Value-Added Resellers (VARs) software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437100 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Value-Added Resellers (VARs) software Market Size

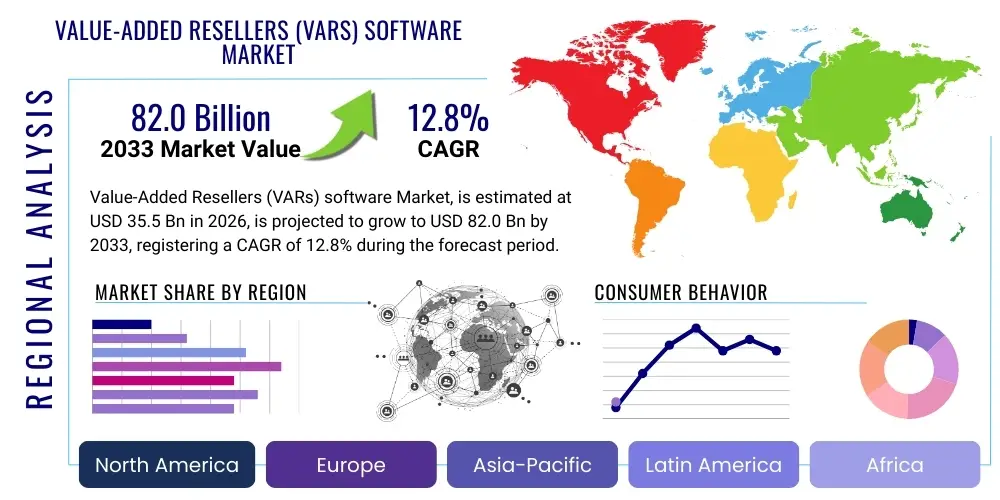

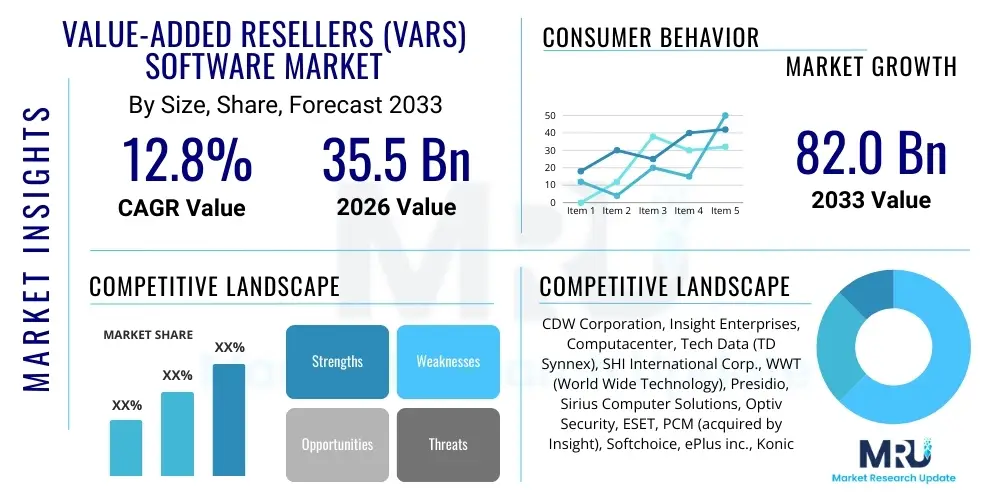

The Value-Added Resellers (VARs) software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 82.0 Billion by the end of the forecast period in 2033.

Value-Added Resellers (VARs) software Market introduction

The Value-Added Resellers (VARs) software market encompasses the ecosystem of third-party organizations that purchase software licenses or subscriptions from primary vendors and then resell them to end-users after adding customized services, integration, training, and ongoing support. This sector is crucial for software publishers as VARs bridge the gap between complex enterprise technologies and the specific operational needs of small and medium-sized enterprises (SMEs) and specialized vertical markets. VARs often develop proprietary customizations or vertical applications built atop core vendor platforms, substantially increasing the utility and relevance of the original software package. The market growth is fundamentally tied to the increasing complexity of enterprise IT environments, the rapid adoption of cloud computing platforms, and the demand for highly specialized industry-specific solutions that require expert implementation.

The primary products within this market include enterprise resource planning (ERP) systems, customer relationship management (CRM) platforms, cybersecurity suites, cloud infrastructure management tools, and specialized industry software (e.g., healthcare informatics, financial trading systems). Major applications span digital transformation initiatives, operational efficiency improvements, regulatory compliance, and enhanced customer engagement across virtually all economic sectors. VARs act as trusted consultants, guiding clients through selection, deployment, and optimization phases. Key benefits derived from utilizing VAR services include reduced deployment risk, highly tailored solutions that fit precise business processes, and access to specialized technical expertise that end-users often lack internally. The ability of VARs to provide localized support and context-specific knowledge further drives their market relevance.

Driving factors propelling the expansion of the VARs software market include the sustained shift towards subscription-based cloud delivery models (SaaS), which necessitates continuous integration and managed services provided by VARs. Furthermore, the increasing prominence of complex multi-cloud and hybrid IT architectures requires deep integration skills, positioning VARs as essential partners for successful enterprise transitions. Regulatory changes, particularly concerning data privacy and security, also fuel demand for VARs specializing in compliance software and managed security services. The ongoing need for businesses to leverage data analytics and business intelligence tools, which require significant customization and integration into existing systems, continues to solidify the VAR channel's pivotal role in modern software distribution and service delivery.

Value-Added Resellers (VARs) software Market Executive Summary

The Value-Added Resellers (VARs) software market is experiencing robust global expansion, driven predominantly by shifting business models towards cloud-centric, recurring revenue streams and a heightened focus on specialized vertical solutions. Current business trends indicate a consolidation among larger VARs seeking broader geographical reach and deeper technical specialization, often through strategic mergers and acquisitions, particularly in high-growth areas like cybersecurity, artificial intelligence integration, and industry-specific ERP customization. The transition from transactional license sales to long-term managed service provider (MSP) contracts is reshaping the competitive landscape, emphasizing service quality, proactive maintenance, and specialized consulting rather than volume sales. This pivot ensures more predictable revenue for VARs and better lifetime value for software vendors, promoting market stability and sustained investment in emerging technologies.

Regional trends highlight North America and Europe maintaining dominance due to high IT spending and the early adoption of complex enterprise software solutions, particularly within the financial services and manufacturing sectors. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid digital transformation across emerging economies, increasing government investment in digital infrastructure, and the expansion of global software vendors into local markets. In APAC, VARs are crucial for localizing global solutions and navigating diverse regulatory environments. Segment trends indicate that the Software as a Service (SaaS) delivery model remains the largest and fastest-growing segment, significantly outpacing on-premise solutions. Within application segmentation, advanced analytics and integrated security solutions are exhibiting superior growth rates as businesses prioritize data-driven decision-making and robust defense against sophisticated cyber threats, positioning VARs specializing in these domains for premium market capture.

AI Impact Analysis on Value-Added Resellers (VARs) software Market

User inquiries regarding AI's influence on the VARs software market frequently center on three main themes: the potential displacement of traditional VAR consulting roles by automated tools, the opportunities for VARs to develop new AI-driven service lines, and the necessity for VARs to integrate AI capabilities into existing enterprise software deployments (e.g., integrating predictive maintenance into ERP systems or conversational AI into CRM). Users are concerned about the investment required to upskill their workforce in AI engineering and data science, balancing the adoption of vendor-supplied AI features with the need for unique, value-added customization. The consensus expectation is that while routine integration tasks may become automated, VARs specializing in strategic consultation, complex data migration, ethical AI implementation, and industry-specific AI application development will see significant demand growth, transforming the VAR model from a simple system integrator to a strategic digital transformation partner focused on intelligence layer deployment.

- AI enables VARs to automate routine software deployment, configuration, and maintenance tasks, improving operational efficiency and lowering service delivery costs.

- The development of new specialized services centered around AI integration, machine learning model training, and ethical AI governance creates high-margin revenue streams for specialized VARs.

- AI-powered tools enhance customer support and predictive maintenance capabilities, allowing VARs to transition clients from reactive support contracts to proactive Managed Services Provider (MSP) models.

- VARs are now responsible for integrating vendor-provided AI features (like embedded analytics or automated workflows) into client-specific data environments, requiring advanced data management and security expertise.

- The shift requires significant upskilling of VAR personnel in areas such as data science, prompt engineering, and the deployment of Large Language Models (LLMs) to maintain competitive relevance.

DRO & Impact Forces Of Value-Added Resellers (VARs) software Market

The Value-Added Resellers (VARs) software market is fundamentally shaped by the intersection of rapid technological advancements and evolving customer expectations regarding customized service delivery. Key drivers include the pervasive shift to cloud infrastructure and the increasing need for system interoperability across disparate enterprise environments, making specialized VAR integration expertise indispensable. Conversely, major restraints involve the persistent challenge of talent acquisition and retention within the VAR channel, particularly for highly specialized skills like advanced cybersecurity and AI integration, coupled with the rising complexity of maintaining certifications across numerous vendor platforms. Significant opportunities arise from vertical market specialization, enabling VARs to develop unique intellectual property (IP) built on vendor platforms, offering differentiated solutions that command premium pricing. The overarching impact forces—including digitization trends, regulatory pressures demanding data security and privacy compliance, and fierce competition from direct vendor channels—require VARs to continuously refine their service offerings, invest heavily in training, and foster strong, collaborative relationships with software publishers to sustain long-term growth and market relevance in an accelerating technology landscape.

Segmentation Analysis

The VARs software market is broadly segmented based on deployment type, solution component, organization size, and end-use industry, reflecting the diverse ways VARs deliver value across the IT ecosystem. The segmentation by deployment type, encompassing on-premise, cloud, and hybrid models, remains critical, although the cloud segment dominates due to its scalability and flexibility, driving demand for VARs skilled in complex cloud migration and optimization. Segmentation by solution component differentiates VARs offering foundational hardware and software resell from those providing specialized consulting, integration services, or proprietary managed services. The increasing complexity of software systems necessitates sophisticated integration and maintenance contracts, which significantly boost the Service component's market share relative to the Software/Hardware component.

Further analysis by organization size reveals that Small and Medium Enterprises (SMEs) are the most dependent segment on VARs, lacking the internal IT resources to manage sophisticated systems, making VARs essential for their digital transformation. Conversely, Large Enterprises utilize VARs primarily for highly specialized project work or niche integrations that fall outside their core IT competencies. The segmentation by end-use industry, such as Banking, Financial Services, and Insurance (BFSI), Healthcare, and Manufacturing, highlights the strategic importance of industry-specific VAR expertise. For instance, healthcare VARs must possess deep knowledge of regulatory standards like HIPAA, allowing them to tailor general-purpose software into compliant and functional specialized systems, thus demonstrating the core value proposition of the VAR model: turning generic technology into vertical-specific solutions.

- Deployment Type:

- Cloud (SaaS)

- On-Premise

- Hybrid

- Component:

- Software/Hardware Resale

- Consulting Services

- Managed Services (MSP)

- Integration and Customization

- Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- End-Use Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Manufacturing and Automotive

- Retail and E-commerce

- IT and Telecommunications

- Government and Public Sector

Value Chain Analysis For Value-Added Resellers (VARs) software Market

The value chain for the VARs software market is complex, beginning with upstream software publishers and hardware manufacturers who create the foundational technology. These original equipment manufacturers (OEMs) and independent software vendors (ISVs) establish tiered partner programs, certification requirements, and pricing structures that govern VAR operations. The upstream segment is characterized by intense research and development investment to ensure product competitiveness, often dictating the technological focus and specialization required downstream. Successful management of the upstream relationship is critical for VARs, as access to preferential pricing, technical support, and early product roadmaps directly influences the VAR's ability to offer compelling, cutting-edge solutions to end-users. The quality and stability of the core software dictates the ease of integration and the volume of support services required later in the chain.

The core of the value chain is the VAR itself, acting as the intermediary layer responsible for acquiring, customizing, deploying, and supporting the solution. This middle layer significantly enhances value through specialized consulting, integration across multiple vendor platforms, data migration services, and developing proprietary applications or scripts tailored to client workflows. Distribution channels are predominantly indirect, relying on the VAR channel to penetrate specialized and geographically dispersed markets that vendors cannot efficiently reach through direct sales forces. While direct sales from vendors exist, the vast majority of solutions requiring high levels of customization and managed support pass through VARs. Downstream activities involve the delivery of the finalized, integrated solution to the end-user, followed by ongoing support, training, maintenance, and regular upgrades, often under a Managed Services Provider (MSP) agreement, which secures a recurring revenue stream for the VAR and ensures long-term customer retention.

The structure of the distribution channel is defined by the type of relationship between the vendor and the reseller—ranging from simple fulfillment partners to highly integrated strategic alliances. Direct channels are generally reserved for high-volume, standardized SaaS products or engagements with the largest global accounts. In contrast, the indirect channel, which dominates the VAR space, relies on a structured network where VARs invest heavily in training and certification specific to vendor products (e.g., Microsoft Certified Partner, Oracle Gold Partner). This investment validates their expertise, allowing them to secure better pricing tiers and expanded service scopes. The effectiveness of the value chain is measured by the VAR's ability to minimize friction during deployment and maximize the return on investment (ROI) for the end-user, demonstrating a successful translation of raw technology into tangible business value.

Value-Added Resellers (VARs) software Market Potential Customers

The primary potential customers and end-users of VARs software services span a broad array of organizational sizes and industry verticals, all sharing a common need for specialized expertise to implement complex digital solutions. Small and Medium Enterprises (SMEs) represent a crucial customer base, as they often lack the budgetary capacity or internal human resources to hire dedicated IT staff capable of managing enterprise-level software like advanced ERP, robust CRM systems, or comprehensive cybersecurity frameworks. For SMEs, VARs serve as outsourced IT strategists and implementation specialists, providing end-to-end guidance from initial system selection through training and post-deployment managed services, effectively democratizing access to sophisticated technology historically reserved for large corporations.

Beyond SMEs, large enterprises in highly regulated or technologically niche sectors also represent significant buyers. Organizations in banking and finance, healthcare, and complex manufacturing frequently purchase software through VARs who possess the requisite compliance knowledge and system integration skills necessary to operate within strict regulatory mandates. These large corporate customers engage VARs for highly specific projects, such as integrating legacy on-premise systems with new cloud platforms (hybrid deployments) or developing proprietary middleware to connect disparate vendor applications. Therefore, the target buyer profile is diverse, ranging from the small local business seeking basic IT infrastructure setup and maintenance to the global conglomerate requiring bespoke, industry-compliant, multi-platform integration solutions, underscoring the VAR's role as a scalable, specialized service provider.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 82.0 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CDW Corporation, Insight Enterprises, Computacenter, Tech Data (TD Synnex), SHI International Corp., WWT (World Wide Technology), Presidio, Sirius Computer Solutions, Optiv Security, ESET, PCM (acquired by Insight), Softchoice, ePlus inc., Konica Minolta Business Solutions, Zones, Bechtle AG, Logicalis, All Covered (Konica Minolta), Netrix, Atos SE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Value-Added Resellers (VARs) software Market Key Technology Landscape

The technological landscape defining the VARs software market is rapidly evolving, primarily centered around sophisticated cloud computing architectures and the services necessary to manage these environments effectively. The dominance of hyperscale cloud providers (AWS, Azure, GCP) mandates that successful VARs possess deep expertise in multi-cloud deployment, workload optimization, and infrastructure-as-code (IaC) principles. This technological shift has transitioned VAR business models from purely transactional software sales to recurring revenue generated from managed cloud services, demanding proficiency in tools for automation, continuous integration/continuous deployment (CI/CD), and advanced cost management within public cloud environments. Furthermore, the proliferation of data and the subsequent need for sophisticated security solutions have pushed cybersecurity technology—including Security Information and Event Management (SIEM), Extended Detection and Response (XDR), and zero-trust architectures—to the forefront of VAR offerings, often bundled into comprehensive Managed Security Service Provider (MSSP) packages.

The increasing emphasis on application modernization and proprietary software development within the VAR channel also defines the current technology landscape. Many advanced VARs are leveraging low-code/no-code platforms and API management tools to expedite the creation of vertical-specific applications built on top of core vendor products like Salesforce or Microsoft Dynamics. This allows them to create unique Intellectual Property (IP), enhancing differentiation and increasing client stickiness. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities is becoming standard, not only for internal VAR operations (e.g., predictive support) but also as a customer-facing service, where VARs deploy and tune ML models for clients seeking competitive advantages through data analytics and automation. The strategic alignment with technologies that enable hyper-automation and intelligent workflows is crucial for VARs seeking to capture high-value contracts in the forecast period.

The reliance on interconnected systems necessitates a technological focus on robust integration platforms and data governance tools. VARs are increasingly specializing in middleware solutions and data virtualization technologies that allow seamless communication between disparate systems—whether cloud-native or legacy on-premise—ensuring data integrity and flow across the client's entire IT infrastructure. This technological competency in complex system integration is arguably the most valuable service VARs provide, differentiating them from pure software vendors. The entire technology stack, therefore, rests on cloud infrastructure, fortified cybersecurity, intelligent automation tools, and highly sophisticated integration technologies, all requiring constant investment in technical training and certification to maintain expertise and serve the dynamic demands of the end-user market.

Regional Highlights

The global VARs software market exhibits distinct regional dynamics driven by varying levels of digital maturity, IT investment scales, and local regulatory requirements. North America holds the largest market share, characterized by high adoption rates of cutting-edge enterprise technologies, a mature cloud computing ecosystem, and substantial demand from key verticals such as finance, tech, and aerospace. The regional market is highly competitive, dominated by large, sophisticated VARs (many of whom have transitioned into national MSPs) specializing in complex security and multi-cloud transformation projects. Europe follows as the second-largest market, with strong growth fueled by stringent data privacy regulations (like GDPR) driving demand for security and compliance-focused VARs. Western European countries demonstrate high technological sophistication, while Eastern Europe presents significant opportunities for market penetration as businesses accelerate their modernization efforts.

The Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This acceleration is attributed to rapidly expanding economies in countries like India, China, and Southeast Asian nations, coupled with increasing investments in digital infrastructure and government initiatives supporting SME digitization. APAC VARs are essential for overcoming language barriers and localizing complex global software solutions. Latin America and the Middle East & Africa (MEA) represent emerging markets where VAR growth is closely tied to commodity price stability and foreign direct investment into critical sectors like telecommunications, energy, and government services. VARs in MEA often focus on foundational IT infrastructure, security, and specialized ERP implementations tailored to regional fiscal regulations, highlighting the importance of localized market knowledge for effective distribution.

- North America: Market leader, strong MSP model penetration, high demand for cybersecurity and multi-cloud governance solutions, led by the US and Canada.

- Europe: Mature market, growth driven by GDPR compliance services and public sector digitization, significant activity in Germany, the UK, and the Nordics.

- Asia Pacific (APAC): Fastest growing region, fueled by SME digitization and cloud adoption in China, India, and Australia, high reliance on VARs for localization.

- Latin America (LATAM): Emerging market focused on financial technology and regional ERP customization, high growth potential due to increasing internet penetration.

- Middle East and Africa (MEA): Growth centered around oil and gas sectors, government IT modernization projects, and foundational security infrastructure requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Value-Added Resellers (VARs) software Market.- CDW Corporation

- Insight Enterprises

- Computacenter

- Tech Data (TD Synnex)

- SHI International Corp.

- WWT (World Wide Technology)

- Presidio

- Sirius Computer Solutions

- Optiv Security

- ESET

- PCM (acquired by Insight)

- Softchoice

- ePlus inc.

- Konica Minolta Business Solutions

- Zones

- Bechtle AG

- Logicalis

- All Covered (Konica Minolta)

- Netrix

- Atos SE

- Datto (Kaseya)

- Crayon Group

- Softcat plc

- Accenture (IT Consulting Division)

- DXC Technology

Frequently Asked Questions

Analyze common user questions about the Value-Added Resellers (VARs) software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of a Value-Added Reseller (VAR) in the software supply chain?

A VAR acquires software or hardware from primary vendors and enhances it with specialized services, including integration, customization, consulting, training, and ongoing support, transforming the generic product into a tailored, deployable solution for the end-user market.

How is the growth of Managed Services Providers (MSPs) impacting the traditional VAR business model?

The traditional transactional VAR model is rapidly evolving into the MSP model, where VARs focus on recurring service contracts for proactive maintenance, cloud management, and continuous security monitoring. This shift provides VARs with more predictable revenue and fosters deeper, long-term client relationships.

Which technology segment drives the highest growth rate for VARs?

The Managed Security Services (MSS) and multi-cloud integration services segments exhibit the highest growth. The increasing complexity of cyber threats and the widespread enterprise migration to hybrid and multi-cloud architectures necessitates specialized VAR expertise in security provisioning and cloud orchestration.

What are the main challenges faced by Value-Added Resellers today?

The principal challenges include managing talent scarcity for highly technical areas like AI and advanced cybersecurity, mitigating channel conflict with direct vendor sales teams, and continuously adapting to rapid technological obsolescence and complex vendor certification requirements.

Why are SMEs highly dependent on Value-Added Resellers for software adoption?

SMEs rely heavily on VARs because they typically lack the internal IT expertise and budget necessary to successfully select, implement, and maintain complex enterprise software platforms, making the VAR an essential outsourced provider of both technology and strategic IT consultation.

What role does industry specialization play in VAR market success?

Industry specialization allows VARs to command premium pricing by developing deep vertical expertise and proprietary IP (Intellectual Property) tailored to sector-specific compliance, workflow, and operational needs, such as healthcare informatics or specialized financial trading systems.

How does the shift to SaaS affect VAR revenue models?

The shift to Software as a Service (SaaS) reduces initial high transactional revenues from perpetual license sales. However, it significantly increases recurring revenues derived from subscription management, continuous integration support, optimization services, and ongoing professional consultation.

Which geographical region is showing the fastest adoption of VAR services?

The Asia Pacific (APAC) region is demonstrating the fastest CAGR due to widespread digital transformation initiatives, rapid cloud adoption across emerging economies, and the essential role VARs play in localizing global software platforms for diverse markets.

What is a key difference between a VAR and a typical distributor?

A distributor primarily handles logistics and bulk fulfillment of software/hardware with minimal intervention. A VAR, in contrast, adds substantive technical value, integrating systems, customizing code, and providing strategic consulting to create a complete, ready-to-use solution.

How do VARs utilize AI to enhance their service offerings?

VARs use AI to automate routine deployment and support tasks, enhance predictive maintenance for client systems, and offer strategic AI consulting services, helping clients integrate machine learning and intelligent automation into their core business processes.

What is the significance of the Hybrid Deployment segment for VARs?

Hybrid deployments—combining on-premise infrastructure with multiple cloud services—are complex and require specialized integration expertise. This complexity elevates the value proposition of VARs who can skillfully bridge legacy systems with modern cloud environments while ensuring security and compliance.

What drives the competitive environment among leading VARs?

Competition among major VARs is driven by geographic expansion, the breadth and depth of technical certifications across critical vendor platforms (e.g., Microsoft, Cisco, AWS), and the ability to bundle proprietary Managed Services offerings that ensure recurring revenue and client loyalty.

How important are vendor certifications to a VAR's market credibility?

Vendor certifications are critical as they validate a VAR's technical competency, granting them preferred access to advanced product roadmaps, better procurement pricing, and co-selling opportunities, which are essential for winning large, complex enterprise contracts.

Which end-use industry is the most sensitive to regulatory compliance requirements provided by VARs?

The Healthcare and Financial Services (BFSI) industries are the most sensitive, requiring VARs to possess deep regulatory knowledge (HIPAA, GDPR, financial trading rules) to ensure all software installations and data handling practices meet strict legal compliance standards.

In the value chain, what constitutes the upstream segment for VARs?

The upstream segment includes the original software publishers (ISVs) and hardware manufacturers (OEMs) who design, develop, and own the core technology that VARs subsequently purchase, customize, and resell to the end-user market.

What kind of customization services do VARs typically offer for ERP systems?

VARs typically offer extensive customization for ERP systems, including tailoring specific workflows, developing industry-specific modules, integrating the ERP with third-party applications (like warehouse management systems), and ensuring local regulatory reporting compliance.

How is digital transformation fueling the demand for VAR services?

Digital transformation necessitates the integration of numerous new technologies (cloud, AI, IoT) and the modernization of legacy systems. VARs provide the crucial expertise and implementation capacity required for businesses to execute these complex, long-term strategic transformation projects successfully.

What strategic advantage does developing Intellectual Property (IP) give a VAR?

Developing proprietary IP, such as industry-specific software extensions built on vendor platforms, grants the VAR product differentiation, higher profit margins compared to pure resale, and enhanced client lock-in, insulating them somewhat from direct competition.

What is the impact of supply chain volatility on VARs specializing in hardware resale?

Supply chain volatility, particularly for hardware components (servers, networking equipment), forces VARs to diversify suppliers, manage longer lead times, and leverage specialized procurement services, potentially increasing project timelines and cost structures for their clients.

How are VARs adapting to the rise of open-source software solutions?

VARs are adapting by specializing in the integration, maintenance, and security hardening of open-source solutions. They provide the necessary support structure and assurance that commercial enterprises require when deploying typically unsupported open-source technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager