VAE Redispersible Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431590 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

VAE Redispersible Powder Market Size

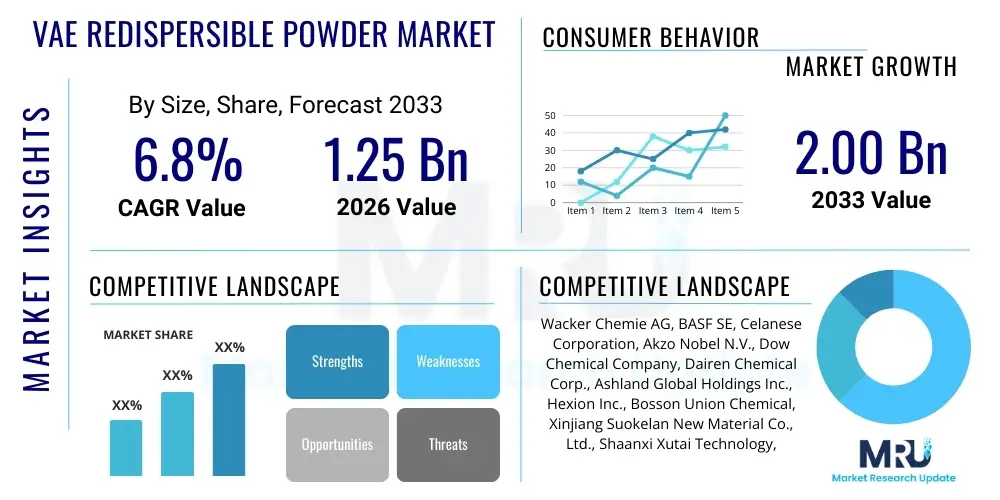

The VAE Redispersible Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. This robust growth trajectory is primarily driven by the expanding global construction industry, particularly the increasing emphasis on sustainable, high-performance building materials, and the rapid urbanization trends observed across Asia Pacific and Latin America. VAE RDP enhances the workability, adhesion, flexibility, and water resistance of cementitious formulations, making it indispensable in modern construction chemistry.

The market is estimated at USD 1.25 Billion in 2026, reflecting the current installed capacity and demand from specialized applications such as External Thermal Insulation Composite Systems (ETICS) and high-quality tile adhesives. Market valuation is significantly influenced by raw material costs, particularly vinyl acetate monomer (VAM) and ethylene prices, and the implementation of stringent building codes requiring durable, energy-efficient structures.

By the end of the forecast period in 2033, the market is projected to reach USD 2.00 Billion. This valuation surge is underpinned by anticipated technological advancements leading to the development of tailored RDP products for highly specialized applications, such as low-VOC formulations and products designed for extreme climatic conditions. Furthermore, the growing adoption of dry-mix mortars over traditional wet mortars, owing to logistical advantages and consistent quality, will significantly contribute to market expansion.

VAE Redispersible Powder Market introduction

The VAE Redispersible Powder Market involves the production and distribution of spray-dried copolymer powders, primarily based on Vinyl Acetate Ethylene (VAE) chemistry, which are designed to enhance the physical and chemical properties of cement and gypsum-based dry-mix mortars. These powders, when mixed with water at the job site, redisperse into an emulsion, acting as organic binders. Upon drying, they form a flexible polymer film within the mortar matrix, thereby improving characteristics such as adhesion strength, flexural strength, resistance to abrasion, and water repellency. VAE RDP is a cornerstone of modern construction material science, facilitating the high performance required in contemporary infrastructure and building projects.

The primary product description centers on its function as a polymeric additive that significantly modifies the performance profile of hydraulic binders. Key applications predominantly include high-quality tile adhesives (C2 classifications), crack-bridging waterproofing membranes, self-leveling underlayments (SLUs), External Thermal Insulation Composite Systems (ETICS/EIFS) adhesives and base coats, and wall putty formulations. The use of VAE RDP ensures structural integrity and durability, particularly in specialized applications where traditional mortars often fail, such as bonding non-absorbent tiles or adhering insulation boards in extreme temperature environments. This versatility is crucial for the modern building envelope.

Driving factors for this market include the global momentum toward green building standards and energy efficiency, necessitating the widespread use of ETICS. Additionally, benefits such as improved handling characteristics, reduced site waste through pre-mixed dry formulations, and enhanced durability leading to longer structure lifespans are compelling end-users to adopt VAE RDP-modified products. The rapid construction pace in emerging economies, coupled with increased per capita spending on housing renovation and new construction, further accelerates the demand for these performance-enhancing chemical additives.

VAE Redispersible Powder Market Executive Summary

The VAE Redispersible Powder Market exhibits strong growth, fueled by robust demand from the global construction sector, particularly the surge in residential and commercial infrastructure projects emphasizing thermal efficiency and structural resilience. Key business trends indicate a strong focus on sustainable product innovation, including the development of low-VOC and formaldehyde-free VAE RDP variants, driven by increasing regulatory pressures in North America and Europe. Strategic mergers, acquisitions, and capacity expansions, especially in the Asia Pacific region by major global chemical producers, define the competitive landscape, aiming to secure localized supply chains and reduce logistical costs associated with high-volume specialty chemicals.

Regional trends highlight Asia Pacific (APAC) as the dominant market, characterized by rapid urbanization, significant government investment in affordable housing, and the large-scale adoption of dry-mix mortars in China and India. Europe maintains a strong position due to strict energy efficiency mandates, particularly those governing ETICS installation, where VAE RDP is essential for performance guarantees. North America is poised for stable growth, concentrating on renovation projects and infrastructure repair, demanding high-durability specialty construction chemicals. Pricing dynamics are sensitive to VAM fluctuation, leading manufacturers to optimize production processes for cost efficiency and backward integration in the supply chain.

Segment trends underscore the Tile Adhesives segment as the largest revenue generator, driven by the global shift towards larger-format and porcelain tiles which require superior bonding performance facilitated by high polymer content. The ETICS segment is witnessing the highest growth rate due to global climate change mitigation efforts and mandatory thermal insulation standards. The dominance of VAE homopolymer chemistry is being slightly challenged by specialized VeoVa co-polymers, particularly in applications demanding enhanced hydrophobicity and flexibility. Furthermore, the shift towards functionalized RDPs (e.g., those providing rheological modification or specific set times) reflects a key area of technological differentiation among market leaders.

AI Impact Analysis on VAE Redispersible Powder Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) can optimize the complex chemical synthesis and spray-drying processes involved in VAE RDP production, focusing on consistency, yield optimization, and energy consumption reduction. Common concerns revolve around the integration cost of AI platforms in existing chemical plants and the ability of AI to accurately model the performance characteristics of RDPs in diverse mortar formulations under varying environmental conditions. Expectations center on AI's potential to accelerate the discovery of novel polymer compositions with superior properties, specifically tailored for demanding applications like high-alkaline environments or extreme temperature cycling. The consensus anticipates AI's primary immediate impact will be felt in process control and quality assurance.

AI is projected to revolutionize quality control in VAE RDP manufacturing by employing predictive analytics to monitor critical process parameters (temperature, pressure, feed rates) in real-time during polymerization and spray-drying. This level of granular control minimizes batch variability, ensuring the consistent particle size distribution and polymer content necessary for high-performance end products. Furthermore, advanced AI algorithms are beginning to analyze vast datasets relating polymer structure, morphology, and mortar performance, significantly reducing the R&D cycle time needed to formulate new, highly efficient grades of redispersible powders, moving beyond traditional trial-and-error methods.

Beyond production, AI-powered supply chain management offers substantial benefits in managing the procurement of volatile raw materials like VAM and ethylene. Predictive modeling assists in optimizing inventory levels and hedging against price risks. In the construction industry itself, AI integration into Building Information Modeling (BIM) software can precisely calculate the required type and quantity of VAE RDP-modified mortars for a project, leading to optimized material usage, reduced waste, and enhanced project cost control, thus subtly increasing the perceived value and efficiency of VAE RDP-based dry mixes.

- AI optimizes polymerization reaction kinetics, increasing VAE conversion efficiency.

- Machine learning enhances spray-drying process control, ensuring uniform particle morphology and stability.

- Predictive maintenance schedules for high-cost spray dryers minimize operational downtime and extend equipment lifespan.

- AI-driven simulation tools accelerate the development of specialized RDPs for novel applications (e.g., 3D printing mortars).

- Big data analysis improves raw material procurement strategies, mitigating price volatility of VAM and ethylene.

- Automated quality assurance systems using computer vision detect subtle deviations in powder quality immediately.

DRO & Impact Forces Of VAE Redispersible Powder Market

The VAE Redispersible Powder Market is significantly driven by mandatory energy efficiency regulations (Driver) leading to increased ETICS adoption globally, coupled with the rising consumer preference for high-quality, durable construction (Driver). However, the market faces restraints primarily due to the volatility of key raw material prices, particularly vinyl acetate monomer (VAM), which impacts production costs and profit margins. Opportunities are abundant in developing specialized RDPs for niche applications such as waterproof concrete additives and high-performance repair mortars, alongside the expansion into emerging geographical markets lacking sophisticated construction chemical infrastructure. The primary impact forces shaping the market include competitive pricing from Chinese manufacturers and the constant regulatory pressure demanding lower volatile organic compound (VOC) content in building materials.

Key drivers center around global urbanization and infrastructure modernization programs, especially in Asia and the Middle East, demanding reliable and fast-curing dry-mix mortars. The inherent benefits of VAE RDP, such as improved flexibility and adhesion to difficult substrates (like slick surfaces or non-traditional materials), make it essential for modern architectural designs. Furthermore, the drive towards sustainable construction practices favors dry-mix systems, which inherently reduce water usage on-site and offer more consistent performance compared to traditional mixing methods.

Restraints include the logistical challenges associated with transporting bulk specialty powders, requiring specialized packaging and storage conditions to maintain efficacy. Competition from alternative polymer technologies, although currently less prevalent for core applications, poses a potential threat. The market’s sensitivity to global petrochemical prices requires continuous efforts in operational excellence and supply chain risk mitigation to sustain profitability. Successfully navigating these restraints while capitalizing on the increasing demand for high-performance building materials will determine long-term market leadership.

- Drivers: Increased adoption of External Thermal Insulation Composite Systems (ETICS); Growing demand for high-quality tile adhesives; Global shift towards pre-mixed dry mortars.

- Restraints: Volatility in raw material (VAM, ethylene) pricing; High investment cost required for spray-drying facilities; Potential substitution risk from liquid polymer dispersions in certain segments.

- Opportunities: Development of customized RDPs for 3D printing construction; Expansion into repair and renovation of aging infrastructure; Focus on ultra-low VOC and sustainable bio-based VAE RDP alternatives.

- Impact Forces: Stringent environmental regulations (VOC standards); Intense price competition, especially from Asian manufacturers; Technological substitution pressure.

Segmentation Analysis

The VAE Redispersible Powder market is comprehensively segmented based on its chemical composition (Type) and its end-use function (Application), allowing for precise market tracking and strategic focus. The segmentation by type primarily distinguishes between standard Vinyl Acetate Ethylene (VAE) copolymers and specialized variants such as Vinyl Acetate-VeoVa (VAC/VeoVa), with the former dominating due to its cost-effectiveness and broad utility. The application segmentation provides critical insights into the consumption patterns across the construction value chain, with flooring and wall applications being the primary consumers. Understanding these segments is vital for manufacturers to tailor their product offerings and optimize their distribution networks, addressing the unique performance requirements of different construction specialties.

The dominant application segment remains Tile Adhesives and Grouts, driven by global flooring trends and the necessity of high-strength polymer modification for large-format and non-porous ceramic tiles. However, the fastest-growing segment is projected to be External Thermal Insulation and Finish Systems (ETICS/EIFS), directly correlated with governmental energy efficiency mandates across developed and rapidly developing nations. Segmentation also reflects regional preferences; for example, North American markets show a strong emphasis on repair mortars, while Asian markets prioritize wall putties and standard tile adhesives due to high volume residential construction.

Further segmentation includes the categorization by function within the mortar, such as RDPs designed specifically for enhancing water repellency (hydrophobic grades) versus those focused purely on adhesion and flexibility. This functional differentiation enables producers to command premium pricing for highly engineered products tailored to demanding environments like basement waterproofing or façade applications exposed to severe weather. The increasing complexity of modern building designs necessitates this high degree of product specialization, ensuring the market remains innovation-driven and segmented based on performance metrics rather than just volume.

- By Type:

- Vinyl Acetate Ethylene (VAE)

- Vinyl Acetate VeoVa (VAC/VeoVa)

- Vinyl Acetate Copolymer (VAC)

- By Application:

- Tile Adhesives & Grouts

- External Thermal Insulation Composite Systems (ETICS/EIFS)

- Wall Putty

- Self-Leveling Compounds (SLCs)

- Repair Mortars

- Skim Coats & Base Coats

- Dry-mix Concrete Additives

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (Saudi Arabia, UAE, South Africa, Rest of MEA)

Value Chain Analysis For VAE Redispersible Powder Market

The VAE Redispersible Powder value chain begins with the upstream segment involving the production of key raw materials: Vinyl Acetate Monomer (VAM), ethylene, and protective colloids (like Polyvinyl Alcohol, PVA). Manufacturers of VAE RDP are often integrated backward into VAM production or maintain long-term supply agreements due to VAM price volatility, a critical determinant of final product cost. The core manufacturing stage involves the polymerization of VAM and ethylene into a liquid emulsion, followed by the energy-intensive spray-drying process which converts the emulsion into a stable powder form. Quality control and packaging are crucial steps ensuring the powder’s redispersibility and storage stability.

The distribution channel is predominantly indirect, utilizing specialized distributors and agents who possess deep technical knowledge of construction chemistry and logistics capabilities required for handling specialty chemicals. These intermediaries bridge the gap between large chemical producers and thousands of decentralized dry-mix mortar manufacturers. Direct sales channels are typically reserved for very large customers or strategic global accounts, allowing for direct technical support and customized product development. Effective distribution minimizes storage time and ensures that the end-product (the RDP) reaches the mortar producers efficiently, preventing moisture contamination.

Downstream analysis focuses on the customers, primarily dry-mix mortar producers who blend the VAE RDP with cement, sand, and other additives to create the final construction product (e.g., tile adhesive bags). The end-users are the contractors, applicators, and construction firms utilizing these dry-mix products on residential, commercial, and infrastructure projects. The value derived at the downstream level is the enhanced performance of the construction material—superior bond strength, extended open time, and improved crack resistance—justifying the premium cost of RDP-modified mortars over conventional materials. Continuous communication between RDP manufacturers and mortar formulators is essential for developing products optimized for specific regional climate and building codes.

VAE Redispersible Powder Market Potential Customers

The primary potential customers and end-users of VAE Redispersible Powder are industrial manufacturers operating within the construction chemicals and building materials sector. Specifically, these include large-scale producers of dry-mix mortars, which encompass companies specializing in tile adhesives, grouts, and cement-based repair compounds. These manufacturers integrate VAE RDP as a critical performance additive to meet required national and international building standards (e.g., European EN standards for adhesion strength in tile mortars). Their buying decisions are driven by consistent supply, technical support for formulation optimization, and competitive pricing linked to polymer loading efficiency.

A second significant customer segment comprises manufacturers focused on specialized applications, notably companies producing External Thermal Insulation Composite Systems (ETICS). For these customers, VAE RDP is non-negotiable as it provides the necessary alkali resistance, freeze-thaw stability, and adhesion required for securing insulation boards (like EPS or mineral wool) to structural substrates and for formulating flexible, weather-resistant base coats. This segment is highly performance-driven, often requiring customized, high-specification polymer powders to achieve necessary certifications.

Furthermore, smaller but growing customer groups include manufacturers of gypsum-based products like wall putties and plasters, where RDP enhances surface hardness and reduces cracking. Construction contractors and large infrastructure project developers indirectly influence demand, as their specification requirements dictate whether the dry-mix mortar manufacturer must utilize VAE RDP to ensure the longevity and performance of the completed structure. The consistent demand for energy-efficient buildings globally ensures a robust and expanding customer base across all major geographic regions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.00 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wacker Chemie AG, BASF SE, Celanese Corporation, Akzo Nobel N.V., Dow Chemical Company, Dairen Chemical Corp., Ashland Global Holdings Inc., Hexion Inc., Bosson Union Chemical, Xinjiang Suokelan New Material Co., Ltd., Shaanxi Xutai Technology, Shandong Sancai Building Material, Henan Taiying Chemical, Sidley Chemical Co., Ltd., China National Petroleum Corporation (CNPC) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

VAE Redispersible Powder Market Key Technology Landscape

The core technology underpinning the VAE Redispersible Powder market is emulsion polymerization followed by highly specialized spray drying. Emulsion polymerization technology has evolved to focus on creating copolymers with tailored glass transition temperatures (Tg) and molecular weights, optimizing the powder's performance characteristics such as flexibility and minimum film-forming temperature (MFFT). Current advancements emphasize incorporating highly hydrophobic monomers (like VeoVa) during the polymerization stage to yield RDPs that offer enhanced water repellency, moving beyond simple polymer modification to functionalize the mortar against moisture ingress, crucial for façade and basement applications. Manufacturers are continually investing in optimizing reactor design and process control to ensure a narrow and consistent particle size distribution, which is directly linked to the final product's redispersibility and effectiveness.

Spray drying remains the most critical and energy-intensive technological step. Modern technological improvements in this area focus on maximizing thermal efficiency and recovery to reduce manufacturing costs and environmental impact. Advanced spray-drying towers now incorporate sophisticated nozzle design and airflow management to produce powders with exceptional flow characteristics and anti-caking properties, thereby extending shelf life and ease of use for the dry-mix manufacturers. Furthermore, encapsulation technologies, utilizing protective colloids like polyvinyl alcohol (PVA), are being refined to ensure superior long-term stability and prevent blocking during storage, particularly in humid climates prevalent in Southeast Asia and Latin America.

The technology landscape is also heavily influenced by R&D focused on sustainability. This includes the development of VAE RDPs based partly on bio-derived feedstocks, reducing reliance on petrochemicals, and the formulation of low-emission RDPs that comply with stringent indoor air quality standards (e.g., GEV Emicode requirements). Additionally, specialized RDP technologies are emerging to serve high-growth areas like 3D printing in construction, requiring unique rheological modifiers and rapid setting characteristics that standard VAE RDPs cannot fully deliver. These innovations ensure the VAE RDP sector remains technologically relevant against competing polymer types.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for VAE Redispersible Powder, primarily driven by massive infrastructure development, rapid urbanization, and high-volume residential construction in China, India, and Southeast Asian countries. The shift from traditional construction methods to industrialized dry-mix mortar systems is accelerating RDP consumption. China remains the largest consumer and producer, often setting the global benchmark for price competition, while India represents an explosive growth opportunity due to increasing quality standards and adoption of organized construction practices. The region's demand is heavily skewed towards standard and cost-effective VAE grades used extensively in wall putties and basic tile adhesives.

- Europe: Europe represents a mature market characterized by high regulatory standards, particularly concerning energy efficiency (ETICS/EIFS) and indoor air quality (low-VOC requirements). This region demands premium, specialized VAE RDP grades, especially those formulated for thermal insulation systems and renovation projects. Germany, France, and the UK are key markets where strict building codes necessitate superior-performing adhesives and base coats, driving innovation towards hydrophobic and highly flexible RDPs. The focus here is on product performance and sustainability rather than just volume growth.

- North America: The North American market is stable, driven mainly by repair, renovation, and non-residential construction. Demand is concentrated in high-performance applications like self-leveling underlayments, floor preparation, and specialized roofing membranes. While growth rates are moderate compared to APAC, the U.S. and Canada prioritize durable, certified materials, leading to consistent demand for high-quality, technically supported RDP products. The market is highly influenced by regulatory compliance related to construction safety and environmental impact.

- Latin America (LATAM): LATAM exhibits significant potential, particularly in Brazil and Mexico, due to urbanization and governmental housing initiatives. The market is developing, with increasing awareness of the benefits of RDP-modified mortars for enhancing construction quality and speed. Price sensitivity is a key factor, but the move toward modern construction techniques ensures a steady rise in RDP adoption, focusing on tile adhesives and basic repair mortars.

- Middle East and Africa (MEA): The MEA market, driven by large-scale commercial and infrastructure projects in the GCC countries (UAE, Saudi Arabia), shows strong demand for RDPs tailored for extreme heat and high-salinity environments. Specialized hydrophobic and high-temperature-resistant VAE RDPs are required for façade applications and specialized concrete repair necessary in harsh desert climates. Africa remains nascent, but construction growth in South Africa and Nigeria suggests future opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the VAE Redispersible Powder Market.- Wacker Chemie AG

- BASF SE

- Celanese Corporation

- Akzo Nobel N.V.

- Dow Chemical Company

- Dairen Chemical Corp.

- Ashland Global Holdings Inc.

- Hexion Inc.

- Bosson Union Chemical

- Xinjiang Suokelan New Material Co., Ltd.

- Shaanxi Xutai Technology

- Shandong Sancai Building Material

- Henan Taiying Chemical

- Sidley Chemical Co., Ltd.

- China National Petroleum Corporation (CNPC)

- Synthomer PLC

- Nippon Gohsei

- Shandong Xindadi Industrial Group Co., Ltd.

- Jining Hualong Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the VAE Redispersible Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is VAE Redispersible Powder (RDP) and how does it function in construction materials?

VAE Redispersible Powder is a white, free-flowing organic polymer powder derived from vinyl acetate and ethylene. It acts as an organic binder in dry-mix mortars (like tile adhesives or putties). When mixed with water, the powder redisperses into an emulsion, forming a polymer film upon drying that improves the mortar's adhesion, flexibility, water resistance, and tensile strength, crucial for high-performance building applications.

Which application segment holds the largest share in the VAE RDP market currently?

The Tile Adhesives and Grouts segment currently holds the largest revenue share. This dominance is driven by the global trend toward using larger, heavier, and non-absorbent porcelain and stone tiles, which require superior polymer modification (using VAE RDP) to ensure strong, durable bonding on diverse substrates.

What primary factors restrain the growth and profitability of the VAE Redispersible Powder market?

The main restraint is the high volatility and fluctuating cost of key raw materials, primarily Vinyl Acetate Monomer (VAM) and ethylene, which are derived from petrochemical sources. These input cost fluctuations significantly impact the manufacturing economics and profit margins of VAE RDP producers globally, necessitating sophisticated procurement strategies.

How are environmental regulations influencing the demand for VAE Redispersible Powder?

Environmental regulations, particularly those concerning energy efficiency and indoor air quality, significantly boost VAE RDP demand. Strict mandates for thermal insulation (ETICS) necessitate high-quality RDPs for reliable adhesive coats, while low-VOC construction material standards drive innovation towards ultra-low emission RDP formulations, particularly in developed economies like Europe and North America.

Why is the Asia Pacific region dominating the global VAE Redispersible Powder market?

APAC dominates due to unprecedented rates of urbanization and infrastructure development, particularly in China and India. The rapid adoption of modern, organized dry-mix mortar technology over traditional wet mixing, coupled with supportive government policies for housing construction, creates immense volume demand for cost-effective VAE RDPs.

What are the key technical differences between VAE RDP and VAC/VeoVa RDP?

VAE (Vinyl Acetate Ethylene) is the standard, cost-effective copolymer offering good general adhesion and flexibility. VAC/VeoVa RDP incorporates vinyl laurate (VeoVa) monomers, resulting in significantly enhanced hydrophobicity (water repellency) and reduced water absorption, making it highly preferred for exterior facade mortars and waterproofing applications where moisture resistance is critical.

How does the quality of the protective colloid impact the shelf life of RDP?

The protective colloid, typically Polyvinyl Alcohol (PVA), is crucial for RDP quality. It prevents the polymer particles from coagulating during the spray-drying process and maintains the powder’s ability to redisperse in water later. A high-quality colloid ensures excellent stability against moisture ingress and elevated temperatures, preventing caking and prolonging the powder's effective shelf life.

In what specific way does VAE RDP improve the workability of cement mortars?

VAE RDP acts as a rheological modifier, improving the cohesion and plasticity of the wet mortar mix. This leads to better "open time" (the time the adhesive remains workable) and "tackiness," which makes application easier for contractors, especially when applying materials to vertical surfaces like walls or facades.

What is the significance of the glass transition temperature (Tg) in VAE RDP formulation?

The Tg determines the polymer film's hardness and flexibility. Manufacturers adjust the monomer ratio to achieve an optimal Tg: a lower Tg provides greater flexibility and crack-bridging ability (needed for ETICS base coats), while a slightly higher Tg provides improved tensile strength and resistance to dirt pickup (needed for tile adhesives).

Which emerging technology is expected to drive specialized demand for VAE RDP?

Construction 3D printing is an emerging technology expected to drive specialized RDP demand. 3D printing mortars require additives that offer unique rheological properties, extremely fast setting times, and sufficient structural integrity post-deposition, necessitating customized VAE RDPs tailored for these high-precision additive manufacturing processes.

Do VAE Redispersible Powders contribute to the alkali resistance of mortars?

Yes, VAE RDPs provide improved resistance to alkaline environments inherent in cementitious materials. The polymer film formed acts as a barrier, protecting the mortar from chemical degradation and ensuring long-term adhesion strength, which is vital for outdoor and high-moisture applications.

What role does backward integration play for major VAE RDP manufacturers?

Backward integration—where manufacturers control the supply of raw materials like VAM—is a critical competitive advantage. It helps secure supply, stabilize production costs against market volatility, and ensures consistent quality of the input materials, thereby enhancing the overall reliability and cost-competitiveness of the final RDP product.

How is the market addressing the need for sustainable VAE RDP alternatives?

The market is pursuing sustainability through two main avenues: optimizing the energy efficiency of the spray-drying process (reducing the carbon footprint) and researching the use of bio-based or partially bio-derived vinyl acetate monomers, aiming to reduce the reliance on purely fossil fuel-based feedstocks for polymerization.

What distinguishes VAE RDP from liquid polymer dispersions?

The key distinction is physical form and handling. VAE RDP is a solid powder, offering superior logistical advantages: easier handling, lighter weight, reduced transportation costs, simplified storage (no freezing issues), and extended shelf life. Liquid dispersions contain significant water content and require preservatives, making them less practical for dry-mix mortar production.

Which European country is the largest consumer of VAE RDP specifically for ETICS applications?

Germany is typically considered the largest consumer in Europe for VAE RDP dedicated to ETICS (External Thermal Insulation Composite Systems). This is due to stringent national energy saving ordinances (EnEV) that mandate high levels of thermal performance in both new and renovated buildings, heavily relying on RDP-modified adhesives and base coats.

What is the primary function of VAE RDP in self-leveling compounds (SLCs)?

In SLCs, VAE RDP primarily enhances adhesion to the subfloor, improves cohesion, and crucially minimizes shrinkage cracks during the curing process. The polymer addition ensures a smooth, highly durable, and crack-free surface necessary for subsequent floor coverings.

How does AI contribute to quality control in VAE RDP manufacturing?

AI utilizes machine learning algorithms to continuously monitor data points from the polymerization and spray-drying processes. By analyzing subtle variations in temperature, pressure, and chemical composition in real-time, AI predicts and corrects deviations, ensuring maximum batch consistency, uniform particle size, and minimizing off-specification products.

What is the correlation between urbanization in developing nations and VAE RDP demand?

Rapid urbanization necessitates fast-track, large-scale construction. VAE RDP-modified dry-mix mortars facilitate rapid construction timelines while ensuring high quality and durability, making them essential for high-rise residential and commercial projects in rapidly growing cities across APAC and LATAM.

What are the key technical properties tested for in VAE Redispersible Powders?

Key properties tested include Minimum Film-Forming Temperature (MFFT), ash content (measuring inorganic fillers), bulk density, pH value, moisture content, and, most importantly, redispersibility in water (particle size analysis after redispersion) to ensure optimal performance in the mortar mix.

What competitive advantage do specialized hydrophobic VAE RDP grades offer?

Hydrophobic grades offer superior resistance to water absorption compared to standard grades. This is a critical advantage in applications like external plaster, roof repair mortars, and waterproofing membranes, providing enhanced durability and protecting the substrate from weather-related degradation and efflorescence.

How does the shift towards large format tiles influence RDP consumption?

The popularity of large format and non-porous tiles (like porcelain) requires significantly higher bond strength and flexibility from the adhesive to prevent failure due to thermal stress or building movement. This necessitates increasing the polymer content (RDP loading) in tile adhesives, directly driving up overall VAE RDP consumption.

What role do distribution channels play in the VAE RDP market strategy?

Distribution channels, often comprised of technical distributors, are crucial for market penetration. They provide localized warehousing, manage smaller quantities required by regional mortar manufacturers, and offer essential technical support and formulation guidance, serving as the interface between the major chemical producer and the decentralized construction industry end-user.

In the Value Chain, what is the significance of Polyvinyl Alcohol (PVA)?

PVA is the primary protective colloid used during polymerization and spray drying. It stabilizes the polymer emulsion particles and, in the final powder, ensures that the polymer particles can separate and reform a stable dispersion when the dry-mix mortar is introduced to water at the construction site—a requirement defining "redispersibility."

How do manufacturers customize VAE RDP for repair mortar applications?

For repair mortars, RDPs are customized to enhance adhesion to aged or damaged concrete, improve crack resistance, and optimize dimensional stability (low shrinkage). This often involves using RDP grades with specific Tg levels and potentially incorporating fiber reinforcement or specialized additives within the RDP formulation to handle the severe stress conditions inherent in structural repair.

What is meant by the term "dry-mix mortar" and why is RDP essential to it?

A dry-mix mortar is a cementitious product pre-mixed with all necessary additives (like RDP, sand, cellulose ethers) in a factory and bagged. RDP is essential because it provides the critical performance characteristics—flexibility, adhesion, and water resistance—that are impossible to achieve with standard on-site mixed cement and sand, ensuring consistent quality and high performance.

What is the difference between RDPs designed for base coats versus final skim coats in ETICS?

RDPs for ETICS base coats require high flexibility, excellent adhesion to insulation boards, and crack-bridging capability, necessitating a low Tg. RDPs for final skim coats (top layers) may focus more on surface hardness, reduced dirt pickup, and water repellency, often incorporating VeoVa or specific functional groups.

How does AI optimize the energy consumption of the spray-drying process?

AI utilizes sophisticated sensors to model the moisture content and heat transfer dynamics within the spray dryer. By predicting the minimum necessary drying temperature and residence time required to achieve the target powder specification, AI systems minimize thermal energy input without compromising product quality, leading to significant cost and energy savings.

What impact does the geographical location of manufacturing facilities have on the VAE RDP market?

Due to high transportation costs relative to product value and the sensitivity of the product to handling, proximity to high-demand construction markets (like APAC) is crucial. Manufacturers strategically locate facilities in key regions to shorten lead times, reduce logistics expenses, and offer tailored technical support specific to regional climate and construction needs.

How are mergers and acquisitions shaping the competitive landscape of the RDP market?

M&A activities are often driven by major players seeking geographical expansion, particularly into emerging markets, or acquiring specialized technology portfolios (e.g., highly hydrophobic RDP formulations). These consolidations reduce competition, rationalize capacity, and enhance the acquiring company's global supply chain resilience and market share.

What is the expected long-term impact of regulatory efforts to ban high-VOC materials on the VAE RDP segment?

The drive to ban high-VOC materials creates a positive long-term outlook for VAE RDP. Since RDPs are utilized in dry-mix formulas, they inherently contain minimal to zero VOCs, positioning them favorably compared to traditional wet polymer dispersions which often require higher levels of stabilizers and solvents, thus reinforcing RDP's market dominance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager