Valve Sealant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436776 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Valve Sealant Market Size

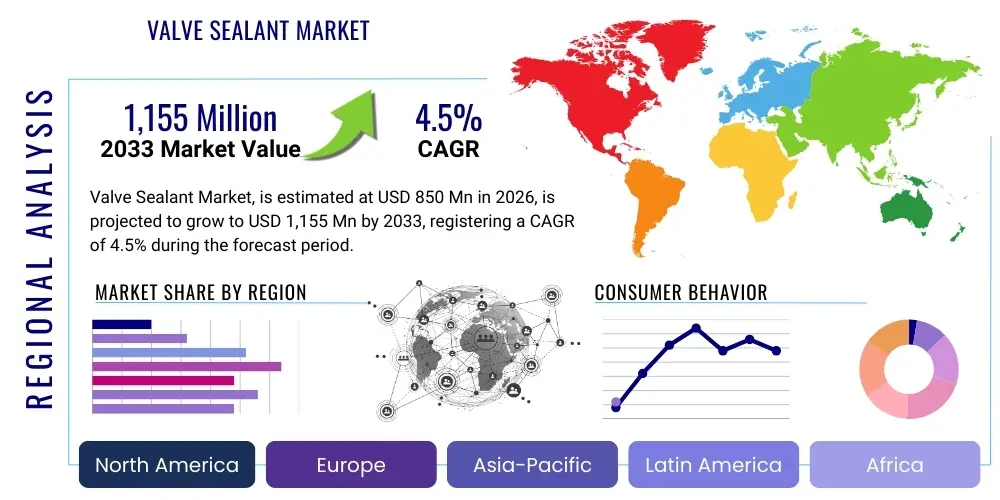

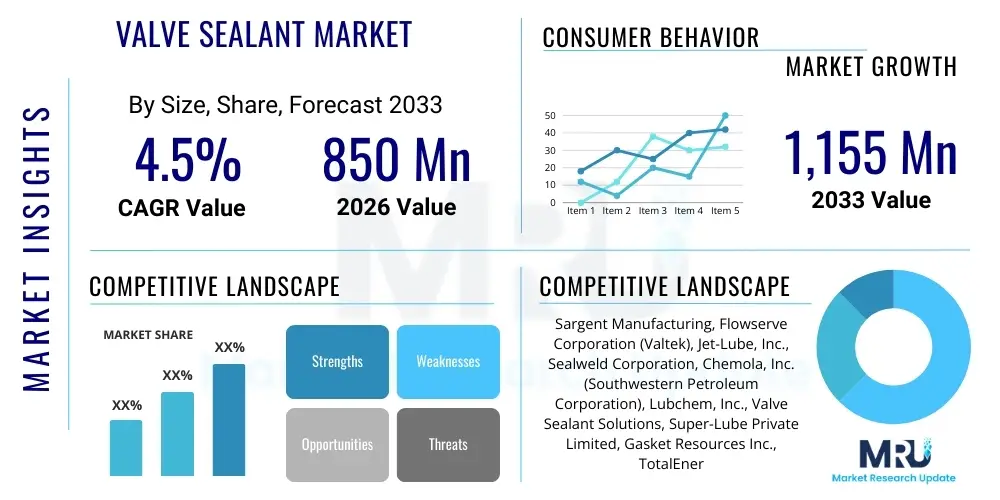

The Valve Sealant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,155 Million by the end of the forecast period in 2033.

Valve Sealant Market introduction

The Valve Sealant Market encompasses specialized chemical compounds designed to maintain the integrity and functionality of industrial valves, particularly in high-pressure and high-temperature environments. These sealants, often complex polymeric mixtures or specialized greases, are essential for preventing fluid or gas leakage across the sealing surfaces (seats and packing) of various valve types, including ball, gate, plug, and check valves. Their primary role is to ensure zero leakage, minimize friction during operation, and protect internal components from corrosion and wear caused by abrasive media or extreme thermal cycling. The reliability of critical infrastructure, such as long-distance pipelines, chemical processing plants, and power generation facilities, is heavily dependent on the efficacy of these sealing compounds, leading to stringent quality and performance standards within the industry.

Valve sealants are formulated using a diverse array of base materials, including synthetic oils, mineral oils, specialized thickeners (such as PTFE or inorganic fibers), and performance-enhancing additives. The selection of a sealant is highly application-specific, dictated by the media being handled (e.g., natural gas, crude oil, caustic chemicals, steam), the operational temperature range, and the pressure requirements of the system. High-performance sealants are specifically engineered to resist solvent wash-out, thermal degradation, and chemical attack, providing long-lasting sealing capabilities that extend the mean time between failures (MTBF) for expensive valve infrastructure. Key benefits derived from the consistent use of quality valve sealants include enhanced operational safety, reduction in fugitive emissions (crucial for environmental compliance), and significant cost savings achieved by minimizing product loss and deferring costly valve replacement or overhaul procedures.

The market growth is fundamentally driven by the continuous expansion of oil and gas pipeline networks, the increasing necessity for predictive and preventative maintenance strategies in aging industrial facilities, and rising global energy demand that fuels upstream and midstream activities. Furthermore, regulatory pressures focusing on minimizing greenhouse gas emissions and volatile organic compounds (VOCs) are compelling industries, particularly petrochemical and power generation sectors, to adopt superior sealing solutions. Developing regions, especially in Asia Pacific, are contributing significantly to demand owing to rapid industrialization and substantial investment in new infrastructure projects requiring robust and reliable valve components and maintenance consumables.

Valve Sealant Market Executive Summary

The global Valve Sealant Market is characterized by stable growth, primarily anchored by robust demand from the Oil and Gas sector, which utilizes sealants extensively for pipeline maintenance and refinery operations. A key business trend involves the industry's shift toward high-performance, synthetic, and biodegradable sealant formulations, driven by stringent environmental, safety, and operational efficiency standards. Manufacturers are investing heavily in R&D to develop products capable of handling extreme service conditions, such as ultra-high pressure deep-water applications and valves operating with sour gas (H2S), necessitating materials with superior chemical resistance and thermal stability. The competitive landscape remains moderately fragmented, with large specialty chemical companies dominating through established distribution channels and technical expertise, while smaller regional players focus on specialized niche applications.

Regionally, the Asia Pacific (APAC) area is emerging as the fastest-growing market, propelled by massive infrastructure development in countries like China and India, coupled with significant investments in new petrochemical complexes and liquefied natural gas (LNG) terminals. North America and Europe, while mature markets, maintain substantial market share due to extensive existing pipeline networks requiring continuous maintenance and the presence of advanced manufacturing and R&D capabilities. Demand within these mature regions is concentrated on highly certified products and solutions that facilitate carbon capture and storage (CCS) or meet rigorous EU environmental directives (REACH). Geopolitical stability and fluctuation in global commodity prices, particularly crude oil and natural gas, directly influence capital expenditure on pipeline projects, thereby affecting sealant consumption rates.

From a segmentation perspective, synthetic sealants are expected to exhibit higher growth compared to their hydrocarbon-based counterparts, primarily due to their superior temperature tolerance and longevity, making them cost-effective over the long term despite a higher initial price point. Application segmentation highlights the dominance of the midstream Oil and Gas segment, which requires massive volumes of sealant for routine maintenance of transmission pipelines. Furthermore, the rising need for operational uptime in critical industrial processes drives the adoption of advanced injection equipment and proprietary sealing methodologies, transforming the market from a simple consumable supply model to a comprehensive, technology-driven maintenance service offering.

AI Impact Analysis on Valve Sealant Market

User inquiries regarding AI's influence in the Valve Sealant Market predominantly center on how artificial intelligence can enhance predictive maintenance schedules, optimize material formulation, and revolutionize supply chain management for highly specialized chemical products. Users are keen to understand if AI can predict valve failure risks based on operational data (pressure, temperature, flow rates) more accurately than traditional methods, thereby optimizing the timing for sealant injection and extending asset life. Furthermore, there is significant interest in computational chemistry models powered by AI, which promise faster identification of novel high-performance polymer combinations required for extreme operating conditions (e.g., high-pressure hydrogen service or corrosive fluids), significantly reducing the R&D cycle time for new sealant formulations. The integration of AI into quality control and injection process monitoring is also a key concern, aimed at ensuring consistent application and preventing costly human errors.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data from pipelines and valves (e.g., vibration, acoustic emissions, temperature fluctuations) to predict the exact optimal time for sealant injection, thereby maximizing efficiency and minimizing downtime.

- Optimized Sealant Formulation: Employing AI and computational chemistry to simulate molecular interactions and performance under various conditions, accelerating the development of new, chemically resistant, and high-temperature sealant compounds.

- Supply Chain and Inventory Management: Using AI to forecast regional demand fluctuations for specific sealant types (e.g., gas vs. liquid service), optimizing inventory levels at distribution hubs, and reducing lead times, particularly for remote industrial sites.

- Automated Quality Control: Implementing AI-powered vision systems and data analytics during sealant manufacturing to ensure consistent batch quality, viscosity, and chemical composition, meeting stringent industry specifications.

- Robotics in Application: Integration of AI-controlled robotic systems for precise, automated injection of sealants into large, complex valve systems in hazardous or hard-to-reach industrial environments, enhancing worker safety and application accuracy.

DRO & Impact Forces Of Valve Sealant Market

The dynamics of the Valve Sealant Market are dictated by a complex interplay of Drivers, Restraints, and Opportunities (DRO) that collectively shape market direction and growth trajectory. Key drivers include significant global infrastructure investments in oil and gas midstream projects, where maintaining pipeline integrity against highly corrosive and high-pressure media is paramount, directly translating into steady demand for effective sealing solutions. Furthermore, the global regulatory environment, particularly mandates concerning fugitive emissions (such as EPA regulations and European Union directives), necessitates the adoption of superior, long-lasting sealants to minimize environmental impact and avoid punitive fines. The increasing age of global industrial assets, especially in mature economies, compels operational teams to utilize preventative maintenance products like valve sealants to extend the operational life of existing infrastructure rather than incurring the high costs associated with replacement. These factors establish a strong underlying demand foundation for specialized sealant products.

However, market growth faces considerable restraints, including the ongoing competitive threat posed by the development and adoption of advanced, zero-leakage valve technologies that are inherently sealant-free or require significantly less maintenance, such as high-performance bellows-sealed valves or sophisticated packing materials. The volatility of raw material prices, including specialized synthetic polymers and performance additives, poses a continuous challenge to manufacturers' cost structures and pricing stability. Moreover, strict environmental regulations governing the use and disposal of petrochemical-based sealants are increasingly pushing manufacturers towards expensive R&D into bio-based or biodegradable alternatives, adding compliance costs and potentially restricting the use of traditional, highly effective chemistries in specific regions.

Opportunities for market expansion are significant, primarily centered on technological advancements and emerging industrial applications. The growth in unconventional energy sources, such as shale gas and deep-sea drilling, requires sealants capable of withstanding unprecedented pressures and extremely high concentrations of corrosives (H2S, CO2), creating a high-value niche for specialized products. Furthermore, the global push towards hydrogen as a future energy carrier presents a substantial long-term opportunity, as hydrogen service requires exceptionally high integrity sealing due to the small molecular size and explosive nature of the gas. Developing cost-effective, environmentally friendly (bio-based or silicone-free), and high-durability sealant solutions that integrate seamlessly with digital monitoring and injection systems will be crucial for capitalizing on these future opportunities. The impact forces are generally weighted toward drivers, given the critical nature of leak prevention in global energy transmission and processing.

Segmentation Analysis

The Valve Sealant Market is rigorously segmented based on product type, application, and end-user industry to cater to the highly specialized demands of various industrial environments. Product types differentiate based on chemical composition and performance characteristics, ranging from traditional hydrocarbon-based compounds to advanced synthetic and specialty formulations. Application segmentation focuses on the specific type of valve and the operational conditions, recognizing that sealants for high-pressure gate valves in a sour gas environment differ drastically from those used in general utility ball valves. Understanding these segment dynamics is vital for manufacturers to tailor their R&D and marketing strategies, ensuring that performance specifications meet the stringent compliance and safety requirements of end-users across critical infrastructure sectors.

- By Type:

- Hydrocarbon-Based Sealants (Greases, Mastics)

- Synthetic Sealants (Silicone, PTFE, Ceramic-based, Fluoropolymer)

- Specialty/Biodegradable Sealants

- By Application (Valve Type):

- Gate Valves

- Plug Valves

- Ball Valves

- Check and Globe Valves

- By End-User Industry:

- Oil & Gas (Upstream, Midstream, Downstream/Refining)

- Chemical and Petrochemical

- Power Generation (Thermal, Nuclear)

- Water and Wastewater Treatment

- Mining and Minerals

- By Function:

- Lubricating Sealants

- Emergency Leak Sealing Compounds

- Non-Setting Packing Sealants

Value Chain Analysis For Valve Sealant Market

The value chain for the Valve Sealant Market begins with the highly specialized upstream procurement of raw materials, which primarily includes base fluids (synthetic oils, mineral oils), performance polymers (such as PTFE powders, specialized elastomers), thickeners (e.g., silica, clay, metallic soaps), and proprietary chemical additives (corrosion inhibitors, anti-wear agents). The cost and purity of these raw materials significantly impact the final product quality and manufacturing costs, leading to high dependence on a few specialized chemical suppliers. Manufacturing involves complex blending, heating, and quality control processes to ensure the sealant meets specific viscosity, temperature resistance, and pressure rating requirements. Manufacturers often invest heavily in in-house testing labs to validate performance against API and ISO standards before the product moves downstream.

The downstream component of the value chain is critical for reaching geographically dispersed and technically demanding end-users. Distribution channels are typically segmented into direct and indirect routes. Direct distribution involves large, strategic contracts with major international oil companies (IOCs) or national oil companies (NOCs) where manufacturers provide technical support, product training, and emergency service directly. Indirect distribution relies heavily on a network of specialized industrial distributors, maintenance, repair, and overhaul (MRO) suppliers, and certified service companies. These distributors hold essential local inventory and provide immediate technical consulting and application services, crucial for critical and emergency sealing operations in remote pipeline locations or operating refineries.

A key characteristic of this value chain is the emphasis on technical service and application expertise, which often differentiates competitors more than the product itself. The efficacy of a valve sealant depends heavily on correct diagnosis of the leakage issue and proper injection methodology. Therefore, training, technical support provided through specialized service teams, and the use of proprietary injection equipment become integral parts of the final offering. This emphasis pushes the value proposition beyond mere commodity sales toward a comprehensive maintenance solution, ensuring end-users receive not only the chemical compound but also the necessary expertise to maximize asset performance and regulatory compliance.

Valve Sealant Market Potential Customers

The primary consumers and end-users of valve sealants are large industrial entities responsible for the transmission, storage, and processing of fluids and gases under high-pressure conditions. The most significant customer base resides within the midstream Oil & Gas sector, encompassing major pipeline operators and transportation companies that utilize massive networks of gate and ball valves requiring continuous preventative maintenance and emergency leak sealing. These customers require high-volume, reliable sealants certified for natural gas and crude oil service, often under extreme temperature and pressure variations across vast geographical distances. Their procurement decisions are driven by total cost of ownership, product longevity, and adherence to strict regulatory safety standards, making them high-value, long-term clients for manufacturers.

Another crucial customer segment includes operators in the downstream petrochemical and refining industries. These facilities process corrosive and volatile chemicals, requiring sealants that exhibit exceptional chemical resistance against strong acids, solvents, and high temperatures associated with distillation and cracking units. Refineries demand specialized, non-setting sealant compounds that can maintain packing integrity in control valves and steam service applications. Procurement in this sector often involves approvals based on strict material safety data sheets (MSDS) and compatibility with existing plant safety protocols, prioritizing specialized synthetic and fluoropolymer-based products over generic hydrocarbon options.

Furthermore, major Engineering, Procurement, and Construction (EPC) firms, particularly those focused on building new energy and infrastructure projects (such as LNG terminals, power plants, and chemical manufacturing facilities), represent significant potential customers. While EPC firms purchase sealants for initial commissioning and testing, they also often dictate the preferred maintenance consumables specified in long-term operational agreements, thereby influencing purchasing patterns for years to come. Other growing customer segments include water and wastewater treatment plants, where sealants are needed for large isolation valves, and the power generation sector, particularly nuclear and thermal facilities requiring high-radiation-tolerant and high-temperature graphite or ceramic-based sealing solutions for critical steam valves.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,155 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sargent Manufacturing, Flowserve Corporation (Valtek), Jet-Lube, Inc., Sealweld Corporation, Chemola, Inc. (Southwestern Petroleum Corporation), Lubchem, Inc., Valve Sealant Solutions, Super-Lube Private Limited, Gasket Resources Inc., TotalEnergies SE, DuPont de Nemours, Inc., Klüber Lubrication (Freudenberg Group), Loctite (Henkel AG), Chesterton International, Molykote (Dow Chemical). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Valve Sealant Market Key Technology Landscape

The technological landscape in the Valve Sealant Market is driven by the necessity for formulations that can withstand increasingly demanding industrial conditions, particularly concerning temperature extremes, chemical corrosion, and operational pressures (up to 20,000 psi in some deep-water applications). A significant focus area involves the development of hybrid sealant technologies that combine the lubrication properties of high-quality greases with the structural integrity provided by fibrous or polymeric additives like high-molecular-weight PTFE, carbon fibers, or specialized ceramic particulates. These advanced materials ensure that the sealant resists migration and wash-out under differential pressure, maintaining a consistent seal layer between the valve components. Furthermore, research into non-petroleum-based thickening agents and synthetic base fluids (such as esters or polyalphaolefins) is crucial for developing sealants that offer wider temperature ranges and superior hydrolytic stability compared to traditional mineral oil formulations, extending the maintenance interval for end-users.

Innovation is also highly concentrated in the application and monitoring side of valve sealing. Automated and smart sealant injection systems represent a key technological shift. These systems often utilize electronic control and metering to ensure the precise volume and rate of sealant application, minimizing waste and preventing over-pressurization of the valve cavity, which can lead to component damage. Some advanced systems are being integrated with industrial IoT platforms, allowing maintenance personnel to remotely monitor injection pressures and material consumption in real-time, thereby transitioning from time-based maintenance to condition-based sealant application. The use of diagnostic tools, such as ultrasonic leak detectors and specialized pressure gauges, is becoming standard practice to verify the effectiveness of the sealing procedure immediately after application, ensuring operational compliance and safety.

Emerging technologies focus on environmental sustainability and specialized service requirements. The rise of bio-based and biodegradable sealants, formulated using vegetable oils and environmentally benign additives, addresses stringent environmental regulations, particularly in marine, offshore, and ecologically sensitive land applications. For highly corrosive service, such as hydrogen or extremely high temperatures (>400°C in power generation), the industry is exploring nanocarbon-enhanced composites, including graphene-doped polymers, which offer superior barrier properties, thermal conductivity, and mechanical strength. These advanced materials are essential for maintaining sealing integrity in future energy infrastructures, requiring manufacturers to maintain continuous collaborative research with material scientists and end-users to ensure rapid technological adoption.

Regional Highlights

The global consumption and growth patterns for valve sealants display significant regional variations driven by differing levels of industrial maturity, infrastructure investment, and regional regulatory frameworks.

- North America: This region represents a mature and technologically advanced market, dominating consumption due to its extensive, aging oil and gas pipeline infrastructure in the US and Canada, which requires continuous maintenance and rehabilitation. Demand is stable, characterized by a preference for high-quality, synthetic sealants that comply with rigorous safety and environmental standards, particularly within high-pressure shale gas extraction activities.

- Europe: Characterized by highly stringent environmental regulations (e.g., REACH compliance, fugitive emissions mandates), the European market drives innovation towards bio-based and environmentally friendly sealant solutions. While pipeline expansion is slower, the emphasis on upgrading existing chemical and power generation plants to meet modern efficiency standards maintains steady demand for specialty, high-performance, and non-toxic sealing compounds.

- Asia Pacific (APAC): The fastest-growing regional market, fueled by rapid industrialization, massive investments in new chemical and petrochemical complexes, and expansion of energy infrastructure, particularly in China, India, and Southeast Asia. The demand is currently high for both high-volume, cost-effective sealants for new installations and increasingly for sophisticated products to handle complex refining processes and LNG facilities.

- Middle East and Africa (MEA): Growth is driven by significant upstream oil and gas production and infrastructure projects, particularly involving sour gas processing and export pipelines. Demand focuses on extremely durable, corrosion-resistant sealants designed for harsh desert environments and offshore operations, with procurement heavily influenced by major national oil companies (NOCs).

- Latin America: The market is driven by sporadic but large-scale upstream exploration projects (e.g., Brazil’s pre-salt fields) and general midstream maintenance. Market stability is often influenced by fluctuating government policies and commodity prices, but long-term potential remains strong, especially in countries investing in energy independence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Valve Sealant Market.- Sargent Manufacturing

- Flowserve Corporation (Valtek)

- Jet-Lube, Inc.

- Sealweld Corporation

- Chemola, Inc. (Southwestern Petroleum Corporation)

- Lubchem, Inc.

- Valve Sealant Solutions

- Super-Lube Private Limited

- Gasket Resources Inc.

- TotalEnergies SE

- DuPont de Nemours, Inc.

- Klüber Lubrication (Freudenberg Group)

- Loctite (Henkel AG)

- Chesterton International

- Molykote (Dow Chemical)

- Bel-Ray Company, LLC

- A.W. Chesterton Company

- CST Industries

- W. R. Grace & Co.

- SKF Group

Frequently Asked Questions

Analyze common user questions about the Valve Sealant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving demand for high-performance valve sealants?

Demand is primarily driven by stricter global regulations on fugitive emissions (methane, VOCs), the necessity to extend the operational life of aging industrial infrastructure (pipelines, refineries), and the expansion of high-pressure and high-temperature service environments in unconventional oil and gas extraction.

How do synthetic sealants differ in performance from traditional hydrocarbon-based formulations?

Synthetic sealants typically offer superior temperature stability, extended service life, greater chemical resistance (especially against sour gas or solvents), and better lubrication properties compared to lower-cost hydrocarbon-based sealants, making them preferred for critical and severe service applications.

Which end-user segment utilizes the largest volume of valve sealants globally?

The midstream Oil and Gas sector, specifically pipeline transmission and distribution companies, represents the largest volume consumer due to the extensive network of mainline gate and ball valves requiring frequent preventative maintenance and emergency sealing operations.

What impact do environmental regulations have on the Valve Sealant Market?

Environmental regulations compel manufacturers to innovate, shifting market focus toward developing non-toxic, bio-based, and biodegradable sealant formulations, while simultaneously pushing end-users to adopt higher quality sealants to minimize non-compliant fugitive emissions.

Is the Valve Sealant Market moving towards digitalization or AI integration?

Yes, digitalization is occurring through the integration of smart sealant injection systems and AI-driven predictive maintenance platforms, enabling operators to determine the optimal timing for sealant application, reduce waste, and improve overall asset reliability based on real-time operational data.

The technological sophistication of the Valve Sealant Market continues to rise in direct response to the increasing complexity and severity of industrial operating conditions worldwide. Manufacturers are continually challenged to produce materials that offer robust mechanical and chemical integrity under extreme stress, necessitating deeper collaboration with materials science researchers and adopting advanced manufacturing processes. The shift towards higher pressure and temperature services, especially in deep-water offshore drilling and specialized chemical processing like hydrogen production or carbon capture and storage (CCS), requires sealants that maintain elasticity and adhesion over extended periods without degrading or washing out. This focus on durability translates into higher R&D expenditure for specialized fluoropolymers, high-purity inorganic thickeners, and engineered synthetic base oils, ensuring the market remains competitive through innovation rather than price alone. Furthermore, the global push for operational safety means that fire-safe and non-flammable sealant compositions are becoming mandatory in many critical applications, particularly within the petrochemical and power generation industries.

The market structure is also evolving as major players acquire smaller, specialized technology firms to integrate unique chemical formulations or proprietary application equipment into their portfolios. This consolidation aims to offer comprehensive maintenance solutions that encompass not only the sealant product but also the necessary tools, training, and technical consultation required for optimal application. The ability to provide certified training for maintenance technicians on proper sealant selection and injection techniques is a key differentiator, particularly in highly regulated markets such as North America and Europe, where compliance and safety records are paramount. The long-term trajectory of the market suggests a continued premium placed on materials science excellence and technical service integration, making the value proposition for high-end sealants increasingly strong despite the higher initial cost.

In terms of geographical expansion, while APAC leads growth in new infrastructure, the maintenance market in developed regions, driven by regulatory upkeep and asset life extension, ensures consistent, high-value demand. Manufacturers must effectively manage regional complexities, including diverse certification requirements (e.g., CE marking in Europe, API certifications globally), fluctuating currency risks, and the need for localized technical support teams. The focus on developing modular, easily transportable injection equipment that can function reliably in remote or harsh environments (such as Siberia or the African interior) is another key technological area being addressed to ensure market reach and service availability in emerging industrial hubs. The future of the Valve Sealant Market is inextricably linked to global energy stability, environmental stewardship, and continuous advancements in polymer chemistry and material engineering.

The complexity involved in delivering effective sealing solutions is further underscored by the need to manage inventory across thousands of different valve types and operating conditions. A pipeline company might require several dozen distinct sealant formulations tailored for specific valve manufacturers, pressure classes, and transported media. This inventory management challenge necessitates strong, technologically supported distribution networks that can guarantee rapid, reliable delivery of the correct sealant product, often under emergency conditions. Digital tools and centralized purchasing platforms are beginning to play a crucial role in simplifying this complexity for end-users, enabling better tracking of consumption rates and optimizing procurement strategies. The trend is moving away from generic sealing solutions towards highly customized, 'fit-for-purpose' chemical compounds, solidifying the market’s reliance on specialized chemical expertise and technical service excellence.

Furthermore, the competitive dynamic is increasingly shaped by lifecycle analysis and total cost of ownership (TCO). While cheaper, lower-quality sealants might offer initial savings, the costs associated with increased leakage, frequent reapplication, environmental fines, and eventual component replacement far outweigh the expense of premium, long-lasting synthetic sealants. Consequently, procurement decisions in major industrial entities are shifting from a purely price-driven model to a performance-driven TCO approach. This favors manufacturers who can provide certified performance data, proven case studies of extended valve life, and comprehensive technical warranties, thereby reinforcing the segment dominance of established, high-quality chemical suppliers.

The market also faces pressures from sustainability initiatives that extend beyond basic biodegradability. Customers are increasingly scrutinizing the supply chain for ethical sourcing of raw materials and demanding lower volatile organic compound (VOC) content in sealants to improve worker health and safety during application. This layered regulatory and corporate social responsibility (CSR) pressure drives manufacturers to continually reformulate products, ensuring their offerings are not only technically superior but also align with global sustainability goals. This focus on green chemistry is expensive but necessary for maintaining relevance in developed markets, acting as a strong barrier to entry for smaller firms lacking the necessary R&D resources.

The long-term growth of the valve sealant market remains robust, sustained by the irreplaceable role these chemical compounds play in preventing catastrophic failures and maintaining system efficiency in global energy, utility, and chemical infrastructure. The continuous operation of complex, interconnected industrial systems means that any compromise in sealing integrity leads to significant financial loss and safety hazards. Therefore, valve sealants are considered essential consumables, insulated somewhat from cyclical economic downturns affecting capital expenditure, as maintenance budgets are usually prioritized over new project spending. Innovation in this sector, particularly concerning high-temperature, high-pressure hydrogen and carbon dioxide service (related to energy transition initiatives), ensures that the market will evolve alongside future energy shifts, maintaining its strategic importance within the industrial maintenance ecosystem.

The key technological breakthroughs anticipated in the latter half of the forecast period (2030-2033) revolve around smart materials—sealants that may potentially possess self-healing capabilities or change viscosity based on monitored pressure parameters. Although still highly experimental, the research aims to create materials that actively respond to developing leaks, further extending the interval between manual maintenance applications. Such advancements would drastically reduce operational expenditure for end-users and significantly improve environmental compliance by practically eliminating micro-leakage. Manufacturers who successfully patent and commercialize these next-generation active sealants will secure a substantial competitive advantage in the high-value segment of the market, redefining the standard for industrial sealing performance.

Furthermore, the standardization of sealant performance testing across various international bodies remains an area of continuous improvement. While API standards provide a framework, the sheer diversity of industrial operating environments necessitates more granular, application-specific certification protocols. Industry collaboration between sealant manufacturers, valve manufacturers, and end-users (such as the Pipeline Safety Trust) is essential to establish universal benchmarks for longevity, chemical compatibility, and environmental impact. Greater standardization would simplify procurement processes globally and accelerate the adoption of proven high-quality products, benefiting the established market leaders who already invest heavily in certification and performance validation. This emphasis on verifiable performance metrics solidifies the technical nature of the purchasing decision, favoring technical expertise over purely price-based competition.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager