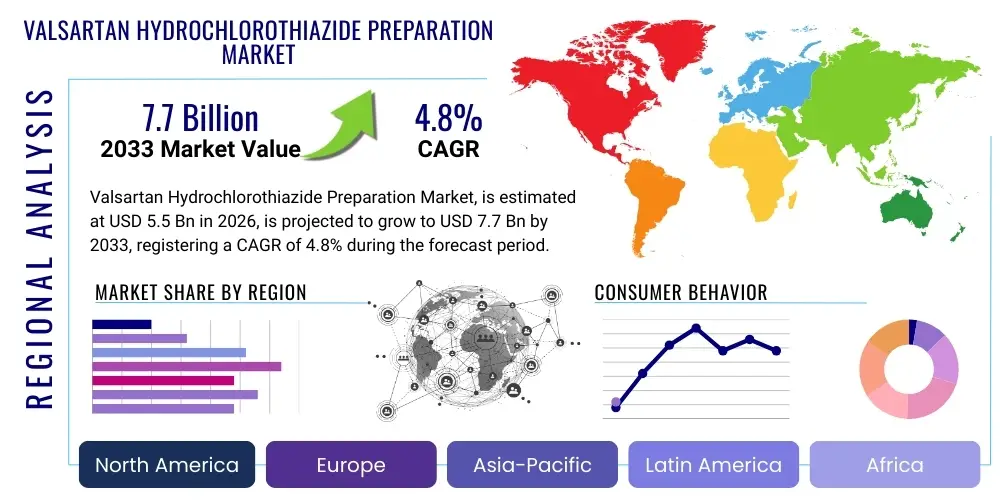

Valsartan Hydrochlorothiazide Preparation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437581 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Valsartan Hydrochlorothiazide Preparation Market Size

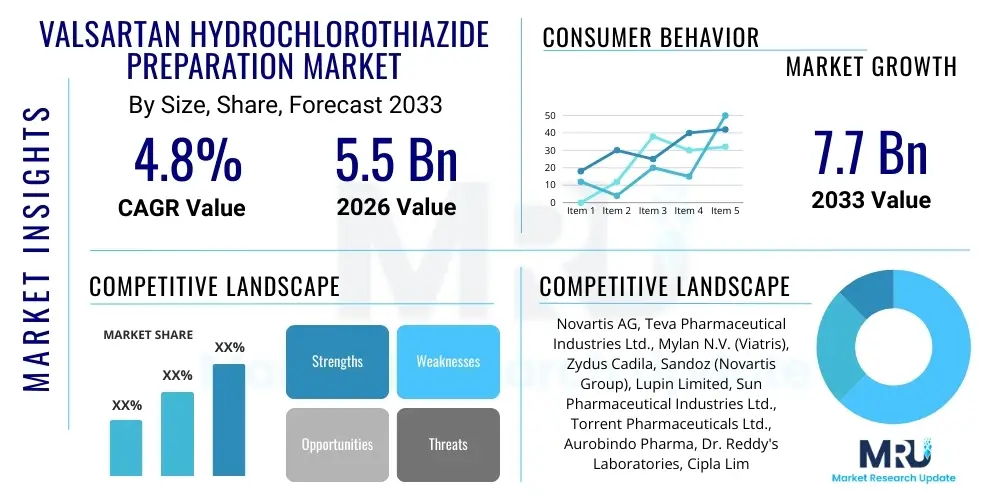

The Valsartan Hydrochlorothiazide Preparation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $5.5 Billion in 2026 and is projected to reach $7.7 Billion by the end of the forecast period in 2033.

Valsartan Hydrochlorothiazide Preparation Market introduction

The Valsartan Hydrochlorothiazide (VHC) preparation market centers around a critical fixed-dose combination therapy used primarily for the management of hypertension, particularly in patients whose blood pressure is not adequately controlled by monotherapy. Valsartan, an Angiotensin II Receptor Blocker (ARB), works by blocking the binding of angiotensin II to the AT1 receptor, leading to vasodilation and reduced blood pressure. Hydrochlorothiazide (HCTZ), a thiazide diuretic, increases the excretion of sodium and water, contributing a synergistic effect to the antihypertensive action. This dual mechanism offers superior efficacy and significantly enhances patient adherence compared to taking two separate medications, addressing a major challenge in chronic disease management.

Major applications for VHC preparations include the treatment of essential hypertension, complicated hypertension requiring combination therapy, and in managing cardiovascular risk in high-risk patient populations. The inherent benefits of VHC, such as improved efficacy, simplified dosing regimens, and established safety profiles, solidify its position as a cornerstone therapy in cardiovascular medicine globally. The increasing global prevalence of hypertension, driven by factors such as aging populations, poor dietary habits, and sedentary lifestyles, serves as a fundamental market driver, ensuring sustained demand for effective and convenient treatment options like VHC.

The driving factors underpinning market expansion are deeply rooted in epidemiological trends and pharmaceutical innovation strategies. A growing awareness among healthcare providers regarding the benefits of fixed-dose combination therapies for improving long-term therapeutic outcomes acts as a significant catalyst. Furthermore, the expiration of patents for branded versions has allowed for the entry of high-quality generic equivalents, increasing accessibility and affordability across diverse economic regions, thereby expanding the potential patient base. However, market growth is often tempered by patent cliffs and stringent regulatory hurdles associated with demonstrating bioequivalence for generic formulations, demanding precise quality control measures.

Valsartan Hydrochlorothiazide Preparation Market Executive Summary

The Valsartan Hydrochlorothiazide preparation market is characterized by mature therapeutic adoption combined with incremental growth driven primarily by demographic shifts and the robust demand for fixed-dose combinations (FDCs). Business trends show a distinct shift towards generic manufacturers dominating volume share, although branded products maintain price stability in select premium markets. The primary competitive dynamic revolves around efficient supply chain management, ensuring the availability of high-quality Active Pharmaceutical Ingredients (APIs), particularly in the aftermath of global recalls related to nitrosamine impurities, which necessitated significant operational overhauls across the industry. Investment focus is increasingly shifting towards post-marketing surveillance and robust quality control systems to mitigate regulatory risks and rebuild prescriber confidence.

Regional trends indicate North America and Europe retaining the largest market shares due to high healthcare expenditure, established diagnostic pathways for hypertension, and comprehensive reimbursement coverage. However, the Asia Pacific (APAC) region is poised for the fastest expansion, fueled by rapidly rising hypertension prevalence, improving access to healthcare, and the increasing adoption of Western-style treatment protocols. Government initiatives in countries like China and India aimed at controlling non-communicable diseases (NCDs) are accelerating the demand for affordable, combination antihypertensive drugs. This regional segmentation underscores a bifurcated market strategy: high-value retention in developed economies and volume-driven expansion in emerging markets.

Segmentation trends highlight the dominance of oral tablet dosage forms, reflecting standard patient compliance and established manufacturing practices. While standard dosages remain core, demand for specialized low-dose or high-dose variants caters to specific patient subsets requiring tailored blood pressure management strategies. The application segment continues to be overwhelmingly driven by essential (primary) hypertension treatment. Strategic movements within the market include pharmaceutical companies diversifying their product portfolios to include multi-component fixed-dose combinations (e.g., VHC combined with a Calcium Channel Blocker) to capture patients requiring more aggressive or triple combination therapy, ensuring sustained relevance in an evolving cardiovascular therapeutic landscape.

AI Impact Analysis on Valsartan Hydrochlorothiazide Preparation Market

User queries regarding the impact of Artificial Intelligence (AI) on the Valsartan Hydrochlorothiazide market frequently center on three core areas: how AI can enhance patient adherence to this FDC therapy, the role of machine learning in optimizing drug manufacturing quality control (especially impurity detection), and the potential for AI-driven clinical trials to accelerate next-generation hypertension treatments. Users are particularly concerned about AI's ability to personalize dosing recommendations based on real-time patient data and wearables, moving beyond standard fixed doses. There is significant interest in AI's capacity to predict and prevent supply chain disruptions, a critical issue following recent regulatory scrutiny related to Valsartan API contamination, ensuring a reliable supply of the medication.

The integration of AI technologies promises revolutionary improvements across the lifecycle of VHC preparations. In the research and development phase, sophisticated algorithms can analyze vast genomic and clinical datasets to identify non-responders or those prone to adverse effects, optimizing patient selection for VHC therapy and refining personalized medicine approaches for hypertension management. Furthermore, AI-powered predictive analytics are instrumental in forecasting regional demand fluctuations, minimizing stock-outs, and improving inventory efficiency for generic and branded distributors. This optimization reduces waste and ensures product availability where it is most needed, enhancing market responsiveness.

Within manufacturing and quality assurance, AI is deployed to manage complex analytical processes. Advanced deep learning models are used to monitor high-performance liquid chromatography (HPLC) data in real-time, detecting minute irregularities or potential N-nitrosamine precursors during API synthesis or formulation blending, far surpassing human capabilities in speed and accuracy. This preemptive quality control is essential for maintaining compliance with stringent global regulatory standards (FDA, EMA) and safeguarding brand reputation, directly influencing the stability and trust in the Valsartan supply chain following past public health challenges associated with impurities.

- AI enhances patient adherence monitoring through smart packaging and personalized reminders, optimizing long-term VHC efficacy.

- Machine learning algorithms significantly improve the precision and speed of quality control in API manufacturing, specifically targeting impurity detection like nitrosamines.

- Predictive analytics optimize VHC supply chain logistics, minimizing inventory risk and ensuring consistent product availability across diverse geographic markets.

- AI aids in clinical trial design for related cardiovascular therapies, potentially streamlining the path for next-generation combination drugs complementing VHC.

- Natural Language Processing (NLP) is used to analyze patient feedback and post-marketing surveillance data, identifying potential unrecognized side effect patterns faster.

DRO & Impact Forces Of Valsartan Hydrochlorothiazide Preparation Market

The market dynamics for Valsartan Hydrochlorothiazide are shaped by powerful opposing forces, balancing high therapeutic necessity against intense commercial competition and regulatory pressures. The primary driver is the sheer demographic necessity—the global burden of hypertension continues to rise, especially among aging populations, creating a perpetually large and expanding patient pool requiring chronic medication. However, the market faces intense downward pricing pressure from widespread generic entry, which acts as a major restraint, eroding the revenue potential for branded manufacturers and necessitating continuous cost efficiency from all players. Opportunities lie in expanding geographical penetration into underserved emerging markets and developing advanced drug delivery systems that offer superior patient benefits or patent protection, counteracting generic substitution effects.

Key drivers include the recognized benefit of fixed-dose combination therapies in improving patient compliance, which is crucial for managing chronic asymptomatic conditions like hypertension. Healthcare professionals actively seek FDCs like VHC to simplify dosing schedules, directly leading to better blood pressure control and reduced cardiovascular events. Conversely, significant restraints involve the ongoing regulatory complexity, particularly related to the integrity and safety of the API sourcing, highlighted by the FDA and EMA investigations into N-nitrosamine contamination found in several sartan class drugs. This scrutiny demands substantial investment in quality assurance, which can increase operational costs and slow down market entry for certain generic suppliers.

The impact forces are substantial, creating a highly regulated, price-sensitive environment. The threat of generic erosion is high, necessitating innovation in formulation technology or peripheral services (like digital adherence tools) to differentiate products. The regulatory environment acts as a strong external force; compliance failures can result in massive product recalls, fundamentally disrupting market supply and significantly damaging corporate reputations. Technological forces, specifically advancements in analytical chemistry and AI-driven quality control, are acting as powerful enabling factors, allowing manufacturers to meet stringent safety requirements and maintain market trust, ultimately influencing competitive success in this mature therapeutic segment.

- Drivers: High global prevalence of essential hypertension; established efficacy and safety profile of VHC; enhanced patient adherence facilitated by fixed-dose combinations; increasing geriatric population segment.

- Restraints: Intense generic competition and subsequent price erosion; regulatory challenges related to API purity and impurity testing (nitrosamines); potential side effects associated with thiazide diuretics; patent expiration of key branded versions.

- Opportunities: Untapped growth potential in emerging economies (APAC, LATAM); development of superior co-formulations or triple combination therapies; implementation of advanced manufacturing technology to ensure quality and lower production costs; expansion of usage in high-risk patient subgroups.

- Impact Forces: Competitive rivalry (High); Threat of Substitutes (Moderate, as FDCs are preferred); Buyer Bargaining Power (High, driven by generics and reimbursement bodies); Regulatory Intensity (Very High); Technology Advancement (High, particularly in QC/QA).

Segmentation Analysis

The Valsartan Hydrochlorothiazide Preparation market is comprehensively segmented based on Dosage Strength, Application Type, and Distribution Channel, reflecting the diverse clinical needs and commercial pathways globally. The segmentation provides crucial insights into prescriber preference and patient accessibility, helping market participants tailor their manufacturing and marketing strategies effectively. Dosage strength segmentation, which includes various ratios of Valsartan (e.g., 80 mg, 160 mg, 320 mg) combined with Hydrochlorothiazide (e.g., 12.5 mg, 25 mg), is vital because treatment guidelines recommend titration based on blood pressure response and patient tolerability. The most common medium-strength dosage combinations typically hold the largest volume share, serving the broad population with standard Stage 2 hypertension.

Application analysis clearly demonstrates that the treatment of essential (primary) hypertension dominates the market, constituting the vast majority of prescriptions globally, often initiated when monotherapy fails to achieve target blood pressure goals. A smaller, but significant, segment involves treating severe or resistant hypertension, often requiring higher dosage strengths or specific combination ratios. Understanding this application split is critical for pharmaceutical companies focusing their clinical research and marketing materials to align with the accepted therapeutic algorithms used by cardiologists and primary care physicians internationally. The stability of these clinical indications ensures consistent demand, regardless of generic fluctuations.

Distribution channel segmentation differentiates between hospital pharmacies, which handle the initial diagnosis and inpatient prescriptions, and retail pharmacies (including mail-order services), which manage the long-term, chronic refill market. Retail pharmacies, encompassing both traditional brick-and-mortar stores and increasingly prevalent online drug distributors, account for the largest proportion of VHC sales due to the chronic nature of hypertension management. The rising trend of mail-order and specialized pharmaceutical services, particularly in North America and Western Europe, highlights the growing importance of efficient logistics and cold chain management for high-volume chronic medications, presenting new avenues for maximizing market reach.

- By Dosage Strength:

- Valsartan 80 mg / HCTZ 12.5 mg

- Valsartan 160 mg / HCTZ 12.5 mg

- Valsartan 160 mg / HCTZ 25 mg

- Valsartan 320 mg / HCTZ 12.5 mg

- Valsartan 320 mg / HCTZ 25 mg

- By Application:

- Essential Hypertension (Primary Indication)

- Severe or Resistant Hypertension

- Adjunctive Therapy for Cardiac Conditions (e.g., post-MI)

- By Distribution Channel:

- Retail Pharmacies

- Hospital Pharmacies

- Mail-Order Pharmacies and E-Commerce

Value Chain Analysis For Valsartan Hydrochlorothiazide Preparation Market

The value chain for the Valsartan Hydrochlorothiazide Preparation market is complex and highly scrutinized, starting with sophisticated pharmaceutical research and development, moving through specialized API production, precise formulation, and highly regulated global distribution. Upstream analysis focuses intensely on the synthesis of the two primary Active Pharmaceutical Ingredients: Valsartan and Hydrochlorothiazide. Given the public health crisis stemming from nitrosamine contamination, the sourcing and synthesis of the Valsartan component have become the most critical and high-cost activity. Companies investing in vertical integration or maintaining robust, transparent relationships with certified, high-quality third-party API manufacturers (primarily in India and China) gain a significant competitive advantage regarding regulatory compliance and supply security.

Midstream activities involve the formulation and manufacturing process, where the two APIs are combined into fixed-dose oral tablets. This stage requires precision engineering to ensure uniform drug dissolution and bioequivalence, especially critical for generic manufacturers seeking regulatory approval. The stability testing, packaging, and serialization processes are also integral components of the midstream value chain, directly impacting product shelf-life and preventing counterfeiting. Efficiency gains at this stage, achieved through continuous manufacturing techniques and automated quality control, are essential for maintaining profitability in a high-volume, low-margin generic environment.

Downstream activities center on distribution channels, segmented into direct and indirect routes. Direct distribution involves sales to large hospital systems or national procurement agencies, often through structured tender processes. Indirect channels, which form the bulk of the market, involve wholesalers and distributors who move the product to retail pharmacies, private clinics, and mail-order providers. The market relies heavily on optimized cold chain logistics and inventory management, ensuring the product reaches the end consumer reliably. The influence of pharmacy benefit managers (PBMs) and national reimbursement bodies in setting pricing and preferred formulary lists exerts significant control over the downstream revenue flow, particularly in highly regulated markets like the US and Western Europe.

Valsartan Hydrochlorothiazide Preparation Market Potential Customers

The primary customers for Valsartan Hydrochlorothiazide preparations are the millions of patients diagnosed with hypertension who require chronic, effective blood pressure control, especially those who have not responded sufficiently to monotherapy. However, from a pharmaceutical sales perspective, the immediate customer groups—the decision-makers and purchasers—are multi-layered, including healthcare providers, institutional buyers, and large managed care organizations. The initial prescription gatekeepers are essential customers, predominantly cardiologists and general practitioners (GPs) or primary care physicians. These professionals make the critical decision on initiation, dosage, and whether to prescribe a branded product or a generic equivalent, heavily relying on clinical guidelines and drug formulary coverage established by institutional customers.

Institutional customers represent high-volume buyers and include governmental health systems (e.g., NHS in the UK, centralized procurement in China), large private hospital networks, and integrated delivery systems. These entities prioritize cost-effectiveness, supply security, and demonstrated quality, often leveraging large purchase volumes to negotiate favorable pricing, particularly for generic versions. The economic buyers, such as Pharmacy Benefit Managers (PBMs) and insurance companies in the US, wield immense power, defining the preferred drug lists (formularies) that dictate which VHC product patients and pharmacies are incentivized to utilize, making them crucial targets for market access strategies.

The final layer of potential customers includes wholesale distributors and retail pharmacy chains, which serve as the physical interface for dispensing the medication. These customers prioritize efficient inventory turnover, reliable supply from the manufacturer, and competitive wholesale pricing that allows for reasonable margins. Manufacturers must maintain robust relationships across this entire ecosystem, recognizing that while the patient is the ultimate beneficiary, the successful distribution and adoption of VHC preparations hinge upon securing formulary acceptance and professional endorsement from clinical, procurement, and dispensing stakeholders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.5 Billion |

| Market Forecast in 2033 | $7.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novartis AG, Teva Pharmaceutical Industries Ltd., Mylan N.V. (Viatris), Zydus Cadila, Sandoz (Novartis Group), Lupin Limited, Sun Pharmaceutical Industries Ltd., Torrent Pharmaceuticals Ltd., Aurobindo Pharma, Dr. Reddy's Laboratories, Cipla Limited, Hetero Drugs, Alkem Laboratories, Fresenius Kabi, Hikma Pharmaceuticals PLC, Bristol-Myers Squibb Company, Merck & Co., Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Valsartan Hydrochlorothiazide Preparation Market Key Technology Landscape

The technological landscape surrounding the Valsartan Hydrochlorothiazide preparation market is less focused on discovering entirely new compounds and more on optimizing existing formulation methods, ensuring superior bioavailability, and, critically, implementing advanced analytical technology for quality assurance and control. Given the history of regulatory issues associated with API impurities, particularly N-nitrosamines, sophisticated analytical chemistry techniques have become paramount. High-performance liquid chromatography tandem mass spectrometry (HPLC-MS/MS) and Gas Chromatography-Mass Spectrometry (GC-MS) are standard technologies utilized extensively to detect and quantify trace levels of genotoxic impurities, forming the technological backbone of modern VHC production compliance.

Beyond analytical technology, formulation science plays a crucial role in maintaining product quality and therapeutic efficacy, especially across generic versions. Technologies such as controlled release or sustained-release mechanisms are continuously being explored, though the immediate-release nature of VHC remains dominant due to established clinical profiles. Advanced co-processing and tablet compression technologies ensure high content uniformity between the two disparate APIs—Valsartan, which is poorly soluble, and HCTZ, which is highly soluble—a vital factor for achieving bioequivalence and consistent therapeutic action. Manufacturers invest heavily in optimizing dry granulation or roller compaction techniques to improve flowability and prevent drug degradation during the tableting process.

Furthermore, digital transformation technologies, including the deployment of Industry 4.0 principles, are being integrated into manufacturing facilities. This involves implementing continuous manufacturing systems and real-time process monitoring (Process Analytical Technology or PAT) using sensors and integrated data analytics. PAT allows manufacturers to monitor critical quality attributes (CQAs) of the blend and tablets continuously, reducing batch variability, enhancing efficiency, and drastically decreasing the likelihood of costly batch failures or recalls. This technological investment, though significant, offers a substantial competitive advantage by guaranteeing regulatory adherence, speeding up time-to-market for generics, and lowering long-term production costs in this price-competitive sector.

Regional Highlights

- North America: North America, particularly the United States, holds the largest revenue share in the Valsartan Hydrochlorothiazide market, driven by high prescription rates, established reimbursement systems, and aggressive marketing by branded pharmaceutical companies prior to patent expiration. The region benefits from high healthcare expenditure and a pervasive hypertension burden. However, the market is characterized by intense price competition due to the rapid uptake of high-quality generic equivalents, heavily influenced by Pharmacy Benefit Managers (PBMs) and their formulary decisions, which prioritize cost efficiency while maintaining quality standards.

- Europe: Europe represents a mature market with steady demand, primarily governed by stringent regulatory standards (EMA) and national health services (NHS, etc.). Market access is often determined by tender systems and health technology assessment (HTA) bodies focusing on cost-effectiveness. Germany, France, and the UK are key contributors. While generic penetration is exceptionally high, the focus on patient safety and quality control, especially post-contamination incidents, mandates robust investment in supply chain integrity and analytical testing, maintaining a qualitative competitive edge among regional manufacturers.

- Asia Pacific (APAC): APAC is anticipated to exhibit the fastest Compound Annual Growth Rate (CAGR) during the forecast period. This growth is attributable to massive, largely untreated hypertensive populations in countries like China and India, coupled with improving healthcare infrastructure, rising disposable incomes, and government initiatives promoting access to essential medicines. Market strategies in APAC focus heavily on affordability and volume sales, often involving local partnerships to navigate diverse regulatory landscapes and optimize distribution in vast, rural areas, making the region a critical future growth engine.

- Latin America (LATAM): LATAM presents a growing but volatile market. Demand is strong due to rising urbanization and Westernized lifestyles leading to higher hypertension prevalence. However, economic instability, fluctuating currency values, and varying levels of healthcare reimbursement pose challenges. Brazil and Mexico are the most significant markets, with procurement often influenced by public sector tenders seeking cost-effective generic solutions for chronic disease management programs.

- Middle East and Africa (MEA): The MEA region is characterized by heterogeneous market development. Countries in the Gulf Cooperation Council (GCC) show high purchasing power and adopt branded and high-quality generic products rapidly, often following European or US regulatory guidelines. In contrast, most African nations face significant challenges related to drug affordability, distribution complexity, and infrastructural deficits, though increasing international health aid focuses on making essential FDC antihypertensives more widely available.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Valsartan Hydrochlorothiazide Preparation Market.- Novartis AG

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V. (now Viatris Inc.)

- Sandoz (Novartis Group)

- Lupin Limited

- Sun Pharmaceutical Industries Ltd.

- Zydus Cadila

- Torrent Pharmaceuticals Ltd.

- Aurobindo Pharma

- Dr. Reddy's Laboratories

- Cipla Limited

- Hetero Drugs

- Alkem Laboratories

- Fresenius Kabi

- Hikma Pharmaceuticals PLC

- Pfizer Inc.

- Bayer AG

- Sanofi S.A.

- Daiichi Sankyo Company, Limited

- Apotex Inc.

Frequently Asked Questions

Analyze common user questions about the Valsartan Hydrochlorothiazide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Valsartan Hydrochlorothiazide Market?

The market is projected to grow at a CAGR of 4.8% between 2026 and 2033. This moderate growth is sustained by the high global prevalence of hypertension, counterbalancing the intense pricing pressure exerted by generic drug competition following major patent expirations.

What are the primary factors driving the demand for Valsartan Hydrochlorothiazide fixed-dose combinations?

The key drivers include the rising global incidence of essential hypertension, particularly in aging populations, and the established clinical benefit of fixed-dose combination therapies in significantly improving patient adherence to long-term medication regimens compared to multiple pills.

How has generic competition impacted the market structure of Valsartan Hydrochlorothiazide preparations?

Generic competition has drastically reduced the average selling price (ASP) across most geographic regions. While branded products (like Diovan HCT) maintain a small, high-value segment, generic manufacturers now dominate the market volume, necessitating cost efficiency and robust quality control from all market players.

What role does advanced technology play in addressing regulatory concerns regarding Valsartan API safety?

Advanced analytical technologies, specifically High-Performance Liquid Chromatography Mass Spectrometry (HPLC-MS/MS), are critical for real-time detection and quantification of trace genotoxic impurities, such as N-nitrosamines, ensuring strict compliance with stringent global regulatory standards set by agencies like the FDA and EMA.

Which geographic region is expected to experience the highest market growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest growth due to the immense, largely untapped patient population, improving healthcare infrastructure, and favorable government initiatives aimed at controlling chronic non-communicable diseases, thereby increasing access to affordable combination therapies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager