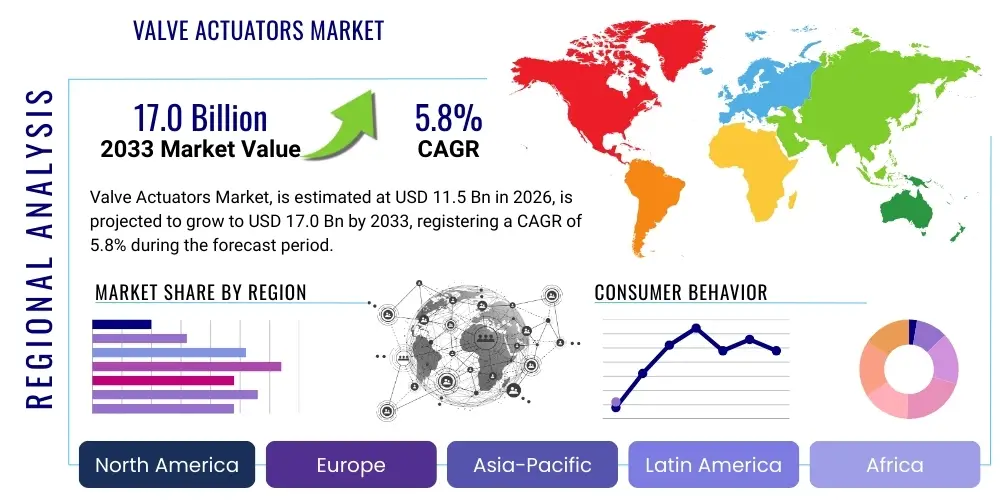

Valve Actuators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439089 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Valve Actuators Market Size

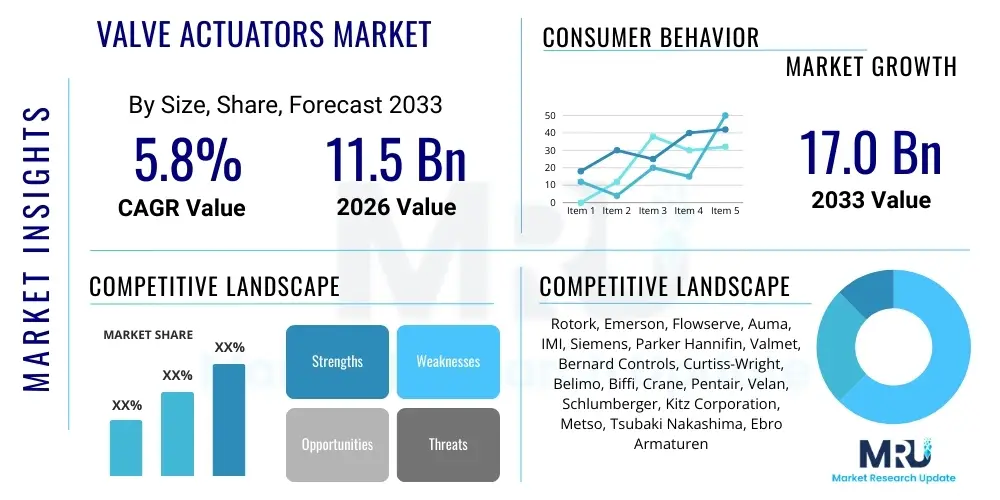

The Valve Actuators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 17.0 billion by the end of the forecast period in 2033.

Valve Actuators Market introduction

Valve actuators are sophisticated mechanical devices that enable the automated, precise, and remote control of valves in industrial processes. They translate a control signal (electrical, pneumatic, or hydraulic) into mechanical motion to open, close, or modulate fluid flow within pipelines and systems. The fundamental product description encompasses a range of technologies, including electric (multi-turn, quarter-turn, linear), pneumatic (piston, diaphragm), and hydraulic systems, all designed to enhance operational efficiency, safety, and regulatory compliance in critical infrastructure.

Major applications for valve actuators span essential industries such as oil and gas (upstream, midstream, and downstream operations), water and wastewater treatment, power generation (thermal, nuclear, and renewable energy plants), chemicals, and pharmaceuticals. These devices are critical components in process automation, ensuring reliable fluid handling and preventing catastrophic failures. They offer significant benefits over manual operations, including faster response times, highly accurate positioning, reduced labor costs, and improved safety standards, especially in hazardous environments.

The primary driving factors propelling the Valve Actuators Market include the rapid global expansion of industrial infrastructure, stringent safety and environmental regulations demanding precise flow control, and the accelerating trend towards digitalization and Industrial Internet of Things (IIoT) implementation in process industries. The need for energy efficiency and reduced operational downtime further mandates the adoption of advanced, smart actuation systems capable of real-time diagnostics and predictive maintenance.

Valve Actuators Market Executive Summary

The Valve Actuators Market is characterized by robust growth driven by capital expenditure cycles across vital infrastructure sectors globally, particularly in Asia Pacific’s expanding manufacturing and utilities sectors. Business trends show a distinct shift toward electric and smart actuators, which offer superior control fidelity, easier integration into centralized control systems (DCS/SCADA), and lower overall maintenance requirements compared to traditional hydraulic or pneumatic systems. Furthermore, market competition is intensifying around developing intelligent field devices that incorporate advanced diagnostics, condition monitoring, and cybersecurity features, reflecting a commitment to operational excellence and minimizing unplanned outages across high-pressure, high-temperature applications.

Regionally, the Asia Pacific (APAC) market leads in terms of market size and growth trajectory, fueled by large-scale investments in new power generation facilities, urban water infrastructure projects, and significant refinery expansions, particularly in China and India. North America and Europe, while being mature markets, maintain high revenue shares due to the stringent regulatory framework in the oil, gas, and chemical sectors, necessitating frequent upgrades to comply with safety and emission standards, driving demand for high-reliability, sophisticated actuators. Emerging markets in Latin America and MEA are focusing on modernizing their existing oil and gas infrastructure, creating specific opportunities for retrofitting and heavy-duty actuators.

Segment trends highlight the dominance of electric actuators due to their energy efficiency and integration capabilities, overshadowing pneumatic systems in new builds where power availability is not a constraint. In terms of end-use, the water and wastewater treatment segment is exhibiting the fastest growth, primarily driven by global urbanization and increased governmental spending on utility infrastructure modernization. Quarter-turn actuators, favored in petrochemical and refining for ball and butterfly valves, maintain a high market share due to their widespread use and simplicity in operation, although multi-turn actuators remain crucial for gate and globe valve applications demanding linear movement and high thrust.

AI Impact Analysis on Valve Actuators Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Valve Actuators Market consistently center on themes of predictive maintenance, optimization of control loops, and autonomous operation capabilities. Users are seeking to understand how AI algorithms can leverage the vast amount of operational data generated by smart actuators—such as torque levels, cycle times, vibration signatures, and temperature fluctuations—to forecast potential failures, schedule maintenance precisely, and drastically reduce unexpected downtime. Key concerns involve the integration complexity of AI platforms with existing legacy industrial control systems (ICS) and the ensuring of cybersecurity for cloud-connected actuation devices, while expectations focus on achieving unprecedented levels of reliability and energy efficiency through data-driven operational adjustments.

The primary influence of AI manifests through the enhancement of diagnostics and asset performance management (APM). By analyzing historical operational patterns and anomalies identified through machine learning models, AI moves actuator maintenance from calendar-based schedules to condition-based and predictive models. This shift dramatically extends the operational lifespan of actuators and reduces the total cost of ownership (TCO). Furthermore, AI is increasingly being applied to optimize PID (Proportional-Integral-Derivative) control parameters in real-time, allowing for finer modulation of flow rates, temperature, and pressure, leading to enhanced product quality and significant energy savings across complex process units.

Ultimately, AI is positioning valve actuators as true intelligent field devices, capable of learning their optimal operating characteristics and even making micro-adjustments autonomously. While full autonomy remains a nascent concept, the immediate impact lies in advanced anomaly detection and prescriptive recommendations provided to operators. This confluence of reliable hardware and intelligent software integration is crucial for industries pursuing Industry 4.0 objectives, ensuring that flow control systems operate not just reliably, but optimally, adapting dynamically to changing environmental or process conditions.

- AI-driven predictive maintenance forecasts component failure, maximizing actuator uptime.

- Machine learning optimizes valve position control, leading to improved process accuracy and reduced energy consumption.

- Enhanced diagnostics through pattern recognition identifies subtle operational anomalies often missed by human supervision.

- AI facilitates autonomous calibration and tuning of actuators, minimizing manual intervention.

- Integration of AI algorithms strengthens cybersecurity protocols by detecting unusual communication or operational patterns.

DRO & Impact Forces Of Valve Actuators Market

The Valve Actuators Market dynamics are shaped by potent drivers, restrictive elements, and significant opportunities, with these forces collectively impacting market growth trajectories. The central driver is the global infrastructure spending boom, particularly in developing economies, coupled with the mandatory automation drive in mature industries focused on safety and efficiency. However, the market faces restraints such as high initial capital investment costs associated with sophisticated smart actuators and the technical complexity involved in integrating these new systems with fragmented legacy industrial infrastructures. Opportunities primarily lie in the retrofitting of existing plants with advanced electric actuators and leveraging the rapidly expanding need for specialized, small-scale actuators in emerging sectors like hydrogen and carbon capture.

Key impact forces further influencing market evolution include increasing global energy demand, which spurs investments in power generation and oil and gas extraction, directly boosting actuator deployment. Conversely, volatile raw material prices, particularly for metals used in housing and gears, exert inflationary pressure on product manufacturing and potentially restrain mass adoption in price-sensitive segments. Moreover, rapid technological evolution, particularly the transition from purely mechanical to digital and network-enabled actuators, acts as a pivotal force, compelling manufacturers to continuously innovate and provide solutions that comply with industrial communication protocols like Foundation Fieldbus and Profibus.

The most significant impact force shaping the future is the commitment to environmental sustainability. Regulations pertaining to methane emission reduction in the oil and gas sector and the necessity for zero leakage in critical chemical processes mandate the use of high-integrity, highly reliable valve systems controlled by advanced actuators. This regulatory pressure accelerates the phase-out of older, less efficient pneumatic or hydraulic systems susceptible to fugitive emissions, favoring sealed, electric actuation technologies that offer superior positional accuracy and leak detection capabilities, thereby fundamentally altering product specifications and market demand.

Drivers:

- Escalating demand for process automation and remote operation capabilities across critical industries.

- Stringent governmental regulations concerning operational safety, emissions control, and environmental protection.

- Increasing capital expenditure in infrastructure development, including utilities, pipelines, and power plants, especially in APAC.

- Technological advancements leading to the development of smart, IIoT-enabled actuators with enhanced diagnostics.

Restraints:

- High initial procurement and installation costs associated with high-end, intelligent actuation systems.

- Complexity and challenges in retrofitting legacy infrastructure with modern, digital actuators.

- Vulnerability of networked smart actuators to sophisticated cybersecurity threats and data breaches.

Opportunities:

- Growing adoption of electric actuators in previously hydraulic or pneumatic dominant markets due to better energy efficiency.

- Expansion into niche and emerging energy sectors such as hydrogen infrastructure, renewable energy storage, and carbon capture (CCUS).

- Development of modular and standardized actuator platforms reducing inventory costs and speeding up deployment.

Segmentation Analysis

The Valve Actuators Market is intricately segmented based on Type, Operation, End-Use Industry, and Component, reflecting the diverse requirements of industrial process control. This detailed breakdown provides stakeholders with granular insights into specific market drivers and growth pockets. The segmentation by Type, specifically distinguishing between electric, pneumatic, and hydraulic technologies, reveals distinct competitive landscapes and technological maturity levels; for instance, electric actuators are rapidly gaining traction due to superior control features, while pneumatic systems maintain dominance in applications requiring high speed and resilience in hazardous areas where electrical sparking must be avoided.

Analysis by End-Use Industry is crucial, as the performance requirements for an actuator in a nuclear power plant differ significantly from those in a municipal water treatment facility. The Oil and Gas sector demands high torque, explosion-proof ratings (ATEX/IECEx), and absolute reliability, whereas the Water and Wastewater segment prioritizes cost-effectiveness, corrosion resistance, and simplified maintenance. Understanding these industry-specific needs allows manufacturers to tailor product development, focusing on certifications and material science appropriate for the operating environment.

Furthermore, segmentation by Operation (Quarter-turn, Multi-turn, Linear) highlights functional differentiators. Quarter-turn actuators, suitable for ball and butterfly valves, facilitate fast open/close action, ideal for on/off control. Multi-turn actuators, designed for gate and globe valves, offer precise, fine modulation, essential in throttling applications. The dynamics within these segments are driven by the proliferation of corresponding valve types in new infrastructural projects and the ongoing replacement cycle across various industrial installations.

- By Type: Electric, Pneumatic, Hydraulic, Manual.

- By Operation: Quarter-turn, Multi-turn, Linear.

- By Component: Motor, Housing, Sensing Devices, Power Transmission, Accessories.

- By End-Use Industry: Oil & Gas, Chemicals & Petrochemicals, Water & Wastewater Treatment, Power Generation, Metals & Mining, Pharmaceuticals, Others.

Value Chain Analysis For Valve Actuators Market

The value chain for the Valve Actuators Market is robust and spans from raw material procurement to final deployment and maintenance services. The upstream analysis involves the sourcing of specialized materials, including high-grade steel, alloys, and precision components for motors, gearing, and housing, often requiring strict adherence to metallurgical standards for resilience against corrosion, temperature extremes, and pressure. Key upstream players include specialized component manufacturers for integrated circuits, sensors, and electric motors, whose pricing and quality significantly impact the final product cost and performance, driving manufacturers towards vertical integration or long-term supply agreements to manage volatility and ensure quality control.

In the midstream segment, actuator manufacturing involves design, assembly, rigorous testing, and certification processes (e.g., SIL certification, explosion-proof ratings). Manufacturers utilize complex assembly processes, leveraging robotics and advanced quality assurance protocols to ensure high precision, which is critical for functional reliability. The distribution channel is bifurcated: Direct sales are common for highly customized or large-scale projects, particularly in the Oil & Gas and Nuclear Power sectors where direct technical consultation and project management are essential. Indirect distribution relies heavily on global and regional distributors, system integrators, and channel partners who provide localized inventory, installation, and essential after-sales support to a broad base of smaller industrial customers.

Downstream analysis focuses on installation, commissioning, maintenance, and long-term service agreements. The rise of smart actuators has led to an increased need for skilled service technicians capable of managing software configuration, data diagnostics, and cybersecurity updates, shifting the service focus from purely mechanical repair to integrated operational technology (OT) support. System integrators play a crucial role in the downstream segment, connecting the actuators to the customer's Distributed Control Systems (DCS) or Supervisory Control and Data Acquisition (SCADA) systems, ensuring seamless automation and centralized monitoring, thereby closing the loop on the value delivery proposition.

Valve Actuators Market Potential Customers

Potential customers, or end-users/buyers, of valve actuators are predominantly large industrial entities operating complex process systems where precise fluid control is paramount for safety, quality, and operational output. In the Oil & Gas sector, this includes national and international oil companies, pipeline operators, refinery owners, and petrochemical plants, all requiring actuators for critical isolation, regulation, and shutdown applications. These customers typically demand high-performance, resilient actuators certified for extreme environments and hazardous locations, often procuring based on long-term reliability metrics and vendor reputation rather than simple unit cost, making Total Cost of Ownership (TCO) a key decision factor.

The Water and Wastewater Treatment sector represents a growing customer base, including municipal utility districts, private water companies, and engineering, procurement, and construction (EPC) firms specializing in utility infrastructure. These customers seek cost-effective, corrosion-resistant actuators, often electric or pneumatic, for managing flow in pump stations, filtration units, and chemical dosing systems. The driving need in this sector is energy efficiency and the ease of remote operation across geographically dispersed facilities, favoring IIoT-enabled solutions for centralized monitoring and simplified fault detection, moving away from high-maintenance traditional systems.

Furthermore, key buyers exist in the Power Generation industry, encompassing thermal, nuclear, and renewable energy facility operators, who utilize actuators for boiler feed water control, steam regulation, and turbine bypass systems. Similarly, the Chemicals and Pharmaceuticals industries are critical consumers, requiring sterile, high-purity, and highly precise actuators for batch processes, clean-in-place (CIP) systems, and reactor control. These potential customers prioritize material integrity, regulatory compliance (e.g., FDA validation), and diagnostic capabilities to ensure product quality and adherence to strict manufacturing guidelines, often driving demand for specialty alloys and advanced sealing technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 billion |

| Market Forecast in 2033 | USD 17.0 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rotork, Emerson, Flowserve, Auma, IMI, Siemens, Parker Hannifin, Valmet, Bernard Controls, Curtiss-Wright, Belimo, Biffi, Crane, Pentair, Velan, Schlumberger, Kitz Corporation, Metso, Tsubaki Nakashima, Ebro Armaturen |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Valve Actuators Market Key Technology Landscape

The technology landscape for the Valve Actuators Market is rapidly transitioning, driven by the principles of Industry 4.0, emphasizing connectivity, intelligence, and predictive capabilities. The most pivotal technological shift involves the integration of advanced electronics and software into traditionally mechanical devices, transforming them into smart actuators. These devices utilize high-resolution encoders, advanced microprocessors, and integrated communication chips to manage complex control algorithms, perform continuous self-diagnostics, and communicate real-time status data (such as position, torque, vibration, and temperature) using industrial protocols like HART, PROFIBUS, and Modbus TCP/IP, ensuring seamless interoperability within modern plant control architectures.

A significant technological focus is placed on enhancing power efficiency and precision. Electric actuators are increasingly adopting brushless DC motors (BLDC) and variable speed drives (VSDs) to optimize energy consumption and deliver highly repeatable, precise positioning control, a feature critical for throttling and modulation applications. For harsh and safety-critical environments, advancements in fail-safe technology, including sophisticated spring-return mechanisms and redundant electronics, are crucial. Manufacturers are also heavily investing in non-intrusive setup and diagnostic features, allowing technicians to configure and troubleshoot actuators without opening the housing, thereby maintaining the integrity of environmental sealing and simplifying field service operations.

Furthermore, material science advancements play a vital role in actuator longevity and performance. The use of robust, corrosion-resistant coatings, specialized gearing materials (e.g., treated alloys and composite plastics for lightweight, low-friction operation), and high-integrity sealing technology (meeting stringent ISO standards) ensures reliability in challenging environments like deep-sea oil rigs or highly acidic chemical plants. The convergence of robust mechanics with sophisticated digital intelligence defines the competitive edge in the current market, making smart field instrumentation the baseline expectation for new capital projects.

Regional Highlights

Regional dynamics are critical to understanding the global Valve Actuators Market, reflecting varying levels of industrial maturity, regulatory standards, and investment cycles across geographies.

- Asia Pacific (APAC): This region dominates the global market both in terms of revenue growth and market volume. The growth is underpinned by substantial government investments in national infrastructure, including extensive expansion of power generation capacity (coal, gas, and renewables), large-scale water purification projects driven by urbanization, and significant capital expenditure in the establishment of new petrochemical complexes and oil refineries across China, India, and Southeast Asia. The demand here is highly diversified, requiring cost-effective, scalable, and robust actuation solutions for high-throughput processes.

- North America: Characterized by high technological maturity and stringent operational safety regulations, North America remains a crucial market. Demand is driven less by new infrastructure build-out and more by replacement, modernization, and regulatory compliance. The U.S. and Canada’s vast pipeline networks and sophisticated refining industries demand high-reliability, SIL-certified electric and hydraulic actuators for emergency shutdown (ESD) systems and high-pressure control. The increasing focus on natural gas extraction (shale) and renewables further fuels specialized actuator demand.

- Europe: The European market is defined by a strong emphasis on sustainability, energy efficiency, and adherence to complex environmental standards (e.g., REACH). This drives demand for highly efficient, smart electric actuators that minimize energy consumption and facilitate precise monitoring of emissions. Key sectors include advanced chemical manufacturing, pharmaceutical production, and significant investment in offshore wind energy and green hydrogen projects, requiring highly specialized, durable actuator components designed for demanding marine and potentially explosive environments.

- Middle East and Africa (MEA): Growth in MEA is inextricably linked to the region’s dominant oil and gas sector. Significant investments in exploration, production, and liquefaction terminals (LNG) drive strong demand for heavy-duty, high-torque actuators, primarily pneumatic and hydraulic systems, known for their reliability in extremely high-temperature and harsh desert conditions. Modernization efforts in Saudi Arabia and UAE are also creating opportunities for smart electric actuators capable of remote monitoring and diagnostics.

- Latin America (LATAM): Market growth is steady, influenced by infrastructure development in Brazil and Mexico. The primary demand centers around the water and sanitation sector modernization and the national oil and gas industries. Budget constraints often favor cost-competitive solutions, but there is an increasing adoption of modern electric actuators to improve operational efficiency and reduce maintenance costs in long-term projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Valve Actuators Market.- Rotork

- Emerson Electric Co.

- Flowserve Corporation

- Auma Riester GmbH & Co. KG

- IMI plc

- Siemens AG

- Parker Hannifin Corporation

- Valmet Oyj

- Bernard Controls

- Curtiss-Wright Corporation

- Belimo Holding AG

- Biffi (part of Emerson)

- Crane Co.

- Pentair plc

- Velan Inc.

- Schlumberger (Cameron)

- Kitz Corporation

- Metso Outotec

- Tsubaki Nakashima Co., Ltd.

- Ebro Armaturen

Frequently Asked Questions

Analyze common user questions about the Valve Actuators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of selecting electric actuators over pneumatic systems?

Electric actuators offer superior positional accuracy, higher energy efficiency, and better integration with digital control networks (IIoT and DCS). They require less ongoing maintenance than pneumatic systems, eliminate the need for compressed air infrastructure, and are essential for applications requiring highly precise modulation and data logging.

How does the implementation of IIoT affect the lifecycle management of valve actuators?

IIoT implementation transforms lifecycle management by enabling real-time remote diagnostics, condition monitoring, and predictive maintenance. This capability allows operators to forecast potential failures, schedule maintenance based on actual usage, and significantly extend the Mean Time Between Failures (MTBF), thereby reducing total operational costs.

Which end-use industry is expected to demonstrate the highest growth rate for valve actuators?

The Water and Wastewater Treatment industry is projected to exhibit the highest growth rate, primarily driven by rapid global urbanization, increasing regulatory focus on water quality, and substantial global investment in modernizing aging municipal infrastructure, necessitating automated flow control solutions.

What is SIL certification, and why is it important for critical actuator applications?

SIL (Safety Integrity Level) certification assesses the reliability and risk reduction capabilities of safety instrumented systems, including actuators used in emergency shutdown (ESD) applications. High SIL ratings (e.g., SIL 3) are crucial for critical processes in oil and gas and nuclear power, assuring the actuator will perform its safety function upon demand, minimizing catastrophic risk.

What role does cybersecurity play in the design of modern smart valve actuators?

Cybersecurity is a critical design requirement for smart actuators, which are interconnected through industrial networks. Manufacturers must incorporate secure communication protocols, robust authentication mechanisms, and firmware protection to prevent unauthorized access, manipulation, or cyber-attacks that could compromise process control and operational safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager