Vacuum Suction Cup Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437079 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Vacuum Suction Cup Market Size

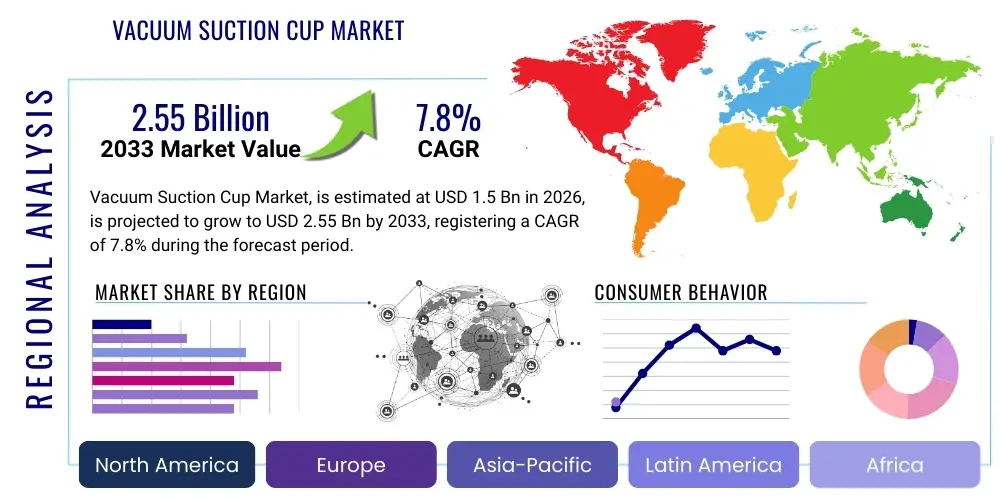

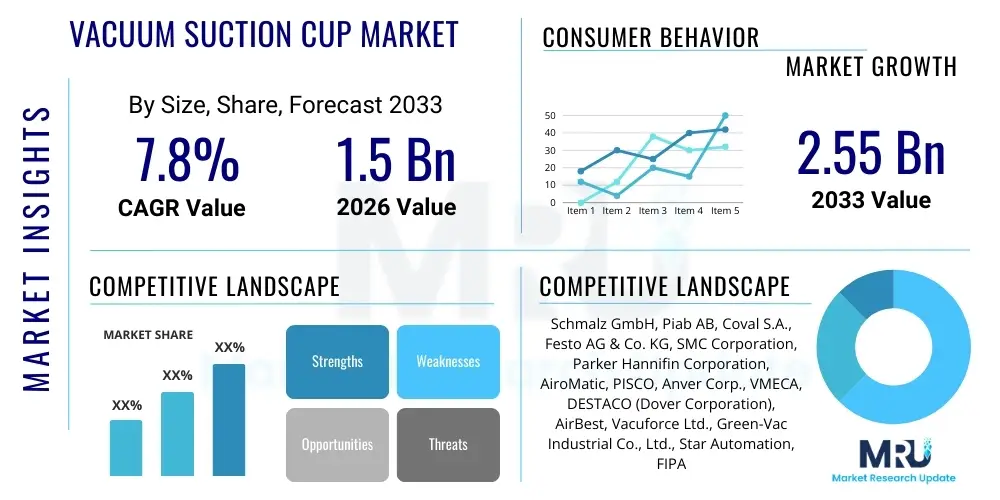

The Vacuum Suction Cup Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033.

Vacuum Suction Cup Market introduction

The Vacuum Suction Cup Market encompasses the manufacturing, distribution, and utilization of components designed to lift, hold, or manipulate objects using negative pressure (vacuum). These essential industrial components, often made from elastomers such as silicone, NBR (Nitrile Butadiene Rubber), and polyurethane, are fundamental enablers of automated handling processes across diverse industrial sectors. Their primary function is to provide a non-marring, secure grip on a wide variety of surfaces, ranging from porous cardboard and textured plastics to smooth glass and delicate electronic components. The reliability and material science behind modern suction cups allow for high cycle rates and integration into complex robotic systems, making them indispensable in the context of Industry 4.0 and advanced manufacturing environments.

The product portfolio within this market is extensive, featuring flat cups for rigid, planar surfaces; bellows cups (single or multi-fold) for handling curved or uneven geometries; and specialized cups for oil-coated or sensitive materials. Major applications span the entire industrial lifecycle, including pick-and-place robotics in electronics assembly, automated packaging and palletizing in logistics and e-commerce fulfillment centers, sheet metal handling in the automotive stamping process, and glass manipulation in construction and solar panel manufacturing. The core benefit derived from their use is the significant enhancement of operational efficiency, reduction of manual labor costs, and minimization of product damage during handling, which collectively drives their pervasive adoption globally.

Key driving factors accelerating market expansion include the global surge in industrial automation investments, particularly the deployment of collaborative robots (cobots) that require precise and compliant gripping mechanisms. Furthermore, the rapid expansion of the e-commerce sector has intensified demand for high-speed, flexible packaging and fulfillment solutions, where vacuum handling is crucial for processing diverse product shapes and sizes efficiently. Technological advancements, such as the introduction of wear-resistant materials and smart cups integrated with sensors for grip detection and predictive maintenance, further solidify the market's growth trajectory, offering superior performance and longevity in demanding operational environments.

Vacuum Suction Cup Market Executive Summary

The global Vacuum Suction Cup Market is characterized by robust growth driven fundamentally by the pervasive trend of factory automation and the necessity for increased operational throughput across industrial verticals. Business trends indicate a significant shift towards modular vacuum systems and smart components capable of communicating performance data, aligning perfectly with smart factory initiatives. Manufacturers are increasingly focusing on developing application-specific cup designs, such as those tailored for handling lightweight composite materials in aerospace or specialized food-grade materials for the processing industry. Competition remains intense, centered on material quality, durability, customization capabilities, and the integration of sophisticated vacuum generation technology, often moving away from centralized vacuum pumps towards decentralized, energy-efficient ejectors.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, largely due to monumental investments in manufacturing capacity, particularly in China, South Korea, and Japan, across the automotive, electronics, and semiconductor fabrication sectors. North America and Europe maintain strong market positions, driven by the high adoption rate of advanced robotics and stringent industrial safety standards that favor automated handling solutions. The European market, in particular, demonstrates high demand for sustainable and energy-efficient vacuum components. Growth in emerging markets, such as Latin America and the Middle East, is steadily increasing, propelled by infrastructure development and the establishment of new logistics and manufacturing hubs requiring modern material handling equipment.

Segmentation trends reveal that bellows suction cups are expected to register the highest growth rate due to their superior ability to compensate for height and angular differences and adapt to uneven surfaces, which is critical in packaging and assembly lines dealing with variability. Material-wise, high-performance elastomers like silicone and specialized polyurethanes are gaining traction over traditional materials like NBR, offering enhanced resistance to heat, chemicals, and abrasion, thereby extending product lifespan. Furthermore, the demand for vacuum cups in the automotive and electronics industries continues to dominate the application segment, although logistics and warehousing are rapidly increasing their market share due to the automation of fulfillment processes.

AI Impact Analysis on Vacuum Suction Cup Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Vacuum Suction Cup Market frequently revolve around optimizing gripping performance, enabling predictive maintenance, and enhancing system adaptability. Common questions address how AI can dynamically adjust vacuum levels based on real-time material properties or environmental factors (like temperature or humidity), thereby maximizing energy efficiency and reducing component wear. Users are also concerned with leveraging AI-driven visual systems to improve quality control, ensuring flawless surface contact before a lift operation is initiated, especially in sensitive processes like semiconductor handling or glass manufacturing. The consensus concern is centered on minimizing operational downtime and maximizing the effective lifespan of suction cups, which are consumable components critical to uninterrupted production flow, making predictive failure analysis a major area of interest.

The implementation of AI algorithms dramatically enhances the performance and reliability of vacuum handling systems, transforming traditional vacuum cups from passive components into active, intelligent gripping tools. AI is crucial for processing the vast amounts of sensor data generated by integrated smart suction cups—measuring temperature, pressure drop, force feedback, and cycle counts. This data is fed into machine learning models to identify anomalies indicative of incipient failure, such as micro-cracks in the elastomer or vacuum leakage resulting from seal deterioration. By accurately predicting component failure, AI enables just-in-time replacement, preventing costly unscheduled stops and significantly improving overall equipment effectiveness (OEE) across automated production lines.

Furthermore, AI plays a pivotal role in optimizing operational parameters, particularly in robotic applications involving highly variable workloads, such as sorting and kitting in e-commerce fulfillment centers. AI models can dynamically select the appropriate cup size or type in multi-tool systems and adjust the suction pressure required for optimal grip, minimizing energy consumption while ensuring the safety of the handled object. This adaptive capability is essential for handling delicate or irregularly shaped items without damage. The future integration will likely involve advanced computer vision systems powered by AI, which verify the exact position and orientation of the workpiece, guiding the robotic arm and cup placement with precision far exceeding human capability, leading to zero-defect handling processes.

- AI enables predictive maintenance of vacuum components by analyzing real-time pressure and force sensor data.

- Machine learning models optimize vacuum generation efficiency, reducing energy consumption dynamically based on load and surface material.

- AI-driven visual inspection systems verify correct cup seating and object integrity prior to lift, minimizing product damage.

- Enhanced system adaptability allows robotic grippers to handle varied object geometries and porous materials with maximized grip force utilization.

- Integration with Digital Twin technology for simulating cup wear rates and optimizing maintenance schedules.

DRO & Impact Forces Of Vacuum Suction Cup Market

The Vacuum Suction Cup Market is primarily driven by the exponential global increase in industrial automation, particularly within high-growth sectors like automotive manufacturing, electronics assembly, and logistics, necessitating reliable and high-speed material handling solutions. Restraints include the inherent wear-and-tear nature of elastomer-based components, requiring frequent replacement, and the sensitivity of vacuum technology to porous materials and dusty environments, which can lead to system performance degradation and increased maintenance costs. Opportunities lie in the development of specialized, highly durable materials (e.g., high-temperature elastomers or chemically resistant polymers) and the integration of smart features, such as RFID tags or embedded sensors, enhancing traceability and enabling advanced diagnostics. These dynamics create a competitive landscape defined by technological innovation in material science and system integration.

Key drivers include government initiatives supporting smart manufacturing and Industry 4.0 adoption, which mandate the modernization of existing factory infrastructure with robotic handling systems. The proliferation of collaborative robots (cobots) in small and medium-sized enterprises (SMEs) further fuels demand, as vacuum cups are the most versatile and cost-effective end-of-arm tool (EOAT) for light-duty applications. Furthermore, the increasing complexity and miniaturization of components in the electronics sector necessitate extremely precise, non-contact handling, a capability perfectly met by specialized vacuum suction cups. The global shift toward highly customized and variable production runs (mass customization) places a premium on flexible gripping solutions that can be rapidly changed or adjusted.

Conversely, the market faces significant restraints related to operational limitations. The effectiveness of vacuum suction cups is critically dependent on the surface condition and air impermeability of the workpiece; handling materials like textiles or heavily contoured objects remains challenging, requiring complex sealing systems or alternative gripping technologies. Price competition, especially from Asian manufacturers offering low-cost standard products, pressures margins for specialized and high-performance material producers. Moreover, end-users are increasingly sensitive to the total cost of ownership (TCO), factoring in the replacement frequency and associated downtime, which pushes manufacturers to invest heavily in developing ultra-long-life materials to mitigate this restraint.

Impact Forces, analyzed through the lens of Porter's Five Forces, demonstrate moderate to high competitive intensity. The threat of new entrants is moderate; while manufacturing standard cups is relatively easy, specialized, high-precision cups require significant R&D and material expertise (e.g., silicone formulation for food safety or high-temperature resistance). The bargaining power of buyers is significant, particularly large automotive OEMs and tier-one suppliers who purchase in massive volumes and demand competitive pricing, standardization, and global support. The threat of substitutes, primarily mechanical grippers, magnetic grippers, or electrostatic grippers, is notable, particularly in applications where vacuum is inefficient. However, the versatility and low cost of vacuum solutions ensure their continued dominance in general handling tasks. Supplier bargaining power is moderate, influenced heavily by the volatility of key raw material costs (elastomers, polymers, and aluminum for vacuum components).

Segmentation Analysis

The Vacuum Suction Cup Market is comprehensively segmented based on material, type, application, and industry verticals to accurately reflect its diverse end-user requirements and technological configurations. This granular segmentation aids in understanding specific product demand drivers, such as the preference for food-grade silicone in the packaging sector or the need for high-strength NBR/Viton in high-temperature environments like metal stamping. The segmentation by type—flat, bellows, and specialty cups—is critical as it dictates the suitability of the cup for different surface geometries and handling dynamics, influencing purchasing decisions across different industrial automation projects. Overall market analysis confirms that application specificity is the dominant factor shaping segmentation trends and driving research and development efforts toward highly customized gripping solutions.

Segmentation by material is crucial as it determines performance metrics such as wear resistance, chemical compatibility, temperature range, and life expectancy. The choice of elastomer directly impacts the market positioning of the product, with standard materials targeting general applications and specialized materials commanding premium pricing for demanding operations. Analyzing segments by application—including pick-and-place, clamping, and gripping—provides insight into the core function fulfilled by the component, differentiating between high-speed assembly line functions and heavy-duty structural handling tasks. The continued growth in high-speed, light-duty applications, such as sorting small components in electronics, reinforces the growth of smaller, precision cup segments.

Furthermore, industry segmentation reveals where major capital expenditures on automation are concentrated. The automotive and electronics industries consistently remain the largest consumers due to their high degree of automation and relentless focus on quality control and speed. However, the rapidly expanding logistics and food and beverage sectors are emerging as high-growth segments, particularly demanding solutions that comply with hygiene standards (FDA/EC 1935/2004) and can handle the fragility and diversity of consumer goods. This analysis confirms that future market growth will be bifurcated, driven by both high-precision, high-durability needs in traditional manufacturing and high-volume, flexible handling requirements in new industrial domains like e-commerce fulfillment.

- By Material:

- Nitrile Rubber (NBR)

- Silicone

- Polyurethane

- Viton (FKM)

- Other Elastomers (EPDM, Natural Rubber)

- By Type:

- Flat Cups (Standard and Deep)

- Bellows Cups (Single, Double, Multi-Fold)

- Oval Cups

- Specialty Cups (Oil-resistant, Foam, High-temperature)

- By Application:

- Pick-and-Place

- Clamping and Fixturing

- Loading and Unloading

- Palletizing and Depalletizing

- By Industry Vertical:

- Automotive

- Electronics and Semiconductor

- Packaging and Logistics

- Food and Beverage

- Metal Fabrication and Processing

- Plastics and Rubber

- Pharmaceutical and Medical Devices

Value Chain Analysis For Vacuum Suction Cup Market

The value chain for the Vacuum Suction Cup Market begins with the upstream sourcing of raw materials, primarily specialized synthetic elastomers and polymers such as NBR, silicone, and polyurethane, along with metals and high-grade plastics for fittings and vacuum generators (ejectors/pumps). Material purity and quality are critical, especially for applications in the food, medical, and semiconductor industries, where compliance with stringent regulatory standards dictates supplier selection. Manufacturing processes involve precision injection molding and curing of the elastomer components, followed by assembly with coupling fittings, ensuring the integrity of the seal and durability under high cycle repetition. Efficiency in manufacturing and rigorous quality control are key competitive differentiators at this stage.

The midstream stage involves sophisticated distribution and logistics. Vacuum suction cup manufacturers employ a dual-channel strategy: direct sales to major OEMs (Original Equipment Manufacturers) in the automotive and aerospace sectors, who require deep technical consultation and customized solutions; and indirect sales through specialized industrial distributors, automation system integrators, and MRO (Maintenance, Repair, and Operations) suppliers. System integrators play a vital role as they combine vacuum components with robotic arms and peripheral devices to create complete, tailored automation solutions for the end-user. This indirect channel facilitates penetration into the highly fragmented SME market and provides essential local technical support and fast inventory replenishment.

Downstream analysis focuses on the end-user industries, which include massive production facilities requiring continuous supply and maintenance services. The vacuum suction cup, being a consumable component, necessitates a robust aftermarket and spares distribution network, often managed by the distributor channel. Direct engagement with end-users allows manufacturers to gather crucial performance data, leading to iterative product improvements and the development of application-specific solutions. The efficiency of the distribution channel—especially concerning lead times for unique or specialized cups—directly influences customer satisfaction and retention, making optimized inventory management and swift logistical capabilities critical for market success.

Vacuum Suction Cup Market Potential Customers

Potential customers for the Vacuum Suction Cup Market are fundamentally characterized as entities undergoing or committed to high levels of industrial automation, where precise, reliable, and high-speed material handling is paramount. The largest cohort of buyers includes global automotive original equipment manufacturers (OEMs) and their tier-one suppliers, who utilize vacuum cups extensively in stamping, assembly, painting, and interior component installation lines. These customers demand large, durable, and oil-resistant cups for sheet metal handling, as well as smaller precision cups for component assembly. Their purchasing behavior is defined by long-term contracts, rigorous qualification processes, and a strong preference for suppliers offering standardized global product platforms and extensive engineering support.

The second major customer group comprises Electronics Manufacturing Services (EMS) providers and semiconductor fabrication plants (fabs). These environments require ultra-clean, non-marking suction cups, often made of special high-purity silicone or polyurethane, capable of handling delicate wafers, microchips, and display panels without contamination or damage. The purchasing decision here is heavily influenced by cleanliness standards (e.g., ISO Class requirements), precision, and the ability of the cup to perform reliably at very high cycle rates. This sector is highly sensitive to technological advancements, frequently requiring the latest innovations in smart gripping and sensor integration.

A rapidly expanding segment of buyers includes third-party logistics (3PL) providers and large e-commerce fulfillment centers. These customers require highly flexible and adaptable vacuum solutions capable of handling an enormous variety of packaging materials, shapes, and weights, often at speeds exceeding conventional sorting systems. Their primary need is versatility, durability, and easy integration into existing automated storage and retrieval systems (AS/RS) and palletizing robots. Other significant customer bases include companies in the food and beverage sector (demanding FDA-compliant materials), the glass industry (requiring large, heavy-duty cups for windows and solar panels), and the construction industry (using robust systems for panel lifting and structural assembly).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schmalz GmbH, Piab AB, Coval S.A., Festo AG & Co. KG, SMC Corporation, Parker Hannifin Corporation, AiroMatic, PISCO, Anver Corp., VMECA, DESTACO (Dover Corporation), AirBest, Vacuforce Ltd., Green-Vac Industrial Co., Ltd., Star Automation, FIPA GmbH, Graco Inc., WENGLOR sensoric group, Bimba Manufacturing Company, VTEC Industrial Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vacuum Suction Cup Market Key Technology Landscape

The technology landscape of the Vacuum Suction Cup Market is rapidly evolving, moving beyond simple elastomer components towards sophisticated, integrated systems designed for efficiency and adaptability. A critical technological distinction lies in vacuum generation methods, primarily utilizing either centralized mechanical vacuum pumps or decentralized pneumatic ejectors (Venturi principle). Modern trends heavily favor high-performance ejectors due to their compactness, energy efficiency (only generating vacuum on demand), and ease of integration directly onto the robotic arm (End-of-Arm Tooling, EOAT), minimizing air losses and enhancing response time. Recent innovations focus on multi-stage ejector technology to achieve higher vacuum flow rates and deeper vacuum levels, crucial for handling porous or textured materials that leak air.

Material science represents another core technological pillar. Manufacturers are continuously developing proprietary elastomeric compounds that offer superior longevity, especially in harsh industrial environments. Key advancements include highly oil-resistant NBR alternatives, food-grade silicones that withstand rigorous cleaning cycles (CIP/SIP), and specialized polyurethanes designed for extremely high abrasion resistance in applications like stone or concrete handling. Furthermore, the development of dual-hardness cups, featuring a rigid base for stability and a soft lip for optimal sealing, significantly enhances gripping reliability across various load conditions and surface irregularities, maximizing the operational envelope of robotic systems.

The most transformative technology involves smart system integration. Modern vacuum suction cup systems increasingly incorporate sensors for real-time monitoring of key performance indicators, including vacuum pressure, temperature, and grip detection force. These smart cups facilitate crucial diagnostics, enabling operators to confirm successful part acquisition and monitor the condition of the cup itself. This data connectivity, often utilizing IO-Link communication standards, allows for seamless integration into the wider industrial internet of things (IIoT) infrastructure, enabling sophisticated process control, condition monitoring, and the aforementioned AI-driven predictive maintenance strategies, thereby minimizing unscheduled downtime and optimizing system efficiency.

Regional Highlights

- North America: This region holds a significant market share, characterized by high adoption rates of advanced manufacturing techniques and robotics, particularly in the automotive, aerospace, and general machinery sectors. Growth is driven by the reshoring of manufacturing operations and substantial investment in automation across logistics and e-commerce fulfillment centers. The United States is the primary market, focusing heavily on integrating smart automation components that offer diagnostics and energy optimization. Strict labor safety regulations also encourage the rapid replacement of manual handling tasks with automated vacuum systems.

- Europe: The European market is mature but highly focused on quality, precision, and sustainability. Countries like Germany, Italy, and Scandinavia are leaders in industrial automation, emphasizing high-performance, long-life vacuum components and highly energy-efficient vacuum generation technologies. Demand is strong from the automotive, machinery, and pharmaceutical industries. Regulatory pressures regarding energy consumption (EU energy efficiency mandates) and material compliance (REACH, RoHS) significantly influence product design and market trends toward specialized, compliant elastomers.

- Asia Pacific (APAC): APAC is the fastest-growing and largest regional market, fueled by massive industrial expansion and government initiatives promoting smart factories in China, Japan, South Korea, and India. China dominates the consumption due to its enormous manufacturing base spanning electronics, automotive parts, and consumer goods. The demand here is massive for both standard, cost-effective cups for high-volume manufacturing and highly specialized, precision cups necessary for advanced semiconductor and display panel fabrication processes, driving both volume growth and technological investment.

- Latin America: This region is an emerging market, experiencing steady growth driven by modernization efforts in automotive assembly, packaging, and infrastructure projects in countries like Brazil and Mexico. Market penetration is accelerating as local manufacturers seek to improve competitiveness against global standards. Demand is typically focused on durable, general-purpose suction cups and vacuum systems that offer a favorable cost-to-performance ratio for mid-level automation requirements.

- Middle East and Africa (MEA): The MEA region is developing, with growth concentrated in Gulf Cooperation Council (GCC) states driven by diversification away from oil dependence, leading to investments in logistics, construction, and specialized manufacturing (e.g., solar energy). The market is smaller but presents significant potential, particularly for heavy-duty, robust vacuum handling solutions required for large-scale construction materials and logistics hub operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vacuum Suction Cup Market.- Schmalz GmbH

- Piab AB

- Coval S.A.

- Festo AG & Co. KG

- SMC Corporation

- Parker Hannifin Corporation

- Anver Corp.

- VMECA

- DESTACO (Dover Corporation)

- PISCO

- FIPA GmbH

- Vacuforce Ltd.

- Green-Vac Industrial Co., Ltd.

- Star Automation

- AiroMatic

- Graco Inc.

- Bimba Manufacturing Company

- WENGLOR sensoric group

- Shiji Automation

- VTEC Industrial Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Vacuum Suction Cup market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Vacuum Suction Cup Market?

The market is primarily driven by the escalating adoption of industrial automation and robotics across manufacturing sectors, the rapid expansion of e-commerce necessitating high-speed logistics handling, and the continuous demand for precision gripping solutions in electronics and automotive assembly lines. The trend toward smart factories integrating IO-Link sensors also boosts demand for intelligent vacuum components.

Which material segment is expected to witness the highest growth and why?

The Silicone and Polyurethane material segments are projected for the highest growth. Silicone is crucial for the stringent hygiene requirements of the Food and Beverage and Medical industries, while advanced Polyurethane offers exceptional abrasion resistance and durability, addressing the need for longer product life cycles in heavy-duty and abrasive environments.

How does the type of vacuum generation affect system performance?

Vacuum generation technology (pumps vs. ejectors) profoundly affects system performance. Ejectors (Venturi) are favored for decentralized systems due to their quick response time, compact size, and energy efficiency (only consuming air when suction is needed), making them ideal for high-speed, light-to-medium-duty robotic pick-and-place applications.

What challenges do vacuum suction cup manufacturers face in handling porous materials?

Porous materials, such as cardboard or certain textiles, are challenging because they leak air, preventing the establishment of sufficient vacuum pressure. Manufacturers address this by utilizing specialized foam sealing cups, implementing multi-stage ejectors for high flow rates, and oversized bellows cups to maximize contact area and compensate for leakage.

What role does Asia Pacific (APAC) play in the global Vacuum Suction Cup Market?

APAC is the dominant and fastest-growing region, driven by massive investments in manufacturing, particularly in the electronics and automotive industries of China, Japan, and South Korea. This region drives both high-volume demand for standard components and high-precision demand for advanced semiconductor handling equipment, making it central to global market dynamics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager