Value Stream Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437319 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Value Stream Management Software Market Size

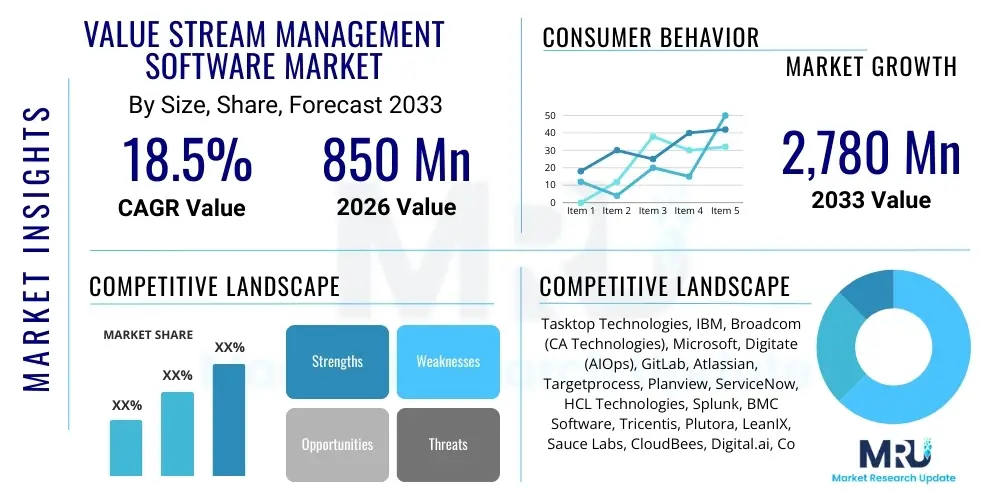

The Value Stream Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $850 million in 2026 and is projected to reach $2,780 million by the end of the forecast period in 2033.

Value Stream Management Software Market introduction

Value Stream Management (VSM) software represents a critical evolutionary step in agile and DevOps methodologies, focusing on optimizing the flow of value from initial concept or idea through to delivery to the end customer. This software provides a holistic, end-to-end view of the entire software delivery pipeline, encompassing diverse activities such as planning, development, testing, deployment, and feedback loops. By visualizing and analyzing these complex workflows—often spanning numerous disparate tools and teams—VSM platforms help organizations identify bottlenecks, measure lead time, and eliminate waste, thereby enhancing efficiency and accelerating time-to-market. The primary goal of implementing VSM tools is to shift organizational focus from mere activity tracking to quantifiable value delivery, ensuring that technology investments directly align with strategic business outcomes.

The market growth is primarily driven by the escalating complexity of modern IT environments, characterized by multi-cloud strategies, microservices architecture, and high demand for rapid feature releases. As enterprises embrace digital transformation initiatives, the limitations of traditional project management tools become evident, necessitating a solution that provides cross-functional visibility and governance over the entire value chain. VSM software integrates previously siloed tools—such as JIRA, ServiceNow, GitHub, Jenkins, and proprietary systems—into a unified data model, enabling real-time analytics and predictive insights into delivery performance. Major applications span across large enterprises in sectors like BFSI, telecommunications, and high-tech, where efficient software delivery is a primary source of competitive advantage. The ability of VSM platforms to provide actionable metrics, such as cycle time and throughput, facilitates continuous improvement and drives superior operational performance.

The core benefits derived from VSM software adoption include significantly improved software quality, reduction in operational costs associated with rework and manual integration, and accelerated response to market demands. Furthermore, VSM aids in establishing standardized governance and compliance mechanisms across diverse development portfolios, which is essential for regulated industries. Driving factors include the pervasive adoption of DevOps practices globally, the imperative for enhanced collaboration between business stakeholders and IT departments (BizDevOps), and the increasing need for measurable return on investment (ROI) from enterprise software development expenditures. The technological maturity of AI and machine learning integration within VSM platforms further amplifies their capability to offer prescriptive recommendations for process optimization, cementing their role as foundational elements of modern software delivery pipelines.

Value Stream Management Software Market Executive Summary

The Value Stream Management Software Market is experiencing robust expansion driven by the global imperative for digital resilience and accelerated application delivery. Current business trends indicate a significant shift towards integrated VSM platforms that offer deep analytics and predictive capabilities, moving beyond basic visualization tools. Enterprises are increasingly prioritizing platforms that can natively integrate artificial intelligence (AI) and machine learning (ML) for intelligent bottleneck identification and automated process remediation. A primary trend involves the consolidation of niche VSM vendors into larger platform providers, aiming to offer comprehensive DevSecOps capabilities integrated within the VSM layer. Cloud-based deployment models are dominating the market landscape, reflecting the widespread adoption of SaaS delivery for enterprise software, offering scalability and reduced infrastructural overhead, which appeals particularly to Small and Medium-sized Enterprises (SMEs) seeking rapid implementation and lower total cost of ownership (TCO).

Regionally, North America maintains its leadership position, attributed to the high concentration of technological innovators, early adoption of advanced DevOps practices, and substantial investment in digital transformation initiatives across major industries, especially the high-tech and financial sectors. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid growth is fueled by expanding IT infrastructure, government initiatives promoting digitalization in countries like India and China, and the burgeoning demand for optimized software delivery processes among the region’s massive manufacturing and telecommunications entities. European markets are also showing strong uptake, driven primarily by stringent regulatory requirements (e.g., GDPR) necessitating traceable and compliant software development processes, making the governance and auditability features of VSM platforms highly attractive.

Segmentation trends highlight the increasing demand for 'Services'—including consulting, implementation, and managed services—as organizations require expertise to map complex value streams and integrate VSM tools effectively into existing disparate ecosystems. Furthermore, the 'Large Enterprises' segment remains the largest revenue generator due to the scale and complexity of their software portfolios, making waste reduction and efficiency gains crucial. Within the vertical segmentation, the Banking, Financial Services, and Insurance (BFSI) sector is a key growth engine, as these institutions rely heavily on rapid, secure, and compliant software updates to compete in the fintech landscape. The technological segment is leaning heavily towards AI-infused analytics, moving VSM from a reactive monitoring tool to a proactive optimization engine that recommends resource allocation and pipeline improvements based on historical performance data and real-time flow metrics.

AI Impact Analysis on Value Stream Management Software Market

Common user questions regarding AI's influence on Value Stream Management Software (VSMS) center on how artificial intelligence can move VSM platforms beyond passive monitoring and into predictive optimization. Users are frequently asking: "How accurately can AI predict bottlenecks before they impact delivery?", "Can machine learning automate the identification and prioritization of waste within complex value streams?", and "What is the role of AIOps in enhancing VSM metrics and governance?" Users are concerned about the integration complexity and the trustworthiness of AI-generated insights, particularly regarding compliance and resource allocation decisions. The overarching expectation is that AI integration will fundamentally transform VSM from a descriptive tool (showing what happened) into a prescriptive engine (recommending what should happen), driving true continuous improvement and eliminating the need for manual analysis of delivery data across dozens of tools. The key themes revolve around intelligent automation, predictive performance modeling, and enhanced risk management.

- AI facilitates predictive bottleneck identification by analyzing historical delivery data and flagging potential choke points in real-time, significantly improving flow efficiency.

- Machine Learning algorithms enable intelligent prioritization of work items, automatically adjusting the sequencing of tasks based on business value and dependency risk.

- AIOps integrates seamlessly with VSM, automating root cause analysis during incidents and providing intelligent correlation across performance, infrastructure, and application monitoring data.

- AI-driven flow metrics offer more accurate and dynamic calculations of cycle time, lead time, and process predictability than traditional statistical methods.

- Generative AI capabilities are beginning to assist in automated documentation generation and intelligent suggestion of process mapping improvements.

- Enhanced anomaly detection using deep learning helps in proactively identifying security or compliance deviations within the CI/CD pipeline, reinforcing DevSecOps integration.

DRO & Impact Forces Of Value Stream Management Software Market

The Value Stream Management Software market dynamic is shaped by powerful driving forces rooted in organizational digital transformation needs, coupled with strategic restraints related to integration complexity and data silo fragmentation, while offering significant opportunities through technological convergence. Key drivers include the pervasive adoption of DevOps and Agile frameworks, which demand superior visibility into cross-team dependencies and delivery cadence. Organizations are increasingly mandated to demonstrate the business value of IT investments, making the measurable metrics provided by VSM indispensable. Restraints predominantly involve the challenge of integrating VSM platforms with highly heterogeneous, legacy toolchains prevalent in large enterprises, requiring significant upfront effort and specialized consulting services. Furthermore, cultural resistance to transparency and change management hurdles often slow down widespread VSM adoption across functional silos. Opportunities are vast, particularly in leveraging VSM data for advanced prescriptive analytics and extending VSM capabilities beyond software delivery into non-IT business processes, such as marketing value streams or supply chain optimization.

The primary driver accelerating market growth is the need for speed and quality in software delivery. In competitive sectors like e-commerce and finance, time-to-market for new features directly impacts revenue generation, making optimization a survival necessity. VSM directly addresses this by exposing wait times and non-value-add activities, enabling systematic waste elimination. Regulatory compliance pressure is another significant driver; VSM provides the necessary audit trails and governance frameworks to ensure all development artifacts and releases adhere to strict industry standards (e.g., SOX, HIPAA). The growing popularity of microservices and containerization, while enhancing deployment flexibility, also increases overall system complexity, creating an urgent demand for VSM solutions that can visualize and govern the interactions between hundreds of independent services.

Conversely, one major restraint involves data governance and security concerns associated with centralizing sensitive performance metrics across various business units. Organizations must trust the VSM platform to handle highly proprietary performance data securely. The high initial capital expenditure (CapEx) and the steep learning curve associated with properly configuring and operationalizing VSM tools can deter SMEs. However, the market impact forces overwhelmingly favor expansion. The move towards subscription-based cloud deployment models mitigates the cost restraint, making VSM accessible to a wider audience. The increasing standardization of API interfaces and open-source integration frameworks is gradually lowering the barrier to integrating complex legacy environments. Consequently, the high impact forces related to digital transformation imperatives and the maturation of VSM technology are expected to maintain the market’s high growth trajectory throughout the forecast period, transitioning VSM from a niche technology to a fundamental requirement for modern software enterprises.

Segmentation Analysis

The Value Stream Management Software Market is extensively segmented based on Component, Deployment Type, Organization Size, and Industry Vertical, reflecting the diverse needs of enterprises undergoing digital transformation. The Component segment, split into Platform and Services, reveals a growing dependency on expert services for successful VSM implementation, integration mapping, and cultural adoption. The Services segment is characterized by high growth, often outpacing platform sales, as organizations require specialized consulting to standardize processes and extract actionable intelligence from the complex flow data. Deployment Type segmentation highlights the dominant trend towards Cloud-based (SaaS) solutions, favored for their rapid scalability and operational efficiency, although On-premise options remain critical for highly regulated or security-sensitive sectors like government and specialized finance.

- Component:

- Platform (Software)

- Services (Consulting, Integration, Training, Managed Services)

- Deployment Type:

- Cloud (SaaS)

- On-premise

- Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- Industry Vertical:

- IT and Telecommunication

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare and Life Sciences

- Retail and E-commerce

- Manufacturing

- Government and Public Sector

- Others (Media, Energy, Utilities)

Value Chain Analysis For Value Stream Management Software Market

The Value Chain of the VSM Software Market begins with the upstream activities centered on core technology development and intellectual property creation. This involves sophisticated R&D for advanced analytics, AI/ML integration, and the development of robust integration frameworks (APIs/connectors) necessary to interface with hundreds of disparate DevOps and IT tools. Upstream providers are specialized in deep data correlation technologies and flow metric visualization engines. Key strategic relationships are formed with major technology providers (e.g., hyperscalers like AWS, Azure, Google Cloud) to optimize platform deployment and scalability. The competitive advantage at this stage hinges on the breadth and depth of native integrations and the sophistication of predictive algorithms designed to identify non-value-add activities automatically.

The midstream section focuses on product delivery, licensing, and implementation services. Distribution channels are predominantly indirect, relying heavily on specialized System Integrators (SIs), Value-Added Resellers (VARs), and Managed Service Providers (MSPs). These partners are crucial for translating complex VSM capabilities into tangible organizational change within the customer environment, especially concerning cultural adoption and process re-engineering required for effective VSM implementation. Direct sales channels are typically reserved for engaging large, strategic enterprise accounts requiring highly customized solutions and direct support from the VSM vendor.

Downstream activities center on customer engagement, support, and continuous enhancement. Post-sale, the focus shifts to ensuring high adoption rates, maximizing the measurable ROI for the client, and providing continuous training on evolving DevOps practices. The feedback loop from downstream users (DevOps engineers, release managers, business product owners) is vital for informing upstream R&D priorities, ensuring the VSM platforms evolve with the rapid changes in software development technologies (e.g., serverless, edge computing). The overall value chain is highly integrated, where the success of the software depends heavily on the quality of the services provided by the channel partners in configuring the platform to accurately reflect the client's unique business value streams, ensuring data integrity and actionable insights.

Value Stream Management Software Market Potential Customers

The primary consumers and end-users of Value Stream Management Software are large and medium-sized enterprises that rely critically on software delivery for competitive differentiation and operational efficiency. The key buyers are typically executives driving digital transformation (e.g., Chief Digital Officers, CIOs), along with senior leadership in IT and product development, such as VPs of Engineering, Directors of DevOps, and Release Managers. These stakeholders require comprehensive tools to manage and govern complex, distributed software development processes across multiple teams and geographical locations. Potential customers are organizations that have already adopted some level of Agile or DevOps maturity but are struggling with bottlenecks caused by toolchain fragmentation, lack of cross-functional visibility, or difficulties in accurately measuring the ROI of their development efforts.

Specific end-user groups include regulated industries, particularly BFSI and Healthcare, where the need for stringent auditability, compliance tracking, and risk management during rapid deployment cycles is paramount. Within the BFSI sector, the rapid launch of new financial products and maintaining secure transaction systems necessitates precise control over the value stream. Similarly, in the Manufacturing sector, VSM is increasingly used to optimize the development and deployment of embedded software and IoT systems critical for smart factory operations. Furthermore, modern technology companies and SaaS providers, whose core business is software, represent the most advanced user base, seeking VSM for micro-optimizations and achieving true hyper-automation in their delivery pipelines. The common denominator among potential customers is the scale and complexity of their software portfolio, where even marginal gains in efficiency translate into millions in cost savings or enhanced revenue.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 million |

| Market Forecast in 2033 | $2,780 million |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tasktop Technologies, IBM, Broadcom (CA Technologies), Microsoft, Digitate (AIOps), GitLab, Atlassian, Targetprocess, Planview, ServiceNow, HCL Technologies, Splunk, BMC Software, Tricentis, Plutora, LeanIX, Sauce Labs, CloudBees, Digital.ai, ConnectALL |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Value Stream Management Software Market Key Technology Landscape

The technological landscape of the Value Stream Management Software market is rapidly evolving, driven by the need for platforms that can handle massive volumes of data generated by modern CI/CD pipelines and complex toolchains. Core VSM technology relies heavily on robust data integration fabrics, often utilizing event-driven architectures and standardized APIs (like OpenValueStream) to pull data in real-time from disparate sources such as project management tools, source control repositories, testing platforms, and monitoring systems. This integration capability is foundational, allowing the platform to build a unified, accurate data model of the entire value flow. Advanced visualization techniques, including sophisticated flow mapping interfaces and dynamic dashboarding, are essential for translating raw data into actionable insights for both technical teams and business stakeholders.

The current innovation focus is centered on leveraging Artificial Intelligence (AI) and Machine Learning (ML). These capabilities are integrated to perform crucial functions such as automated identification of process anomalies, predictive analysis of future delivery timelines, and prescriptive recommendations for resource reallocation or process changes to optimize flow efficiency. Technologies like Natural Language Processing (NLP) are also emerging to help categorize and correlate unstructured data from communication channels (like Slack or emails) back into the value stream context. Furthermore, the adoption of cloud-native architectures—utilizing microservices and Kubernetes—is critical for VSM platforms themselves, ensuring they can scale horizontally to handle the enormous data throughput generated by large enterprise clients, particularly those embracing hyper-agile development cycles.

Security and governance are paramount technological components. Modern VSM solutions are incorporating advanced DevSecOps principles, ensuring security gates and compliance checks are built directly into the value stream mapping, providing a verifiable and auditable record of all activities. Distributed ledger technology (blockchain) is being explored by some providers to enhance the immutability and trustworthiness of audit trails, particularly in highly regulated banking and defense sectors. Overall, the technology trajectory is moving VSM platforms from simple tool integrators to sophisticated analytical engines that utilize data science techniques to automatically guide organizational improvements and ensure continuous alignment between technology output and defined business outcomes.

Regional Highlights

- North America: North America is the dominant market leader, driven by significant early adoption of DevOps, the presence of major technology hubs (Silicon Valley, Seattle, Boston), and high IT spending across industries like tech, BFSI, and media. The region benefits from a highly mature vendor ecosystem, intense digital transformation initiatives, and a culture that rapidly embraces advanced analytical software. The US market, in particular, dictates global trends in VSM adoption and innovation, particularly in the integration of AI/ML for advanced prescriptive analytics and complex portfolio management.

- Europe: Europe represents a highly mature market segment, characterized by robust growth in Western European countries (Germany, UK, France). The demand here is strongly influenced by regulatory compliance requirements (GDPR, stringent financial reporting) that mandate transparent, auditable software delivery processes. VSM adoption is particularly strong in the automotive manufacturing sector and within large, established financial institutions looking to modernize legacy systems while maintaining high governance standards.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid digitalization across China, India, and Southeast Asia. Massive investments in cloud infrastructure, burgeoning fintech ecosystems, and government pushes for smart city technologies are fueling VSM demand. While adoption started later than in the West, the sheer volume of software development activity and the need to scale agile practices quickly positions APAC as the primary growth engine for VSM software in the latter half of the forecast period.

- Latin America (LATAM): The LATAM VSM market is characterized by moderate but steady growth, led primarily by Brazil and Mexico. Adoption is concentrated in large multinational corporations and growing domestic banking and retail sectors seeking to optimize costs and improve delivery efficiency in competitive regional markets. The preference leans towards cost-effective, cloud-based VSM solutions.

- Middle East and Africa (MEA): Growth in MEA is driven by large-scale government-backed digital initiatives and infrastructure projects, particularly in the UAE and Saudi Arabia. The financial services and energy sectors are key adopters, utilizing VSM to manage large, complex IT portfolios and accelerate core digital services crucial for economic diversification efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Value Stream Management Software Market.- Tasktop Technologies (now part of Planview)

- IBM

- Broadcom (CA Technologies)

- Microsoft

- Digitate (AIOps)

- GitLab

- Atlassian

- Targetprocess

- Planview

- ServiceNow

- HCL Technologies

- Splunk

- BMC Software

- Tricentis

- Plutora

- LeanIX

- Sauce Labs

- CloudBees

- Digital.ai

- ConnectALL

Frequently Asked Questions

Analyze common user questions about the Value Stream Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between VSM software and traditional Project Management tools?

VSM software differs fundamentally by focusing on optimizing the flow of value across the entire, end-to-end delivery pipeline, connecting disparate tools and teams (DevOps metrics). Traditional project management focuses primarily on managing tasks, deadlines, and resources within a single project scope. VSM prioritizes flow metrics (lead time, cycle time) over activity metrics.

How does Value Stream Management benefit organizational efficiency and business alignment?

VSM significantly boosts efficiency by identifying and eliminating non-value-add activities, wait states, and bottlenecks across the software delivery process, leading to accelerated time-to-market. It ensures business alignment by linking development outcomes (features delivered) directly to measurable strategic business objectives (ROI, revenue generation).

Which industry vertical is projected to drive the highest growth in VSM software adoption?

The Banking, Financial Services, and Insurance (BFSI) sector is projected to drive substantial growth. BFSI institutions require VSM to manage complex regulatory compliance, ensure auditability, and rapidly deploy secure digital services necessary to compete against agile fintech companies.

What role does Artificial Intelligence play in modern VSM platforms?

AI plays a crucial role by moving VSM from descriptive monitoring to prescriptive optimization. AI algorithms analyze flow data to predict future bottlenecks, automate root cause analysis, and provide intelligent, data-driven recommendations for improving resource allocation and accelerating delivery cadence, often integrating with AIOps capabilities.

Is the Value Stream Management Software Market dominated by Cloud or On-premise deployment?

The market is increasingly dominated by Cloud (SaaS) deployment models. Cloud-based VSM platforms offer superior scalability, lower initial implementation costs, faster deployment cycles, and easier integration with multi-cloud and distributed DevOps environments, making them the preferred choice across all organization sizes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager