Vacuum Meat Mixer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434193 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Vacuum Meat Mixer Market Size

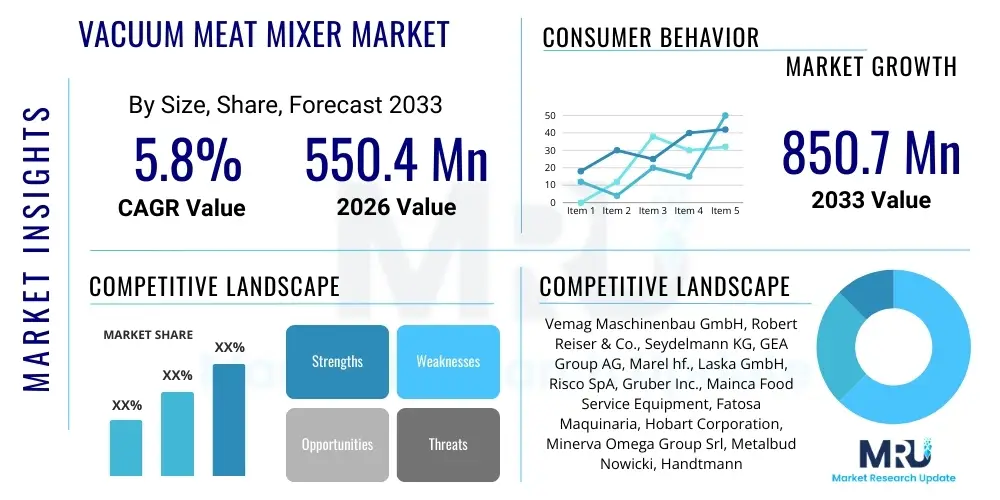

The Vacuum Meat Mixer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $550.4 Million in 2026 and is projected to reach $850.7 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the increasing global demand for processed meat products, ready-to-eat meals, and standardized sausage production, coupled with stringent quality control requirements enforced by food safety regulations worldwide. The integration of advanced automation technologies and the need for improved texture, color stability, and binding properties in meat mixtures further solidifies the market's robust expansion prospects throughout the forecast horizon.

Vacuum Meat Mixer Market introduction

The Vacuum Meat Mixer Market encompasses specialized industrial equipment designed for homogenously blending meat, poultry, fish, and various additives (spices, curing agents, binders, and liquids) under a reduced-pressure environment. The primary function of operating under vacuum is to remove air pockets from the mixture, which significantly prevents oxidation, improves protein extraction (crucial for binding and emulsification), and enhances the final product's color, texture, and shelf life. These mixers are indispensable in large-scale food processing facilities, particularly those specializing in sausages, restructured meat products, ground meat, and prepared foods, ensuring product consistency across batches and maximizing operational efficiency.

The core product range includes mixers categorized by their shaft configuration (single, double, or paddle) and capacity (ranging from laboratory scale to industrial giants capable of handling several tons). Major applications span across the entire processed meat industry, including pet food production and vegetarian meat alternatives, where precise mixing and texture control are paramount. The inherent benefits derived from vacuum mixing—such as improved ingredient dispersion, reduction in bacterial load potential through elimination of surface air, and superior moisture retention—drive their adoption, making them critical assets in achieving high-quality meat preparations that meet modern consumer expectations for freshness and appearance. Furthermore, ergonomic design features focused on sanitation, easy cleaning, and reduced cross-contamination risk are key selling points for contemporary vacuum meat mixer models.

Key driving factors supporting the market expansion include the rapid urbanization and associated changes in dietary habits globally, leading to higher consumption of convenient, packaged processed meat items. Regulatory mandates for hygienic food production, particularly in developed economies, necessitate the use of enclosed, automated mixing systems like vacuum mixers. Technological advancements, such as the incorporation of programmable logic controllers (PLCs) for recipe management and real-time temperature monitoring, enhance operational precision and reduce labor dependency. The continuous innovation by manufacturers to offer mixers with variable speed controls, improved paddle designs for gentle mixing of delicate products, and integration with upstream and downstream processing equipment sustains the market's momentum.

Vacuum Meat Mixer Market Executive Summary

The Vacuum Meat Mixer Market is currently experiencing robust growth, driven primarily by globalization of the processed food supply chain and a sharp increase in demand for consistent, high-quality, long-shelf-life meat products. Business trends indicate a strong shift towards fully automated, large-capacity double-shaft mixers, favored by major industrial processors due to their superior efficiency and ability to handle complex, high-volume production schedules. Investment in advanced materials, specifically stainless steel alloys (SUS 304 and 316), and hygienic design principles are dominating capital expenditures, responding directly to stringent international food safety standards (HACCP, ISO 22000). Mergers and acquisitions, particularly involving technology-focused startups and established machinery manufacturers, are shaping the competitive landscape, aiming to consolidate expertise in integrated processing lines.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, propelled by expanding middle-class populations, rapid proliferation of modern supermarkets, and increasing foreign direct investment in local food production facilities across countries like China, India, and Southeast Asia. North America and Europe, while mature, remain dominant in terms of value, characterized by high adoption rates of IoT-enabled, high-precision mixers required for premium product segments and efficient labor utilization. Conversely, regulatory hurdles concerning capital investment and high electricity costs in certain developing regions present localized restraints, though these are increasingly being mitigated by the introduction of energy-efficient mixing technologies.

Segmentation trends reveal that the Automatic operation segment holds the largest market share, reflecting the industry-wide push for reduced human intervention, minimizing contamination risks, and achieving unparalleled consistency. Among end-users, large-scale Processed Meat Producers, specializing in emulsified products like frankfurters and luncheon meats, constitute the primary revenue generator due to the fundamental requirement of vacuum technology in achieving optimal texture and binding. Capacity segmentation shows a notable demand surge for Medium-Capacity mixers (500 kg to 2,000 kg), catering to regional processors who require flexibility alongside scale. Strategic planning among key players focuses on developing modular systems that can be easily integrated into existing production lines and offering comprehensive post-sales service packages to maintain a competitive edge.

AI Impact Analysis on Vacuum Meat Mixer Market

Common user inquiries regarding the influence of Artificial Intelligence on the Vacuum Meat Mixer Market typically revolve around predictive maintenance schedules, optimization of complex mixing recipes, and enhancing real-time quality control. Users often ask: "Can AI truly reduce downtime in high-volume processing?" or "How can machine learning models optimize ingredient ratios based on raw material variability?" and "Is it feasible to use AI for automated texture analysis during the mixing cycle?" The consensus expectation is that AI integration will transition vacuum mixers from simple mechanical tools to intelligent, self-optimizing processing units, drastically improving efficiency and product uniformity while minimizing material waste. Key themes summarized include leveraging AI for anomaly detection in mechanical performance, optimizing energy consumption based on load dynamics, and using computer vision systems integrated with the mixer for automated defect detection in the resulting mixture or batter.

- AI-Powered Predictive Maintenance: Algorithms analyze sensor data (vibration, temperature, power consumption) to anticipate component failure, scheduling maintenance preemptively and reducing unscheduled downtime critical for high-throughput facilities.

- Recipe Optimization and Formulation: Machine learning models analyze historical performance data, adjusting mixing parameters (speed, time, vacuum level) instantaneously based on input raw material characteristics (fat content, moisture level, pH), ensuring consistent final product attributes regardless of raw material variability.

- Automated Quality Control (AQC): Integration of computer vision and spectral analysis with AI allows for real-time monitoring of color homogeneity, particle size distribution, and emulsification status within the mixer bowl, triggering alerts or adjustments immediately if deviations occur.

- Enhanced Energy Efficiency: AI dynamically controls motor speed and vacuum pump power based on the actual load and required mixing intensity, significantly lowering overall operational energy consumption compared to traditional fixed-parameter systems.

- Supply Chain Integration: Predictive analytics forecasts optimal ingredient ordering and storage conditions, integrating mixer performance data with inventory management systems to minimize spoilage and ensure just-in-time material availability.

DRO & Impact Forces Of Vacuum Meat Mixer Market

The Vacuum Meat Mixer Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively dictate its growth trajectory and competitive dynamics. Primary drivers include the global expansion of the processed food industry, necessitating high-throughput equipment capable of producing consistent, quality-assured products efficiently. Strict regulatory standards related to food hygiene and safety globally compel processors to adopt vacuum technology, which demonstrably reduces air incorporation and inhibits oxidation, crucial for extending shelf life and maintaining microbial integrity. Furthermore, the persistent demand for high-quality emulsified products, where optimal protein binding is essential, mandates the use of vacuum mixing to achieve superior textural and binding characteristics, directly fueling market adoption across all regions. These drivers are fundamentally linked to macroeconomic factors such as rising disposable incomes and changing consumer lifestyles that prioritize convenience, further cementing the role of automated processing equipment.

Conversely, significant restraints temper the market's expansive potential, most notably the high initial capital investment required for purchasing and installing large-scale, automated vacuum mixing systems. This high barrier to entry disproportionately affects small and medium-sized processors, particularly in emerging economies, leading to slower adoption rates in these crucial markets. Operational restraints include the specialized technical expertise required for maintenance and troubleshooting complex vacuum systems and integrated PLC controls. Moreover, the inherent high energy consumption associated with maintaining vacuum pressure and running powerful mixer motors contributes to elevated operational costs, challenging profitability in regions facing volatile energy pricing. The long lifespan of existing conventional mixers also acts as a restraint, delaying replacement cycles unless mandated by modernization or capacity expansion needs, slowing the influx of new machinery sales.

Opportunities for future growth are substantial, particularly in the rapidly evolving market for plant-based and alternative protein products, where vacuum mixers are uniquely suited to handle complex, sticky, and texturally sensitive vegetable protein mixes, ensuring superior hydration and homogeneity. Geographical expansion into untapped markets in Africa and specific parts of Latin America, coupled with strategic partnerships that offer financing solutions for capital expenditure, represent key avenues for revenue generation. Technological advancements focusing on enhanced integration with Industry 4.0 paradigms, such as improved IoT connectivity, modular design for versatile applications, and development of compact, high-efficiency vacuum pumps, offer manufacturers competitive differentiation. Ultimately, minimizing the environmental footprint through energy-saving mechanisms and waste reduction remains a significant opportunity for innovation and market leadership.

Segmentation Analysis

The Vacuum Meat Mixer Market is segmented based on critical operational and structural characteristics, allowing for detailed analysis of demand patterns across different end-user types and production scales. Segmentation by Type focuses on the mechanical design, distinguishing between Single Shaft and Double Shaft (or Twin Shaft) mixers, where the latter is generally preferred for high volume, viscous, and complex mixtures requiring faster, more thorough blending. Segmentation by Capacity categorizes mixers into Small (below 500 kg), Medium (500 kg to 2,000 kg), and Large (above 2,000 kg), directly reflecting the scale of the processing facility and production throughput requirements. The operational method defines the degree of human intervention, separating Automatic systems, which include integrated weighing and discharge systems, from Semi-Automatic systems that rely more on manual loading or monitoring. Finally, End-User segmentation outlines the primary purchasers, primarily Processed Meat Producers, Ready-to-Eat Meal Manufacturers, and Specialty Food Processors (including vegetarian and vegan product producers).

- Type

- Single Shaft Vacuum Mixers

- Double Shaft Vacuum Mixers (Twin Shaft/Paddle)

- Z-Blade/Spiral Vacuum Mixers (Specialty)

- Capacity

- Small Capacity (Up to 500 kg)

- Medium Capacity (500 kg – 2,000 kg)

- Large Capacity (Above 2,000 kg)

- Operation

- Automatic

- Semi-Automatic

- End-User

- Processed Meat Producers (Sausages, Emulsified Products)

- Ready-to-Eat Meals & Prepared Foods

- Specialty Food Processors (Including Plant-Based Products)

- Pet Food Industry

Value Chain Analysis For Vacuum Meat Mixer Market

The value chain for the Vacuum Meat Mixer Market is extensive, starting with the procurement of highly specialized raw materials and culminating in the delivery, installation, and ongoing servicing of complex machinery to end-users globally. The upstream segment is critical, involving the sourcing of high-grade stainless steel (predominantly 304 and 316 for hygiene and corrosion resistance), specialized motors, complex vacuum pump systems, and advanced electronic components (PLCs, sensors, HMI touchscreens). Manufacturers must maintain stringent quality control over these components, as the reliability of the mixer depends heavily on the durability of the vacuum seal and the precision of the motor controls. Relationships with steel suppliers and proprietary sensor manufacturers are strategic, often dictating the final cost and technological capabilities of the resulting mixer unit. The complexity of the manufacturing process—involving precision welding, surface finishing to hygienic standards, and rigorous testing of the vacuum integrity—adds significant value at this stage.

The midstream focuses on the assembly, integration, and branding of the finished machinery. Manufacturers differentiate themselves through proprietary mixing geometries, such as specialized paddle designs engineered for specific meat textures, and the integration of sophisticated automation software. Distribution channels are typically dual-layered: Direct sales channels are utilized for large, custom-built industrial systems sold to major multinational food corporations, allowing for direct negotiations, installation supervision, and specialized training. Indirect distribution involves leveraging specialized equipment dealers, authorized regional distributors, and engineering firms that provide comprehensive food processing line integration services. These indirect channels are particularly effective in penetrating fragmented local markets and providing necessary localized support and maintenance expertise.

The downstream segment encompasses the delivery, installation, commissioning, and, most critically, the aftermarket services. Post-sale support, including the supply of spare parts (seals, bearings, vacuum filters), routine maintenance contracts, and software updates, constitutes a significant revenue stream and a crucial factor in customer retention. The effectiveness of the servicing network often determines the competitive edge, as minimizing downtime is paramount for high-volume processors. Furthermore, compliance with regional safety certifications (CE marking in Europe, UL in North America) and adherence to local regulatory requirements add complexity to the value chain, requiring deep market specific knowledge from distributors and service providers.

Vacuum Meat Mixer Market Potential Customers

The primary customers for Vacuum Meat Mixers are entities within the vast food processing sector that require precise, large-scale blending of proteins, fats, and additives to create emulsified or structured food products. The largest segment of end-users consists of major Processed Meat Producers, including multinational corporations specializing in high-volume production of sausages (frankfurters, bologna), luncheon meats, deli slices, and cured products. These industrial giants depend heavily on automated vacuum mixers to achieve the optimal protein extraction necessary for superior binding, textural consistency, and extended shelf life, justifying substantial capital investment in the latest, highest-capacity machinery. Their purchasing decisions are driven by throughput, hygiene compliance, and integration capabilities within continuous processing lines.

Another rapidly expanding customer base is composed of manufacturers producing Ready-to-Eat (RTE) meals and various prepared foods, including meatloaf, meatballs, stews, and specialized fillings. As consumer demand for convenient, high-quality frozen or chilled meals grows, these producers utilize vacuum mixers to ensure ingredient homogeneity, flavor dispersion, and prevent freezer burn by minimizing air incorporation. Furthermore, the Specialty Food Processors segment, which notably includes producers of plant-based meat alternatives, vegan patties, and proprietary functional foods, represents a high-growth opportunity. These new food formulations often require meticulous mixing of complex, sticky raw materials (e.g., soy protein concentrates, vital wheat gluten) under controlled conditions to achieve the desired fibrous texture, making vacuum technology essential for their product quality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550.4 Million |

| Market Forecast in 2033 | $850.7 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vemag Maschinenbau GmbH, Robert Reiser & Co., Seydelmann KG, GEA Group AG, Marel hf., Laska GmbH, Risco SpA, Gruber Inc., Mainca Food Service Equipment, Fatosa Maquinaria, Hobart Corporation, Minerva Omega Group Srl, Metalbud Nowicki, Handtmann Group, SPS-Schulz GmbH, Zhengzhou Newslong Machinery, Qingdao T-Jin Machinery, Jiangsu Jinyong Machinery, Zibo Taibao Food Machinery, Fomaco A/S. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vacuum Meat Mixer Market Key Technology Landscape

The technological landscape of the Vacuum Meat Mixer Market is characterized by intense focus on automation, connectivity, and hygienic design, moving beyond mere mechanical blending to integrated processing solutions. Modern vacuum mixers increasingly feature advanced Human-Machine Interfaces (HMI) with intuitive touchscreens that allow operators to store hundreds of proprietary recipes, ensuring precise control over variables such as mixing time, paddle rotation patterns (including reversing capabilities), and the exact level of vacuum applied throughout the cycle. This shift to highly customizable, program-driven operation minimizes human error and guarantees repeatable product quality, a critical requirement for maintaining brand consistency across global production sites. Furthermore, advanced monitoring systems integrated into the HMI track and log operational data, facilitating compliance reporting and simplifying the traceability process mandated by food safety authorities.

A significant technological development is the implementation of sophisticated sensor technology, transforming mixers into data-generating assets integral to the larger processing ecosystem. High-precision load cells continuously monitor ingredient weight and discharge accuracy, while integrated temperature probes ensure the meat mixture remains within critical processing limits, crucial for controlling microbial growth and protein denaturation. Furthermore, connectivity through the Industrial Internet of Things (IIoT) allows these mixers to communicate real-time operational status, maintenance needs, and performance metrics to central Manufacturing Execution Systems (MES). This integration facilitates optimized scheduling, enables remote diagnostics by manufacturers, and supports the implementation of predictive maintenance strategies, drastically reducing downtime and optimizing overall equipment effectiveness (OEE).

The focus on hygienic engineering and sustainability also defines the current technology landscape. Manufacturers are incorporating Clean-In-Place (CIP) capabilities, designing mixers with minimal crevices, fully welded bowls, and accessible components to streamline sanitation processes and reduce water consumption. Advanced paddle and mixing arm designs, such as overlapping paddle geometries and variable pitch configurations, are being engineered to maximize mixing efficiency while minimizing shear and friction heat, which can negatively impact meat texture. The continuous drive towards energy efficiency sees the use of high-efficiency servo motors and sophisticated vacuum pump technologies that consume less power while maintaining tight vacuum tolerances, addressing both operational cost concerns and environmental sustainability goals within the industry.

Regional Highlights

- North America (Dominant Value Market): North America maintains a leading position in market value, driven by the large-scale industrialization of meat processing, high consumer demand for convenience foods, and the pervasive adoption of automated machinery to offset high labor costs. The US market, in particular, showcases high penetration rates of large-capacity, double-shaft vacuum mixers with sophisticated sensor and software integration. Key factors include stringent USDA regulations demanding high sanitation standards, which favor closed, hygienic vacuum systems, and continuous investment by major food conglomerates in technological upgrades to enhance efficiency and maintain product consistency across large distribution networks. Canada also contributes significantly, focusing on exporting value-added meat products that necessitate superior mixing quality.

- Europe (Innovation and Regulatory Compliance): Europe represents a mature market characterized by exceptionally strict food safety and hygiene regulations, notably the European Union’s directives, forcing processors to invest in mixers featuring advanced hygienic design, traceability features, and energy-efficient operations. Western European countries, particularly Germany and Italy, are hubs for manufacturing high-precision vacuum mixers and often dictate global technological standards. The trend in Europe leans towards versatility and specialized mixing solutions for traditional charcuterie products and high-end gourmet preparations, alongside a burgeoning market for vegetable-based substitutes, requiring flexible, high-precision vacuum capabilities.

- Asia Pacific (Fastest Growth Trajectory): APAC is projected to be the fastest-growing region, fueled by massive population growth, increasing urbanization, rising disposable incomes, and the modernization of the food processing infrastructure, especially in China, India, and Southeast Asia. The transition from traditional, manual mixing methods to automated vacuum systems is accelerating rapidly to meet the soaring domestic demand for standardized, packaged meat products. While price sensitivity remains a factor, the long-term benefits of improved quality and higher throughput are driving investment, with manufacturers focusing on offering customizable, mid-capacity mixers suitable for regional processing standards.

- Latin America (Capacity Expansion Focus): The Latin American market, led by Brazil and Argentina (major meat exporters), is characterized by strong demand driven by capacity expansion and the need to meet international quality standards for export markets. The adoption of vacuum mixers is accelerating, particularly among beef and poultry processors seeking to improve yield and texture consistency in manufactured products like restructured steaks and canned meats. The investment focus is balanced between cost-effectiveness and operational reliability, favoring robust, easily maintainable semi-automatic systems initially, with a gradual shift toward full automation in larger, vertically integrated operations.

- Middle East and Africa (Emerging Opportunities): The MEA region is an emerging market with specialized needs. Growth is concentrated in the Gulf Cooperation Council (GCC) states due to high investment in modern food manufacturing and strong import reliance on processed foods, necessitating local production infrastructure. Vacuum mixers are crucial here for handling imported frozen meat and blending it with spices and halal additives efficiently. Market growth is dependent on successful infrastructure development and the increasing regulatory scrutiny on locally produced food quality, creating opportunities for specialized, mid-sized mixer deployments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vacuum Meat Mixer Market.- Vemag Maschinenbau GmbH

- Robert Reiser & Co.

- Seydelmann KG

- GEA Group AG

- Marel hf.

- Laska GmbH

- Risco SpA

- Gruber Inc.

- Mainca Food Service Equipment

- Fatosa Maquinaria

- Hobart Corporation

- Minerva Omega Group Srl

- Metalbud Nowicki

- Handtmann Group

- SPS-Schulz GmbH

- Zhengzhou Newslong Machinery

- Qingdao T-Jin Machinery

- Jiangsu Jinyong Machinery

- Zibo Taibao Food Machinery

- Fomaco A/S

Frequently Asked Questions

Analyze common user questions about the Vacuum Meat Mixer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using a vacuum meat mixer over a standard mixer?

The primary benefit is the removal of air pockets, which prevents oxidation, enhances color stability (reducing graying), significantly improves protein extraction leading to superior product binding and texture, and extends the overall shelf life of the processed meat mixture.

Which type of vacuum meat mixer, single shaft or double shaft, is more suitable for high-viscosity products?

Double shaft (or twin shaft/paddle) vacuum mixers are generally more suitable for high-viscosity and high-volume products, as they provide a faster, more aggressive, yet homogenous blend, drastically reducing mixing time and ensuring even ingredient distribution throughout the viscous mass.

How does the integration of Industry 4.0 technologies affect the operational efficiency of vacuum mixers?

Industry 4.0 integration, including IoT sensors and PLC controls, allows for real-time monitoring, remote diagnostics, automated recipe execution, and predictive maintenance scheduling. This drastically reduces unscheduled downtime, ensures consistent product quality, and optimizes energy consumption based on batch requirements.

What is the key driver of market growth in the Asia Pacific region for vacuum meat mixers?

The key driver in the Asia Pacific region is rapid urbanization, coupled with rising disposable incomes and the subsequent increase in demand for packaged, standardized processed meat and ready-to-eat products, compelling local processors to adopt efficient, high-capacity automation machinery.

Are vacuum meat mixers used in the production of plant-based meat alternatives?

Yes, vacuum meat mixers are increasingly utilized in the production of plant-based meat alternatives. They are essential for optimally hydrating and homogenously blending complex, sticky vegetarian proteins (like soy or wheat gluten) to achieve the necessary fibrous texture and binding properties required for high-quality imitation meat products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager