting older governmental and public infrastructure are seeing rapid uptake in the retrofitting VIG segment, often utilizing slim-profile products that minimize structural intrusion while maximizing energy performance outputs.

- By Component:

- Low-Emissivity (Low-E) Coated Glass

- Standard Glass

- Spacer Materials (Micro-pillars, Supports)

- Edge Sealing Materials (Solder Glass, Metallic Seals)

- By Application:

- Construction (Windows, Doors, Facades, Skylights)

- Commercial Refrigeration (Display Cases, Freezers)

- Transportation (Automotive, High-Speed Rail)

- Solar Thermal Collectors

- By End-Use:

- Residential Buildings

- Commercial Buildings (Office, Retail, Healthcare)

- Industrial Facilities

- Institutional and Government Buildings

Value Chain Analysis For Vacuum Insulated Glass Market

The Value Chain for Vacuum Insulated Glass begins with the upstream processes encompassing the sourcing and preparation of highly specialized raw materials. This includes high-quality float glass manufacturing, the synthesis of low-emissivity coatings (requiring sophisticated sputtering technology), and the precision manufacturing of internal micro-spacers, which must withstand high compression loads and extreme temperatures without compromising the vacuum integrity. Upstream analysis focuses heavily on supply security and quality control of these specialized inputs, as the overall performance and lifespan of the VIG unit are highly dependent on the purity and dimensional accuracy of components like the edge seal material, often proprietary solder glass or advanced metallic alloys. Efficiency in this phase directly impacts the final unit cost, a critical factor for market adoption.

Moving downstream, the process transitions to the complex VIG fabrication stage, involving precise assembly in a cleanroom environment, the establishment of the vacuum via specialized pumping ports, and the critical edge sealing process, which must ensure hermetic closure for decades. Distribution channels play a pivotal role, characterized by a mix of direct sales to large-scale construction firms and indirect distribution through specialized window and facade fabricators. Direct distribution is common for customized, large-format commercial projects where technical consultation is essential, ensuring the VIG unit meets specific structural and thermal performance requirements of modern high-rise architecture. Conversely, indirect channels, utilizing established networks of window manufacturers, dominate the standardized residential and retrofit markets, leveraging existing installation expertise and local presence for widespread reach.

The crucial connection between the manufacturer and the end-user is maintained through certified installers and architectural consulting firms. The complexity of VIG installation, especially in retrofitting applications where precise fit into existing frames is mandatory, necessitates highly skilled personnel. Therefore, the downstream value chain emphasizes training and certification programs for installers to maintain quality assurance and uphold the product's warranted performance standards. The efficiency of the distribution channel, balancing the fragility of glass with the need for timely delivery, significantly affects project timelines and logistics costs, underscoring the necessity for specialized handling and transportation solutions within the VIG supply chain infrastructure.

Vacuum Insulated Glass Market Potential Customers

Potential customers and primary end-users of Vacuum Insulated Glass span a broad spectrum, unified by the common need for superior thermal performance and acoustic dampening, coupled with a minimal thickness profile. The largest customer segment encompasses large commercial property developers and institutional investors engaged in constructing high-value office buildings, healthcare facilities, and educational campuses. These buyers prioritize life-cycle cost savings over initial capital expenditure, recognizing that VIG significantly reduces operational energy consumption and contributes positively to green building certifications, thereby enhancing property value and attracting high-quality tenants committed to sustainability metrics and corporate social responsibility goals.

Another rapidly expanding customer base includes residential homeowners, particularly those in high-income brackets seeking premium, energy-efficient home renovations or new constructions. These consumers are motivated by improved indoor comfort, reduced energy bills, and minimizing their carbon footprint. The retrofit market, driven by governmental incentive schemes and aging building stock, represents a substantial customer opportunity, targeting owners of properties built before modern energy codes were enacted, offering VIG as a drop-in solution that preserves architectural aesthetics while dramatically boosting efficiency. Furthermore, specialized industrial customers, such as manufacturers of refrigerated display cases and companies in the cold chain logistics sector, are increasingly adopting VIG to minimize heat exchange in temperature-sensitive environments, ensuring product integrity and minimizing refrigeration unit workload, making them a crucial segment for specialized VIG products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,410 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nippon Sheet Glass (NSG), Pilkington, LandGlass, Viracon, AGC Inc., Guardian Industries, Technoform, Vacuum Glass LLC, IGU Glass, Air-Insulating Technology, Oulu Glass, Taiwan Glass Industry, Vitro Architectural Glass, VIG Technologies, Qingdao Kirin Glass, Panasonic, Saint-Gobain, Schott AG, AET Vacuum Glass, Xuzhou Glass. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vacuum Insulated Glass Market Key Technology Landscape

The technology landscape governing the Vacuum Insulated Glass market is highly specialized, centered primarily on achieving and maintaining an ultra-high vacuum level between the glass panes, which is essential for minimizing conductive and convective heat transfer. Central to this landscape is the advancement in edge sealing technology. Traditional VIG relied on specialized solder glass seals which necessitated high processing temperatures, often limiting the integration of heat-sensitive materials like certain low-E coatings. The current technological evolution focuses on low-temperature sealing methods, including advanced polymer seals and metallic alloy seals, which not only reduce manufacturing costs and energy consumption but also expand the range of compatible materials, enhancing overall thermal performance and structural robustness, crucial for ensuring long-term product durability in diverse climatic conditions.

Another critical area of technological focus is the development of optimized micro-spacer systems. These minute pillars are necessary to maintain the separation distance between the glass panes against the immense compressive force exerted by atmospheric pressure on the evacuated cavity. Innovations here involve moving from metallic pillars to low-conductivity ceramic or specialized polymer micro-spacers, which significantly reduce thermal bridging, thereby improving the overall U-value performance of the VIG unit without compromising its structural integrity. Furthermore, continuous advancements in glass preparation, including precise edge grinding and thorough cleaning processes, are vital to ensure that the vacuum sealing is consistently hermetic and that contaminants do not compromise the low-emissivity coatings or the interior glass surfaces during assembly.

The third major technological thrust involves vacuum creation and port sealing. Efficient, high-throughput vacuum pumping systems capable of quickly evacuating large glass units are essential for manufacturing scalability. The technology for sealing the vacuum port, typically via specialized laser or induction welding techniques, must be flawless to guarantee the longevity of the vacuum, often requiring specialized coatings or materials that prevent gas permeation over the product's lifespan (typically 20-25 years). Emerging research also explores integrating thin-film photovoltaics directly onto the VIG structure, transforming the highly insulating window into an energy-generating facade component, a development that promises to unlock further market opportunities within the sustainable and smart building sector globally.

Regional Highlights

- Asia Pacific (APAC)

The Asia Pacific region currently holds the dominant share of the Vacuum Insulated Glass market, primarily driven by massive, ongoing construction activities and the governmental push for sustainable building practices in economic powerhouses like China, Japan, and South Korea. China, in particular, is undergoing rapid urbanization and infrastructure development, coupled with increasingly stringent energy conservation standards in its northern regions where heating demands are significant. Japan, a pioneer in VIG technology development and application, continues to be a robust market, especially for retrofitting its extensive stock of residential buildings and utilizing VIG in high-speed rail transportation due to its acoustic and thermal benefits. The large scale of manufacturing capacity established in this region also contributes to competitive pricing and wider adoption rates, making VIG a more accessible solution for both commercial and large-scale residential projects.

The regulatory environment across APAC is rapidly evolving, with local governments implementing mandatory thermal performance requirements that favor high-efficiency glazing like VIG. Markets like India and Southeast Asia, while starting from a lower base, are experiencing accelerating growth as the demand for air conditioning drives the need for heat-rejecting and insulating glass solutions in commercial hubs. The challenge here remains balancing the high initial cost of VIG with local affordability, which is being addressed by localized manufacturing and technological optimization. The region’s diverse climate, ranging from extremely hot and humid to bitterly cold, necessitates highly versatile VIG products, often incorporating solar control and low-E coatings tailored for regional performance requirements, solidifying APAC's role as both a major producer and consumer of advanced VIG solutions.

- Europe

Europe is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period, largely attributable to the ambitious climate targets set forth by the European Union, notably the European Green Deal and the Renovation Wave strategy. These initiatives place enormous pressure on the building sector to achieve deep energy renovations, making VIG an indispensable material for achieving mandated reductions in building energy consumption. European markets prioritize extremely low U-values, and VIG, often achieving performance comparable to, or better than, thick triple-glazing while retaining a slimmer profile, is ideally suited for renovation projects, particularly in aesthetically sensitive historic buildings where bulky frames are prohibited.

The demand is particularly strong in Nordic countries and Central Europe (Germany, France, UK), where high heating loads dominate the energy profile of buildings for a significant portion of the year. Furthermore, European consumers and businesses demonstrate a high willingness to invest in premium sustainable products, supported by national and regional incentive programs (subsidies, tax reductions) aimed at energy efficiency upgrades. This regulatory and financial ecosystem has created a favorable environment for VIG adoption, positioning Europe as a leading region for technological integration, focusing on integrating VIG with window frames made of sustainable materials and ensuring seamless installation into diverse architectural styles, driving continuous innovation in sealant and frame design for optimized whole-window performance.

- North America

The North American market, comprising the US and Canada, shows stable and significant growth, driven by stringent energy codes at the state and provincial levels, and federal incentive programs designed to promote high-performance building envelopes. Programs like Energy Star and various utility rebates incentivize homeowners and commercial developers to invest in premium fenestration products that exceed minimum thermal standards. The regional diversity in climate, ranging from the extreme heat of the Southwest US to the severe winters of Canada and the Northeast, mandates the use of highly insulating glass to manage both heating and cooling costs efficiently. VIG is recognized as a key technology for achieving net-zero energy ready homes in both residential and light commercial sectors.

Market penetration in North America is accelerating as domestic manufacturers increase production capacity and address previous supply chain constraints related to specialized VIG components. The preference for large windows and expansive glass facades in modern North American architecture necessitates VIG solutions that can provide structural robustness alongside extreme thermal isolation. Furthermore, the increasing awareness among architects and engineers about the life-cycle cost benefits of VIG, including HVAC downsizing potential and long-term energy savings, is fueling its specification in major infrastructure and commercial development projects. The market is also seeing robust R&D activity aimed at developing standardized VIG units that can integrate easily into conventional North American window systems, simplifying the procurement and installation process across both new build and renovation segments.

- Latin America, Middle East, and Africa (LAMEA)

While smaller in market share, the LAMEA region represents a burgeoning opportunity for VIG, driven primarily by infrastructure investment and the critical need for cooling solutions in hot climates. In the Middle East, monumental construction projects and the push for sustainable cities (e.g., NEOM, Dubai's green initiatives) are demanding best-in-class insulation to mitigate the high costs and environmental impact of air conditioning, making high-performance VIG an attractive solution for reducing cooling loads dramatically. Latin American countries, particularly those with rapid urban growth like Brazil and Mexico, are increasingly adopting VIG in high-end commercial projects where energy efficiency and architectural aesthetics are paramount considerations. The unique challenge in this region is the need for VIG solutions optimized for high solar gain control, requiring specific coatings that block infrared radiation effectively.

Growth in Africa, though concentrated, is focused on high-specification commercial and institutional buildings where energy costs are particularly volatile or unreliable power necessitates highly efficient thermal envelopes. Across LAMEA, the adoption trajectory is closely linked to foreign direct investment in commercial real estate and the implementation of local green building codes, which are slowly becoming standardized across major economic hubs. Educational initiatives aimed at demonstrating the superior return on investment of VIG versus standard reflective glass are critical for overcoming the initial price sensitivity prevalent in many parts of the region, ensuring that VIG is perceived not just as a construction material but as a strategic asset for long-term operational sustainability and cost reduction in a rapidly developing region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vacuum Insulated Glass Market.- Nippon Sheet Glass (NSG)

- Pilkington

- LandGlass

- Viracon

- AGC Inc.

- Guardian Industries

- Technoform

- Vacuum Glass LLC

- IGU Glass

- Air-Insulating Technology

- Oulu Glass

- Taiwan Glass Industry

- Vitro Architectural Glass

- VIG Technologies

- Qingdao Kirin Glass

- Panasonic

- Saint-Gobain

- Schott AG

- AET Vacuum Glass

- Xuzhou Glass

Frequently Asked Questions

Analyze common user questions about the Vacuum Insulated Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary performance benefit of Vacuum Insulated Glass (VIG)?

The primary benefit of VIG is its exceptionally low U-value, often below 0.5 W/m²K, which signifies vastly superior thermal insulation compared to standard double or triple glazing, leading to maximum energy savings in both heating and cooling cycles due to minimized heat transfer.

How does the lifespan of VIG compare to conventional insulating glass units (IGUs)?

Modern VIG units are engineered for a lifespan comparable to, or exceeding, high-quality standard IGUs, typically warrantied for 20 to 25 years. Longevity is critically dependent on the integrity of the perimeter edge seal and the internal micro-spacers maintaining the vacuum over time.

Is Vacuum Insulated Glass suitable for retrofitting existing buildings?

Yes, VIG is exceptionally well-suited for retrofitting due to its thin profile (often 6-10mm total thickness). This slim design allows it to be installed into existing window frames or narrow sashes without the need for extensive structural modifications, making it ideal for historic preservation projects.

What factors currently restrain the widespread adoption of VIG?

The main restraints include the high initial manufacturing cost driven by complex vacuum sealing processes and specialized material requirements, coupled with the need for specialized, trained installers to ensure proper handling and fitting to guarantee the unit’s long-term performance and warranty validity.

Which geographical region dominates the production and consumption of VIG?

The Asia Pacific (APAC) region, particularly China and Japan, currently dominates the VIG market share due to large-scale manufacturing capabilities, significant construction volume, and pioneering adoption of energy-efficient glazing solutions in both new construction and transportation infrastructure sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager